BlockFi and Gemini are two big names in the cryptocurrency world. If you are looking for a reliable platform to invest your idle crypto assets to get interest yields, the two are some of the main options you are likely to come across.

Besides their interest yield account, the two companies also have various other products for crypto holders. But, while you can get desirable yields regardless of which you choose, it is vital to ensure you make an informed choice by understanding what each has to offer.

This article looks at the two companies side by side and highlights what sets them apart. But, first, here is a brief overview of the two companies.

[wptb id="12304" not found ]BlockFi vs. Gemini: Introduction

BlockFi is one of the few crypto-lending platforms registered and regulated in the USA. The company has been in operation since 2017 and currently has its headquarters in New Jersey.

The company holds at least $1.5 billion in user assets on its platform. Additionally, it has a solid financial muscle with backing from leading investors like Morgan Creek, Bain Capital Ventures, and Valar.

Gemini is one of the oldest players in the cryptocurrency market as they have been in the business since 2014. Besides acting as a custodian for many cryptocurrency platforms, including BlockFi, the New York-based company also offers interest yield accounts for its customers.

With Gemini, you get a secure and straightforward platform that you can use to grow your crypto holdings. Gemini manages more than $25 billion in user assets, giving you some confidence that it is a solid company.

Supporting Crypto Assets & LTV

Both BlockFi and Gemini try to cater to the needs of all kinds of crypto investors by offering them a wide variety of crypto assets that they can invest to earn interest yield and grow their portfolios.

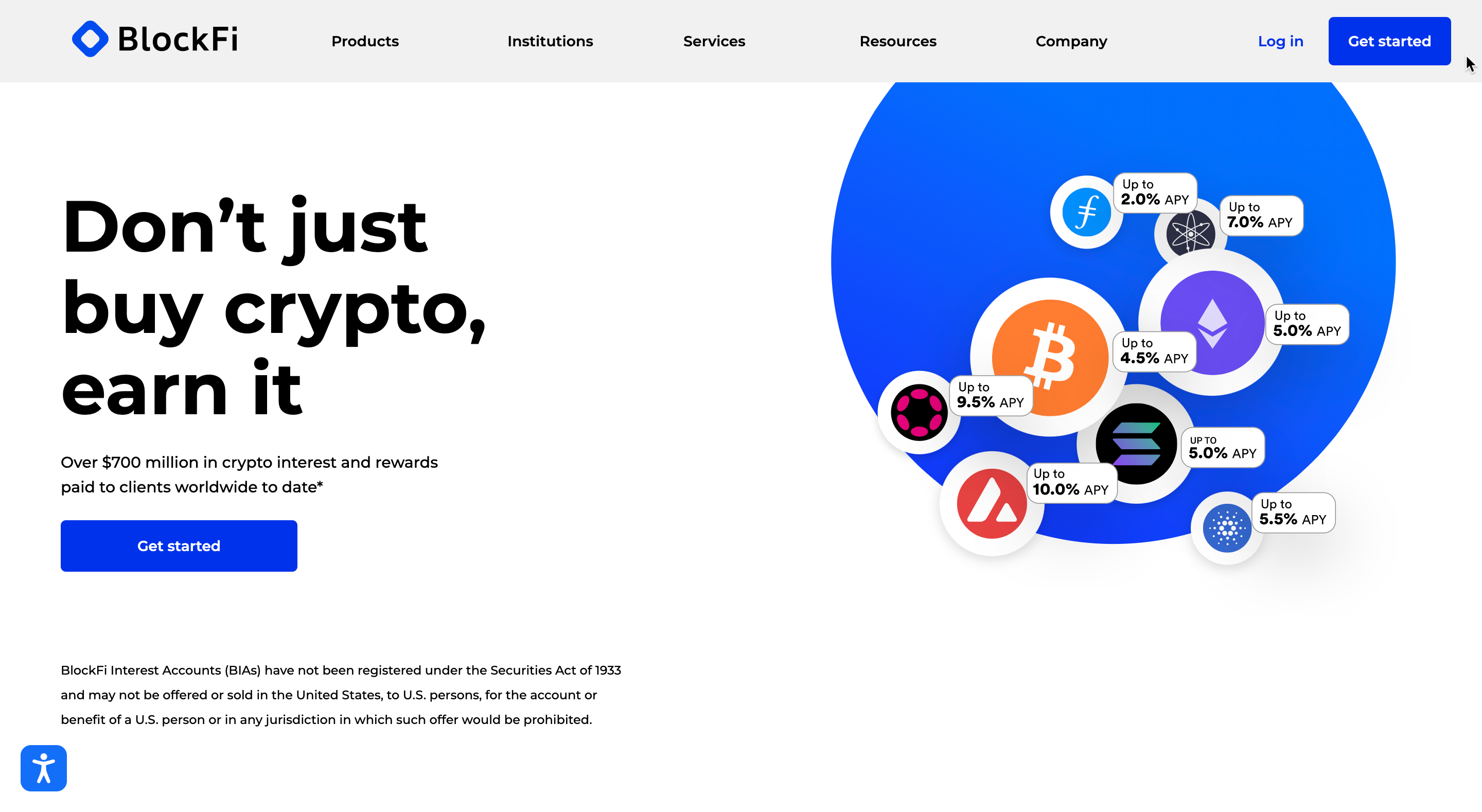

BkockFi supports at least 10 different crypto assets that you can use to get crypto-backed loans or deposit with the company’s interest account to get yield. These assets include at least 6 of the primary coins, including BTC and ETH and Stablecoins like USDC and Gemini’s GUSD.

For those that want to take crypto-backed loans from BlockFi, the company offers three LTV options. Investors can borrow at 20%, 33% or 50% LTV ratio. But, it is vital to note that the LTV you choose determines the interest rate you pay for the loan.

Gemini is one of the world’s largest cryptocurrency platforms, so one can rightfully expect them to support a wide variety of crypto assets. The company supports over 40 different crypto assets that traders can deposit to get interest yields. These assets include BTC, ETH, LTC, and a wide variety of ERC-20 tokens like 1INCH, AAVE, BNT, and DAI.

BlockFi vs Gemini: Interest Rates, Lock-in Terms & Payouts

When you deposit your crypto assets with BlockFi and Gemini, you can expect to get some of the highest interest yields, given that these two are some of the largest platforms out there.

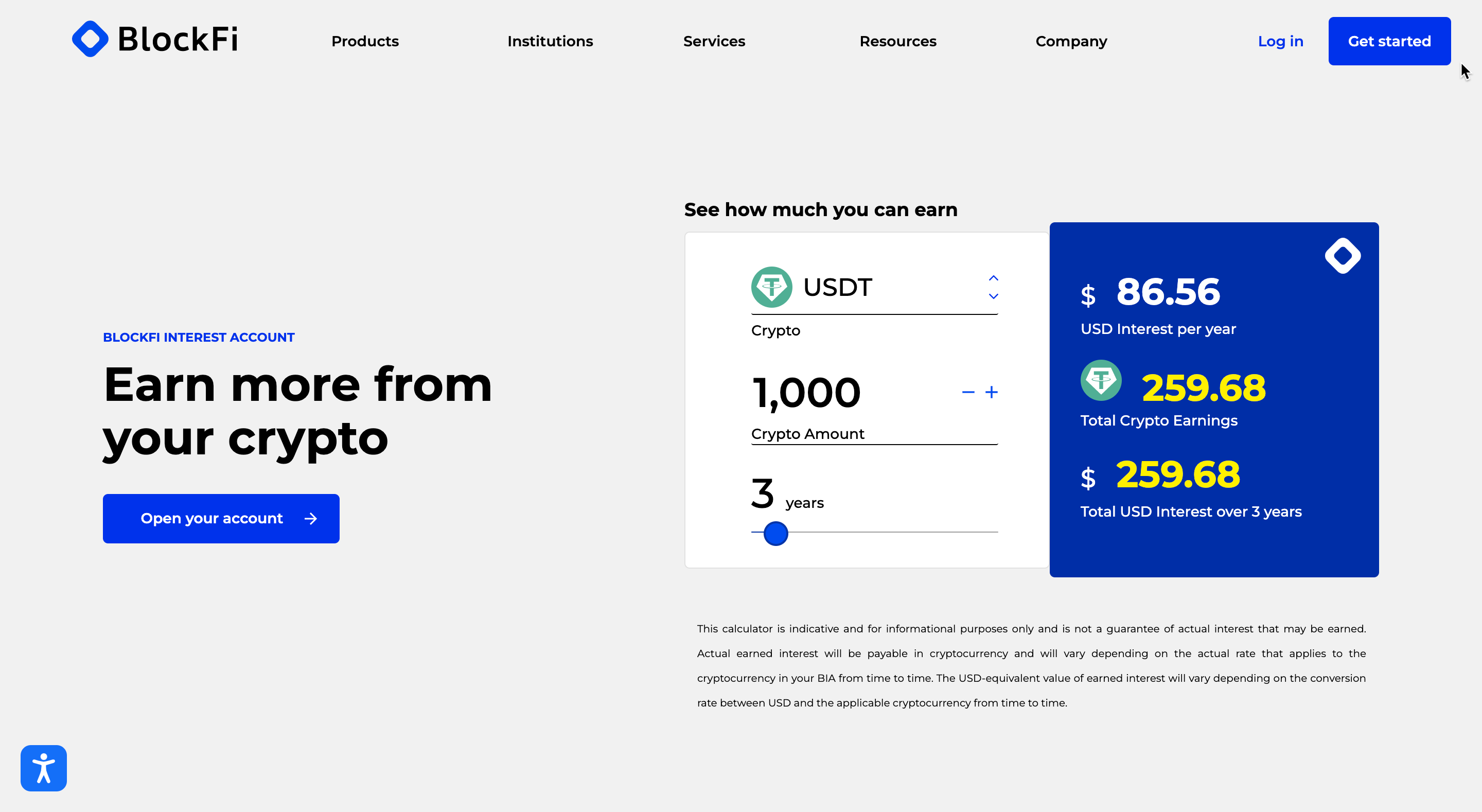

By opening a BlockFi interest account, you can expect to get an interest yield of up to 7.5%, depending on the specific asset you deposit with the company and the tier level. Common digital currencies like BTC will earn you 4% APY, while the Stablecoins like USDC and GUSD will give you a higher yield of up to 7.5% APY.

BlockFi pays out the interest yields once at the beginning of every month, but the interest on your assets will accrue daily. Additionally, the company does not have a lock-in period as you can withdraw your funds anytime you want. Also, the investors can keep earning from the deposited assets for up to 30 years.

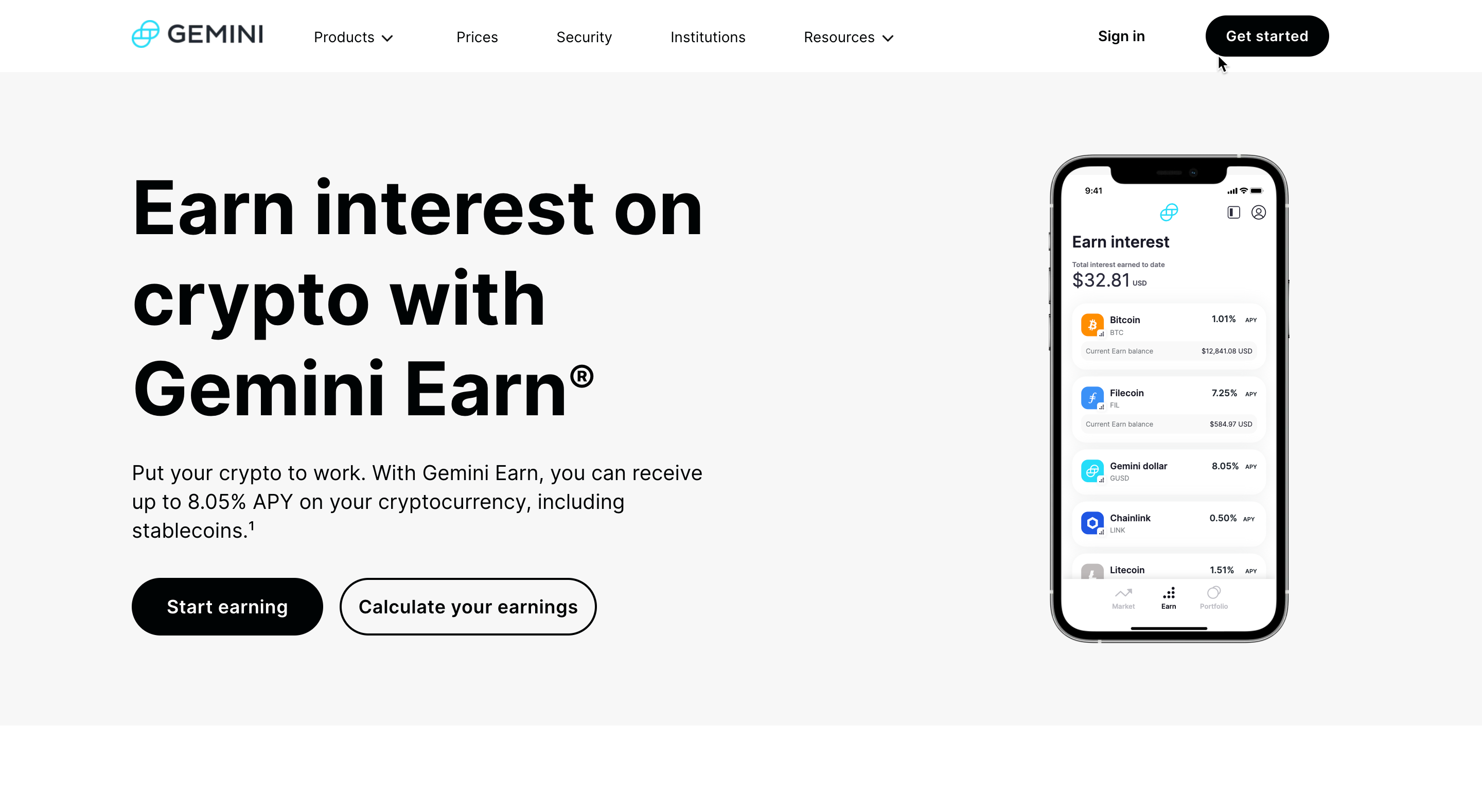

Gemini offers investors a chance to earn up to 7.4% APY by depositing their digital coins with the company. Interest yields depend on the specific asset you deposit. For example, BTC earns 1.65% APY, ETH earns 2.05% APY, while 1INCH yields 7.4% APY.

When it comes to the Gemini payouts, the company will compound the interest yield daily to ensure you start earning immediately after you deposit the assets. Better still, the company does not have a lock-in period, meaning investors can withdraw their funds anytime they want.

BlockFi vs. Gemini: Products & Features Comparison

Both BlockFi and Gemini have a wide variety of products to cater to different kinds of crypto holders. However, their interest accounts are their most similar products.

BlockFi seems to have an edge for this particular product as it will give you up to 7.5% APY, which is a little higher than the 7.4% APY, which is the maximum you can get from Gemini. Also, BlockFi will give you a higher yield on the most common coins. For example, the company offers 4% APY for BTC while Gemini’s yield is 1.65%.

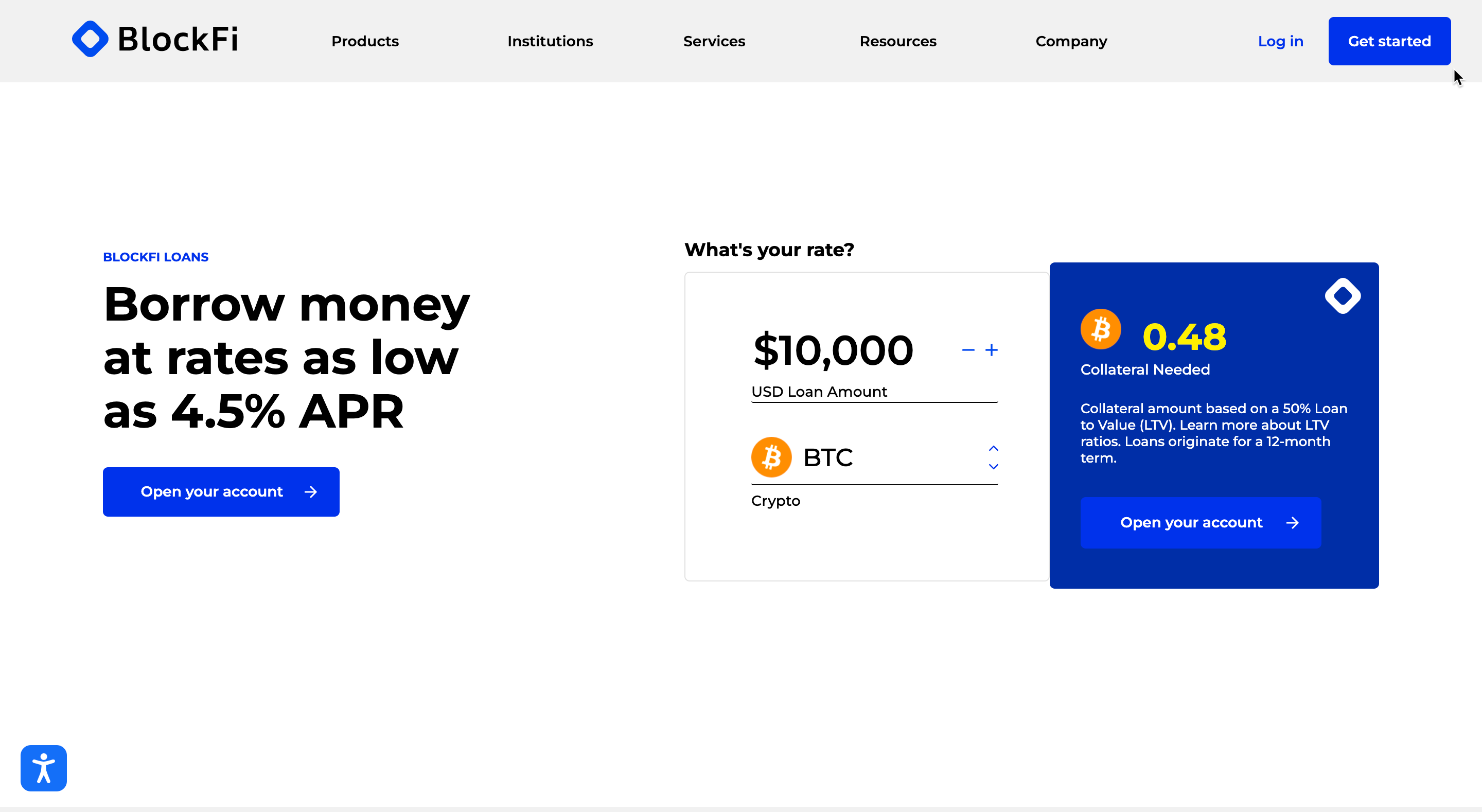

Other BlockFi products include the crypto-backed loan account that allows you to borrow fiat currencies or Stablecoins against your digital assets at an interest rate of as low as 4.5%. The company will enable you to borrow a minimum of $10,000 at up to 50% LTV.

Gemini currently does not have a crypto-backed loan product, but it still has many other products. These other products include a crypto exchange platform that supports over 40 different assets, and there are soon launching a credit card rewards program.

BlockFi vs. Gemini: Fees

You should never overlook the fees when choosing a cryptocurrency investment platform, as they will have a considerable impact on your overall experience and how much money you make.

Although BlockFi and Gemini try to keep the fees as low as possible and eliminate most of them, there are always some charges you need to know about, whether you are lending or borrowing.

BlockFi makes their fee very clear on their rates schedule. The most significant fee that every investor needs to know is the 2% origination fee that is standard for all crypto-backed loans. Hence, as you calculate the cost of getting a loan from the platform, you should add this fee to the actual interest rate you pay.

Gemini does not have any hidden fees, and since they do not offer any crypto-backed loans, there are no origination fees to worry about. However, the company charges transaction and convenience fees. For example, when transacting anything less than $10, you must part with a $0.99 transaction fee.

BlockFi vs. Gemini: Safety & Security Features

Crypto assets are pretty sensitive, so you cannot afford to take chances with platform security. There have been security issues on some platforms in recent years as they have been hacked and user assets were stolen.

With top-tier companies like BlockFi and Gemini, one can rightfully expect to get maximum security. What’s more, both companies handle assets worth billions, so they have some of the safest platforms.

BlockFi uses multiple security features and protocols to ensure user assets and accounts are secure on their platform. Key among them is making unauthorized access almost impossible with security features like 2FA and requiring PII verification to ensure it is only you who has access to your account.

Additionally, BlockFi users get some extra security features when using the mobile app like biometric login where they can use Face ID or fingerprint to access their account. What’s more, the company stores the majority of the user assets in offline cold storage.

Besides offering crypto deposit account and exchange platforms, Gemini also acts as a custodian for other companies. Hence, you can be sure they have one of the safest platforms out there. Like BlockFi, they use multiple security protocols from address allowlisting to a multi-signature digital signature scheme.

Moreover, Gemini uses HSMs for their cold and hot wallets and has achieved some of the highest security ratings. Additionally, the company also has 2FA, and they support hardware security keys for maximum security.

BlockFi vs. Gemini: Insurance

Given how risky the crypto industry tends to be, it is always good to have some assurances that you will not lose your assets no matter what happens.

Many crypto lending platforms have an insurance scheme for this, but the actual coverage differs from one to the other. While some companies have private insurance for user assets, others rely on their custodians for insurance coverage.

BlockFi has insurance coverage for their digital assets but not in the way most investors think. Unlike money kept in the bank, digital assets that BlockFi holds are not FDIC insured. Instead, the company relies on insurance from their custodian, Gemini.

Gemini keeps 95% of the BlockFi digital assets in offline cold storage while the remaining 5% is kept in hot wallets that the company insures with AON.

Besides being a custodian, Gemini is also an independent crypto trading and lending platform. Most of the cryptocurrency assets you deposit with Gemini will go to offline cold storage and hot wallet with commercial crime insurance. The coverage is by highly reputable third-party underwriters such as AON.

BlockFi vs. Gemini: Minimum Deposits & Withdrawal Limits

Many crypto lending platforms will require investors to deposit a specific number of assets or amounts before starting earning yield or borrowing against the assets. However, BlockFi and Gemini do not seem to have these restrictions.

BlockFi does not have any minimum deposit requirements, and neither does the company require the investors to maintain a specific number of assets in their account. However, you need to have some assets in the interest account to earn yields, and the actual number of assets you have also determines the yield you will get.

For example, investors with between 0 and 0.25 BTC on their interest account will earn a 4% APY yield, while those with over 5 BTC earn 0.25% APY.

BlockFi allows you to withdraw up to 100 BTC every 7 days when it comes to the withdrawal limit. For other digital assets like ETH, investors can withdraw up to 5,000 ETH every week, while Stablecoin holders can withdraw up to $1 million every 7 days.

Gemini does not have a minimum deposit requirement whether you have an institutional or individual account. The company also allows you to withdraw up to $100,000 per day once your account is fully verified.

BlockFi vs. Gemini: Account Sign-Up Process & KYC

Most top-tier cryptocurrency platforms always make the signing up process for their account quick and straightforward. BlockFi and Gemini keep up with this trend, and with both platforms, you should have an account set up and ready to use in just a few minutes.

As you choose between these two platforms, it is essential to note that both have mandatory KYC verification requirements, and so you should have your ID documentation ready.

Signing Up on BlockFi

- Start by going to https://blockfi.com/ and click “Get Started”

- Create an account by adding your names, email, and password.

- Use BlockFi Referral Code to get up to a $250 Bonus in BTC.

- Verify the email address.

- Do personal information verification

- Add funds to the account to start lending or borrowing

Signing Up on Gemini

- Go to https://www.gemini.com/ and hit the “Get Started” button

- Fill up your names and create a password for your account

- Agree to the terms

- Click “Next” to verify your email address

- Do KYC verification

- Fund your account, and you are all set

BlockFi vs. Gemini: Supported Countries

While both BlockFi and Gemini are US-registered companies, they aim to accommodate users from across the world, so you can use their services from different countries.

BlockFi allows anyone to open and use their interest accounts from anywhere in the world. But, there is an exception as they will not support countries sanctioned by the USA or under their watch lists like North Korea and Iran. BlockFi crypto-backed loan accounts, on the other hand, are only available in the USA.

Gemini supports over 60 countries from across the world. The platform provides a complete list of the countries they support, meaning it will be pretty easy to figure out whether you can use the services where you are.

- Is BlockFi Safe?

BlockFi uses some highly advanced security features and protocols to ensure investors get one of the most secure platforms in the world. Additionally, they keep most assets offline and have insurance coverage to make the platform even safer.

- Is Gemini Safe?

Several reputable companies use Gemini as a custodian, indicating that the platform is safe enough to use. Besides the multiple platform security features, Gemini also utilizes several other security features like offline cold storage and insurance to ensure maximum safety.

Conclusion

BlockFi and Gemini are two of the most reliable crypto lending platforms out there. Besides offering some of the highest interest yields, the two companies allow investors to invest most of the common crypto assets and are also straightforward to use.

Other things that make the two platforms worth a try include having some highly secure systems and insurance coverage for their hot wallets.

When deciding between the two top-tier companies, it will mostly boil down to your preferences as a crypto investor, given that each platform has its merits and shortcomings. That said, an easier way to decide between them is to give both a try before settling for what works best for you.

[wptb id="12304" not found ]- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023