Crypto markets are live all the time. They function 24/7 and 365 days, making it hard to cope up with the amount of follow-up one needs to do.

This can take a toll on anyone, but there is a huge opportunity to make decent profits out of this perpetual phenomenon.

Are you wondering how?

Well, the answer is through a bit of automation.

Crypto trading bots make that automation possible so that you don’t need to trade crypto full-time.

It is time you also embrace these trading bots to make the most of your crypto trading journey without sacrificing your sleep for perpetual crypto markets.

Here are some of the best crypto trading bots that I have tried and researched, so on the meat now:

Best Crypto Bots To Trade Smartly

#1. Pionex

Pionex is not just a crypto trading bot platform but a cryptocurrency exchange with built-in automated bots.

It has been one of the fastest-growing crypto trading platforms globally, with over 100,000 users and a monthly trading volume of $5 billion.

Pionex has secured a license from FinCEN as Money Services Business and Singapore MAS. The exchange has plans to go big soon with listing in the NASDAQ through IPO.

Now speaking about the platform, it aggregates liquidity from Binance and Huobi Global Exchange near the ticker price. Currently, it is one of the biggest brokers of Binance and market makers for Huobi in the world.

The exchange offers access to 12 free crypto trading bots in three broad categories- trend trading, arbitrage, and market-making.

It includes- Grid Trading Bots, Spot Futures Arbitrage Bot, Dual-coin Rebalancing, Leveraged Grid Bot, Margin Grid Bot, Reverse Grid Bot, Leveraged Reverse Grid Bot, Infinity Grids, Smart Trade, Trailing Sell, Trailing Buy, Dollar-cost Averaging, and TWAP.

One of the best features of Pionex is the mobile-first rule that helped it provide a user-friendly interface for the mobile app among all crypto trading bot platforms.

It has a flat trading fees structure and charges 0.05% per trade, both as a maker and taker fee.

#2. Quadency

Quadency is a decent alternative to Coinigy that, too, at half of its cost.

It integrates with 35 major cryptocurrency exchanges and wallets such as Binance, Bittrex, Poloniex, KuCoin, etc. To give you the reach you want on all these exchanges through a single trading window.

As of now, Qudaency is supporting 800+ cryptocurrencies with 4000+ trading pairs all in one place, making it a smarter way to trade and manage your cryptocurrencies. And offers 15+ automated crypto trading bots and strategies.

- Do check out the complete Quadency review here !!

Upgrade To Pro For FREE By Following These Simple Steps After a successful trade execution, your account will automatically be upgraded to Pro for FREE (worth $49) within approximately 1 hour, triggering an email notification to confirm.

Moreover, Qudaency has inbuilt trading bots and provides you backtesting features to do automated trading on these multiple supported exchanges along with sophisticated charting tools for your TA.

#3. BitsGap

BitsGap is an Estonia-based multi-exchange automated trading platform that offers full-featured trading, portfolio management, arbitrage, signals, and bot trading services all within a single interface.

Using BitsGap, you can integrate and trade on 25+ exchanges, including OKEx, Kraken, Bitfinex, Binance Futures, etc. The algorithms used in the platform helps to analyze over 10,000 crypto pairs every second and filter out the coins with the most substantial potential.

You get access to various predefined trading strategies based on successful backtest results to automate your trading setup. Also, you can create your automated trading strategy with just a few clicks.

Through TradingView charts, you can assess the bot’s performance and backtest your trading strategy to check its effectiveness in the actual market situation.

Under portfolio management services, BitsGap imports all your holdings-related information into one dashboard for accurate tracking and monitoring of trade performances.

About pricing, it offers three account types- Basic ($19 per month), Advanced ($44 per month), and Pro ($110 per month).

#4. 3Commas [Best Crypto Trading Bot for BitMEX]

If you want a severe crypto bot to trade on your behalf, you should look no further than 3Commas.

I have been following the 3Commas team since 2018 and can say safely that they have taken their time to develop their product. I tried their trading software in their early years, and it worked like a charm.

But now, it has certainly become much better as well as bigger.

By bigger, I mean bigger in reach.

3Commas now supports 20+ crypto exchanges to make you omnipresent on all the exchanges and help you trade smartly with other 100,000+ 3Commas subscribers.

3Commas supports Binance, Bittrex, Bitfinex, Poloniex, and many more popular exchanges. Using 3Commas, you effectively make your trading strategies and use features like trailing stop-loss & trailing take-profit to get the maximum out of their trades.

They also have mobile apps for traders who would like to do this on the go.

Furthermore, the feature of copying each other’s winning bots, strategies, and algorithms is also present on 3Commas to give you the perfect feel of social crypto trading.

#5. Cryptohopper

Touting itself as the most powerful crypto trading bot in the industry, Cryptohopper has undoubtedly carved a place for itself in the bitcoin trading bot niche.

I have had the good fortune to make a few trades through it; I can say overall, it was a good experience.

As of now, Cryptohopper allows you to access ten crypto exchanges altogether, where you can trade 100+ cryptocurrencies. This way, you can join 140,000+ crypto traders who are already using Cryptohopper features to increase their profits.

Using Cryptohoppers technical indicators, make your custom technical analysis strategy according to which your Cryptohopper will take trailing profits or cut the losses with trailing stop-loss.

Moreover, this strategy will be honed and backed by extensive backtesting of crypto data, which Cryptohopper has gathered from different sources.

Lastly, you can do paper trading, arbitrage, and shorting all from one trading terminal, which Cryptohopper integrates for you in one go.

#6. Coinigy

Coinigy is one of the oldest crypto trading platforms in the market and has been operational since 2014.

It is a multi-exchange trading platform that lets you connect with 45+ crypto exchanges and provides a host of services linked to cryptocurrency portfolio management. It offers access to real-time pricing data, full-featured spot trading, arbitrage matrix, and portfolio management.

Other features include- automatic exchange and wallet portfolio monitoring system, access to more than 75 advanced charts for technical analysis, enterprise-grade data feeds, and allows integration with many third-party apps and plugins.

With its comprehensive offerings, Coinigy is a one-stop solution for all advanced traders. Also, through the integration of many third-party trading bots, you can automate your trading journey and improve performance.

#7. TradeSanta

Automated trading that too of crypto sounds sometimes complicated to people, but TradeSanta does an excellent job simplifying the stuff, which is why it is their tagline.

I have been following TradeSanta since late 2018, and it has been coming up well.

As we speak, TradeSanta provides integration of five major crypto exchanges such as Binance, Bittrex, Upbit, Bitfinex, and HitBTC to help you simultaneously trade on them.

Furthermore, Huobi, BitMex, and Okex are on their radar to help crypto traders like you.

Finally, play and place large volume orders without any slippages using TradeSanta and enjoy its automated trading strategies for long & short positions to deal with 500+ cryptocurrencies pairs.

Features like this of TradeSanta help you become a full-time crypto trader without making you sit 24/7 in front of your computer, so make use of it to reap decent profits.

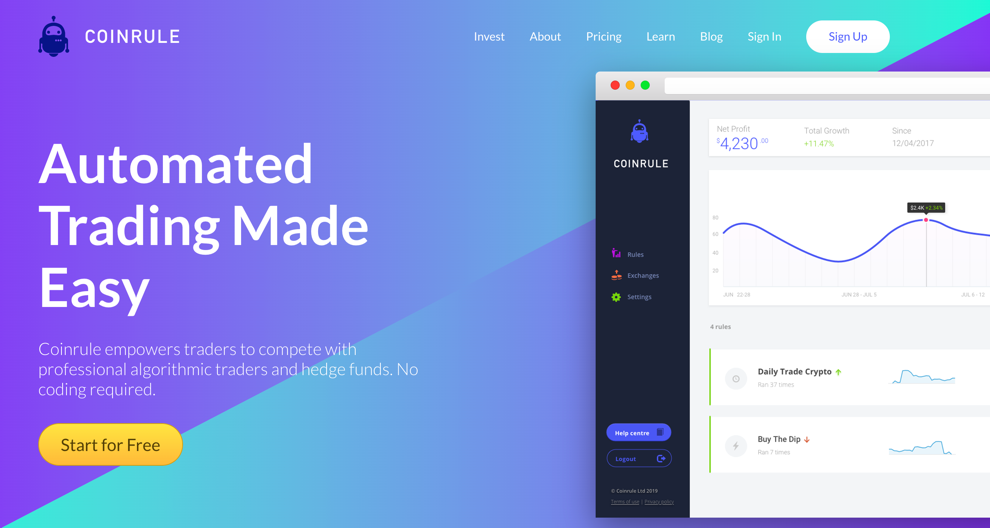

#8. Coinrule [Free Crypto Trading Bot]

Operating in this space since 2017, Coinrule has established itself as a go-to beginner’s friendly platform for automated crypto trading.

Coinrule doesn’t ask for your private keys, and you remain in control of your funds at any point in time. Instead, it facilitates the ability to send automated trading instructions to your favorite crypto exchanges without you writing code.

This way, it empowers other traders to compete with professional algorithmic traders and hedge funds. With Coinrule, one can easily trade on exchanges like Binance, HitBTC, Coinbase Pro, OKex, Bitstamp, Poloniex, Kraken, and Bitmex from a single interface.

Right now, Coinrule is running a lucrative offer in conjunction with the OKex exchange. You need to trade on OKEx to get Cashback in your favorite coin!

Speaking of the interface and features, Coinrule’s interface is user-friendly and very intuitive, helping traders to choose from 150+ successful trading strategies.

Coinrule lets you build rules for multiple exchanges without any code, and the process is as simple as If-This-Then-That (IFTTT) logic helping you maximize your profits in the volatile crypto world.

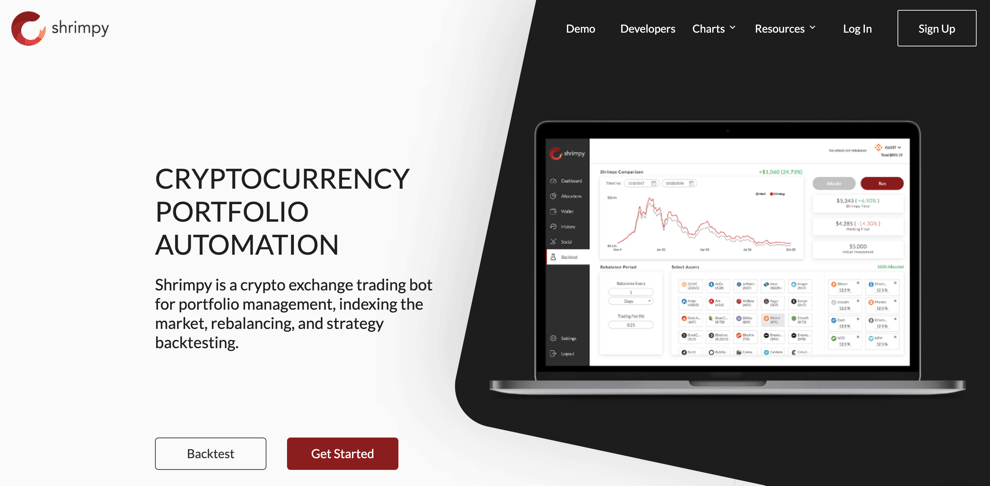

#9. Shrimpy [AI Crypto Trading Bot]

If you are not a heavy-grade trader but still want to use automation for smartly handling your crypto portfolio, you should look at Shrimpy.

Shrimpy is unlike any other crypto trading bot.

It is an automated portfolio management software first and then a bot. Shrimpy’s way can deceive you into thinking it is like the rest, but it is a bit different.

Of course, to start with, Shrimpy lets you connect with 10+ crypto exchanges, which means you have access to 100s of cryptocurrency pairs.

You can do custom indexing using Shrimpy and backtest its potential in real-time. Furthermore, if you like HODLing your currencies, the best way is to use Shrimpy’s auto rebalancing feature, which does HODLing for you while maximizing your profits.

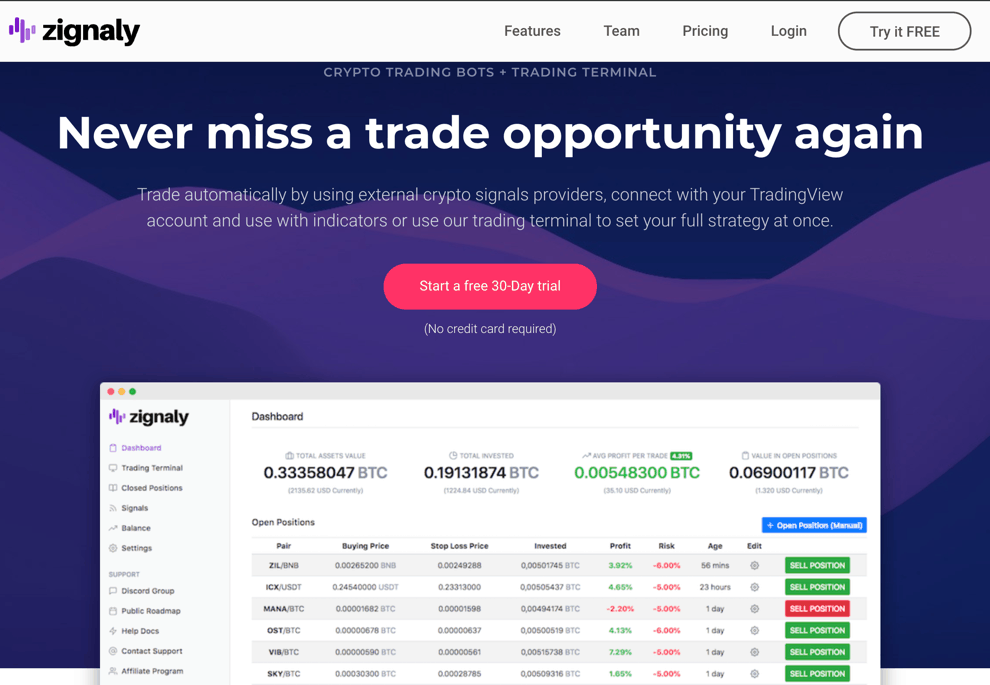

#10. Zignaly

Zignaly has recently started getting a slot of traction, and few traders in my network are using it.

I have never personally experienced it, but upon initial scrutiny, it is looking impressive. I have a friend who runs crypto signals also, and even he has recommended this tool.

Moreover, Zignaly is one of the few Bitcoin and crypto trading bots, which allows you to integrate third-party signals in the tool to automate your trading strategy.

So you see, you use the expertise of signals and combine it with the software of Zignaly, which acts as your trading terminal. As of now, Zignaly allows you to access 1000s of cryptocurrency pairs on all the major exchanges.

If you are serious about your crypto trading game, Zignaly is the tool you should have in your arsenal.

#11. Haasonline

Hassonline started way back in 2014 and has been a time-tested crypto automated trading bot for buying/selling cryptocurrencies.

If you want granular control over your crypto trading strategies, like buying the coins with one indicator and selling with another, you should look no further than Hassonline.

Furthermore, you can make Hassonline your trading terminal as it lets you connect with more than a dozen of crypto exchanges.

Their visual strategy designers let you paper trade and help in backtesting the data, which helps make custom scripts for automation.

So use Hassonline’s technical indicators to chart your trading strategies and extensively customize your dashboard to feel at home whenever you check automated crypto trading strategies. The platform is also suitable for high-frequency trading/

#12. Stackedinvest

Stackedinvest is a crypto bot trading platform founded in 2019 and headquartered in Chicago, US. It currently integrates with almost all the leading crypto exchange platforms, including BitMEX, Binance Futures and Bybit, etc.

The platform currently offers three types of services- trading bots, investing in cryptos through indices, and portfolio management.

With Stacked, you get access to pre-built trading strategies curated by advanced traders, investors, and hedge funds.

You can instantly connect your trading account with Stacked and automate your trading journey. The crypto bots listed in the marketplace are real and have a proven history with no misleading backtest results.

Just click on the bot to read more about the historical data, performance, efficacy, etc.

Under the investing services of Stacked, you can allocate a part of your portfolio to a pre-built index of coins with just a few clicks. The indices are designed by experts to provide you with diversified exposure to the crypto market and are vetted with full performance history.

The portfolio management or automatic rebalancing service provides you with the most profitable portfolio composition based on historical data. It uses a powerful backtesting engine to find out the profitable composition and also enables automatic rebalancing.

It involves periodic selling and buying, adjusting the weight of the assets in the portfolio based on market trends. Currently, the services of the platform are made available for free to all crypto investors.

#13. Autonio [AI Crypto Trading Bot]

Autonio automated an AI trading bot, and it is a big deal.

Big deal because Autonio is based totally on decentralized infrastructure, making it the only crypto trading bot which is decentralized.

Moreover, it incorporates the complexities of the crypto world and uses AI plus blockchain to give you the most advanced experience of trading using cryptocurrency trading bot.

There is more to it:

Using Autonio, you can use its popular technical indicators and backtest it using a considerable amount of data to make AI-based algorithms yourself. Autonio can now integrate with six crypto exchanges such as Bittrex, Binance, Bitfinex, BitStamp, bitshares, and Okex.

Of course, Autonio is not free and comes with a monthly subscription fee of $50 payable in NIO tokens, which are the native token of Autonio Bot to fuel operations on it.

Crypto Trading Bot Strategies

There are majorly six types of automated trading bots used for trading. It includes:

- Arbitrage Bot: The bot uses an arbitrage strategy and allows you to profit from the discrepancies in the market. It scans the price of crypto-assets across different exchanges and conducts trades if there are any differences in prices. It is a very popular trading bot with the least risk in the trading process.

- Market-Making Bot: This bot is used to create liquidity in the market by filling up the order book with buy and sell orders with higher spreads. It’s an attempt to profit from the spreads. The market-making bot continuously scans the market with bigger spreads, thus giving the trader an advantage of time, volume, and price. The very idea of the bot is to buy cheap and sell at a higher price.

- Technical-trading Bot: As the name suggests, it continuously scans the technical charts of different crypto assets to identify a trend or future price movement using various technical indicators and signals. This bot is suitable for conservative traders and widely used in the market.

- Algorithmic Crypto Trading Bot: It’s a code-driven program to generate and execute buy & sell signals in the market. The bot is programmed with the rules of executing a trade, including when to enter or exit, order size, and portfolio allocation. One can create their bot based on their trading strategies and experience in the market.

- Portfolio Automation Bot: This is a kind of trading bot or piece of computer software that executes trades based on certain preselected market conditions. The bot is suitable for risk-averse investors, and it helps in portfolio rebalancing based on the market trends and helps in diversifying the portfolio.

- Mean Reversion: The mean reversion is a type of AI crypto trading bot in which the strategy is built on the assumption that the price of an asset tends to move around its average.

- And, if it differs from average, it tends to correct its position towards the average price of the asset. Therefore, if the price of an asset falls by 25% from its average, traders will buy it in large quantities.

Which are the best cryptocurrency trading bots?

As the crypto market has expanded, the choice of crypto trading bot provider has also increased, thus making it difficult for traders to select a platform.

However, considering the factors like the number of years in operation, user sign-up, trading volume on the platform, and services offered, 3Commas and Quadency are counted as the best crypto trading bot platforms.

They are best for advanced traders and provide investors with many crypto trading bots, sophisticated settings, and features. Both platforms provide a smarter way to trade and manage cryptos.

This doesn’t mean the other platforms are not worth your time or provide the best crypto trading bots. You can check each one out and choose the best one according to your needs.

However, I would suggest staying away from a free trading bot because the risk of losing all your cryptocurrencies due to a faulty and free trading bot is much higher than earning some profits through it.

Are Crypto Trading Bots Profitable?

Trading bots is not a new concept and is very popular among large institutional players in the financial market.

They deploy different trading bots to easily capture opportunities in the global financial market, which otherwise would be difficult to track for a trader given the complexities involved and time differences.

The trading bots in the crypto market and traditional financial markets are no different and work on the same principle.

All crypto bots work on pre-coded scripts and algorithms and contain three important parts: signal generator, risk allocation, and execution.

- Signal Generator: A signal generator contains all the information and data of the trading strategy based on which it scans the market and pops out trading signals.

- Risk Allocation: Based on the probability of success of the trading signal, which is computed by the bot itself based on an algorithm, it allocates the capital (entire or partial) for the trade.

- Execution: The next and final part, execution of the trade. It includes entering, tracking the performance, and exit from the trade.

Now, coming to the question, are crypto bots profitable? Yes, they are profitable and trade with a higher chance of profit.

You should know, even the best crypto trading bots are not 100% efficient, but they are efficient at reducing the loss percentage in the trade as bots are not driven by emotion and execute trades at lightning-fast speed.

Do Crypto Trading Bots Really Work?

I know, there are a lot of apprehensions about the success rate of crypto trading bots, and they are worth it.

The cryptocurrency market is highly volatile, and its 24/7 nature of trading operation makes it difficult for every trader to track and trade manually. And, here comes the need of crypto trading bots, which can function 24/7 with greater speed and efficiency.

The success of a trading bot depends on multiple factors, like access to quality market data, algorithms, and the effectiveness of the trading strategy.

And, bots can bring efficiency to your trading by cutting down on emotional trading, bringing trading discipline, and managing the risks well within the defined parameters.

You should understand that crypto trading bots are not a get-rich-quick solution but primarily help increase the percentage of your return and reduce the loss percentage.

The risks like a programming error, mechanical failure associated with crypto bot trading remain. Therefore, you should be extra cautious while determining the bot’s trading rules and actions to achieve a higher success rate.

Conclusion

With the market expanding rapidly, the role of trading bots has increased significantly to track and take advantage of the opportunities in the market. However, trading bots are not a silver bullet or get rich quick tools.

You need constant manual interventions to fine-tune the bots’ settings as per the market condition. And, they are suitable for traders with the knowledge of executing various trading strategies and how the market works under different technical presets.

Therefore, a beginner should always take expert guidance and practice on the demo version of the trading platform before using a cryptocurrency trading bot in the live market.

Also, you need to be cautious while dealing with trading bots. A trading bot usually communicates with the targeted exchange through API (Application Programming Interface). And, because both the trading bot platform and crypto exchange are centralized in nature, there remains the risk of hacks.

Therefore, always keep your API keys secret and disable automatic withdrawals. Before signing up with any trading bot platform, check the security infrastructure and records of the platform you are considering.

Now you tell us: Are you using crypto trading bots? Which are the best crypto trading bots, according to you? How has been your experience with crypto bots? If not, do you plan to use one in the future?

Adios !!

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023