Have you ever imagined an organization operating without a centralized authority and voting power is often collectively held by its members?

Welcome to the revolutionary thing that is Decentralized Autonomous Organizations (DAOs)!

As you dive deeper into cryptocurrencies and blockchain, you’ll discover that DAOs are a seismic shift in how we think about organizational structures and governance.

By leveraging the power of blockchain technology, DAOs offer a transparent, democratic, and efficient way to manage and operate entities.

In this article, I’ll guide you through the intricacies of DAOs, shedding light on their workings, benefits, and challenges.

What is a DAO (Decentralized Autonomous Organization)?

It is like any other organization, but with a twist.

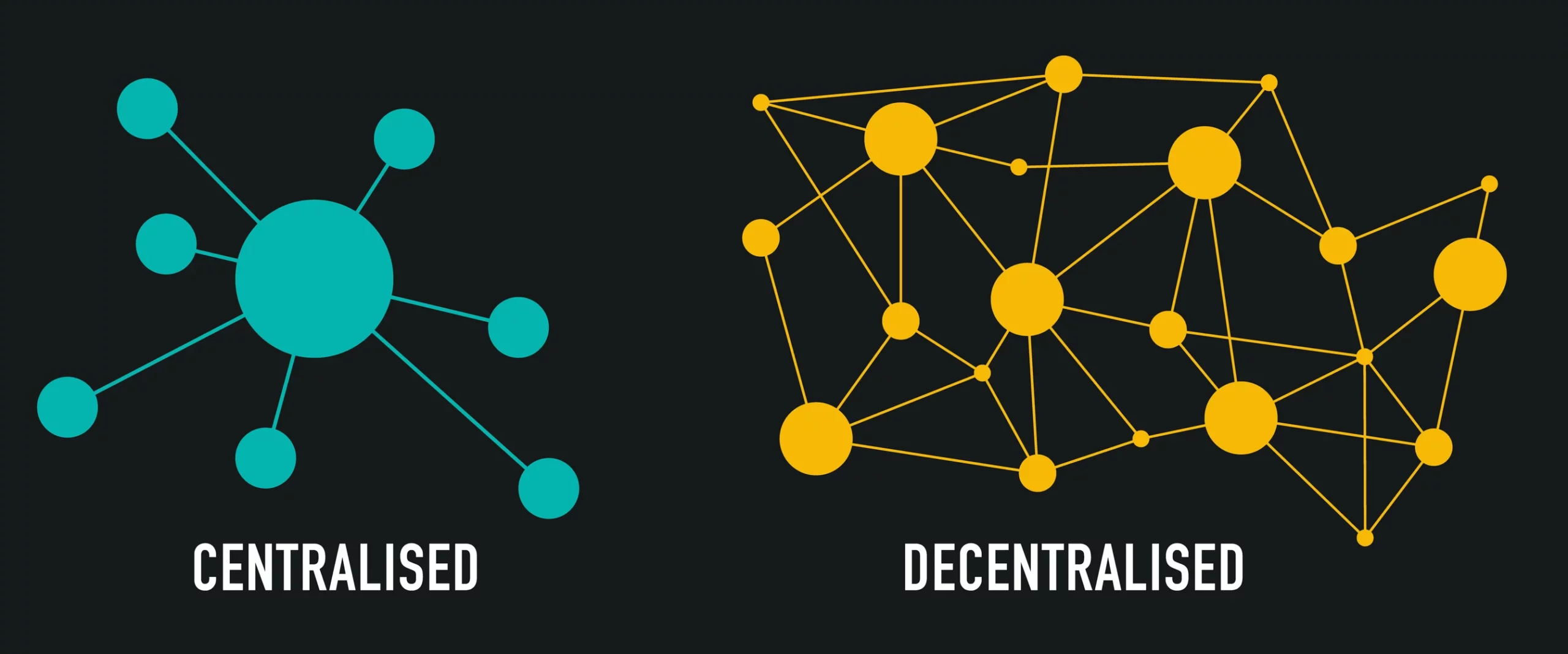

Instead of being controlled by a centralized authority or a group of individuals, the DAO model operates through rules of the organization encoded as computer programs on a blockchain.

Think of it as an organization where decisions are made via code and governance tokens rather than people.

Now, here’s where it gets even more interesting.

A CEO, a management structure, or a board of directors doesn’t make decisions within a DAO.

Each member has a say, and decisions are typically made through voting power and ownership of crypto tokens.

The more stake or native tokens a member holds the more weight their vote carries.

In essence, DAO is a type of organization that blends modern technology and democratic principles to create transparent, efficient, and fair autonomous corporations using digital assets.

They challenge the traditional hierarchical structures and execute a new paradigm of governance for token holders.

New to learning Crypto? Know What is over-leveraging in crypto?

Historical Context: The Evolution of DAOs

The idea of fully decentralized organizations isn’t entirely new.

Humans have always sought ways to work with like-minded folks to distribute power and decision-making.

But the fusion of this idea with blockchain technology using smart contracts?

Now, that’s revolutionary.

The term “DAO” first gained traction around 2016, with “The DAO ” launching on the Ethereum network, created by Vitalik Buterin.

It was a groundbreaking project that acted as a form of venture capital fund without intermediaries.

However, the DAO was hacked, amongst other challenges.

This unfortunate event paved the way to change the rules, improving DAO structures and security.

Fast forward to today, and they have evolved immensely.

They’ve expanded beyond finance, influencing governance, art, and real estate.

The journey of DAOs, filled with highs and lows, showcases the relentless pursuit of innovation and a new kind of organizational structure in the crypto world.

Key Features of a DAO

Diving deeper into the DAO world, you might wonder: What sets them apart from traditional organizations?

Well, let’s break it down.

- Decentralization at its Core: The most striking feature? There’s no central authority. Instead, power is distributed among members. This means decisions aren’t made by a single CEO but by a collective consensus.

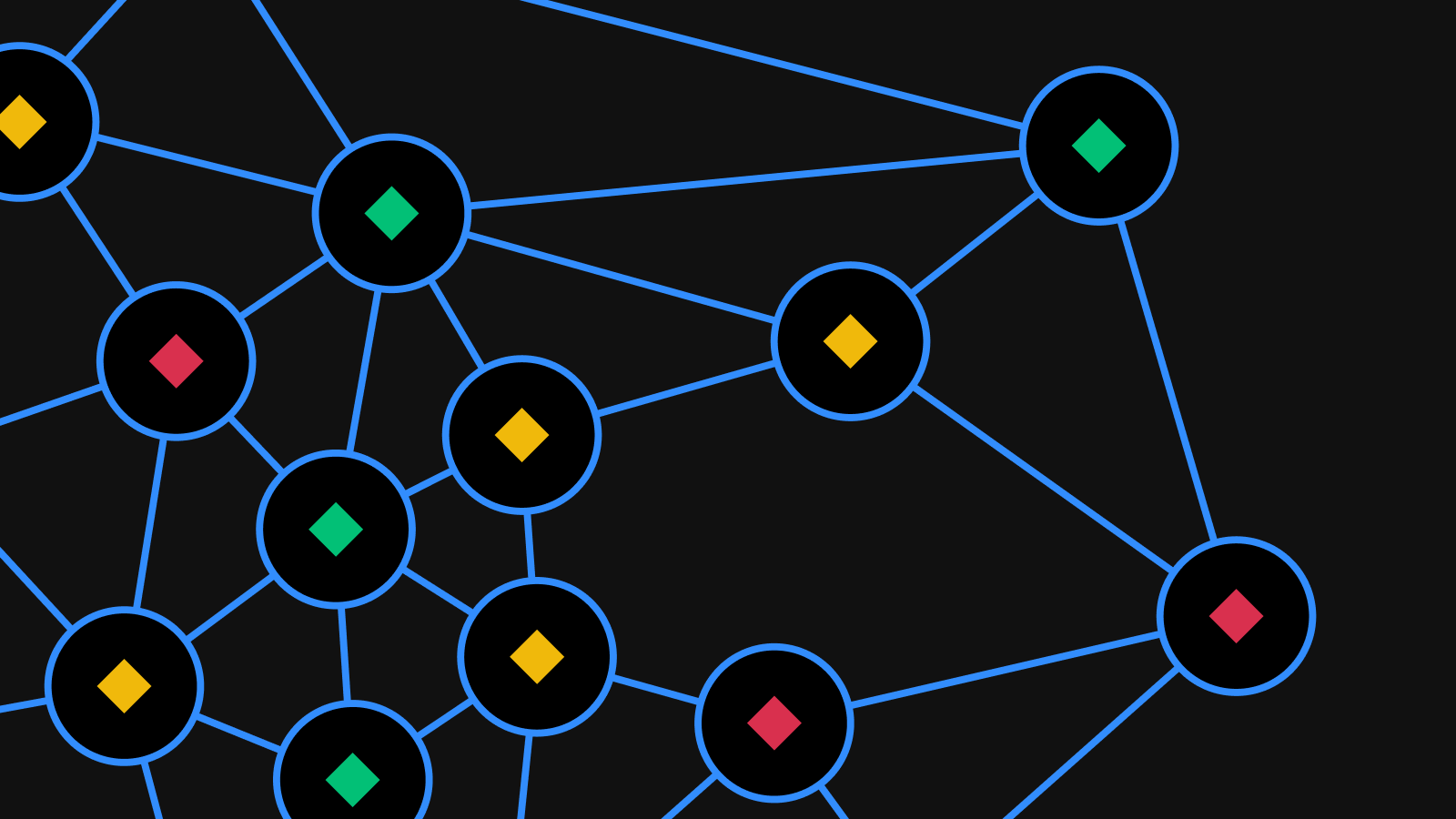

- Smart Contracts: Have you ever heard of these? DAOs operate on smart contracts, which are self-executing contracts that define the rules of the organization and hold the DAO tokens, which is the treasury of the people invested in the DAO. This ensures transparency and trustworthiness.

- Token-based Governance: DAO governance is often tied to token ownership. The more tokens you hold, the bigger your voice. It’s democracy in action.

- Immutable and Transparent: Thanks to blockchain technology, once a decision is made, it’s recorded and can’t be altered. Plus, anyone can verify it. Talk about accountability!

- Global Collaboration: DAOs aren’t restricted by geographical boundaries. Members worldwide can vote on how to use cryptocurrency, bringing diverse perspectives.

In essence, DAOs are reshaping how we think about organizations by providing a decentralized structure to allow members to participate in the management.

By prioritizing decentralization, transparency, and collective decision-making, DAO tokens could challenge the status quo and point us toward a more inclusive future.

Recommended Read: Why Invest In Bitcoin?

How Does a DAO Work?

So, how exactly does a DAO act in the best interest of the entity?

Let’s dive in.

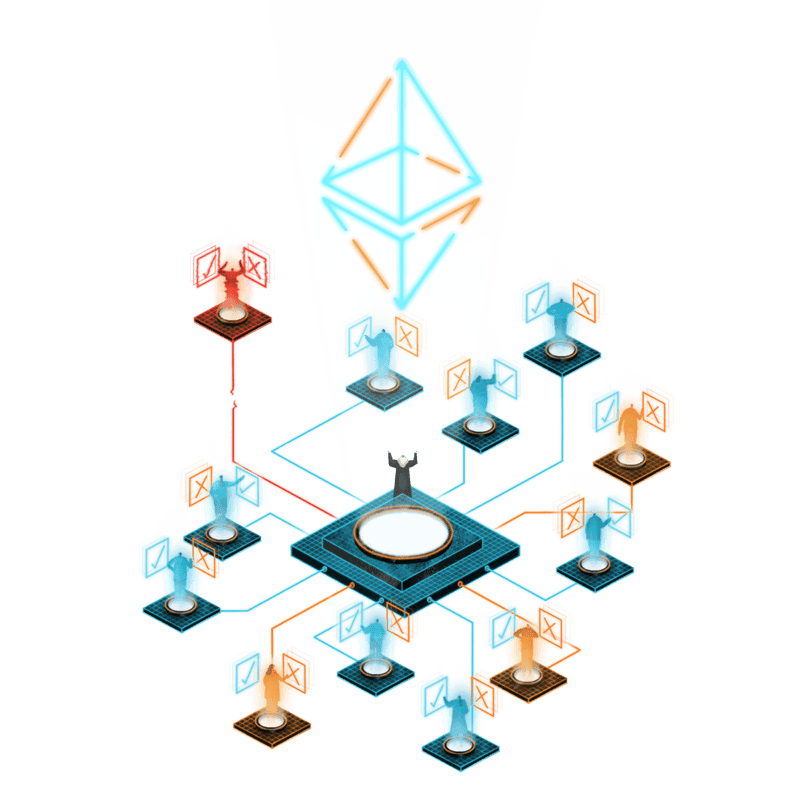

- Creation of the DAO: First, a DAO is initiated by a group of individuals who lay down its rules. These rules are then encoded as smart contracts on a blockchain. Think of it as the DNA of the DAO.

- Token Distribution: Members of the DAO receive tokens representing their stake in the organization. These tokens aren’t just for show; they give members voting power. The more tokens you have, the louder your voice.

- Decision-making Process: Remember when I mentioned decentralization? Well, in a DAO, decisions are made collectively. Proposals are put forward, and members vote using their tokens. If a proposal garners enough support, the smart contract automatically enforces it. There are no middlemen and no bureaucracy.

- Funding and Investments: DAOs often have a pool of funds contributed by members. These funds can be allocated to various projects or investments. How they’re used is also determined by member voting.

- Continuous Evolution: The beauty of a DAO? It’s ever-evolving. Members who feel a rule isn’t serving its purpose can propose changes. If the community agrees, the DAO adapts.

A DAO is like a living, breathing entity powered by its community.

It’s a radical shift from traditional top-down organizations, placing power back into the hands of the people.

Honestly, it’s a breath of fresh air!

Benefits of DAOs

- True Decentralization: With DAOs, power isn’t concentrated in the hands of a few. Instead, it’s spread out among members. This means decisions are made collectively, ensuring a fair and democratic process.

- Transparency at Its Best: Everything in a DAO, from financial transactions to voting results, is recorded on the blockchain. This ensures complete transparency and accountability. No more hidden agendas or backdoor deals!

- Reduced Bureaucracy: Tired of the red tape in traditional organizations? DAOs cut through the clutter. With smart contracts automating processes, operations become smoother and more efficient.

- Enhanced Security: The decentralized nature of DAOs, combined with blockchain technology, ensures top-notch security. It’s incredibly challenging for malicious actors to alter data or manipulate the system.

DAOs are reshaping how we think about organizations, offering a more transparent, efficient, and inclusive alternative.

I think it’s about time!

Recommended Read: Who Regulates Bitcoin in the US?

Challenges and Limitations of DAOs

It’s essential to keep a balanced perspective when talking about DAOs.

While DAOs in general offer numerous benefits, they aren’t without their challenges for the member of a DAO.

Let’s dive deeper into some of the criticisms and hurdles they face.

- Security Concerns: Remember the DAO hack in 2016? It’s a stark reminder that while blockchain is secure, it’s not infallible. Smart contracts, the backbone of DAOs, can have vulnerabilities that a group of developers can exploit.

- Decision-making Delays: With every member having a say, DAO decision-making can become lengthy. It’s democracy in action, but sometimes, it could allow for inefficiencies.

- Legal Ambiguities: The legal status of DAOs remains a gray area in many jurisdictions. Without clear regulations, a DAO is an organization that operates in a somewhat uncertain environment, which can deter potential participants. In July 2017, the Securities and Exchange Commission (SEC) issued a report that determined that The DAO sold securities in the form of tokens on the Ethereum blockchain, violating portions of US securities law.

- Potential for Centralization: Ironically, DAOs allow for centralization. If a few members accumulate a significant portion of voting tokens, they can wield disproportionate power and bring the future of the organization into question.

- Complexity for Newcomers: The decentralized nature and reliance on the blockchain of a DAO may make it intimidating for the uninitiated, potentially limiting broader adoption.

Recommended Read: Learn the differences between CBDC vs Bitcoin

Notable DAOs in the Crypto Space

When looking into DAOs, you’ll quickly realize it’s a vibrant ecosystem brimming with innovation.

Let’s take a moment to spotlight some of the most notable DAO examples that have made waves in the crypto community.

- The DAO: The pioneer, called The DAO also was one of the earliest and most ambitious projects, raising 150 million USD. Though it faced a significant setback due to a hack, it set the stage for future DAOs.

- MakerDAO: A game-changer in the DeFi space, MakerDAO is behind the DAI stablecoin. Its decentralized governance model has been a beacon for other DAOs also.

- Aragon: Focusing on creating tools and platforms, Aragon facilitates establishing and managing DAOs, making the process more accessible and streamlined.

- MolochDAO: With a mission to fund Ethereum community projects, MolochDAO has a unique proposal and voting system that has garnered attention, allowing more investors to participate in the DAO.

- Kyber Network: A decentralized exchange, Kyber operates as a DAO, ensuring transparency and community involvement in its decision-making.

Diving deeper into these projects, it’s evident that DAOs are not just a concept but a practical solution, reshaping decentralized finance and how we think about organizational structures in crypto.

The Role of Smart Contracts in DAOs

When you look at how DAOs do what they do, you’ll quickly encounter a key player: smart contracts.

At their core, smart contracts are self-executing, with the agreement terms written into code.

Think of them as the backbone a DAO requires.

They automate, enforce, and verify the execution of the DAO’s operations, ensuring everything runs smoothly and transparently.

Moreover, these contracts eliminate the need for intermediaries.

Instead of relying on a centralized authority to oversee transactions or enforce rules, smart contracts do the job autonomously.

Smart contracts are the lifeblood of DAOs, providing the automation and trustless execution that make decentralized governance possible.

Without them, the vision of DAOs would remain just that—a vision.

Legal and Regulatory Implications of DAOs

It’s a complex landscape, so let’s unpack it.

First, they operate decentralized, meaning there’s no central entity to hold accountable.

This presents a challenge for regulators.

Furthermore, since DAOs are global, jurisdiction becomes a gray area.

Conversely, some see DAOs as a way to usher in a new era of transparency and fairness, potentially reducing fraudulent activities in the business world.

However, as regulators grapple with these questions, it’s clear that the legal framework surrounding DAOs is still in its infancy.

As DAOs evolve, so will the laws that govern them, and need DAOs to adhere to them.

Future Prospects: Where are DAOs Headed?

The horizon looks promising for DAOs, and here’s why.

Firstly, the applications are vast, from arts, NFTs, and entertainment to supply chain management.

Moreover, with the continuous evolution of blockchain technology, DAOs are bound to become more sophisticated, efficient, and user-friendly according to what the DAO needs.

Imagine a world where DAOs seamlessly integrate with other decentralized systems, creating a web of interconnected, autonomous organizations.

But here’s the kicker: a DAO must ensure they can face more scrutiny as they gain traction.

Lastly, the rise of DAOs might also pave the way for a new era of global collaboration.

Hold onto your hats; the DAO revolution is just getting started!

Conclusion: The Potential to Revolutionize Traditional Organizations

Looking back at the big picture, it’s clear that DAOs are more than just a fleeting trend.

They’re poised to reshape the very fabric of how organizations operate.

By merging the power of blockchain with decentralized decision-making, DAOs offer a fresh, transparent, and democratic approach to governance.

As technology advances and regulatory landscapes adapt, the influence of DAOs could extend far beyond the crypto realm.

So, whether you’re a crypto enthusiast or a curious observer, one thing’s for sure: DAOs are here to stay, and their impact will be profound.