With a user base of 1.6 million, Bybit is a rapidly growing cryptocurrency trading exchange specializing in perpetual futures products.

Launched in March 2018 in the British Virgin Islands, the exchange is now competing with established exchanges like BitMEX, Binance, and Phemex.

One of the key features of Bybit is crypto-leveraged trading. It offers up to 100x leverage on perpetual futures contracts. Along with that, it provides competitive fees, excellent trading tools, and cutting-edge security.

But since the platform is relatively new, deciding whether you should trade on Bybit can be challenging. This in-depth Bybit review will help you make the right choice.

Let’s delve in.

ByBit Exchange Review: Supported Coin List- What Is Bybit Exchange?

Here are the types of assets traded on Bybit:

- Bitcoin – BTC

- Ethereum – ETH

- Litecoin – LTC

- Polkadot Coin – DOT

- EOS Token – EOS

- Uniswap Token – UNI

- Cardano Coin – ADA

- ChainLink Coin – LINK

- Ripple – XRP

- Tezos – XTZ

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Bybit Leverage Trading Offerings

Bybit is a cryptocurrency exchange and crypto futures trading platform that offers inverse perpetual contracts known as perpetual swaps.

These contracts have been the most successful in crypto in the past years. BitMEX launched the concept of perpetual futures contracts, and Bybit uses the same model.

This model allows traders to go long or short on Bitcoin or other crypto assets with up to 100x leverage. Moreover, you can keep your positions open for as long as you want.

The second type of contract offered by Bybit is the USDT perpetual contract. Unlike coin-margined inverse perpetual contracts, USDT perpetual contracts are USDT-margined. Therefore, the margin used in these contracts is USDT.

Bybit Order Types

Bybit offers three order types – Limit Order, Market Order, and Conditional Order, which most traders will likely be familiar with. So let’s look at how these orders work:

- Market Order: When you place a Buy or Sell order at the current price, it’s referred to as a Market Order. Your order is executed at the current price once you place the order.

- Limit Order: In Limit Order, you place an order at a particular level of your choice. For example, if a coin is trading at a higher level and you want to buy it at a lower price, you can place a Limit Order at your desired price. The order will trigger only when the price reaches your desired level.

- Conditional Order: In a Conditional Order, the order can execute as either a market order or a limit order. When placing a trade, you have to specify the trigger price, along with quantity, leverage, and direction. Conditional orders are effective when the price reaches technically meaningful levels.

Along with the aforementioned order types, Bybit also offers Stop Loss orders, an essential feature that can be seen in all trading platforms.

Stop-loss orders are orders placed against your initial order and are crucial in leveraged trading to limit your losses. Unfortunately, trading without stop losses is one of the major reasons why new traders end up blowing their accounts.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Apart from the market, limit, and conditional orders, Bybit offers an advanced ordering system that provides traders with greater control and flexibility. For example, the following advanced orders are available on Bybit:

- Good till Cancelled (GTC): GTC orders remain open until you close the open order.

- Immediate or Cancel (IOC): You can opt for an IOC order if you want your order to be filled instantly. If the order remains unfilled, it’ll be canceled. Bybit’s IOC orders support partial order execution. If your order is partially filled, the remainder will get canceled.

- Fill or Kill (FOK): If you don’t want your orders to be partially filled, you can opt for FOK orders. In this order type, your order is either filled entirely or not filled at all.

On top of advanced orders, you can select how your orders are executed.

For example, when placing a Limit or Conditional order, you can choose “Post Only” to ensure your order is executed as a “market maker” (more about this in further sections).

You can choose “Reduce Only” if you want your order to be only executed if it’ll reduce in position. If it were to increase, the order will either be revised down or cancelled.

Lastly, you can choose “Close on Trigger” if you want to ensure that your stop losses reduce your position without increasing orders.

Bybit’s Liquidation Mechanism

Liquidation refers to the closing of an open position due to the loss of all (or nearly all) of the trader’s initial margin. Bybit uses a dual price liquidity mechanism, in which the ‘Global Index Spot Price’ acts as the trigger for liquidation.

This is unlike the majority of other exchanges that use the ‘Mark Price mechanism.’ This dual price mechanism prevents price manipulation and ensures a fair trading environment for all users. In addition, it enhances protection against malevolent liquidations and market manipulation attempts.

Hence, Bybit users get more peace of mind and can trade without worrying about price manipulations.

Bybit Trading Fees

| Perpetual Contracts (Inverse) |

Highest Leverage | Maker’s Rebate | Taker’s Fee |

| BTC/USD | 100x | -0.025% | 0.075% |

| ETH/USD | 50x | -0.025% | 0.075% |

| XRP/USD | 50x | -0.025% | 0.075% |

| EOS/USD | 50x | -0.025% | 0.075% |

Bybit follows a “Market Maker and Market Taker” trading fees structure. It classifies traders in two categories:

- Market Makers: Traders who add depth and liquidity to the market

- Market Takers: Traders who take away depth and liquidity from the market

Traders who place market orders are considered market takers. Market orders are filled immediately before going to the order book, thereby reducing the depth and liquidity. Traders who place limit orders and conditional orders that go to the order book are considered market makers.

Limit and conditional orders that go to the order book add depth and liquidity, which helps “make” the market.

For perpetual contract trading, market takers need to pay 0.075% per executed order (taker fee), while a market maker can get a 0.025% rebate (maker fee). Bybit makes 0.05% on both taker and maker fees.

Please note that whether you choose to go long or short or your trading volumes don’t affect the Bybit fees.

The global average taker fee is 0.063%, whereas the average market maker fee is 0.018%. Thus, while Bybit fees are slightly above the global trading competition when it comes to taker fees, it’s significantly lower in maker fees.

Bybit Deposit & Withdrawal Fees

The Bybit platform doesn’t charge any fee to deposit cryptocurrency in your exchange account. However, there is a small fee on Bybit withdrawals, which is significantly lower than other exchanges.

For example, Bybit charges 0.0005 BTC on Bitcoin withdrawal, compared to 0.0008-0.0009 BTC charged by other exchanges.

Refer to the following table to learn about the withdrawal fees on other coins.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Bybit Funding Rates/Fees

Funding fees or rates are periodic payments to traders based on the difference between the perpetual contract and spot prices.

Since contracts traded on Bybit are futures perpetual contracts, ensuring that the futures price remains the same as the market price is essential. To ensure that, there’s a funding rate.

If the trading price is higher than the prevailing market price, long position holders will pay funding fees to short position holders, enabling them to open more positions.

When the trading price is lower than the spot price, short position holders will pay the trading fees while long position holders will be in the driving seat.

The funding rate isn’t fixed and changes every eight hours at 08:00 UTC, 16:00 UTC, and 00:00 UTC. Buyers and sellers settle the rate directly without any involvement in the exchange.

Bybit Margin Offerings

As discussed, Bybit offers leverage of up to 100 times your margin. You’ll need to put up a 1% margin as the notional amount to place an order.

You can select the amount of leverage you want on your order. Furthermore, you can change the leverage after opening a position, a feature not many exchanges offer.

By leveraging your trade, you can work on a larger trading volume and receive a higher exposure towards a crypto’s price without actually holding the assets. This can multiply your profits as well as your losses.

Higher leverage means the distance to the liquidation level will reduce. For example, suppose you have $100 in your exchange account. You use 100x leverage and take a position in BTC worth 10,000 USD.

Now, if the price of BTC goes in the opposite direction by 1%, you’ll lose your entire 100 USD. Therefore, only experienced traders should use higher leverage.

Therefore, when you enter sizable positions and a larger trading volume, the leverage could be less.

As you increase the position size, the required initial margin also increases to limit the risk. The maintenance margin base rate is 0.5% for BTCUSD contracts and 1% for ETHUSD, XRPUSD, and EOSUSD contracts.

Bybit Trading Platform & Tools

Bybit has an advanced web-based charting platform and trading software. For mobile users, the Bybit app is available on both iOS and Android. In addition, Bybit offers various tools that help you get in-depth market insights and make informed trading decisions.

Here’s a quick overview of Bybit’s trading platform and tools.

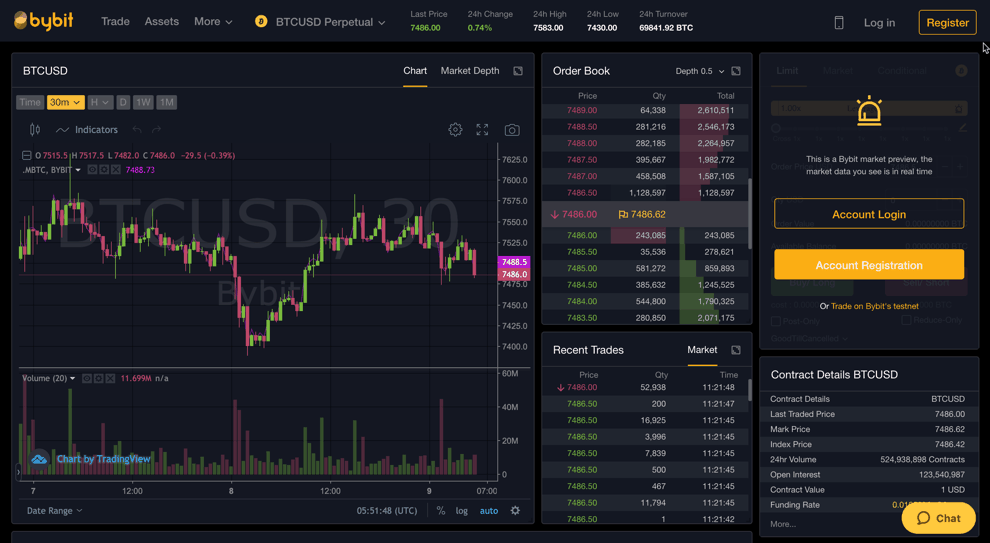

- Trading View

Bybit’s trading view is similar to the trading views of other trading competitors. It comprises the order book, Buy/Sell boxes, and chart view demonstrating an asset’s price history.

Like most modern-day charting platforms, Bybit offers candlestick charts and enables multiple timeframe analyses using indicators and price action.

- Mobile App

There’s a mobile app for iOS and Android devices that enables you to track information, place orders, and manage your positions on the go. It has all the features available in the web version. For example, you can view advanced order forms and set price level notifications.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

- Bybit Calculator

Bybit Calculator enables you to calculate Profit/Loss, Target Price, and Liquidation Price. Hence, you can minimize your risk and better manage your positions. You can also calculate the available leverage and required margin for different quantities of Bitcoin and other coins.

- Bybit Testnet

If you want to test the Bybit platform before signing up, the Bybit Testnet is for you. It’s a dummy version of Bybit where you can make a demo account, trade contracts using virtual currency, and check how everything works.

- Trading Bot

Bybit exchange has integrated with 3Commas to provide a crypto trading bot. You can program the bot to buy and sell crypto assets. You can also copy successful strategies from other portfolios.

You can also choose from short, composite, composite short, and simple bots. To use the Bybit trading bot, you need to link your Bybit account to 3Commas.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

- Data Analysis Tools

Bybit offers an “Advanced Data” section, a feature that’s becoming increasingly popular among cryptocurrency exchanges. Technical analysis is crucial for cryptocurrency traders, especially short-term traders.

Here are the four major data analysis tools available in Bybit. You can also download the data in the form of an image, CSV, or vector file.

- Price Moving Averages: It demonstrates the asset’s price and various moving average indicators for multiple time frames.

- Monthly Price Range: It shows the highs and lows of an instrument on the monthly time range.

- Rolling Volatility: It shows the realized volatility of the asset in 30 days compared to the period’s average. This gives traders the idea of how volatile the instrument is.

- Daily Realized Volatility: This indicator shows the actual realized volatility over one day. Apart from these tools, the Bybit tech team continues to add new screeners and indicators to their charting platform to help you make more accurate trading decisions.

Deposit Methods Bybit

If you already have crypto assets, you can deposit crypto directly.

First, you need to head to the Assets section and generate a wallet address. Once you have the address, you can initiate a transaction. It could take some time for the transaction to be completed.

Bybit exchange doesn’t accept fiat currency deposits. So, if you don’t have any crypto holdings, you can’t invest or trade on Bybit. However, you can use the Bybit Fiat Gateway to deposit fiat money and convert it into crypto assets.

You can choose from BTC, ETH, and USDT. You can choose the amount you want to add and the service provider. Once the process is completed, your funds will reflect on the Assets page.

Bybit Account Types & Limits

Bybit recently introduced subaccounts. You can create up to 20 sub-accounts under one individual account and compartmentalize all of them. The main account has full managerial access.

Subaccounts are ideal for institutional traders who want to deploy different crypto futures trading strategies at once. The P&L of each subaccount is calculated separately to help you better track and manage your trading performance.

You can transfer funds from your main account to subaccounts (and vice versa) without incurring any transfer fee. Moreover, trading fee discounts apply to the main account are automatically inherited by the subaccounts.

Bybit has transaction limits on all the listed coins.

For example, for BTC, the per transaction minimum limit is 0.001 BTC, per transaction maximum limit is 25 BTC, 24 hours user exchange limit is 100 BTC, and 24 hours platform exchange limit is 4,000 BTC. The limits for other coins are mentioned in the table below.

How to Start Leveraged Trading On Bybit?

Now that you’re acquainted with the contracts, order types, fees, and tools available on Bybit, let’s discuss how you can start futures margin trading on the exchange. Here’s a quick, step-by-step tutorial on setting up your Bybit account and entering the first trade.

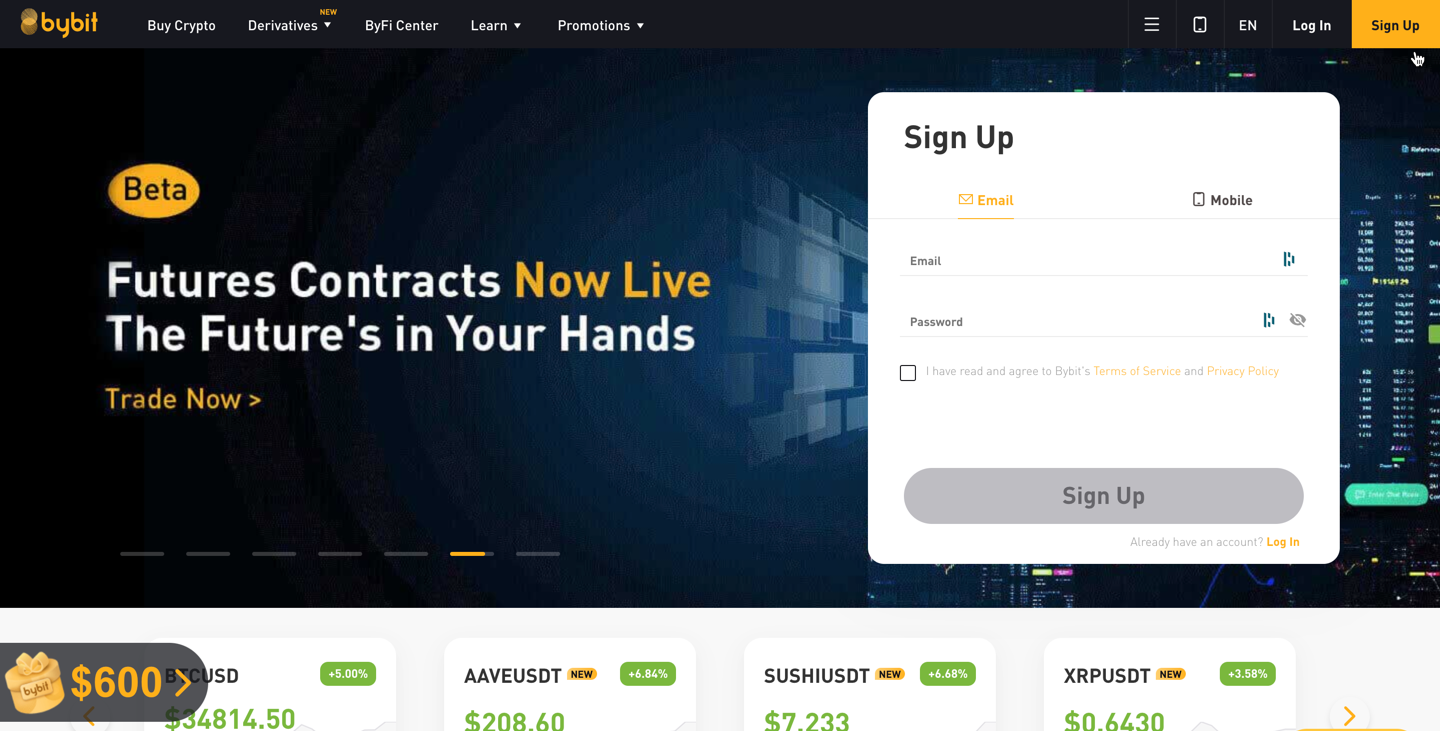

1. Sign Up on Bybit

First things first, you’ll have to sign up on Bybit. The registration process is quick and easy, and you can sign up using your email or phone number. (Here is our Bybit Referral Code)

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

2. Deposit Funds

Once you have registered your account, you’ll need to deposit crypto. As discussed, if you have crypto assets, you can deposit them directly in your Bybit account. If not, you can convert your fiat currency into cryptocurrency using Bybit Fiat Gateway.

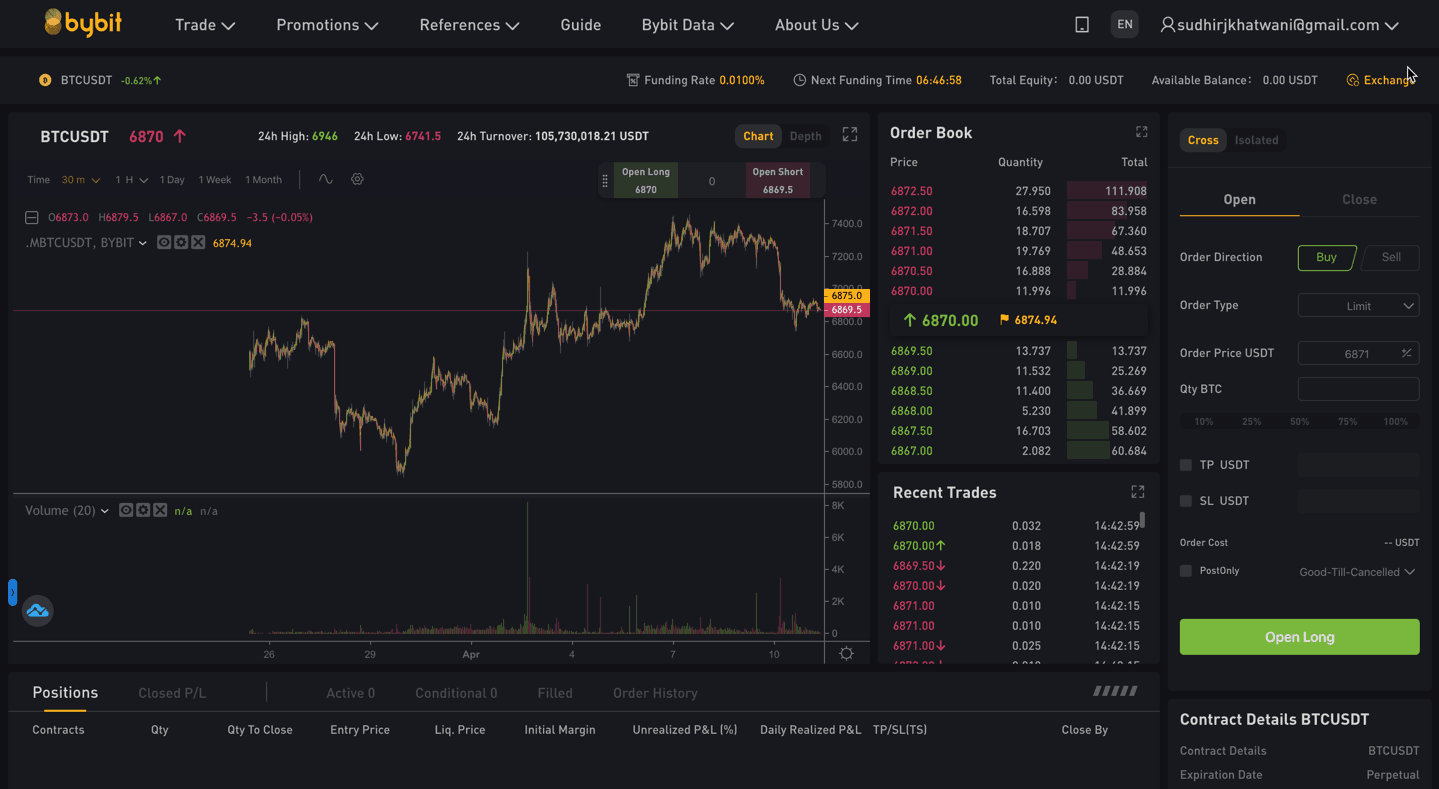

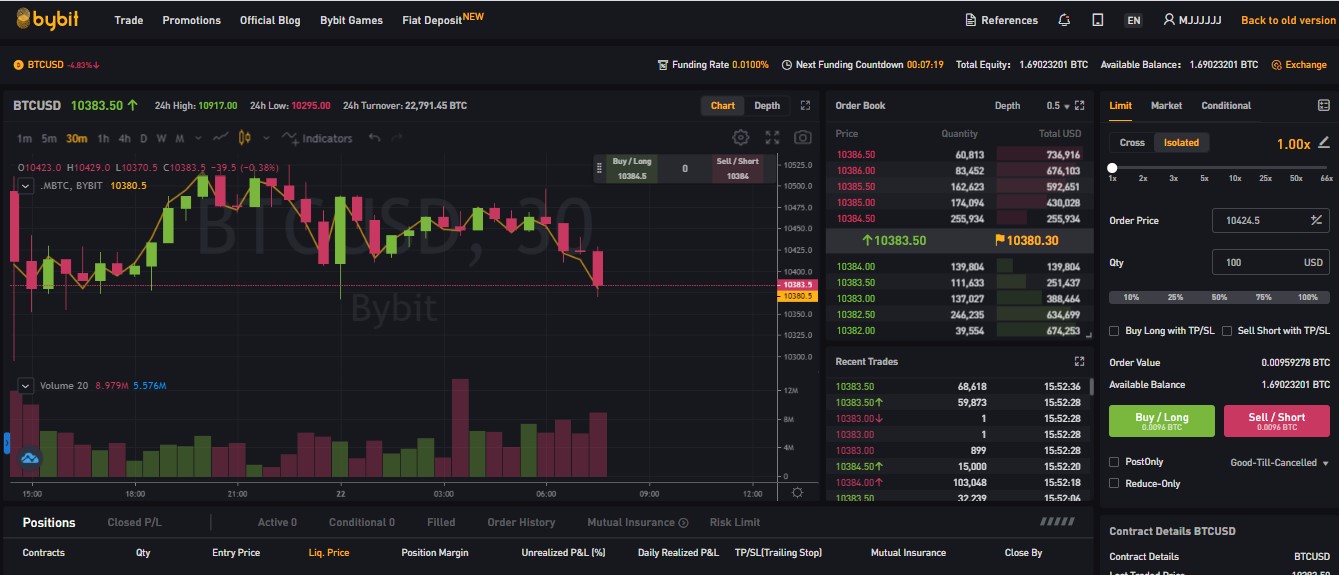

3. Enter a Trade

Once you have funds in your account, you’re ready to take a trade. Follow these steps to place an order.

- Click on “Limit,” “Market,” or “Conditional,” depending on the type of order you want to place.

- Enter the quantity you want to buy or short, along with the leverage you need. You’ll see two quantities: Order Value, which indicates the margin you have used in the trade, and Available Margin, which is the total margin you have in your trading account.

- Click on Buy/Long or Sell/Short to place a buy or sell order. If your order was “Market,” it’ll be executed at the current price. If it was “Limit” or “Conditional,” it’ll execute once the price reaches the desired levels. You can also select advanced order types as per your requirements.

That’s it. You’re into your first Bybit trade.

4. Exit a Trade

As you probably already know, once you enter a trade, only three outcomes are possible: profit, loss, or break-even (no profit, no loss). Unfortunately, break-evens are obsolete in crypto trading, so your trade will most likely either end in a profit or loss.

Now, exiting a trade is as crucial as entering a trade. If you don’t have an exit strategy, you can either miss out on profits or end up taking huge losses.

Since risk management is the cornerstone of trading, you should place your stop loss as soon as you enter the trade. In the Order Details of the active order, you’ll find the Take Profit and Stop Loss options.

In Take Profit, enter the price at which you want to exit your trade-in a profit. In Stop Loss, enter the price at which you want to exit your trade if things go south.

Both Take Profit and Stop Loss are placed as conditional orders.

5. Close Your Position

If you have set a Stop Loss and Take Profit, your position will close automatically once the price reaches the specified levels.

If you didn’t set a stop loss or take profit, you could manually close your position. To do that, click on order details and exit the position.

Make sure to read our detailed guide on How to Margin Trade Crypto with Bybit exchange

Bybit Security Features: Is Bybit Safe?

When it comes to cryptocurrency trading, security is one of the biggest concerns among traders. Bybit doesn’t disappoint in the security segment. Let’s look at Bybit’s key security features that protect traders from potential fraud and other safety concerns.

Cold Wallets: The majority of your funds are stored in a multi-signature offline cold wallet. Some funds are stored in hot wallets to facilitate client withdrawals. To transfer funds from cold storage to hot storage, Bybit uses a multi-signature address, which requires more than one address to complete the transaction.

SSL Communication: The Bybit website uses SSL communications and two-factor authentication to prevent phishing attacks and other sorts of cyberattacks.

Transparent and Self-Regulated Platform: Bybit’s platform is transparent and self-regulated. The users can review Bybit’s platform assets through the Exchange Transparent Assets program by BitUniverse. Furthermore, any on-chain and off-chain movements are independently monitored.

Mark and Index Pricing: Bybit uses the Mark and Index pricing system to guarantee 99.99% availability and provide reliable rates.

Bybit Insurance Fund

Bybit insurance fund is a risk management tool covering excessive losses that occur when a trader gets liquidated at worse than the bankruptcy price.

Now, how is this insurance fund collected? Well, it’s from the residual margin from your positions closed at better than bankruptcy price levels.

When your initial margin is completely exhausted, auto deleveraging mechanisms take over. The Bybit insurance fund alleviates the risk of auto deleveraging and protects you from incurring hefty losses.

Another robust tool that can help you manage your risk and minimize your losses is Bybit Mutual Insurance. It protects you from sudden market fluctuations.

If you’ve traded crypto for a while, you probably have understood that the cryptocurrency market can be mercurial and highly volatile.

For example, a mere tweet from Elon Musk can depreciate an asset as strong as Bitcoin by 17%. Bybit mutual insurance provides well-rounded protection from such fluctuations.

Bybit Customer Support

A big reason why Bybit has managed to secure 1.6 million users in just two years is their 24/7 customer support. In fact, Bybit’s incredible customer support is one of the major reasons to trade on the platform.

The response time is quick, and the agents are well-trained. They’re determined to do everything they can to help you and make your experience more pleasant as a customer.

ByBit when compared with StormGain, it’s one of the closest competitors, Bybit offers far better and quicker customer support. Bybit’s customer support includes:

- 24/7 customer support

- Multilingual support is available in 7 languages

- Live chat functionality

Additionally, you can seek email support at [email protected]. The team of Bybit is also available on Telegram and Reddit.

-

Is Bybit legit?

Yes. Bybit is a legitimate cryptocurrency trading exchange owned and operated by Bybit Fintech Limited.

As mentioned earlier, the exchange features bank-like operational and security features. In addition, features like offline cold wallet storage and multi-signature withdrawals make Bybit a safe and secure crypto trading platform.

-

Is KYC Needed to Open a Bybit Account?

No. Currently, Bybit isn’t regulated in any country, so users don’t require a KYC to use Bybit.

You can sign up using your email or phone number, add funds, and start trading in less than 30 seconds. This quick sign-up process is another positive feature that exchange other than Bybit doesn’t offer.

-

Is trading on Bybit illegal?

No. Trading on Bybit is not illegal. However, there are some restrictions that traders should keep in mind.

-

Is Bybit Better than Coinbase?

Both exchanges are good and offer their sets of advantages. However, Coinbase doesn’t offer margin or futures trading, while Bybit does. This gives Bybit a slight edge over Coinbase.

Bybit Review Recap: Pros and Cons of Bybit

Let’s quickly recap the pros and cons of trading on Bybit.

Pros:

- A powerful 100,000 transactions per second (TPS) matching engine

- Futures perpetual contracts on Ripple and EOS, which aren’t available on other platforms

- Powerful API that pushes market data at 20 ms

- Smaller-sized contracts compared to other exchanges

- Cutting-edge platform and trading tools

- Competitive trading, withdrawal, and funding fees

- Best-in-class customer support

- No KYC Needed

Cons:

- Comparatively new platform

- Not regulated in any country

- Not available in the US and several other countries

- Offers less number of crypto trading pairs when compared ByBit to Binance.

Bybit Review Summary

Bybit, registered in the British Virgin Islands, has all the qualities of a top-notch crypto-only exchange. It is transparent and trustworthy, with industry-leading security features.

It offers up to 100x leverage on margin trading, enabling you to get started and trade futures with minimal margin. And it has a cutting-edge trading platform and tools, along with mobile apps, which make trading an effortless and enjoyable experience.

All in all, Bybit is an amazing crypto trading exchange with all the features and capabilities needed to offer a superior trading experience.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023