I think you will agree with me when I say:

Coinbase has become synonymous with buying cryptocurrencies like Bitcoin or Ethereum. This is a good thing, but for decentralization for which cryptocurrencies like BTC stand for, this is not so good.

Having an over-reliance on Coinbase or any other centralized service for cryptocurrencies is not healthy.

Plus, Coinbase acts like a typical crypto bank that usually takes a lot of time to settlement of orders (hours to days) which should not be the case with crypto-assets.

It gets better:

Coinbase also doesn’t support many cash currencies, and in many countries, traders aren’t allowed to trade on Coinbase. These are some of the downsides of over-reliance on one service.

Moreover, after the last bull run in 2017, many investors have started looking out for Coinbase alternatives because at that time they suspended new registrations for a long time as well as halted trading.

This can happen with you as well that’s why in preparation for the future you must keep your other accounts ready so that you can take advantage of the bull run at the right time.

Note: I always keep my alternative bitcoin trading accounts ready, so that I can switch between them whenever the one I am using goes down.

| Best Coinbase Alternative 2022 | Quick Links |

| CEX.io (All Countries) | Register Now |

| Paxful (All Countries) | Register Now |

| Paybis (All Countries) | Register Now |

| Bitit

(USA, UK, Europe, Australia, Canada, etc) |

Register Now |

| Coinmama (All Countries) | Register Now |

| LocalBitcoins (All Countries) | Register Now |

| Kraken (USA, Europe, UK) | Register Now |

| Exmo | Register Now |

| ByBit | Register Now |

| Bittrex | Register Now |

Best Alternative To Coinbase in 2022

So let’s see some of the Alternatives sites like Coinbase where you must have your alternative crypto/bitcoin trading account.

#1. CEX.io [Recommended]

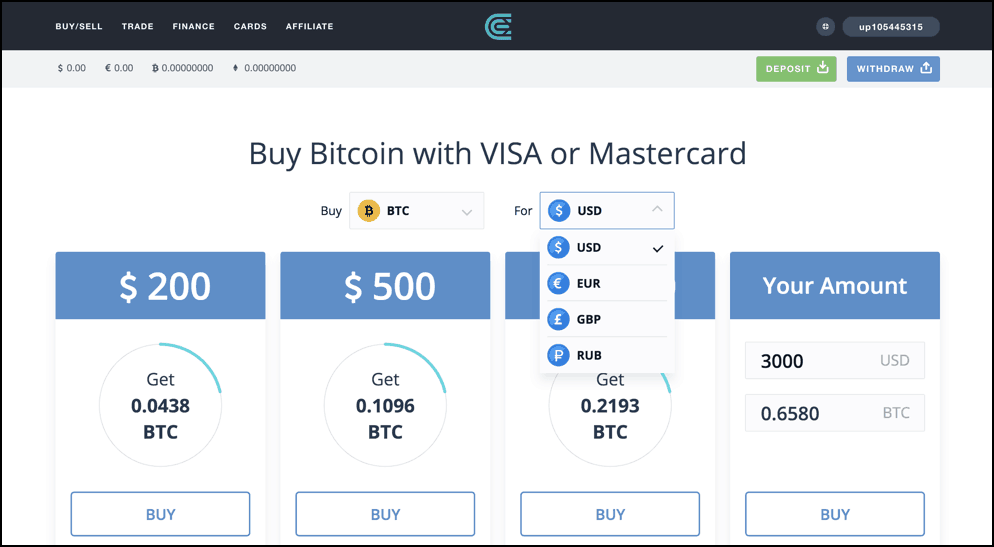

Since 2013, CEX -which is a popular UK-based exchange is catering to the crypto needs of the world.

And now CEX.io has become a multi-functional cryptocurrency exchange, trusted by over a million users, and provides user-friendly web app and mobile apps for trading popular cryptocurrencies.

To get started with buying on CEX you need to register using your email ID and as it is a crypto cum fiat exchange one needs to abide by the KYC-AML Security rules of CEX.

Post your identity verification which maximum takes 24-hours, and then traders are free to trade and deposit fiat currencies like US Dollars or Euro.

New to crypto trading? Learn What is the best leverage for bitcoin trading?

If you wish to buy bitcoins or any other cryptocurrency from your Visa/MasterCard, you can very well do so by verifying your card, and it can take up to 60 minutes to do this verification.

Apart from that CEX is as safe as Coinbase and has good security features such as 2-factor authentication and 24/7 customer support.

Furthermore, if you are someone who likes to trade cryptocurrencies from the mobile on the go, then CEX apps are there to help you out. Also, customer support of Cex.io is also very reliable.

#2. Paxful

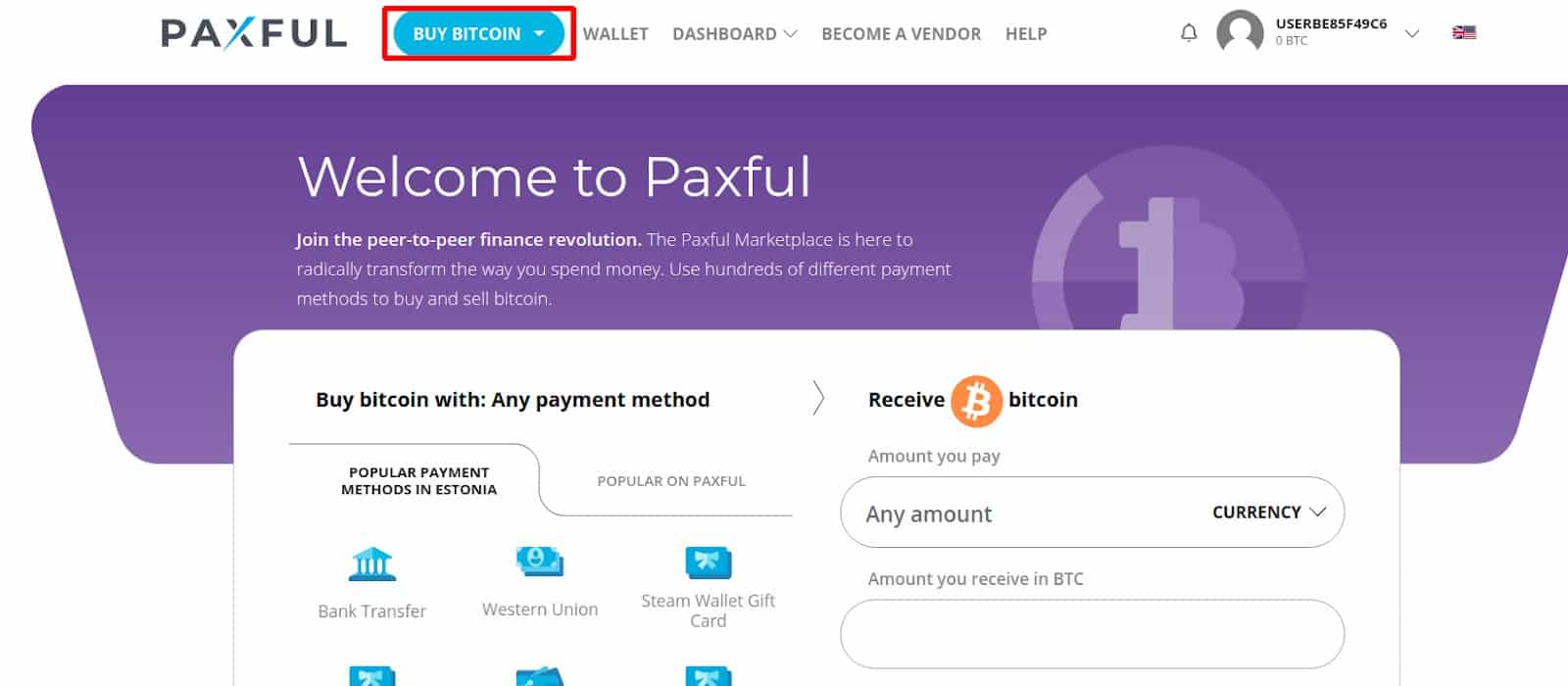

Paxful is another peer to peer service like LocalBitcoins but it is much bigger as it supports several other currencies including Bitcoin.

Paxful is based out of the US and is operating in the space since 2015. Surely, this is some experience given the pace at which cryptosphere moves.

Another cool thing is, it supports many payment methods which even LocalBitcoins don’t support (300+ payment methods including PayPal).

Paxful is also having an escrow system so that sellers & buyers cannot cheat you when you have paid them or released the bitcoins.

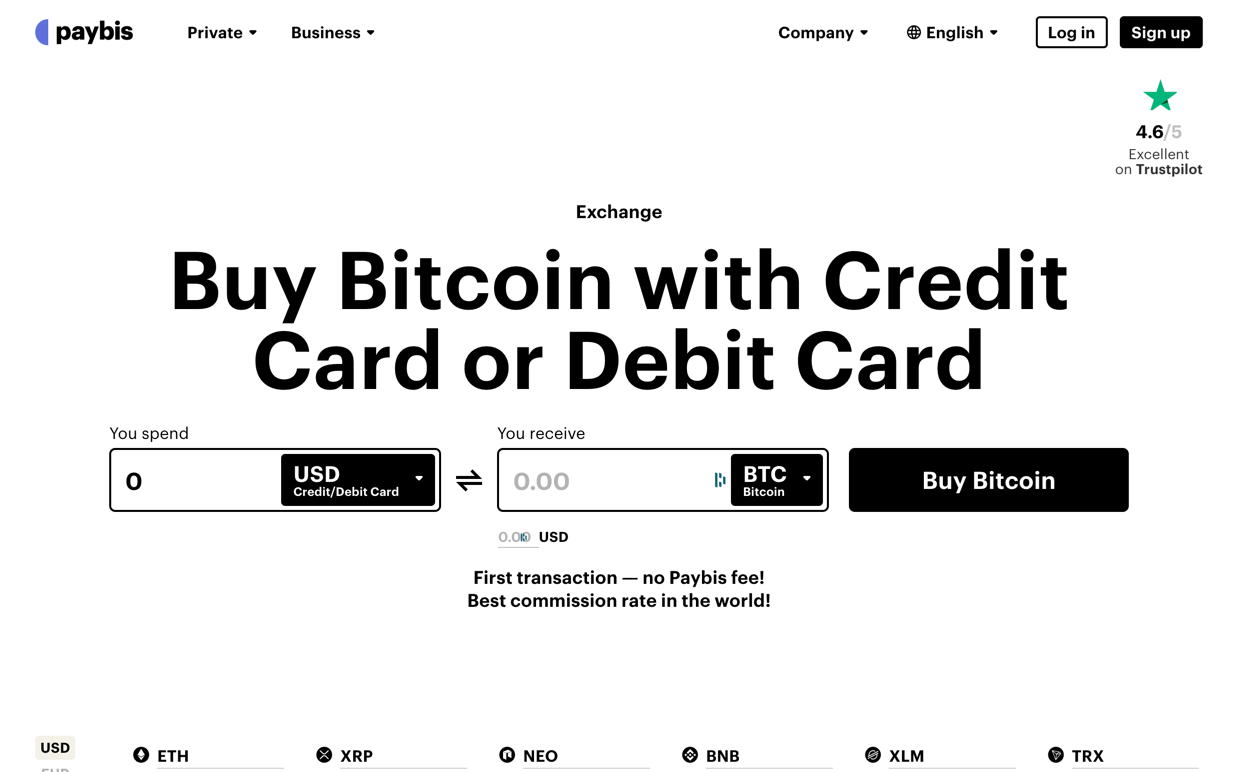

#3. Paybis

Paybis helps its users purchase cryptocurrencies and digital currencies using many different payment methods. These include credit/debit cards, bank transfers, Skrill, Neteller, Payeer, and Advanced Cash.

Founded in 2014, the exchange has amassed a large user base and counts thousands of positive reviews for its service.

Paybis allows all users to make their first transaction without paying any fees when they choose the make a transaction using the credit or debit card. Apart from that, its minimalistic interface and quick verification process make it an excellent choice for amateur and experienced investors alike.

One thing that stands out with this platform is the multilingual support team, which is online 24/7, ready to help users with their questions and guide them through the buying process. They can be accessed through the live chat functionality or by sending an email.

Finally, when buying cryptocurrency on Paybis, users need to provide their own private wallet at the start of each transaction. This is an additional measure taken to ensure the safety of users’ funds.

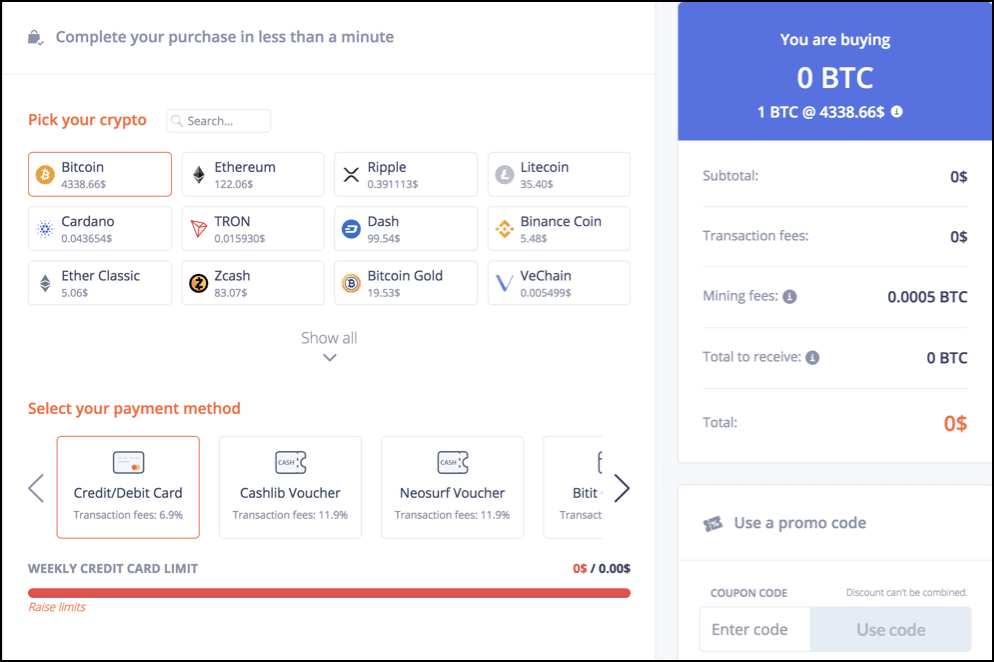

#4. Bitit

Bitit is based out of Paris, France, and tags itself as the simplest platform for bitcoin and cryptocurrency purchases.

And I must say, upon the first login, I found Bitit very user-friendly and it is certainly more user-friendly than Coinbase.

On Bitit you can instantly, easily, and securely purchase cryptocurrency like BTC, ETH, etc. via credit cards, cash, direct banking, and more.

Furthermore, to start buying bitcoin (and other coins) on Bitit, users need to complete there ID verification for which a passport will be required.

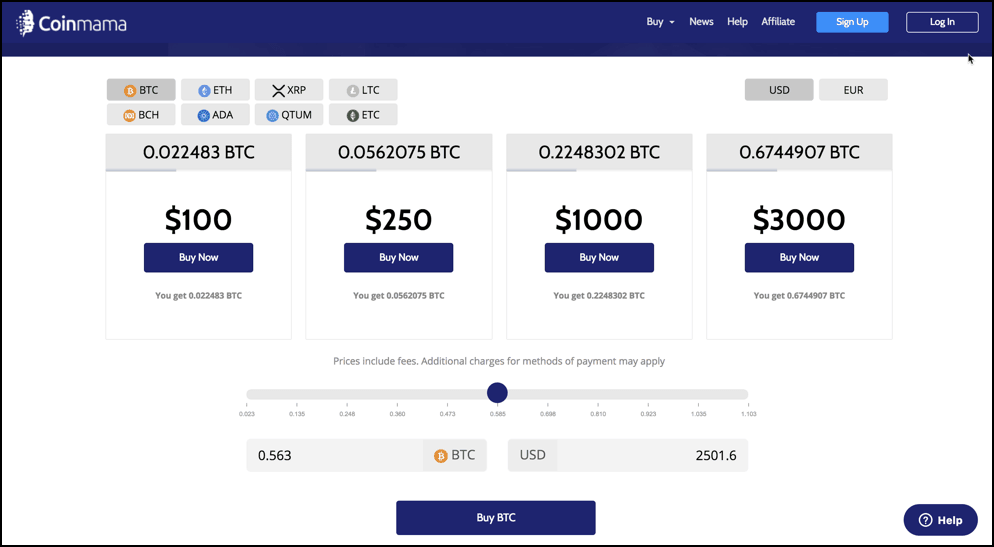

#4. Coinmama

Coinmama is one of the fastest and easiest ways to buy bitcoin and another cryptocurrency from across 200 countries of the world. And indeed, it is much quicker than Coinbase.

Coinmama’s service is active in the cryptosphere since 2012 and has served more than a million users so far. So you need not worry about their reliability, security, and experience in crypto.

Recommended Read: Types of Crypto Exchanges

Coinmama is swift than other services because here you can start buying BTC and another popular crypto in minutes through your Visa/MasterCard credit/debit card easily.

But before that, you need to register on Coinmama using your email ID. After which Coinmama will ask for certain identity verification documents to verify your identity. Note: The process takes around 15 minutes.

So virtually you can buy bitcoin in any currency through your debit/credit card via Coinmama almost instantly.

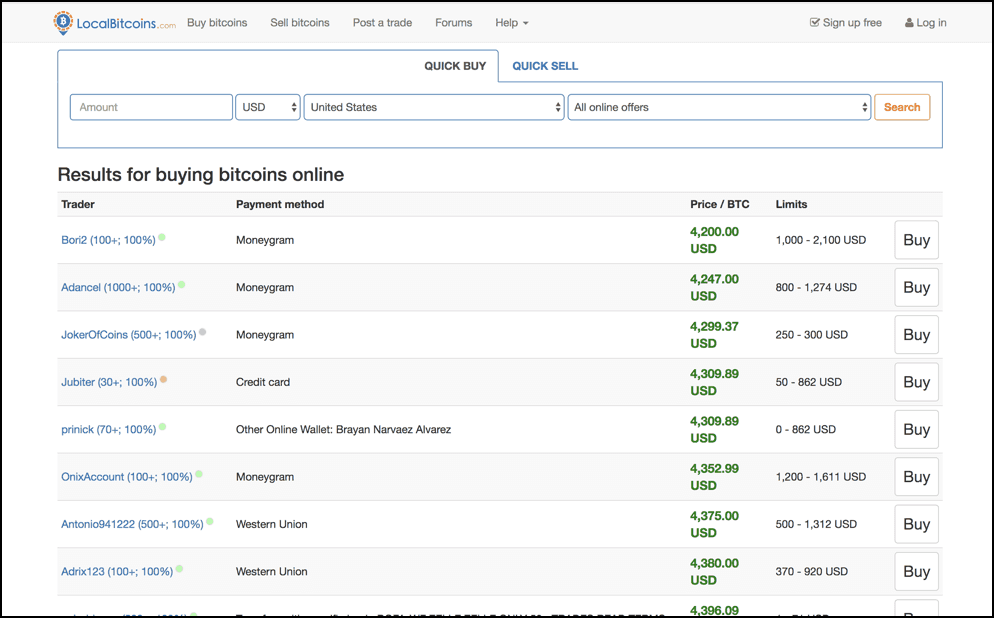

#5. LocalBitcoins

LocalBitcoins, believe me, the fastest amongst all when you want to buy Bitcoin and yes, it is more convenient than Coinbase if you only wish to buy bitcoin.

LocalBitcoin is a peer to peer Bitcoin exchange based out of Finland since 2012.

If you are someone who wants to buy BTC in cash or through a wire transfer by meeting in-person than LocalBitcoin is for you.

Through LocalBitcoins you can connect with buyers/sellers in more than 15000 cities across 200 countries around the world.

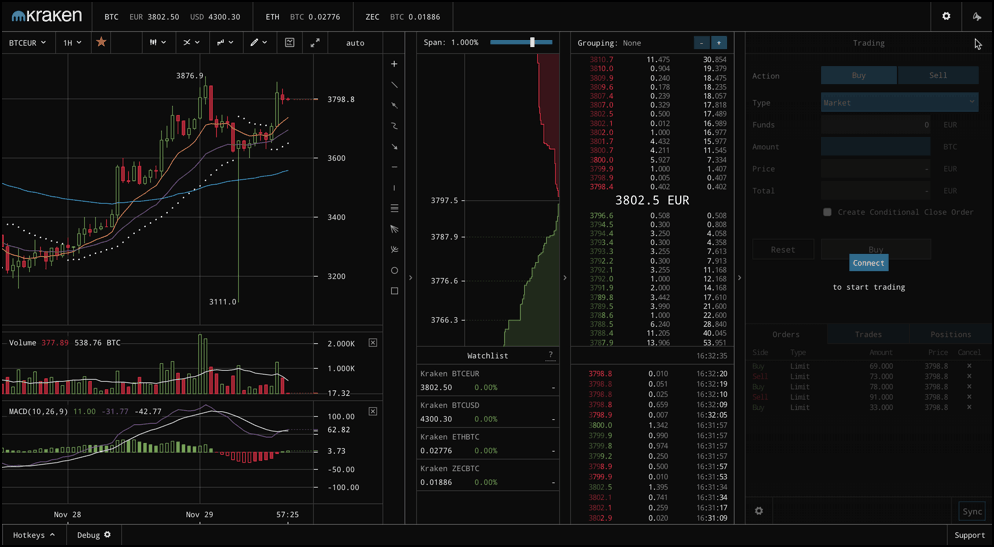

#6. Kraken

Kraken is one of the oldest cryptocurrency exchanges of the ecosystem and is a decent Coinbase alternative to try right now.

Kraken is a US-based margin trading crypto exchange operating in Canada, the EU, Japan, and the US, and “the world’s largest bitcoin exchange in euro volume and liquidity.”

Opening a trading account on Kraken requires you to complete your identity verification by submitting relevant documents, and this is the standard case with Coinbase or Coinbase like sites because dealing with cash currency requires KYC.

Kraken has four tiers of verification and tier 3 & tier 4 level verification can take up to 5 days. Otherwise, for other levels, it takes up to 60 minutes.

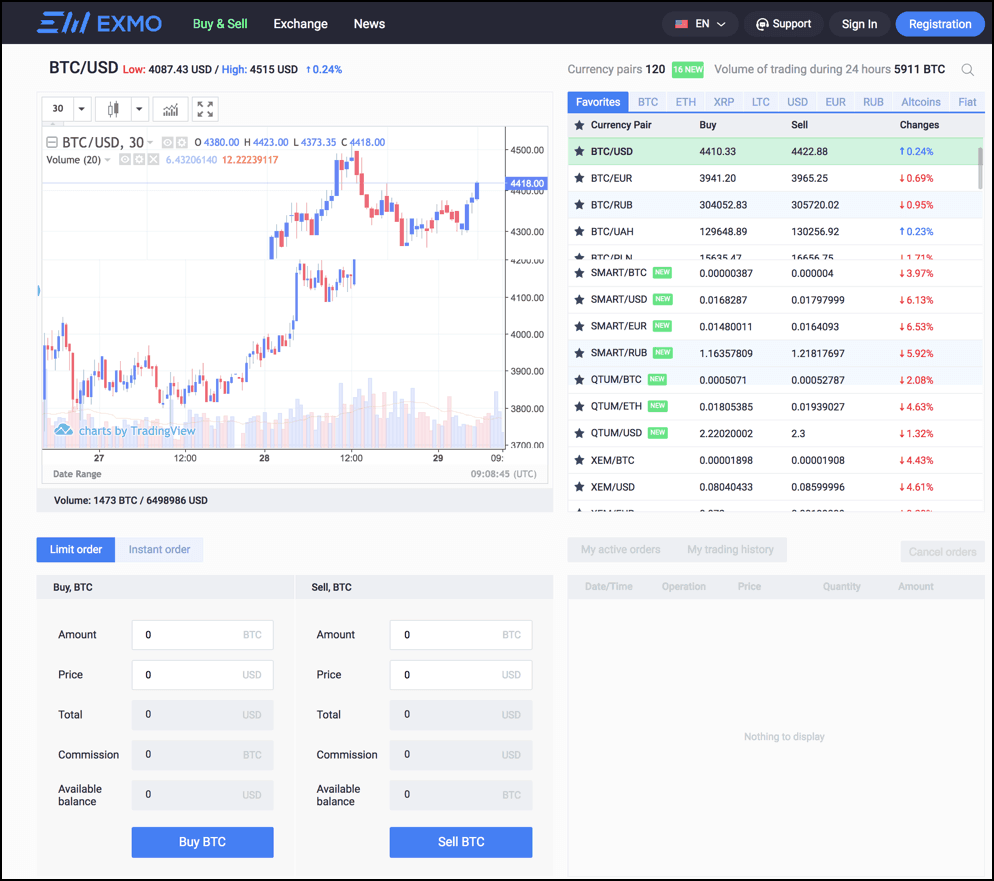

#8. Exmo

This is another bitcoin and crypto exchange which is an excellent service similar to Coinbase, and it had also started in 2013.

Exmo is based out of London, UK, and has been one of the busiest exchanges in Eastern Europe concerning volume and liquidity.

There are 1.5 mln users, thousands of thousands of active traders, 315 000 daily visitors, 87 trading pairs, six cash currencies (US Dollars, EUR, RUB, PLN, UAH, TRY) on the platform. The average monthly trading volume is $1.5 bn.

Getting started on Exmo is easy, and it only takes your email ID, to begin with, but for higher levels of freedom for dealing with fiat, you need to undergo identity verification, which happens quite swiftly here.

They also have a cashback program in which you can get up to 70% of your trading fee back; amazing isn’t it !!

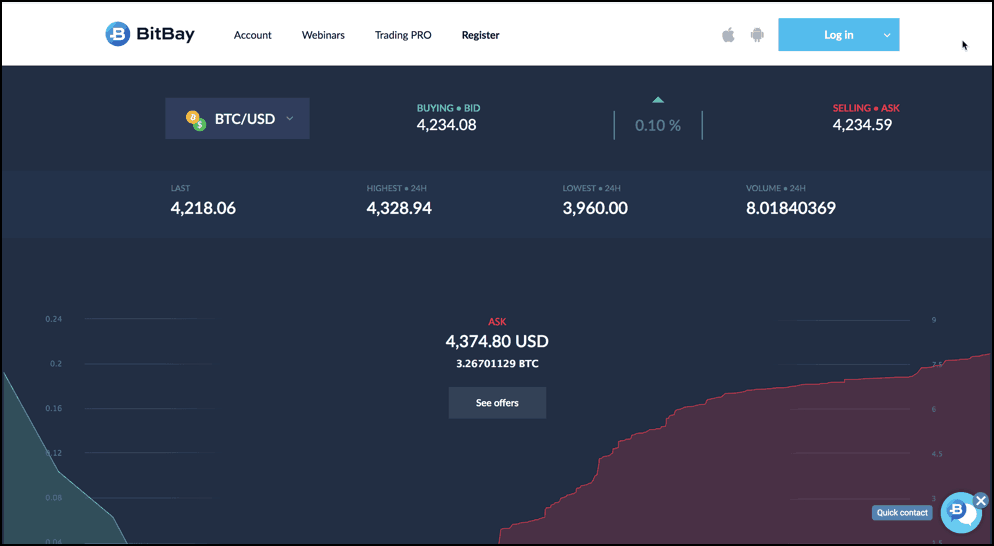

#9. BitBay

Based out of Poland, Europe BitBay has earned itself a name in the cryptosphere since 2014.

BitBay is one of the most reliable crypto exchanges in Europe and certainly a better alternative for Coinbase if you are living in the UK or Europe.

And unlike Coinbase they are quite swift and have a much better customer satisfaction index when it comes to trading cryptocurrency for fiat like US Dollars, Euro, etc

Recommended Read: Can your balance go negative in crypto leverage trading?

To get access to the full functionality of the BitBay exchange, it is recommended to verify yourself by submitting your documents.

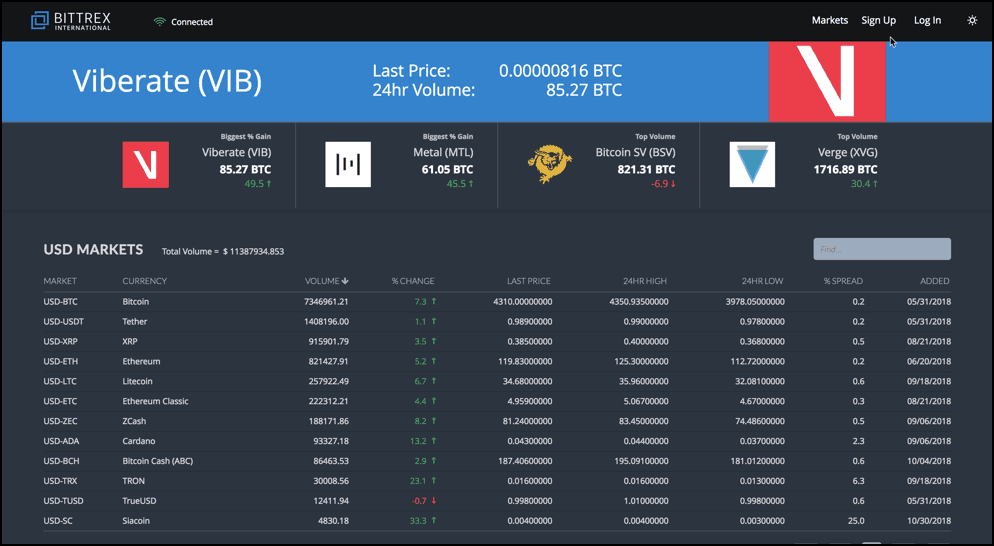

#10. Bittrex

The good news is Bittrex is also dealing now in fiat currencies which makes it a decent contender in the list of Coinbase alternatives.

Bittrex is another US-based exchange that provides trading of popular cryptocurrency in fiat currency like US Dollars.

But to enjoy fiat-crypto trading one needs to complete the KYC verification on Bittrex and by this, you will be able to enjoy higher deposit/withdrawal fees also.

Conclusion: Sites Like Coinbase

There are some more alternative sites like Coinbase for trading Bitcoin, Ethereum, etc. like cryptocurrencies and here are they:

- Liquid

- Livecoin

- CoinsBank

- Gemini

- Bitcoin ATMs

Liquidity on these exchanges is generally low, but you can count them in your reliable exchange list for now as an alternative to Coinbase.

Moreover, all these exchanges are only good for trading purposes. So don’t think of storing your cryptocurrency on any of these exchanges.

We suggest you move your bitcoins and cryptocurrency to any reliable wallet that we use ourselves like:

- Ledger Nano X – Hardware Wallet of our Choice

- Trezor

- Exodus – Desktop Wallet of our Choice

- Coinomi etc..

Now you tell us: Which Coinbase alternative you would prefer and why? Did I miss any worth noticing, Coinbase like websites? Do let us know in the comments below 🙂

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023