Options trading has been an integral part of traditional finance for a very long time, and now it is coming for Bitcoin and other cryptocurrencies.

I am talking about crypto options trading.

I think you are already aware of it but are looking for more information on crypto options trading.

If that’s the case, I must say you are in the right place.

Bitcoin and crypto options trading are catching up, especially among people who have well-established crypto portfolios so that they can hedge the risk of their positions.

Therefore, when trading options, one needs to find a reliable crypto exchange. Let’s have a look at some of the best crypto exchanges for Bitcoin options.

Don’t fret; I’ve got you covered. In this article, I will take you through the best crypto Options trading platform available in 2023.

So buckle up, and let’s get started!

Best Crypto Options Exchanges For Trading Bitcoin Options

| Best Crypto Options Exchange | Quick Links |

| Bybit – Options USDC [$30,000 Bonus]<<—–BEST DEAL | Try Now |

| Deribit [10% Fee Discount – ONLY BTC & ETH] | Try Now |

| Delta Exchange [Bonus Upto 30%- All Cryptos] | Try Now |

| StromGain | Try Now |

| Binance Options | Try Now |

| Quedex | Try Now |

| LedgerX | Try Now |

| Binance JEX | Try Now |

Usually, people who find out about crypto Options trading are generally confused about how and where to trade crypto Options.

We have made this curated list of the best crypto Options trading platforms from where you can quickly learn how to trade Options!!

Moreover, you should know that not all crypto exchanges are created equal, nor do all exchange platforms offer crypto Options contracts for trading.

Bitcoin Options trading is still a niche business, and not many established players have entered this space. But whatever crypto Options exchanges are available out there are suitable for the job.

So here they are:

- Bybit – (USDC Options)

- Deribit (best crypto options exchange for Bitcoin & Ethereum)

- Delta Exchange (best for Institutions use for all major Cryptos & Tokens)

- Binance Options (Long-standing options exchange)

- MEXC Global

- Bitget

- Bit

#1. Bybit – USDC Options

Bybit is a fast-growing global cryptocurrency day trading platform, with over 6 million users worldwide.

It offers an ecosystem of crypto financial products, including Futures, Spot trading, NFTs, Copy trading, Savings, and Investment Products to start trading.

Bybit’s newest addition to its vast array of financial instruments is USDC Options which includes Bitcoin Options contracts.

Bybit’s USDC option is the first stablecoin-margined Options contract on the market. USDC Options are collateralized and margined in USDC — the world’s most trusted stablecoin.

Stablecoins like USDC do not suffer from the extreme price fluctuations commonly associated with cryptocurrencies like Bitcoin.

In contrast to coin-margined Options, using USDC as collateral has been a prudent choice on several occasions this year, especially during volatile periods.

Furthermore, USDC is pegged to the U.S. dollar, which indicates that 1 USDC would be equal to $1.

In other words, when trading USDC Options on Bybit, the profits are calculated in USDC, making it easier for traders to benchmark and calculate returns.

Portfolio margin is another benefit of Options traders on Bybit. Using the portfolio margin trading feature, traders can fully leverage their portfolios for enhanced capital efficiency.

The portfolio margin mode evaluates positions across Bybit’s extensive USDC trading products and calculates the margin accordingly. This reduces margin trading requirements and potentially amplifies return on capital.

To top it all, Bybit’s USDC Options offer deep liquidity, high trading volume, and market depth. This gives users a fair and transparent trading experience with minimal slippage.

With Bybit’s significant market depth and best-in-class liquidity, traders can enjoy maximum profits on their trades even in times of price fluctuations. To know more about it, check this in-depth Bybit review.

#2. Bitget: Simplifying Options Trading

Bitget is a rapidly growing crypto leverage trading platform that’s earning a reputation as a solid choice for Options and trading crypto derivatives. It has a robust suite of advanced features that make it stand out in the crowded crypto trading exchange market.

For starters, the platform offers a user-friendly interface that doesn’t compromise on the depth of functionality, making it suitable for both beginners and seasoned traders.

Bitget offers a wide range of trading pairs to choose from, giving you the flexibility to trade Options contracts on various cryptocurrencies. Also, they ensure high liquidity, enabling smoother transactions even at large volumes.

On the security front, Bitget is quite impressive, with industry-standard measures in place. They use a cold-hot wallet system, multi-signature access, and anti-DDoS protection to secure users’ funds.

With its competitive Options trading fees and excellent customer support available round-the-clock, Bitget has established itself as a reliable choice for Options traders.

#3. MEXC Global: An Excellent Platform for Options Trading

MEXC Global is an exchange that truly stands out when it comes to trading Bitcoin Options.

First and foremost, this platform is known for its easy-to-understand user interface that appeals to both newcomers and experienced traders alike.

One notable feature is the diverse range of trading pairs MEXC offers.

From Bitcoin to Ethereum and various altcoins, the choice is vast. This means that you’re not restricted in terms of the Options contracts you can trade.

When it comes to security, MEXC does not skimp. It provides a multi-level firewall, multi-signature withdrawals, cold storage for assets, and an anti-DDoS system to ensure your funds are as safe as possible.

The fees on MEXC are competitive, and it also has a lucrative VIP program that offers low fees based on trading volumes, making it particularly attractive to institutional investors and high-volume traders.

Finally, the platform provides 24/7 customer support to assist users with any issues they might encounter, which only adds to the overall appeal of MEXC for Options traders.

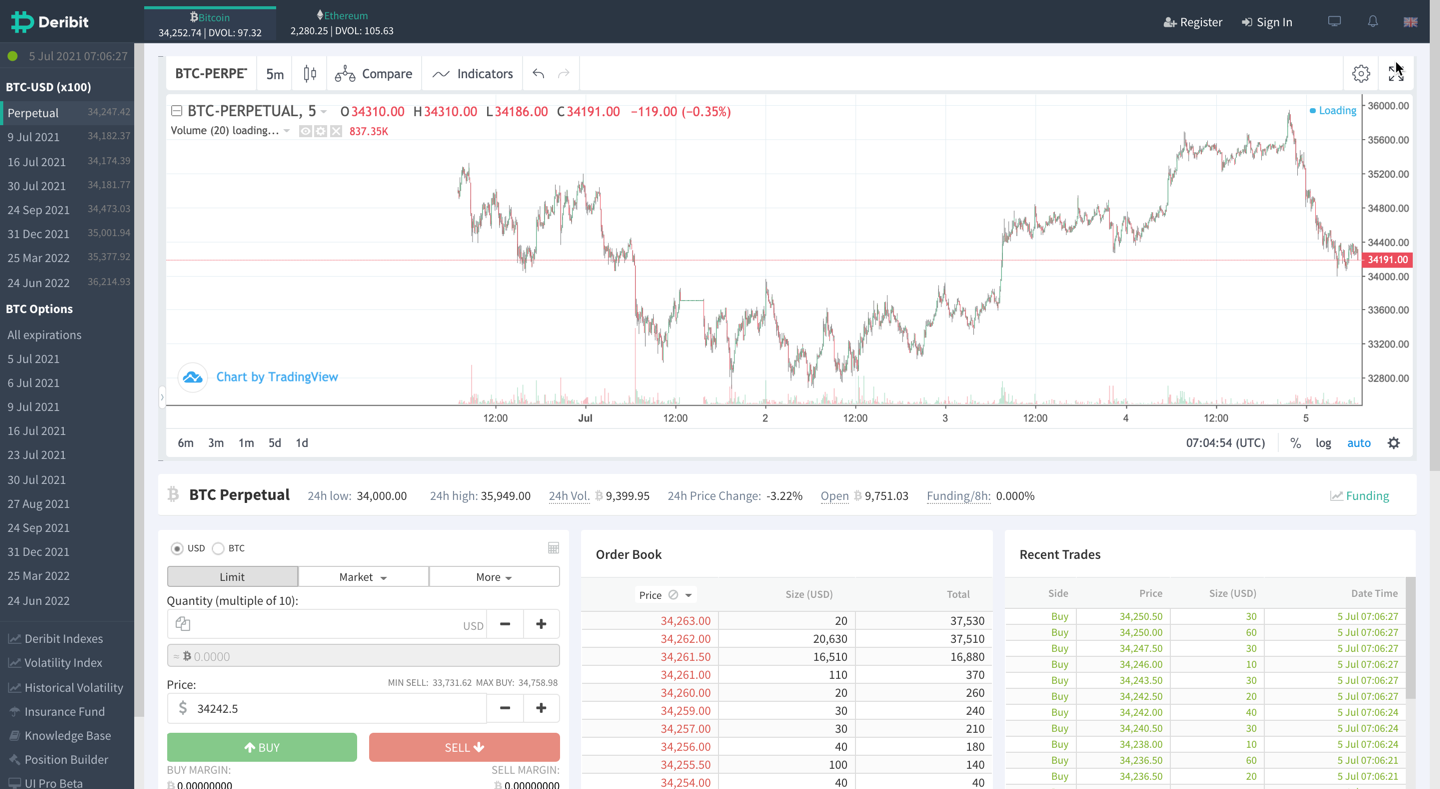

#4. Deribit

Deribit is the most preferred crypto contract trading platform for Bitcoin Futures and Options trading.

It is based in Amsterdam, Netherlands, serving the crypto community with its crypto derivatives products since 2016.

Due to the less availability of crypto Options exchanges, Deribit has become the go-to crypto Options exchange for many cryptocurrency traders with well-established portfolios.

Further, Deribit provides European-style Options, meaning such Options can only be exercised at the time of expiration date.

Also, the settlement happens in cash instead of the underlying asset, but this shouldn’t be a problem for anyone as it still does the job for you!

Lastly, as of now, Deribit facilitates Options trading on its crypto Options platform, where the trading fees are applied in a maker-taker fashion.

The maker fee is either 0.03% of the underlying or 0.0003 BTC per Options contract, and the taker fee is 0.03% of the underlying or 0.0003 BTC per Options contract.

To know further, have a look at this comprehensive Deribit review.

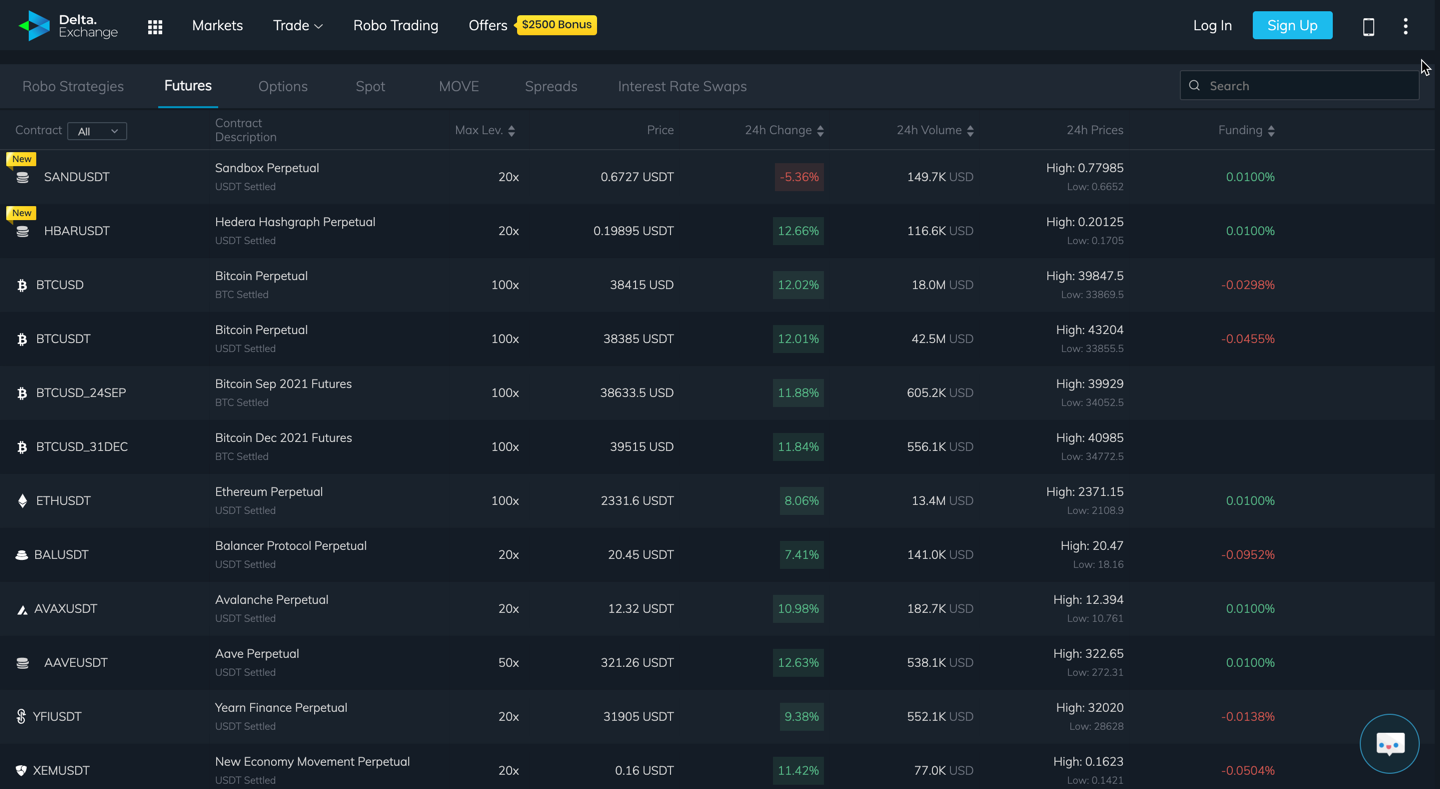

#5. Delta Exchange

Delta Exchange is a Singapore-based cryptocurrency derivatives platform started in 2018 and is backed by some of the big names in the cryptosphere, including Kyber Network, AAVE, Sino Global Capital, CoinFund, etc.

It offers a wide range of trading products in the crypto derivatives segment, including Futures (perpetual, and with expiry) on BTC and 50+ altcoins, European Options, MOVE contracts, etc.

You can buy and sell, call & put Options on BTC, ETH, XRP, LTC, BCH, BNB, and LINK in the Options segment. It is one of the first crypto exchanges to offer Options trading for a wide range of crypto assets with up to 100X leverage.

The exchange charges meagre trading fees for Options trading, which is 0.03% of the transaction amount as taker fees, and maker fees for Options contracts. And, it has a fixed fee of 0.03% as settlement fees on the crypto Options trading platform. To learn more, here is an in-depth Delta Exchange review.

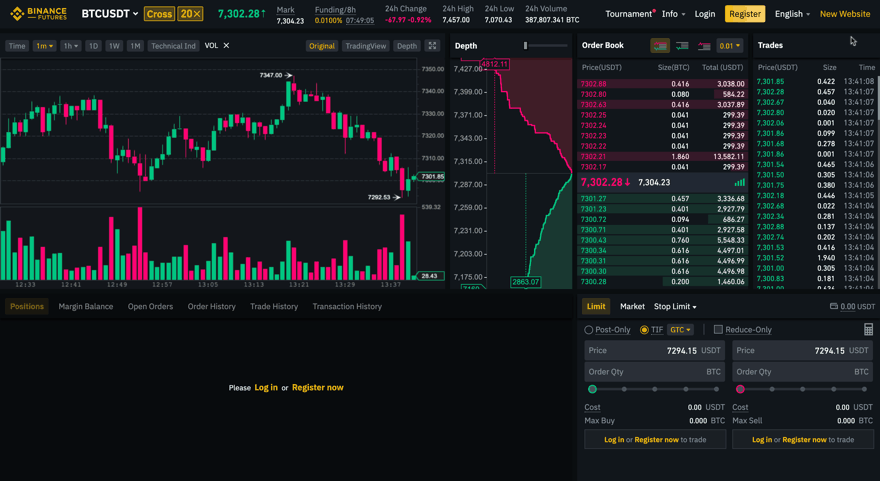

#6. Binance

Binance is one of the leading global crypto Options trading platforms that offers trading in a wide range of crypto assets. The crypto exchange also has the most liquid market for all assets in both the spot and the derivatives marketplace.

It allows you to trade crypto Options contracts through its Options platform, which was launched in 2020. You can use leverage of up to 125X to trade cryptocurrency Futures and Options contracts.

Binance allows buying and selling of European-style vanilla Btc Options, which can only be exercised on the contract expiration date. The crypto Options contracts are priced and settled in USDT.

The Options trading fees has two parts- the transaction fee and the fee to exercise.

- Transaction fee: Index price * Transaction fee rate, i.e., 0.02% of the underlying asset value (charged as maker fees and taker fees)

- Exercise fee: Exercise price * Fee to exercise rate, i.e., 0.015% of the underlying asset value

To get an in-depth idea of the exchange, check this Binance futures review.

HOT Offer: Get $25 on account opening & first deposit using this link to sign up. |

#7. Bit.com: Bridging the Gap in Crypto Options Trading

Bit.com, a subsidiary of Matrixport, is dedicated to providing an innovative and professional platform for crypto Options and crypto Futures trading only. The platform excels in offering comprehensive and reliable services that have gained the trust of many traders.

One of Bit.com’s greatest strengths is its intuitive and user-friendly interface, making it accessible for beginners yet robust enough for experienced traders.

What makes Bit.com stand out is the wide array of trading pairs available. It offers Options trading on various major cryptocurrencies like BTC, and ETH, and expands the opportunities for diversification.

Bit.com prides itself on its top-notch security features. They employ cold storage for funds, SSL encryption, and two-factor authentication, ensuring a secure trading environment for users.

Moreover, Bit.com has highly competitive and low fees too, transparent pricing, and flexible contracts, making it a solid choice for traders looking for a cost-effective and efficient Options trading platform.

With 24/7 customer support ready to assist, Bit.com offers an all-around great experience for Options trading in the crypto world.

What Is Bitcoin/Crypto Options Trading?

Options trading is not a new concept, but I believe you might not be aware of its benefits.

So allow me to help you out.

Options are financial instruments that derive their value from other underlying asset prices. These assets can be stocks, bonds, indexes, or in our case, cryptocurrencies.

As the name suggests, Options trading gives an option or choice to the trader, and not the obligation, to buy or sell an asset in the future at a pre-agreed fixed price, irrespective of whatever the asset price is at the expiry date.

Complicated? Let me explain with an example.

Let’s say you have a healthy-looking Bitcoin portfolio, and you are satisfied with it. But you are also aware of the volatility of the BTC market and are expecting a bear market.

You are sceptical of this impending bear market and are unsure whether your healthy-looking portfolio will continue to look healthy.

In this case, you would want to minimize the risk of your portfolio and would not want to lose unrealized profits, especially if the bear market never ends.

Enter Bitcoin Options.

You can purchase Put Options for Bitcoin.

Put Options are the financial instruments that will lock the selling price for your underlying asset in the future. Having put Options in such a case is like having portfolio insurance in a declining market situation.

Put Options can be bought easily through crypto Options exchanges, where you need to pay a small premium to purchase such put Options.

Now, let’s say you have 10 BTC, which you bought for $10,000 each, and the current market price is $12,000.

You are expecting the price per BTC to hit $8,000 in the future. So, you have purchased 10 Bitcoin put Options for $50 each at a strike price of $10,000 per BTC.

After some time, your scepticism comes true, and the BTC price falls to $8,000 (strike price), and you want to exit your position.

So, in this case, you can exercise your put Options and still sell Bitcoin for $10,000 per BTC.

In this scenario, you realized all the profits from your BTC portfolio regardless of the market price. You have BTC put Options to thank for it.

Also, notice you were able to exercise these put Options because you had already paid a premium of $500, i.e., $50 per put option, which I think is a cool deal to hedge against your portfolio risk.

If you did not have a put option, you would have lost $20,000, i.e., $2,000 per BTC, because Bitcoin was later trading at the $8,000 mark.

But remember, Bitcoin Options holders are not obligated to do this in case the price of BTC shoots up in the future. That’s why it is called an option.

Still, for the seller of a put option, it is an obligation now to buy the underlying asset, i.e., BTC, if the buyer decides to exercise their put option in a scenario of a Bitcoin price downturn.

Some More Basics About Bitcoin Options

In general, there are two types of Options, Puts & Calls.

Traders and hedgers use the call option (right to buy) or Put option (right to sell). These are also called Options contracts and consist of broadly four essential components:

- Size: It means the number of Options contracts you need to buy, either calls or puts. It is also sometimes also referred to as the lot size.

- Expiry Date: The date before which one can exercise the option. After this day, the Options expire, and the holder no longer enjoys the option to exercise the contract.

- Strike Price: The price at which the asset will be bought or sold if the asset’s actual price in the market hits it.

- Premiums: It is a fee to buy different kinds of Options. The premium is affected by the underlying asset’s volatility and intrinsic value.

When you pay a premium for a call option, it means you are paying to exercise the option to buy under the expiration date.

On the other hand, when you pay for put Options, it means you are purchasing the option to sell an asset once the Bitcoin option expires.

So using Bitcoin Options, Bitcoin owners usually do these two types of trades:

- Protective Put: Here, you are buying put Options for the Bitcoin you already own. Buying this ensures your BTC portfolio is protected against the potential downturn. If the downturn doesn’t happen, you only lose the option premium you paid to purchase these puts.

- Covered Call: In this case, too, you own the BTC and are sure of the price movements in the future. Using this situation, you can make extra income from your holdings.

So when the call option you are selling expires, and the strike price is not reached, you would have earned extra through the premium of the call option you sold.

On the other hand, if the strike price is reached and the buyer of the call option wants to exercise the contract, as a seller, you would be obligated to sell your Bitcoin.

Are crypto Options risky?

Like any form of investment, crypto Options trading isn’t devoid of risks. Let’s deep dive into the potential hazards and get a more nuanced perspective of this market.

1. Inherent Volatility: Cryptocurrencies, by their very nature, are highly volatile. This means that their prices can soar or plunge dramatically in a matter of hours or even minutes. Such price swings can have a significant impact on the value of your Options. While volatility can present lucrative opportunities for the savvy trader, it also amplifies the potential for losses.

2. Market Direction Risk: With Options, you’re essentially betting on the future price movement of an underlying asset. If the market moves in the direction you predicted, you could see substantial profits. However, if the market moves against your prediction, you could face considerable losses, potentially even losing your entire initial investment.

3. Regulatory Risks: The regulatory landscape around cryptocurrency trading is still very much in flux. Changes to laws and regulations can drastically affect the value and viability of crypto Options. This can include bans on certain types of spot trading or even total prohibition of cryptocurrency trading in certain jurisdictions.

4. Liquidity Risk: While the crypto market as a whole has seen a surge in volume over recent years, some Options markets may still suffer from low liquidity. This could make it harder to open or close positions at your desired price and could potentially lead to losses.

5. Counterparty Risk: In traditional Options markets, a clearinghouse acts as a neutral third party to ensure trades are settled correctly. In the crypto exchange world, however, many Options trades are conducted peer-to-peer without a clearinghouse. This exposes traders to the risk that the counterparty will not fulfill their side of the deal.

6. Operational Risk: This includes risks related to the technology underpinning crypto Options trading. For instance, glitches or failures in trading platforms can lead to trades not executing correctly. Also, the security of your underlying asset is always a concern in the crypto world, with hackers constantly seeking ways to breach wallets and exchanges.

But all these risks shouldn’t deter you from considering crypto Options. With careful planning, disciplined trading strategy, advanced trading tools, and diligent risk management, you can navigate these potential pitfalls.

Crypto Options can offer high-profit potential and serve as a valuable tool for hedging against other investments.

They offer a way to tap into the potential of cryptocurrency markets with a smaller upfront capital commitment compared to outright buying crypto assets.

Remember, as with all investments, never risk more than you can afford to lose, and it’s always wise to diversify your portfolio.

How to Choose the Best Crypto Options Trading Platform

In the digital age, selecting the right platform to trade Bitcoin Options is absolutely critical.

The platform you choose will not only influence your overall trading experience, but it will also determine the types of resources you have at your disposal, and, in many ways, your potential profitability.

So, the burning question is: how do you sift through the multitude of choices to find the best platform for your trading needs?

1. Security Measures: First and foremost, security is of paramount importance. Your chosen platform must employ robust security measures such as two-factor authentication (2FA), advanced encryption technology, cold storage Options for your funds, and preferably, have some level of insurance coverage for digital assets.

2. Regulatory Compliance: Opting for platforms that are regulated in reputable jurisdictions gives you an added layer of protection. Regulation ensures that the platform operates within the confines of the law, which invariably adds to the platform’s credibility.

3. User-Friendly Interface: As a trader, you want to be trading crypto Options with a platform that is easy to navigate, especially if you are new to trading. A clean, intuitive interface that simplifies the trading strategies will make your trading experience smoother, more enjoyable, and less overwhelming.

4. Variety of Trade Types: Different platforms offer different types of trading strategies. Some may offer just simple call-and-put Options, while others may provide more complex trades like straddles, strangles, and butterflies. It’s important to choose a platform that aligns with your trading style and offers the types of trades you wish to execute.

5. Liquidity: A platform with higher liquidity ensures that you can open and close positions with ease. Platforms with high liquidity usually have tighter spreads, which translates into reduced trading costs for the underlying asset.

6. Transparent Fee Structure: Understanding the platform’s fee structure is absolutely vital. Some platforms may seem attractive with lower trading fees, and taker fees but may charge hefty amounts for deposits, withdrawals, or inactivity. Be sure to read the fine print.

7. Responsive Customer Service: Reliable and top-notch customer support is particularly vital, especially for new traders. Check whether the platform offers multi-channel support, the response times from the support team, and whether support is available around the clock.

8. Educational Tools and Resources: Does the platform offer educational resources that help you understand Options trading better? Look for comprehensive guides, tutorial videos, webinars, informative blog posts, and the possibility of getting a demo account for practice.

9. Wide Asset Selection: The platform should offer Options trading for a wide array of cryptocurrencies. The broader the Options you have, the more opportunities there are for advanced traders to find potentially profitable trades.

10. Solid Reputation: Lastly, take some time to research the platform’s reputation. User reviews, blog posts, and forum discussions can provide valuable insights into the experiences of other users.

Bear in mind that there isn’t a one-size-fits-all answer when it comes to choosing a crypto Options trading platform. The best platform for you will ultimately depend on your specific needs, trading goals, and level of trading experience.

It is absolutely crucial to do your due diligence before starting to ever trade Bitcoin Options. As the saying goes, “Knowledge is power,” and in the realm of crypto Options trading, knowledge is profit.

What is a good crypto Options trading strategy?

You’ve mastered the fundamentals, analyzed the platforms, and now you’re standing on the precipice, ready to dive headlong into the exhilarating, dynamic, and sometimes turbulent world of crypto Options trading.

Hold your horses, though!

Do you have your map?

And by map, I mean your trading strategy.

Yes, my friends, a well-constructed, meticulously planned, and adaptively flexible trading strategy is your North Star in the often chaotic and volatile world of crypto trading.

Without it, even the bravest of traders may find themselves lost in the sea of unpredictability that characterizes the crypto market.

So, what ingredients make a good crypto Options trading strategy? Let’s take a look.

1. Profound Understanding of the Market: Your first task is to acquire an in-depth understanding of the crypto market. This market is renowned for its volatility and is influenced by an array of factors such as technological advancements, regulatory announcements, shifts in market sentiment, and global macroeconomic trends. As a trader, it is imperative to stay updated on these market conditions, as they will heavily impact the value of your Options.

2. Judicious Selection of Options: Once you have a handle on the market dynamics, consider the type of Options you wish to trade. Are you gravitating towards ‘Calls’ or ‘Puts’? Is your preference inclined towards ‘American’ or ‘European’ style Options? The selection of your option type plays a significant role in determining your potential profitability.

3. Mastering the Art of Timing: In the realm of Options trading, timing isn’t just an advantage—it’s a necessity. Why? Because Options come with an expiration date. Thus, your strategy should not just involve predicting the market direction, but also ascertaining when your prediction is likely to come to fruition. Is it a week from now, a month, or perhaps even a year?

4. Solid Risk Management: Don’t forget to establish a robust risk management strategy. This could encompass setting stop-loss and take-profit levels, avoiding investing more than a specified percentage of your portfolio in a single trade, and maintaining portfolio diversification to spread your risk.

5. The Value of Paper Trading: Prior to immersing yourself in live trading, consider getting your feet wet with paper trading. This risk-free approach allows you to practice your strategy without the risk of losing real money, and it provides a solid understanding of how your strategy performs under various market conditions.

6. Consistent Evaluation and Adjustment: Last but not least, make sure to continually evaluate and adjust your strategy. The crypto market is ever-evolving, meaning a strategy that was effective last year might not yield the same results this year. Regular assessment allows for fine-tuning, keeping your strategy aligned with market dynamics, and thereby enhancing profitability.

Remember, a good trading strategy aligns with your risk tolerance, trading goals, and understanding of the market.

It might take some trial and error to find the strategy that clicks with you, but once you do, it will serve as your guiding light, leading you through the labyrinth of market volatility towards your desired financial outcomes.

In conclusion, remember this: a good strategy in crypto Options trading is not just about making profitable trades. It’s about longevity.

It’s about staying in the game long enough to meet, and perhaps exceed your financial goals.

Here’s to making well-informed, strategic decisions on your journey through the vibrant landscape of crypto Options trading. Stay curious, stay informed, and most importantly, happy trading!

Benefits and Drawbacks of Crypto Options Trading

When it comes to crypto Options trading, there are several benefits and potential drawbacks that traders should consider. Let’s dive deeper into these factors:

Benefits

1. Leverage and Amplified Profits: One of the key advantages of crypto Options trading is the ability to trade on leverage. With crypto Options exchanges, you can control a larger position with a smaller upfront investment. This leverage allows you to potentially amplify your profits if the trade goes in your favour. However, it’s important to remember that leverage also magnifies losses if the trade and market price moves against you.

2. Risk Management and Hedging: Options offer unique risk management features. They allow you to hedge your crypto Options holdings against potential losses. For example, you can purchase put Options to protect your portfolio if you expect a price decline. By incorporating Options into your trading strategy, you can mitigate risks and protect yourself from adverse market movements.

3. Flexibility and Versatility: Trading crypto Options provide traders with a wide range of strategies to capitalize on various market conditions. Whether you’re bullish, bearish, or have a neutral outlook, Options allow you to customize your trading approach. You can buy call Options for potential upside gains, sell covered call Options to generate income or use complex strategies like straddles and strangles to profit from volatility.

4. Diversification Opportunities: Options trading enables you to diversify your portfolio and reduce dependence on a single asset or Futures trading. By trading Options on different cryptocurrencies or using Options alongside spot positions, you can spread your risk and potentially enhance your overall returns.

Drawbacks

1. Complexity and Learning Curve: Crypto Options trading can be complex, especially for beginners. Understanding Options terminology, pricing models, and various trading strategies require time and effort. It’s crucial to educate yourself about Options before diving into this market to make informed trading decisions.

2. Market Volatility and Risk: Cryptocurrency markets are known for their volatility, and Options trading is not exempt from it. Sudden price swings can impact option prices and create challenges in executing trades at desired prices. Higher volatility also increases the probability of Options expiring out of the money, resulting in potential losses.

3. Limited Liquidity: Some crypto Options may have lower liquidity compared to major cryptocurrencies, which can impact trade execution and pricing. Illiquid Options can lead to wider bid-ask spreads, making it harder to enter and exit positions at desired prices. Traders should be mindful of liquidity risks and consider trading Options with sufficient trading volume.

4. Risk of Capital Loss: As with any investment, trading Options involve the risk of capital loss. Options have an expiry date, and if the market doesn’t move in the anticipated direction within the specified timeframe, the Options may expire worthless. Traders should carefully manage their positions, set stop-loss orders, and consider risk-reward ratios to protect their capital.

By understanding the benefits and drawbacks of crypto Options trading, traders can make informed decisions and tailor their strategies to their risk tolerance and investment objectives.

It’s essential to conduct thorough research, stay updated on market trends, and practice risk management techniques to navigate this dynamic and potentially rewarding trading landscape.

However, it’s important to approach crypto Options trading with caution and a solid understanding of the complexities involved.

Consider the benefits of leverage, risk management, and flexibility, but also be mindful of the potential drawbacks such as complexity, market volatility, and liquidity risks.

As the market matures, trading crypto Options will become a thing; after all, who doesn’t want to mitigate their portfolio risk.

With proper education, research, and risk management, BTC Options trading can be a valuable tool in your trading arsenal. So, dive in, stay informed, and always trade responsibly.

Conclusion

In conclusion, crypto Options trading offers an exciting avenue for me to explore in the ever-evolving cryptocurrency market.

The ability to leverage positions, manage risks, and employ various trading strategies makes it an attractive choice for me to increase my potential profits and portfolio diversification.

Cryptocurrency Options trading is still a niche, and not many cryptocurrency exchanges provide this service. Partly the reason for this is the low daily trade volume of the Options market.

Therefore, I have chosen a trustworthy Bitcoin Options exchange like Binance for purchasing Options, as it offers deep liquidity and enables safe trading in the Bitcoin Options space.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023