Three weeks after the Coinbase IPO – a landmark event in the cryptocurrency industry – another piece of news is floating in the crypto space.

PrimeXBT, a leading cryptocurrency trading platform, is partnering with Covesting, a Europe-based software firm, to build Covesting Yield Accounts.

Covesting Yield Accounts will integrate Covesting Copy Trading Module on PrimeXBT, thereby allowing traders to stake crypto assets and leverage built-in charting tools and over 50 trading instruments.

Here’s an introduction to Covesting Yield Accounts and why crypto traders should care about them.

What Is a Covesting Yield Account & How Does it Work?

Consider Covesting Yield Accounts similar to traditional bank accounts.

When you put money in a savings account, you authorize the bank to use it for other financial activities, such as investing in bond markets, lending to third parties, etc. In return, you get some interest, though the yield is by no means attractive.

Covesting Yield Accounts work in the same manner.

Using the service, you authorize your funds to be used for various crypto market activities and decentralized finance operations. And in turn, you’ll receive an interest payment.

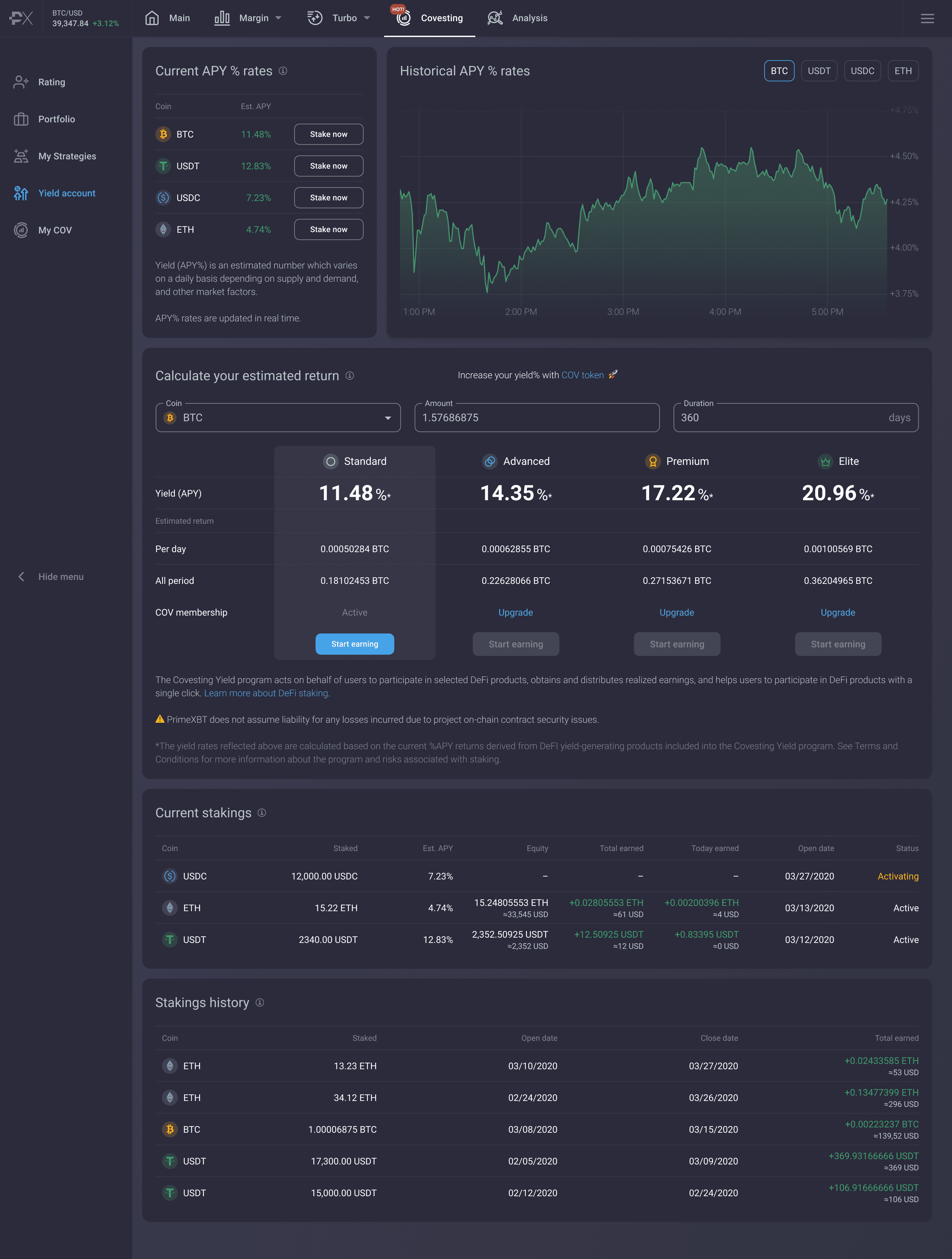

The difference, however, is that the yield rates are higher than a savings bank account. You can choose from four plans – Standard, Advanced, Premium, and Elite.

The annual percentage yield (APY) for the four plans is 11.48%, 14.35%, 17.22%, and 20.96%, respectively. In contrast, the APY of a savings account is less than 1%.

Effortless Staking with Covesting Yield Accounts

Bitcoin mining is a well-known way to earn cryptocurrency without putting down any money for it. However, the process is resource-intensive and not for everyone.

Staking is a less resource-intensive alternative to bitcoin mining. Instead of solving cryptographic equations using high-end computers, all you need to do is “lock-in” your existing cryptocurrencies to receive rewards.

You can either hold the funds in an existing cryptocurrency wallet or a staking service, such as PrimeXBT.

The funds you hold are used to support the operations and security of a blockchain network. And you earn rewards in exchange for holding your coins in the wallet or exchange.

To get a better grasp of how staking works, you’ll need to understand what Proof of Stake (PoS) is and how it works. We won’t go into the details here, but you can learn more about staking here.

We’re discussing staking because Covesting Yield Accounts allow you to stake your crypto assets in exchange for an APY.

You can get started with as low as $100 and earn returns for holding your assets while Covesting takes care of the DeFi staking process.

Why Should Crypto Traders Use Covesting Yield Accounts?

While the release of Covesting Yield Accounts is still due, many crypto traders are looking forward to the launch.

Various crypto wallets and exchanges allow you to stake your assets, but transparency and flexibility are the main factors that make Covesting Yield Accounts the preferred choice.

For starters, you only need a hundred bucks to get started, as discussed earlier. Instead of locking in your money for lengthy lockup periods, you can withdraw your staking amount anytime.

The interest is paid out daily. When you choose to withdraw, you’ll receive the full staking amount along with interest accrued.

You also get the flexibility to choose the crypto asset and the number of coins you want to stake.

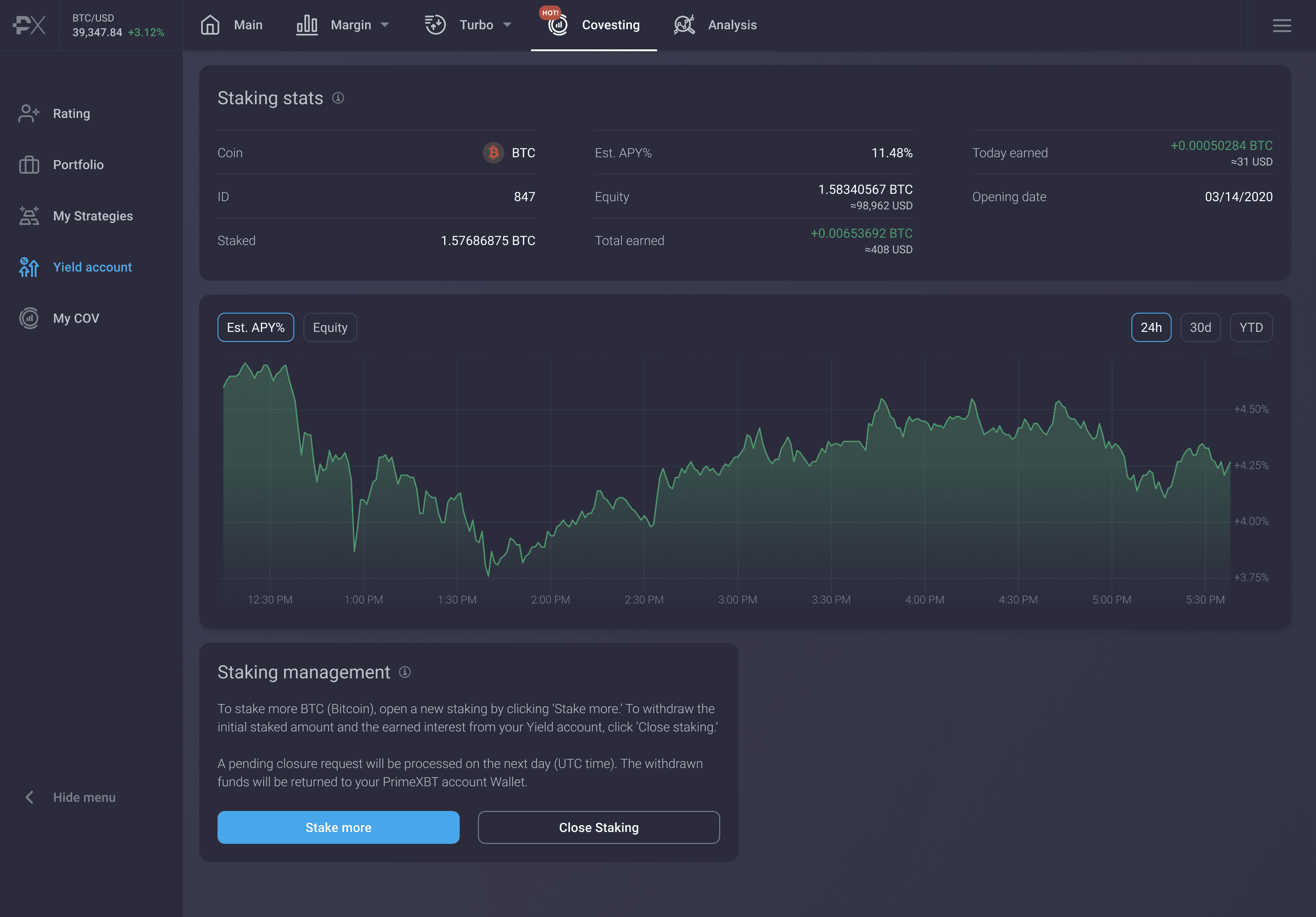

The platform shows the interest you have earned and how much you are likely to make. Each crypto asset has an individual page with in-depth information, including historical APY, equity curve, etc.

How to Start Earning?

Once the final product launches later this year, PrimeXBT users will be able to stake their crypto assets effortlessly. If you’re a PrimeXBT user, you’ll have to:

- Log in to your dashboard, or if you don’t have an account yet then use the PrimeXBT promo code to sign-up.

- Visit the Covesting Tab, and

- Select Yield Account to get started.

Recommended Read: How to make money with PrimeXBT’s covesting?

How Much Can You Earn?

One of the major thoughts that might cross your mind is how much money you can make. While there’s no fixed amount, let’s put some numbers into play.

Suppose you stake 60,000 USDC for a staking period of three months, with an average APY of 11% for the first month, 15% for the second, and 12% for the third.

Hence, you’ll earn (60000 x 11%) x 31/365 = 560 in the first month, (60000 x 15%) x 30/365 = 739 in the second month, and (60000×12%) x 31/365 = 611 in the third month. In all, you’ll make 1910 USDC in three months by simply letting your crypto assets sit in your account.

However, remember that APY rates fluctuate according to liquidity and market conditions. Therefore, users will have to monitor the rates closely and manage them periodically for the best results.

Recommended Read: PrimeXBT tutorial for beginners

Wrap Up: Happy Staking

When Covesting Yield Accounts release later this year, crypto investors will be able to leverage DeFi more easily.

Users with limited technical knowledge of blockchain and cryptocurrencies will benefit from yield-generating instruments.

Furthermore, the launch of another innovative Covesting product is likely to explode the value of the COV token even further.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023