With the advent of cryptocurrency in mainstream news, seasoned traders are looking toward this asset class as a way to hedge or diversify their portfolios and crypto options are one of the lucrative ways to do it.

Even though this space is rife with rug pulls and malicious actors, there are above-board methods of making money from them.

This article discusses a few exchanges that let you do the same depending on your need for anonymity (a cornerstone of the crypto manifesto), or any geographical restrictions that might hinder this.

Although new exchanges are popping up by the day, traders need to bet on the safer horse in this case, rather than the exciting and new one.

How & Where To Buy Crypto Options?

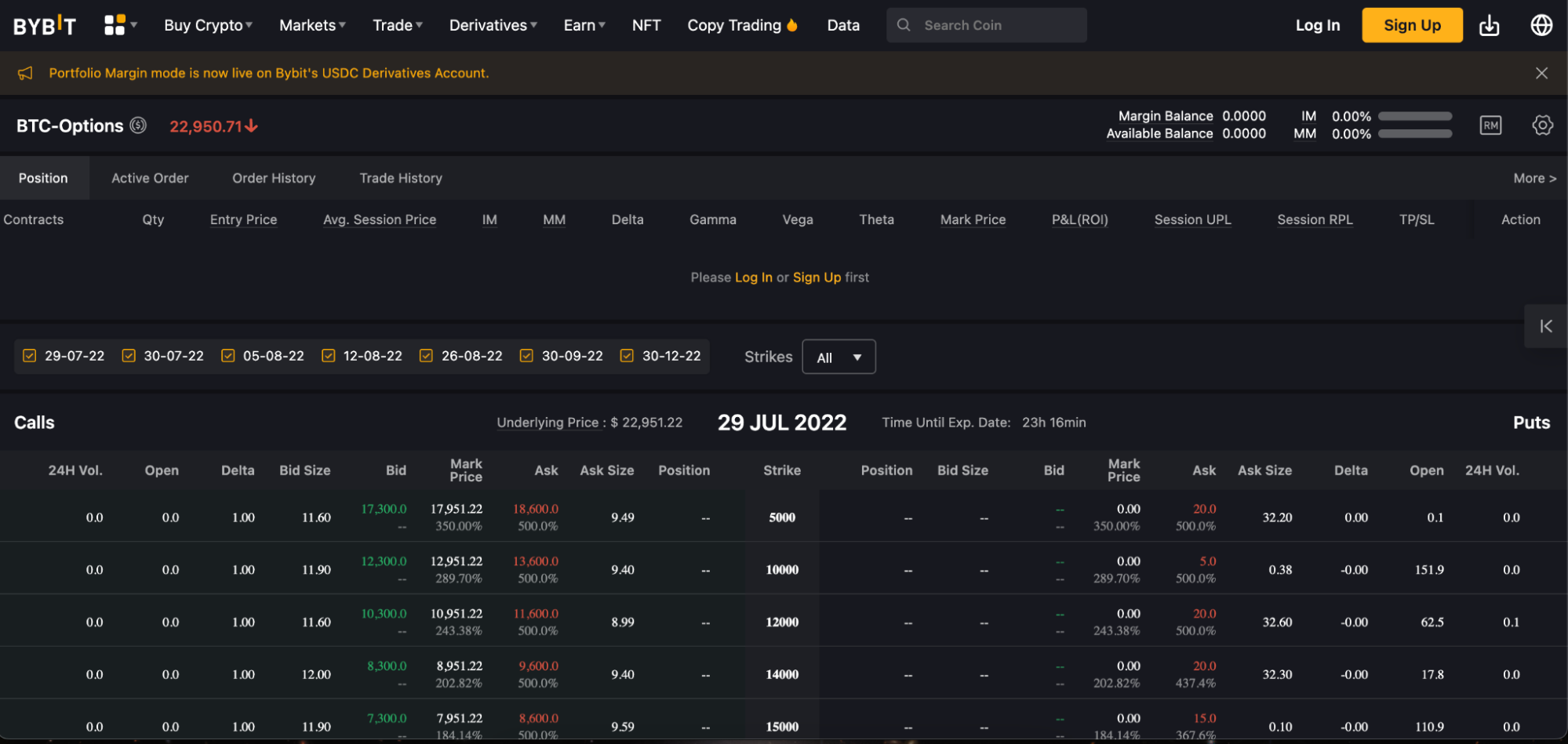

#1. Bybit

Boasting 99.99% system functionality ensuring minimal downtime, a cold wallet for storing user funds to safeguard against hackers, and a lightning-fast API to facilitate high-frequency trading.

Bybit is headquartered in Singapore with offices in Hong Kong and Taiwan and was established in March 2018.

The platform offers a variety of options contracts, namely Daily, Bi-Daily, Weekly, Bi-Weekly, Monthly, Bi-Monthly, and Quarterly for its varied customer base. This can get a little confusing and it is best to go through their FAQ2 page before taking the plunge.

Currently, only European-style, USDC-settled Bitcoin options can be traded here.

This might be a problem for someone who keeps up to date on the news in the crypto space with a couple of ‘stablecoins’ having lost their peg and struggling to gain it back, it is a risky bet to take.

Especially with an options contract that settles in 3 months. Things tend to change very quickly in an industry as volatile as this.

….read our detailed Bybit review here.

When it comes to trading fees, Bybit has introduced the concept of tiers wherein the lowest rung is users who have traded less than $5M in the last 30 days who are charged a maker-taker fee of 0.03%, up to users who have traded $300M or more are charged a taker fee of 0.015% and a maker fee of 0.012%.

Bybit’s services are available globally except for the USA which is on the list with countries like Iran, China, North Korea, Sudan, and Syria to name a few.

Although there is no need for KYC and a simple phone number/email address will do, the risk element is too high in case there is a crackdown.

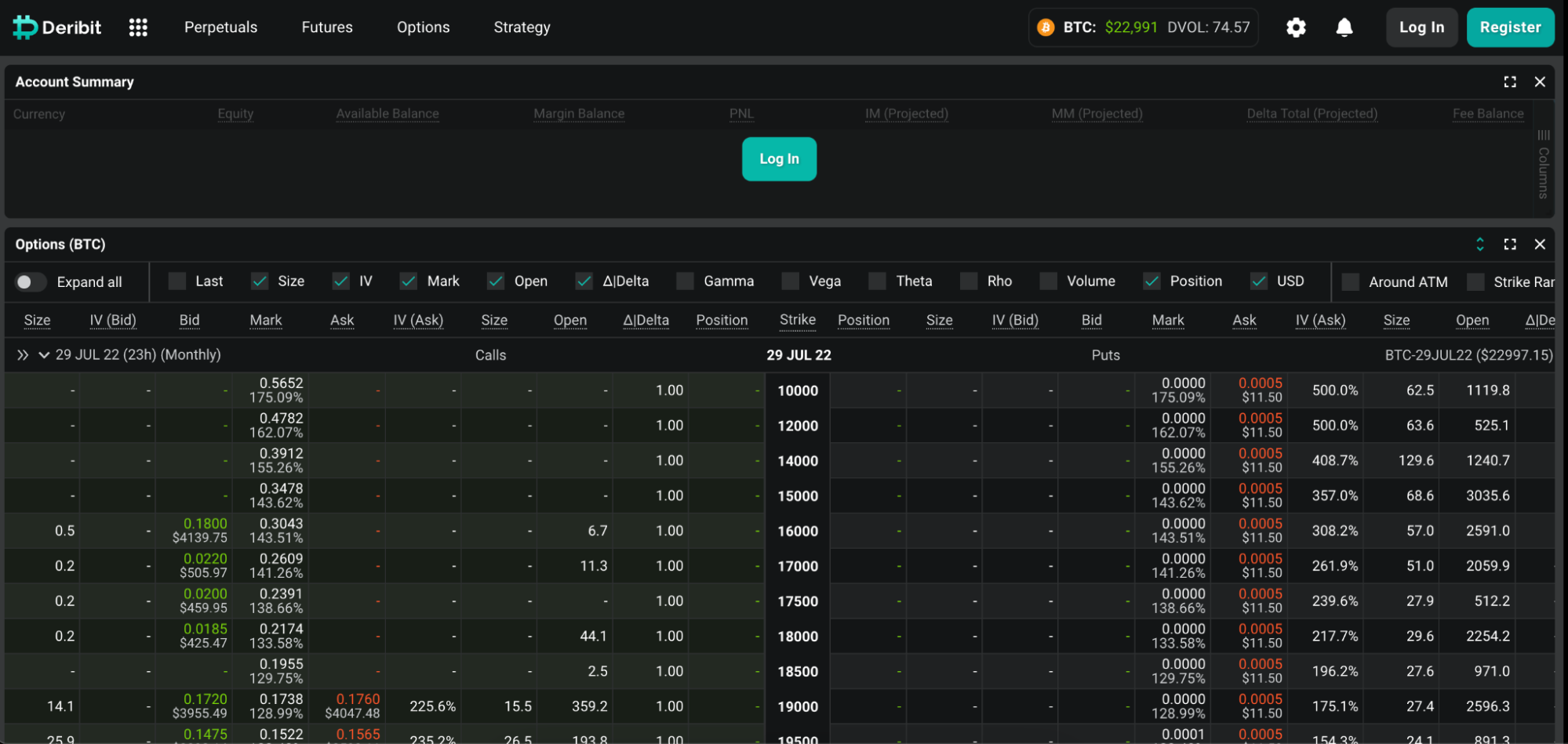

#2. Deribit

Headquartered in Panama City, Panama, Deribit was started in 2016, after two years of intense development, and has quickly become the go-to platform for options trading.

Currently, it offers BTC, ETH, and SOL derivative contracts for options that are cash settled in the European style, i.e. the options can only be exercised at expiry and the writer of the options contract pays out any profit due to the holder at the time of expiry.

Deribit uses the maker-taker model and charges 0.03% of the underlying or 0.0003 BTC/ETH/SOL per options contract, capped at 12.5% of the options’ price.

The platform looks to have upped its KYC requirements in the recent past, and now needs new customers to do a liveness check to make sure the photo on the ID matches the person using the account.

This might be a deal breaker for people looking to make their trades anonymously but this is the price you pay to work on a reputed platform and not get cheated out of your money.

….read our detailed Deribit review here.

Another thing the platform has going for it is that it is licensed to conduct derivatives business in the USA.

This is a big plus as it allows institutional investors that are wary of wading into crypto to feel safer as the business is licensed and everything is above board.

Liquidations are charged an additional fee of 0.19% of the underlying asset or 0.0019 BTC per options contract, and 0.16% of the underlying asset or 0.0016 BTC per contract is added to the insurance fund.

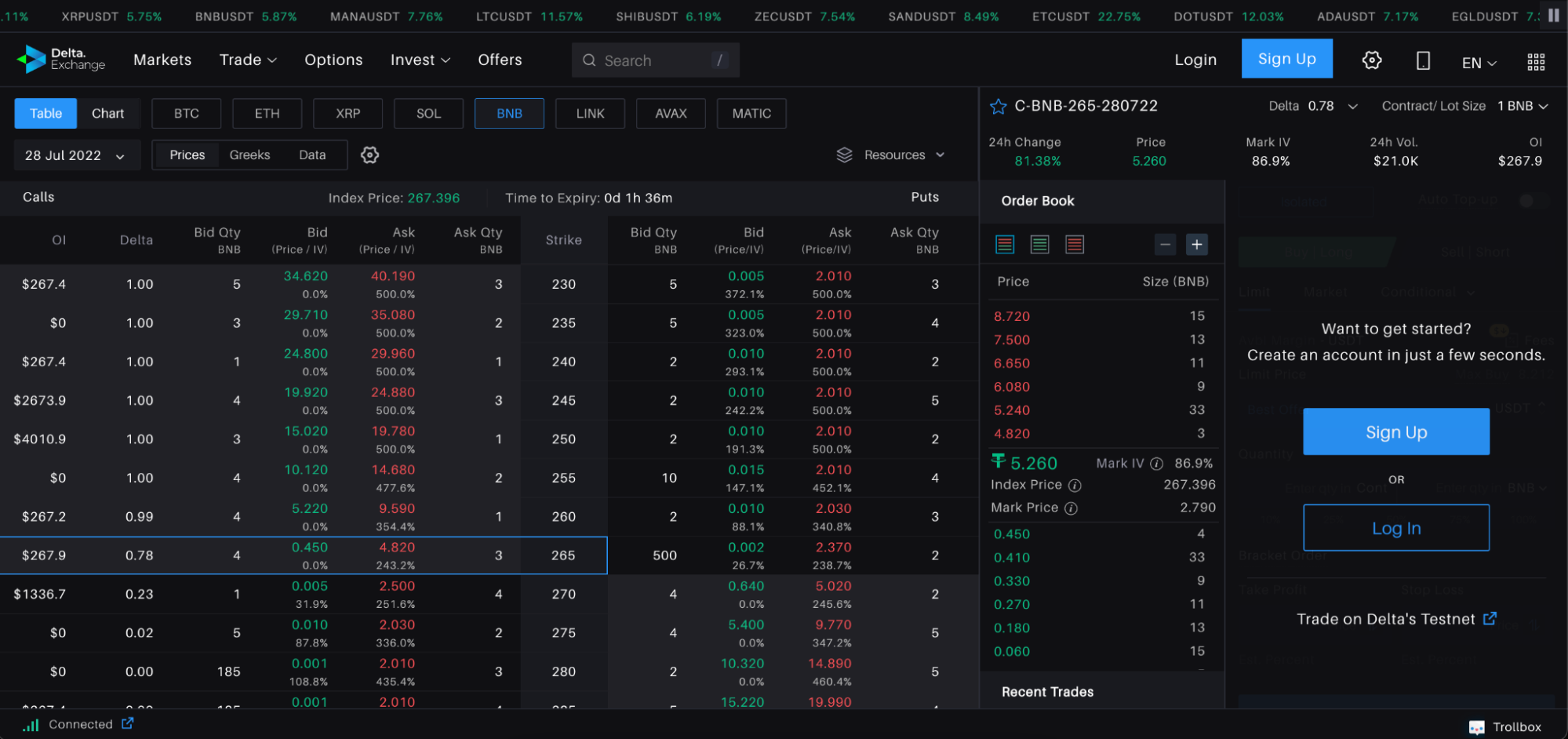

#3. Delta.Exchange

Delta.Exchange’s strength lies in its options trading catalogue, which includes BTC, ETH, XRP, SOL, BNB, AVAX, and MATIC. The lengthy list makes it the #2 player in the crypto options space, with close to 25%4 of the market share.

They have a flat fee structure for the maker, taker, and settlement fees, of 0.05% with a cap of 10% of the premium of that option.

This is to prevent excessive losses on deep out-of-money positions. The exchange also has its currency $DETO (Delta Exchange Token), which if you hold more than 2500, withdrawals are majorly 0 fees.

Headquartered in Kingstown, Jamaica, and started in 2018 Delta has been backed by some of the biggest names in the venture capitalist space, namely Sino Global, Aave, Coinfund, and Kyber Network.

….read our detailed Delta Exchange review here.

The exchange seems to also be ahead of its competitors in offering innovative products like Calendar Spreads, Interest Rate Swaps, and Turbo options on Bitcoin.

It is very simple to get started and only requires basic information unless you wish to withdraw 2 BTC a day, or have 5 BTC in your account. In that case, basic KYC is required.

This exchange gets its footfall from the United Kingdom, Australia, Netherlands, and Sweden, but is unfortunately not available in the United States of America yet. To know more about the exchange, you can check how Delta.exchange compares to ByBit.

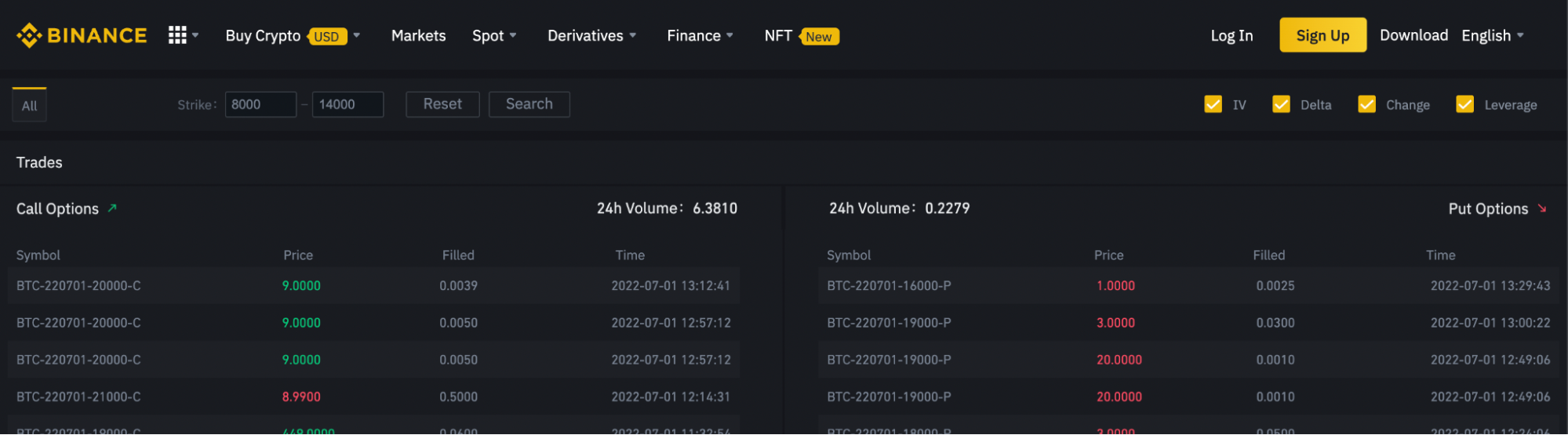

#5. Binance

It is impossible to be in the crypto trading space, and not have heard of the name of Binance. At least where I come from, Binance is synonymous with cryptocurrency trading.

This scale is seldom achieved without a great user interface, which Binance has. It works for a new entrant into the space, as well as someone who does it day in and day out.

The exchange offers European-style vanilla options that cannot be exercised before the expiry date.

The maker-taker fee, as well as the delivery fees, are tiered6 according to the 30-day trade volume, and extra discounts can be received on the fees by simply holding some amount of $BNB (Binance’s native token) in the trading account.

Currently, Binance offers only Bitcoin options to be traded but is looking to expand the offering to compete with ByBit.

A private company registered in Malta and led by the socially active (read Twitter) founder Changpeng Zhao, Binance has made multiple acquisitions in the crypto domain and has turned into a one-stop shop for anything relating to crypto.

….read our detailed Binance Exchange review here.

Due to their sheer size and volume, there are frequent allegations of mischief and wrongdoing on their part, none of which have been proven to this day.

Binance has a separate product available in the USA called binance.us because of the stringent regulations associated with crypto trading in the country. This product does not allow the user to conduct options trading.

Although KYC is not required to make an account on the exchange, use basic functions, and perform limited transactions, it is required to identify yourself for full access and higher deposit and withdrawal limits.

Fees

- Trading Fee – is charged when a trade is either opened or closed. Most crypto leverage exchanges tend to use the maker-taker model for this process.

- Delivery Fee – will be charged when the option is exercised

- Liquidation Fee – is charged in addition to other fees in case of liquidation

FAQs:

– How to trade crypto options in the US?

Crypto options are a little tricky to trade with the crypto derivatives markets being heavily regulated in the country.

There are a few licensed platforms that can offer derivatives services like FTX US Derivatives which has contracts for both Bitcoin and Ethereum, or Deribit which additionally has Solana contracts as well.

– Can you trade crypto options on Coinbase?

As of 24 June 2022, Coinbase has rebranded newly acquired1 Fairx to Coinbase Derivatives Exchange as a starting point for offering derivatives as part of their product.

With regards to crypto, only futures contracts are offered for Bitcoin at 1/100th the current price. (If the notional price is $30,000, the futures contract is worth $300) Although not mentioned separately, it can be safely assumed that options trading is just around the corner.

– How to buy puts in crypto?

Using the basic definitions of calls and puts, traders tend to devise personal ways to work with how they think the market will change.

A few strategies that utilize puts to make money in a bidirectional market are long puts and married puts.

With the long put strategy, the trader is betting that the market price falls below the strike price at the time of expiration.

This will earn the trader multiples of their initial investment. Again, this strategy works because a put is a right to sell the asset at the price higher than the current market price

A married put strategy is essentially the upgraded version of a long put, where the trader buys the underlying asset as well.

This works as a hedging technique to protect against any downward movement in the market. In such a case, the long put covers the incurred loss.

Conclusion

Just like regular options trading, crypto options are not for the faint of heart or new traders. The potential returns are huge, but a small miscalculation can lead to a quick loss of initial capital.

With time as the liquidity in the cryptocurrency market increases, there will be a barrage of companies offering these services but for now, it is best to look for the cryptocurrency day trading exchanges that have deep order books and have been regulatorily compliant for an extended time.

As per the research done for this article, Binance is a clear frontrunner to start your options journey owing to its intuitive interface if it is available in your jurisdiction.

For our readers from the USA, FTX US Derivatives seems to be the best choice for regulatory safety, and FTX is one of the most trusted names in the space.