I aim to demystify Bitcoin for you in this article.

If you’ve found yourself intrigued by headlines about this crypto but are still scratching your head about what it is, you’re in the right place.

We’ll delve into its origins, how it works, and why it has become a financial phenomenon that’s impossible to ignore.

Whether you’re considering an investment or want to be in the know, read on to get a comprehensive understanding of Bitcoin.

History and Origin of Bitcoin

So, you’re curious about where Bitcoin came from?

Let’s take a trip down memory lane.

- The Birth of Bitcoin

First, Bitcoin was introduced to the world as a form of digital currency in 2009 by a mysterious person or group of people known as Satoshi Nakamoto.

The concept was outlined in a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” that set us up for what would become a revolutionary technology and many other cryptocurrencies.

- The Genesis Block

The first entry in the Bitcoin blockchain, launched in 2009, known as the “Genesis Block,” was mined by Nakamoto themselves.

This block contained a hidden message which was a nod to the financial instability of the time and a hint at Bitcoin’s disruptive potential for institutions like banks and governments.

- Early Adoption and Development

You might be wondering, how did Bitcoin gain traction?

In the early days, it was mostly used by tech enthusiasts and those skeptical of traditional financial systems.

But as time went on, more developers joined the project, and the Bitcoin network was continually improved.

Companies started to take notice, and some even began accepting Bitcoin as payment.

- The Silk Road and Public Awareness

Hold on because this part is crucial.

Bitcoin first came into the public eye due to its association with the Silk Road, an online black market.

While this brought some negative attention, it also led to increased scrutiny and debate about the potential and legality of digital currencies and cryptocurrency transactions.

- The Rise of Bitcoin Exchanges

By now, you’re probably asking, how did Bitcoin become so accessible?

The answer lies in the rise of cryptocurrency exchanges.

Platforms like Mt. Gox initially, and later Coinbase, Kraken, and others, made it easier for the average person to buy Bitcoin, sell Bitcoin, and become Bitcoin holders.

- Mainstream Acceptance

Fast forward to today, and Bitcoin has moved from the fringes to mainstream financial discussions.

It’s discussed by policymakers, studied by academics, and invested in by millions worldwide.

Since 2021, BTC is legitimately considered a payment system and legal tender in El Salvador, so users can make purchases of goods and services as long as they are connected to the internet.

From its mystery beginnings to its current status as a financial asset and “digital gold”, Bitcoin and Bitcoin’s price have come a long way.

And guess what?

Its journey is far from over.

What is Bitcoin?

So, you’ve heard about Bitcoin’s intriguing history, but what exactly is it?

Let’s dive into the nitty-gritty details of what Bitcoin is, its role as a store of value, and the intriguing aspect of its supply limitation.

Definition Of Bitcoin

In simple terms, Bitcoin is a digital or virtual currency that uses cryptography for security.

It operates on a decentralized network of machines, often referred to as a blockchain, where every Bitcoin transaction is added to the blockchain.

Unlike traditional currencies issued by governments (like the U.S. dollar or the Euro), Bitcoin is outside the control of a single entity.

Fascinating, isn’t it?

Bitcoin as a Store of Value

Now, you might be wondering, what’s the big deal about Bitcoin?

One of the aspects that sets it apart is its role as a store of value.

Over the years, Bitcoin has been compared to “digital gold” because, like the precious metal, it is a finite resource.

People buy and hold Bitcoin in the hope that its value will increase over time, much like they do with gold or other assets.

And guess what?

For many, this strategy has paid off handsomely, and they have seen Bitcoin make money for them.

Supply Limitation

Hold on because this is where it gets really interesting.

One of the most unique features of Bitcoin is its supply limitation.

The Bitcoin protocol dictates that the amount of Bitcoin ever to exist is limited by the source code to 21 million coins in circulation.

Out of this, close to 1.52 million are left to be mined.

This scarcity mimics the scarcity of precious metals like gold.

The idea is to create a form of money that can’t be manipulated by printing more, as is the case with traditional fiat currencies.

So, 1 BTC will always be equal to 1 BTC.

How Bitcoin Works

Alright, so you’ve grasped what Bitcoin is and why it’s unique.

But how does it actually work?

Buckle up because I’m about to delve into the mechanics of Bitcoin, including the blockchain technology that powers it, the mining process, and the role of anonymous Bitcoin wallets.

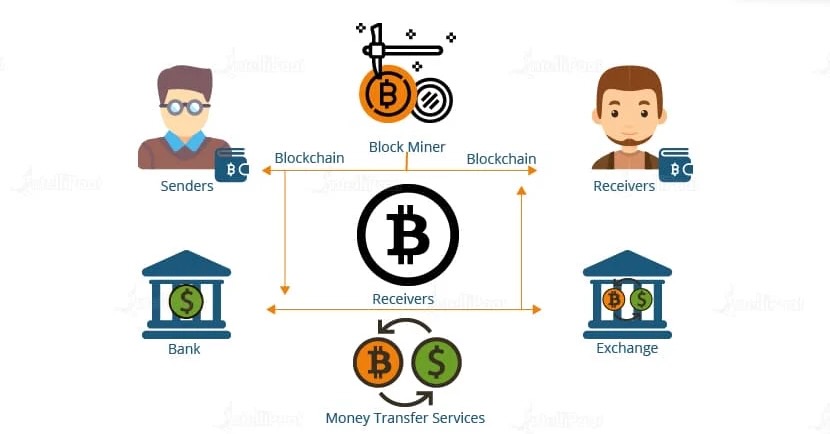

- Blockchain Technology

Simply put, a blockchain is a public, digital ledger that records all transactions made with Bitcoin.

Every “block” in the blockchain contains a list of transactions.

Once a block is filled, a new block is created and linked to the last one, forming a chain.

This is a decentralized system, meaning no single entity controls it.

Instead, it’s maintained by a network of machines, also known as nodes.

- Mining and Proof of Work

You might be wondering, how are new Bitcoins created?

The answer lies in understanding Bitcoin and the mining process.

To mine Bitcoin, a network of miners use powerful computers to solve complex mathematical problems.

This process is used to record and verify transactions on-chain.

As a reward for their work, network miners receive newly minted Bitcoins.

This is known as the “block reward”.

The “Proof of Work” algorithm ensures that mining requires effort to compute, making it costly and time-consuming to produce new blocks.

This adds a layer of security to the network.

The Bitcoin reward is halved after every 210,000 blocks. After May 2020, 6.25 BTC is the new block reward for miners.

You can increase your chances of being rewarded if you join a mining pool.

You’ll need to make do with the fact that you will all receive lower rewards as that is being shared among all the participants of the pool.

- Bitcoin Wallets

So, where do you store your Bitcoins?

In a digital crypto wallet, of course!

A Bitcoin wallet is a software where these coins are stored.

To be accurate, Bitcoins are not stored anywhere; there is a private key (a secret number) for every Bitcoin address that is saved in the Bitcoin wallet of the person who owns it.

Wallets facilitate sending and receiving Bitcoins and transfer ownership of it to the new user.

When you send an amount of coin from one wallet to another, there is no physical movement of assets, just the ledger notes that there was a debit in one wallet and a credit in the other.

Simple, yet incredibly vital for your Bitcoin journey.

Recommended Read: Who regulates bitcoin in the US?

Advantages of Bitcoin

So, you’ve got a handle on the first cryptocurrency, aka Bitcoin, and how it works.

But what makes it so revolutionary?

Why are people around the world so enamored with this digital currency?

Let’s dive into some of the key advantages that set Bitcoin apart from traditional currencies and financial systems.

- Decentralization and Autonomy

One of the most compelling aspects of one Bitcoin is that any single entity, government, or organization do not control it.

Instead, Bitcoin uses the blockchain, and transactions occur directly on-chain between users, and are verified by network nodes through cryptography.

What does this mean for you?

It means you have complete control over your money without the need for intermediaries like banks and no need for advisory or brokerage services.

This level of autonomy is unprecedented in the financial world, and it’s a game-changer.

- Transparency and Security

Because of its open-source nature and blockchain technology, anyone with internet access can analyse all transactions, and any transferred funds can be traced back to their original source.

This level of transparency can act as a deterrent for fraudulent activity by those who use Bitcoin.

At the same time, the cryptographic nature of these transactions also ensures a high level of security.

Intrigued?

You should be.

This dual benefit of transparency and security is one of Bitcoin’s standout features.

- Potential for Financial Inclusion

There are billions of people worldwide without access to traditional banking systems or means to open a bank account.

Bitcoin, accessible by anyone with internet access, offers a means of financial inclusion for these individuals.

This is not just a minor advantage; it’s a significant step toward leveling the financial playing field globally.

- Low Transaction Fees

Traditional banking systems and online money transfers usually involve fees and exchange costs if they are done via cryptocurrency exchanges.

Bitcoin transactions may not be entirely free, but they are significantly cheaper than the fees you’d incur using a traditional financial system.

This is especially beneficial for international transactions, which usually come with high fees and exchange rates.

Challenges and Criticisms Of Bitcoin

Alright, so we’ve covered the advantages of Bitcoin, and you might be thinking it’s all sunshine and rainbows.

But hold on a minute.

Like any revolutionary technology, Bitcoin has its share of challenges and criticisms.

Let’s delve into some of the key issues that are often brought up when discussing cryptocurrency.

- Volatility

If you’ve been following Bitcoin even casually, you’ve probably noticed its price can swing wildly in a short period.

One day, it’s breaking all-time highs, and the next, it’s plummeting.

This volatile behavior can be a double-edged sword for your portfolio.

While it offers the potential for massive gains, it also poses a risk of significant losses.

So, if you’re considering Bitcoin investing, this is a factor you can’t afford to ignore.

- Regulatory and Legal Concerns

Because Bitcoin operates in a decentralized manner, it’s often seen as a grey area in the eyes of the law.

Different countries have different stances on its legality, and the regulatory landscape is constantly changing. And if you are from USA, you should know about the crypto legality in the state.

What does this mean for you? Is Bitcoin right for your circumstances?

Well, it means that using or investing in Bitcoin might come with legal risks, depending on your jurisdiction.

Your financial situation is unique, but you should use Bitcoin as an alternative investment and never invest more than you are comfortable losing.

The Securities Investor Protection Corporation in the USA ensures that investors are paid up to $500,000 if a fund they are invested in fails.

Sadly, there is no such measure for cryptocurrencies.

So, it’s crucial to stay updated on the latest regulatory developments in your area.

- Environmental Concerns

You might have heard that Bitcoin mining consumes a lot of energy.

And you heard right.

The mining process involves solving complex mathematical problems to encrypt and validate new transactions and requires significant computational power.

This has led to concerns about the carbon emissions related to Bitcoin and its impact on climate change.

If you’re environmentally conscious, this is a point worth considering.

Recommended Read: Crypto Wallets vs Crypto Exchanges

Conclusion

So, what’s the final word on Bitcoin?

Well, as we’ve seen, it’s a complex and multi-faceted technology that can potentially change the financial world as we know it.

From its decentralized nature and the promise of financial inclusion to its regulatory hurdles and environmental concerns, Bitcoin is a mixed bag of opportunities and risks.

What does this mean for you?

Essentially, if you’re considering diving into the world of Bitcoin, it’s crucial to do your homework.

Whether you’re looking at it as an investment, a transactional currency, or a technological marvel, understanding its pros and cons will help you navigate this complex landscape.

And remember, the world of Bitcoin is ever-evolving.

Regulatory changes, technological advancements, and shifts in public perception can all impact its value and utility.

Ultimately, whether Bitcoin is the future of money or a speculative bubble waiting to burst is a matter of debate.

But one thing is clear: it’s a groundbreaking innovation that has already left an indelible mark on the financial industry.

And if you ask me, that alone makes it worth your attention.