Have you ever wondered how much Bitcoin the US government owns?

It’s a question that piques the curiosity of many, from crypto enthusiasts to casual observers.

But unraveling this mystery isn’t just about numbers; it’s a journey into legal seizures, auctions, and a complex dance of crypto regulations.

Intrigued? There’s more.

The US government’s Bitcoin holdings tell a tale of a traditional power intersecting with the decentralized ethos of cryptocurrencies.

Imagine the dynamics – the authority of a sovereign nation meets the autonomy of digital currencies.

Sounds like a plot twist, right?

Ready to dive into this enigmatic narrative?

Stick around.

We’re about to pull back the curtain, unveiling the how, why, and implications of the US government’s Bitcoin holdings.

The revelations promise to be as enlightening as they are intriguing.

Let’s jump right in!

The Genesis of Government-Owned Bitcoin

So, we’ve set the stage, and now you’re probably itching to uncover the origins of the US government’s tryst with Bitcoin.

Well, brace yourself because this tale is as riveting as it is complex.

It all began with legal seizures.

Law enforcement agencies cracking down on illicit activities and, in the process, confiscating a treasure trove of Bitcoin.

These seizures weren’t random acts but targeted operations against dark web marketplaces and criminal networks.

Each Bitcoin in the government’s coffers tells a tale of intrigue, crime, and justice.

But here’s where it gets juicy.

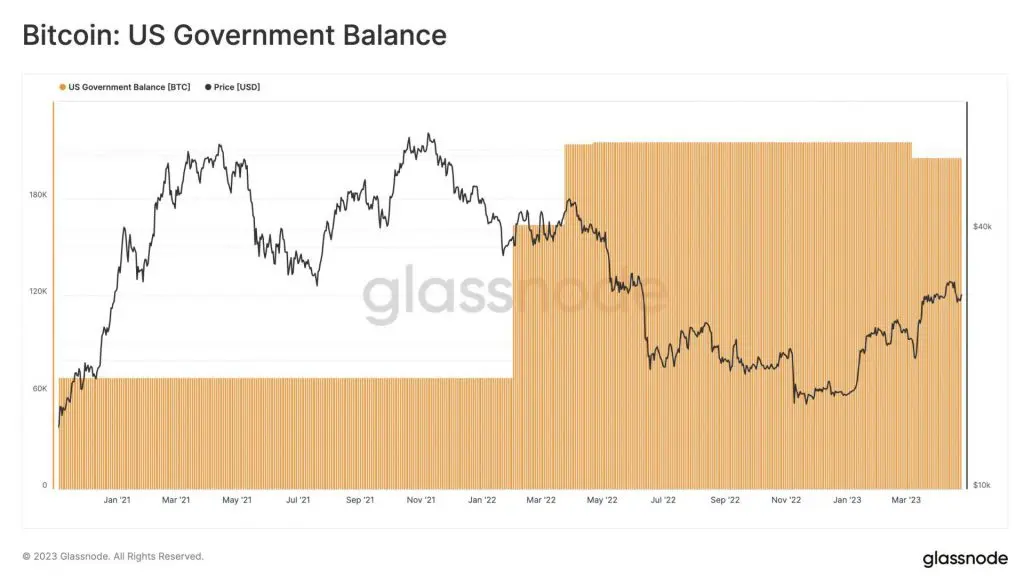

The government isn’t a HODLer; it auctions off its Bitcoin holdings.

Picture this: seized digital assets, once evidence in criminal cases, now up for grabs to the highest bidder.

Are you curious about the legal intricacies and the journey of these seized Bitcoins?

You’re in for a treat.

As we delve deeper, we’ll unravel the legal framework governing the custody, auction, and implications of these government-owned Bitcoins.

New to crypto trading? Check these Best crypto leverage trading platform for USA

Methods of Acquisition

Now that we’ve peeled back the layers of the origins, you’re likely curious about the specific avenues through which the U.S. government acquires Bitcoin.

Hold onto your seat because this exploration will take an intriguing turn.

- Seizures:

Imagine a scenario where law enforcement agencies swoop in, dismantling illegal operations. In the process, Bitcoin, often used in illicit transactions, falls into the hands of the government. It sounds dramatic, but a reality unfolds more often than you might think. - Auctions:

The government isn’t in the business of holding onto Bitcoin. So, what happens next? Auctions. Picture a scenario where seized Bitcoins are sold to the highest bidder, turning government vaults into transient stops for these digital assets. Intriguing. - Confiscations:

And here’s another layer. Beyond seizures, there are confiscations, where Bitcoin is legally taken from criminals as part of the judicial process. It’s a dance of law and order, where digital assets become entwined in legal proceedings.

But here’s where it gets complex.

These acquisition methods aren’t just about adding Bitcoin to the government’s holdings; they’re steeped in legal, ethical, and regulatory nuances.

Each Bitcoin seized or auctioned is a narrative of crime, justice, and the ongoing dialogue between the decentralized crypto world and the structured legal oversight realm.

As we venture further, we’ll dissect the legal framework that underpins the U.S. government’s interaction with Bitcoin.

Ready for the revelations?

Each insight promises clarity and a deeper understanding of the intricate dance between two disparate worlds – the autonomy of cryptocurrencies and the authority of sovereign governance.

The Legal Framework

Having ventured into the acquisition methods, you’re probably on the edge of your seat, curious about the legal tapestry that governs these processes.

Well, your wait is over.

We’re about to embark on a journey where law, policy, and cryptocurrency intersect in a dance as intricate as it reveals.

- Custody:

First off, let’s tackle custody. Imagine a world where digital assets, decentralized and autonomous, fall under the jurisdiction of legal authorities. It’s a paradox. But here’s the deal – every seized Bitcoin is held in custody, subject to legal protocols until it’s auctioned. - Auctions:

Speaking of auctions, picture a scenario where Bitcoins, once entwined in illicit activities, are sold off to the highest bidder under the gavel’s strike. It transforms from criminal assets to legal tender, governed by stringent legal protocols. - Regulations:

But wait, there’s more. The regulatory landscape is as dynamic as the cryptocurrency market itself. Each Bitcoin in government custody is subject to a fluid set of regulations, a blend of existing legal frameworks, and emerging policies crafted to address the unique challenges posed by digital assets.

Now, here’s where it gets interesting.

This legal framework isn’t set in stone.

As the crypto landscape evolves, so does the law.

It’s a dance of adaptation, where legal precedents and regulatory innovations are as much a part of the narrative as the Bitcoins themselves.

As of now, you have crypto exchanges registered with SEC that allows you to interact with crypto. But the rules still may seem confusing.

Curious about the implications?

As we peel back the layers, a world where law and digital innovation intersect unveils a narrative of challenges and opportunities.

It’s a dialogue that not only shapes the fate of government-owned Bitcoin but also influences the broader cryptocurrency landscape.

Ready to delve deeper?

Each revelation promises to illuminate a facet of this intricate dance, offering insights as enlightening as essential for anyone venturing into the crypto space.

The journey continues, and each step is a revelation.

Dive deeper!

Recommended Read: Can the IRS track crypto?

Transparency and Public Perception

Ever wondered how the U.S. government’s Bitcoin holdings are viewed by the public?

It’s a hot topic.

Transparency plays a pivotal role here.

Imagine a scenario where every acquisition and holding is laid bare for public scrutiny.

Sounds ideal.

But here’s the catch – while transparency can bolster public trust, it also raises questions about privacy and security.

It’s a delicate balance where disclosure and discretion dance to the complex tunes of legal, ethical, and security concerns.

Curious about the impact?

Public perception shapes market dynamics.

Every revelation, every disclosure, can sway market sentiments, driving fluctuations that are as intriguing as they are unpredictable.

Ready to explore this intricate dance?

The intersection of government holdings, transparency, and public perception is a narrative unfolding in real time, and you’re right in the midst of it!

Implications for the Bitcoin Market

Now that we’ve unraveled the legal intricacies, you’re likely pondering the ripple effects on the Bitcoin market.

Hold tight because we’re about to explore the uncharted waters where government actions and market dynamics converge.

- Market Influence:

Imagine the U.S. government, a colossal entity, maneuvering within the nimble, volatile terrains of the Bitcoin market. Intriguing. Each seizure and auction sends ripples across the market, influencing prices and investor sentiment. - Legal Precedents:

But wait, there’s another layer. The legal actions surrounding these Bitcoins aren’t just isolated events; they set precedents. Picture a world where each legal maneuver shapes the regulatory landscape, influencing current holdings and future legal and market dynamics. - Future Trends:

And here’s where it gets captivating. These interactions are carving out future trends. Imagine a scenario where the dance between government actions and Bitcoin evolves into a symbiotic relationship, each influencing the other, shaping a future that’s as unpredictable as it is fascinating.

Ready to explore the nuances?

Each Bitcoin in government hands is more than a digital asset; it’s a player in an unfolding narrative, a story where law, market dynamics, and digital innovation are the co-authors.

As we step into the next chapter, the implications of government-owned Bitcoin promise to blend challenges and opportunities, an enlightening narrative that’s as complex as it is.

The exploration is far from over; the most riveting revelations await.

Are you ready to dive deeper?

The journey is about to get even more exciting!

Recommended Read: Who regulates bitcoin in the US?

Conclusion

We’ve embarked on a journey from the enigmatic corridors of government vaults to the volatile yet exhilarating terrains of the Bitcoin market.

It is enlightening, but as we draw this exploration to a close, one revelation stands paramount – the dance between government-owned Bitcoin and the market is as intricate as it is impactful.

Imagine a world where every seizure and auction is not just a transaction but a catalyst, influencing market dynamics, legal landscapes, and investor sentiments.

But here’s the golden nugget – this dance is not just about the present; it’s weaving the fabric of the future.

Each legal precedent, each market reaction, is a thread in a tapestry that’s unveiling a future where digital assets and sovereign entities coexist, interact, and influence each other.

It’s a narrative of adaptation, innovation, and evolution.

But wait, the journey doesn’t end here.

As the landscape of Bitcoin and cryptocurrencies continues to evolve, so will the narrative of government-owned Bitcoin.

Each revelation and development promises to be a stepping stone to deeper insights, broader perspectives, and informed decisions.

Ready for the ongoing revelations?

In the dynamic world of Bitcoin, the conclusion isn’t an end but a gateway to continuous exploration, where every answer breeds new questions, and every revelation is a precursor to deeper mysteries.

The odyssey is perpetual, and you’re not just an observer but a participant.

Welcome to the unfolding narrative of Bitcoin!