OKEx and Binance are two of the best crypto exchanges for day trading. With a daily spot-trading volume of over $22 billion and a derivatives trading volume of $58 billion, Binance leads the charts in terms of the trading volume.

OKEx isn’t far behind. It has a daily spot trading volume of $7 billion and a derivatives trading volume of $15 billion, which is second to Binance only.

Both cryptocurrency exchanges support hundreds of assets and offer a wide range of features. So, which exchange should you choose and why? Keep reading to find out.

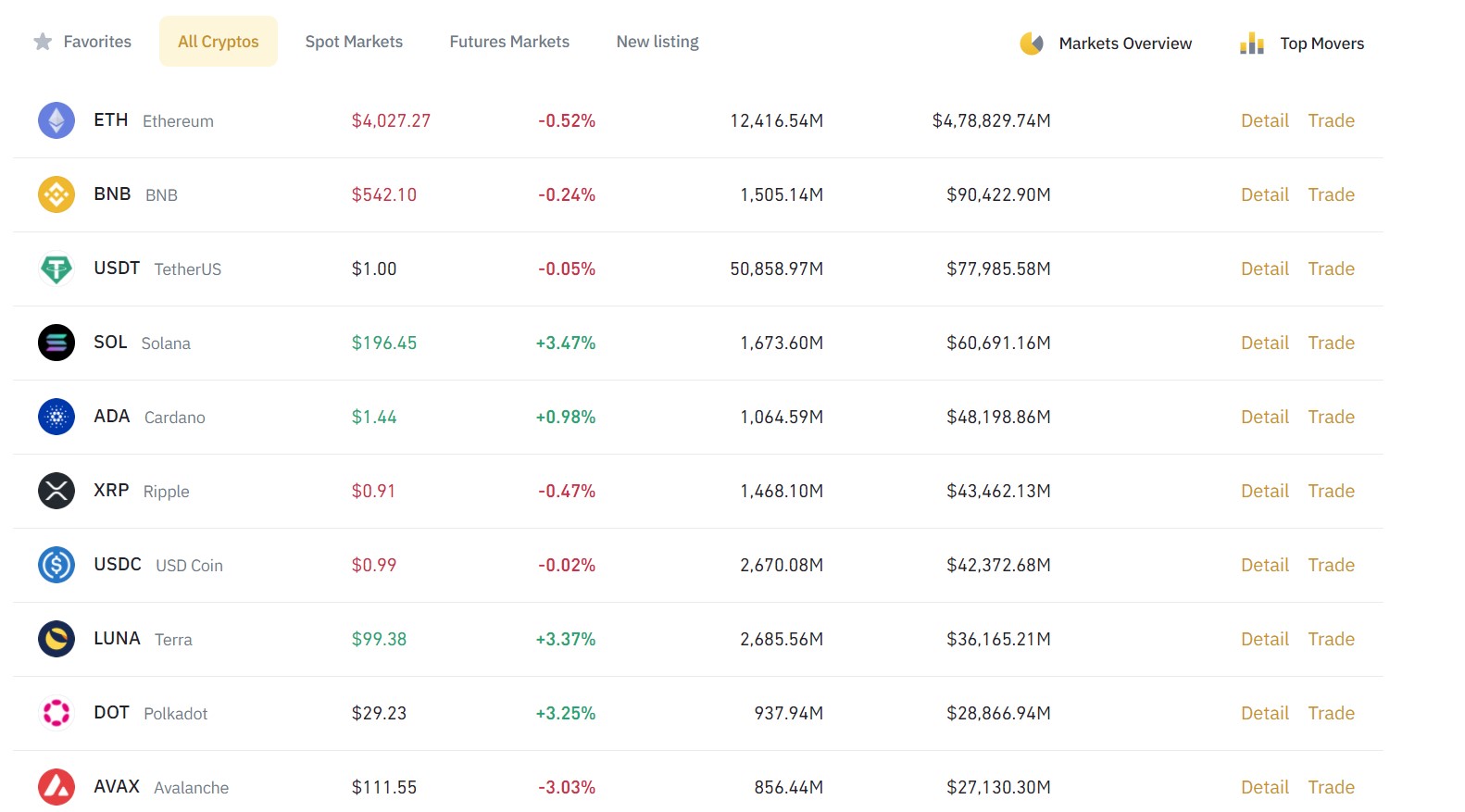

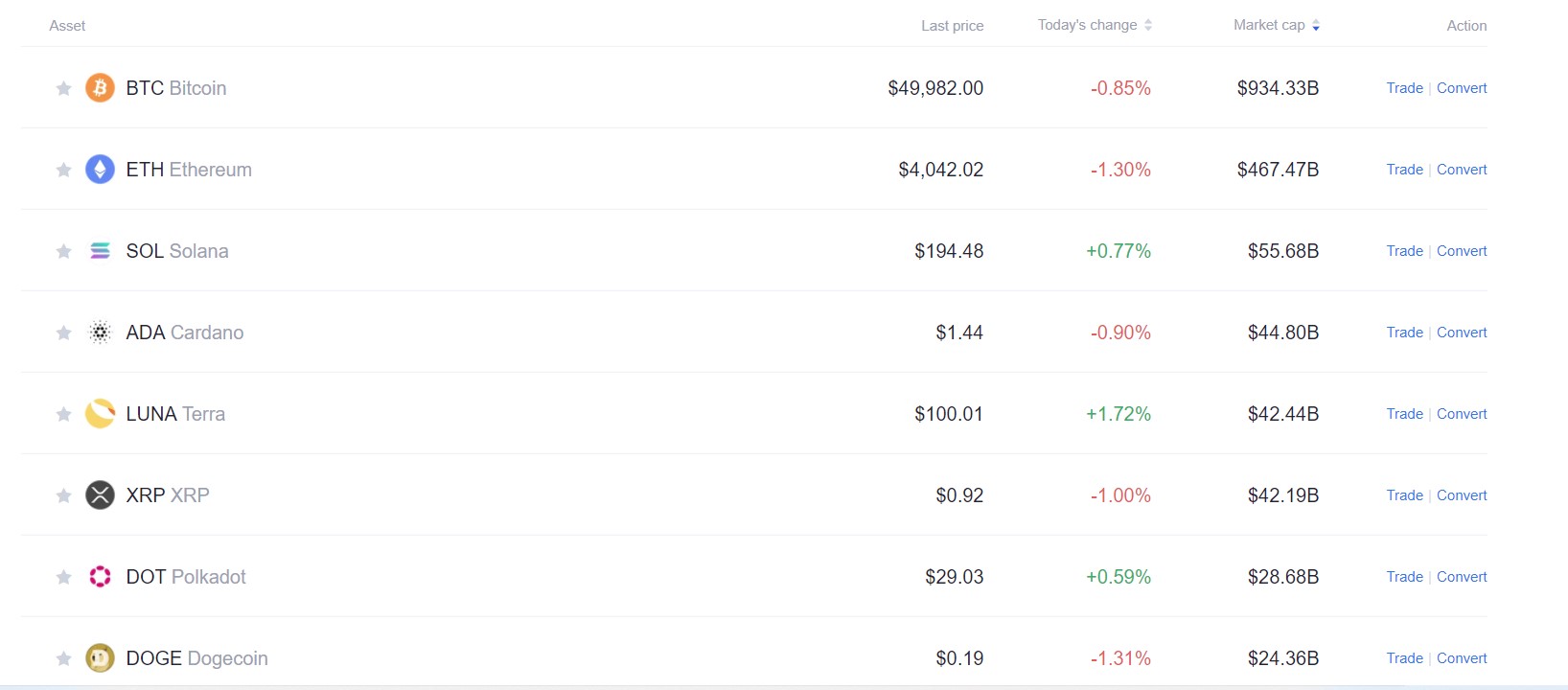

OKEx vs Binance: Supported Cryptocurrencies

OKEx and Binance support hundreds of cryptocurrencies and also offer other trading and financial products. Let’s discuss it in detail.

Binance

Binance has one of the largest pools of cryptocurrencies in the crypto space. It has over 500 cryptocurrencies, and the exchange keeps on adding new ones.

Binance has a comprehensive range of features and options. It has a standard exchange that lets you buy, exchange, and sell crypto. You can trade crypto, as the exchange supports margin trading and strategy trading.

Coming to derivatives, Binance supports USDS-M futures, COIN-M futures, vanilla options, and leveraged tokens. It also offers financial products like staking, crypto loans, etc.

OKEx

OKEx has over 300 listed cryptocurrencies. These include all cryptos, from popular names like BTC and ETH to newly listed coins like GF, RACA, and BICO. Besides, OKEx has over 400 trading pairs, and you can trade crypto against various assets.

The exchange offers traditional currency conversion, basic trading, margin trading and futures trading. It also has a DeFi portal where you can stake crypto, borrow funds, etc. Overall, OKEx has a wide range of options to explore.

Verdict: Binance is the winner, as it supports more cryptocurrencies and offers a wide range of other features.

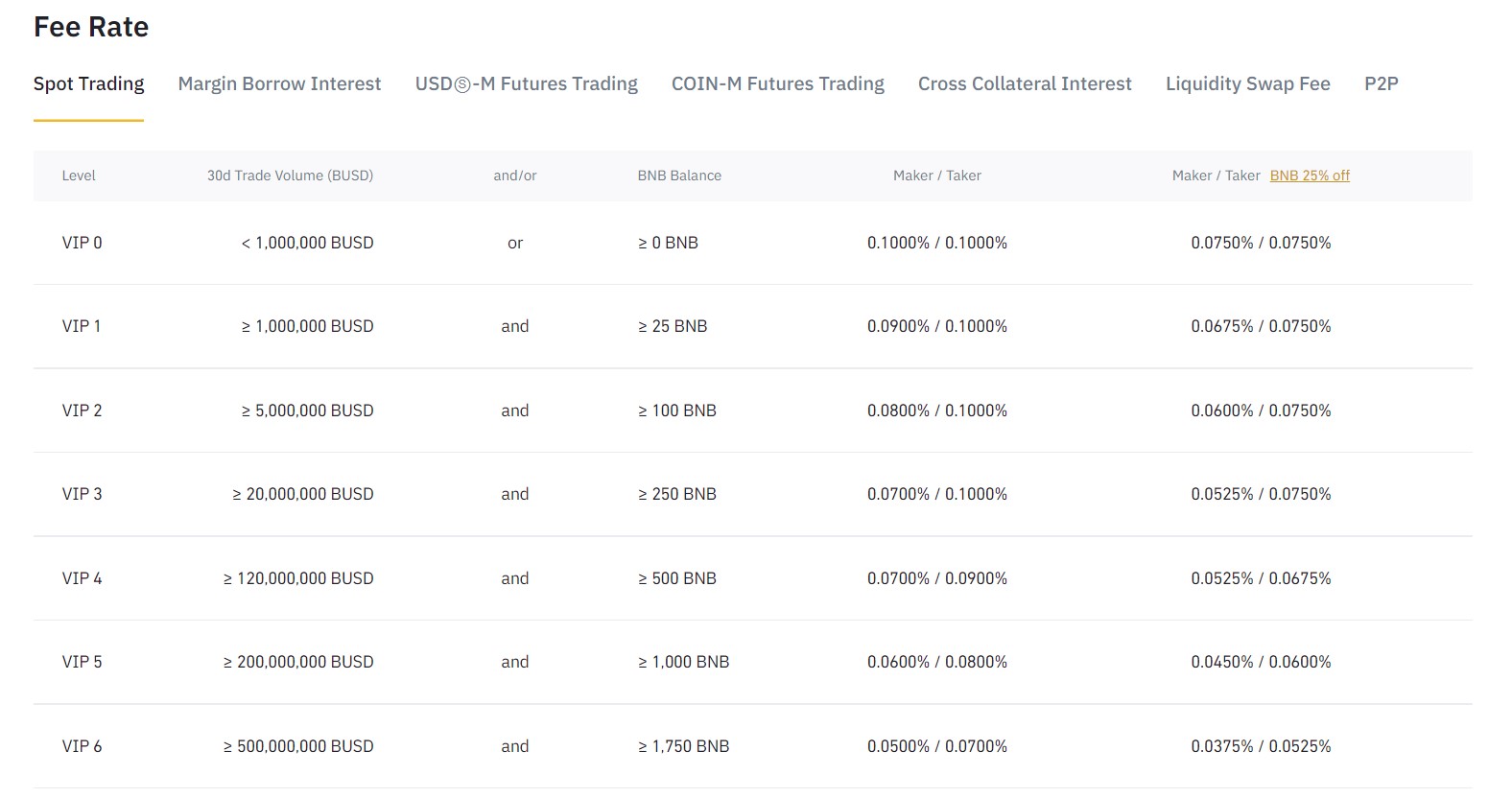

Trading Fees

OKEx and Binance both implement a tiered fee structure. Let’s compare the trading fees charged by the two exchanges.

OKEx

The fee structure implemented by OKEx is a bit complicated. First, all tokens listed on OKEx are classified into three classes: Class A, Class B, and Class C. The fee is the lowest for class A trading pairs and the highest for class C trading pairs.

In addition, OKEx classifies users into two types: Regular Users and VIP users, and the fee is lower for VIP users.

That said, let’s talk about the trading fee. For regular users, there are five tiers or levels. Users with a 30d volume of under $10 million and OKB holding of less than 500 are in Level 1 and have to pay a market maker/taker fee of 0.08%/0.1%.

Similarly, users with a 30d trading volume of over $10 million and the OKB holdings of over 2,000 are in the fifth tier, and their fee is 0.06%/0.08%.

For VIP users, there are eight tiers. Users with a 30d volume of over $10 million are in the first tier and need to pay 0.06%/0.08%. Users with a 30d volume of over $10 billion are in the final tier, and their fee is –0.010%(rebate)/0.025%.

Please note that this fee structure is applicable to class A tokens only. The fee will increase slightly for class B and class C tokens.

For futures, there are five tiers for regular users and eight tiers for VIP users. However, the trading fee is slightly lower for futures trading.

Binance

The fee structure of Binance is simpler than OKEx because there are now token classes or distinctions between regular and VIP users.

Binance has ten trading fee tiers. Users with a 30d trading volume of less than 50 BTC or BNB holdings of less than 50 BNB are in the first tier. The trading fee for them is 0.10%/0.10%, respectively.

Users with a 30d volume of over 150k BTC and the BNB balance of over 11,000 BNB are in the final tier, and the market maker/taker fee for them is 0.02%/0.04%, respectively.

Furthermore, you can claim a flat 25% discount on the spot trading fee by using BNB for fee deductions.

Coming to futures fees, Binance has different fee structures for USDS-M futures and COIN-M futures. The fee for VIP 0 traders is 0.02%/0.04%, and for VIP 9 traders, it’s 0.0%/0.01% for USDS-M futures trading.

For COIN-M futures, the market maker/taker fee is 0.01%/0.05% for VIP 0 traders and –0.009%(rebate)/0.024% for VIP 9 traders. Furthermore, you can get a 10% discount on USDS-M futures trading fees if you use BNB for transactions.

Verdict: It’s a tie, as both OKEx and Binance have a similar fee structure.

Account Funding Methods

Both the exchanges support various funding methods, and you can buy crypto using fiat currencies. Let’s compare the funding methods of the two exchanges.

OKEx

OKEx allows you to use cryptocurrencies and other stablecoins to buy cryptocurrencies. The exchange is quick and happens in a few minutes.

You can also deposit fiat currencies; however, the deposit methods depending on your currency. For example, you can deposit USD using MasterCard, VISA, bank transfer, Advcash Wallet, ApplePay, PayPal, SEPA, and Google Pay. If you want to deposit EUR, you can do so using all the methods mentioned earlier, along with Sofort and iDEAL.

OKEx also has a P2P terminal where you can find sellers and buy crypto directly from them.

Binance

Binance also allows you to buy crypto using other cryptos, stablecoins, and fiat currencies. The supported fiat currency deposit methods depending on your currency. If you want to deposit EUR, you can do so via credit and debit cards, bank transfer, Simplex, Banxa, and P2P trading.

To deposit USD, you can use SWIFT bank transfer, credit and debit cards, Simplex, Banxa, Pazos, and P2P trading.

Verdict: It’s a tie, as both the exchanges allow you to fund your account using cryptocurrencies and fiat currencies.

Opening Account & Account Limits

OKEx and Binance both provide a hassle-free account opening process to their users. Let’s compare the account opening procedures and limits imposed by the two exchanges.

OKEx

To open an account on OKEx, visit the OKEx website homepage and click on Sign Up in the top right corner. Fill the registration form and confirm your email ID to open an account. By default, all accounts on OKEx are unverified.

OKEx has three levels of identity verification: Level 1, Level 2, and Level 3. Though KYC verification isn’t mandatory, unverified users can withdraw up to 10 BTC daily. You’ll need to verify your identity to increase withdrawal limits. Also, P2P transactions aren’t available for unverified users.

Binance

Binance Futures, too, has an effortless account opening process. Visit the website homepage and click on Register New. Follow the same procedure as you did in OKEx and create an account.

All accounts created on Binance have the Basic Account Verification by default. It has certain limits. For example, you can’t withdraw over 0.006 BTC in a day, and the maximum available leverage is 20x only. To unlock these limits, you’ll need to verify your identity.

Verdict: OKEx is the winner, as it allows you to withdraw up to 10 BTC a day without identity verification.

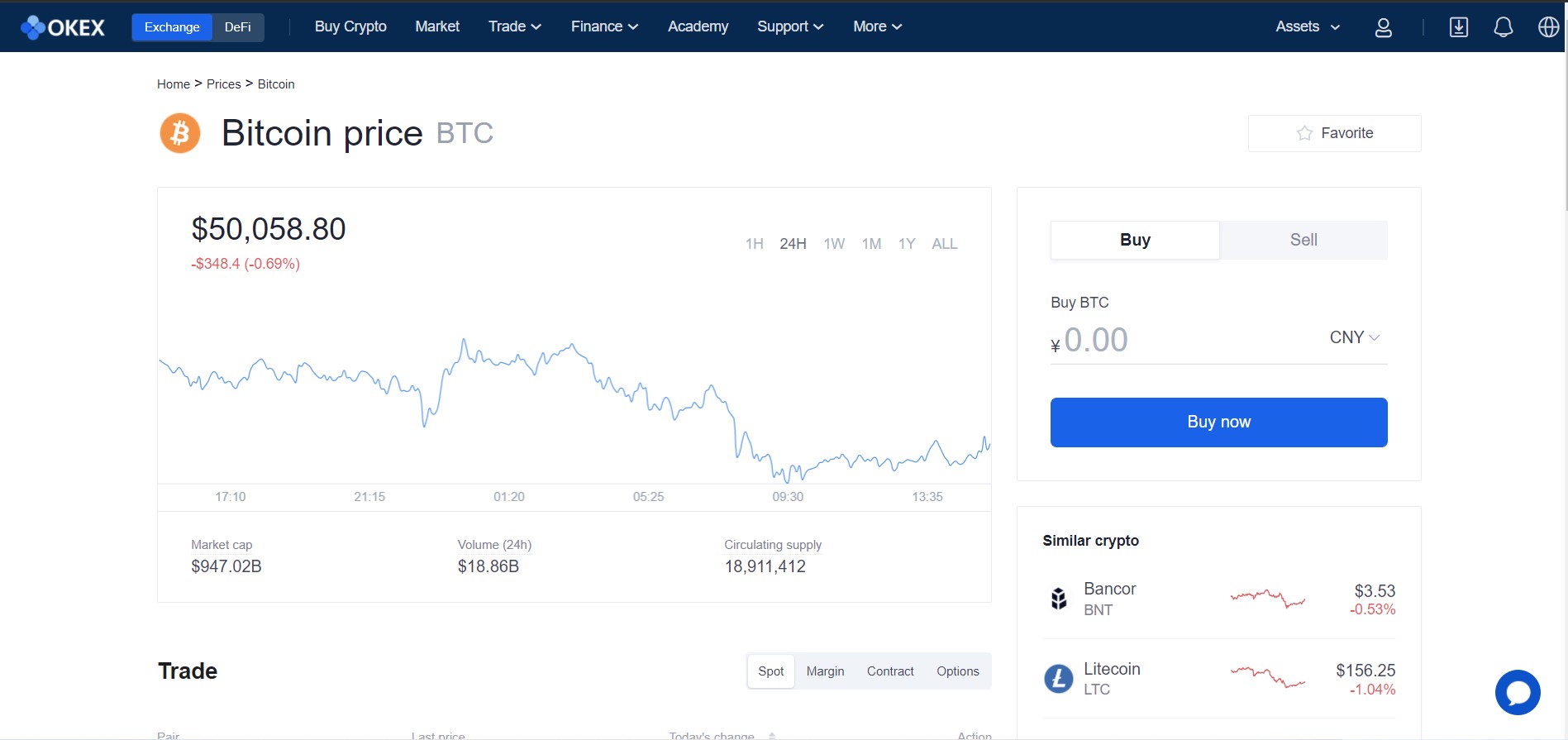

Ease Of Use & Interface

Since OKEx and Binance are both industry-leading derivative trading platforms, it’s apparent that they both have top-notch trading platforms. Let’s compare the trading terminals of the two exchanges.

OKEx

OKEx allows you to convert your crypto in a hassle-free manner. The platform is intuitive and easy to use, and the process is simple. If you want to trade crypto, you can access the trading terminal.

OKEx has an advanced trading terminal. It has two chart visualization tools: OKEx Proprietary Chart and TradingView. Both charting systems are feature-rich and provide a fantastic experience. However, TradingView has more features, like more chart types, time frames, indicators, drawing tools, etc.

The charting system covers the right side of the terminal, along with the depth chart. As you go right, you’ll find the Order Book that provides real-time trade data. Next to the Order Book is the order form, where you can place Buy and Sell orders. OKEx supports limit, market, stop, trigger, and advanced limit orders.

The lower portion of the terminal has sections like open orders, order history, positions, position history, assets, etc. You can also use the terminal to deploy trading bots. To learn more about the exchange, check this OKEx futures guide.

Binance

Binance, too, has a powerful trading terminal, and it resembles OKEx in many ways. It has two chart systems, one being Binance’s proprietary system and the other being TradingView. With TradingView, you get all the features, like multiple timeframes, indicators, drawing tools, and chart types.

The right side of the charting system is the Order Book which shows real-time trading activity. Next to the Order Book is the Order Form, where you can place limit, market, stop limit, and OCO orders. Below the order book, you’ll find the assets section. The left side of the assets section has the open orders and order history options. To help you learn more, here is a quick guide on how to trade futures on Binance.

Verdict: It’s a tie. OKEx and Binance have almost identical trading platforms.

Security Features

OKEx and Binance are two of the most trusted and secure cryptocurrency exchanges in the world. Both the exchanges implement similar security features, like:

- Cold storage wallets

- Two-factor authentication

- IP allowlisting

- IP Encryption

- Manual authentication of withdrawals

- KYC requirements for high-value transactions and withdrawals.

Additionally, both OKEx and Binance have faced a security incident in the past.

Verdict: It’s a tie, as both OKEx and Binance are secure exchanges.

Customer Support

OKEx has a comprehensive help center with various guides, articles, and FAQs to answer common questions. If you need further help, you can raise a ticket and send an email to the OKEx team. You’ll get a response in a few hours. OKEx also has a virtual assistant that can answer common queries.

Binance also has a vast help center with many blog posts, guides, and FAQs. It also has a virtual assistant, and you can raise a ticket and send an email for further help.

Verdict: It’s a tie.

Is Binance a safe exchange?

Yes, Binance is a safe exchange. It takes all the mandatory steps needed to provide a safe experience to its users. It also has strict KYC requirements, and users need to verify their identity if they want to withdraw over 0.06 BTC per day.

Is OKEx a safe exchange?

OKEx is one of the safest cryptocurrency exchanges out there. It implements industry-leading security measures, including cold storage wallets, two-factor authentication, and KYC verification, to create a safe trading environment for everyone.

Conclusion

You may have already figured out by now that both Binance and OKEx are fantastic cryptocurrency exchanges, and there is no clear winner.

Binance has a small edge in diversity, as it supports more cryptocurrencies and crypto products than OKEx. In contrast, OKEx has lenient KYC requirements, as unverified users can withdraw up to 10 BTC a day.

So, it’s a tie, and you can choose whichever exchange you like.

Learn how does OKEx & Binance stack up against the competition: