Crypto derivative exchanges are quickly becoming the way of life for serious crypto traders.

Why not also when applying derivatives to a volatile class like crypto is so rewarding!!

Chances are, you, too, are looking to take advantage of derivatives products based on crypto assets. If that’s the case, I must say you are in the right place.

TheMoneyMongers have been tracking several cryptocurrency derivatives exchanges and concluded that not all are made equal.

So it would be best if you didn’t get tricked by the vague language these derivatives exchanges use and use your wisdom to make the correct choice.

Here you go to find the best crypto derivatives exchanges:

(Editor's Choice For 2023) |

| Get Upto $30,000 Bonus |

| Welcome Bonus upto $5135 | |

- Deposit in: Bitcoin & altcoins - KYC & VC Backed | Joining Bonus uptp $5000 |

Top Cryptocurrency Derivatives Exchanges

| Best Crypto Derivatives Exchange | Quick Links |

| ByBit [Get Deposit Bonus up to $30,000] | Try Now |

| StromGain [Get Deposit Bonus up to $25] | Try Now |

| PrimeXBT [100x Leverage] | Try Now |

| Binance Futures | Try Now |

| BitMEX | Try Now |

| Deribit | Try Now |

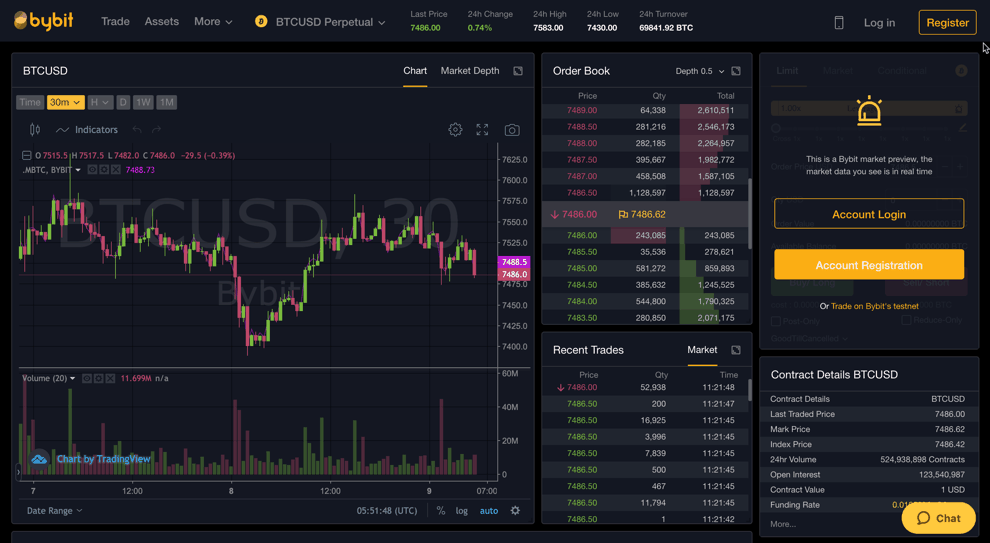

# 1. ByBit (Best Crypto Derivatives Trading Platform)

It’s a Singapore-based crypto exchange launched in March 2018. It offers crypto-based Swaps as well as crypto futures contracts.

But it primarily specializes in crypto-to-fiat currency pairs perpetual contracts with 100:1 leverage all the major cryptocurrencies to help you trade derivatives that are highly liquid.

In just a short period, the ByBit platform has emerged as a popular choice among cryptocurrency traders and managed to build up enough liquidity.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

During our detailed analysis of Bybit Exchange, a few features which make ByBit really stand out from others:

- State-of-the-art matching engine: Bybit exchange platform can support up to 100,000 transactions per second, ten times the industry’s speed. And each transaction is settled within 10 microseconds.

- Security of assets: All the funds are kept safe in a hierarchical deterministic cold storage system, and manual withdrawals are processed three times a day. But for additional security, it is recommended to use two-factor authentication while using Bybit.

- Deposits and withdrawals are supported in BTC, ETH, EOS, and XRP

- There is no server downtime on the web app, but it also has active mobile apps for iOS & Android devices.

#2. BingX [No KYC]

BingX is one of the top social cryptocurrency trading exchanges out there. The exchange was founded in 2018 and currently serves more than 5 million users in more than 100 countries.

With BingX, you can trade it in different crypto markets, spots or derivatives. For derivatives trading, it offers up to 150x leverage for perpetual and standard futures contracts, one of the highest among crypto exchanges.

You can also use BingX for copy trading, grid trading, and P2P crypto trading, besides derivatives and spot. Plus, it offers you access to a wide range of cryptocurrencies.

Furthermore, BingX is known for offering one of the lowest trading fees in the industry.

For spot trading, it charges a flat trading fee of 0.1% for both maker and taker fees. Also, perpetual and standard futures contracts charge you a maker and taker fee rate of 0.0200% and 0.0500%.

BingX also doesn’t require you to complete your KYC to start trading. Without identity verification, you can deposit/withdraw funds and place trades. But verifying your account would bring additional benefits.

Overall, the crypto exchange offers you a safe place to store and trade crypto and access a wide range of security features.

#3. Bitget: Empowering Traders with Advanced Derivatives Trading

Bitget, a Singapore-based platform, is making waves as one of the top crypto derivatives exchanges on the global stage.

Since its inception in 2018, it has steadily climbed the ranks, now boasting a substantial user base spread across over 50 countries.

Bitget stands out for its intuitive user interface, which makes the process of trading derivatives straightforward even for novices.

It offers a variety of crypto derivatives, including Futures and Perpetual contracts, with trading Bitcoin (BTC) and Ethereum (ETH) being the most traded.

The ability to leverage trades up to 100x also attracts a substantial number of users.

One unique feature of Bitget is the Copy Trade system, a social trading feature that allows users to replicate the trades of experienced traders.

This has proven to be a game changer, particularly for beginners who can learn from seasoned traders and potentially maximize their returns.

Security, often a major concern in crypto trading, is another strong suit for Bitget.

The platform employs multi-layer security measures, including cold storage, anti-DDoS protection, and two-factor authentication (2FA), aiming to safeguard users’ assets and data.

Lastly, Bitget provides robust customer service with a 24/7 support system, which includes a live chat feature. Their dedication to user experience reflects in their quick response time to resolve queries and issues.

#4. MEXC Global: A Leading Cryptocurrency Derivatives Exchange

MEXC Global, founded in 2018, is a Singapore-based cryptocurrency exchange that has made significant strides in the list of crypto derivatives exchanges.

The platform has a global presence, with users spread across more than 70 countries, speaking to its international appeal.

MEXC offers a wide range of crypto derivatives, including Futures and Swaps for a variety of cryptocurrencies.

Bitcoin (BTC) and Ethereum (ETH) contracts are the most traded, but the platform also supports derivatives trading for a broad spectrum of altcoins, thereby offering the chance for traders to diversify their trading portfolio.

A standout feature of MEXC is the platform’s easy-to-use interface, which provides a smooth and intuitive user experience.

It is well-suited for both beginners and seasoned traders due to its blend of industry-leading fees, market liquidity, and simple and advanced trading features.

Another remarkable feature is the leveraged trading it offers. Traders on MEXC can leverage their trades up to 100x, making it an appealing platform for those seeking significant potential returns.

In terms of security, MEXC takes robust measures to safeguard user assets and data.

This includes the deployment of multi-layer firewalls, multi-signature withdrawals, and cold storage solutions for crypto assets.

It also has an insurance fund to further protect its regular users and institutional investors.

One more thing to note is MEXC’s commitment to customer service.

It offers round-the-clock support and maintains an active presence on social media platforms, where users can get updates and engage with the exchange directly.

#5. PrimeXBT

PrimeXBT platform is another popular crypto exchange where you will not be worried about liquidity.

This cryptocurrency derivatives exchange has rapidly started scaling up in 2019, and for many serious crypto derivative exchange traders, has become a go-to platform.

I have also placed a couple of trades on PrimeXBT, and found their UI intuitive.

Furthermore, it is also an exchange that allows you to trade 30+ crypto assets, including BTC, Ethereum, Litecoin, Ripple, EOS, Bitcoin Cash, and many more.

You only need your email ID to start with your account, and there are no KYC requirements.

Users can execute five types of advanced orders to long or short different cryptocurrencies, including stock indexes (S&P500, FTSE100), commodities, and forex, all in one place.

But you should know that it is more like a CFD market for cryptocurrencies rather than a Futures’ market.

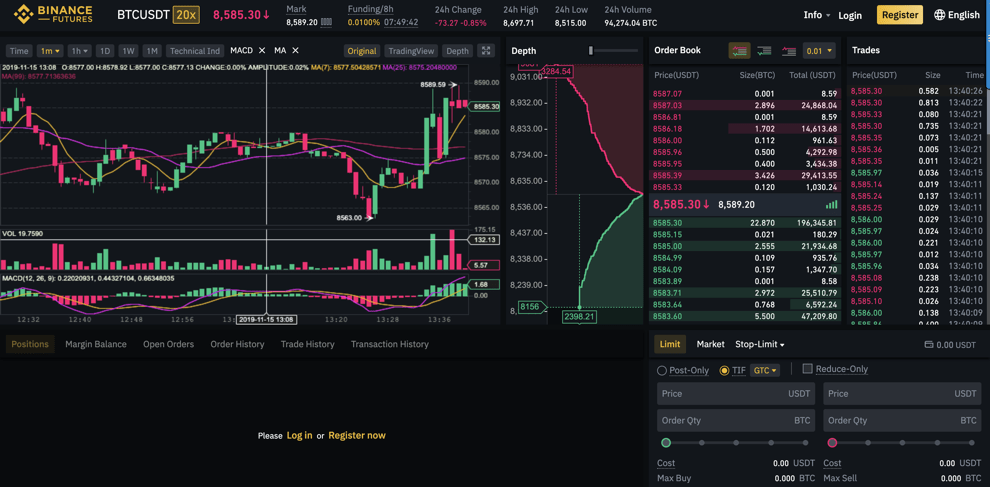

#6. Binance

Binance Futures exchange is a great platform for crypto futures trading.

It is one of the most famous brands for cryptocurrency trading, specifically for spot trading markets for beginners and institutional traders. But now, they have a Futures trading platform as well for the big trading pairs of crypto space.

Binance has been serving the cryptocurrency market since 2017. It has recently launched its products to lure derivative traders who want to hedge or speculate on standardized futures contracts.

With Binance Futures, you can access up to 125x leverage on cryptocurrency Futures products. In terms of trading fees of cryptocurrency Futures and derivatives contracts, too, Binance is pretty decently placed.

Binance now offers active derivative products of over 300+ trading pairs for interested market takers and makers. It also has standardized contracts for coin margined inverse Futures which is a rarity in the crypto derivatives industry.

Binance has started offering crypto Options products too for Options traders and allows funding of traders’ accounts with fiat currencies using any popular debit card providers.

Apart from allowing trading of Futures, coin margined swaps, and Options, Binance also allows traders to stake cryptocurrencies on its platform to earn interest.

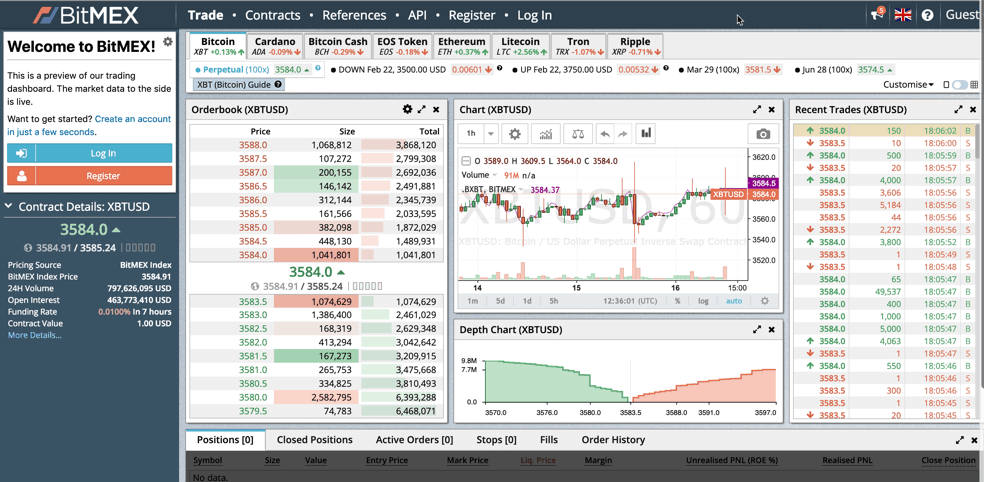

#7. BitMEX

Many crypto derivatives exchanges have come and gone, but shining like the beacon, the BitMEX platform has carried the load of the crypto derivatives market since 2015.

Of course, now new players have entered the the crypto derivatives exchange industry, but in terms of brand name and liquidity- BitMEX still stands in the top ten platforms in the crypto derivatives exchange market.

BitMEX exchange offers the best crypto derivatives with negligible slippage and high liquidity. Moreover, the sign-up process is easy and requires just your email ID.

You will get an exclusive 10% discount on trading fees for the first six months if you register NOW and open your account.

Moreover, it is the perfect place to deal with cryptocurrency because it offers derivatives for a lot more cryptocurrencies apart from just BTC.

To learn more about the exchange, check this comprehensive BitMEX review.

#8. Deribit (Best Bitcoin Derivatives Exchange)

Deribit is one of the high-performance crypto derivatives exchanges unlike any other which allows you to trade Futures and Perpetual contracts, i.e. swaps with leverage.

It is serving the cryptocurrency Options and Futures trading market since 2015 and is super specific in doing what it does.

It has a decent share of cryptocurrency whales because it was one of the first crypto derivative exchanges ever to allow crypto Options products for crypto traders.

And its popularity amongst Options traders can be gauged by the volume of Open Interest Deribit has at any point.

In terms of fees and ease of sign-up, it is similar to the BitMEX exchange, but in terms of liquidity, it is a bit less, but still does a decent job. Moreover, you will find crypto Options also here, which are hard to find.

It also follows the maker and taker model to allow you to trade Futures, Swaps & Options, which you will not find in other places.

Lastly, trading on 100x leverage is the best part of the crypto market because you do not want to pay a considerable sum upfront to get actual exposure in this liquid market.

To learn more, have a look at this detailed Deribit review.

#9. Delta.Exchange: Empowering Crypto Derivatives Trading

When it comes to the best crypto derivatives exchanges around, Delta.Exchange stands out as a prominent platform that empowers traders with a wide range of features and tools to trade crypto assets.

Here’s why Delta.Exchange deserves recognition as one of the best crypto derivatives exchanges:

Delta.Exchange offers an extensive selection of derivative products, including

- USD margined Futures contracts,

- Coin-margined Futures contracts,

- Perpetual Futures contracts, and

- Options,

allowing traders to diversify their more sophisticated trading strategies and explore various market opportunities.

With competitive fees and a comprehensive range of trading instruments, Delta.Exchange caters to the needs of both experienced traders and newcomers to one of the best crypto derivatives market.

The platform provides a user-friendly interface that prioritizes simplicity and ease of use.

Traders can easily navigate the platform, access real-time market data, and execute trades efficiently with a high trading volume, and level of market efficiency.

Delta.Exchange also offers advanced trading features such as stop-loss orders, take-profit orders, and customizable leveraged trading Options, empowering traders to implement their strategies effectively.

Liquidity is a key aspect of derivatives trading and Delta.Exchange excels in this area. The exchange has established partnerships with leading market makers and liquidity providers, ensuring deep liquidity pools and tight spreads.

This translates into efficient order execution and margin trading with minimal slippage, enabling traders to enter and exit positions seamlessly, even during periods of high market volatility and adverse price movements.

Security is paramount at Delta.Exchange. The platform employs industry-standard security protocols, including robust encryption, multi-factor authentication (MFA), and cold storage for user funds.

By implementing stringent security measures, Delta.Exchange prioritizes the protection of user assets and personal information.

Delta.Exchange understands the importance of responsive customer support.

Traders can reach out to the support team through various channels, including email and live chat, to seek assistance or resolve any issues they may encounter during their trading journey.

The dedicated support team is known for its prompt and helpful responses.

With a commitment to transparency, Delta.Exchange provides comprehensive and real-time market data, including order books, trading volume, and price charts.

Traders can access this information to make informed decisions and execute trades based on accurate market insights.

10. Bit: A Cutting-Edge Cryptocurrency Exchange

Bit.com, established by Matrixport, a financial services firm spun off from Bitmain, is fast emerging as a leading player in the world of trading crypto derivatives on exchanges.

Registered in Singapore, it boasts a strong presence in the Asian cryptocurrency market, while rapidly expanding globally.

Bit.com offers an impressive array of derivative products, including Perpetual Swaps and Options for major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). It stands apart from the crowd by also offering derivatives for less common cryptocurrencies.

Traders can leverage up to 100x on Futures contracts, making it attractive to those seeking high-risk, high-reward strategies.

One of Bit.com’s distinguishing features is its dedicated focus on crypto Options, a less ubiquitous derivative in the crypto realm.

It remains one of the few exchanges offering a substantial liquidity pool for Options trading. This niche focus has attracted a unique subset of traders and increased its market share significantly.

When it comes to security, Bit.com deploys comprehensive measures.

The exchange has a solid trading history and employs institutional-grade security protocols like cold storage for assets, advanced SSL technology, and two-factor authentication to safeguard users’ information and funds.

The platform is also known for its professional customer support. It provides a 24/7 service with a dedicated team that promptly handles user queries and issues.

What Is Crypto Derivatives Trading?

Real money is being made by trading crypto derivatives on exchanges. By now, I believe you have already sensed this, and the fact you read until here tells me your interest in the crypto market is piqued.

Derivatives investing has existed for a couple of centuries on a wide variety of products. Derivatives are financial instruments that allow users to hedge or speculate based on the future price of a cryptocurrency.

They derive their price from the underlying asset, and this underlying can be from the stock market, bonds, forex, commodities, or cryptocurrencies.

A variety of them (Futures, Forwards, Options, Swaps, etc.) give the buyer or seller different kinds of rights and obligations to exercise based on the underlying asset’s price movements.

When this concept is applied to a crypto asset, you get cryptocurrency derivatives. These are tradable from crypto derivative exchanges, with Bitcoin Futures taking up most of the volume.

Using this, a trader can hedge their portfolio’s risk. Let’s say, for example, this trader is excellent in sentiment and technical analysis. According to him, the price of Bitcoin Futures is going to fall 50% in the next three months.

Bitcoin is at $10,000 per BTC, and knowing that there is a good chance of BTC reaching around $5,000 per BTC, the trader would want to hedge the risk of just holding their coins.

In this case, the trader takes a short position and buys BTC Options contract with an expiry date in 3 months. This will allow him to sell his holdings at $10,000 BTC even if the price is $5,000 at the time of contract expiration.

When the expiry date arrives, BTC is actually at $5,000.

Now, you must be thinking, who will buy at this price?

The other party who has sold these short contracts is legally obligated to make financial contracts and buy Bitcoins as per the agreed price in the contract. Do note, that the seller of these short contracts was bullish and long on BTC !!

This way, the smart trader saved $5,000 per BTC by trading the derivatives of Bitcoin, which are deriving its price from the underlying price of Bitcoin.

How To Trade Bitcoin and Crypto Derivatives?

Remember, it is no easy feat to time and analyzes the wild world of cryptocurrencies, but having access to the very best crypto derivatives exchange and trading platform that offers competitive fees can resolve a lot of friction.

Also, since this class is too volatile, even a second’s miss can cost you a considerable sum of money, especially when margin trading.

That’s why it is only recommended to trade on a specialized crypto exchange with dedicated infrastructure for cryptocurrency trading.

The process of opening your account is similar to spot trading and only requires your email ID registration, to begin with. There are no mandatory KYC requirements on some platforms.

So, if you are looking for a single recommendation, I suggest you go for ByBit.

Bybit has huge liquidity and a long-standing reputation of servicing 300,000+ traders with Futures contracts, Perpetual contracts, and coin-margined swaps.

Conclusion

Navigating through the dynamic world of cryptocurrency derivatives exchanges can be a challenging endeavour. And zeroing in on which is the best crypto derivatives platform is a step above.

However, with the insights offered in this article, I believe you are better equipped to explore these top platforms and make informed trading decisions.

Remember, understanding the nuances of each exchange is key to leveraging its potential.

But most importantly, always trade wisely. The volatility of the crypto market requires a well-thought-out strategy and constant vigilance.

I hope this guide aids you in your crypto journey, empowering you to tap into the untapped potential of these innovative financial markets.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023