I have a couple of friends who trade in the crypto market, and I learned about Bitcoin CFD trading from them some time ago.

All this while I have been digging and researching on my own to find out more about this. The findings have been startling, and I felt like sharing them with you !!

Crypto and Bitcoin CFD trading is a new way of trading cryptocurrencies. Of course, the concept of CFD, i.e., Contracts For Difference, has existed for a long time in the forex market.

Now applied to the realm of cryptocurrencies, you get cryptocurrency cfds. It is an easy way of trading and speculating in cryptocurrencies without the extra hassle of keeping them in your wallets with private keys.

Now, I am playing with some more Crypto CFD brokers that I think are decent enough to discuss. Here is a comprehensive list of crypto CFD trading platforms for your reference:

Best Crypto CFD Broker In 2024

#1. PrimeXBT

PrimeXBT is an established crypto derivatives exchange and crypto CFD exchange where you will not be required to worry about liquidity.

This crypto CFD exchange has rapidly started scaling in 2019, and for many serious crypto traders, it has become a go-to platform.

I have also placed a couple of trades on PrimeXBT, and I found their UI intuitive.

It allows you to trade in CFDs of Bitcoin, Ethereum, Litecoin, Ripple, EOS, and much more.

PS: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers.

To start with, you only need your email ID, and there are no KYC requirements as such.

You can execute five types of advanced orders to long or short different cryptocurrencies, including stock indexes (S&P500, FTSE100), commodities, and forex all in one place. To know more about the exchange, check this PrimeXBT review.

#2. Margex

Margex is a relatively new cryptocurrency broker launched in 2020 and has grown massively popular in a short period. It offers a reliable way to trade Bitcoin and other crypto-assets with leverage of 5X to 100X and is known for its highly secure trading platform and price protection system.

You can go long and short in six different crypto pairs, including BTCUSD, ETHUSD, EOSUSD, LTCUSD, XRPUSD, YFIUSD. The platform also lets you buy bitcoin using your bank card and transfer it to your Margex wallet.

The platform interface is quite straightforward and lets you register using your email address, thus providing an anonymous trading environment—furthermore, the exchange pools liquidity from 12+ liquidity providers into a single, deep order book.

You can start to trade bitcoin CFDs with a minimum deposit of $10, and combined with leverage of 100X; you can initiate a substantial trade position.

Trading fees on the platform are quite competitive, and the maker fee is 0.019%, and the taker fee is 0.060%.

#3. SimpleFX

SimpleFX is a trusted CFD and forex broker that allows users worldwide to trade Forex, CFDs on Bitcoins, Litecoins, indices, precious metals, and energy.

SimpleFX WebTrader makes CFD trading easy and intuitive with a presence in 150+ countries and 200,000+ traders onboard which enjoy 1:500 leverage and fast deposits.

With SimpleFX, you can choose any application suitable for your device and enjoy the simplest and powerful trading platform.

One can also use the mobile device to use SimpleFX with its native iOS or Android apps fully.

Lastly, in terms of deposits, the traders have great flexibility in using Neteller, Skrill, Cryptocurrencies, or FastPay. But SimpleFX Ltd. does not provide services to citizens and residents of the United States or any country where such distribution or use would be contrary to local law or regulation.

#4. Plus500

Plus500 is a leading provider of forex, commodities, stocks, indexes, and cryptocurrency CFDs. They have a very prominent position in Europe with the most CFD traders.

The company is based out of Israel and has been serving the CFD needs of customers worldwide since 2009. Also, it is an FCA-approved regulated broker house listed on the London Stock Exchange.

Professional traders can trust this platform to trade CFDs of any kind, especially cryptos, and expect to get decent liquidity. Furthermore, you can fund your Plus500 account with a credit card or Skrill account and expect it to not go to zero because of the negative balance protection in place.

You can trade CFDs of these cryptos on Plus500, including Bitcoin, Ethereum, Bitcoin, Crypto 10 Index, Litecoin, NEO, Ripple XRP, IOTA, Stellar, EOS, Bitcoin Cash, Cardano, Tron, Monero, etc.

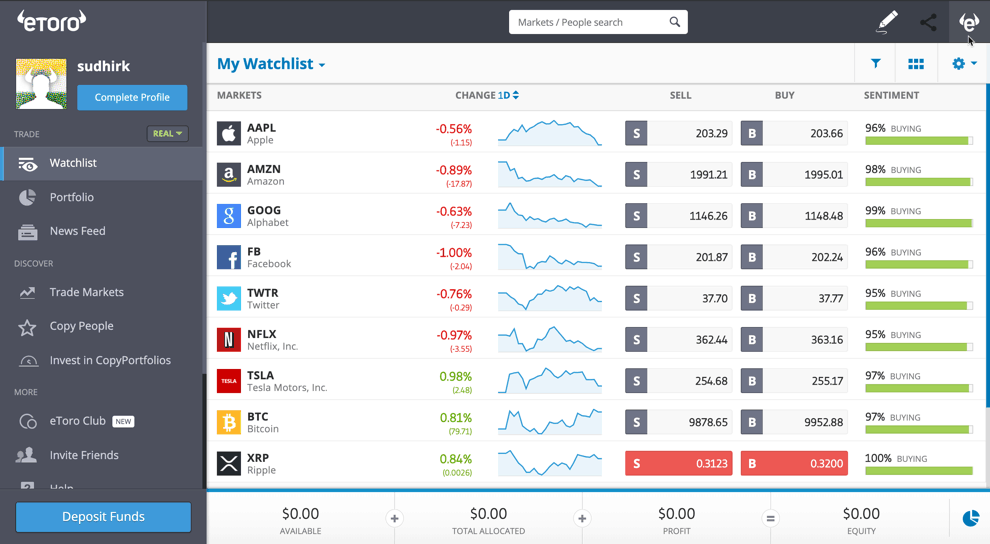

#5. eToro

eToro is Israel’s one of the leading forex brokers operating in this space for more than a decade. They very well know the nuts and bolts of this game and boasts of having 20 million-plus customers.

However, it doesn’t serve US customers due to regulatory barriers, but if you are from any other country that wants to start trading CFDs, eToro is the way to go!!

You can trade here using your fiat currencies, which can be quickly deposited using your credit card, PayPal, ACH, or wire transfers.

As of now, for Crypto CFD traders, it is one of the best trading platforms because it has 10+ popular crypto assets on its platform with an option to go up to 100x in leverage.

There have been etoro alternatives come up in the market, but few are legit. Lastly, if you want to copy successful Bitcoin or crypto CFD traders, eToro facilitates that by being a copy trading platform for CFDs. It is also an award-winning CFD trading platform that is regulated by FCA and Cysec authorities.

#6. AvaTrade

AvaTrade has been serving the financial markets since 2006 with its innovative online trading instruments, and it is no surprise that they are one of the leaders in forex trading and CFDs. It has recently forayed into the cryptocurrency exchanges market with its crypto CFD offering.

It is based out of Ireland and regulated by Irish law, specifically the central bank of Ireland, which regulates CFD and forex brokers.

AvaTrade offers unique options and CFD products on a range of assets, including cryptocurrency cfds. The range of crypto CFDs includes BTC, BTG, BCH, XLM, LTC, ETH, XRP, IOTA, EOS, etc.

Furthermore, there are various funding options available to deposit funds in AvaTrade. You can use credit cards, wire transfers, e-wallets, Neteller, etc., to fund your retail CFD accounts.

What is CFD Trading?

CFD, or contract for difference, is a financial contract between the investor and a CFD broker to pay the difference in the settlement price between an asset’s opening and closing trade price.

The trades are cash-settled and involve margin, allowing investors to take huge positions by paying a small amount of the contract’s notional price.

In CFD, no delivery of security takes place.

It may look similar to futures contracts, but they aren’t. In futures trading, the long and short contracts are traded through an order book in a peer-to-peer manner, but in CFD trading, it is an over-the-counter affair where contacts are bought and sold through the broker all the time.

So, in short, in the case of CFDs, the brokers themselves are market makers because they are buying/selling the contracts.

What is Crypto CFD Trading?

Over the years, CFD trading has gained extreme popularity due to low entry barriers and speculating on the price of an underlying asset without actually owning it.

Earlier CFD trading was only allowed in forex, stocks, indices, bonds, commodities, etc. But, with the rise of digital currency, crypto and bitcoin cfds are also traded extensively now.

Bitcoin and crypto CFDs are similar to trading forex CFD, and there lies no difference. Therefore, anyone who wants to speculate and benefit from the price movements of Bitcoin or other cryptos without actually owning it can opt for cryptocurrency CFD trading.

Using Crypto CFDs, you can go long or short on an asset without the headache of buying the underlying asset and managing its private keys or bitcoin wallets.

Furthermore, most of the CFD trading happens using margin and leverage. By keeping a reasonable margin, one can get leverage of up to 100x to increase their exposure.

Look at this example to understand more:

But in general, crypto CFDs are preferred over bitcoin futures when you want to go long or short because there are fewer regulatory barriers to open a trading account with a bitcoin broker, and a CFD online broker provides the same benefit as futures.

Is Crypto CFD Trading Legit & Safe?

Yes, it is safe to trade in crypto CFDs through a reputed CFD broker, but you should know the risks well, as it is categorized under high-risk investment.

CFDs are highly leveraged products, meaning a small movement in asset price in your favor can deliver you potential profits. Still, if a trade moves against you, it could result in losing money rapidly.

Other risks include account close-out, market volatility, holding cost, etc.

But through the use of various trading tools at your disposal, like take profit and stop-loss tools, you can minimize your loss percentage.

If you are new in CFD trading, start trading in a demo account, a feature offered by all bitcoin brokers that helps you to learn various trading tools and trading strategy, and get used to the market functioning.

Conclusion: Best Cryptocurrency Brokers for Trading CFDs

Most of the CFD crypto trading platforms provide a range of assets that you can trade.

But if you are looking for the best cryptocurrency trading platforms and are interested mainly in Ethereum & Ripple CFDs, you should look no further than PrimeXBT.

PrimeXBT has been in the business of CFDs for more than three years now, and they know what it takes to handle the huge trading volume.

Along with that, PirmeXBT is a crypto trading platform, which supports bitcoin trading, crypto futures contracts, stock indices, commodities, and forex pairs at a low cost.

Now you tell us: What do you think about Crypto CFD trading? Do you think it is the future? Have you ever tried Crypto CFDs? Tell us in the comments below 🙂

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023