What if you could invest in cryptocurrencies and benefit from their short-term price movements without holding any assets? It’s entirely possible. We’re talking about cryptocurrency futures trading on Kraken.

Crypto futures work similarly to stock and index futures. They are derivatives (derived from the underlying asset), and you can trade them even if you have no crypto assets in your wallet. Trading futures has many benefits, such as high leverage, high volume, and cashless trading.

Today, let’s talk about futures trading on Kraken, including the available leverage, fee, futures and margin trading and other features.

Let’s get started.

Kraken Futures Trading Guide: What Are Kraken Futures?

Kraken futures are contracts that allow you to buy or sell an asset for a fixed price at a later date. Unlike crypto assets that are stored in your crypto wallet, your futures investment remains in your exchange account until you sell them. This makes the buying/selling process faster.

Earlier, crypto users used futures to hedge their investments. Let’s understand this with an example.

Suppose you’ve bought Bitcoin, and after a great up move, it starts falling. You analyze the charts and market sentiment to figure out the market is likely to fall in the upcoming days. Sadly, you can’t do anything but see your portfolio shrink and wait for another up move.

With futures, you can benefit from that down move, thereby hedging your profits. You can short the futures of the asset you have invested in. The more the underlying asset falls, the more profit you will make. This way, neutralize your losses and make profits in both bull and bear markets.

With the rise of derivative exchanges like Kraken, futures trading has become commonplace, and people trade futures independently and not just to hedge their investments. Futures trading has become so popular that on some exchanges, the daily derivatives trading volume is higher than the spot trading volume.

Kraken also has an impressive 24h derivatives trading volume of over $250 million.

What Are Kraken Futures Fee?

Kraken, like all other crypto exchanges, has a different fee schedule for futures trading. Since futures trading generally comprises high volumes, exchanges charge a lower fee, and some even offer a rebate.

Kraken uses a market maker/taker, tiered fee schedule. If you’re not familiar with those terms, here’s a quick explanation.

When you place an order, it either adds liquidity to the market or reduces it. Orders that add liquidity are called market maker orders. The ones that reduce it are called market taker orders. Ideally, limit orders are market maker orders, and market orders are market taker orders.

Now, let’s talk about the tiered fee schedule. In this structure, the trading fee depends on your last 30d trading volume. A high volume means a high tier and a low fee. Some exchanges use native token holding as an additional criterion, but that’s not the case with Kraken.

Coming to the fee, Kraken has eight futures trading fee tiers. Users with a 30d trading volume of under$100,000 are in the first tier, and their market maker/taker fee is 0.02%/0.05%. Similarly, users with a 30d trading volume of over $100 million are in the final tier, and their fee is 0.00%/0.01%.

Kraken Provides Futures on Which Assets?

At the time of writing, Kraken offers futures trading on the following pairs:

- BTCUSD

- ETHUSD

- LTCUSD

- BCHUSD

- XRPUSD

- BTCEUR

- ETHEU

Three time frames — perpetual, monthly, and quarterly — are available for all pairs. BTCUSD and ETHUSD have semi-annual contracts as well.

How Does Kraken Futures Work?

Before delving into how Kraken futures work, let’s talk about how to unlock futures trading on Kraken.

Kraken futures are not available to unverified users. If you want to trade futures, you’ll need to verify your account to Intermediate or higher. Once you complete your KYC, head to the Futures Trading section and sign in with Kraken SSO. After logging in, you can trade futures.

Now, let’s understand how futures work.

The process of buying and selling futures is similar to spot assets. You choose an asset, select the quantity, set the leverage, select the order type, and place the order. Once your position is in a good profit, you can exit your position and book the profits.

However, two elements play a vital role in futures trading that doesn’t exist in spot trading. They are:

- Leverage

- Contract timelines

Leverage refers to the funds you can borrow from an exchange on a single order. A 10x leverage means you can borrow funds up to 10x your initial margin and take a 10x bigger position. So, if you have $1,000 in your trading account, you can take positions worth $10,000, thereby multiplying your profits. However, this also increases your exposure and the risk of loss.

Contract timelines refer to the time period for which a futures contract is valid. In stock and index training, there are monthly and quarterly contracts. In futures trading, apart from monthly and quarterly contracts, there are perpetual contracts, which have no expiry. Kraken also offers semi-annual contracts on BTCUSD and ETHUSD.

How To Trade Kraken Futures?

Trading futures on Kraken is easy and beginner-friendly. Here’s a step-by-step process to trade Kraken Futures.

1. Create a Futures Account

First things first, you need to create a Futures account on Kraken. Go to the Kraken futures page and click on Create Account to get started. If you already have a futures account, click on Sign In.

2. Open the Futures Trading Terminal

After signing in, click on Start Trading to reach the Kraken futures trading terminal. Please note that Kraken Futures is a different platform from the spot trading platform. The interface is different, so you may need some time to get used to it.

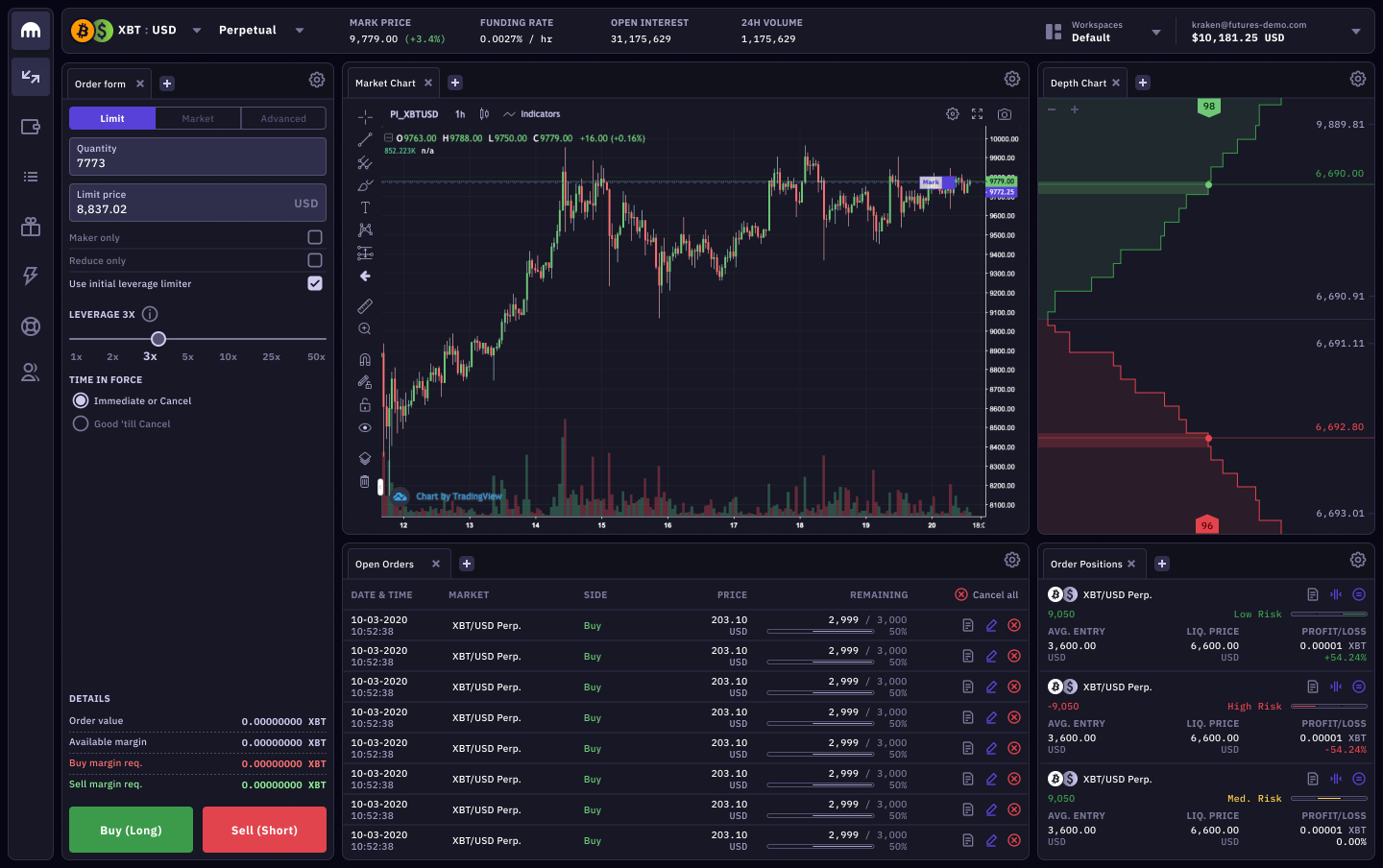

The center of the terminal has TradingView-enabled charts. On the right of the chart, you’ll find the Order Book that shows real-time long/short trades.

3. Select the Contract and Trading Pair

The next step is to select the contract type and trading pair. You can do that by going to the Market Preview section, as shown in the picture.

4. Fill the Order Form

Next, fill up the order form. Here, you need to specify whether you want to place buy/sell order, the order type, and the leverage you want to use.

5. Place a Trade

Once you fill the order form, you need to click on Buy (Long) to place a buy order or Sell (Short) to place a sell order. Your order will immediately show up in the Open Orders section until it gets executed.

6. Exit a Trade

The final step of this quick Kraken tutorial is to exit a trade, and you can do that by opening your positions and exiting your position. Exiting a trade means placing an order opposite of the order you initially placed. So, if you initially placed a buy order, a sell order will be an exit order.

That’s it. Your trade is complete.

How Much Leverage on Futures?

Kraken offers up to 50x margin in futures trading. Kraken has a margin level schedule where the margin parameters depend on your contract size. For perpetual contracts, there are 11 margin levels, and the following are the margin parameters for each margin level.

- Level 1: 50x

- Level 2: 25x

- Level 3: 17x

- Level 4: 10x

- Level 5: 6.7x

- Level 6: 5x

- Level 7: 4x

- Level 8: 3.33x

- Level 9: 2.5x

- Level 10: 2x

- Maximum: –

The contract size for each level varies among trading pairs. For example, BTCUSD contracts under $500,000 are in the first level. For Ether, the contract size for Level 1 users is under $250,000.

For fixed maturity futures, there are nine levels:

- Level 1: 50x

- Level 2: 25x

- Level 3: 17x

- Level 4: 10x

- Level 5: 6.67x

- Level 6: 5x

- Level 7: 4x

- Level 8: 3.33x

- Level 9: 2.5x

- Maximum

Funding Rates/Fees on Kraken Futures

The concept of funding rates is new, and it’s applicable to perpetual futures only. Let’s quickly understand funding rates and how they work.

Futures have high volumes. So, if there’s bullish sentiment in the market, traders could take long positions in large quantities, increasing the futures price. If the buying continues, the gap between the spot price and index price can increase, leading to high volatility.

To avoid this constant one-sided move and keep the futures price in line with the spot price, funding rates are used. The funding rate is a small fee short traders pay to long traders or vice versa.

If the market is bullish, the funding rate is positive, which means long traders pay a funding fee to short traders. If the market is bearish, short traders pay a funding fee to long traders.

The funding rate on Kraken is dynamic and changes every eight hours. Please note that traders pay a funding fee to other traders, and the exchange doesn’t have a share in it.

What Is the Initial Margin in Kraken?

The initial margin refers to the percentage of the total order amount that should be in your trading account to place an order. Kraken sets initial margin requirements based on the trader’s margin level, as discussed in the previous sections.

Here’s how the initial margin requirements look like for a perpetual futures contract:

- Level 1: 2%

- Level 2: 4%

- Level 3: 6%

- Level 4: 10%

- Level 5: 15%

- Level 6: 20%

- Level 7: 25%

- Level 8: 30%

- Level 9: 40%

- Level 10: 50%

- Maximum: —

For fixed maturity contracts, the initial margin requirements are as follows:

- Level 1: 2%

- Level 2: 4%

- Level 3: 6%

- Level 4: 10%

- Level 5: 15%

- Level 6: 20%

- Level 7: 25%

- Level 8: 30%

- Level 9: 40%

- Maximum: —

For example, suppose you want to buy BTCUSD perpetual futures contracts worth $100,000. As per the margin parameters, your order will be of Level 1, and your initial margin requirements will be 2%. Hence, you’ll need 2% of $100,000, which is $2,000.

What Is the Maintenance Margin in Kraken?

The maintenance margin refers to the minimum percentage of funds you should have in your trading account after placing the order. The same margin level requirements apply for maintenance margin as well.

For perpetual contracts, the maintenance margin requirements for the 11 levels are 1%, 2%, 3%, 5%, 7.5%, 10%, 12.5%, 15%, 20%, 25%, and NIL. For fixed maturity contracts, the requirements for the 10 levels are 1%, 2%, 3%, 5%, 7.5%, 10%, 12.5%, 15%, 20%, and NIL.

What is Kraken Futures Brawl?

Kraken futures brawl is a unique way to trade futures where you compete for a one-on-one with another trader. You can join a Kraken futures brawl, also known as futures battle, by going to the Futures section and then to Futures Brawl.

In the Brawl section, click on Battle to enter the battle. In the battle, you need to select the contract size and then predict if the price will go up or down in the next one or five minutes. Once you place your order, you’ll be matched against someone with the opposite order.

After five minutes, the player with the right prediction will win. You can either end the order manually after ten seconds and take the profit/loss or wait for it to close automatically.

What Is Kraken Futures Bonus?

Futures bonus refers to the bonus money you receive by the exchange in your trading account. Many exchanges offer a small cash bonus to help traders kickstart their trading journey. In most cases, you get a bonus when you sign using a referral link. Kraken offers up to a 20% signup bonus.

Conclusion

Kraken futures are ideal for experienced traders who want to use up to 50x leverage to maximize their profits. Trading futures on Kraken is super-easy, and Kraken’s futures trading platform is easy to use.

Kraken offers generous leverage, along with exciting features like Brawls. However, traders should avoid trading with high leverage as the risk becomes significant.

If you’re a beginner, use Kraken’s Demo Platform to learn futures trading.