Both Celsius and Crypto.com are two of the best options when it comes to earning APY on your crypto holdings. These two are known for their lucrative APY rates, crypto-backed loans at affordable rates, and lower fees.

But when it comes to choosing the right platform between these two, most users are confused. Hence, to help you make the right decision, I am going to share a celsius vs crypto.com comparison.

So here we go:

Celsius vs Crypto.com: Introduction

What is Celsius?

Celsius Network is a well regulated, SEC complaint crypto lending platform that allows you to earn interest on your deposited crypto holdings or get a crypto backed loan.

The platform is built by HODLers by HODLers. Using Celsius, you can buy cryptocurrencies and earn a high yield on your crypto assets. Plus, you get to borrow crypto over 30 different cryptocurrencies.

Using the platform, you will be able to manage your crypto account and earn compounding rewards up to 15% APY.

Plus, as a qualifying user, you can get instant approval for a dollar or stablecoin crypto loan that too without any fees or credit checks. Plus, it covers all network costs and will never charge transfer fees, origination fees, or withdrawal fees.

Overall, the platform can be used for buying, earning, withdrawing, and transferring all your tracked crypto in no time.

What is Crypto.com?

Crypto.com is one of the top crypto exchanges out there. The company has been around since 2016, and it offers you a ton of features.

In comparison to Celsius, Crypto.com has a Crypto earn program that lets you earn higher APY. You can earn up to 14.5% APY on your crypto deposits and about 10% P.A on stablecoins.

Apart from offering you interest accounts, Crypto.com is a one-stop solution for trading crypto, investing, staking, NFTs, and crypto-wallets.

The exchange supports more than 250 different currencies plus comes with reasonable fees, and offers you lucrative discounts on trading fees if you hold CRO tokens (Crypto.com’s native token).

Celsius vs Crypto.com: Supporting Crypto Assets & LTV

When it comes to supported cryptocurrencies, the Celsius network has a higher number of coins than crypto.com. Celsius supports about 58 tokens, including stablecoins, gold tokens, and cryptocurrencies. Plus, the number of supported cryptocurrencies is growing only.

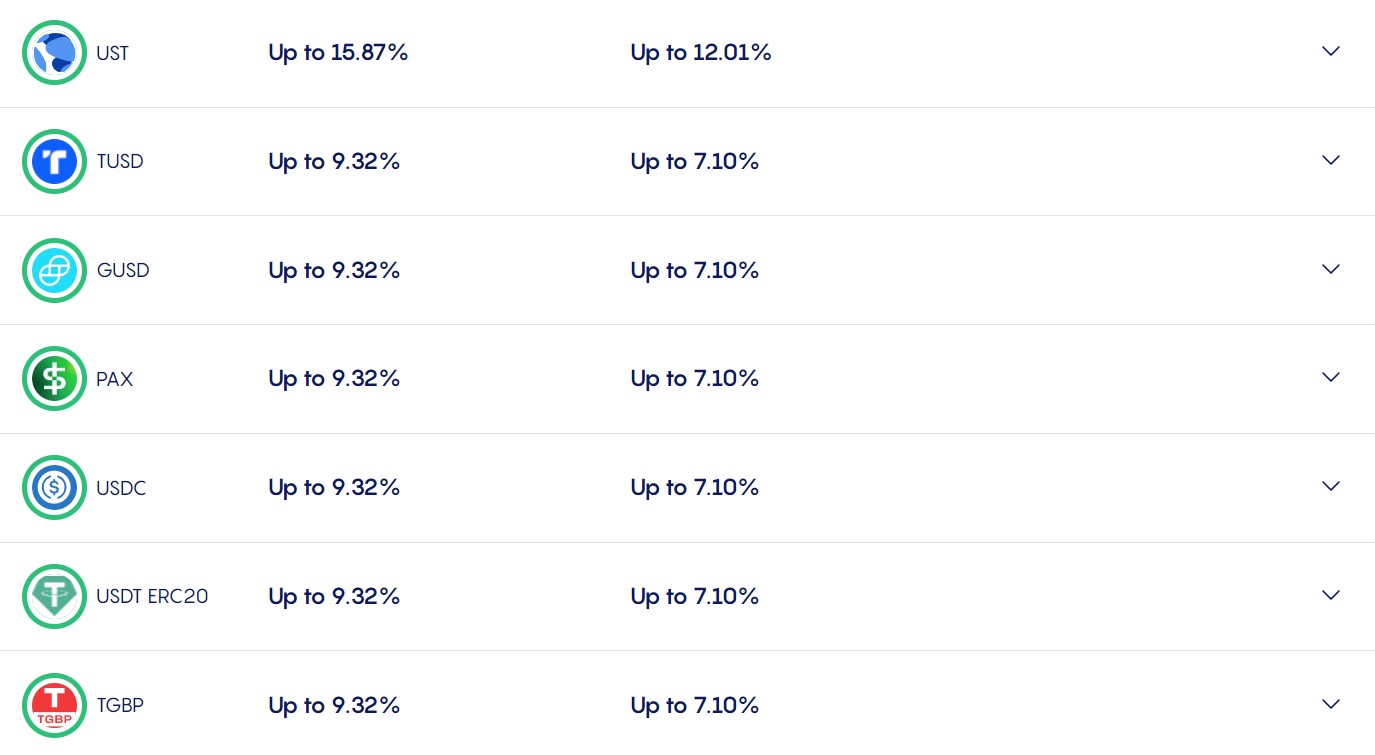

Some of the supported coins that Celsius has are UST, GUSD, PAX, TUSD, USDT ERC20, PAXG, DOT, MATIC, LUNA, CEL, ETH, WBTC, BTC, BCH, and many more. Also, depending on your crypto deposit, you will earn different interest rates.

When it comes to getting crypto backed loans using Celsius Network, you will enjoy an LTV of up to 50%, which is a common thing with most other platforms.

However, crypto loan interest rates would vary depending on your LTV. For instance, if you use 25% LTV, you will have to pay a 2.95% APY, but if you use 50% LTV, the payable interest rate would be 8.95%.

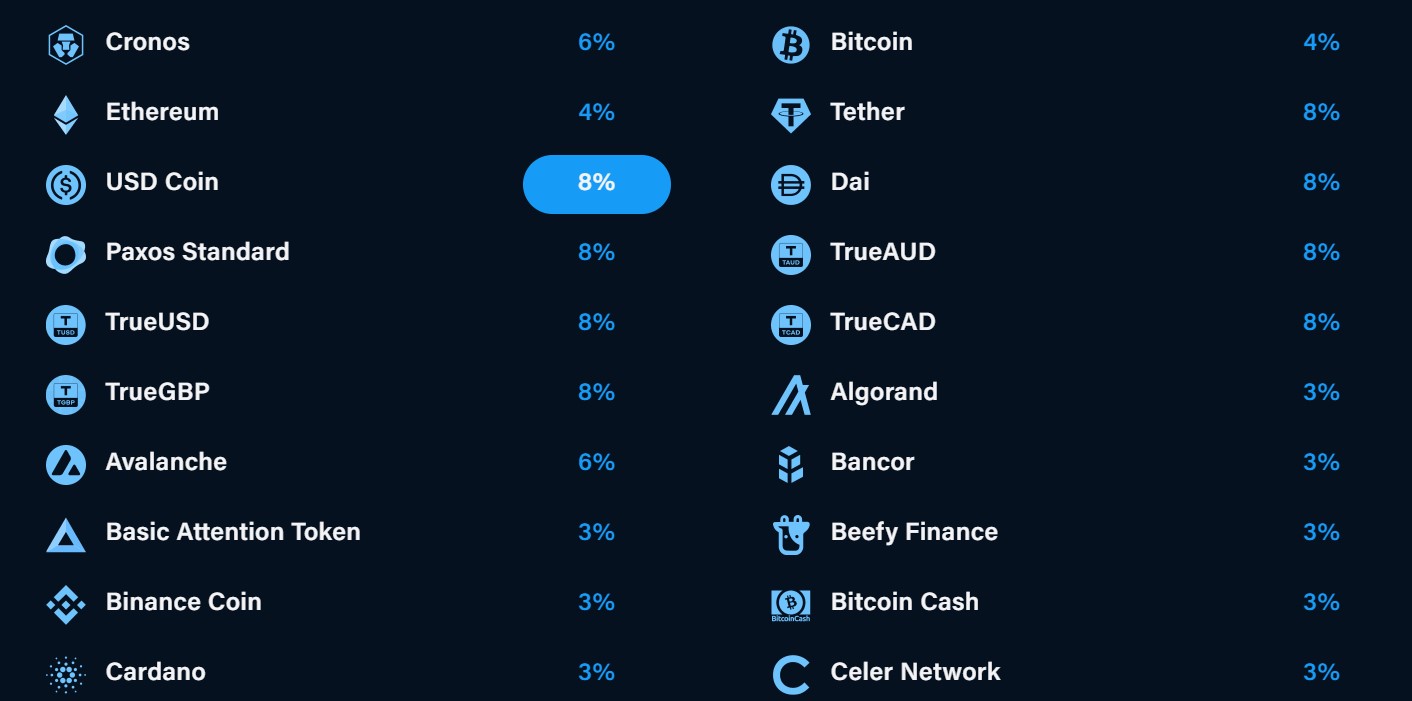

On the other hand, Crypto.com supports 40+ cryptocurrencies, including stablecoins and cryptocurrencies. Some of the top coins that Crypto.com supports are TrueCAD, TrueGBP, Binance Coin, Dai, Ethereum, Bitcoin, Tether, USD Coin, Chainlink, COSMOS, Dogecoin, EOS, and more.

Also, newer coins are kept being added to the platform. So you can deposit your favorite currency and earn interest on it.

You can also use crypto.com to get a crypto-backed loan under its Crypto Credit program. It allows you to borrow up to 50% of your crypto collateral which is the same as Celsius.

Also, depending on your LTV, the interest rate will vary. On top of that, you will enjoy lower interest rates when you stake CRO on the platform.

Interest Rate Accounts, Lock-in Terms & Payouts

When it comes to choosing a platform for earning interest on your crypto holdings, it is important to look at the interest rates. The higher the interest rate a platform pays, the faster you can grow your portfolio.

But on the other hand, you should also consider the lock-in terms. So you don’t have to give access to your funds for an extended period of time.

Talking about Celsius interest rates, the platform offers up to 18.63% APY. Simply transfer your funds to the platform and you are all set to earn interest on your crypto holdings.

The interest rates depend on what currency you are holding on the platform. For instance, Celsius pays up to 15.87% for UST tokens while it pays up to 8.53% for Bitcoin and up to 7.87% for ETH.

Moreover, the interest rates also vary between the United States users and international users. Also, if you choose to earn CEL tokens, you will earn extra rewards. To know about all of these, you can use Celsius’s onsite calculator to calculate how much you could be earning.

Another good part about Celsius is that it does not have a lock-in period. It does not require you to lock up your funds for a given period of time. So you can earn interest for as long as you would like to.

Additionally, the Celsius account does not require a minimum deposit to earn interest or it has any hidden fees.

Plus, it has a weekly interest payments system. The interest gets paid to your wallet each week. Also, the earned interest earns compound interest.

Now coming to Crypto.com, it lets you earn up to 14.5% APY. Unlike Celsius, crypto.com has three holding terms.

There is a flexible holding term, one month fixed term and 3 months fixed term. So depending on your holding term, you will enjoy different interest rates. Also, you can enjoy better annual rewards if you have CRO tokens locked up.

Talking about the APY, if you have DOT or Matic assets of less than $400 then you will get 5%, 8%, and 11% interest rates for flexible, one-month, and three months terms respectively.

Also, the APY will vary depending on how many assets you have in your wallet. For more information, I would recommend you check out their Crypto Earn rewards structure.

On top of that, crypto.com has a compounding interest model. So your assets will start earning rewards immediately after you deposit your funds. Also, it pays out yield weekly in fiat currencies or crypto.

Products & Features Comparison

When it comes to Celsius vs crypto.com comparison in terms of products and features, it is surely a bit tricky. Since both the platforms do not fall into the same category.

On one side, we have Celsius which is a Blockchain-based marketplace platform, and it offers you features like earn, borrow, buy, pay credit card, and swap.

Its earn and borrow features let you lend your crypto out for higher APY or get crypto-backed loans.

Using its buy program, you can buy a bunch of cryptocurrencies using the Celsius app and its web portal. Its pay product lets you send and receive crypto payments.

Also, you can use the Celsius credit card for making purchases and earning rewards on it. And its swap product lets you swap one token for another one for zero fees.

On the other hand, Crypto.com is a full-fledged crypto exchange. It takes care of your crypto management and crypto exchange needs.

It offers you features like Crypto Earn, Crypto Credit, NFT, Pay, Margin trading, derivatives trading, wallet, swap, and many more.

Crypto Earn and Crypto credit lets you lend out your crypto for higher interest rates or get a crypto loan. Its pay product lets you send and receive cryptocurrencies, and with the NFT marketplace, you can buy/sell NFTs.

If you go to its advanced trading section, you will see features like margin and derivates trading. So if you are a crypto trader, these features will come in handy.

Apart from these, crypto.com also offers you tons of other crypto services that will help you to indulge in the crypto ecosystem more and more.

Celsius vs Crypto.com: Fees Comparison

When it comes to celsius vs crypto.com comparison, fees definitely play a key factor. If a service is taking too much fee, you won’t really get to make a lot of money.

Luckily, both celsius and crypto.com have relatively cheaper fees compared to most other services in this niche.

Talking about Celsius, it does not charge you any fee for its services. It means you will enjoy free withdrawals, zero transfer fees, or transaction fees. Nor there is any early termination fees or origination fees.

Although, Celsius.network does not charge you any deposit fees. But you will still have to fee some fees when depositing funds from your bank account. If you use fund depositing methods like wire transfer or any other payment gateway, there might be some charges that you have to pay.

On the other hand, crypto.com charges you different fees for different services. For instance, if you use crypto.com for trading, then it follows a tiered fee structure.

The lowest trading fee it charges is 0.4% as taker and maker fees for a trading volume between $0 – $25,000. As you increase your trading volume, the maker and taker fees will vary.

But when it comes to its crypto earn program, it charges you withdrawal fees. But apart from that, there are no deposit fees or transaction fees.

So overall, if you are planning to earn interest on your crypto, you don’t really have to worry about paying any fees.

Safety & Security Features

It is extremely important to choose a crypto lending platform that has top-notch security measures. This gives you peace of mind that your funds are safe and secure, and you won’t have to take a huge loss.

When it comes to security, both celsius and crypto.com have implemented strong security measures. Their end goal is always to keep your crypto holdings stored in a secure place.

If we talk about Celsius, the platform is known to be one of the highly secured crypto interest accounts.

Celsius.network is licensed by the SEC. Also, they have received the ISO/IES 27001 certification from the international organization for Standardization. Also, they don’t have any history of security breaches. Plus, they are backed by a dedicated security team.

As an end-user, you are also getting features like 2FA, so you can protect your celsius portfolio and keep your funds secure. Plus, they keep most of their funds in cold wallets. As a result, there is hardly any chance of loss of funds.

Similarly, crypto.com is also a highly secured platform. It has a strategic partnership with Ledger, and they have implemented Ledger’s institutional-grade custody solution, Ledger Vault.

The crypto exchange keeps 100% of its assets stored in cold storage. So you don’t really have to worry about the loss of funds.

Along with that, Crypto.com uses hardware security modules (HSM) and multi-signature technologies to provide you with additional security.

On top of that, the exchange also offers advanced encryption for user funds and data. They have security features like multi-factor authentication, address whitelisting, bug bounty, etc.

Celsius vs Crypto.com: Insurance Coverage

No matter how secure a platform is when you lose funds, most crypto interest-earning platforms do not really help you with funds recovery. Hence, it is a good idea to choose a lending platform that offers some sort of insurance coverage.

But most crypto interest accounts do not offer any sort of insurance. However, some of the platforms offer third-party insurance like Celsius.

Although, Celsius does not have an insurance policy. But they have Fireblocks as their custodian, and they offer insurance on digital assets held by Celsius.

But there is a little catch. Since Celsius pays you interest after lending your funds to other users. So they don’t really hold your assets, and hence the funds cannot be insured.

However, this should not worry you much. As Celsius requires borrowers to post collateral of up to 150%. As a result, even if the loan borrower does not pay back, you will still receive your funds back.

On the other hand, talking Crypto.com Earn program, it does not provide you with any sort of insurance.

Cryptocurrencies held in the Earn account are not protected by any government-backed insurance scheme including, but not limited to, the Federal Deposit Insurance Corporation (“FDIC”) or the Canada Deposit Insurance Corporation (“CDIC”).

However, if you are a U.S resident, then your USD balances are held at Metropolitan Commercial Bank, an FDIC member, and insured depository institution. As your result, USD funds held at the Metropolitan Commercial Bank are insured for up to USD $250,000.

Also, you retain ownership of those funds in Metropolitan Commercial Bank accounts, meaning your fiat funds cannot be claimed by Crypto.com or its creditors.

However, users from outside the united states would not get any sort of insurance coverage. And it would have been better if they provided some sort of third-party insurance.

Minimum Deposits for earning interest & Withdrawal Limits

Minimum required funds are also something that you must check while choosing a crypto interest-earning platform. Most services ask you for a minimum deposit before you can start earning rewards on your assets.

But that does not go with Celsius. Celsius does not have any minimum funds requirement. This means you can deposit as low as $1 and start earning interest daily.

When it comes to withdrawal limits, there are no such restrictions. You are allowed to withdraw as little as $1. However, depending on how much you wish to withdraw, the processing time can take a few days.

For instance, withdrawals above 150,000 USD are processed manually, and it can take up to 24 hours (or 48 hours depending on the time zones). Also, there is a 600,000 USD withdrawal limit per 24 hours.

Similarly, Crypto.com also does not ask you for minimum deposits. However, you are required to have a specific amount of funds in your earn account to start earning rewards.

Also, withdrawal limits completely depend on what asset you are trying to withdraw. If you have BTC in your Celsius account, then you can only withdraw 10 BTC each day.

Account Sign-Up Process & KYC

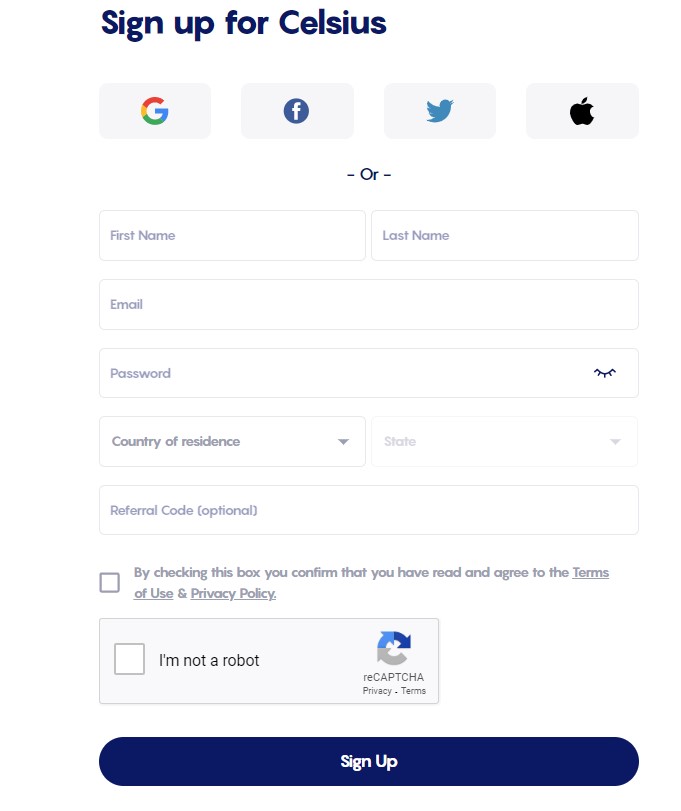

Getting started with any of these platforms is super easy and should only take a few minutes. However, you should know that both celsius and crypto.com have a mandatory KYC verification process. So make sure to keep your KYC verification documents close while signing up on Celsius or Crypto.com.

How To Sign Up On Celsius.network?

- Go to celsius.network and click on Get Started button.

- Fill up the form and verify your email address.

- Next, enter and confirm your 6 digit pin.

- Next, verify your account by entering your personal details and submitting a government ID.

- Once your account is created, add funds to your account, and you are all set to earn higher rates.

How To Sign Up On Crypto.com?

- Go to Crypto.com and click on the Sign Up button.

- Next, fill-up the form by entering all the required details and confirming your email.

- Verify your phone number.

- Go through the KYC verification by submitting all the required details.

- Once your account is approved, add funds to your account, and you can start earning higher rates.

Supported Countries

Both Crypto.com and Celsius.network has a global presence. So users from any location can access their services and earn simple interest.

If we talk about Celsius, it is available in over 100 countries worldwide. However, there are a few countries where Celsius is yet to start their operations. Users from regions like Iran, Sudan, North Korea, South Sudan, Syria, and a few other countries.

Similarly, Crypto.com is also available in 100 countries globally. But not all of the crypto.com services are available in all the regions because of rules and regulations.

For instance, the Crypto.com app is only available in 49 states in the United States of America and US territories as of now. Similarly, you get to see such restrictions for its credit card programs.

However, most countries should not have any issues accessing or using crypto.com. But there are certain features that you might not be able to access.

Celsius Pros & Cons

Pros:

- There are no hidden fees, minimum deposit requirements, loan origination, or transfer fees.

- You can earn extra rewards by using CEL tokens.

- You can earn interest payments up to 18.63% APY on your cryptocurrencies.

- Rewards get paid out weekly.

- Available in over 100 countries

Cons:

- U.S. residents don’t have access to the CEL token or its benefits

- It does not have a crypto exchange. Instead, all trades happen via third-party vendors.

- A limited number of tokens.

Crypto.com Pros & Cons

Pros:

- Earn interest up to 14.5% p.a. on your crypto assets.

- Supports a huge number of cryptocurrencies.

- Zero fees for sending crypto to other users through a mobile app.

- Earn up to 8% cashback on purchases with Crypto.com Visa Card.

Cons:

- Some services are not available in the United States.

- No crypto to crypto trading.

- Higher fees for credit and debit purchases.

Is Celsius Safe?

Celsius is definitely a safe and secure platform to earn interest on your crypto holdings. There is no history of security breaches on the platform.

Also, the company is well regulated and offers you third-party insurance, and keeps most of your funds in cold storage.

On top of that Celsius.network has implemented high-standard security features in place. Also, as an end-user you are getting different security features.

Is Crypto.com Safe?

Crypto.com is also highly secured, and it uses a wide range of security features like multi-factor authentication and whitelisting. This helps them to keep your accounts safe.

On top of that, the exchange uses robust compliance monitoring and stores customer deposits offline in cold storage to help prevent hacks and losses.

Plus, the company has partnered with local banks in the USA to provide $250,000 in FDIC insurance on U.S balances.

Conclusion

When it comes to Celsius vs crypto.com comparison, both the platforms are highly secure and known for providing higher interest. They are known for offering the best in the industry APY and offer you tons of features. So you can grow your crypto portfolio worry-free.

Also, both the platforms are extremely different from each other, with a few similarities. For example, instance, Celsius does not have any withdrawal fees, but crypto.com does not offer you any free withdrawals.

Also, the interest rate depends on what currency you are keeping in your interest-earning account.

So go ahead and check both the platforms out and see which one is standing out to be the best as per your requirements.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023