After you purchase crypto, it’s time to decide whether you want to use a custodial or a non-custodial wallet to store crypto. I know you have questions related to them, about their functioning, their features and most importantly, which one will be the best for you.

It can be a little overwhelming to distinguish between these wallet types, which is why I will simplify and bring into your knowledge all you need to know about them.

So, let’s begin with what these wallets actually are.

Custodial vs Non-custodial wallet: Introduction

You all are familiar with digital wallets and the advantages of using them while trading. It is impossible to trade in the cryptoverse without them, right? And these digital wallets, based on their usability and functions, are divided into custodial and non-custodial wallets.

The exchanges that we trade on provide these wallets for their users to trade with. Wallets are used to store cryptos and funds to execute your transactions.

Public vs Private Keys

While trading, you might have gone through two types of keys, one is your public key, and the other is your private key. On one hand, a public key is like your home address; a public-facing data point to receive inbound cryptocurrencies and encrypt outbound transaction data.

And on the other, private key is the key to your house, used to safely transfer cryptocurrencies out of the wallet and prove ownership over any funds held inside. The private key is not to be shared, and in further discussion, this is the key I will be referring to.

So now, let’s discuss these custodial and non-custodial wallets in detail.

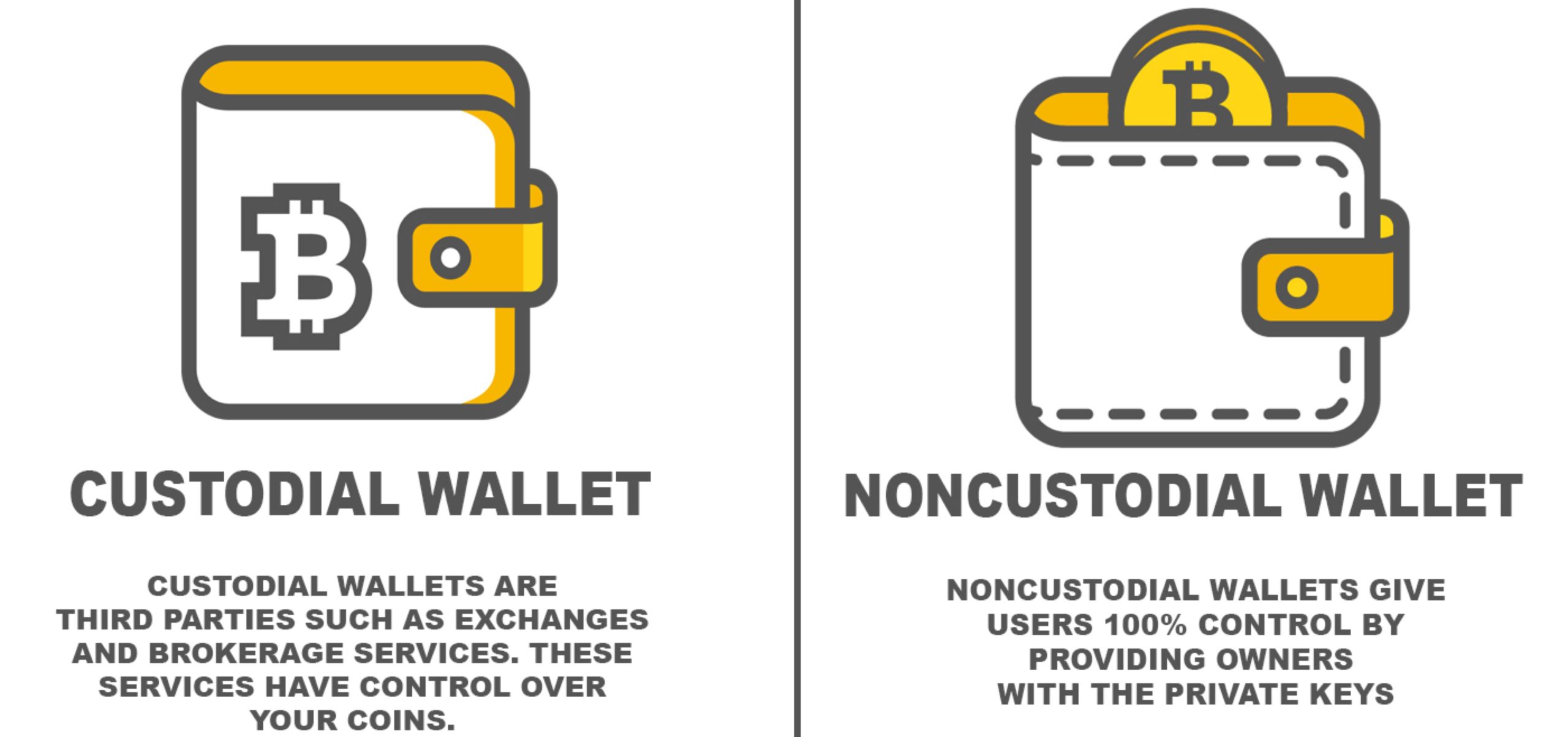

What is a Custodial Wallet?

As the name suggests, a custodial wallet service takes custody of your digital assets, which means that a third party, (the crypto exchange) would manage and handle your private keys. It can prove to be advantageous for new users. A blockchain analysis report suggests that 3 million BTC were lost due to losing their private keys.

This suggests that trading through a custodial wallet-equipped trading exchange would let the beginners trade without the hassle of handling the private keys themselves. It reduces the risk of misplacing those private keys.

As these exchanges have access to your wallet, you can easily retrieve your private key by contacting customer service and easily get them back.

What is a Non-Custodial Wallet?

On the other hand, non-custodial wallets offer you to have unshared access and full control over your cryptocurrency holdings and are suitable best for experienced traders only. If you forget or misplace your private keys, you will lose access to your wallet forever with no chance of retrieving them back.

Various decentralized exchanges have a non-custodial wallet as there is no centralized authority to share custody. Non-Custodial wallets are of different kinds; they can be either browser-based or software-based, computer or mobile device, or hardware wallets as well.

However, the hardware wallets are considered the safest, connected to a computer or a mobile phone through USB ports or Bluetooth. On these devices, though your transactions are carried out online, the signing in is done offline, eliminating the risk of a malware-infected device infecting your wallet and accessing it.

Now that you know what these wallets are let’s compare them based on different aspects.

Custodial vs Non-Custodial Wallets

Both the wallets provide distinct utility and features; now, I will be comparing them on these bases.

- Custody of Private Key

As I already told you, the major aspect of these wallets is custody. In custodial online crypto wallets, a third party manages the private key. And that is why some traders don’t prefer them because of the trust factor. Choosing a safe, regulated, trustworthy exchange as a custodial wallet is essential.

Coming to the non-custodial wallet, the custody is held with you, and you are entirely responsible for all the blockchain custodian services. That is why it becomes crucial to keep your private key safe and accessible anytime you need it, because of which it becomes difficult and complex for new users.

- Transaction Type

Another significant aspect is the reason why we opt for a wallet, and that is transactions. Both the wallets are pretty distinct in this aspect.

In the custodial wallet, transactions are executed through the exchange you opt for as the former leader. This means that all your transactions are carried out through those third-party exchanges.

A non-custodial wallet is the opposite, meaning all your transactions are reflected on the chain in real-time with no mediator. As soon as you buy or sell a crypto asset, the transaction is instantly carried out on the blockchain network.

- Security

Security is also a critical factor to consider while comparing them, as you want your trades to be executed with all the top-notch security measures there can be.

In the case of a custodial wallet, all the sensitive data and funds are stored in either a hot or a cold wallet. Hot wallets are online wallets, and the data, as well as the funds here, are saved on the network.

Whereas cold wallets are offline and are distributed around the globe by various exchanges to keep them secure from cyber-attacks and theft.

As there is a centralized entity in custodial wallets, the exchange you choose to use as the custody holds critical importance to the security of your wallet.

On the other hand, in a non-custodial wallet, all the information remains with the users, thereby reducing the risk of data theft unless you share the details with someone. You are safe unless all your hardware devices are safe and you don’t share your passwords with anyone.

Recommended Read: Difference between Hot and Cold Wallets

- Backup and Recovery

This aspect changes the overall scenario of the comparison.

In a custodial wallet, there is an option to regain access to your data in case you misplace or forget the private key. As the key is shared in custody with the third-party exchange, requesting the key from the exchange and getting it back is easy.

Well, it is not the same with a non-custodial wallet, where you are the sole authority, and if you lose the key and the recovery phrase, your access is lost forever.

- Offline accessibility

When you access your funds or other details and login into the custodial wallet, the request is sent to the centralized entity, which is all carried out online in the presence of an internet connection.

But that is not the case in a non-custodial wallet, as the login is carried out offline and significantly reduces the risk of a cyber breach.

- Future Variability

As decentralization and web3.0 gain pace, non-custodial wallets will continue to get an edge over custodial due to the threat of data breaches and hacks. Non-custodial wallets surely eliminate the risk of theft.

And the comfort of not being liable for losing access when losing a private key will be soon implemented through some means in non-custodial wallets as well.

And that is why I recommend beginners to start their trading journey with a custodial wallet and then, after understanding them well, switch to non-custodial ones.

Custodial Wallets Pros and Cons

Pros

- No significant effect of lost private keys: On a custodial wallet, there is no hassle of remembering your private or public keys instead they require just the profile password that you can retrieve easily if you forget by any chance using your email address.

- Higher backup possibility: The central authorities and the exchanges offer backup facilities making it easy to restore a previous version or undo any transaction.

Cons

- Custodian’s control over your money: One of the most significant disadvantages of a custodian wallet is that you do not have 100% control over your wallet. It is shared with the centralized authority, and the third party has complete control over your funds and transactions. They can even freeze your accounts if needed, which means having less ownership of your account.

- Relatively Expensive: Custodial wallets are comparatively expensive when it comes to the fee structure of these platforms. There are various transaction fees, gas fees and network fees associated with exchange accounts on these platforms which make a custodial wallet provider expensive.

- Need for KYC: Custodians strictly want you to go through KYC and AML procedures which verify your account through the customer’s identity verification. You cannot access your funds or any other wallet features without proving your identity. Often these procedures take time until the exchanges approve them and become quite a hassle for some traders.

- Data breach threat: Even though there is a very minimal chance since a central authority handles your wallets with impenetrable security protocols implemented by most exchanges, there can be a chance of data breach and theft.

- No offline facility: Internet connectivity is a must for logging in to the wallet or executing a transaction. It can be a little disheartening for some users as, in case of emergencies, you won’t be able to access your account in areas with no internet connectivity.

Non-Custodial Wallets Pros and Cons

Pros

- Control over funds: The key reason for the popularity of a non-custodial wallet is that it provides crypto users individual access to their funds. It ensures you have complete control over your wallet with no middle entity.

- Safe Funding: As all the information and customer funds in the wallets lie solely with them with no central authority in the process, the risk of security breaches becomes minimal. Therefore, it makes all your funds and transactions safe.

- Instant withdrawals: Withdrawals in non-custodial wallets don’t require confirmation from a third party for executing crypto transactions. This makes the overall trading experience much more seamless and more straightforward.

- Anonymous trading: Non-custodial wallets don’t require lengthy KYC or AML procedures and offer you don’t need to share your personal information with the exchange. Therefore, keeping their user’s data unshared and out of bounds.

Cons

- More responsibility: In non-custodial crypto wallets, you hold sole responsibility for all your account-related processes, including the funds and keys. And that is why the responsibility of managing and keeping your account safe increases on you. Because of this, new traders should first get a proper understanding and experience with the custodial wallets.

- User Interface: To be honest, the overall functioning of a non-custodial wallet is comparatively a little more complex. It takes time to master and get familiar with its interface, which can be quite a hassle for some.

- Keys lost means funds lost: If you lose your key and the seed phrase, you will lose access to your wallet with no chance of backup and recovery. With so many cases of crypto assets of traders lost due to this, it is essential to keep your private key secure and accessible.

Now, let’s discuss the best custodian and non-custodian wallet-enabled exchanges currently in the market that you can use with safety and profitability.

Custodial wallet-supported exchanges

Some significant custodian exchanges are

- Free Wallet

- Binance

- BitMex

- Bitgo

- Holy Transaction

- Blockchain.com

These are some of the most popular and reliable crypto exchanges with millions of users from around the globe.

Non-Custodial wallet-supported exchanges

Major non-custodian exchanges include

- Ledger Nano X

- Trezor Once

- Model T

- Ledger Nano S

- Electrum

- Exodus

- Zengo

- Wasabi

- Trust wallet

These are among the best non-custodial crypto wallet exchanges, which are safe and offer great functionality.

Conclusion

When comparing both custodial and non-custodial, it can be seen that both of them have different use cases. Where custodial wallets reduce the complexity, on the other hand, non-custodial wallets give you complete ownership and freedom of your funds and account.

And when the question arises of which one is the better option between the two, the answer lies in your requirements. Multiple reports suggest that most users (66%) around the globe are opting for a non-custodial wallet for their decentralized organization. However, the difference is not so much.

Therefore, the decision lies upon you, of which among the two will you use. And it is important to choose wisely.

And if you are new to crypto trading, I highly recommend using a custodial wallet for a hands-on experience. Then when you are familiarized enough, you can switch to non-custodial wallets. The wallets are excellent utility tools and help in seamless and profitable trading.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023