When it comes to trading cryptocurrencies on margin and leverage, there are so many options available in the market, and they are only increasing with every passing day.

But not all margin platforms are made the same. When you research this, two names that will come up, again and again, would surely be Binance and PrimeXBT.

At first glance, they might look similar, but at a deeper dive, they are a bit different depending primarily upon what’s your exact requirement.

So in this comparative guide, I have tried to explore both the trading platforms based on the following salient points to drive home the message which is relevant to you:

- Leverage & Trading Pairs Comparison

- Product Offerings

- Trading Fee Comparison

- Funding Fee Comparison

- Deposit and Withdrawal Fees Comparison

- Liquidity Comparison

- Long/Short Assets

- Trading Platform Comparison

- TA Tools & Indicators Comparison

- PrimeXBT vs. Binance- Account Opening Process

- Order Books Comparison

- Deposit Limits & Deposit Options

- Security Features Comparison

- Customer Support Options

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

PrimeXBT vs. Binance: At A Glance

| Features | Binance | PrimeXBT |

| Trading Fee | 0.03% | 0.05% |

| Highest Leverage | 125x (only on a few) |

100x (on all pairs)

|

| Customer Support | Yes | Yes |

| Mobile Trading | Yes | Yes |

| Customizable UI | No | Yes |

| Sign-up Bonus | No |

Yes (35% Bonus)

|

| Sign-up Link | Trade Now | Trade Now |

PrimeXBT has been a margin trading platform operating in this space since 2018. It’s a multi-asset exchange that provides you with the option of trading 50+ markets across three segments, including cryptocurrencies, traditional stocks, and forex markets.

The main USP of PrimeXBT is its 100x leverage across all the crypto markets with an ultra-fast trading engine designed to take the pressure of margin trading. Using PrimeXBT, you can go long or short on many popular cryptocurrencies at the lowest feasible trading fees, but it is more of a CFD like the product and doesn’t have contracts. But it offers the same leverage options as futures contracts with high liquidity.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

Binance exchange needs no introduction if you have been in the cryptosphere for some time. But for the uninitiated, Binance is one of the biggest cryptocurrency exchanges globally, which has been offering spot trading services since 2016.

When speaking of margin and futures trading, Binance Futures started later than PrimeXBT in 2019. Only recently, it went on to open all the features of its crypto derivatives platform.

It provides up to 5x in spot trading but offers up to 125 X if you are dealing in the futures. Moreover, it only deals in cryptocurrencies, and one cannot go long or short on stocks or forex using Binance.

#1. Leverage & Trading Pairs Comparison

Binance provides humongous leverage up to 125x, which is the highest in the industry on its futures contracts. But this huge leverage is not available for all the pairs and is only restricted to BTC/USDT, ETH/USDT, XRP/USDT, & ETC/USDT.

All other trading pairs of BCH, EOS, TRX, LTC, IOST, XMR, XLM, etc., leverage hovers in a range of 50x to 75x. In total, Binance supports more than 50 cryptocurrency futures contracts to help you make the most of crypto volatility.

PrimeXBT, on the other hand, supports only BTC, LTC, ETH, XRP, EOS currencies on margin and provides up to 100x leverage to long/short them.

But the good thing is, this 100x leverage is available on all the pairs, unlike Binance pairs, where the leverage is limited. Another USP of PrimeXBT is that it supports margin trading for popular cryptocurrencies and stocks indices, forex, and commodities.

#2. Product Offering

Binance offers an extensive range of crypto derivatives products in the market and supports a wide variety of altcoins.

The trading products offered on the platform include:

- Coin-M Futures: Perpetual and quarterly futures, margined and settled in cryptocurrency

- USDT-M Futures: Perpetual and quarterly futures, margined and settled in USDT or BUSD

- Binance Options: You can buy and sell European style Bitcoin Vanilla Options with varied leverage level

- Binance Leveraged Tokens: A type of leveraged product that allows you to take a leveraged position in an underlying asset without risk of liquidation

In the cryptocurrency trading segment, PrimeXBT offers trading in crypto CFDs, where you can go long and short on listed crypto assets with a leverage of up to 100X. You can trade in markets like BTCUSD, ETHUSD, LTCUSD, EOSUSD, ETHBTC, LTCBTC, and EOSBTC.

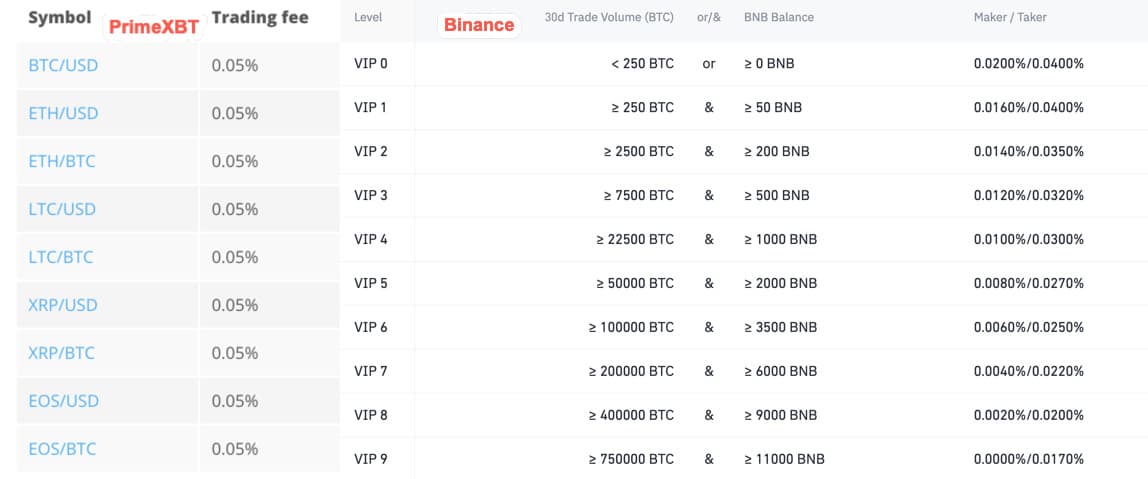

#3. Trading Fees Comparison

This is an essential factor to pay attention to when it comes to trading fees because the higher the fees, the more it will erode wealth from your portfolio.

In terms of fees alone, Binance seems to have the upper hand on PrimeXBT. Binance has divided its trading fees structure into 10 different levels based on the last 30-day trading volume. For the first level (VIP 0), with the last 30-day trading volume less than 250 BTC, the maker fee is 0.020%, and the taker fee is 0.040%.

The trading fees structure is designed to incentivize and attract traders who trade in huge volumes and want to lower their trading costs.

Further, the exchange also offers a 10% discount on trading fees when paid using Binance coin, making it one of the cheapest derivative exchanges in the category.

On the other hand, PrimeXBT charges a flat margin trading fee of 0.05% for all types of trades. Compared with Binance, trading on PrimeXBT is a bit expensive for high-frequency traders.

#4. Liquidity Comparison

Another important factor while deciding on derivatives exchange is liquidity. Crypto derivatives trading is high-frequency trading, and you don’t want liquidity issues when you are trading.

Binance Futures has the highest daily average trading volume in the industry, with a daily average trading volume of over $60 billion across all its trading products.

On the other hand, the average daily trading volume on PrimeXBT with five crypto assets is over $1.5 billion. However, despite low trading volume compared to Binance, liquidity isn’t an issue for the exchange. The exchange is integrated with 12+ liquidity providers that help to process orders at requested quotes.

PrimeXBT has the lowest order slippage rate in the industry.

#5. Funding Fee

Binance has 8 hours funding rate interval starting at 0:00 UTC, and the funding fee is applicable on both long and short trades. The funding rate on Binance is calculated based on the difference between the perpetual contracts and spot prices.

The funding rates are dynamic and change as per the market situation. It is calculated based on the following formula:

- Funding Amount = Nominal Value of Positions × Funding Rate

- Nominal Value = Mark Price × Size of Contract

And, the funding rate is determined by the interest rate and premium (difference in the price of the underlying asset and perpetual contract). The interest rate is kept constant at 0.01%.

In general, when the market is bullish, the funding rates are positive, and you need to pay the traders on the opposite side.

On the other hand, PrimeXBT has a daily financing rate levied on trades carried forward to the next day. The trading day starts at 0:00 UTC and ends at 23:59 UTC. The daily funding fees on the platform changes as per the condition of the market.

#6. Deposit & Withdrawal Fees Comparison

Binance doesn’t charge any fee to make deposits into the Binance account. But, for withdrawals, a flat fee is charged from users to cover the transaction costs (blockchain network fees) to move the cryptocurrency from the Binance account to your personal crypto-wallet.

For instance, the withdrawal fee for BTC is 0.0005 BTC for using the BTC (SegWit) network. And, for BNB, the withdrawal feed is NIL for using the ERC 20 network.

Similarly, PrimeXBT doesn’t charge any fees for deposits. But, for withdrawals, it charges a flat fee of 0.0005 BTC to cover the network costs.

(Result: Tie)

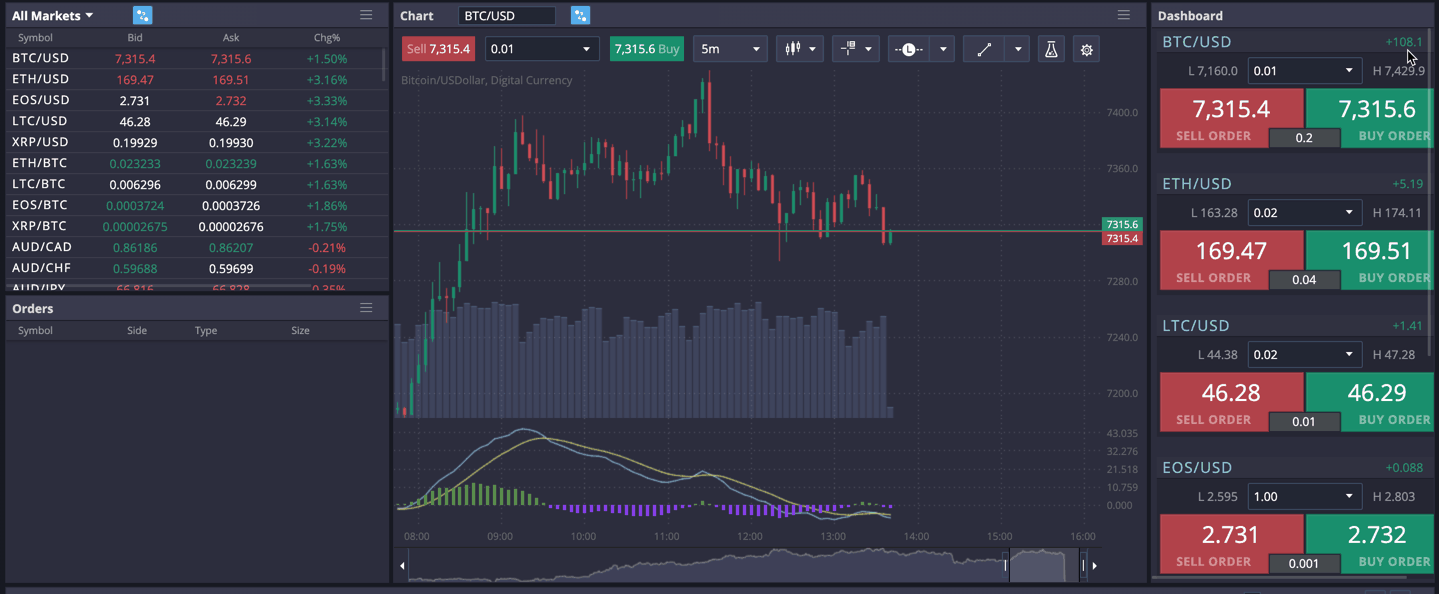

#7. Trading Platform Comparison

The trading platform’s UI and intuitiveness are other things one should consider while deciding on the exchange. I have been a lightweight trader and have used both cryptocurrency exchanges, i.e., PrimeXBT and Binance.

However, I like Binance’s UI, but I liked PrimeXBT’s UI more for derivatives trading with margin. PrimeXBT’s award-winning trading platform is more compact and clean.

It is customizable as per the level of the user, right from beginners to pro, and it also provides the option of multiple windows for experienced traders to help them focus on their technical analysis strategies.

Binance’s UI is also clean, but it tries to show too many things in a single window without providing the option of customization; this can overwhelm some traders.

#8. TA Tools & Indicators Comparison

PrimeXBT comes with just the right amount of trading indicators and charting tools; one would want to do the technical analysis. Binance also offers all the indicators and has the charting system in place for a long time to help the traders maximize the yield through focus.

(Result: Tie)

#9. Long/Short Trading With Advanced Order Types

If used smartly, different types of orders can help you make the most of the margin trading experience.

PrimeXBT offers four main types of orders: Market order, Limit order, Stop order, and OCO (One-Cancels-The-Other). And two protection orders- stop loss order and take profit order.

Binance Futures supports seven types of orders: Market Order, Limit Order, Stop-Limit Order, Stop-Market Order, Trailing Stop Order, Post-Only Order, and Limit TP/SL Order (strategy order).

Both the cryptocurrency exchanges offer similar order types to help you take maximum advantage of the market volatility.

(Result: Tie)

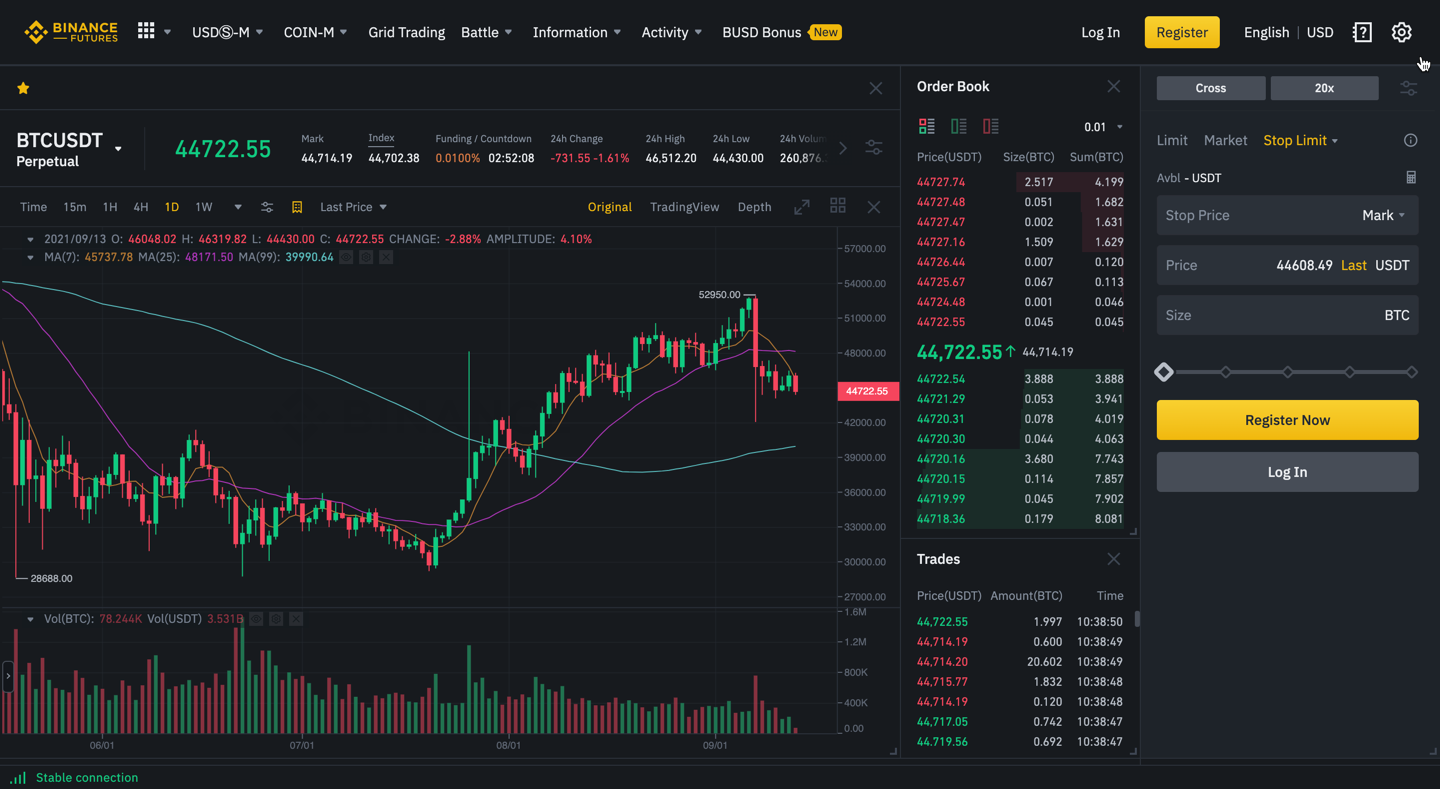

#10. PrimeXBT vs. Binance- Account Opening Process

Both PrimeXBT and Binance are no-KYC exchanges, which makes the account opening process a breeze. The following are the steps involved in opening an account with Binance Futures:

- Go here and click on the Register button

- Enter email-id, create a strong password, and agree to the terms and conditions to create an account

- Open your email account and click on the verification link sent to your email to complete the registration process

Now, login to your Binance account and select the USD(S)-M Futures from under the Derivatives option in the menu section.

Click on “Open Now” to activate the Binance Futures account. You can now make a deposit and start trading in the crypto margins and derivatives segment of the exchange.

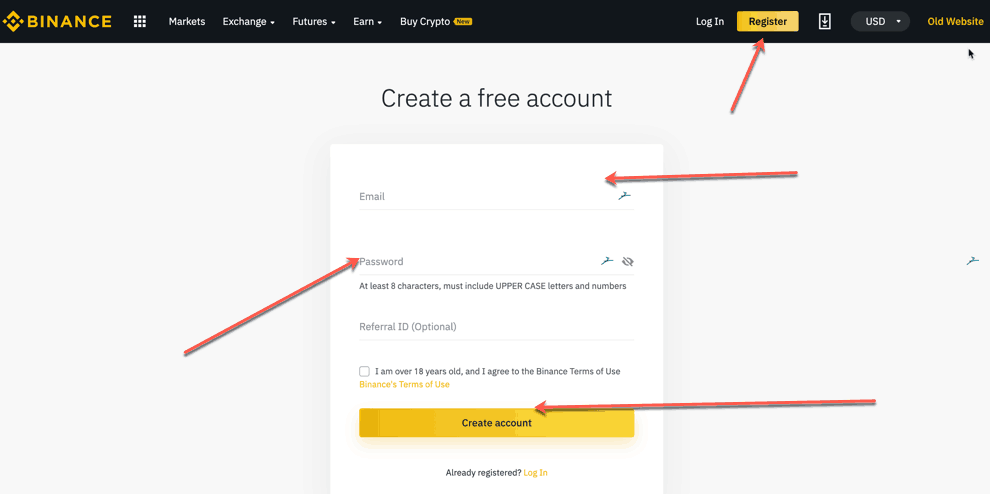

To open an account on PrimeXBT, the following steps are involved:

- Go here and click on the “Register” button

- Enter your email id, phone number (optional), create a safe password, and agree to the terms and conditions to register.

- Confirm the four-digit verification PIN sent to your email address to complete the account creation process

You can start to trade by depositing into the account.

PrimeXBT offers two deposit options to its users, i.e., crypto deposit and fiat option. Also, as a new user, you’re eligible for the PrimeXBT deposit bonus by using the bonus code.

You can buy BTC using your credit card in the fiat deposit option, but you need to pay the payment gateway charges and transaction charges, which can be significant.

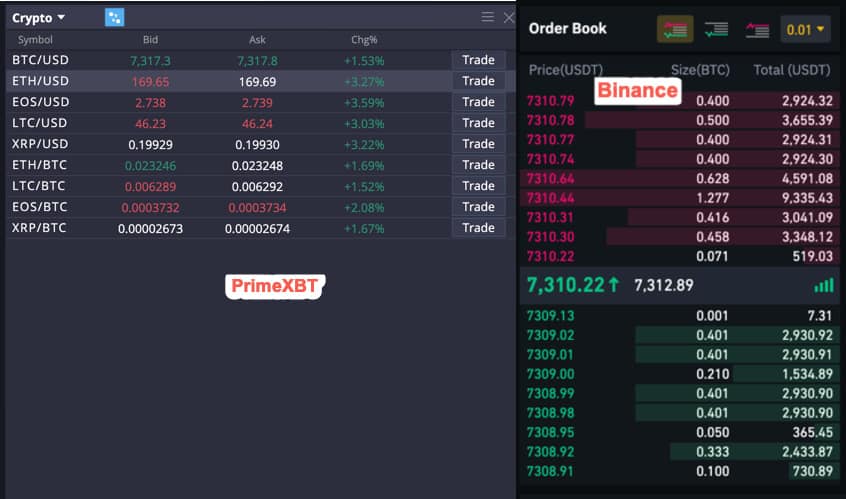

#12. Order Books Comparison

For ease of understanding, you can consider PrimeXBT products as CFD products but settled in BTC. They act as a broker, and all trades are settled in Bitcoin. Also, collateral/margin is used in Bitcoin. But trading itself is more similar to STP brokerage rather than an exchange with internal order books.

On the other hand, Binance has open order books for its futures swaps, which anyone can select to buy/sell as per their guiding research. But this approach also helps PrimeXBT not throw order submission errors.

#13. Deposit Limits & Deposit Options

PrimeXBT’s minimum deposit is 0.001 BTC, and deposit options allow you to deposit BTC directly. You can also buy BTC instantly through PrimeXBT’s internal dashboard to deposit Bitcoin onto the platform.

On the other hand, Binance has a minimum deposit for its futures segment is 0.01 BTC, which is ten times the PrimeXBT’s. In terms of deposit currencies, Binance allows you to deposit all the cryptocurrencies under the sun listed in Binance.

Also, you can deposit fiat currencies to be exchanged for Bitcoin or ETH or USDT, etc.

#14. Security Features Comparison & KYC

Binance and PrimeXBT have high-security standards such as DDOS protecting, encrypted passwords, two-factor authentication, etc. But Binance suffered a minor hack also which it was able to cover through its SAFU funds.

Having insurance funds provides Binance with some degree of protection and can cover investors’ losses in a hack.

Whereas in PrimeXBT, you don’t have any contingency fund to rely on, but so far, PrimeXBT users have not faced any security issues.

When you talk about KYC, both PrimeXBT and Binance require no form of registration or KYC check to start with. You need to use your email ID to make an account, and you can trade without any limits.

(Result: Tie)

#15. Customer Support Options

Binance’s customer support is top-notch and provides the option of live chat, emails, social media contacts, and tickets system to help millions of users trading on their platform.

Similarly, PrimeXBT’s support has also been instantaneous and painless for me until now. They also have a live chat, telegram bots, social media, and ticket system to support their users.

(Result: Tie)

PrimeXBT vs. Binance: Which is a Better Margin Trading Platform

Upon my test, both the trading platforms, i.e., PrimeXBT and Binance, have come neck to neck to provide trading experience, trading platforms, liquidity, and security features. If one is good at one thing, then another comes out good for the other thing.

Binance scores ahead with its extensive trading products, support of crypto assets, and trading fees.

But if you are someone who is purely looking for long/short on popular cryptocurrencies with high leverage, go for PrimeXBT. The exchange is most suited for beginner to moderate-level traders. And, there is not much difference in the trading fees with Binance if your monthly trading volume is less than 2500 BTC.

If you’re a high-frequency trader or want to trade and explore futures of different crypto assets, BTC options, or leveraged tokens, then Binance Futures would offer you a great trading experience and value.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |