Choosing a cryptocurrency exchange has always been challenging for crypto traders, especially when so many crypto exchanges are entering the market.

One of the new crypto exchanges is Phemex. Launched in November 2019, Phemex is a cryptocurrency exchange based in Singapore that offers zero-fees crypto trading. As of February 2021, Phemex had a 24-hour trading volume of USD 912 million, placing it 11th globally among all crypto exchanges in daily trading volume.

While Phemex has become quite popular in the past couple of years, that isn’t the reason why you should use it.

Here’s an in-depth review of Phemex, covering its product offerings, fees, security, trading platform features, and more.

Let’s delve in.

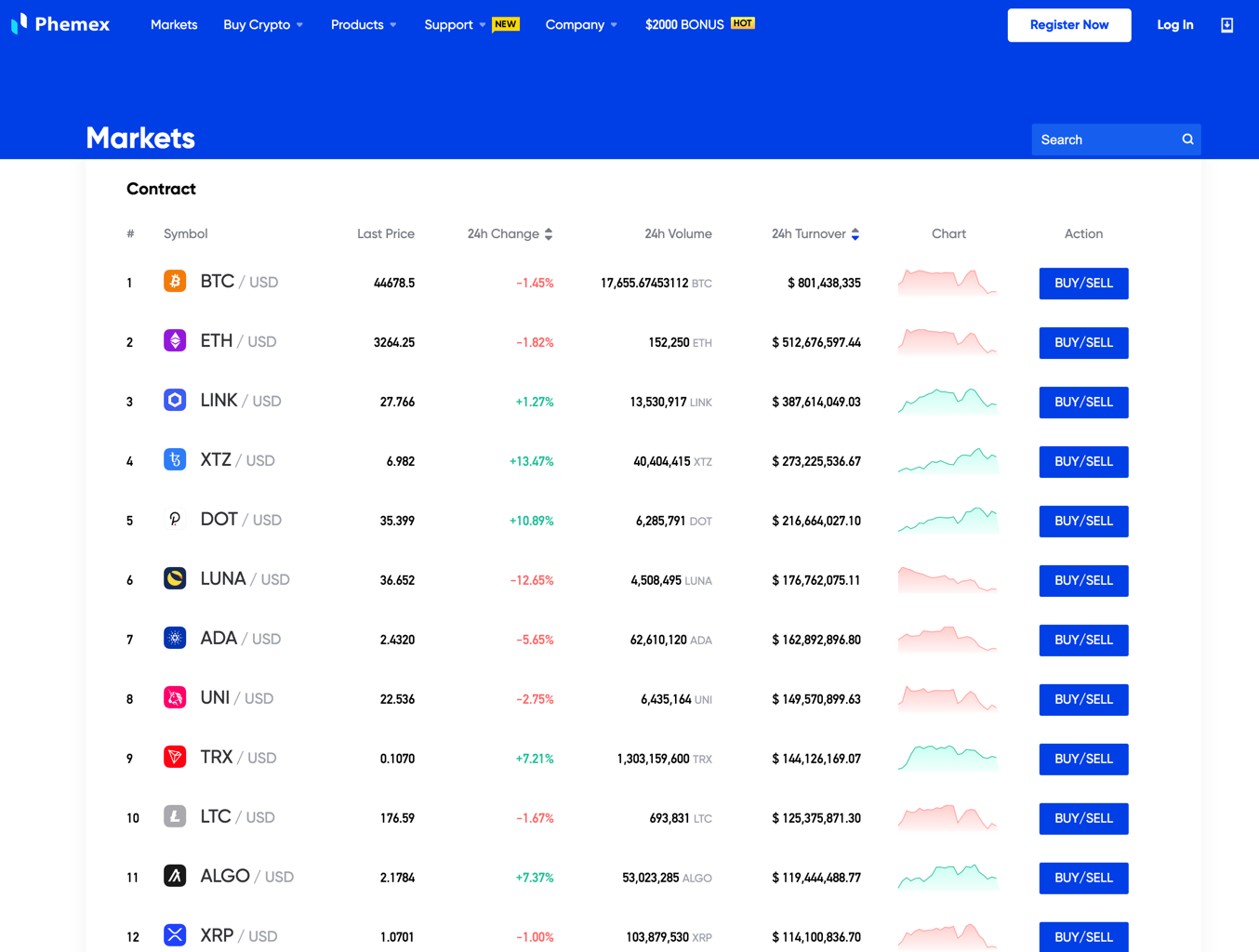

Phemex Exchange Review: Supported Coin List

As of June 2021, Phemex supports 22 coins. Here’s a list of the supported coins in alphabetical order.

- Aave – AAVE

- Algorand – ALGO

- Basic Attention Token – BAT

- Bitcoin Cash ABC – BCH

- Bitcoin – BTC

- Cardano Coin – ADA

- ChainLink Coin – LINK

- Chiliz Token – CHZ

- Compound Coin – COMP

- Decentraland Token – MANA

- Dogecoin – DOGE

- Enjin Coin – ENJ

- Ethereum – ETH

- Litecoin – LTC

- Maker – MKR

- Ripple – XRP

- SushiSwap Token – SUSHI

- Synthetix Network Token – SNX

- Tezos – XTZ

- The Graph Token – GRT

- TRON Coin – TRX

- yearn. finance Token – YFI

Phemex Product Offerings

Phemex offers various products to trade in; however, its offerings aren’t as vast as other derivatives exchanges like ByBit and Binance. For example, Phemex offers cryptocurrency derivatives trading on the following pairs:

- BTC/USD (Bitcoin/US Dollar)

- ETH/USD (Ethereum/US Dollar)

- LTC/USD (Litecoin/US Dollar)

- LINK/USD (ChainLink/US Dollar)

- XRP/USD (XRP/US Dollar)

- XTZ/USD (Tezos/US Dollar)

In addition, Phemex also has a Gold/USD pair.

For the above-mentioned cryptocurrency derivatives, along with the Gold/USD pair, Phemex offers up to 100x leverage. This is comparable with other exchanges like FTX and BitMEX which also offer 100x leverage.

Leverage means you can buy a certain amount of crypto without the need to hold the same amount of assets. For example, 100x leverage means you can hold cryptocurrencies worth 100 times more than your initial investment. So, if you have USD 100 in your Phemex account, you can take positions of up to USD 10,000. This increases your exposure, thereby increasing both risk and reward.

In May 2020, Phemex released Spot Trading services, supporting 11 currencies. Currently, you can trade in BTC, BCH, ETH, XRP, LINK, LTC, XTZ, NEO, and ONT.

However, here are a few things that crypto traders planning to use Phemex should keep in mind.

- Phemex doesn’t support options trading

- Phemex doesn’t support Crypto Crypto pairs

- Phemex doesn’t support fiat currency trading

But apart from these few drawbacks, Phemex has all the trading products that beginners and experienced traders need.

Phemex Order Types

Phemex offers a variety of order types to accommodate all your trading requirements. Here’s a quick look into all order types available on the Phemex trading platform.

- Market Orders

Market orders are performed at the current market price. These orders don’t go into the Order Book and are executed at the price the crypto asset is trading. These orders are ideal if you want to place an urgent order and don’t want the price to reach a specific level.

- Limit Orders

Limit orders, as opposed to market orders, are performed at a particular price. When placing the order, you enter the price at which you want the order to be executed. Once the price reaches that level, your order gets executed. Therefore, limit orders are ideal if you want to place orders only at a specific price.

- Conditional Orders

Experienced traders mainly use conditional orders. In these types of orders, you specify a trigger price (TP) based on the Index Price, Last Traded Price, or Mark Price.

- Stop-Loss Orders

A stop-loss order allows you to exit your trade at a specified price if your trade goes in the opposite direction. So, if your initial order was a Buy order, your stop-loss order will be a Sell order at a price lower than your Buy price. This way, you can manage your risk and limit your loss in case a trade goes south.

- Take-Profit Orders

Take-profit orders are similar to stop-loss orders; however, you place them in the same direction of your trade instead of in the opposite direction. These orders help you exit your positions for a selected amount of profit. For example, you can place a take-profit order, or another Buy order, above your initial Buy price if you place a Buy order. If the price reaches that level, your trade will be closed.

Apart from these basic order types, Phemex also offers advanced order functions that allow traders to get better control over their trades. The following advanced order functions are available in Phemex.

- Post Only Order

A post-only order is a limit order that executes only if they don’t immediately execute. These orders are ideal if you want your orders to enter the Order Book to get the Market Maker advantage. Orders that enter the Order Book ensure that there’s liquidity in the derivatives market.

In Phemex, you can access post-only orders from limit orders, stop-loss orders, take profit orders by checking the “Post-Only” box.

- Close on Trigger orders

Close on trigger orders is an extension of stop-loss and take-profit orders. These high-priority orders attempt to cancer other open orders if enough margin is not available to execute. You can use these orders if you want to reduce your position. If the order would cause an increase in position, it’ll automatically cancel.

Phemex Liquidation Mechanism

Every cryptocurrency derivatives exchange has a liquidation mechanism. Liquidation refers to the process of closing a trader’s position if they lose all or nearly all of their Initial Margin. For example, on Phemex, your position will automatically close if the market price reaches your liquidation price.

Phemex uses a Fair Price Marking mechanism to help traders avoid forced liquidations due to manipulation or lack of liquidity.

Since Phemex exchange offers up to 100x leverage, orders on Phemex are highly leveraged. To keep these positions open, traders need to hold a percentage of their position value on the exchange, called the Maintenance Margin.

If you fail to fulfill the maintenance requirements at any time, your positions will be liquidated, and you’ll lose your entire initial margin. The liquidation mechanism protects traders from such sudden liquidations.

Additionally, Phemex also implements Risk Limits on larger position sizes that need a higher maintenance margin. This extra margin enables the exchange to open and close large positions seamlessly.

If the liquidation is triggered, the system cancels all the open orders for the current perpetual contracts to free up funds and allow the trader to maintain the position.

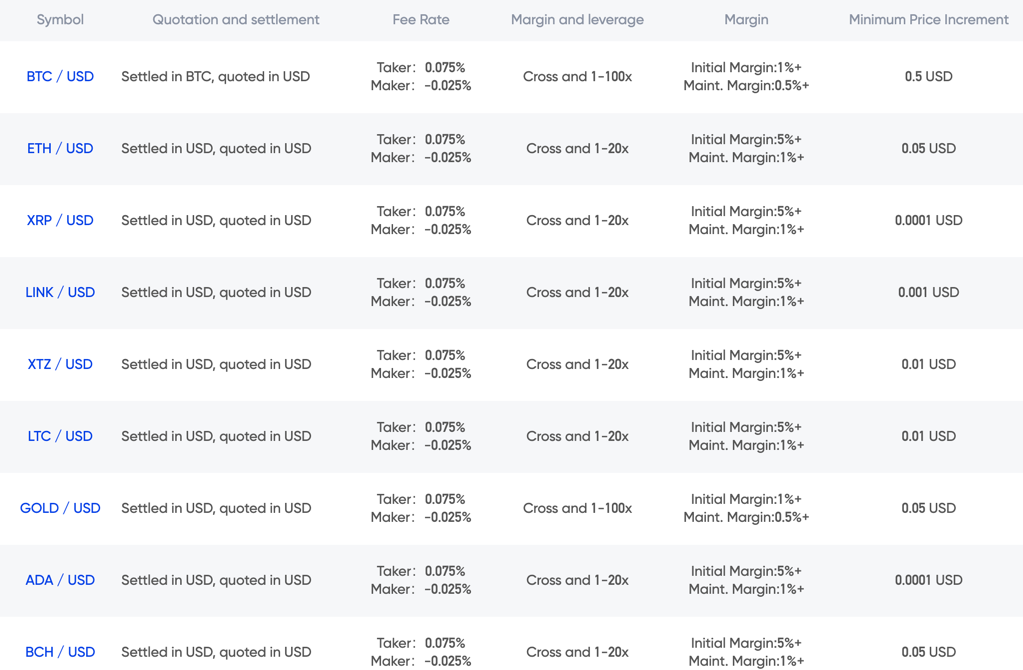

Phemex Trading Fees

Phemex adopts a zero-trading fee model when it comes to Spot Trading. Instead,

For perpetual contracts trading and leverage trading, Phemex follows a Market Maker and Market Taker fee structure. Let’s quickly describe the two terms to help you better understand how Phemex fees work.

- Market Makers: Market makers are traders whose orders enter the Order Book instead of being immediately executed, thereby adding liquidity to the market. These orders include Limit Orders and Conditional Orders. Since liquidity makes the market stronger, these traders are referred to as Market Makers.

- Market Takers: Market takers are traders whose orders get executed immediately instead of entering the Order Book, thereby taking liquidity away from the market. This weakens the market, and these traders are known as Market Takers. Market Orders are considered Market Taker orders.

Phemex charges a fee of 0.075% per order from Market takers. On the other hand, market makers receive a rebate of 0.025%, which means they’re paid to trade.

For Spot Trading, Phemex charges a 0.1% fee per order. Additionally, there’s no fee for Premium and Premium Trial users.

Phemex Funding Rates/Fees

To understand the concept of funding rates, we’ll need first to understand the difference between traditional and perpetual futures.

Traditional futures always have an exact expiration or settlement date. Thus, while their price deviates from the price of the underlying crypto asset, it always converges at expiration.

However, perpetual futures never expire, and they don’t settle like traditional futures. Hence, their price could deviate significantly from the underlying asset’s price.

Crypto exchanges use a funding rate mechanism to ensure that the price of the perpetual future stays close to the underlying asset’s price. If the prices are higher than the spot price, buyers will pay funding fees to sellers. If the price is lower than the spot price, sellers will pay funding fees to buyers.

The funding rate is calculated for each trading pair considering two factors:

- The interest rates for currencies and trading pairs

- The premium index

Since the premium index changes every eight hours, the funding rates also change every eight hours. Please note that funding rates are different for each trading pair. Follow this page for real-time Phemex funding rates.

Phemex Deposit and Withdrawal Fees

There aren’t any Phemex fees for depositing funds. However, there’s a nominal fee for withdrawing funds, which is specific to each cryptocurrency. For instance, Phemex withdrawal fees of 0.0005 BTC with a minimum withdrawal limit of 0.02 BTC.

Furthermore, Phemex doesn’t charge any fee when moving funds from one subaccount to another.

Phemex Deposit Methods

Phemex accepted the only crypto back in the day, making it difficult for new investors to start crypto trading on the platform. But in June 2020, Phemex partnered with Banxa, a payment gateway, to accept debit and credit card purchases as deposit methods for crypto.

However, when it comes to withdrawing your funds, Phemex only supports cryptocurrencies, and you can’t withdraw funds in the form of fiat currency.

Phemex Trading Account Types & Limits

Phemex doesn’t implement a tiered structure based on the leverage trading volume and available account balance, unlike most crypto exchanges.

Currently, Phemex has two types of perpetual futures contracts trading accounts:

- BTC trading account

- USD trading account

The exchange has minimum and maximum withdrawal limits and minimum deposit requirements based on the cryptocurrency you use to deposit and withdraw funds. For example, the maximum withdrawal limit is 2 BTC for standard users.

Phemex is an anonymous cryptocurrency derivatives exchange and doesn’t require any KYC. You can register using your email address and start trading on Phemex within a few minutes.

That said, Phemex also supports KYC services, and you can verify your identity to revoke the 2 BTC daily withdrawal limit.

Phemex also offers a Premium membership. You get the following extra benefits when you become a premium user.

- Zero trading fees on spot trading

- Support for conditional orders

- Hourly withdrawals

- No withdrawal limits

Phemex Sub-Accounts

Phemex is one of the few cryptocurrency exchanges that enable users to create sub-accounts from a single trading dashboard. Sub-accounts are ideal for professional and institutional traders who need multiple trading accounts to test different strategies.

These accounts come with helpful features, including the segregation of trading funds and transferring funds from the mail account to sub-accounts.

Traders can create sub-accounts and tweak the trading environment for each of them. For example, you can change each account’s balances, leverage, permissions, and margin levels without affecting your main account and other sub-accounts.

Besides, Phemex allows you to switch between different sub-accounts seamlessly.

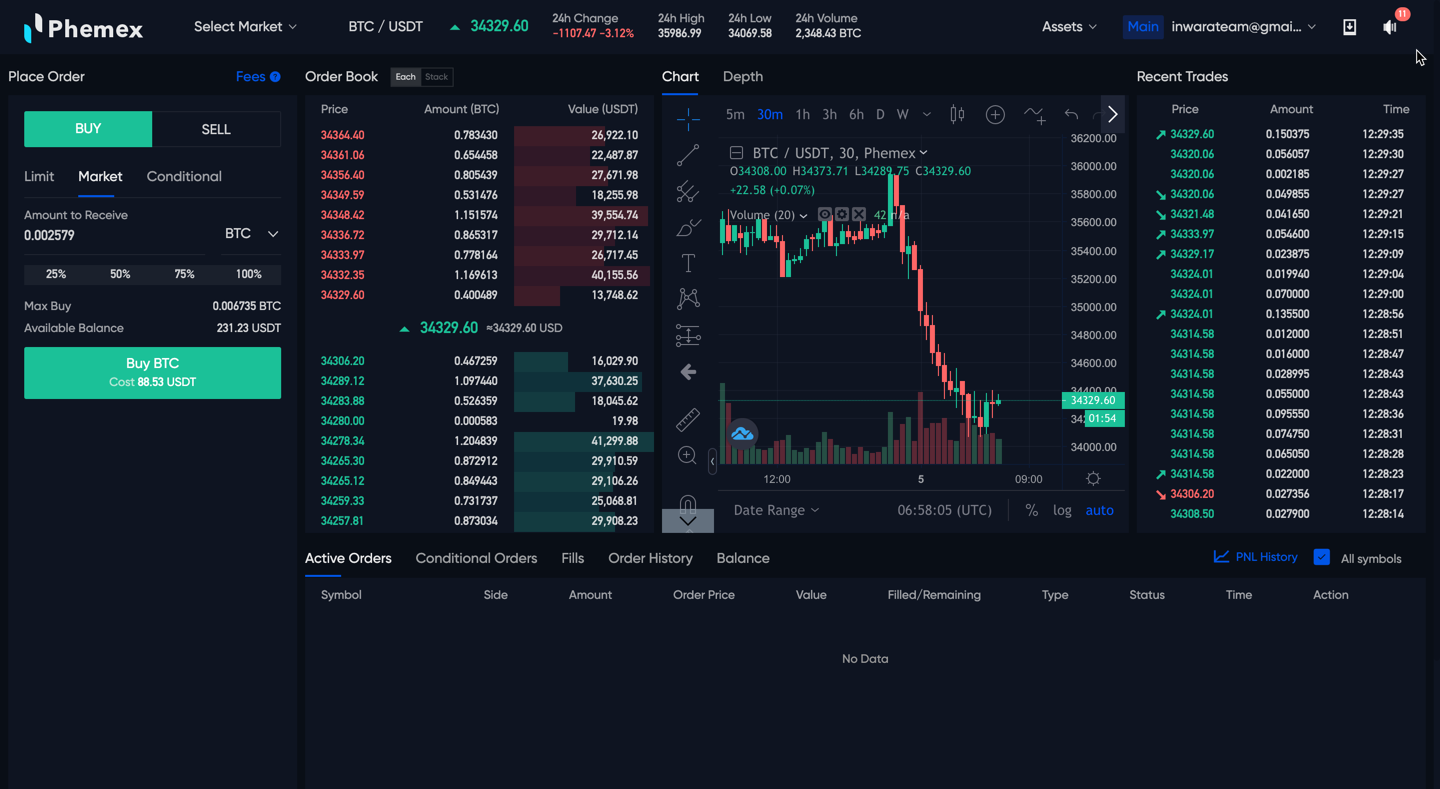

Phemex Trading Platform & Tools for Trading Strategies

The Phemex trading platform is simple to use and user-friendly, making it ideal for beginners. But, at the same time, it comes with all the essential analytical tools and functionalities that experienced traders would need.

Let’s delve into the trading platform and tools offered by Phemex.

- Desktop Platform

Phemex has a cloud-enabled desktop version that allows you to trade from anywhere in the world. In addition, the platform has an easy-to-use trading interface. But despite its simple Phemex user interface, it comprises myriad inbuild technical analysis tools and indicators catering to the requirements of professional traders.

Furthermore, the platform supports the importing of custom-built indicators. This is an important feature of institutional traders who prefer to use their own technical analysis tools.

The platform also has an Order Book to place orders and monitor and manage your running positions. In addition, you get access to real-time price alerts, along with various order types, such as limit orders, market orders, and conditional orders.

And you can also export your previous trades to other trading platforms to analyze your past performance and improve your different trading strategies.

The Phemex desktop platform has features and functionalities ideal for everyone from beginner retail traders to veteran institutional traders.

- Charts and Trading View

The Phemex trading system comes with a modular design to allow traders to customize their dashboard as they like. The vanilla version comes with the following features:

- Order book

- TradingView-powered chart

- Order menu

- Live positions

- Recent trades

- Order book depth chart

- Crypto perpetual contracts details

- Trading account display

The most intuitive feature of the trading system is the TradingView chart. You can choose from various chart types, including line charts, candlesticks, Heikin-Ashi, and more.

You can set the chart for various timeframes, including 1 minute, 5 minutes, 15 minutes, 30 minutes, 1 hour, 4 hours, daily, weekly, monthly, quarterly (3 months), and yearly (12 months). This enables seamless multi-timeframe analysis and helps you make better trading decisions.

Traders get access to all the indicators available on TradingView. In addition, there’s no limit on the number of indicators you can use per chart, which can be an important factor for professional traders.

- Mobile Platform

Phemex exchange has a mobile trading app that allows traders to analyze markets, open and close positions, and monitor their positions from the mobile. The app is available for iOS and Android trading platforms, and you can download them for the respective app stores.

The mobile app comes with the most in-built tools and features that you find in the desktop app. Plus, the app has a clean interface and is effortless to use. The charts are also mobile-friendly, and you can easily view them on your mobile screen without zooming in and out too much.

The app supports essential technical analysis tools, including built-in indicators, multiple timeframes, chart types, and order types. While the desktop version is more intuitive, the mobile app is also excellent and can take care of your trading needs if you can’t access a desktop.

The platform also displays the ping at the top right corner of the chart, which indicates the time lag between the actual price and Phemex servers. The time lag is an essential aspect to keep in mind when trading on shorter time frames.

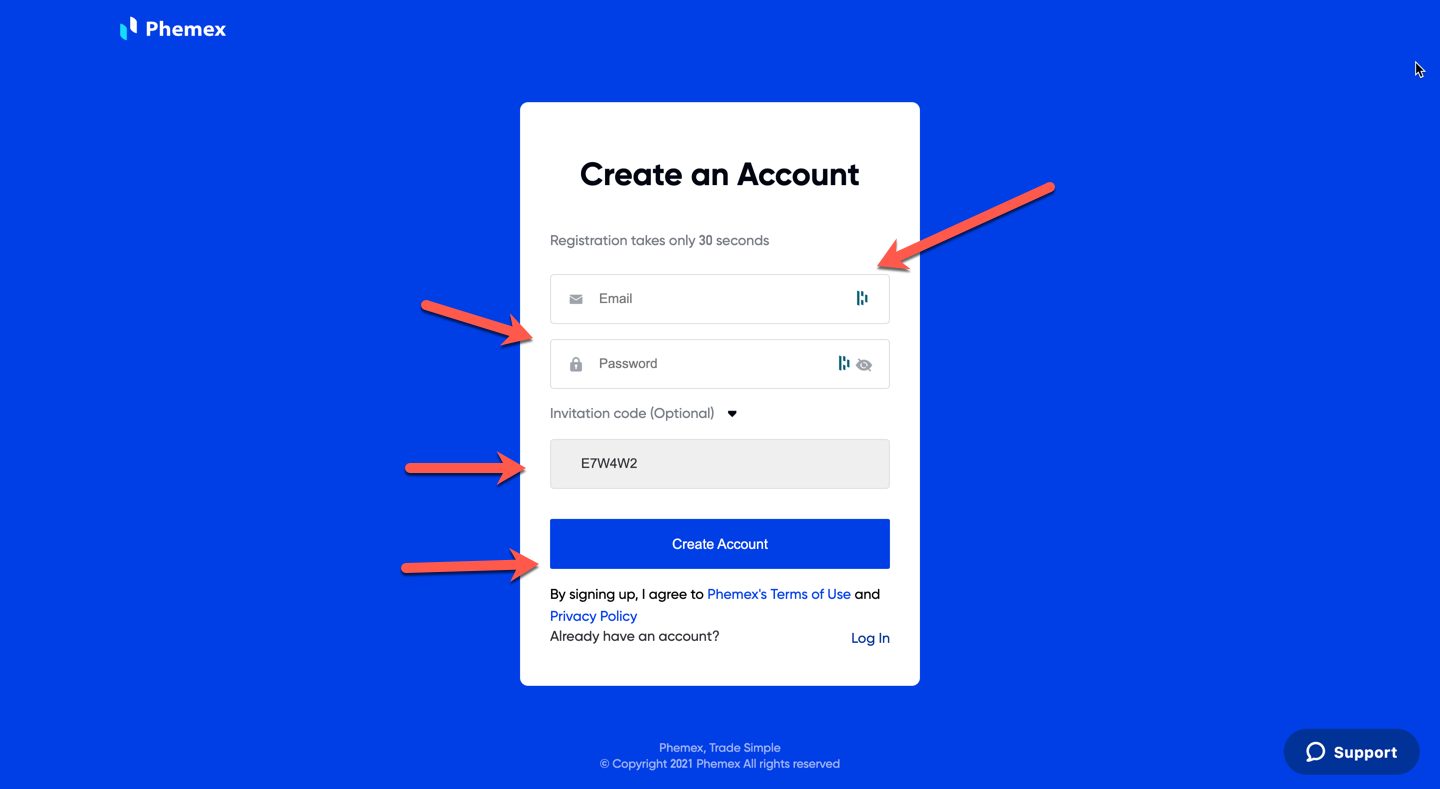

How To Start Trading On Phemex?

To start crypto leverage trading on Phemex, you’ll need first to register your account. As discussed, Phemex doesn’t require KYC, and hence, the registration process is seamless.

Here’s how you can start trading on Phemex.

- Register Your Account

Follow these steps to register an account on Phemex.

- Go to phemex.com and click on the Register button in the top right corner. (Use our Phemex Invite Code to get a Deposit Bonus)

- Enter your email address and password. You’ll be asked to enter an invitation code that you’ll receive in your email.

- Enter the verification code to verify your account.

When registering, you’ll have to choose the type of your trading account – BTC trading account or USD trading account. That’s it. You’re ready to start trading.

- Add Funds

Now, it’s time to add funds to your contract trading account. If you have a BTC trading account, you can only deposit and withdraw your funds in BTC. Click on the Transfer In button and add the desired amount of BTC.

For USD trading accounts, you can deposit funds with both BTC and USDT.

- Place a Trade

Now that you have funds in your account, it’s time to place a trade. Head to the dashboard and open the pair in which you want to trade. Next, select the type of order you want to place from the Order Book. You can choose from limit, market, and conditional orders.

Then, specify the quantity you want to trade and the leverage you want to use. You’ll also need to specify the price you want your order to execute in case of limit orders. Lastly, select advanced order functions, such as Post-Only, if you want to.

Once you’ve entered all the details, click on Buy to place a buy order and Sell to place a sell order.

- Exit a Trade

To exit a trade, you can open your position and click on Exit. By doing so, you will exit your position at the market price. As discussed earlier, if you want to exit your positions at a particular price, you can use stop-loss and take-profit orders.

If still not sure how you can trade crypto with leverage, make sure to read our detailed guide here.

Phemex Security Features

Phemex implements all the security measures you’d find in other cryptocurrency exchanges. So let’s quickly highlight the security features of Phemex.

- The exchange uses a hierarchical Deterministic Cold Wallet System, assigning a unique cold Phemex wallet deposit address to each user. In addition, the exchange periodically gathers all deposits to the company’s multi-signature cold Phemex wallet through an offline signature.

- Amazon Web Services (AWS) is the industry leader in cloud security services. The platform uses AWS Cloud to secure its servers. Furthermore, Phemex implements firewalls based on different trading zones.

- Phemex’s trading platform comprises two key components – TradingEngine and CrossEngine – to ensure minimal time lag and price delays.

Besides, the Phemex team has said that traders can expect zero downtime. This is because the exchange uses a recovery system that provides 99.99% high availability, even in times of abrupt maintenance.

Phemex Customer Support

Phemex offers a direct line of customer support to its users. In case of any issues, you can visit their website and raise a ticket. The team will get back to you in 24-48 hours. In addition, Phemex has a presence on almost all social media platforms, including Twitter, Facebook, Telegram, and Reddit.

Phemex also has a help center with FAQs answering common questions about opening an account, adding funds, withdrawing funds, etc.

However, Phemex doesn’t offer direct telephone support, and you’ll have to rely on email support for any technical issues.

Phemex Review Summary

Overall, Phemex is a relatively new cryptocurrency exchange that has gained significant popularity in the past couple of years. One of the key benefits of Phemex is that it’s an anonymous crypto exchange, so you can set up an account and start trading without a KYC.

Other reasons to use Phemex include 100x leverage, sub-account functionality, support for multiple cryptocurrencies, modular user interface, and advanced order types.

A few drawbacks, though not significant, are worth considering. First, Phemex isn’t available for US citizens, and you’ll have to use a VPN to access it. Or alternatively, you can use crypto leverage trading platforms that work in the USA. Also, Phemex has a lower trading volume, and thus, lower liquidity than exchanges like BitMEX and Binance.

In all, Phemex is an amazing cryptocurrency exchange with all the essential features and functionalities. If you’re new to cryptocurrency trading and looking for crypto exchange, Phemex can be an ideal pick.

See how Phemex compares to other exchanges: