The crypto derivatives segment is an inspiring space, especially for those who want to churn money from the insane volatility of crypto assets.

Sometime back, this space was dominated by only a few exchanges, and one of those was BitMEX.

Launched in 2014, BitMEX carries the first-mover advantage in the market and has popularized crypto leverage trading. It is the first crypto exchange in the market to offer a leverage of 100X.

But today, in this blog, we will be talking about some of the best alternatives to BitMEX because many players are now challenging the status-quo of BitMEX by building better products.

Best BitMEX Alternatives You Shouldn’t Overlook

- Bybit

- Phemex

- PrimeXBT

- Deribit

- Margex

- BaseFEX

- Binance

- Delta Exchange

- Quedex

- Binance JEX

Let’s explore them one by one:

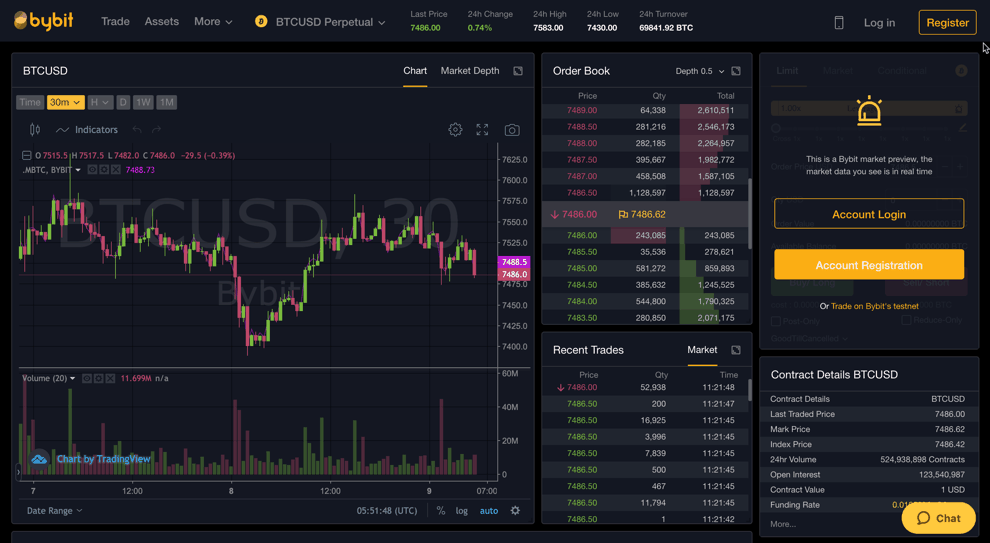

#1. Bybit

At first look at the website, it seems like a gaming website, but hell no.

It’s a Singapore-based crypto derivatives exchange launched in March 2018 and a popular BitMEX alternative. It offers crypto-based perpetual contracts and primarily specializes in crypto-to-fiat perpetual swaps with 100:1 leverage.

In just a short period, ByBit has emerged as a popular crypto trading platform for derivatives traders and managed to build up enough liquidity. It consistently ranks in the list of top 5 crypto derivatives exchanges by trading volume.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Bybit has an advanced trading platform & some of its features include:

- State-of-the-art matching engine: The platform can support up to 100,000 transactions per second, which is ten times the industry’s speed. And each transaction is settled within 10 milliseconds.

- Clean trading interface and offers a wide range of trading tools for technical analysis.

- Asset security: All the funds are kept safe in a hierarchical deterministic cold wallet system, and manual withdrawals are processed three times a day.

- Deposits and withdrawals are supported in BTC, ETH, EOS, and XRP

- No server downtime

- ByBit also allows P2P trading

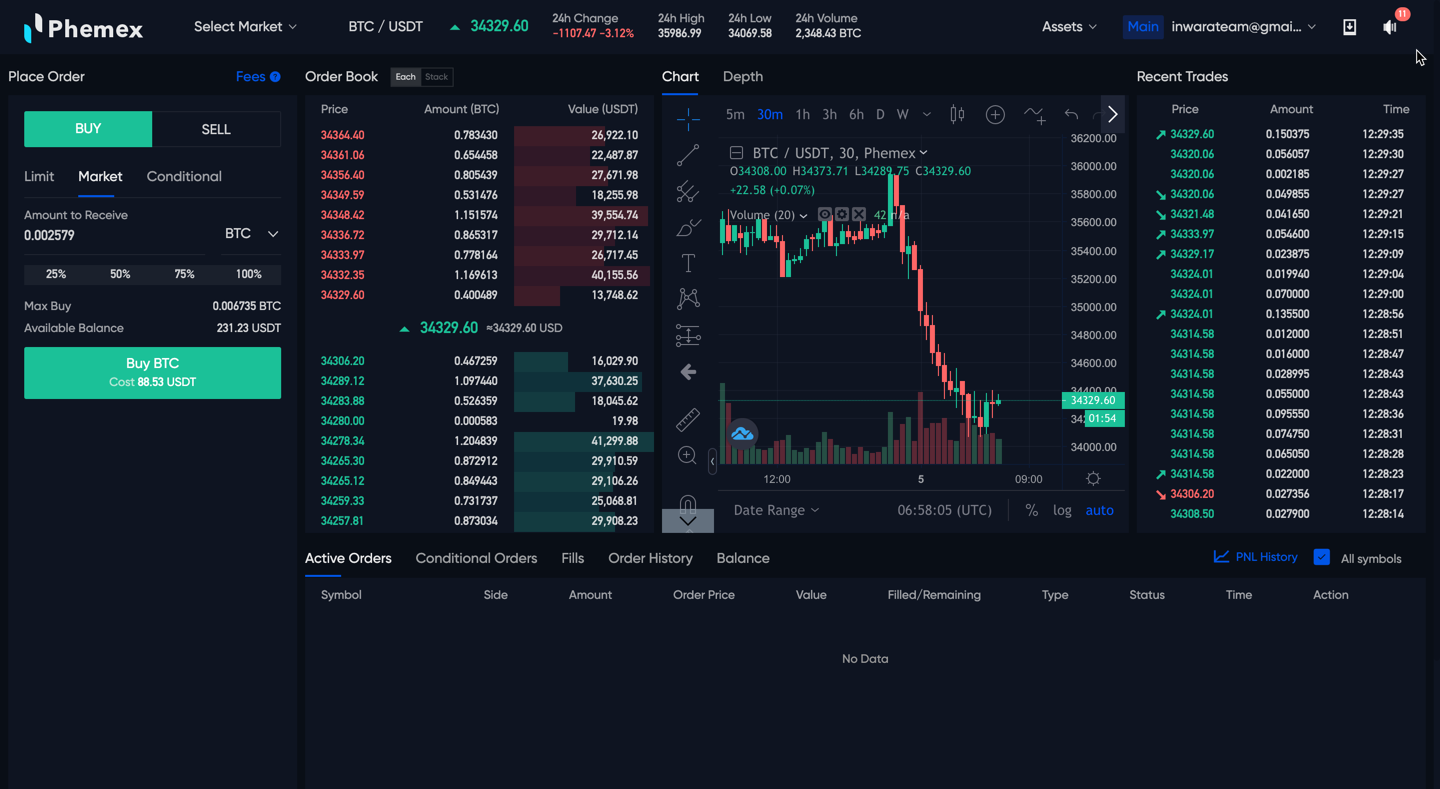

#3. Phemex

Phemex is a global cryptocurrency and derivative exchange headquartered in Singapore and launched its operation in November 2019. The exchange was co-founded and led by 8 former Morgan Stanley executives and is one of the fastest exchanges in the world.

The exchange has attracted over a million users in a short span and enables both spot and futures trading in over 35 crypto pairs. It offers a leverage of up to 100X.

The exchange clocks an average daily trading volume of over $1.1 billion.

Phemex has the most liquid market in the cryptosphere and is integrated with 30+ liquidity providers, which helps it to prevent order slippages and instant execution of trades. The platform can handle up to 300K+ orders per second and process transactions in less than 1 millisecond.

Other advanced functionalities include FIX API for institutional traders and sub-accounts for quantitative traders.

It has a flat trading fee structure, in which it offers a rebate of 0.025% to market makers and charges 0.075% from market takers. All the contracts on the platform are settled in USD.

Also, Phemex doesn’t charge any deposit or withdrawal fee.

#4. PrimeXBT

PrimeXBT is an award-winning margin trading platform registered in Seychelles and was founded in 2018.

It supports leveraged trading in five different crypto assets, including BTC, ETH, XRP, LTC, and EOS. The exchange also allows you to trade global financial markets using Bitcoin, USDT, USDC, and many more.

Alongside digital assets, it also offers trading in traditional financial products like indices, forex, and commodities.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

Features of PrimeXBT platform:

- Anonymous account, no KYC required and takes just 40 seconds for account set-up.

- Bitcoin deposit and withdrawal

- Tight spread and deep liquidity provided by over 12 integrated liquidity providers

- Fast order execution with less than 7.12 MS latency

- Offers 100X leverage on crypto derivatives and 1000X on EUR/USD pair

- Uses industry-leading security mechanism with the majority of assets stored in cold storage

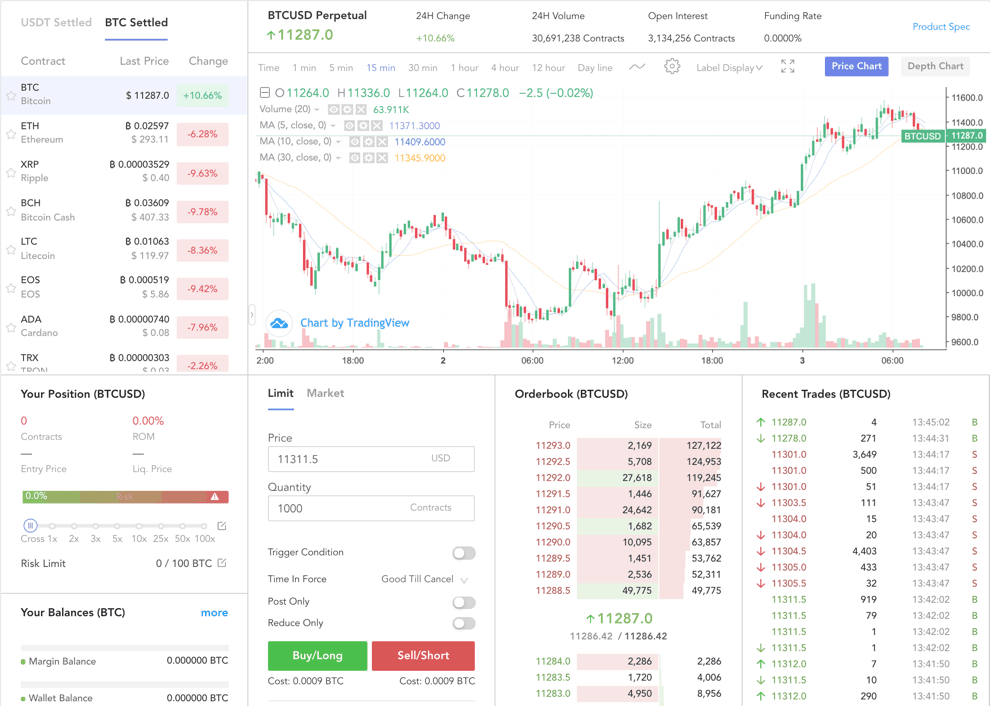

#5. Deribit

Deribit looks like one of the best BitMEX alternatives. It offers trading in cryptocurrency futures contracts and options.

The platform’s name is derived by combining the first letters of words “derivatives” and “Bitcoin.”

Deribit is based out of Amsterdam, Netherlands, and the project was launched in 2016. You can trade Bitcoin and Ethereum options, quarterly and perpetual futures contracts.

Currently, it does not accept users from the US and Netherland; however, you can use VPN to sign-up on Deribit as it is a no-KYC exchange.

Features of Deribit are:

- Trade futures with up to 100X leverage

- Trade options with various strategies with up to 10X leverage

- Ultra-fast trading engine with less than 1-millisecond latency

- Maximum security as 99% of bitcoin kept in cold wallets

- Competitive fee structure

#6. Margex

Margex is a Seychelles-based cryptocurrency derivatives trading platform founded in August 2019 that allows you to trade in cryptos with leverage as high as up to 100X.

It supports trading in only six crypto pairs, BTCUSD, ETHUSD, LTCUSD, EOSUSD, XRPUSD, and YFIUSD.

The exchange offers deep liquidity and offers combined liquidity of 12+ exchanges in one place. Other platform features include an average order execution time of 8 milliseconds, can execute 100,000 trades per second, 24/7 support.

It gives special attention to a safe and secure trading environment. It includes a bank-grade multi-layer security system, MP Shield System- an AI-based algorithmic technology for price manipulation protection, a 100% cold offline wallet system.

It also offers traders a seamless and decentralized payment system, in which you can make fiat deposits in 150+ fiat currencies through 400+ payment options.

Margex is a beginner-friendly platform and has a competitive trading fee structure. It charges a maker fee of 0.019% and a taker fee of 0.060%.

#7. BaseFEX

BaseFEX is a Seychelles-registered and Hong Kong-based crypto exchange that launched its services in Oct 2018. It is backed by blockchain, one of China’s biggest VC funds in the crypto world, and ZhenFund.

You can trade BTC, XRP, LTC, BCH, EOS, and BNB perpetual swaps with a leverage of up to 100X.

The exchange has got the highest security for itself and is rated A+ in Mozilla’s Observatory Test; only four cryptocurrency exchanges have achieved this standard. Other security features on the platform include 2FA and a 100% cold wallet system.

It has a comprehensive API that enables a seamless trading experience and can execute millions of trades, and offers 24/7 customer support.

The trading fees on the platform are quite competitive. It is divided into seven levels based on the last 30-day trading volume. Maker fees start from 0.020- 0.005%, and taker fees start from 0.060-0.030%.

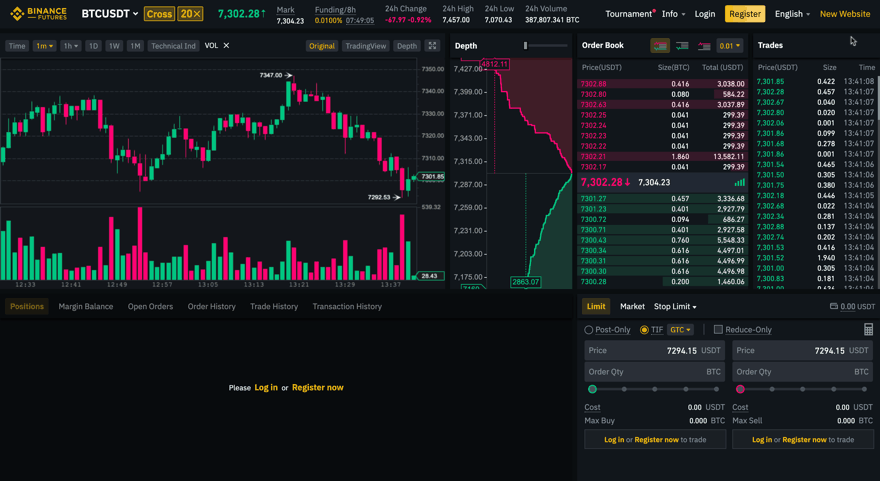

#8. Binance Futures Exchange

Binance Futures is the segment leader and grosses an average daily trading volume of over $60 billion. The exchange offers users the highest leverage in the industry and has the widest range of trading instruments.

The futures segment of the cryptocurrency exchange was launched in early 2020 and provides a comprehensive marketplace to trade crypto derivatives.

It offers trading in COIN-M Futures (quarterly and perpetual contracts settled in cryptocurrency), USDT-M Futures (perpetual and quarterly futures settled in USDT), Binance Leveraged Tokens, and Binance Options. The maximum leverage offered to users on the platform is 125X.

You can choose from over 90 contracts, including USDT and Coin-M instruments.

Binance Futures exchange is known for its industry-leading trade matching engine that can manage up to 100,000 TPS with a minimum latency of 5 milliseconds, a user-centric platform with 24/7 global customer support, and unparalleled liquidity to trade efficiently with minimum slippages.

The trading fees on the platform are pretty competitive. For USDT-M contracts, the maker and take fees start from 0.020% and 0.040%, respectively. While for COIN-M contracts, the maker and take fees start from 0.010% and 0.050%, respectively.

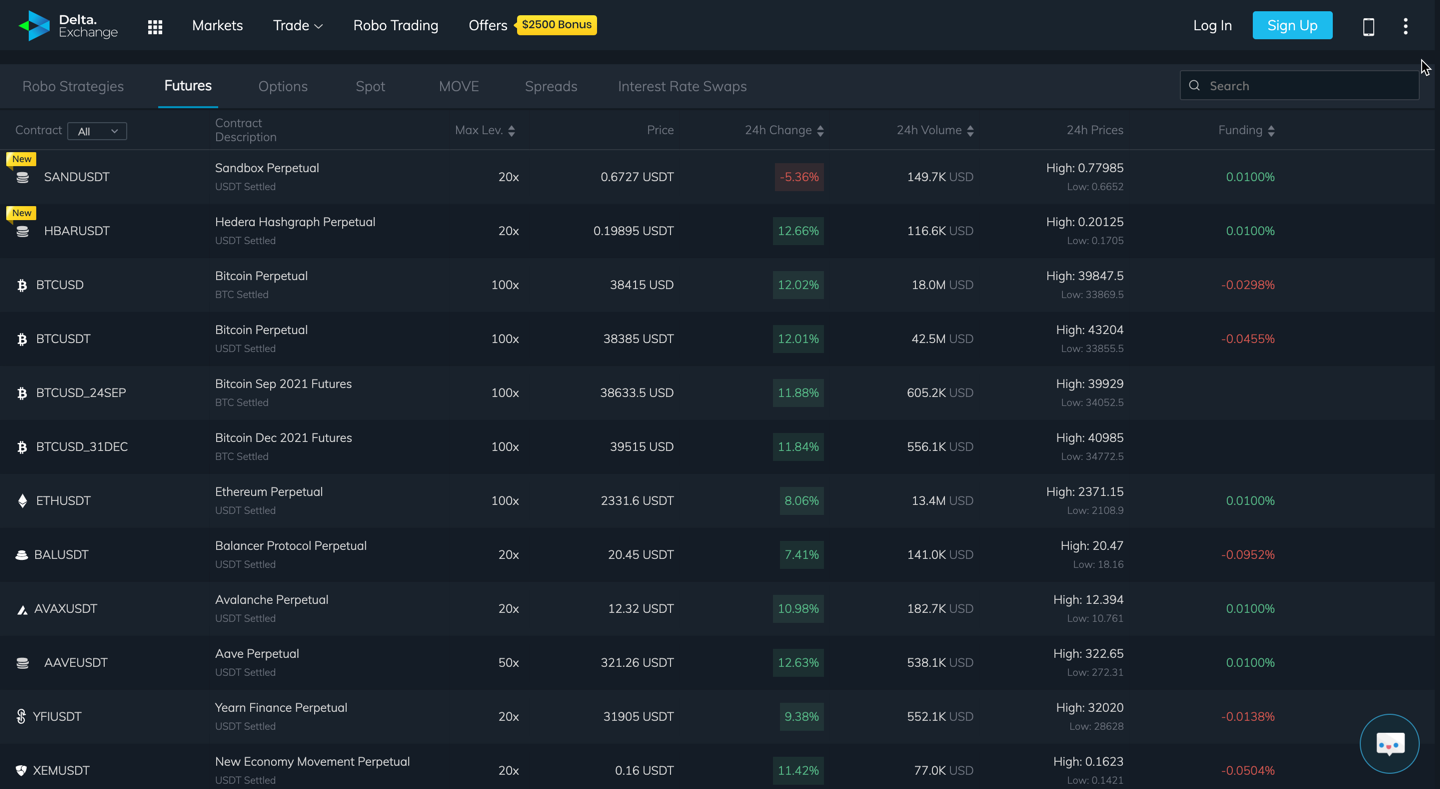

#9. Delta Exchange

Delta Exchange is a Singapore-headquartered crypto derivatives exchange and was founded in 2018. The exchange is backed by marquee investors like Kyber Network, AAVE, Sino Global Capital, BR Capital, CoinFund, etc.

It has the widest range of crypto-asset offerings in the derivatives segment with leverage as high as 100X.

In offers trading in the futures and perpetual swaps on 35+ crypto assets, with up to 100X leverage, spreads (difference in the price of two futures contracts with leverage up to 200X), options trading on BTC, ETH, LTC, XRP, BCH, BNB, and LINK, MOVE contracts, and interest rate swaps.

The exchange has a quite intuitive trading interface suitable for both retail and institutional traders and a powerful trade matching engine complemented by an intuitive trading interface and lightning-fast APIs.

Being an institutional-grade exchange, it has enterprise-grade multi-factor security for digital assets. And all withdrawals are processed with manual review.

The trading fees on the platform are quite competitive. For inverse futures and USDT linear futures, it charges a maker and taker fee of 0.02% and 0.05% respectively. And, for ALT-BTC futures and options contracts, it charges a flat rate of 0.01% and 0.05%, respectively, for all trades.

There is no minimum deposit limit, and for unverified accounts, the daily withdrawal limit is $10,000.

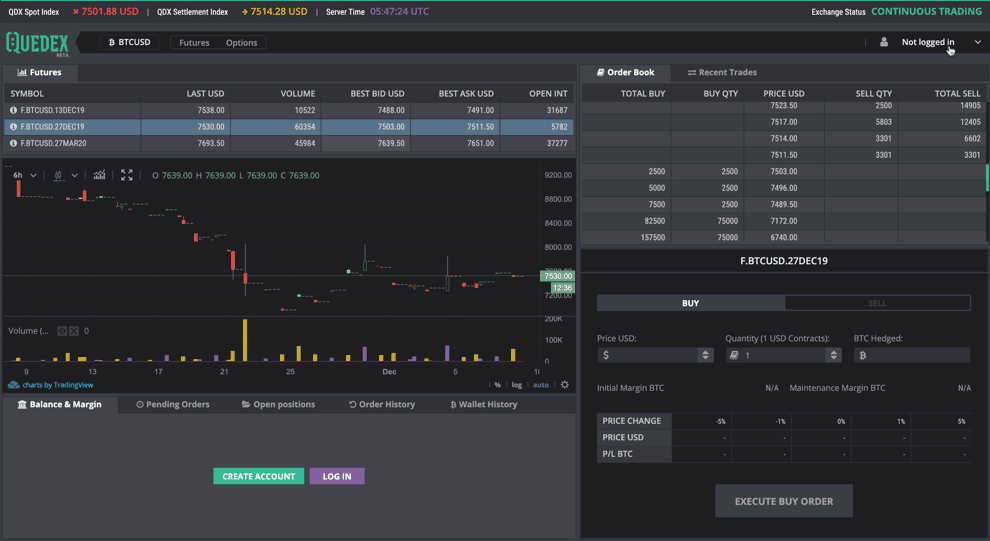

#10. Quedex

Quedex is a new entrant to the crypto derivatives market that allows managing risks through BTC futures and options.

The exchange is licensed by Gibraltar Financial Service Commission, the world’s only licensed crypto futures and crypto options platform. The benefit that even big crypto trading platforms like BitMEX and Deribit lack.

Features of Quedex:

- World’s first consistent Bitcoin-only futures and options exchange.

- Options are fully compatible with the inverse futures standard.

- Volatility trading allows trade and hedge in both directions at once using strategies

- 10X leverage on both bitcoin futures and options

- Uses auction-based bankruptcy prevention mechanisms that prevent negative balance on the trading account

- Highly secure as 100% bitcoin balance is kept in a cold wallet

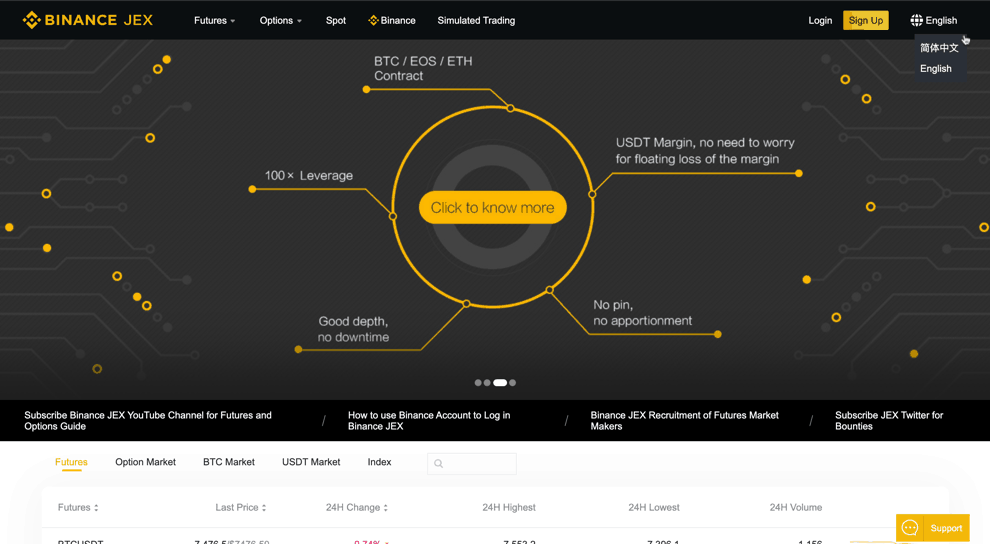

#11. Binance JEX

To fortify its position in the crypto trading business and boost derivatives offering, Binance acquired the Seychelles-registered crypto derivatives platform JEX.

The JEX exchange supports spot trading, BTC futures, trading options.

With advanced technologies like GSLB, distributed server cluster, distributed storage, cold e-wallet, hot e-wallet with offline private keys, high-speed matching engine, JEX provides an unparalleled security mechanism to promote steady and reliable trading transactions.

Compared to other derivatives trading platforms, JEX supports trading in ETH/BTC, LTC/BTC, JEX/BTC, BTC/USDT, EOS/USDT, and ETH/USDT. With USDT, it has a large number of trading pairs in addition to BTC pairs.

JEX is the native currency of the platform and has several trading pairs with it.

Other features of the JEX platform include:

- Provides 100X leverage

- No registration required

- Provides USDT margin, which eliminates worry for floating loss of margin

- Provides good market depth with zero downtime

-

Is BitMEX better than Coinbase for Crypto Trading?

From November 25, 2020, Coinbase has disabled margin trading on the platform due to the regulatory restrictions in the US.

Therefore, you can rely on BitMEX for all your crypto derivatives trading requirements.

-

Why is BitMEX banned in the US?

BitMEX and all cryptocurrency derivatives trading platforms offering high leverage are banned from providing services in the United States.

Commodity Futures Trading Commission (CFTC) is a national supervisory authority in the US for futures and options trading. It also cooperates with the National Futures Association (NFA).

Since NFA doesn’t recognize crypto trading brokers as members, CFTC restricts crypto exchanges to offer margin trading to US citizens to protect the interest of small investors.

But, there is no blanket ban on crypto derivatives trading. US citizens can do margin trading with slight leverage of up to 5:1. There are quite a few US-based exchanges offering margin trading with leverage of up to 50X, but it is unavailable to US citizens.

Also, for exchanges to operate with up to 5X leverage, they require multiple licenses from several authorities in each state, which is a costly procedure.

Therefore, BitMEX and other crypto derivatives exchanges are banned from operating in the US.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Conclusion

In the last few quarters, the crypto derivatives market has grown bigger than the size of the crypto spot market, which is a healthy sign for any emerging market.

BitMEX alternatives are a natural choice for many crypto traders because of its liquidity, experience in space, and institutional-grade services.

But even BitMEX has been one of the best margin trading platforms for many traders. However, in recent years, the launch of several new-age crypto trading platforms has changed space dynamics and is attracting many new first-time users.

The exchanges discussed above are some great alternatives to BitMEX and are rapidly establishing themselves as a go-to futures exchange for trading crypto derivatives.

Among all the BitMEX alternatives discussed here, Bybit, Binance JEX, and Binance Futures score ahead with a large number of trading instruments offering flexibility to users, those who are looking beyond BTC and ETH futures.

In some crypto exchanges, liquidity can be an issue, but as the market matures, such issues will be a thing of the past. And, also exchanges are integrating themselves with multiple liquidity providers to address the lack of liquidity and reduce order slippages.

What do you think about the BitMEX alternatives, do let us know in the comment section below.