PrimeXBT and BitMEX are probably the two most popular and widely used cryptocurrency margin trading platforms in use throughout the world.

However, choosing one over another is no easy task because they appear similar at first and offer traders a host of features.

After looking into them profoundly and exploring them on the factors of trading volume, trading fees, security, stability, trading pairs, and products, etc., I have found noticeable differences that I think are important to convey.

So these are the following factors around which I have explored the differences:

- Trading Fees Comparison

- Leverage & Trading Pairs Comparison

- Product Offerings

- Liquidity Comparison

- Funding Fee Comparison

- Withdrawal and Deposit Fee Comparison

- Short Selling Options

- Trading Platform Comparison

- TA Tools & Indicators Comparison

- Order Types Comparison

- PrimeXBT vs. BitMEX Account Opening Comparison

- Order Books Comparison

- Deposit Limits & Deposit Options

- Security Features Comparison

- Customer Support Options

Let’s check which is a better margin trading platform, PrimeXBT or BitMEX.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

PrimeXBT vs BitMEX- At a Glance

| Features | BitMEX | PrimeXBT |

| Lowest Trading Fee | No (0.075%) | Yes (0.05%) |

| Highest Leverage | No (only on BTC) |

Yes (100x on all pairs)

|

| Aggregated Liquidity | No | Yes |

| Order Submission Error | Yes | No |

| Customizable UI | No | Yes |

| Sign-up Bonus | No |

Yes (35% Bonus)

|

| Quick Link | Trade Now | Trade Now |

PrimeXBT has been a well-established margin trading platform since 2018. It allows trading in 30+ assets, including popular cryptocurrencies like BTC, ETH, LTC, XRP, with leverage up to 100X. The platform is accessible in 100+ countries and requires no tedious registration or KYC process to get started with the lowest fees.

BitMEX has been serving the cryptosphere since 2015 and has remained at the helm of margin trading of cryptocurrencies since then. The exchange was the benchmark for other crypto derivative trading platforms in terms of the trading volume.

It allows for 100x leverage only on Bitcoin and less on other assets. Plus, it is a crypto-only marketplace with no access to forex or traditional markets with high fees.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

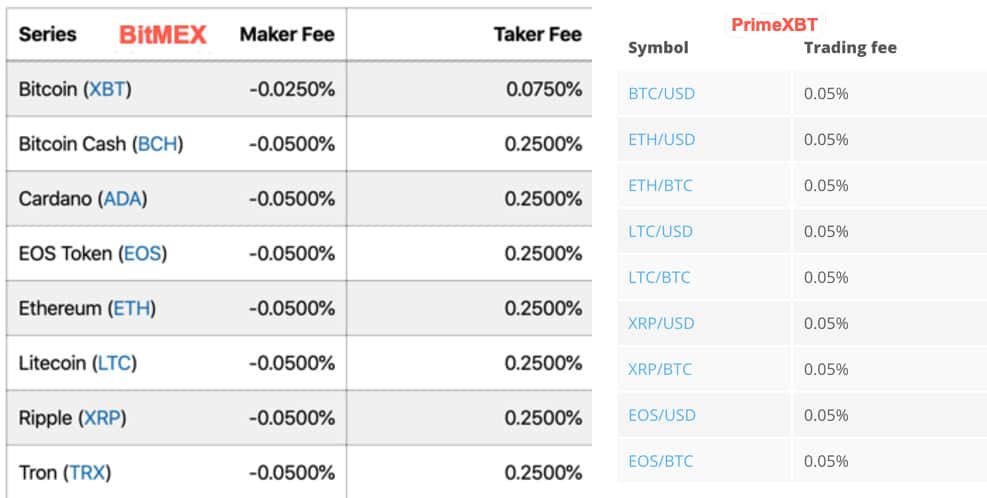

#1. Trading Fees

In crypto margin trading, one should pay attention to the trading fees he/she is paying. This fee, if not within an appropriate band, can quickly drill a hole in your profits.

Compared to all the leverage trading exchanges, I found that PrimeXBT charges the least. PrimeXBT takes 0.05% on all trades, irrespective of which crypto pair you are trading. This fee is applicable for both the market maker and the taker.

On the other hand, BitMEX charges 0.075% from the takers and offers 0.025% as a rebate to makers when trading Bitcoin (BTC). Since the majority of the traders in the derivatives segment are market takers, the fees are 0.025% higher than PrimeXBT, which impacts your profitability when trading crypto with maximum leverage.

(Winner: PrimeXBT)

#2. Leverage & Trading Pairs

BitMEX and PrimeXBT both offer 100x leverage, using which anyone can margin trade. You have 1 BTC, but you can open positions as if you have 100 BTC because of the leverage.

But BitMEX offers 100x leverage only for Bitcoin (XBT USD). That means one can long or short only Bitcoin using the leverage on BitMEX exchange.

On the other hand, PrimeXBT’s 100x leverage or margin funding isn’t just limited to Bitcoin (BTC). You can get 100x leverage on all the five cryptocurrencies, i.e., BTC, ETH, LTC, XRP, EOS. So feel free to go long or short on any cryptocurrency that PriemXBT supports by taking any amount of leverage up to 100x.

#3. Product Offerings

Both the trading platforms offer different categories of crypto derivatives products in their trading platform. BitMEX offers trading in perpetual futures, traditional futures (with expiry), and Quanto futures.

It supports trading in all leading cryptocurrencies, including BNB, BTC, Doge, XRP, BCH, ADA, LTC, etc. Some of BitMEX’s markets, including XBTUSD, are the most liquid in the global cryptosphere.

PrimeXBT offers trading in crypto CFD contracts where it allows you to go long and short on crypto pairs with leverage up to 100X. You can trade in BTCUSD, ETHUSD, LTCUSD, EOSUSD, ETHBTC, LTCBTC, and EOSBTC.

#4. Liquidity

Liquidity is another huge factor to pay attention to when choosing your margin trading platform.

At the time of writing, BitMEX’s trading volume numbers are north of $1.5 Billion in the last 24 hours, whereas PrimeXBT’s trading volume numbers are $545 million.

Though number-wise, BitMEX wins this trading volume battle. But, PrimeXBT is integrated with 12+ liquidity providers, ensuring trades are executed instantly with minimum slippage.

But one must be mindful that BitMEX has been operating in the crypto trading space for more than five years, whereas it has been three years for PrimeXBT, which looks well on the trajectory of overthrowing BitMEX.

Plus, BitMEX has been accused in the past of inflating its numbers, but for now, let say, BitMEX is the winner, but at PrimeXBT too, you won’t face any liquidity issues because $545 million in the last 24 hours is not a small number.

#5. Funding Fee

BitMEX, on perpetual futures contracts, the funding is exchanged between long and shorts over a discreet funding interval. The funding is paid and received every 8 hours starting UTC +5:30, and the funding rate changes as per the liquidity situation in the market.

You can check the funding rate and funding interval details by checking the contract information.

PrimeXBT has a daily funding interval that starts at 0:00 UTC. The funding rate applies to long and short positions in the market if you’re carrying forward your trades to the next day.

The funding rate changes as per the market condition and status of the liquidity. A positive funding rate means you will pay the funding for the funding interval, and the negative rate implies you will receive the funding fee.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

#6. Withdrawal & Deposit Fee

The exchanges, BitMEX and PrimeXBT, don’t charge any fee on deposits and withdrawals, but you need to pay the network fee to cover the transaction cost.

The network fee on BTC is set dynamically based on blockchain load. The minimum transaction cost on PrimeXBT charged is 0.0005 BTC to cover the transaction cost.

(Winner: Tie)

#7. Short Selling Options

Short selling is the main feature you want when trading cryptocurrencies on margin. You want to make a profit whether the market is falling or rising, and that’s the point of having leverage in derivatives trading platforms like BitMEX and PrimeXBT

Both exchanges are pretty good in those lines, but because the leverage limit on PrimeXBT is 100 across all the assets, it has the edge over BitMEX, which provides 100x only for Bitcoin.

(Winner: PrimeXBT)

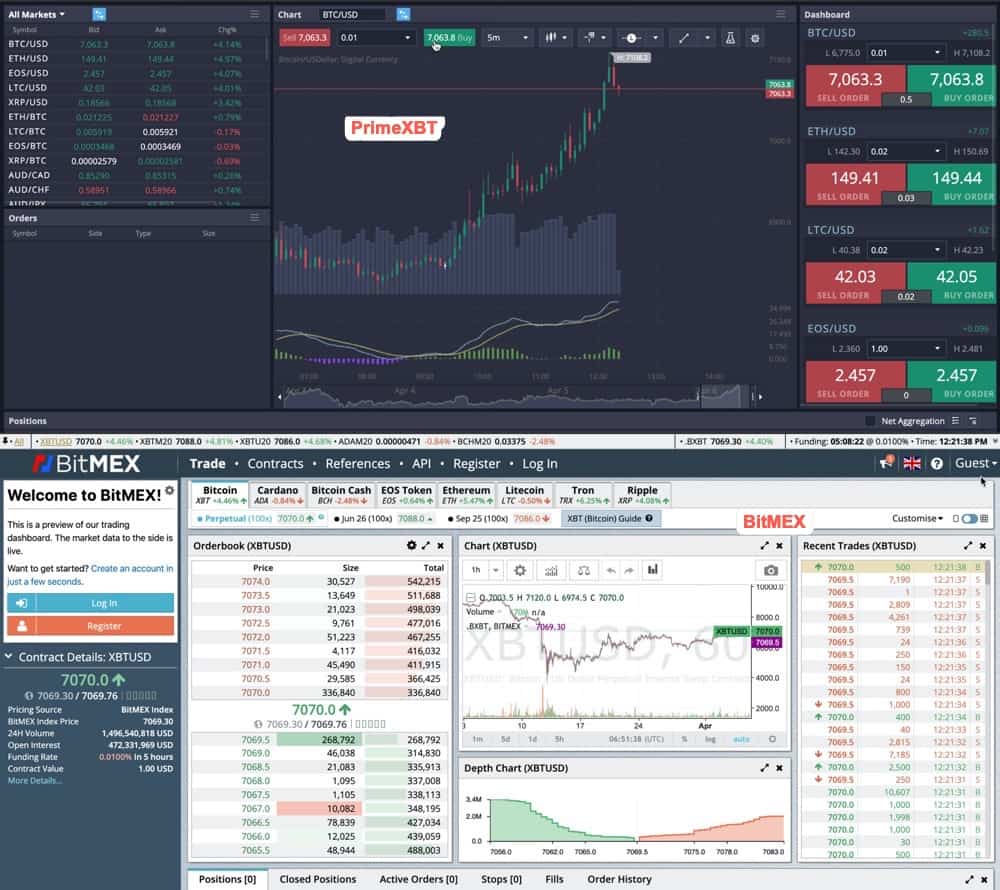

#8. Trading Platform

When you compare PrimeXBT & BitMEX in terms of the trading platform’s UI and usability, PrimeXBT wins this battle hands down.

BitMEX’s UI is fast, but it is still old school. There is only one type of UI for all, i.e., from beginners to pro-traders and everything between. This approach, one size fits all, is not good for the long term.

PrimeXBT understands this way better than BitMEX and provides a highly customizable trading window for all, right from beginners to advanced traders. It also provides Pro traders with multiple screens to fully maximize their trading experience with ease.

#9. TA Tools & Indicators

Technical analysis is how traders do their magic of reading charts and understanding what to do and what not to do. 50+ important trading indicators help traders verify their research and understand the meaning of their studying charts.

PrimeXBT comes with a powerful charting tool that is free to use and different types of charts, along with many indicators for making your technical analysis as accurate as possible. You can read more about their charting tool in our dedicated PrimeXBT tutorial here.

On the other hand, BitMEX’s trading tools and charting window is a bit cranky. The indicators are also very less, and in technical analysis, the more signs you have access to, the better it is.

#10. Order Types

BitMEX offers several order types for trading and hedging purposes. It includes: market order, limit order, stop order, take profit order, and advanced order functions.

There are three types of stop orders- stop market, stop limit, and trailing stop. And, the advanced order functions include hidden orders, iceberg orders, and post-only orders.

PrimeXBT offers four main order types on its trading platform- market order, limit order, stop order, and one-cancels-the-other (OCO). And, two protection order types include stop-loss order, take-profit order.

(Winner:Tie)

#11. PrimeXBT vs BitMEX: Account Opening Process

The registration process on PrimeXBT is real simple and quick. Following are the steps involves in opening an account with the exchange:

- Go here and click on Register.

- Enter your email id, password and agree to the terms and conditions to register. Optionally you can provide a phone number.

- Enter PrimeXBT Promo code to get the first deposit bonus.

- Enter the four-digit verification PIN sent to your email address to confirm your registration

Your account is created, and you can start to trade by depositing into the account. The platform offers two deposit options- crypto deposit and alternative deposit.

In the alternative deposit option, you can buy BTC using your credit card.

PrimeXBT is a No-KYC exchange, which means it doesn’t require your identity verification.

The account opening process on BitMEX is a bit extensive as it requires you to complete the identity verification process to trade and make withdrawals.

Following are the steps involved in opening an account with BitMEX:

- Go here and click on Register

- Enter your email id, password, and choose your country of residence

- Agree to the terms and conditions to register

- Click on the verification link sent to your email ID to complete the registration process.

Post successful registration, complete user verification. You need to upload a photo ID, take a selfie, and answer multiple-choice questions relating to your source of funds and trading experience.

(Winner: PrimeXBT)

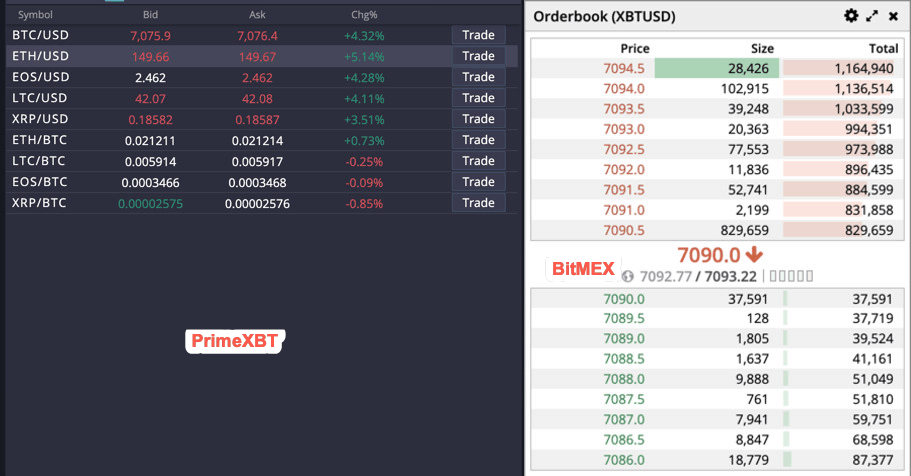

#11. Order Books

Order books are another vital point to see why choosing between BitMEX and PrimeXBT. Very honestly, both do an excellent job of showing order books in their way.

But BitMEX’s order books are flashy and unresponsive at times, throwing too often the error of order submission. In a high pace margin trading environment, where a small movement in price causes huge movement in your open trade positions, the last thing you want is for your order to get an error while submission or your stop-loss not to trigger. This has happened many times in BitMEX.

Whereas, PrimXBT provides a high-frequency trading experience with simple order books that can handle high-pressure margin trading situations and ensure no order slippages.

#12. Deposit Limits & Deposit Options

PrimeXBT and BitMEX both are Bitcoin-focused exchanges where the main funding option is Bitcoin. But PrimeXBT has gone the extra mile and now allows you to buy Bitcoin using your credit card.

In terms of deposit limit, PrimeXBT requires you to deposit 0.001 worth of BTC to start with, and BitMEX has no fixed deposit limit. Rather, it is a dynamic one depending upon the price of BTC at the moment, which is not beneficial for the users.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

#13. Security Features

When you compare both brands for security, both do a reasonably good job.

They both have best security practices like two-factor authentication, cold storage of funds, DDOS protection, addresses whitelisting and cryptographic hashing of passwords, and more implemented.

But yet, once in the past, BitMEX was guilty of leaking personal information of its users where names and email addresses of the people signed up were leaked.

#14. Customer Support Options

I am a lightweight margin trader and have tried both PrimeXBT and BitMEX. I have some experience interacting with support channels of both exchanges.

Firstly, BitMEX’s customer support is good, but it takes a couple of minutes to hours for your query to get resolved. This is good but not the best, especially in a high pace margin trading environment. Plus, the only option to reach them is through email or raising a ticket, and there seems to be no option of live chat, which is a big disadvantage.

Whereas PrimeXBT’s customer support services are active on all possible mediums of exchange, i.e., support tickets, chatbox, emails, and various social media account. Their response time has been instantaneous to a couple of minutes for me.

(Winner: PrimeXBT)

PrimeXBT or BitMEX: Which One to Choose?

Though PrimeXBT has come through our test as a better option, BitMEX can be used if you want specifically short/long Bitcoin using futures contracts.

On the other hand, PrimeXBT is more like a CFD platform where the long/short of Bitcoin, including other cryptocurrencies with leverage of 100X on all crypto pairs, can be done with fewer fees, which I see as a big deal advantage.

At last, each of them has its plus and minus points, so feel free to choose whichever suits your goals. Definitely, for us, it is PrimeXBT.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

Check out how PrimeXBT & BitMEX competing with other crypto exchanges:

- PrimeXBT vs Etoro

- BitMEX vs Binance

- BitMEX vs Bybit

- BitMEX vs Bitfinex

- BitMEX vs Kraken

- BitMEX vs Phemex