Compared to spot trading, cryptocurrency futures trading is very demanding in nature. It requires the right skill and platform for crypto Futures traders to succeed.

Interestingly, the trades are made on borrowed funds (leverage), making them riskier but rewarding. In case of loss, you’ve to pay the amount back to the exchange with interest.

In cryptocurrency Futures and derivatives contracts, trading, timing, skills, and exchange platforms are crucial to profit from the market; else, it will break your back.

Therefore, you must select a trusted crypto exchange with advanced trading tools, best-in-class liquidity, a clean interface, and quick execution of orders.

(Editor's Choice For 2023) |

| Get Upto $30,000 Bonus |

| Welcome Bonus upto $5135 | |

- Deposit in: Bitcoin & altcoins - KYC & VC Backed | Joining Bonus uptp $5000 |

Best Crypto Futures Trading Platforms

- ByBit [100X Leverage Crypto Exchange: Best Overall]

- BingX [100x Leverage & No KYC]

- Bitget [up to 100x on its Futures contracts]

- Phemex [20x Leverage]

- MEXC [100x leverage on Futures platform]

- Binance [20x Leverage On Bitcoin]

- Stormgain [Bonus Of $25 ]

- PrimeXBT [70% Joining Bonus]

- BitMEX

- BaseFEX

- Kraken

- CEX.io

- Poloniex

#1. Bybit (Best Crypto Exchange For Futures Trading)

Bybit is a Singapore-based global futures exchange launched in March 2018 and is credited for increasing retail participation in the futures market as well as spot trading.

It is one of the fastest-growing crypto derivatives exchanges in the market and is trusted by over 1.6 million users, and is constantly ranked within the top 5 crypto futures exchanges by trading volume.

The exchange offers its customers and institutional traders a chance to trade three different crypto assets in the Futures markets- Inverse Perpetual Futures, Linear Perpetual Contracts, and Inverse Futures contracts.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Bybit offers maximum leverage of up to 100X on BTCUSD and BTCUSDT contracts and up to 50X on the rest of the futures contracts.

The transaction costs on the platform are minimal and competitive. It offers a maker rebate of 0.01% and charges a taker fee of 0.03%.

KYC regulations have been changed recently on the website, and any new accounts that have been created need to do a basic level of KYC.

To know more about the exchange, check this detailed Bybit review.

#2. BingX

BingX is one of the leading social trading platforms allowing users to buy and sell cryptocurrencies. Founded in 2018, BingX has quickly become one of the top choices among crypto traders.

The exchange offers spot, derivatives, copy trading, grid trading, and P2P trading services in more than 100 countries. Also, BingX has over 5 million users and offers a safe place to trade crypto derivatives.

With BingX, you get maximum leverage of 150x for perpetual and standard futures contracts, and it has a wide range of crypto trading pairs.

The exchange is also known for being one of the cheapest exchanges. It has a maker and taker fee rate of 0.0200% and 0.0500% for both perpetual and standard futures contracts. On the other side, spot trading charges you a flat trading fee of 0.1% for both maker and taker fees.

BingX is also a no-KYC crypto exchange – meaning there is no need to verify your account to deposit, withdraw or trade on the exchange. However, verifying your account would give you access to additional features.

Overall, BingX is known for offering a safe and secure trading experience. It offers you tons of security features and offers you quick customer support, which is available 24/7.

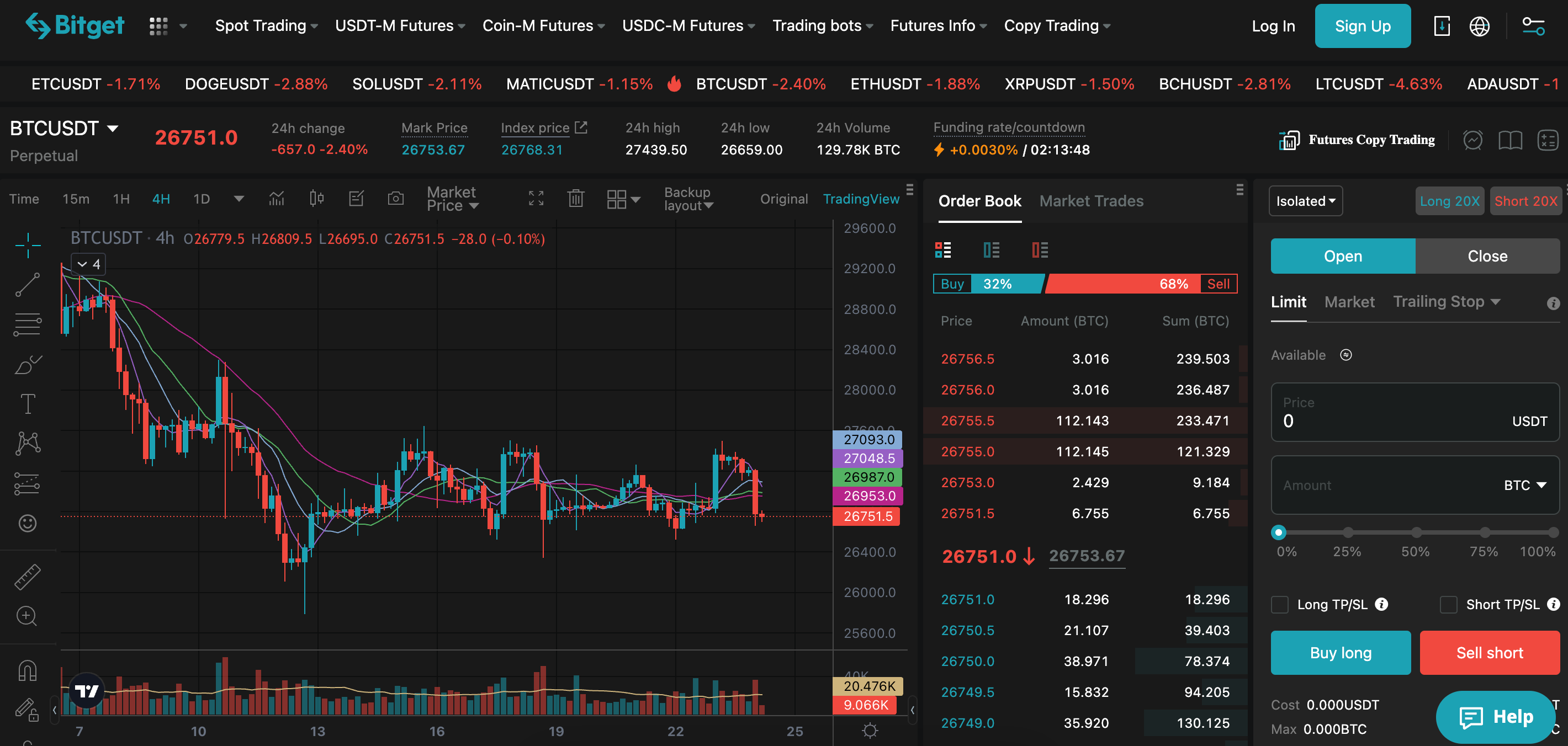

#3. Bitget (The Go-To Platform for Crypto Futures Trading)

Bitget is one of the few exchanges making its mark in the global futures trading market as a dynamic platform for crypto futures trading.

One of Bitget’s key attractions is its wide-ranging derivatives trading options. It offers both USDT-margined and coin-margined futures, enabling traders to execute leveraged trades when margin trading bitcoin, and potentially amplify their returns.

With leverage up to 100x available on various contracts, it caters to experienced traders looking to capitalize on the bearish and bullish movements of digital assets.

In terms of product offerings, Bitget stands out with its comprehensive array of futures contracts, spanning a multitude of cryptocurrencies, including the Bitcoin Futures contract.

This extensive selection empowers traders to trade crypto stock that aligns best with their market perspectives and risk profiles.

You will need to mandatorily complete your KYC procedure and be ready to pay trading fees as 0.02%/0.06% according to the Maker/Taker method.

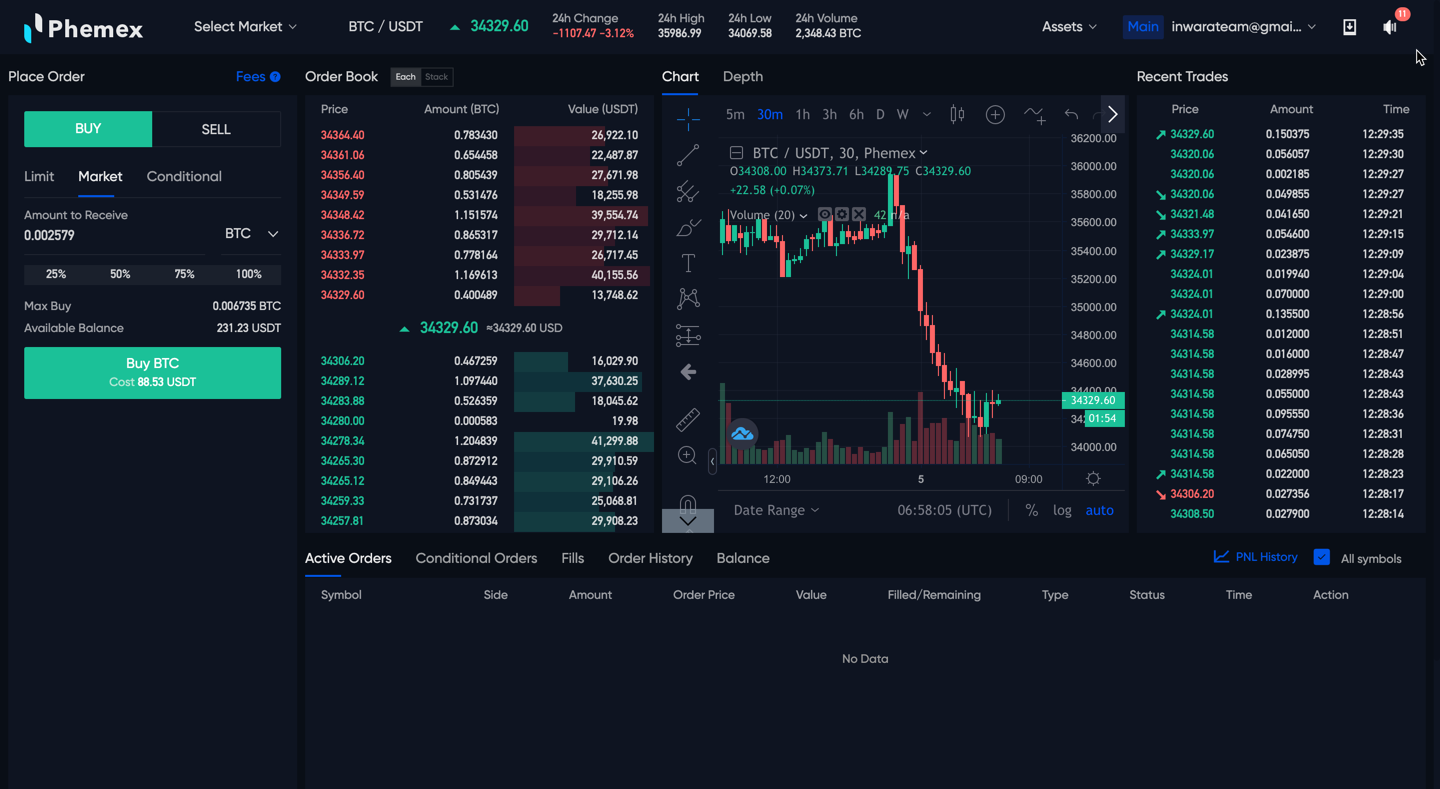

#4. Phemex [Bitcoin & Crypto Futures Trading Platform]

The Phemex exchange was started by eight former Morgan Stanley executives and was launched in November 2019.

The exchange has attracted over a million traders in a short span and gets an average daily trading volume of more than $1.1 billion.

Phemex offers leveraged trading in 15 different cryptocurrencies with a maximum leverage of up to 100X on Bitcoin Futures contracts and up to 20X on the rest of the futures.

Regarding trading fees, the taker trading fee structure is 0.06% and has a maker fee of 0.01%.

Again Phemex is one of the platforms that need a user to undergo KYC mandatorily before using the exchange.

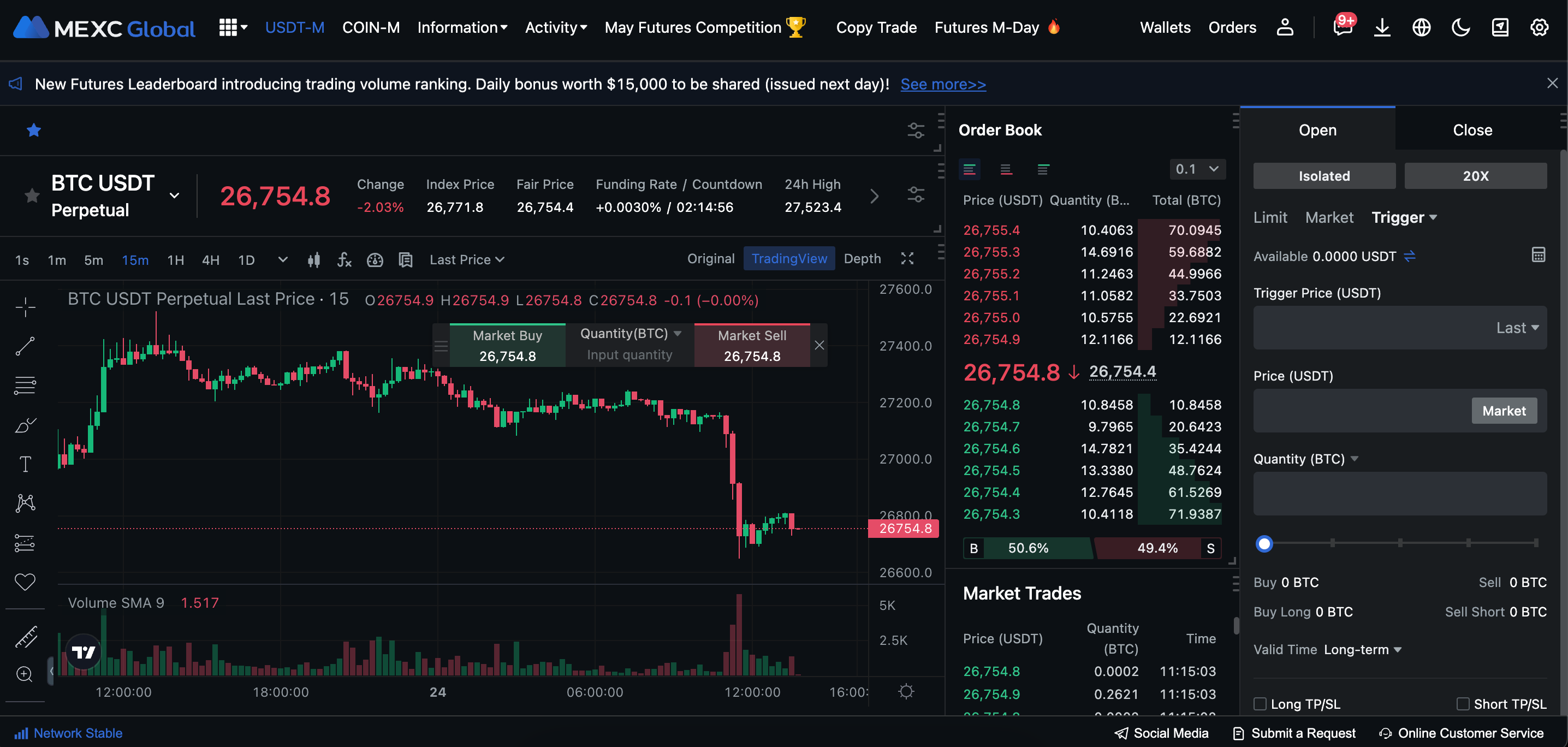

#5. MEXC (Revolutionizing Crypto Futures Trading)

MEXC Global has a user base of over six million users from over 200 countries and stands as a preferred choice for traders to trade Futures around the world.

MEXC offers a variety of futures trading services with both USDT-margined and coin-margined futures available, allowing users to take leveraged positions, potentially maximizing their profits.

Crypto leverage trading enables leverages as high as 125x on selected contracts, it provides significant opportunities for traders to profit from both bullish and bearish market movements.

MEXC’s high liquidity also ensures quick and efficient trade execution, reducing slippage and offering tighter spreads. The fees on the platform are 0%/0.01% and is charged according to the maker/taker model.

Although MEXC does not mandate KYC but a lot of the platform’s features are unusable without it so you might as well indulge.

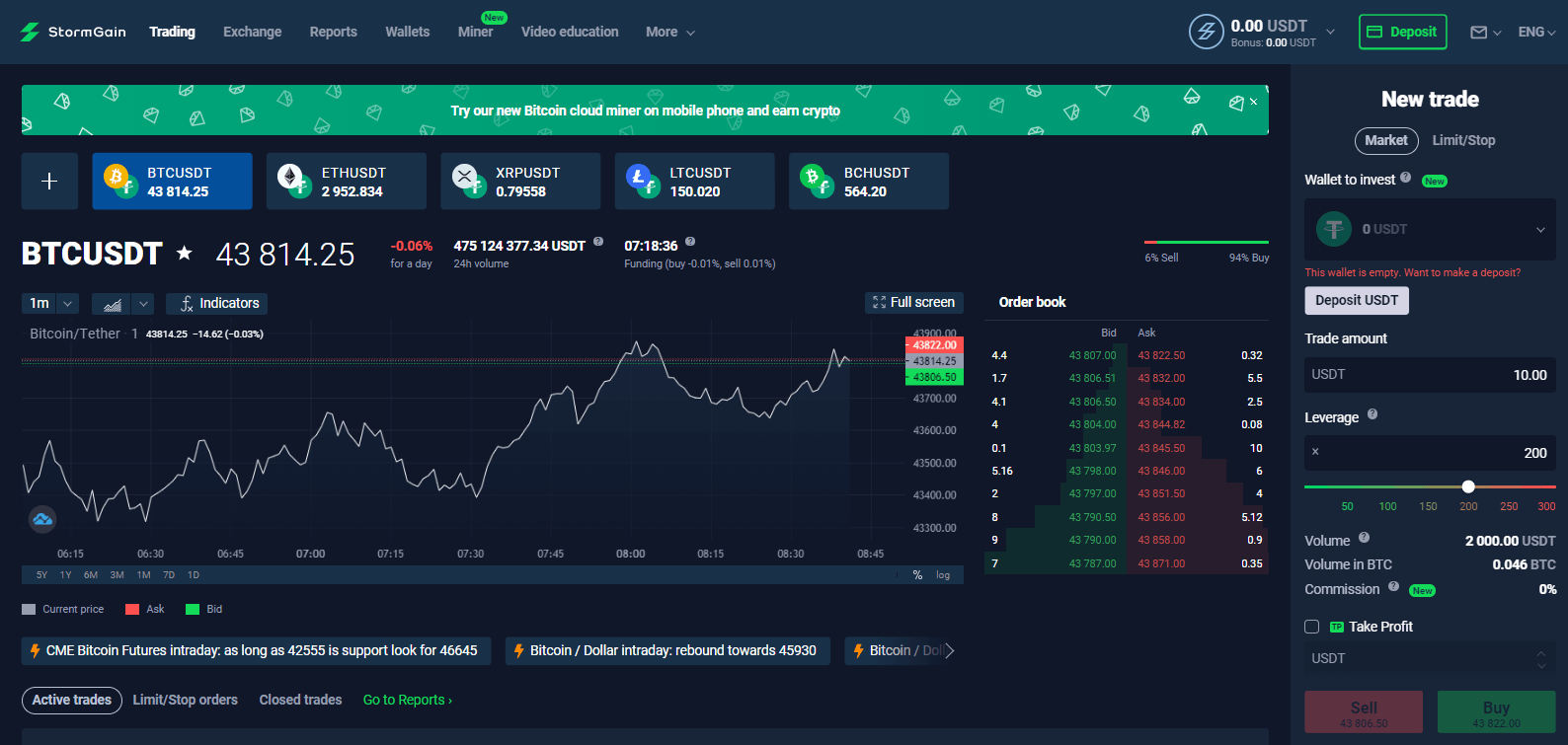

#6. Stormgain

Stormgain is a UK-based global crypto exchange established in 2019, and you can buy bitcoin, trade crypto assets, and futures contracts with a maximum leverage of up to 300X, the highest among all other platforms.

Stormgain doesn’t charge any trading fees for a lot of their trading pairs, but some of them have a maker/taker fee of up to 0.4%. You can have speedy fiat currency deposits through Simplex or using credit/debit cards.

The trading platform is subject to mandatory KYC procedures if you want to be able to use it at all. Also, check this detailed StormGain review to know more about the exchange.

#7. Binance [Best Crypto Futures Trading Platform]

Binance got into the Futures market in early 2020, and in a short span, it has become the top platform to trade in crypto derivatives and has deep liquidity.

It offers Futures and derivatives contracts for USDT-margined perpetual and quarterly futures trading, COIN-M (token margined with or without expiry futures contract), BTC options, and leveraged tokens. You can be trading futures with a maximum leverage of up to 125X.

It has the lowest fee structure among the top bitcoin exchanges and is divided into 10 levels, starting from 0.0108% as the maker fee and 0.027% as the taker fee.

You will also have to abide by the trading platform’s KYC norms to get to trading crypto futures.

To learn further, check this comprehensive Binance Futures review.

#8. PrimeXBT

Based in Seychelles, PrimeXBT is a multi-asset exchange established in 2018 and offers cryptocurrency margin trading in different crypto trading pairs, and offers maximum leverage upto 100X.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

The exchange is integrated with 12+ liquidity providers that offer high market liquidity and has an order execution speed of less than 7.12 ms. You can also take advantage of the PrimeXBT Covesting platform, which allows you to copy the trading strategies of successful traders and succeed in trading Futures.

The exchange has a flat fee structure and charges a commission of 0.05% on all types of trades.

PrimeXBT does not have mandatory KYC but depending on if it thinks your account is being used for purposes other than trading, it can have a Customer Due Diligence (CDD) activity on your account. Also, make sure to check PrimeXBT review to learn more about the exchange.

#9. Kraken (Best Crypto Futures Exchange USA)

Kraken is a US-based exchange set up in 2011 and as one of the best crypto futures exchanges out there, the futures trading segment offers perpetual futures trading with a maximum leverage of up to 50X.

With a decade of experience in the crypto market, Kraken has vastly improved its digital assets offering based on customer suggestions and evolving market requirements.

The platform interface is customizable, and has added tooltips and a simplified order form. It also facilitates discreet trading through its dark pool feature.

It has a tiered transaction fee structure, with maker fees starting from 0.02% and taker fees from 0.05%. As far as KYC is concerned, you will need their Intermediate level of verification to be able to trade Futures.

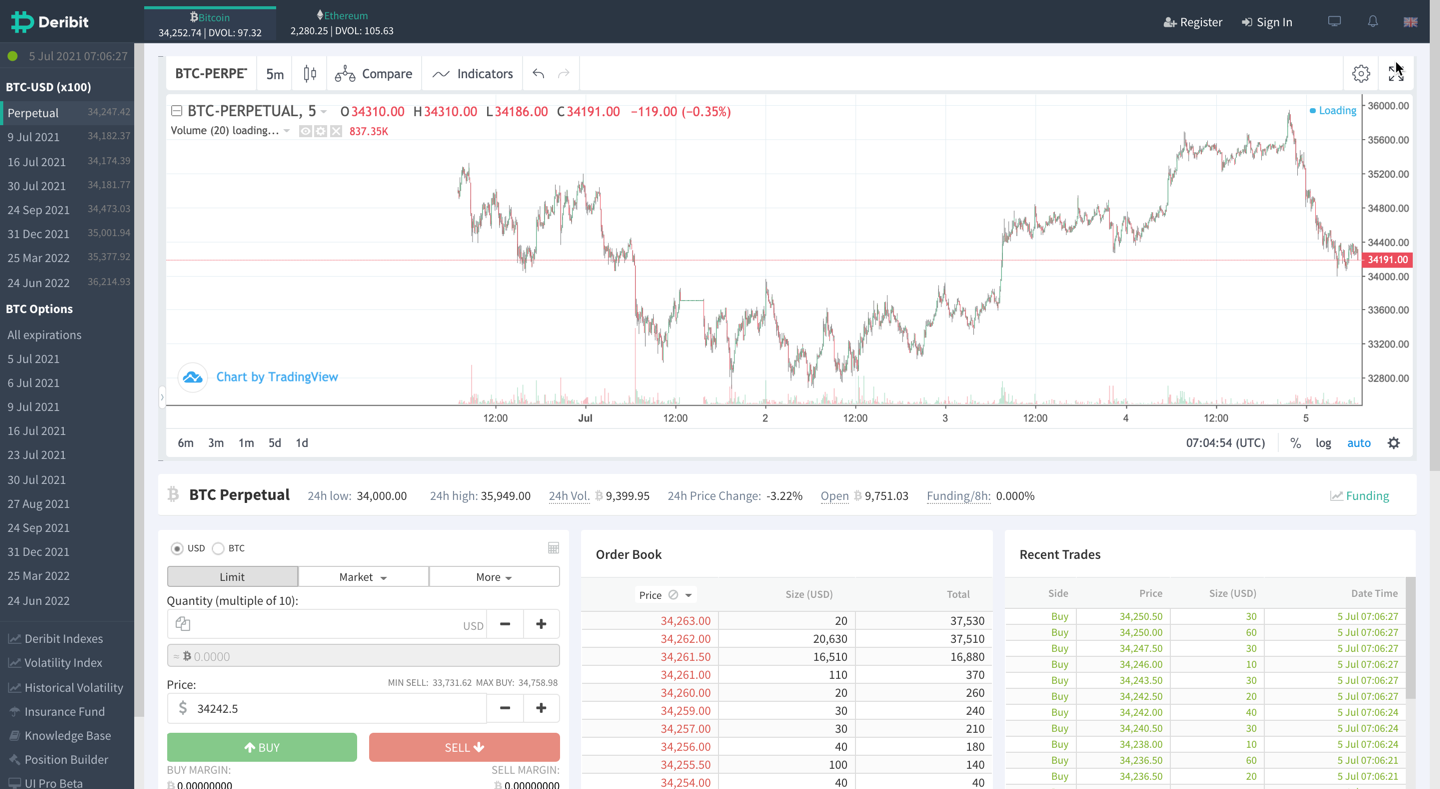

#10. Deribit (Minimalistic Crypto Futures Trading Platform)

Deribit offers trading in traditional futures, perpetual futures, and options of both Bitcoin Futures trading as well as Ethereum.

It offers maximum leverage of 100X on Bitcoin contracts, 50X on Ethereum contracts, and 10X on options. The minimum contract size on the platform is $10.

Deribit API is integrated with third-party trading bots software like HAASONLINE, FMZ Quant, and Actant. The platform also supports multiple order types like Limit, Market, Stop-limit, and Stop-market.

The Deribit platform supports trading certain Bitcoin futures contracts, which other trusted crypto futures exchanges don’t provide

As a new user, there is a mandatory KYC requirement for any kind of operation on the platform.

The exchange offers a maker rebate of 0.01% on BTC weekly futures and charges a taker fee of 0.05%. For BTC/ETH perpetual, the maker fee is NIL, and the taker fee is 0.05%.

#11. BitMEX [Margin Trading With Derivatives Trading]

BitMEX was one of the first crypto exchanges in the market to offer futures trading in certain futures contracts with leverage as high as 100X.

The average daily trade volume ranges between $2-3 billion.

The exchange’s trading engine is written in kdb+, a database, and toolset used by major banks in the high-frequency trading application, and is known for its speed and reliability.

BitMEX has been a mandatory KYC exchange since June 2020 and has a good selection of crypto futures contracts that can be traded as trading pairs.

Its fees start with a maker fee of 0.02% and a taker fee of 0.075% on all trades.

What is Crypto Futures Trading?

Unlike crypto spot trading, where you buy and sell a crypto asset such as Bitcoin and Ethereum for immediate delivery to have direct ownership, numerous crypto Futures trading platforms allow you to trade crypto futures to gain exposure to crypto assets without having to hold the underlying digital asset.

Futures contracts in the derivatives market are a contract with an agreement to buy or sell a specific cryptocurrency at a future date at an agreed price.

The contract tracks the underlying index or asset, and its price changes as per the change in the digital asset’s price.

Derivatives exchanges facilitate both the buy and sell side of this transaction.

Therefore, if digital asset investors think that the price of assets will rise, then they will initiate a long position. At the expiry, the futures trading platform also settles the contract and closes it.

Let’s understand the process of crypto leverage trading with an example of bitcoin futures trading:

Suppose BTC is trading at around $30,000, and you expect the price to increase in the short term.

Therefore, based on the analysis, sophisticated and institutional investors initiate a long position on trading platforms and buy 10 BTC futures contracts valued at $500 each.

And, every increase of $1,000 in BTC’s price will result in the value of the futures contracts increasing by 10%.

At the settlement of the contract, the price of Bitcoin reached $35,000, and the value of each futures contract increased to $804, a total profit of $3,040 on an investment of $5,000.

If you’ve used the leverage of 50X for a total 500 BTC futures contract, your profit would’ve been $30,400 on a trading capital of $5,000.

Therefore, trading crypto futures help you to amplify your profits by multiple times with the same trading capital compared to trading on the spot market.

For institutional investors, a leading global platform for crypto futures helps hedge their position in the spot market and minimize the risk of losses.

For example, if an investor has huge Bitcoin exposure, they will take a short position in the Futures contracts to limit their downside risks.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

How to Trade Bitcoin Futures?

In crypto futures, there is no involvement of the crypto assets as all contracts are cash-settled.

Therefore, you aren’t required to have the cryptocurrencies in the exchange wallet when trading crypto futures.

You need to have enough balance in your exchange account on the trading platform to initiate a position and cover the initial and maintenance margin.

The maintenance margin is the minimum amount of funds you need to have in the account to cover your losses.

Now, let’s have a look, at how to trade bitcoin futures.

- Step 1: Learn how to trade in Bitcoin futures contracts

There are several types of futures products you can trade in the crypto market, like perpetual futures (without expiry), traditional trading cryptocurrency futures contracts (with expiry), inverse perpetual contracts, etc.

You need to understand the products in detail and find the most suitable one for yourself.

- Step 2: Building a trading strategy

It includes finding technical indicators that generate credible trade signals, order types for executing trades, ways to monitor the market movement, and acceptable levels of risks for each trade.

Also, money management and position sizing are important elements in crypto futures trading.

If you think building a trading strategy is difficult, you can use the copy trading feature offered by all the top crypto derivatives exchanges, which allows you to copy the trading strategies of successful traders.

- Step 3: Open an account with a Bitcoin futures exchange

In futures trading, researching numerous cryptocurrency futures exchanges plays a significant role in long-term success. Select the exchange based on your trading goals, liquidity on the platform, strong platform infrastructure, and system security.

- Step 4: Test your trading plan.

Using the demo account feature offered by almost all crypto futures trading platforms, test your trading plan to check how it functions in the real market.

Trading on a demo account is the best way to fine-tune your trading strategy without committing any funds and also helps you to get familiarized with the trading platform.

- Step 5: Go Live

Once you are confident enough about your trading plan and have gained enough confidence to place trades in the live market, buy bitcoin or stablecoins to fund your account and start trading.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

What Happens When Futures Contracts Expire?

All crypto futures contracts are cash-settled on the date of expiry, which means no transfer of cryptocurrencies is involved in the process of settlement of contracts.

Perpetual contracts, which do not have any expiry date, are executed at the will of the buyer or seller of the futures contract.

Conclusion

Selecting the best futures exchange is not an easy task.

The derivatives trading exchanges discussed above are some of the best in the industry and make up a major portion of the market.

You should select based on your requirements and platform preference.

Choosing a platform which allows trading of derivatives contracts involves not being based on higher available leverage or low trading fees, but it should be based on liquidity, platform interface, and speed.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023