Finding a platform to invest in cryptocurrencies and earn interest can be challenging. With hundreds of exchanges and wallets available, you need to analyze the pros and cons of each platform.

Two popular places to invest in digital assets are Abra and BlockFi. While both platforms enable seamless crypto investing, they differ significantly in features, functionalities, and services.

[wptb id="12304" not found ]Abra vs. BlockFi: Introduction

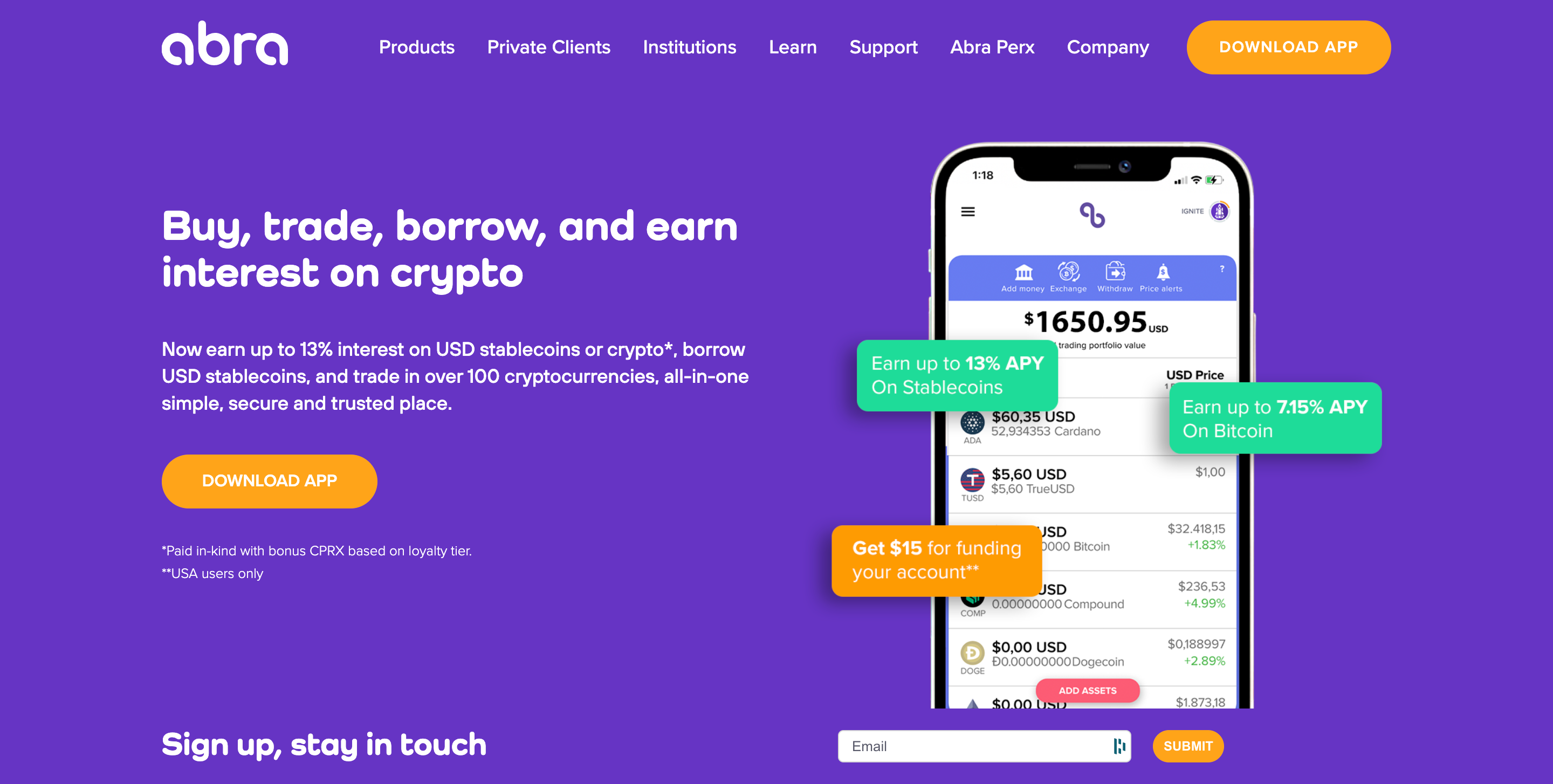

Abra was originally a digital wallet that allowed you to send fiat money. Later, it introduced stock investing, and now, it supports over 30 digital assets. You can also hold your money in the Abra wallet and earn interest.

BlockFi is essentially a crypto investing and lending platform that enables you to invest in crypto and earn interest on it.

Which platform is better and why? This comprehensive comparison between Abra and BlockFi will help you make the right decision.

Abra vs. BlockFi: Supporting Crypto Assets & LTV

Abra supports over 30 digital assets, including BTC, BCH, ETH, EOS, CRP, TRX, XMR, and LTC. Additionally, it supports over 50 fiat currencies, including USD, Australian Dollar, Euro, GBP, SGD, Japanese Yen, and Hong Kong Dollar.

Abra allows you to use your crypto assets as collateral to borrow USD stablecoins for as little as 0% interest. Abra offers flexible loan-to-value (LTV) and annual percentage rate (APR). Here’s how the relationship between LTV and APR looks like:

- O% APR – 10% LTV

- 3.95% APR – 20% LTV

- 7.75% APR – 33% LTV

- 9.95% APR – 50% LTV

Abra also has a Borrow Loan Calculator feature on its website that allows you to calculate the monthly payments, total payment, and total payable interest on your loans.

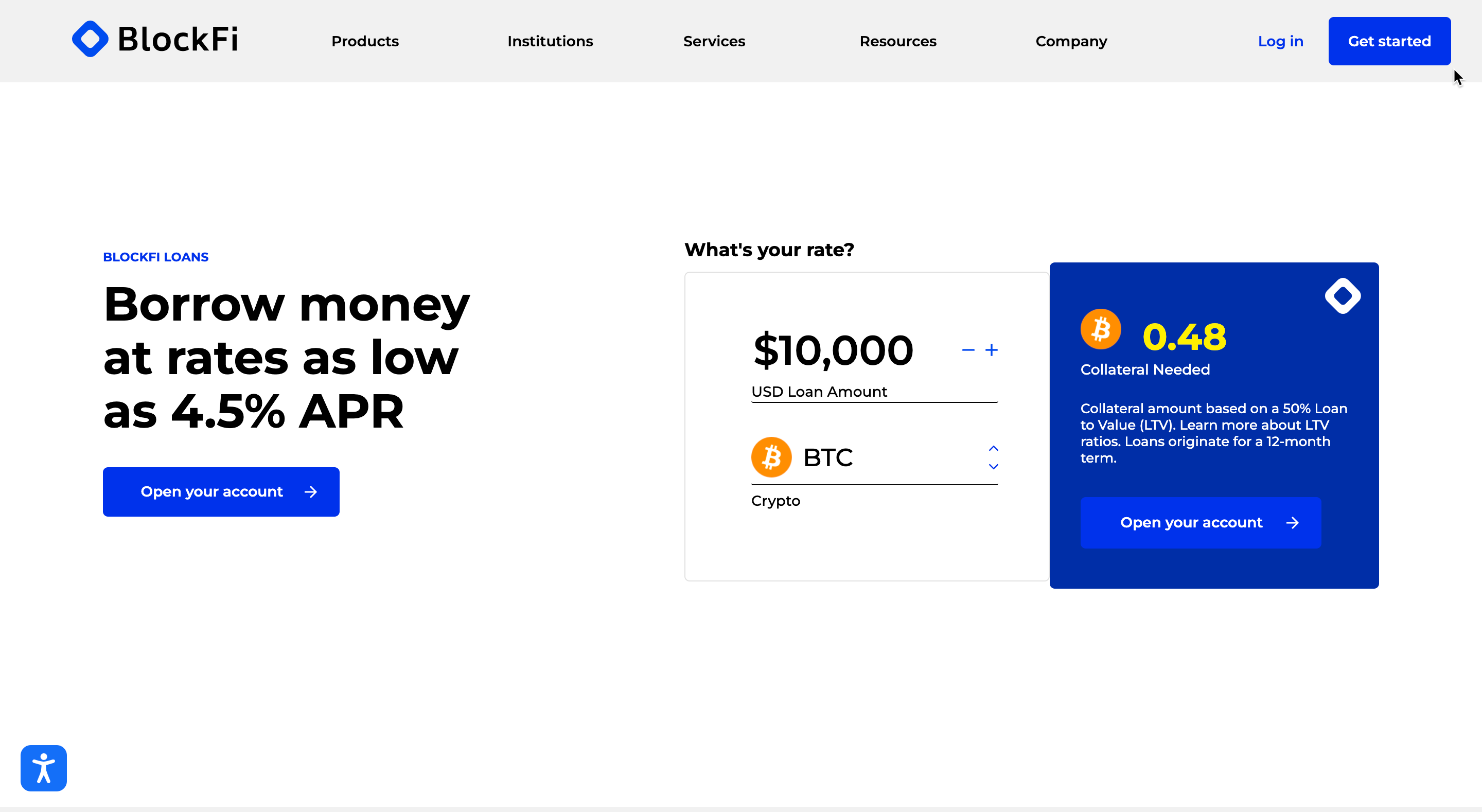

BlockFi, on the other hand, has a straightforward APR and LTV system. It offers a 50% LTV at a fixed 12-month loan period. You can get loans for as low as 4.5%. The minimum loan amount is $10,000.

BlockFi also offers crypto trading and investing. It supports ten digital assets, including BTC, ETH, LTC, and BNB. Both the platforms offer same-day approvals and don’t charge prepayment penalties.

Verdict: BlockFi is the winner, as it charges a lower interest rate for 50% LTV loans.

Abra vs. BlockFi: Interest Rates, Lock-in Terms & Payouts

Abra and BlockFi allow you to store digital assets in their respective wallets and earn interest on them.

Abra offers up to 8% interest on cryptos and USD stablecoins. The per annum interest rates vary from coin to coin. Let’s look at the interest rate offered on each digital asset.

- Bitcoin Cash (BCH) – 2.0%

- Bitcoin (BTC) – 3.15%

- Litecoin (LTC) – 3.25%

- Stellar Lumens (XLM) – 4.0%

- Ether (ETH) – 4.5%

- True USD (TUSD) – 8%

- Tether (USDT) – 8%

- USD Coin (USDC) – 8%

- Paxos (PAX) – 8%

Abra has a lock-up period of 60 days. When you deposit funds in your Abra account, they get locked in for 60 days, after which you can withdraw them. The payout, therefore, also happens every 60 days.

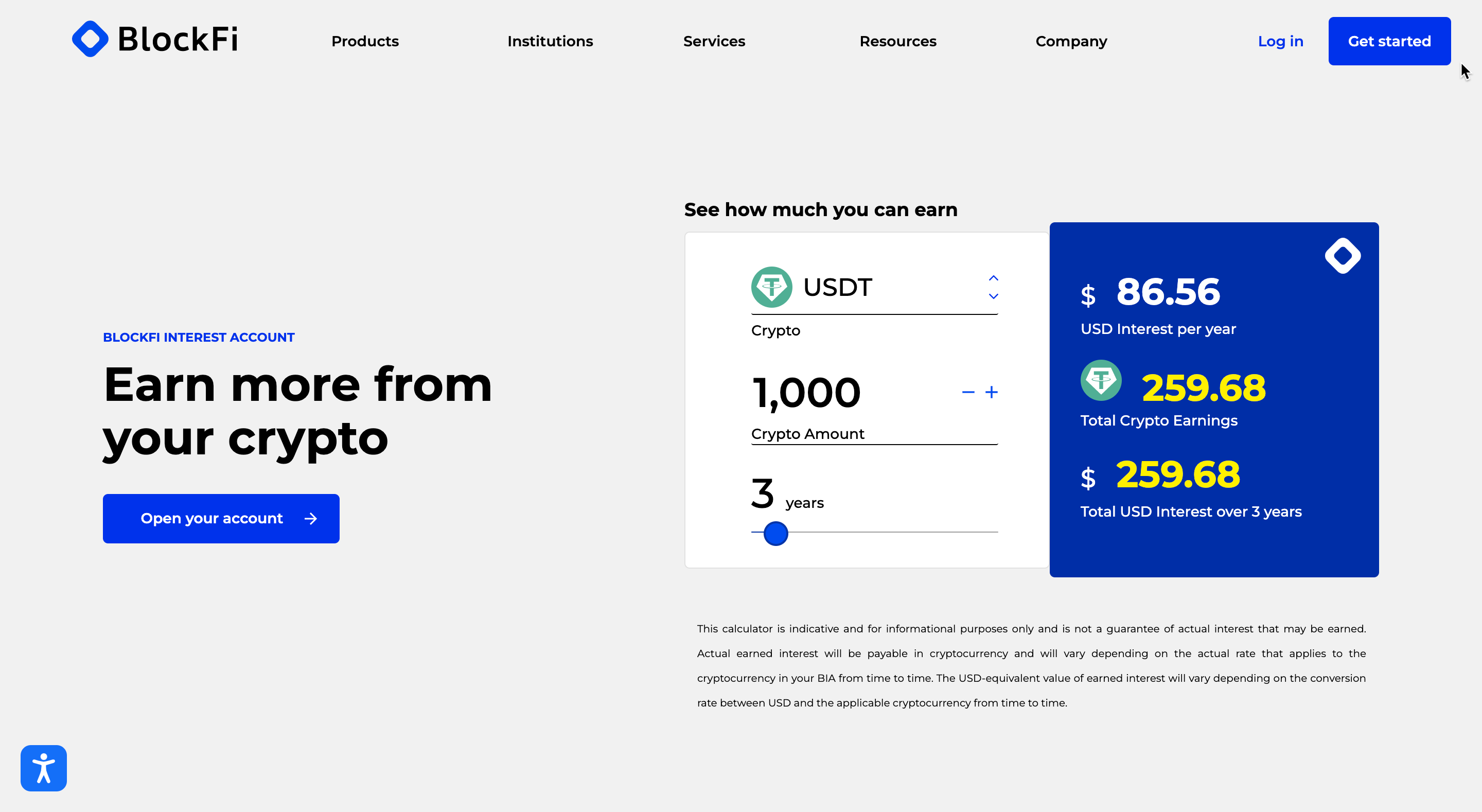

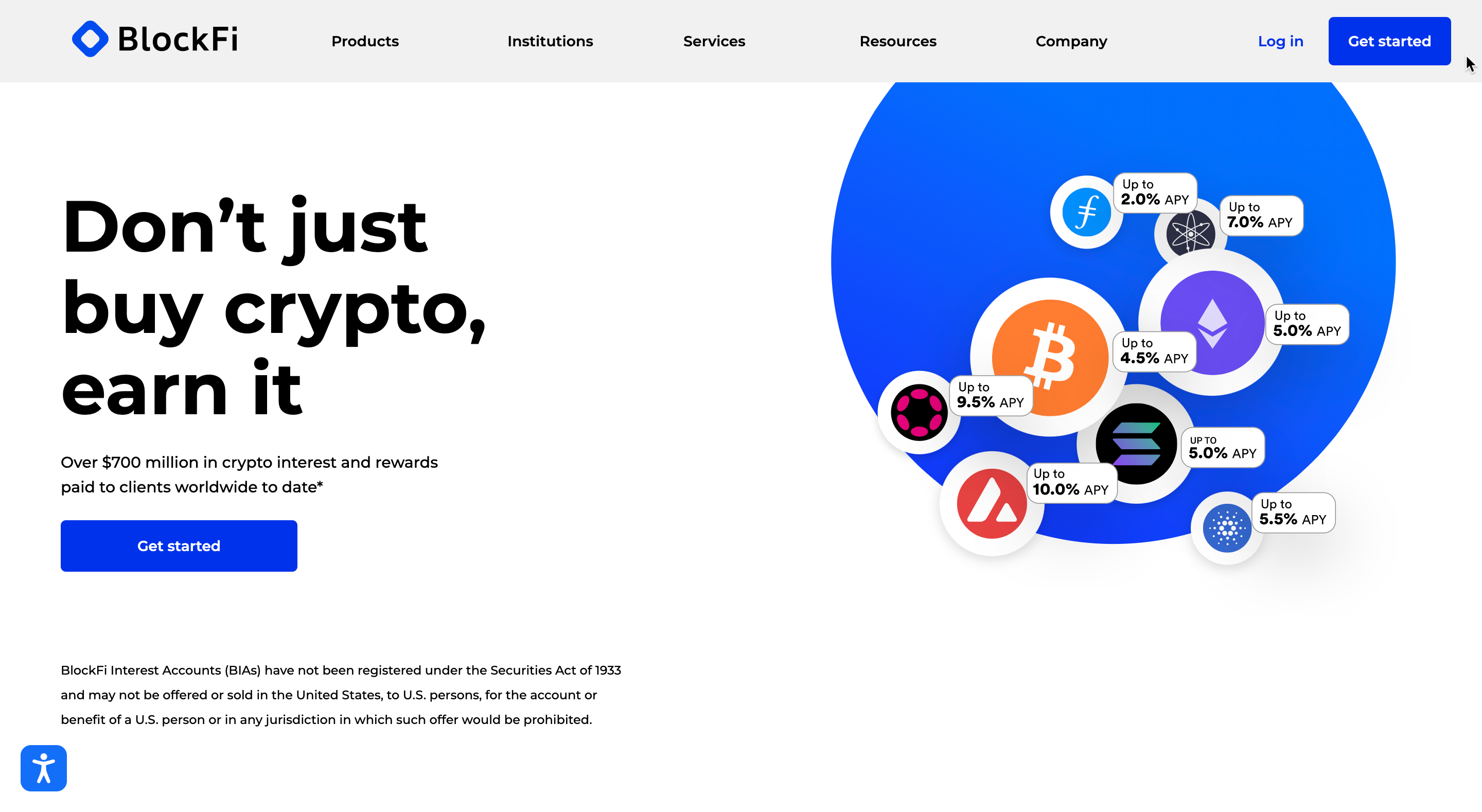

BlockFi offers up to 7.5% p.a. Interest rate on crypto deposits. The interest rate depends on the digital asset. Let’s look at the interest rate offered on each coin.

- Bitcoin (BTC) – 4%

- Ether (ETH) – 4%

- Gemini USD (GUSD) – 7.5%

- USD Coin (USDC) – 7.5%

BlockFi has no lock-up period, but it can take up to 7 days to process withdrawals. BlockFi pays interest payments every month.

Verdict: BlockFi is the winner, as it has no lock-in period and offers monthly payouts.

Products & Features Comparison

BlockFi and Abra offer similar products and features. However, there are some additional features offered by both platforms that users must know about. Let’s look at the product offerings of the two exchanges.

Abra

- Interest Account: Abra allows you to deposit cryptos and earn up to 8% interest on them.

- Crypto Loans: You can use your digital assets as collateral to take loans.

- Credit Card Purchases: Abra allows you to buy BTC directly from your credit card.

- OTC Services: Abra has an OTC desk for institutions that lets you trade digital assets and earn interest on them.

BlockFi

- Interest Account: BlockFi lets you hold funds for flexible lock-up periods and earn up to 7.5% interest.

- Trading Account: You can trade in 10 major cryptocurrencies and stablecoins.

- Crypto Loans: You can borrow USD by using your crypto assets as collateral.

Services for Institutions: BlockFi offers various services for institutions, such as Global Digital Markets, Investment Products, and Corporate Treasury Solutions.

Users must note that Abra and BlockFi are not crypto exchanges like BitMEX and Binance. Though they allow you to buy and sell crypto assets, they lack features like margin trading, derivatives trading, and chart visualization tools.

If you are looking for full-fledged trading platforms, crypto trading exchanges will be a better choice.

Verdict: It’s a tie, as both the exchanges offer similar services.

Services for Institutions

Abra and BlockFi offer dedicated services for institutions. If you’re an institution looking for a crypto platform to deposit, lend, and borrow digital assets, this comparison will help you make the right choice.

- Abra Platinum – OTC Services

Abra OTC services help institutions fill large orders. The key features of the OTC desk are:

- Seamless trading of all the major digital assets with immediate execution and low slippage.

- Earn up to 10% interest on your digital assets. The interest is compounded daily.

- Borrow crypto or USD with flexible LTV and loan terms.

Abra offers customized institutional crypto investing experience. You can enjoy deeper liquidity to execute your orders quickly at better prices. Abra also offers personalized 1:1 service and assigns a dedicated Account Director for your assistance.

Here is how you can get started with the Abra OTC Desk.

- Register: Sign up for the Abra OTC services.

- Complete Onboarding: Complete your registration process. An Account Director will be assigned to you.

- Request Quotes: Connect with your Account Director for actions like placing trades, depositing funds, etc.

- Execute Order: The Account Director will help you execute orders and facilitate settlements.

BlockFi Services for Institutions

BlockFi offers a comprehensive range of services for institutions. These include:

- Global Digital Markets: BlockFi offers OTC trading & execution, innovative investment products, and corporate treasury solutions for a top-notch institutional trading and investment experience.

- BlockFi Prime Services: You can get real-time streaming quotes, 24-hour settlements, seamless trading UI, and flexible APIs.

- BlockFi Trusts: BlockFi offers Bitcoin, Ethereum, and Litecoin Trust to solve your crypto storage challenges. You can leverage turnkey product format, along with the transparency, cost-efficiency, and safety of the system.

- Corporate Treasury Solutions: BlockFi enables seamless business loans that allow you to borrow cash from other institutions and fulfill your financial goals.

Verdict: BlockFi is the clear winner, as it offers broader services for institutions than Abra.

Fees Comparison

BlockFi charges a flat loan origination fee of 2% regardless of the LTV. Abra hasn’t disclosed its loan origination fee. However, their website states that they “handle all loan origination processing in the app.”

Abra and BlockFi also charge fees on deposit and withdrawal of funds, depending on the methods used.

Abra

For deposits, Abra charges the following fees.

- Bank Transfer – 0-0.25%

- Cash – 1-2.5%

- Credit or Debit Card – 4-8%

- BTC, BCH, or LTC deposit – Network fees applicable

- Abra wire program – Variable fees

For withdrawals, Abra charges the following fees:

- Bank Transfer – Bank transfer fees

- Cash – ~2%

- BTC, BCH, or LTC deposit – Standard network charges

- Abra wire program – Variable fees

Please note that both platforms could charge a fee when you buy and sell cryptos on the platform. Abra and BlockFi follow a commission-based fee structure. Be sure to understand the fee system thoroughly to avoid confusion.

BlockFi

BlockFi doesn’t charge a deposit fee. However, it charges a withdrawal fee, depending on the underlying crypto asset. Here is how the BlockFi fee structure looks like.

- BTC – 0.00075 BTC

- ETH – 0.02 ETH

- LINK – 0.95 LINK

- LTC – 0.0025 LTC

- Stablecoins – $10.00 USD

- PAXG – 0.015 PAXG

- UNI – 1 UNI

- BAT – 35 BAT

Verdict: It’s a tie.

Safety & Security Features

Abra and BlockFi are regulated companies and are completely safe and secure. Let’s look at the security features of the two platforms.

- Abra

Abra is a non-custodial HD wallet, which is more secure than most cryptocurrency exchanges out there. It enables users to store their recovery seed phrases and private keys.

Abra cannot access the seed phrases and private keys, and the users are solely responsible for safeguarding them.

The platform uses cutting-edge encryption technology to keep the data of its users safe. It also implements PIN coded, SMS verification, and two-factor authentication to enhance the security even further.

The US Security and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have sanctioned Abra and its brand Plutus Technologies Philippines Corp.

- BlockFi

BlockFi is also a safe and secure crypto platform regulated by the SEC. It stores users’ funds in offline wallets to protect them from hackers. The platform uses modern encryption technologies and multifactor authentication to provide a secure experience to the users.

Verdict: It’s a tie, as both Abra and BlockFi take similar security measures.

Insurance Coverage

The CEO of Abra said that since digital currencies are not legal tenders and are not backed by the government, they are not subject to SIPC or FDIC insurance terms. However, since Abra is a non-custodial wallet, users have better control over their funds.

BlockFi, like Abra, isn’t subject to FDIC insurance. However, BlockFi partners with Gemini to provide custodial wallet services and offers insurance on deposits.

Verdict: BlockFi is the winner, as it offers insurance coverage for deposits.

Minimum Deposits & Withdrawal Limits

BlockFi has a tiered structure, and the interest rates depend on the amount of crypto deposited. For instance, the APY for a BTC deposit of 0-0.25 BTC is 4%, whereas the APY for a deposit of more than 5 BTC is 0.25%.

Abra doesn’t have any minimum deposit requirements, and you can start earning interest on your crypto deposits irrespective of your amount.

However, Abra requires you to deposit at least $5.00 when using the US or PH bank to deposit funds. There are no minimum deposit requirements for crypto deposits.

Both Abra and BlockFi have withdrawal limits. Abra imposes transaction limits based on the withdrawal method used.

For instance, US Bank Wire transfers using W/Synapse have a limit of $500-$40,000k per day. ACH Bank deposits and withdrawals using W/Synapse have a limit of $2,000-$4,000 per day. Please note that these limits apply to both deposits and withdrawals.

BlockFi imposes weekly withdrawal limits based on the cryptocurrency. Here is how the weekly withdrawal limits look like:

- BTC – 100 BTC

- ETH – 5,000 ETH

- LINK – 65,000 LINK

- Stablecoins – 1,000,000

- PAXG – 500 PAXG

- UNI – 5,500 UNI

- BAT – 2,000,000 BAT

Verdict: It’s a tie.

Account Sign-Up Process & KYC

Abra and BlockFi have simple account opening procedures. You can register on Abra by visiting their website and clicking on “Download Now.” Since Abra is available as a mobile app only, you can download it directly from the Google Play or iOS App Store.

To register for BlockFi, you need to go to the BlockFi website and click on “Get Started.” And also make sure to use the BlockFi Promotion code to get up to a $250 BTC Bonus on your deposit.

Both the exchanges are financial institutions regulated by the SEC, and hence, they require KYC. You’ll need to verify your identity before using the services of Abra and BlockFi.

Verdict: It’s a tie, as both the exchanges offer effortless registration processes and require KYC verification.

Supported Countries

Abra is available in over 150 countries. It is not available in some countries, like Iran, Iraq, Sudan, Pakistan, Afghanistan, and China. The Prime Trust feature is available in most countries, while the Abra Tellers feature is available only in India, Guatemala, and the Philippines.

BlockFi is also available in most countries, apart from a few sanctioned or watch list countries with crypto restrictions. Within the US, BlockFi is not available in New York State.

Verdict: It’s a tie, as both Abra and BlockFi are available in the US and various other countries.

- Is Abra Safe?

Yes, Abra is a safe crypto wallet and platform. It is sanctioned and regulated by the SEC and CFTC, and it requires all its users to verify their identity. Besides, Abra is a non-custodial wallet and implements cutting-edge security features.

- Is BlockFi Safe?

BlockFi, like Abra, is regulated by the SEC. It offers insurance coverage in partnership with Gemini, and it has mandatory KYC requirements. BlockFi also uses top-notch security and encryption features to create a safe trading experience for everyone.

Conclusion

Since Abra and BlockFi share many similarities, finding a better platform between the two can be challenging. Let’s discuss the pros and cons of each platform to help you make the right choice.

From a purely lending and interest point of view, BlockFi is a better choice than Abra. BlockFi charges a lower APR at 50% LTV. It also offers better interest rates on cryptocurrencies and has flexible loan periods. The withdrawal fees charged by BlockFi are also reasonable.

One of the biggest advantages of BlockFi is its institution services. It offers various investment products, corporate treasury solutions, and trading services that allow institutions to make the most of their crypto assets.

Abra is also an amazing platform, but it has a few drawbacks. First, it is only available as a mobile app and has no desktop version. It doesn’t offer any insurance coverage, whereas deposits on BlockFi are insured by Gemini.

Overall, if you are looking for a PayPal-like wallet that supports buying, lending, borrowing, and storing crypto, you can use Abra. If you need a robust crypto platform that helps you make the most of your cryptocurrencies, BlockFi is the better pick.

[wptb id="12304" not found ]- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023