How To Keep Bitcoin, Litecoin, Ethereum Like Cryptocurrencies Safe & Secure !!

Yesterday, late in the evening, my friend asked me if I could tell him some cryptocurrency security tips to safeguard his crypto investments.

That’s where it hit me that I have missed this basic topic on my blog. Of course, you should not lose your Bitcoin like cryptocurrencies because of a silly mistake.

That’s why I urge you to read on:

Of course, I did advise my friend and gave him some tips that I have been following from the last two years in my crypto journey.

And here I am today to share exactly what I shared with my friend so that you can also sleep sound at night without worrying about your crypto investments.

So let’s get in:

How & Where To Keep Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH) Safe From Hackers?

#1. Use Hardware Wallets

Don’t be frugal and invest a hundred bucks in a cryptocurrency hardware wallet.

When you can invest hundreds and thousands of dollars in cryptocurrencies like BTC, LTC, ETH, why not to go and get a hardware wallet to safeguard them.

Having a hardware wallet for all your cryptos is the most straightforward action you can take right now. It will protect your crypto from online theft or accidental loss.

If some of you are hesitating because you have heard about the flaws in hardware wallets. Then let me tell you, your cryptos are safer in a flawed hardware wallet then where they are right now.

That’s because these hardware wallets, even if they have certain flaws are very much capable fo storing your cryptos safely. And these so-called flaws can only be exploited by sophisticated attacks that too by having physical access to your hardware device.

Thus they very difficult to pull off.

So if you want to secure your cryptocurrencies for the long term, then the first thing you should do is to go and grab a hardware wallet. For our side, if you want recommendations, we will vouch for Cool Wallet S and Ledger Nano X because both of them are secure and cool to use.

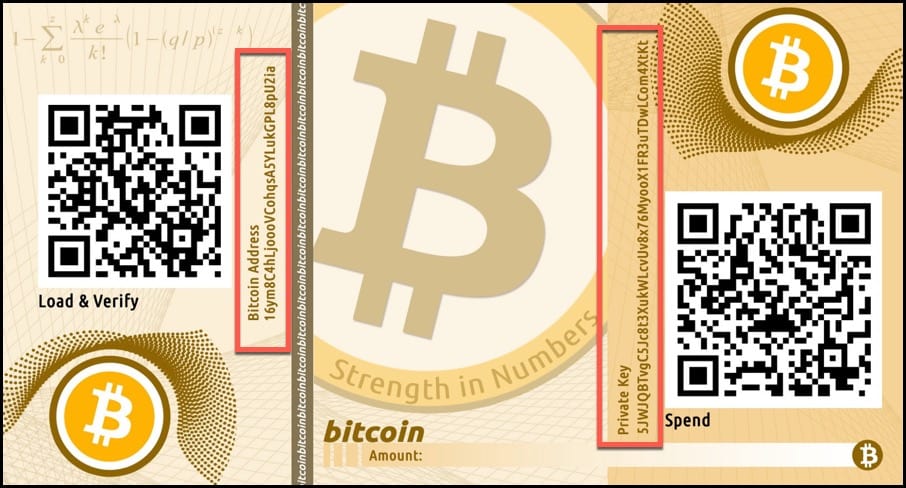

#2. Discard Paper Wallets

The second most important thing you can do to keep your cryptocurrencies safe is to discard paper wallets.

Paper wallets, of course, though easy to make are not that safe. They are vulnerable to attacks and someone with just one snap of your paper wallet can rob you.

Moreover, paper wallets are challenging to manage as you need to import and sweep your private keys for using it which is a cumbersome process.

Also, while doing this, you might accidentally expose your private keys to unwanted entities which can result in loss of your funds.

Lastly, Paper wallets are a thing of past. Who uses them now?

It is 2019, Of course, in the early days when crypto people didn’t have hardware wallets they used to use paper wallets.

But their usage is no more required, so don’t overthink just shift to hardware wallets if you want the safety of your crypto funds !!

#3. Have Multiple Backs Ups Of The Seed

Your seed is everything in crypto.

The seed is a 12 or 18-word long string is your private keys in a human-readable form. You will get this seed while setting-up almost all types of wallets such as mobile, desktop or hardware wallets.

A wallet that doesn’t give you this seed is likely a custodial wallet, and custodial wallet is a big No-No for the safety of your crypto fund.

So when you get this seed words while setting up your software or hardware wallet, you should take every measure to keep this seed safe.

Don’t overthink.

Take a pen and a paper to write it down. Then use this seed to recover the same wallet before sending any crypto to it. The best way to verify if it’s the same wallet or not is to do by looking at the public address.

Once you have tested this, make sure to make multiple copies of this seed to keep it at different places. Maybe at your second home, in your office vault or with a trusted family member, etc.

Note: Don’t be over smart by breaking your seed in two or three parts and then think of scattering them in different places. As this can be dangerous because you might not be able to put the whole seed back together.

#4. Use Multisig Wallets

If you are in crypto for some time, you must have heard news of an international cryptocurrency exchange founder who died in India. And was the only person who was holding the private keys of the exchange fund. Needless to say that the exchange funds are non-recoverable now.

That’s why relying on just one key, and one person is a bad idea.

If you have anywhere close to $500 or more worth of crypto, you need to use hardware wallets or atleast multisig wallets where multiple people have the keys.

They are usually, n-of-m type of multisig wallets. For example, if it is 2-of-3 multisig, this means any two people out of three can unlock the bitcoins stored in that multisig wallet with their private keys.

This is the way when small companies or corporations can keep their Bitcoin and other cryptocurrencies safe without too much reliance on one entity.

#5. Be Aware Of Phishing Attacks (Man In The Middle Attack)

This attack looks very sophisticated, but it is easy to do.

Phishing or man in the middle attack is a fraudulent attack to garner your password/seed or similar sensitive information from you by showing the same type of user interface or system.

The most popular form of a phishing attack in crypto has happened with MyEtherWallet (MEW). Where attackers have taken passwords from crypto users by fooling them to enter their details in a fraudulent replica site like MEW.

So the best way to avoid these types of attacks and to safeguard your crypto is by double checking the website or the software client you are using. Or by checking the wallet address where you are sending your crypto !!

#6. Avoid Public Wifi

Not only for crypto but from the perspective of your cyber security also, it is recommended that you don’t use public Wifis. Using public Wifis can relay your personal information to attackers who also might be on the same network.

In the case of crypto, sophisticated attackers can even get a copy of your relayed transaction. And they might try to replay attack you or double spend your currency.

So better be away from such networks for the security of your Bitcoin and other cryptocurrencies.

#7. Don’t Invest In Bitcoin Doublers & Bitcoin

For those you who aren’t aware of these two investment options, please read Bitcoin doublers & Bitcoin HYIPs.

First things first, if you are into cryptocurrencies, you will hear a lot of such crypto Ponzi schemes and let me tell you they are not for you !!

The best way to identify a Ponzi scheme is to do a litmus test like this:

Does it promise regular returns that exceed average market returns?

It's a Ponzi

Does it focus more on recruiting new people than any product?

It's a pyramid scheme#litmustests

— Andreas (aantonop) (@aantonop) December 1, 2017

If it qualifies, you must stay away for your benefit.

#8. Use 2-FA & A Password Manager

This piece of advice is for laggards, and I hope you are not one of them.

By laggard, I mean people who are still keeping their cryptocurrencies on online crypto exchanges despite repeated reminders from TheMoneyMongers.

But I know there will always be this breed of people. Assuming this is important because some of them will not learn untill their cryptos are stolen. And some will not be genuinely knowing about avoiding exchanges for storage.

In any case, if you are one of these people. You need to use atleast two-factor authentication and set strong passwords using the password managers like Dashlane.

Having said that it is essential to remind you once again that Bitcoin exchanges are buying Bitcoin and not for storing your bitcoins there. So once you have bought your crypto, get it off from the exchanges into hardware wallets.

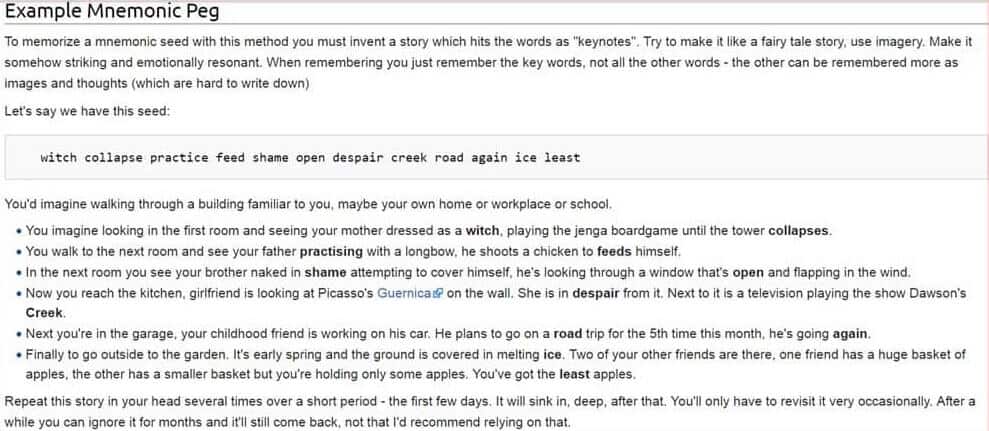

#9. Maybe Memorize The Recovery Seed

This is not recommended from me, but many do it.

The way it works is that you somehow memorize the seed words of your crypto wallet and make brain wallet instead or writing it down on a piece of paper.

However, upon consideration, this looks safe, but it isn’t according to me.

Humans are fragile. We are not sure of your lives tomorrow then how can we be assured of our minds. Minds are fickle and anything . can happen to it.

Memory loss, head injury or brain hemorrhage, etc. So having a brain wallet where you memorize your seed isn’t recommended option for security of your cryptocurrencies.

But if you still want to try. You can try the mnemonic pegging technique where make hypothetical story or poem to remember your seed pattern.

Conclusion: Keeping Cryptocurrency Safe With These Cryptocurrency Security Tips

So if I have to summarize the cryptocurrency security tips for you in short, it would be:

- Buy a hardware wallet like Cool Wallet S or Ledger Nano X.

- Avoid paper wallets

- Don’t use public Wifi and use 2-FA always.

- Try multisig wallets.

- Discard Ponzi scheme and be aware of phishing attacks.

I hope you enjoyed these security tips for your cryptocurrencies.

Now you tell us: What techniques are you using to safeguard your cryptos? What other tips you can recommend for adding to this list? Let me hear your thoughts below, and I will add it here with your accreditation !!

And if you liked this post, don’t forget to share it with your crypto friends you might also enjoy this post !!

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023

Contents