Only a few cryptocurrency exchanges are operating on a global scale that has an impeccable record of safety and reliability. And, CEX.io is counted among one of those.

Founded in 2013 and headquartered in London, United Kingdom, CEX provides services in 99% of countries across the globe. And, allows buying cryptocurrencies in fiat through bank transfers and VISA/MasterCard.

Despite its attractive features like margin trading, cross-platform trading, and advanced reporting, it sometimes disappoints in terms of low liquidity.

Also, its limited coin support restricts users from taking advantage of the altcoin booms and busts that are part of the cryptosphere.

So, if you’re looking out for CEX alternatives that help you take advantage of the booming crypto market, the following are the five best alternatives you must check.

Alternatives To CEX.io Exchange In 2022

(Editor's Choice For 2023) |

| Get Upto $30,000 Bonus |

- Deposit in: Bitcoin & altcoins - Store funds in cold wallet | Joining Bonus $25 | |

- Can also trade with Forex, Commodities, Indices - No-KYC Exchange | Get +35% on Your First Deposit |

#1. Coinbase

Coinbase is a name synonymous to the cryptosphere. It is one of the most well-recognized, trusted, and oldest crypto exchanges to operate in this space.

Founded in 2012, Coinbase is based in San Francisco, California, and has over 30 million users from 102 countries. And, to date over $150 billion worth of cryptocurrencies have been traded on the platform.

The registration process is rapid and straightforward, as you need to create an account and link your bank account. It supports 18 cryptocurrencies on its platform, including all the major ones and a stablecoin.

New to crypto trading? Learn Does Leverage Increase Profit in Crypto?

The deposit and withdrawal fee on Coinbase is very competitive, and it ranges from 1.49% to 3.99%, depending on the payment method. For instance, credit card transactions have a fee at the higher end of the scale.

Apart from using a cold storage wallet to secure users’ funds, the funds stored on exchange servers are covered by insurance policies, offering all-around protection to users’ funds.

For professional traders, it offers a distinct product under the brand Coinbase Pro having a dynamic fee structure and other advanced features.

#2. Bitit

Bitit is a Paris-based crypto exchange platform launched in 2015, and it describes itself as the most straightforward platform for buying and selling crypto-assets.

It offers global coverage and allows buying cryptocurrencies using your local currencies and preferred payment mode. It also has a feature that will enable you to buy cryptocurrencies with cash worldwide using Neosurf & Cashlib cash vouchers.

To get started on Bitit, you need to create an account by providing basic details, following which you need to verify your identity. This is more like a KYC process, and it is important to unlock your buying limit.

The platform offers to buy & sell 50 different cryptocurrencies with a transaction fee for credit/debit card at 3.9%, and bank transfer fee in the European region is at 0.25%.

One of the disadvantages of Bitit is, it does not have a trading application on its platform.

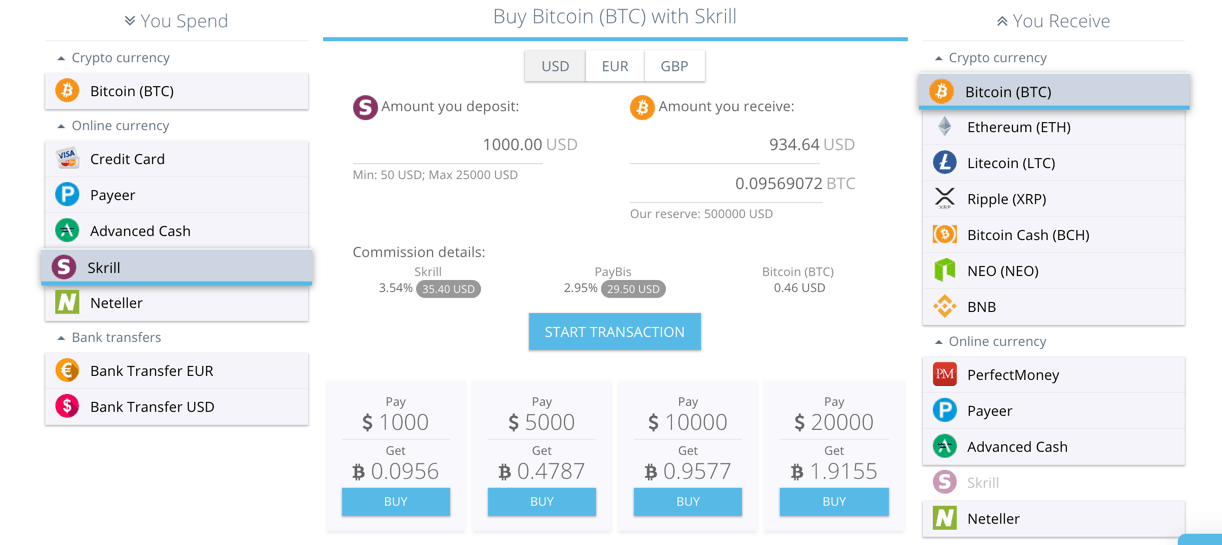

#3. Paybis

Paybis is a UK based crypto exchange platform started in 2014, and it aims to become the most trusted and responsive platform on the market. It supports both credit/debit cards and bank transfers and supports a total of 9 cryptocurrencies.

To get started, you need to create an account and verify your identity to unlock the buying limits. Paybis has three levels of verification; each level enhances the daily, weekly, and monthly spending limit for buying cryptocurrencies.

For instance, for buying cryptocurrencies using a credit/debit card, you need to fulfill the level 2 verification, which provides a daily limit of $20,000 and a monthly limit of $50,000. Similarly, level 3 verification offers a daily and weekly limit of up to $200,000.

Recommended Read: How to start a crypto exchange?

The orders placed on the platform are fulfilled instantly and offer instant Bitcoin, Litecoin, Ethereum, BitcoinCash, or Ripple payout.

Paybis charges a higher commission on credit/debit card purchases, with commissions that can go up to 8%.

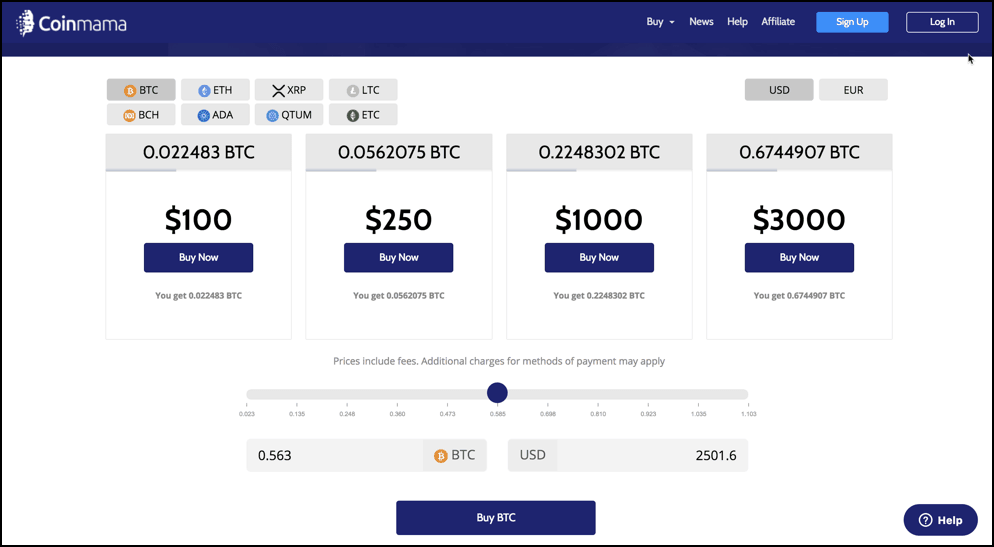

#4. Coinmama

Coinmama is the fastest and most trusted way to buy cryptocurrencies and is operating in the space since 2013. Headquartered in Israel, Coinmama offers its services in about 188 countries, including the 24 US states.

The platform is limited to buying cryptocurrencies using banking channels. Also, it doesn’t support trading, and only selling of few cryptocurrencies is supported.

The verification process is generic, as you need to fulfill the KYC/AML requirements. The initial verification or account opening process takes approximately 10 minutes, and identity verification is processed within a few hours during business hours.

The Coinmama’s fees are based on XBX’s market rate + 2% and a commission fee of up to 3.90%. For credit/debit card purchases, there is an additional 5% processing fee. And, for SEPA bank transfers, there is no processing fee, but SWIFT transfers below $1,000 have a processing fee of 20 GBP.

One can have a monthly spending limit from $15,000 to $1,000,000, depending on the type of verification level he/she has completed. Coinmama has three verification levels (Level 1, 2, and 3). To know more about the exchange, check this Coinmama review.

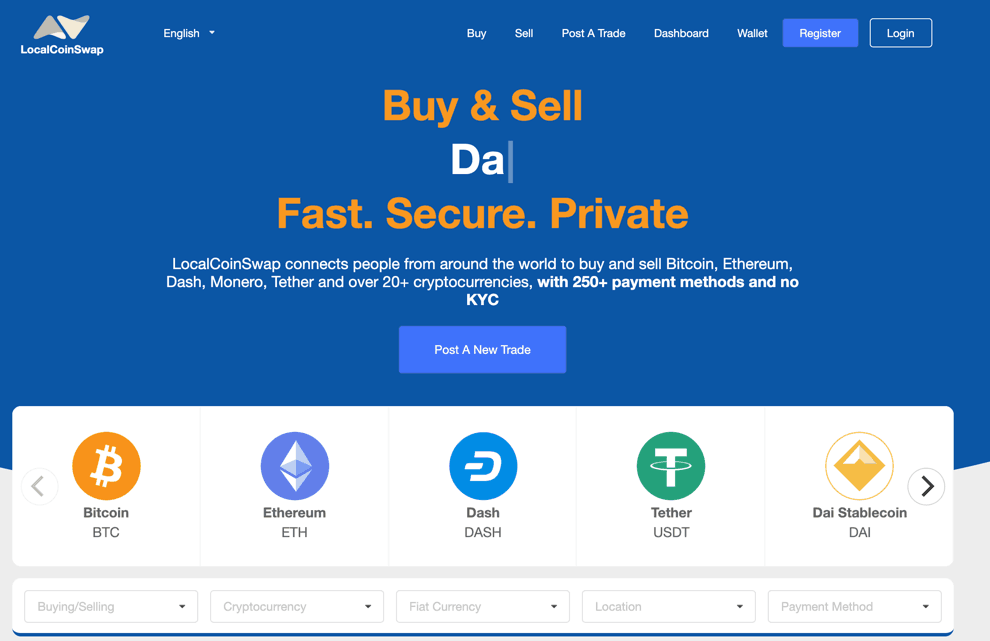

#5. LocalCoinSwap

If you want to keep your crypto transactions anonymous, then LocalCoinSwap is the best alternative.

LocalCoinSwap is a P2P cryptocurrency exchange and is genuinely a decentralized platform. You can trade in over 20 cryptocurrencies with over 250+ payment options, including the possibilities of the bank transfer and PayPal.

Additionally, the user doesn’t need to do any KYC or ID verification.

All the trades are protected by a secure escrow system, thus minimizing risk and ensures the safety of trades. Coming to the fee structure, depositing cryptocurrencies as well as buying & selling them is free.

And, since the fiat payments (bank transfers) are directly handled by the buyers and sellers individually, charges will vary accordingly.

Conclusion

Many exchanges can be included in the list of CEX alternatives, but not all pass the test of safety and reliability. Moreover, the Cex’s alternatives discussed here are industry-leading exchanges and are trusted by millions of users in the cryptosphere.

If you have any more suggestions or want to ask something, please do write in the comment box below.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023