What Is Decentralized Finance (DeFi)?

The present financial system doesn’t provide equal opportunities to all.

It is centralized and thus accessible to only a few who have created it. That’s why there is a never-ending inequality around the globe.

There are many pitfalls of this centralized financial system as it only serves a few. To name a few pitfalls:

- Unequal access

- Censorship

- Time-bounded

- Counterparty risk

- Lack of transparency

- Lack of accountability

- Intermediaries & exorbitant fees etc..

The best system would be which gives fair access to all and equal opportunities. But the present system only provides leverage to a handful of people and all the wealth making ways are just limited to these guys.

This is evident in Oxfam research also that says ‘ The richest 1% now has as much wealth as the rest of the world combined’.

Isn’t it unfair??

Defining DeFi [Decentralized Finance]

Enter #DeFi

DeFi is the new way of finance, and it is called as Decentralized Finance.

To simply put:

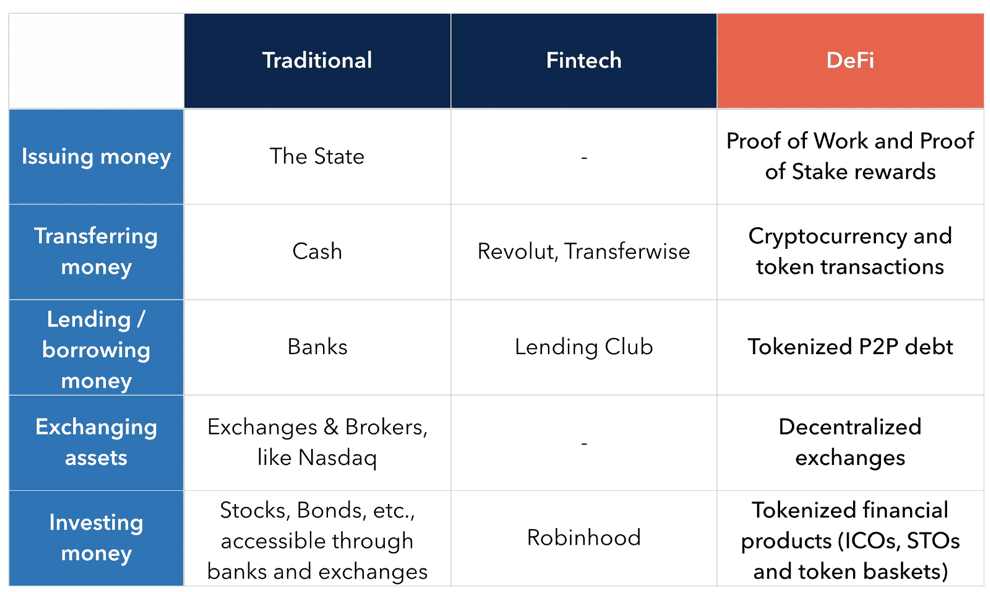

Everything that you know in today’s centralized financial world if put on decentralized infrastructure through public blockchains like Ethereum or Bitcoin, is decentralized finance.

So what all is centralized in today’s financial world:

- Mortgages/lending

- KYC & identity verification

- Trading (bonds, derivatives, equities, cryptos, etc.)

- Insurance

- Escrow

- Custodianship etc…

These are some of the bulk of things that are centralized in today’s financial world.

If these are unbundled and made decentralized using public blockchains like Ethereum or Bitcoin, it can unleash a wave of prosperity for the deprived 4 billion people.

But are these 4 billion people ready for it? That’s a question to ponder…

And I think they have never been so ready as they are now. So lets us see in the next section what being ready for DeFi truly means?

Are We Ready For DeFi?

Being ready for DeFi means, do we have the basic brick and mortar required for a decentralized economy?

These basic brick and mortar include:

#1. Smartphones: 3.8 billion people would be using smartphones by 2021

#2. Internet penetration: 3.2 billion people (50% of world’s population) would be online by the end of 2019

#3. Digital banking: Digital banking crossed 2 billion users last year.

#4. Public blockchains: Public blockchains like Bitcoin & Ethereum exist now.

The last important requirement is being fulfilled by blockchain- a technology that makes making trustless transactions possible without relying on a third party.

From so many years, this was the missing piece that we had been waiting for to create decentralized and trustless solutions. But with the innovative application of blockchain in Bitcoin has helped the world perceive the power of blockchains.

That’s why it is no exaggeration to say that the world is more than ready for decentralized finance based on open and public blockchain technologies like Bitcoin or Ethereum.

Also, it is no surprise that the fintech players have already started building and playing with the new decentralized financial tools and some of them we are going to see in the next section

Applications Of Decentralized Finance

Applications of decentralized finance are increasing across the globe like wildfire and why not also when some applications of finance don’t need that much scalability as consumer applications would require.

However, it also doesn’t mean that financial transactions are trivial but at present, the demand for such DeFi solutions is also limited.

Hence many fintech players are building and testing their products for niche customers who are comfortable with the new learning curve of decentralized financial applications.

As of now decentralized finance has been able to carve out their place in following niches and they are popular also called as open finance platforms:

- Payments: xDAI, OmiseGo

- Stablecoins: DAI, USDC, USDT

- Infrastructure: 0X, Settle

- Exchanges: AirSwap, Loopring, tZero

- Tokenization: Harbor, Polymath

- KYC & Identity: Civic, SelfKey

- Decentralized derivatives: dYdX, VariabL

- Marketplaces & Escrow: Ethlance, Origin

- Prediction markets: Augur, Gnosis

- Mortgages & Lending: BlockFi, Dharma, Celsius

- Insurance: Nexus Mutual

- Custodial Services: MetaMask, Trust Wallet

- DeFi Data & Analytics: LoanScan, Stablecoin Index

Benefits Of Decentralized Finance

Benefits of implementing and using decentralized finance application are manifolds. Some of the benefits are right in front of our eyes to see but some are more complex ones that will be emerging once we reach a critical mass adoption.

For now, let’s look at some of the obvious ones:

#1. Escaping the authoritative regimes

Right now China is censoring almost everything by using AI and IoT devices by implementing a social credit score system. It is no brainer to think that they aren’t censored financially. But by using decentralized payment applications residents of China and similar countries will be able to claim back some of their privacy.

Also, using DeFi applications in places like Venezuela is an efficient way to divest from the falling economy and bundle up your wealth in decentralized finance instruments like BTC or ETH to re-establish yourself somewhere else.

#2. Cheap cross border transactions

Using DeFi applications, one can easily transact from any part of the globe to any other remote place with a fee that is orders of magnitude lesser than the traditional ways.

Last year, $194 million was moved using Bitcoin with $0.1 fee this is the true power and cost-efficiency of blockchain based payments.

Right now the global average fee is 7% for cross border transactions, which means for every $100, you would be paying $7 as a fee.

And do you know $7 is the one-day living cost in many third world nations and DeFi can help save these extra dollars which go into feeding intermediaries…

#3. Wider accessibility for financial products

“Only when borrowers have access to efficient credit networks can they escape from the clutches of loan sharks” – The Ascent of Money

This is a fact, but cheap credit hasn’t simply been available for people in countries like Somalia, Zimbabwe, India, Srilanka, etc. because the residents are scattered in vast geography with almost no credentials or KYC documents.

That’s why traditional financial business considers them a liability rather than an asset.

But with smartphones and DeFi applications, it is much more feasible for financial services to serve these people and provide low-cost financial services such as credit, insurance, etc.

#4. Censorship resistant transactions

Almost everyday Trump-like politicians keep censoring payment across borders by putting economic sanctions on various countries. It results in too much inconvenience to the residents, but no one cares.

This happens mainly because the global payment system is too much dependent on SWIFT and thus much easy to censor. But with DeFi applications like Bitcoin wallets and Ethereum wallets, payments cannot be stopped or censored by politicians or economic sanctions.

#5. Being their own bank

One of the ultimate goals of everyone across the planet is to save the wealth they already have.

But this is not easy when you have inflationary central banking policies in all the countries of the world or like the 2013 bail-ins of Cyrpus where 40% of Citizen’s wealth was confiscated by banks to pay their shareholders to keep the banks afloat.

With DeFi products you will control your wealth with your private keys and no one can either bail-out or bail-in your wealth without your permission.

Who Should Be Worried & Who Should Be Happy?

Needless to say:

The traditional financial system should be worried about the DeFi movement.

But I am not a doomsday guy who likes to proclaim that banks will die tomorrow. Instead, I believe that they will have to adjust to this DeFi movement to become a part of it.

If not done, they will surely extinct.

On the other side, the average joe somewhere in Cambodia or India should be very happy because the financial services that they have longed to get are now coming at their doorstep.

The maximum they have to do to take advantage of it is to stay updated and increase their digital literacy including their understanding of blockchains like Bitcoin.

The good news is:

They don’t need to look very far for that because here at TheMoneyMongers we are doing the same by helping you upgrade your crypto and blockchain literacy.

So don’t forget to share us with your friends and family.

If you liked this article, do share it with your network on Twitter & Facebook !!

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023

Contents