Security Tokens Vs Utility Tokens: Guide In 2020

I think you agree with me when I say:

Blockchain technology is going to change the way businesses are conducted across the industries.

And why not also?

When one knows that blockchain has the power to bring decentralization and transparency to various business operations.

It is a new standard on which the modern digital infrastructure is being built.

We all know, Bitcoin introduced ‘blockchain’ to us and the interesting thing is, it was not even called ‘blockchain’ then because no one knew what to call it…

But many people believe that blockchain is the only underlying technology behind Bitcoin, but that’s a myth because blockchain is only one of the many technologies behind Bitcoin.

Another myth that I want to bust in this tokens article is, Bitcoin is not a token, neither a security token nor a utility token.

So the question ‘is bitcoin a utility token?’ is itself wrong.

Anyways getting back to the point of tokens:

If you have heard of ‘blockchain,’ chances are that you have heard off-blockchain tokens. Blockchains per se can be of many types, but there are mainly two breeds of blockchain tokens i.e.

- Utility Tokens

- Security Tokens

And in this article, we are going to discuss in-depth about these two breeds, but before that, I know some of you might be wondering ‘what are tokens’ itself?

So here is a simple explanation:

A ‘token’ is simply a digital representation of anything. For example, a token can represent a stock, bond, option or real-estate. Or it can also represent that you have the access rights to a blockchain or blockchain app because you hold that particular token. Tokens can also be used for automation of friction points in various industries.

So this is a very high-level explanation of tokens but more on this later in this article because, after all, that’s what we are here to discuss in detail.

Utility Tokens Vs. Security Tokens

| Security Tokens | Utility Tokens |

| You get ownership of the asset | You get access to protocols or utility |

| Investors expecting profits | Purchasers, no profits guaranteed |

| Regulated offerings with AML-KYC | Unregulated token sales |

| Investors are protected | Investors are not protected |

| Can be locked for trading for 3 months to a year | Available for trading soon |

What Is An Utility Token?

Utility tokens as their name suggests are tokens that have utility on the blockchain or DApp.

Utility tokens are often used as the underlying fuel for accessing the features of a blockchain or DApp. And sometimes utility tokens are used to pre-sell exclusive access rights of a particular DApp to the utility token buyers.

It is like, having tickets for a football match entitles you to enter the visitor’s arena on the field, or you can think of it as weapons/skins that one can buy from the steam community and later use it in the game.

So having these utility tokens/digital representations gives you entitlement for various things on a particular blockchain for which you are holding the tokens.

That’s why utility tokens are solely for utility and are not an investment vehicle, but many utility token issuers and even buyers have taken them otherwise.

Part of the reason for this is because utility token issuers & so-called ICOs have misled investors or otherwise are themselves unaware of what they are doing.

While on the other hand these ICO buyers or investors have also not done their due-diligence properly.

Having said that, it doesn’t mean there are no genuine utility tokens in the market. Here is the list of utility tokens or genuine examples of utility tokens:

- Ether (ETH)

- Siacoin (Sia)

- Neblio (NEBL)

Utility tokens are also called app coins because these are explicitly designed for a particular app or blockchain. There is more to it but that I will prefer to discuss in conclusion. So let’s move on and see security tokens.

What Is A Security Token?

Security tokens are simply investable securities such as stocks, bonds, LP shares, funds but in a digital wrapper. So securities of companies, fund houses or real estate funds issued over the blockchain are called security tokens.

And just like traditional securities, security tokens pay dividends, share profits, pay interest or give voting rights, and generate profits for the token holders.

Security tokens are especially useful for private securities which often lack cap table management, liquidity, and tradability.

I know some of you might say that this is a very US-centric definition of security tokens, but the only US has such kind of stringent security laws to which the rest of the world looks up to.

Here is the list of security tokens or genuine examples of security tokens:

- tZero

- Polymath

- Blockestate (real estate security tokens) etc.

But security tokens invites a lot of regulations with them to which the issuer has to abide. This also means higher launching costs because there are regulations to adhere to.

On the other hand, valid utility tokens are not required to adhere to securities regulations, and taking advantage of this point many ICOs have issued securities on the name of utilities.

Yes, that’s true:

Many ICOs have launched securities and trying cover-up by giving a cover-up utility to their token. And this practice is against the US securities law.

Which brings us to the question that:

- How do the US regulators differentiate between a security token or a utility token?

This brings us to inquiring ‘Howey Test.’

The Howey Test

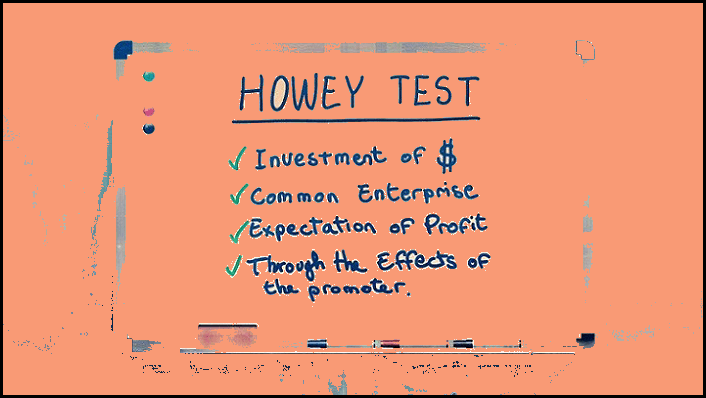

To distinguish utility tokens from security tokens, one needs to apply ‘Howey Test’ to the kind of investment that is being made on that token and here is what a ‘Howey Test’ is:

The “Howey Test” is a test created by the Supreme Court for determining whether certain transactions qualify as “investment contracts.” If so, then under the Securities Act of 1933 and the Securities Exchange Act of 1934, those transactions are considered securities and therefore subject to certain disclosure and registration requirements.

- Investment of money

- In a common enterprise

- With an expectation of profits

- From the efforts of others.

And if the answer to these all four elements is ‘Yes,’ then that token is security.

Under the light of this test now token issuers have started segregating themselves into two categories:

- STOs (Security Token Offering)- Offerings where you get security tokens

- ICOs (Initial Coin Offering)-Offerings where you get utility tokens generally but not always.

Not always because as I said some ICOs even sell unregulated securities under the cover-up of utility tokens. Having said that it doesn’t mean that a utility token cannot be a security token. And when that is the case, the token has to be regulated and launched in a proper security token offering.

But the silver lining is, not all utility tokens are securities, but a security token can have a utility. As rightly said by the US SEC Chairman, Jay Clayton:

Merely calling a token a “utility” token or structuring it to provide some utility does not prevent the token from being security. Tokens and offerings that incorporate features and marketing efforts that emphasize the potential for profits based on the entrepreneurial or managerial efforts of others continue to contain the hallmarks of a security under U.S. law.

Having said that let’s look into the present status of security and utility tokens.

Present Status of Security Tokens & Utility Tokens

The present scene of utility tokens and ICOs is highly unclear and uncertain.

Undoubtedly 2017 was the year of ICOs, hundreds of ICOs raised more than 20 billion dollars but, the majority of them failed to deliver.

A report by Diar shows that 70% of ICOs are underwater and trading at a price lower than their original price. A good chunk of these turned out to be outright scams like the Confido ICO scam of worth $375,000.

A good 7% have lost their track and are out of business, and the remaining chunk is trying to stay afloat. But these remaining needs to deliver otherwise the whole ICO market would become synonymous to scams.

However, ICOs are an excellent tool to pool investments from all around the world, but they need to deliver on the promises instead of taking advantage of investors’ money.

Whereas on the other hand security tokens market is predicted to become a 10 Trillion Dollars industry by 2020.

That’s because security tokens are regulated and backed by the law. Any issuer cannot just cheat an investor as one would do in an ICO.

Depending upon the type of security token you are issuing for the different types of investors there are broadly three types of regulatory exemption to which security tokens need to abide.

Having said that Security tokens or STOs have to be compliant with one of these regulations atleast to launch a token offering in the US and here are those regulations.

- Regulation D (Reg D)

Regulation D (Reg D) is a Securities and Exchange Commission (SEC) regulation governing private placement exemptions. Reg D allows usually smaller companies to raise capital through the sale of equity or debt securities without having to register their securities with the SEC. Read more: Regulation D (Reg D). In this case, investors have to be accredited investors, and their initial purchase will be locked off 12 months initially

- Regulation A+ (Reg A+)

Regulation A+ (Reg A+) is an alternative to a traditional IPO, which makes it easier for smaller, early-stage companies to access capital. With this Reg, one can issue securities to non-accredited investors and can raise up to $50,000,000 in the capital. And this method also takes up more cost and time for implementation on the ground.

- Regulation S (Reg S)

Regulation S is a “safe harbor” that defines when an offering of securities is deemed to be executed in another country and therefore not be subject to the registration requirement under section 5 of the 1933 Act.

And as per the securities law of the US STOs have to provide full disclosure as well as proper documentation to the SEC to get fully regulated. And mind you this document needs to be more detailed than the shitty whitepapers that scammy ICOs have been spitting out randomly.

Note: Security tokens are not traded on regular exchanges where utility tokens are. There are specially regulated and licensed security token exchanges where their trading takes place.

Conclusion: Security Tokens or Utility Tokens

Now the million-dollar question that should pop in your mind, i.e., which is good, a security token or a utility token?

Well, there is no perfect answer for it, but if you like something that is highly speculative and guarantees no protection to investors as well as can give very high returns, you must look at ICOs (good utility ICOs).

Whereas if you want something less speculative with investor’s protection, you should look at security tokens. But don’t expect 100x or 1000x heavenly returns with security tokens, because they are backed by real-world assets such as real estate, commodities, shares, bonds, and all of these, don’t move so wildly.

That’s all from TheMoneyMongers blog today, and I hope you now know well about security tokens and utility tokens.

Stay safe and invest cautiously by never investing more than what you can afford to lose in cryptoassets.

Liked this post? Don’t forget to share it with your network on Twitter & Facebook !!

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023

Contents