Hey there, crypto enthusiasts!

I’m sure you’re all familiar with KYC or Know Your Customer procedures that a major crypto exchange and crypto platform requires. But have you ever wondered about the best crypto exchange that doesn’t need KYC?

I did, and it led me on a fascinating journey to find the best non-KYC exchanges for crypto in 2023.

I’ve learned a lot along the way and can’t wait to share these best no-KYC crypto exchanges with you. It is not only for people looking to escape money laundering rules.

So whether you’re a seasoned crypto trader or a newbie to this vibrant financial world, let’s dive in together to discover these platforms’ possibilities and freedoms without KYC verification!

Best No KYC Crypto Exchange In 2023

Following are the best non-KYC crypto exchanges you can use without going through the KYC process:

#1. BingX [Non-KYC Crypto Trading Innovator]

BingX is a prime example of a non-KYC crypto exchange that stands out in 2023, especially for its diverse crypto offerings and advanced trading features.

As a decentralized trading platform, BingX holds firm to the principle of direct user-to-user trades, eliminating the need to trust centralized platforms with personal data.

BingX does not hold any customer funds.

Instead, it utilizes a unique protocol that ensures that the assets remain under the control of the traders until the moment of the trade, providing a balance of security and control even for unverified accounts.

The decentralized nature of BingX ensures that there is no need for giving up extensive personal data for KYC checks. While this results in increased privacy, it does come with a few trade-offs.

Users might experience a lower liquidity level and longer transaction times compared to more traditional, regulated exchanges.

Also, the platform caters predominantly to seasoned crypto traders, so beginners may find the platform a bit overwhelming at first.

However, despite these challenges, for experienced traders looking for a diverse range of cryptocurrencies and a non-KYC platform that values privacy, BingX presents itself as an attractive choice in 2023.

Why choose BingX?

- No KYC is required, ensuring user data privacy.

- Direct user-to-user trades for swift transactions.

- Protocol ensures assets remain under traders’ control.

- Available to traders worldwide.

- Advanced features and diverse crypto offerings.

- Robust security features with an intuitive trading interface.

#2. PrimeXBT [Offshore non-KYC exchange]

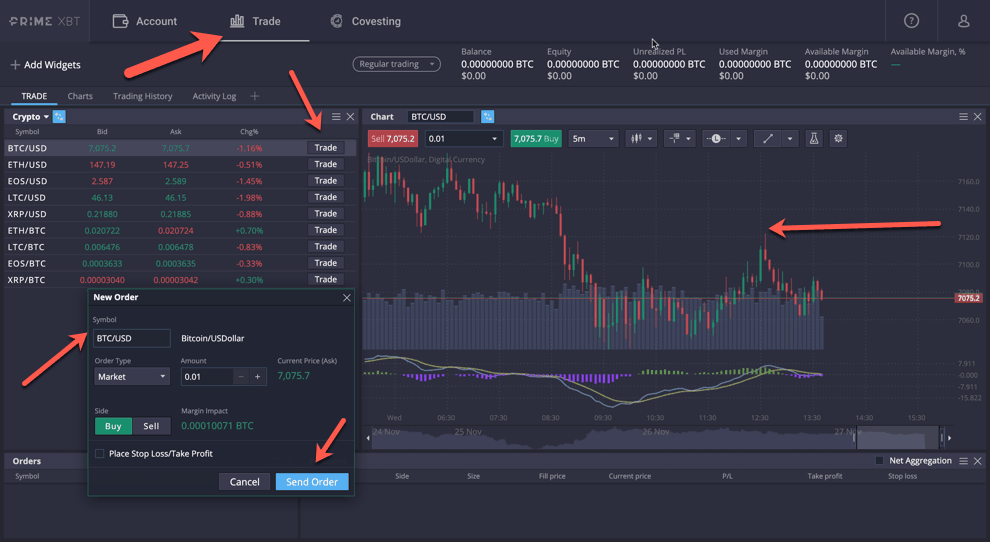

PrimeXBT is a great platform for margin trading and is also a part of the list of non-KYC exchanges. It allows trading in futures markets for cryptocurrencies, stock indices, forex, and commodities with high leverage.

Established in 2018, PrimeXBT has become one of the leading crypto margin trading exchanges in a very short time.

It gets an average daily trading volume of over $1.5 billion. One of the prime features of this cryptocurrency trading exchange is it offers the highest leverage across all asset classes available for trading.

The no-KYC crypto exchange supports trading in thirty-nine different crypto trading pairs with copy trading featured with the Covesting module, which is also a non-KYC module.

It has an intuitive and fully customizable trading interface supporting advanced chart types, indicators, and advanced order types.

This no KYC exchange supports only BTC deposits, and the minimum deposit and withdrawal limit is 0.001 BTC and low trading fees of 0.05% per trade.

With PrimeXBT, you can set up your trading account in just 40 seconds and not require KYC.

Why choose PrimeXBT?

- Fast and easy setup process

- Higher leverage and liquidity

- Competitive trading fee

- Advanced trading platform

- Wide asset range of 39 trading pairs

- Mobile App & Adherence to Anti Money Laundering (AML)

#3. SimpleSwap [Best No KYC Crypto Swapping Service]

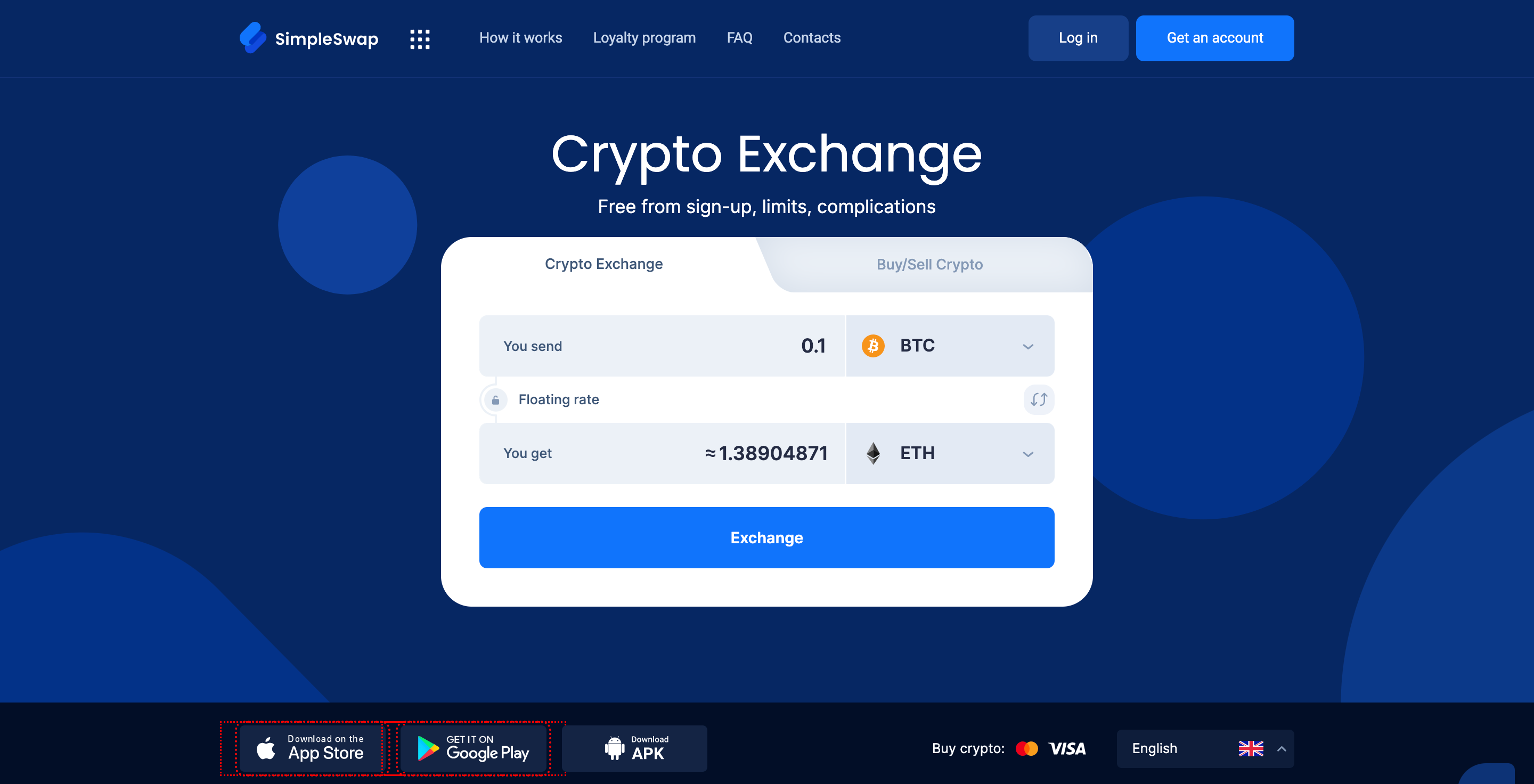

SimpleSwap is one of the prominent no-KYC crypto exchanges that allow you to swap several cryptocurrencies as it has partnered with popular exchanges like Binance, Huobi, HitBTC, Bittrex, Kraken, and a few others to simplify the process of buying/selling crypto.

It allows you to both buy crypto and sell and swap cryptocurrency without needing to sign up on their platform, as it is one of the prominent non-KYC crypto exchanges.

SimpleSwap lets you buy and trade cryptocurrencies by using a credit/debit card, Apple Pay and Google Pay. It allows you to buy or sell more than 400 cryptocurrencies and supports 6 fiat pairs.

Crypto investors can use SimpleSwap for both crypto-to-crypto assets swapping or for traditional crypto exchanges to fiat transactions.

Plus, it offers you an easy-to-use user interface that is easily accessible. SimpleSwap is accessible for both web and mobile apps. To learn more about it, you can also have a look at this SimpleSwap review.

Why choose SimpleSwap?

- Fast and straightforward crypto exchange bank transfer process.

- Supports a wide array of digital currencies.

- Reliable customer service for seamless transactions.

- Guarantees privacy due to non-KYC procedure.

- Simplified exchange process for newbies and professionals.

#4. Dex-Trade [Decentralized Trading Powerhouse]

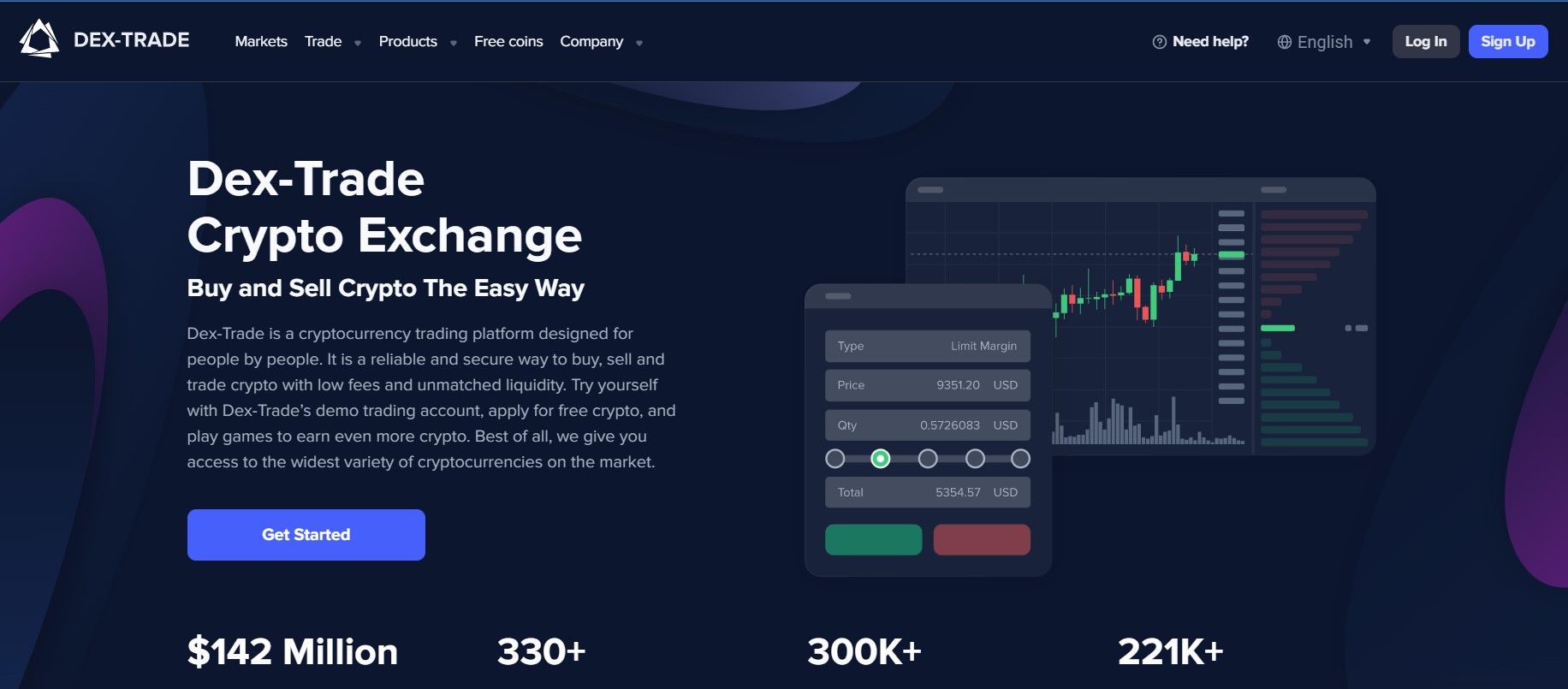

An exchange that came up in the top 50 best crypto exchanges list, in just 5 years, Dex-Trade has been among the major cryptocurrency exchanges thriving in the crypto trading market lately, founded in 2017 and registered in Belize, North America.

The exchange has more than 300K currently registered users, which is increasing at light speed, and is available in almost 180 countries.

Dex-Trade’s interface connects via API to execute trades at blazing speeds and often pre-defined strategies to be able to buy crypto without KYC. It supports over 330 crypto coins for a diversified crypto market.

It offers spot trading, demo trading, staking, tournament, and games, which you can take advantage of to trade crypto. There is no option to practice your margin trading, copy trading, or futures trading skills on this non-kyc crypto exchange.

For spot trading, Dex-Trade charges 0.2% for trading fees when executing market orders and 0.1% for trading fees for the limit order. To understand the fee structure in depth, please click here.

Setting up an account on Dex Trade hardly takes 40 seconds, and you can opt for 2FA, which is readily available on the platform, for enhanced security.

To learn more check this comprehensive Dex-Trade review.

Why choose Dex-Trade?

- Quick and straightforward setup.

- Transparent and competitive fee structure.

- Huge asset range.

- Varied product offerings.

- Fast, powerful, and customizable interface.

- Good customer support and security.

#5. Bisq [Peer-to-Peer Decentralized Non-KYC Exchange]

In the world of non-KYC crypto exchanges, Bisq holds a special place due to its true nature of being a part of the list of best-decentralized crypto exchanges ever.

As an open-source, peer-to-peer platform, it’s as close as it gets to the original, unregulated ethos of a cryptocurrency exchange.

In 2023, it continues to be an excellent choice for those who value privacy above all and do not like ones that require KYC.

Bisq doesn’t hold any of your funds. Instead, it provides software for users to connect directly with each other, facilitating trades via a decentralized arbitration system.

This way, you can trade Bitcoin for a variety of other currencies, including most fiat currencies, without requiring a centralized exchange.

Another thing that sets Bisq apart is its security. Being decentralized, it’s less vulnerable to hacking. Plus, it encrypts all communication over the Tor network, further boosting privacy.

But with all its merits, Bisq does have its limitations. Trade volumes and liquidity can be low compared to centralized exchanges.

It’s also less user-friendly and trades can take longer to complete.

For users who want to buy crypto without KYC, and prioritize privacy and decentralization, Bisq remains a top contender in the no-KYC crypto exchange scene in 2023.

Why choose Bisq?

- Peer-to-peer exchange

- Trustworthy due to its transparency.

- Built-in security features for safe transactions.

- Flexibility in transaction methods.

- Supports numerous digital and fiat currencies.

- No withdrawal limit as the exchange never holds your funds

#6. Local Monero [Fostering Anonymous Monero Trading]

When it comes to privacy-focused cryptocurrencies, Monero stands out, and Local Monero is a dedicated platform for P2P trading of this specific digital asset without KYC.

This platform is well-regarded for its stringent stance on privacy, aligning with the core ethos of Monero itself.

Much like other P2P platforms, Local Monero allows crypto traders to connect directly, allowing the users to purchase crypto without requiring personal identity verification.

Users can choose from a wide variety of payment methods to buy or sell Monero, providing significant flexibility for traders all over the world.

Moreover, all communications between users on the platform are encrypted for an additional layer of privacy.

It’s crucial to keep in mind that Local Monero is centered exclusively around Monero.

Traders looking for a diversified portfolio of multiple cryptocurrencies might find the trading platform too restrictive.

However, for those specifically interested in trading Monero with privacy and anonymity as top priorities, Local Monero will be a go-to platform in 2023 for the best no KYC crypto exchanges to buy Monero.

Why choose Local Monero?

- Available for users around the world.

- Supports multiple payment methods.

- User-friendly platform design.

- Provides escrow service for safe transactions between financial institutions.

#7. CoinEx [Simplified Trading, Minimized Formalities]

Established in 2017, CoinEx has made a name for itself in the list of no KYC exchanges by providing a comprehensive and professional digital coin exchange and trading service.

Even more strikingly, CoinEx offers a “no-KYC” trading option that’s particularly appealing to those who value privacy and wish to stay anonymous.

With the absence of strict KYC regulations, users are not required to go through the typically lengthy process of providing personal details and waiting for verification.

Instead, they can jump right into trading crypto from the get-go.

The platform offers a wide range of trading pairs, with Bitcoin, Ethereum, and a host of other altcoins all readily available.

CoinEx prides itself on its security measures, high-speed matching engine, and excellent customer service.

It offers spot trading and futures trading options to its users, ensuring that traders of all kinds can find a service that suits their needs.

While CoinEx does have non-KYC option for users who need a higher daily withdrawal limit, the basic features of the platform are accessible without any KYC or identity verification either.

However, it is essential to remember that while trading without KYC verification can provide additional privacy, it can also limit some platform features and capabilities.

Thus, successful investors should carefully consider their specific requirements and comfort level with risk before opting for platforms without KYC like CoinEx.

Why choose CoinEx?

- Offers over 100 cryptocurrencies for trading.

- Available for users worldwide.

- Advanced multi-layer, multi-cluster system architecture for protection.

- High-speed matching engine to facilitate trading.

- Easy-to-navigate interface, suitable for beginners.

#8. BlockDX [True Decentralization at Its Core]

BlockDX stands out in the world of cryptocurrency exchanges with its decentralized, no-KYC approach.

This platform goes a step further by providing a truly decentralized exchange (DEX) that operates without a central authority, thus not requiring any KYC procedures.

At its core, BlockDX is built on the Blocknet Protocol, ensuring a high level of security, privacy, and freedom for users.

It supports cross-chain trading, allowing users to trade any pair of assets directly from their own wallets. This means you remain in control of your private keys at all times, a feature that enhances safety and privacy.

Moreover, because of its decentralized nature, there is no central point of failure, making it a robust platform against potential attacks. BlockDX also doesn’t hold any of your funds, minimizing the risk of losses due to hacking or internal fraud.

However, while no-KYC platforms like BlockDX offer benefits like enhanced privacy and control over bank transfer of funds, they also require a higher level of self-responsibility.

Users need to ensure the safekeeping of their private keys and be aware of the transaction processes since the platform will not be able to assist in the case of mistaken transactions.

In a world that’s increasingly concerned with data privacy, BlockDX is a breath of fresh air offering complete autonomy to traders. Still, it’s crucial for users to remember that with great freedom comes great responsibility.

Why choose BlockDX?

- Operates on a peer-to-peer network.

- You maintain control of your private keys.

- Access to numerous cryptocurrencies.

- Transparent and community-driven.

- Reduced trading costs.

#9. HODL HODL: Global P2P Bitcoin Trading

HODL HODL is a brilliant example of a non-KYC crypto exchange, and it’s particularly known for its focus on a single trading pair of Bitcoin, unlike other major exchanges.

Being a peer-to-peer trading platform, it stands by the principle of direct user interaction, removing the need for centralized exchanges and giving extensive personal information to trading platforms to perform trades.

HODL HODL does not hold any cryptocurrency.

Instead, it employs a unique 2-out-of-3 multi-signature setup on smart contracts, allowing for secure transactions without the non-KYC crypto exchange ever touching the funds.

In this setup, both the buyer and seller, along with HODL HODL, generate keys. The release of funds requires at least two keys, providing a good balance of security and control even for unverified accounts.

While its simplicity and focus on privacy make it attractive, HODL HODL does share some common challenges with other exchanges and P2P platforms.

Lower liquidity and longer transaction times can be part of the trade-off for increased privacy compared to regulated exchanges.

Moreover, the platform deals exclusively with Bitcoin, which might not appeal to those interested in altcoins.

Despite these challenges, for experienced traders of Bitcoin seeking a non-KYC crypto platform that respects their privacy and does not have any withdrawal limit, HODL HODL remains an enticing option in 2023.

Why choose HODL HODL?

- No KYC is required, ensuring user data privacy.

- Direct trades between users for faster transactions.

- Uses unique 2-of-3 multi-signature P2SH smart contracts.

- Available to traders worldwide.

- Simple and intuitive trading interface.

Why Might Someone Want to Avoid KYC Verification in Crypto?

1. Privacy: The fundamental principle behind cryptocurrencies like Bitcoin was the promise of privacy and autonomy. KYC process, by its very nature, compromises this when they require KYC. For those who wish to preserve their anonymity, avoiding the KYC process is preferable.

2. Convenience: KYC exchanges can often be time-consuming and require a lot of paperwork. For users who want quick and seamless transactions with just an email address, the non-KYC crypto exchanges offer an advantage.

3. Freedom: Cryptocurrencies have always appealed to individuals seeking financial freedom, free from the reach of traditional banking systems and government regulations. The non-KYC crypto exchanges align with this ethos and crypto taxes do not get in the way.

4. International Accessibility: Not everyone has access to the necessary documents required for KYC on crypto exchanges, especially in underprivileged regions. No KYC crypto exchanges can thus provide a way for such individuals to participate in the global financial system and trade cryptocurrencies without KYC on non-KYC platforms.

Conclusion: Best No KYC Crypto Exchanges

Applying the laws of the traditional financial system when you want to trade crypto greatly restricts its efficiency and the purpose of its existence. A cryptocurrency exchange without a KYC-AML policy tends to fare better and have better product offerings.

The above-discussed list of cryptocurrency exchanges allows you to complete the account setup process without KYC within minutes.

Some non-KYC exchanges might still have some transaction limits and withdrawal limits set up to prevent any money laundering accusations but these go away when you become part of the authenticated accounts.

However, before registering with any non-KYC exchange, always check its terms and policy document, more specifically the trading fees, deposit, and withdrawal limits.

It is also a matter of safety for you to not share any of your personal information with any entity in the decentralized exchanges space.