eToro Alternative – Top 5 Alternatives to eToro [in 2020]

For many of us, trading in cryptocurrencies looks a bit cumbersome as it involves many processes. From the creation of a crypto trading account, purchasing the crypto, transferring it to exchange wallet, and then you can start to trade in cryptos.

But, what if I tell you, you don’t need to own any cryptos to start trading and profit from its price movement. Yes, it is possible through Crypto CFDs.

A popular form of derivative trading, where you do not buy/sell the actual instrument, instead you are buying a contract on the price it is currently trading. And, trading in CFDs does not affect the market, because you are not trading actual cryptocurrency.

And, FinTech platform, eToro is the leader in the segment offering CFDs in various financial instruments and cryptocurrencies. It is a well known social and copy trading broker established in 2007 and recently introduced crypto CFD trading on its platform.

Best eToro Alternative Competitors in 2020

If you’re curious to know more about other eToro Competitors, then here are the best viable alternatives to eToro you can try.

#1. PrimeXBT [Get 35% Deposit Bonus]

PrimeXBT is a relatively new platform launched in 2018 and our top pick for the people looking for eToro alternatives. It is a BTC based platform offering leveraged trading, making it possible to trade in cryptocurrencies without investing a considerable sum of money.

It offers to trade in BTC, ETH, XRP, LTC & EOS with 100X leverage with lowest fees. Moreover, it does not require users to complete any KYC or ID verification related processes. Along with cryptocurrencies, like Toro, you can also margin trade commodities, forex, and stock indices too at higher leverage options.

PS: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT.

Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers.

It has two types of charges, one is a trading fee, and the other one is overnight financing cost. The trading fee is fixed at 0.05% per trade, but the overnight financing fee depends on the contract and liquidity.

Other features of PrimeXBT platform are:

- Ultra-fast order execution of less than 7.12 ms on average

- Industry-leading trade engine with real-time risk management

- Secure and powerful infrastructure powered by Amazon AWS

- Deep liquidity

- Advanced charting tools and option of trading right from the chart

- Low commission rates and tighter spreads

Getting started on PrimeXBT is super easy and quick, as you need to sign-up using your email-id.

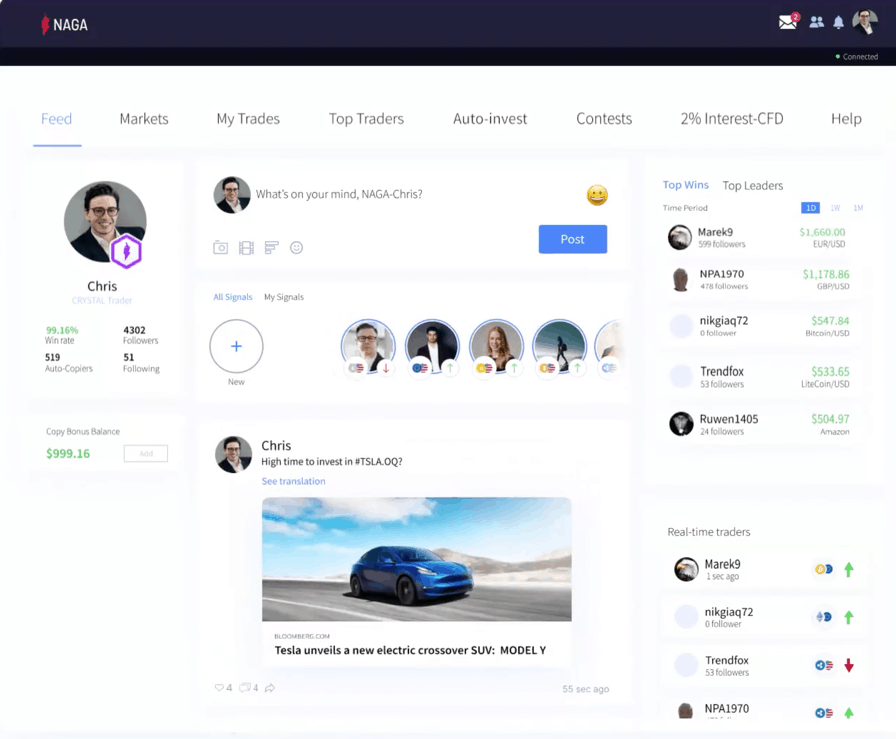

#2. Naga Trader

Naga Trader is the world-leading online trading platform and competitor of eToro which allows investing in FX, CFD, ETFs, and cryptos and is powered by social trading. The platform automatically pays for your trade strategies when other traders copy your strategy.

For crypto traders, Naga Trader is a good alternative since it has its own cryptocurrency Naga Coin (NGC), which offers numerous benefits.

It offers a total of 15 crypto trading pair against fiat currencies. With Naga Trader, you get access to a free cryptocurrency wallet, crypto exchange, and its native cryptocurrency (NGC). Other benefits include:

- Real-time order execution

- Multi-currency account

- Mobile and web interface

- Free daily insights and trading signals

- Personal account manager

- Risk management tools

- Charting tools

Trading in cryptocurrencies requires 100% margin funding, and there are no commissions on trades. There are no charges levied on deposits, but withdrawals through any mode attract 10 EUR/USD or equivalent fee.

Getting started on Naga Trader is quite easy and quick. You need to create an account filling the basic details and upload your documents to verify your info. It’s done, and you can fund your account to start trading.

#3. Plus500

Plus500 is a top-rated, and leading global CFD brokerage firm founded in 2008 in Israel and subsequently got listed through an IPO in AIM of the London Stock Exchange in 2014.

It offers CFD trading in several financial instruments and cryptocurrencies that allow you to speculate the price movement without even owning them. Plus500 offers 14 cryptos CFD pairs, including BTCUSD, ETHBTC, ETHUSD and, Crypto 10 index.

The fees for the trade undertaken on Plus500 are incorporated in the Buy/Sell spread; therefore, whenever you open a position, you pay the spread as a trading fee.

There is no additional charge above the quoted rate. Other account charges include fees for overnight funding, currency conversion, guaranteed stop order, and inactivity fees.

It also offers superb risk management tools, which include placing a limit order, stop-loss order, guaranteed stop order, and trailing stop order. Other features include 24 hrs multi-lingual support, a life-time demo account, mobile-friendly trading platform.

Unlike eToro, Plus500 does not have features like social trading and copy trading,

Plus500 serves 50+ countries that come under the purview of Financial Conduct Authority (FCA UK), Cyprus Securities Exchange (CySEC), and the Australian Securities & Investments Commission (ASIC).

#4. AvaTrade

AvaTrade is a global FX, CFD, and crypto broker founded in 2006 and is headquartered in Dublin, Ireland. It allows 24/7 trading in cryptocurrencies for the MetaTrader account and offers trading in 11 different cryptocurrencies against fiat currencies (USD, EUR, and JPY).

It provides a leverage of up to 25 times and margin requirement of up to 20% on select crypto pairs. The fee and charges are minimal, but it charges an inactivity fee of $50 if the account is inactive for three months and administration charge of $100, after 12 consecutive months of non-use.

AvaTrade offers average to tight spreads, depending on the account type. With low account minimums, AvaTrade is a good option for beginners, those who want to develop their trading skills.

Final Words

There are many CFD trading brokers available, but the discussed are some of the leading platforms in the segment, and also you can enhance your trading experience.

While choosing a broker always focus on a few factors like, is the broker regulated and under which regulator, transparency, security, technology, and customer support.

Remember, as CFDs are highly leveraged trading instruments, the risk of losses are significantly higher. As per statistics, 73% of the retail traders lose money when trading in CFDs.

Therefore, always take your trade positions according to your risk profile and maintain stop losses on your trades to minimize losses.

If you’ve any questions or suggestions regarding any crypto CFD trading brokers, put your comments in the comment box below.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023

Contents