YouHodler is not just any other crypto lending platform where you can earn an interest rate or borrow funds against your crypto deposits. But a platform that helps you free up additional fiat liquidity while not missing out on any profit-making opportunities.

Starting in 2019, YouHodler has made a significant impression in the market by offering improved crypto-backed lending solutions to HODLers. According to its CEO, Ilya Volkov, YouHodler is an answer to the FOMO of crypto HODLers.

As the crypto market is a highly volatile space, HODLers remain in a dilemma, whether to continue holding or liquidating the positions. Due to this FOMO perception, many miss out on massive bull rallies to protect their cash.

Plus, YouHolder has constantly innovated crypto lending products for its users, such as MultiHodl, Turbocharge, Earn Interest. So let’s deep dive and look at the product features and other functionalities of the YouHodler platform.

YouHodler Review 2022: What Is YouHodler?

YouHodler is an EU & Swiss-based company providing crypto-backed instant loans and crypto savings accounts to crypto users worldwide since 2019.

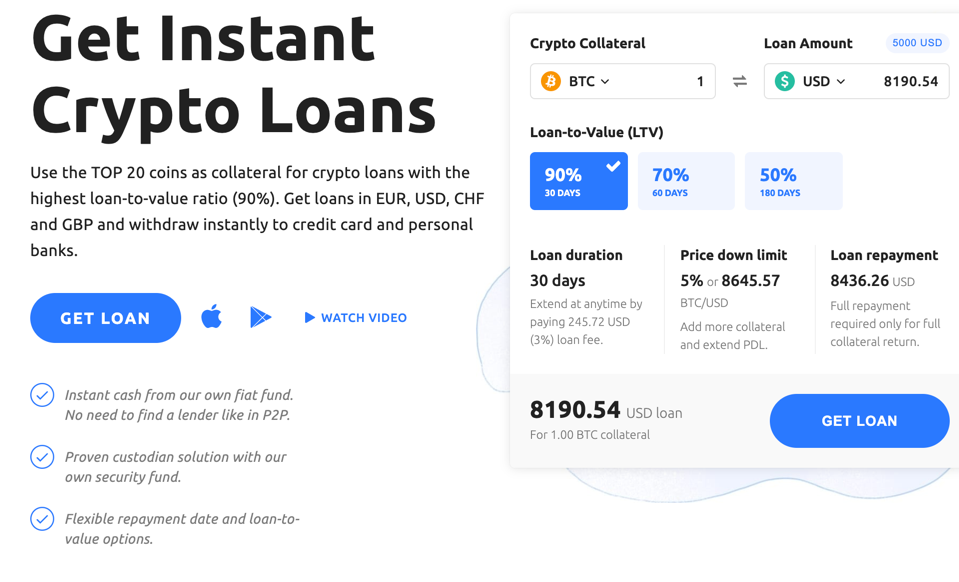

The loans are provided against the top 20 cryptocurrencies offering the highest LTV ratio of up to 90%. It provides fiat loans in USD, EUR, GBP, and CHF, which can be transferred to your credit card or bank account.

Crypto savings accounts let you earn interest on some of the top cryptocurrencies and six stablecoins. The interest rates are compounded weekly and are deposited directly into your wallet.

It also offers Turbocharge and Multi HODL features to users.

How Does YouHodler Work?

You should note that YouHodler is not a P2P lending platform but is a pawnshop. The loan agreement is executed between you and YouHodler that includes the loan tenure and other loan terms. Since there are no credit checks, the approval process is quite fast.

The interest rate depends on the type of token you choose as collateral, and based on that; you need to select one of the following plans:

- 30-day loan: It has a 3% loan fee, 5% price down limit, and offers 90% LTV

- 60-day loan: It has a 5% loan fee, 25% price down limit, and offers 70% LTV

- 120-day loan: It has a 9% loan fee, 40% price down limit, and offers 50% LTV

You can extend the loan tenure indefinitely by paying the loan fee at the end of every tenure. The loan approval process is easy and quick, and you can secure the loan in just three steps:

- Transfer cryptos to your YouHodler wallet

- Apply for the loan and quickly receive funds in your preferred fiat currency (USD, EUR, GBP, and CHF)

- Withdraw the borrowed funds to your credit card or bank account through SWIFT, SEPA, or stablecoins.

Products Offered by YouHodler

Besides crypto-backed instant loans and crypto savings accounts, YouHodler also has a Multi HODL feature to boost savings and the Turbocharge feature, which helps to borrow more. Let’s have a detailed look.

Crypto Loans

YouHodler accepts Top 20 cryptocurrencies as collateral for crypto loans and offers the highest LTV ratio of 90%. The coins include Bitcoin, Ethereum, Ripple, Binance Coin, Bitcoin Cash, Bitcoin SV, DASH, TRON, Cardano, Monero, etc.

The minimum loan amount is $100 and has a flexible repayment and loan-to-value option. The interest is paid at once at the end of the period.

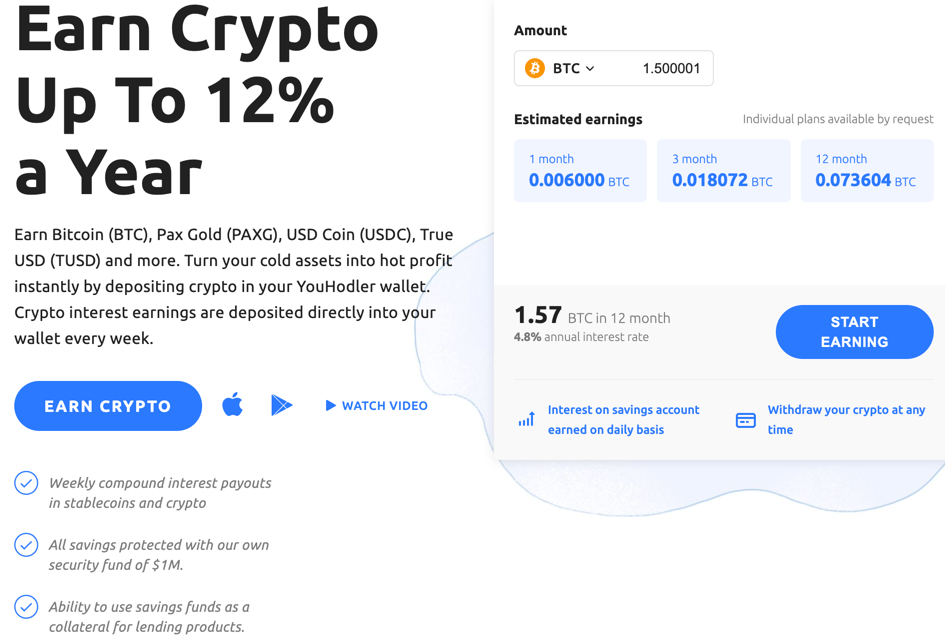

Crypto Savings Account

YouHodler lets you earn up to 12% annually on stablecoins and crypto deposits in YouHodler wallet. The interest rates differ for different cryptocurrencies. On BTC, you can earn 4.8%; on ETH & XRP; the rate is 4.5%; on Binance Coin, it is 3%, etc.

You need to move your cryptos to YouHodler wallet to start earning interest, and the interest payout gets credited every week.

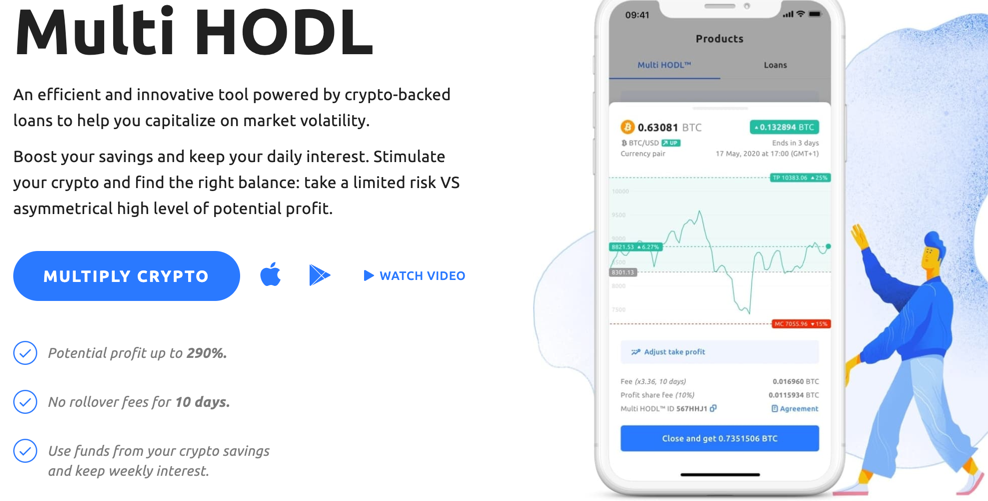

Multi HODL

The Multi HODL is an innovative tool that makes use of the Barbell Strategy to maximize returns potential. In this, you keep 80-90% of your crypto deposits in a safe and stable crypto saving account, and the rest is invested in speculative bets having high profits potential.

How does Multi HODL feature work?

The Multi HODL feature is available for all cryptocurrencies and stablecoins on the platform.

You need to set the percentage of deposit to be invested, desired take profit level, and trigger level before putting your crypto deposits in Multi HODL.

You can close the position whenever you want and get the cryptos back. Anyways, all positions are closed automatically after 10 days or in case the price falls below your loss level (trigger level).

The risks are limited but have huge upside potential, thus providing a boost to your savings. Here, you cannot lose more than what you have set.

YouHodler only charges a one-time origination fee and loan fee when opening the transaction. If there are profits, the profit-sharing rate is 10%.

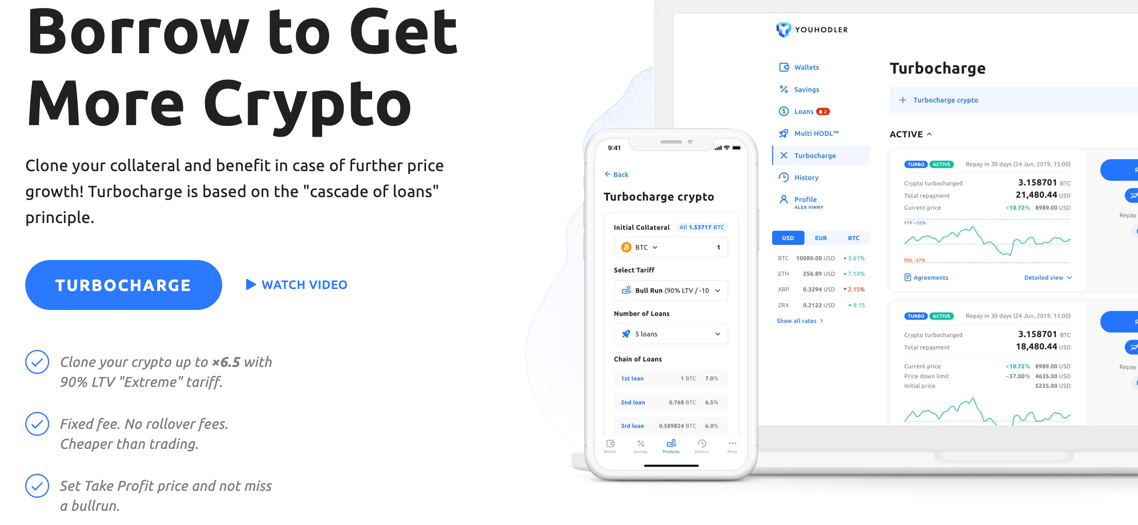

Turbocharge

Turbocharge is a proprietary feature of YouHodler, which allows users to raise additional funds using borrowed money. It works on the principle of the cascade of loans, also known as the waterfall payment structure.

Here the platform buys additional cryptos from the first loan without any conversion fee. Crypto is used again as collateral to raise the next loan, and the process is repeated 3 to 10 times. With each additional loan, the interest rate is decreased by 0.1%, making it a lucrative opportunity.

How does Turbocharge work?

If you can predict a bull run, you want to have as many cryptocurrencies in your wallet to profit more. Here, you loan more to buy additional cryptocurrency.

Set the Take Profit price, and once it hits the level, YouHodler automatically closes the position. Using collateral, YouHodler settles the fees and returns the rest of your cryptos. You can profit up to 6.5 times your initial collateral value.

There is also a downward risk associated, and you have to set the trigger limit as per your risk appetite. If the prices fall below the trigger level, the platform starts closing all your loans and sells the collateral to protect you from further loss.

YouHodler Savings Account Review

YouHodler has one of the top crypto lending platforms in the cryptosphere. It’s an ideal platform for crypto investors who want to earn substantial returns on their assets without exposing their holdings to downside risk.

YouHodler allows you to earn interest on your crypto investment. The earned interest, referred to as annual percentage yield (APY), ranges from 2.5% to 12.3%.

The APY is the highest (12.3%) for stablecoins, including USDT, USDC, PAX, TUSD, DAI, and HUSD. For cryptocurrencies, the APY varies between 2.5% and 7%. The APY is 4.8% for BTC, 5.5% on ETH, and 7% on UNI. YouHodler provides the highest APY on stablecoins in the crypto space.

Furthermore, YouHodler offers a lot of flexibility when it comes to its crypto lending space. It offers weekly interest payouts based on the interest accrued every month. Therefore, you can earn compound interest and grow your crypto portfolio exponentially.

In addition to earning a passive income, you can use your savings funds as collateral to get an initial loan and speed up the loan process. YouHodler also has an earning calculator feature that shows the estimated earnings.

Overall, YouHodler’s crypto lending platform is one of the best in the crypto space. You can earn high weekly APY and enjoy flexible payout terms. YouHodler also offers $150 million worth of insurance via its custodian Ledger Vault.

How Do YouHodler Lending and Interest Account Work?

YouHodler provides a seamless crypto lending and earning experience. Let’s look at how cryptocurrency lending on YouHodler works.

- Deposit crypto assets in your YouHodler account. YouHodler allows you to deposit 33 cryptocurrencies and stablecoins at the time of writing.

- That’s all you need to do. Once you deposit funds in your crypto wallet, you’ll start earning compound interest on it. Importantly, you don’t need to do anything. Let your holdings sit in your YouHodler wallet and earn attractive returns.

- Withdraw your funds anytime into your bank account or deposit additional crypto to enhance your earnings further.

Please note that YouHodler allows you to earn interest before the end of the week. However, if you do so, you won’t earn the interest accrued during that week. Similarly, if you deposit more crypto within the weekly period, the new deposit’s interest rate will apply from the next month.

After every week, YouHodler will pay out interest in your account. You can either withdraw it or let it sit there to earn compounding interest.

YouHodler Crypto Loans Review

In the earlier sections of this review, we briefly discussed YouHodler crypto loans and how they work. If you want to delve deeper into this offering by YouHodler, keep reading further.

YourHolder offers loans on 30 cryptocurrencies and stablecoins at the time of writing. These include popular cryptocurrencies like Bitcoin, Ethereum, Chainlink, and emerging tokens like Synthentix, Cardano, and Monero.

The loan-to-value ratio (LTV) depends on the loan durations. For 15-day and 30-day loans, the LTV is 90%. The LTV reduces to 70% for 61 days and 50% for 150 days.

Suppose the current BTC price is $50,000, and you need a loan of $5,000 for a loan term of 30 days. With the LTV being 90%, you’ll need to use around 0.12 BTC as collateral.

YouHodler doesn’t disclose the loan interest rate on its website, but resources suggest that the loan interest rate charged by the platform is quite high. The interest rate is 25.55% for 30-day loans (90% LTV), 19.14% for 61-day loans (70% LTV), and 16.22% for 180-day loans (50% LTV).

Another concept to understand before taking loans from YouHodler is the “price down limit.” It is the threshold percentage below which YouHodler will sell your collateral at the market price. The price down limit is 5% for 15-day and 30-day loans, 25% for 61-day loans, and 40% for 180-day loans.

Here’s how the limit works. Suppose you take a loan for 30 days. During the loan term, if the crypto value of your collateral drops below 5%, YouHodler reserves the right to sell those assets to recover their loss. However, you always have the option to add more collateral.

Unlike other crypto platforms that charge an interest rate every month or year, YouHodler charges interest payments only once at the end of the month. The minimum loan amount is $100, significantly lower than $1,000 for Celsius, $5,000 for SALT, and $10,000 for BlockFi.

Furthermore, YouHodler is one of the few crypto loan providers that offer loans in multiple fiat currencies. You can take a loan in USD, EUR, GBP, and CHF.

How Do YouHodler Crypto Loans Work?

Getting instant cash loans on YouHodler is easy. Here’s a step-by-step process to using your crypto as collateral to take loans.

- Transfer crypto funds to your YouHodler account. Please note that the loan amount you get will depend on the size of your collateral. So, be sure to deposit crypto as per your loan requirements.

- Once the funds reflect in your crypto portfolio, use YouHodler’s loan calculator to determine the collateral needed for the loan amount you need. Contrarily, you can enter the amount of collateral and see the maximum loan amount you can get against it.

- Select the loan term based on your requirements and click on Get Loan. YouHodler will verify your collateral and put funds in your wallet on the same business day. You can then withdraw those funds via bank wire transfer.

- YouHodler allows you to repay your loan amount anytime within the loan term. You can pay back the loan amount using stablecoins, credit cards, or bank wire transfers. Once you repay your loan with interest, your crypto collateral will return to your verified account.

- YouHodler offers additional features like Increase LTV Ratio, Extend Price Down Limit, Manage Loan Duration, Close without Repay, Borrow Bitcoin, and Set Take Profit Price to manage your loans better.

YouHodler Exchange

Are you looking for an effortless way to buy and exchange the cryptocurrencies of your choice in real-time? YouHodler’s Exchange helps you do that. Like any other cryptocurrency exchange, YouHodler enables you to buy cryptocurrencies.

You can exchange fiat currencies and stablecoins with cryptocurrencies of your choice. The platform also lets you exchange cryptocurrencies with other cryptocurrencies.

YouHodler stores most of your exchange funds in multi-signature cold wallets for added security. You can exchange over 40 cryptocurrencies using YouHodler’s universal conversion feature. It also supports multiple fiat currencies, including USD, EUR, CHF, and GBP.

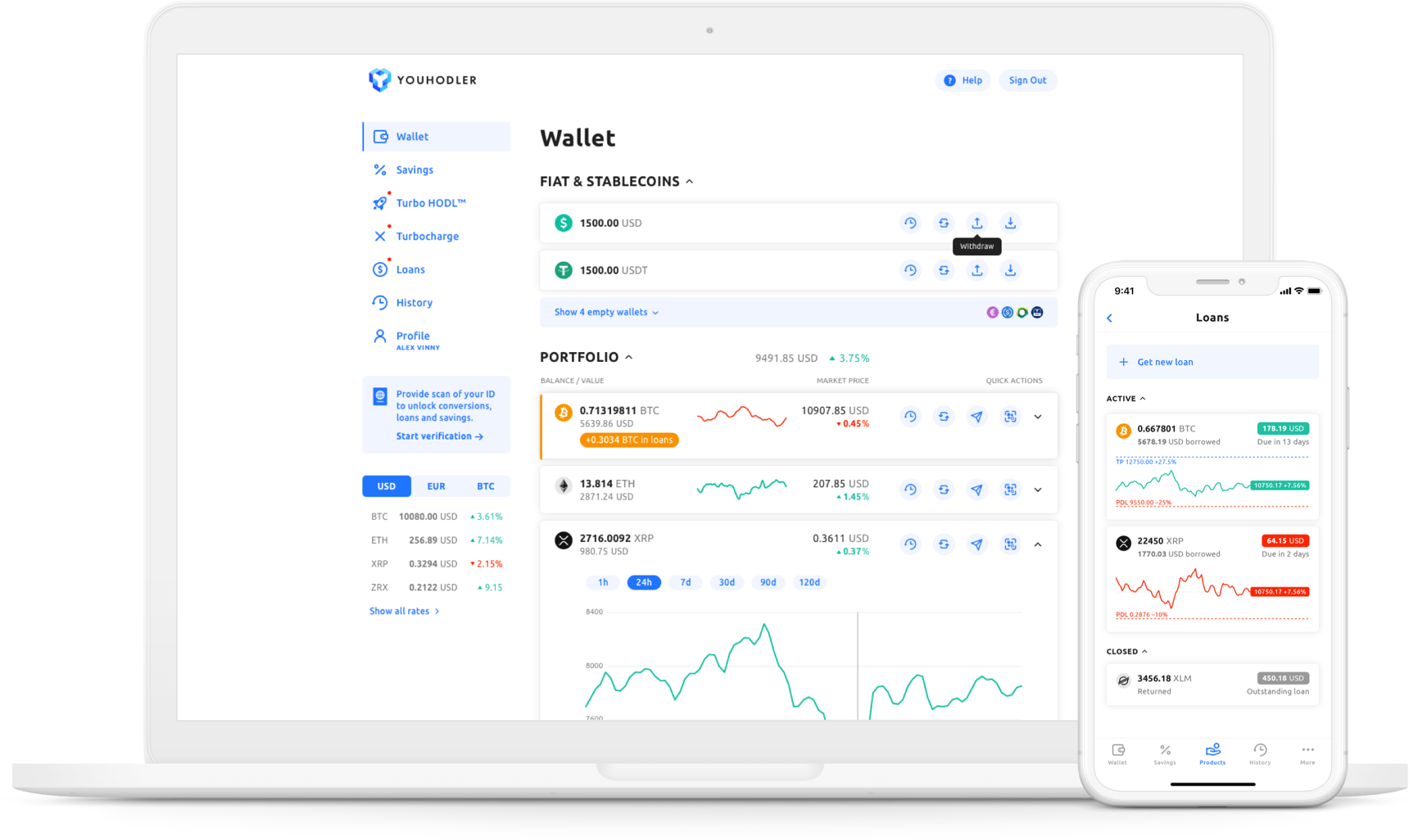

YouHodler Wallet

YouHodler lets you store your digital assets in one of the most advanced Bitcoin and crypto wallets in the market. It comes with an interest account and multi-HODL integration to help you do more with your crypto deposits.

YouHodler wallet supports over 60 cryptocurrencies. Support for multiple currencies, high security, and dynamic development make YouHodler wallet a great option for depositing funds.

YouHodler Fees & Deposit/Withdrawal Rates on Fiat Currencies

Similar to other buying and crypto lending platforms, YouHodler doesn’t charge any loan origination or prepayment fee. The only charge you need to pay is the interest rate when you take a crypto-backed loan.

However, YouHodler charges a fee for using its exchange service. The fee depends on the cryptocurrency you buy or trade. For example, YouHodler charges a 1% fee to convert Bitcoin and 0.2% to convert ETH.

The fee is comparable to other platforms and is subject to change. Be sure to keep an eye on the exchange fees before converting your currencies.

Also, the users must be aware of transaction charges levied on depositing and withdrawing funds. The deposit fees in YouHodler look as follows.

- SWIFT bank wire: $25 or €25

- Credit card: 4.5%

- AdvCash account: 1%

When it comes to withdrawing funds, the following fees are charged:

- SWIFT Bank wire USD: 1.5% or $70 (whichever is higher)

- SWIFT bank wire EUR: €55

- SEPA bank wire EUR: €50

- GBP bank wire: £55

- Credit card: 3.5% (when available)

- Crypto: Varies by crypto

What About KYC and Regulations of the Platform?

YouHodler complies with strict EU laws and needs to adhere to strict legal obligations. All the loan deals are legally binding contracts and fall under the jurisdiction of EU laws.

Also, YouHodler is an official member of the Blockchain Association, an independent and self-regulatory crypto sub-group of the Financial Commission, which needs it to operate with the highest standard of safety and ethics.

Concerning KYC verification, users need to go through an identity verification process to access all the features of YouHodler. Though YouHodler doesn’t operate in the US and isn’t regulated by the SEC, its users are verified.

The KYC process is quick. After you fill the form and provide the desired documents, the YouHodler team verifies your account within 48 hours. Once your identity is verified, you can access all the services available on the YouHodler platform.

Is YouHodler Safe?

YouHodler is in line with all other popular cryptocurrency platforms when it comes to security. It implements all the essential features needed to provide everyone with a safe and secure borrowing and lending experience.

Some major security features of the platform are:

- Two-Factor Authentication: YouHodler offers 2FA functionality that enables you to enhance the security of your account.

- Disable Withdrawals: Users over $10,000 in their savings account can disable all withdrawal options and enable manual withdrawal only.

- Multi-Signature Cold Storage Wallets: YouHodler stores most users’ funds in multi-signature cold storage wallets for enhanced security and protection from hackers.

- Top-Notch Security: Other security features implemented by YouHodler include SSL encryption and IP allowlisting.

Additionally, YouHodler has $150 million in pooled insurance powered by its custodian, Ledger Vault. Since cryptocurrencies aren’t eligible for FDIC insurance, this third-party insurance by YouHodler provides enhanced security to your funds.

YouHodler is also registered with the Crypto Valley Association.

Supported Countries

YouHodler is a FinTech company based in Switzerland and offices in Cyprus. It is an international service provider and renders services in over 150 countries worldwide. However, the YouHodler isn’t available in some countries due to legal restrictions.

YouHodler is available to customers worldwide except in the USA and its unincorporated territories, Iraq, Pakistan, Bangladesh, China, Crimea, Cuba, Iran, North Korea, Sudan, Syria, Afghanistan, and Palestinian Territories.

Customer Support

It offers 24*7 customer support which is available through integrated intercom messaging. Users can live chat with YouHodler employees and get feedback on issues within minutes. The best part is that the whole YouHodler team, including the CEO, provides feedback to their customers.

Apart from this, it has many tutorials and FAQs listed on the website’s Help section, which helps users get started on the platform.

How YouHodler Performs Against its Competitors?

Despite being a new platform with only a year of existence, YouHodler has made a significant mark in the industry and is well above its competitors.

Compared to other lending platforms like Celsius Network, Nexo, SALT, and BlockFi, YouHodler is more flexible with users’ needs and offers more choices.

For instance, only YouHodler offers crypto savings accounts in around 40 cryptocurrencies and stablecoins, and that too at one of the highest interest rates on deposits. It supports unlimited duration limits.

If we compare the crypto loan feature, YouHodler has the maximum collateral option, offers the highest LTV ratio, and offers loans starting at $100. The 90% LTV feature is huge, as no other platform offers more than 70% LTV.

Furthermore, you can get a loan in USD, EUR, GBP, CHF, and BTC, whereas other platforms only provide a loan in USD and stablecoins.

A Three-Step Formula To Earn Interest With YouHodler

If you’re looking for a complete platform for all your crypto needs, YouHodler can be the ideal pick for you. The problem with most lending and borrowing platforms is that they only enable you to earn income through interest payments.

The APY is low, around 5-8%. While these gains can compound over time and help you build a fortune, you won’t see big returns in the short term. YouHodler resolves that hurdle for you. Here’s how you can use YouHodler’s three best features to make big profits in the short term.

1. Deposit a Large Number of Funds in Your Savings Account

As discussed, YouHodler offers an attractive APY of up to 12.3% a year on cryptocurrency deposits. The APY on BTC is 4.8%, paid out weekly. So, if you deposit BTC worth $10,000, your account will have $10,000 + $480 (4.8%) = $10,480 in your account.

If you don’t withdraw the interest amount, YouHodler will give you 4.8% interest on $10,480, resulting in around $10,980. And this cycle continues until you decide to withdraw. This refers to compounding interest.

You can earn attractive returns if you deposit a large amount and let it sit in the crypto interest account for a few years if you do the math.

2. Use a Fraction of Your Funds in Multi HODL

While earning interest is a safe way to generate passive income, it takes time to compound. The Multi HODL feature allows you to use funds in your wallet or savings account to trade cryptos in the live market. You can set profit targets and risk limits to multiply your assets quickly.

Furthermore, Multi HODL has a 30x multiplier feature that offers up to 30x leverage on your positions. This allows you to multiply your profits by 30x without even holding the assets. Among its competitors, YouHodler is the only platform to allow leveraged trading.

Other trading features offered by YouHodler Multi HODL include:

- Real-time execution

- Edit open deals

- Lock trading

Importantly, YouHodler allows you to keep earning interest on your funds even when you use them for trading. Hence, you can earn money in two ways simultaneously by leveraging price volatility and interest payments.

3. Clone Your Collateral Using Turbocharge

An underrated feature of YouHodler is Turbocharge. Imagine you have used 1 BTC collateral to take a loan of $25,000 for 180 days at 50% LTV. In the meantime, the price of BTC surges 20% to $60,000. What if you could use make some quick profit off that price change?

If you have an outstanding loan and your crypto assets are locked up as collateral, you can clone them earn from price growth. Turbocharge helps you do that. You can set your take-profit, and any gains beyond your collateral amount will be transferred to your savings account.

YouHodler allows you to clone your collateral up to ten times and multiply your collateral by 6.5x.

Final Verdict

YouHodler is not just a crypto lending platform but provides true financial autonomy to users. Being regulated under the strict EU laws makes YouHodler a fully legitimate business providing much-needed confidence to users.

Let’s have a look at some of the benefits YouHodler in a gist:

- New loan starting from as low as $100

- Over 20 crypto collateral options

- Up to 90% LTV, the highest in the industry

- Highest LTV ratio and flexible repayment options on loan packages

- Get a high-interest rate on crypto deposits

- Multi HODL and Turbocharge lets you profit more on deposits

- Regulated platform with compliance & AML

- Custody management solution and $150 million pooled crime insurance

YouHodler is a great solution and is a very easy-to-use platform. It is suitable for earning more on their crypto holdings without missing out on rallies. Also, it enables users to raise long-term loans at a desirable rate.

So what are you waiting for? Just go and check out YouHodler now, and if you have used it, tell us in the comments section below what you liked about the service. We are waiting 🙂

Find out how does Nexo Loan stacks up against other crypto lending platforms:

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023