The easiest way to start earning interest on your BTC or cryptocurrencies is by opening a crypto/Bitcoin savings account with popular crypto lending services.

Opening a crypto lending/savings account with them will fetch you anywhere between 4-7% interest on your crypto holdings which is way too much than what you get from the banks. Especially in a world where many government bonds have negative yields.

Many crypto lenders are mushrooming across the globe, but in my opinion, not all are worth your time. Some of the players that I feel are worth pay attention are these:

[wptb id="12304" not found ]Best Places/Ways To Earn Interest On Crypto Assets?

All these crypto lending players are doing a fantastic job serving the market and allowing investors/crypto holders to do more with their crypto assets.

But all are slightly different from each other.

When you compare the interest rates offered and the flexibility of withdrawal of your deposits, Celsius wins over the others.

| Best Celsius Network Alternatives | Quick Links |

| BlockFi [Bonus up to 250$] | Try Now |

| Celsius | Try Now |

| YouHodler | Try Now |

| Nexo | Try Now |

#1. BlockFi

BlockFi app is another popular US-based crypto platform that lets you buy, lend, and borrow cryptocurrencies. If you wish to deposit BTC or ETH, you should consider BlockFi because it offers a 6.2% APR on your deposits, calculated and distributed monthly.

Coming to crypto-backed loans, BlockFi allows you to borrow money at as low as a 4.5% interest rate. However, BlockFi charges a 2% loan origination fee – something users should keep in mind.

#2. Celsius

Celsius is a US-based cryptocurrency lending and borrowing platform that offers loans at competitive interest rates and allows you to earn interest on your crypto holdings.

You get a 7% APR for your stablecoin deposits with Celsius, but it is quite low for ETH and BTC. You will get around 3.9% APR for ETH and 3% APR for BTC deposits, calculated and distributed every Monday.

When it comes to loans, Celsius offers loans at 25%, 33%, and 50% LTV at an interest rate of 1%, 6.95%, and 8.95%, respectively.

#3. YouHodler

When it comes to stablecoins like USDT, YouHodler provides a 12% APR interest rate which is the highest in the industry, provided you hold for a year. It also offers a high APY on cryptocurrencies like MATIC, DOT, and UNI.

When it comes to withdrawal, you can expect the funds to be processed the same day, but BlockFi reserves the right of up to 7 days to process withdrawals.

YouHodler provides crypto loans at up to 90% LTV, one of the highest in the industry. It also offers Multi HODL and Turbocharge features, making it an amazing choice for advanced crypto users.

#4. Nexo

Nexo is a UK-based FinTech company that offers services across the globe. In the US, it’s regulated by the US SEC and is completely trusted. It offers up to 12% APY on crypto deposits and provides loans at a competitive interest rate of 6.9%.

Lastly, in my opinion, if you are from the United States, you should consider BlockFi for your deposit accounts and Nexo or Celsius for the rest of the world.

Why Start Earning Interest In Your Crypto Accounts?

Earning interest on your bitcoins and altcoins wasn’t possible a few years back, but now with increased liquidity and recognition from investors around the world, this has become possible.

But now, Crypto collateralized lending makes it possible for lenders (investors) to earn an extra buck on their idle sitting crypto capital.

Moreover, this is in no way a new concept.

The wealthy millionaires have been using this age-old method of making their money work for them by lending the extra capital they have in some form or other.

In the traditional world, investors/borrowers usually use real estate or stocks or bonds to issue or get loans and accordingly do more with their capital holdings.

Similarly, in the cryptosphere, anyone with extra bitcoins or cryptocurrencies can lend them to the borrowers to earn a fixed interest rate on their lendings.

How Do These Services Give Best Crypto Interest Rates?

There is no rocket science in this business model.

It is the same way banks operate. These crypto lending services take your deposits and lend them further to vetted borrowers at a 10-16% interest rate and give you 4-7% interest from that share.

The balance amount generated from the difference in the interest rate of lending and savings accounts is the profit margin of these crypto lending platforms. This margin also accounts for the risk these players are taking by holding your cryptos and further lending it out.

Moreover, your funds are only lent to vetted individuals or institutions against over-collateralized assets of the institution or the individual, just like crypto-backed loans for borrowers.

How Do You Earn Interest On Crypto Assets?

So this way, you can expect to earn extra passive income on your idle sitting crypto assets, including BTC, ETH, or other altcoins and stablecoins.

You need to verify yourself on any of the above-listed platforms and complete your Bitcoin/crypto deposits to get started with this.

Once these funds are confirmed over the blockchain, they start accruing interest as per the agreed rate.

Depending upon the platform you choose for your savings account and the type of cryptos you deposit, along with the market conditions, decide the interest rate you will receive.

But there are services in the market that pay up to 7% interest on certain coins.

Also, in terms of payment, these services differ a bit. Some services like BlockFi will pay you interest in the BTC or ETH depending upon what you have deposited.

Celsius does the same. If you deposit BTC, you get the interest in BTC and ETH for ETH deposit.

On the other hand, some like Nexo like to pay in BTC for any deposit you keep with them. And I guess Nexo also does the same when you hold your stablecoins with it, and they also pay dividends in BTC to Nexo token holders.

Here is the approximate estimation of holding 1 BTC with BlockFi in their crypto savings account:

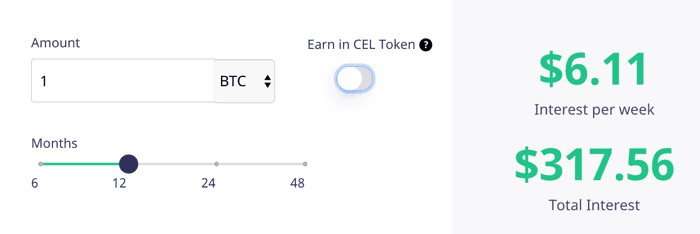

Also, here are the projections for holding 1 BTC with Celsius at the current USD value of Bitcoin:

Clearly, BlockFi is winning over Celsius if we see from an interest accrued point of view.

Best Practices to Earn Interest on Crypto Assets

Until now, we have discussed how you can earn interest by depositing funds in your crypto interest account. However, depositing a few thousand dollars worth of Bitcoin and letting it sit in your crypto accounts for a few months won’t make you rich. You’ll have to manage your capital wisely to earn significant benefits from it in the long run.

Here are some best practices to follow if you want to earn good interest in your crypto deposits.

- Find the Interest Payments Account

The first and most important step in earning handsome interest payments is choosing the right interest account. There are dozens of good providers that offer attractive returns of up to 18%. However, don’t make hasty decisions by believing what the providers claim to offer.

Do some in-depth research to find how the lending works on the platforms. Some factors to keep in mind are:

- The earned interest rate on each crypto

- Lock-up period and payout terms

- Simple interest vs. compound interest

For instance, Celsius Network says it offers up to 17% returns on crypto deposits. But if you delve deeper, you’ll find that it only offers 17% returns on SNX, and that also if you accept CEL payment. Otherwise, the interest rate (or APY) is 8.88% for stablecoins and 6.20% for BTC.

Therefore, it’s critical to conduct proper research. You should look for an interest account as if you’re searching for a bank account.

- Research Cryptocurrencies

The next essential thing to do is research cryptocurrencies. This step may not apply to you if you already own a large amount of a digital asset like Bitcoin, ETH, or a stablecoin. But if you’re planning to buy crypto first and then earn interest on it, picking the right crypto is essential.

Usually, what investors do is see which crypto is receiving the best returns. Then, they purchase large amounts of that crypto, hoping to earn massive returns. That’s not the right approach. Any platform won’t be able to deliver promised returns if a crypto’s value suddenly depreciates.

Therefore, it’s essential to buy a cryptocurrency that has strong fundaments. As of now, Cardano (ADA), Polkadot (DOT), and Binance Coin (BNB) have shown significant future potential.

- Diversify Your Portfolio

Even after doing a lot of research, there’s so 100% guarantee that the cryptocurrency you pick will flourish. Therefore, it’s essential to follow the traditional investing rules and diversify your portfolio.

Diversification means buying and depositing different cryptocurrencies instead of putting all your money in one asset. Let’s do some math to understand this better.

Suppose you invest all your money in Bitcoin. Luckily, Bitcoin has exhibited a stellar 68% growth in the past two months (July August). But in May-June, BTC also lost around 50% of its value. This might hinder your ability to earn consistent returns.

However, if you invest a portion of your investment value in a stablecoin like USDT or USDC, you can hedge yourself against those losses. Since these currencies are regulated, crypto lending companies are confident in offering high returns on them.

You can invest some portion in an emerging cryptocurrency, like ADA or DOT, showing strong upside potential. Lastly, you can invest a part of your funds in crypto, on which the platform is offering the maximum returns. It’s SNX in the case of Celsius and MATIC for YouHodler.

All in all, you should divide your portfolio into four parts:

- 25%: Invest in a popular, in-demand cryptocurrency that has exhibited positive growth recently, such as BTC or ETH.

- 25%: Invest in a stablecoin like USDT, USDC, or PAXG for consistent returns.

- 25%: Invest in rising cryptocurrencies, like DOT and ADA, with future potential.

- 25%: Invest in high-return cryptocurrencies specific to each lending platform.

You can also diversify your interest-bearing accounts by depositing your assets in one account and the remaining assets in another. The aim is to diversify as much as possible.

Note: Though these suggestions are backed by expert knowledge and in-depth research, you shouldn’t consider them financial advice. Be sure to conduct proper research at your end before making any financial or investment decisions.

- Leverage Compounding Interest Rates

You probably already know about the difference between simple and compound interest. If you don’t, here’s a quick explanation. Let’s say an interest account offers 10% simple interest paid out monthly.

This means you’ll earn 10% every month on your initial deposit. If you deposit $10,000, you’ll earn $1,000 every month, which is certainly not bad. In one year, you’ll double your investment.

Now, suppose an interest account offers 10% compound interest paid out monthly. Here, if you deposit $10,000, you’ll earn $1,000 in the first month, and they’ll be added to your account. Your new balance will be $10,000 + $1,000 = $11,000.

When the next month starts, the 10% interest will be calculated on $11,000. Hence, by the end of the next month, you’ll have $11,000 + 10% = $12,000. This cycle will go on, and in one year, you’ll have $25,937. This is the power of compounding!

- Think for the Long Term

There are two ways to earn from crypto. The faster way is to trade cryptocurrencies in the live market and earn huge returns in less time. However, it comes with a significant downside risk as well.

The slower way is to earn interest on crypto holdings for the long term. The interest you accrue in six months or one year may not be significant, but it will multiply significantly over five to ten years.

Therefore, it’s essential to think of long-term instead of short-term profits. When you deposit assets in your account, keep them for at least one year.

- Prioritize Security and Insurance

The final step is to find a platform that offers top-notch security. While the crypto market has come a long way, security remains a major threat to crypto companies and users. Therefore, be sure to examine the security of the cryptocurrency exchange you use for trading crypto.

You should consider two key factors when choosing a crypto platform.

- Does the platform implement essential security measures like cold storage wallets, two-factor authentication, etc.?

- Is the platform insured? Since cryptocurrency isn’t legal tender, it isn’t eligible for FDIC insurance. However, several providers offer insurance via their custodians.

Some Frequently Asked Questions:

- Is Bitcoin Interest-Based?

No, Bitcoin isn’t an interest-based instrument, but by arbitraging on its price movements and thus lending/borrowing it, you can generate interest on it. Like banks do, but this is quite risky.

- Can Bitcoin Earn Interest?

No, Bitcoin cannot earn interest by itself. It has no intrinsic value, but interest can be generated based on its price movements, just like crypto margin exchanges do.

Conclusion

But I want you to know that most cryptocurrencies like Bitcoin are self-sovereign money.

Meaning they are to be held and taken care of by the owner only by design. That’s why handing it to someone else is counterintuitive to the very reason they were conceived for!!

Many crypto investors keep their Bitcoin and other cryptocurrencies in deep cold storage- the right way. While some careless ones also keep them on crypto exchanges that are prone to crypto hacks !!

But in any case, just holding your cryptocurrencies doesn’t increase your wealth. (except the price appreciation part of the underlying asset).

For example:

If you hold 1 BTC, which you bought for $2000, it may be $10,000 now, but your 1 BTC remains the same; it doesn’t become 1.15 or 1.25 BTC.

But what if it could become?

So these were some of the specially designed crypto lending and borrowing services that take care of this complex process in a risk minimized way.

Hence earning interest on your crypto currency digital assets is one of the best ways for a crypto investor to earn in crypto markets.

By making a significant initial investment and depositing your crypto asset in a wallet that provides high APY, you can generate good passive income in the long run.

However, the key to earning good returns is to start investing early. Most investors enter the market late and expect quick returns. They move to highly volatile crypto trading end up making losses.

It’s essential to be patient and deposit your assets for the long term in wallets that offer the highest interest rates.

I hope you liked this detailed article on earning interest on your cryptocurrencies. If you liked it, please do comment below, and we will strive harder to bring more such informative content for you in the future !!

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023