There are as many opinions in the cryptosphere.

Some say cryptocurrencies like Bitcoin and others are only suitable as a store of value, while some see them only as a medium of exchange.

But nothing becomes a store of value just like that !!

It takes time, and it takes a long time.

But in today’s hyperconnected world, you can comfortably assume that 10 years more should be enough for cryptocurrencies like Bitcoin to be considered as a store of value.

10 years is still long for some of us, but the good thing is that some usecases like the medium of exchange, lending, borrowing, refinancing, cash-backs, insurance can be done right now !!

Or rather, I should say, crypto lending and borrowing usecase is right now live.

[wptb id="12304" not found ]

Top Crypto Lending Platforms In 2022

| Best Bitcoin & Crypto Lending Sites | Quick Links |

| BlockFi [Bonus up to 250$] | Try Now |

| YouHodler | Try Now |

| Celsius | Try Now |

| Salt Lending | Try Now |

| CoinLoan | Try Now |

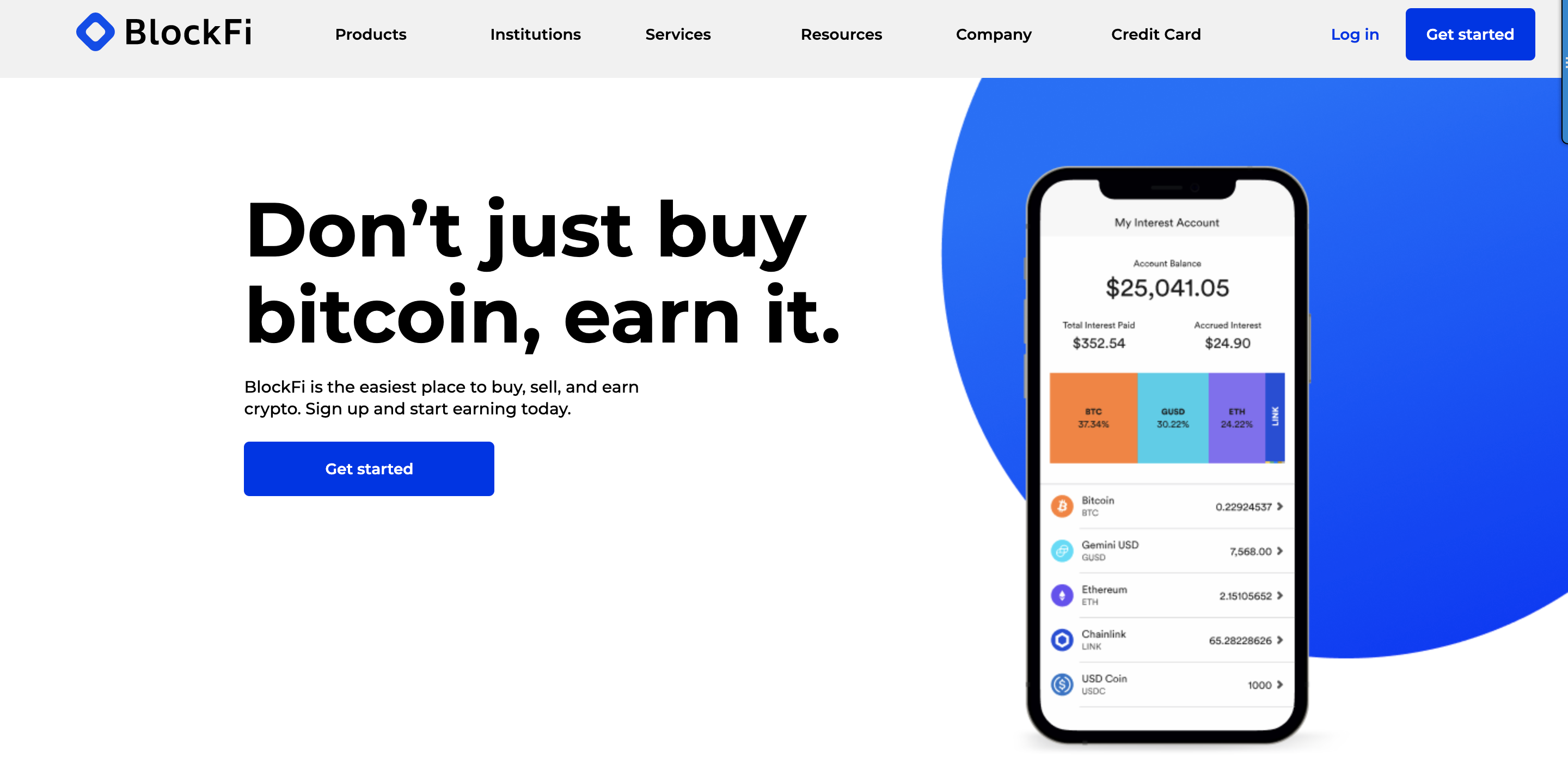

#1. BlockFi [Recommended For All]

BlockFi is another US-based pioneer company that is giving crypto collateralized loans to its users around the US. The operations are majorly centered in the USA, and the company has been getting good traction since 2018.

BlockFi is one of the pioneer companies to raise institutional funding for their crypto-backed loan start-up.

At BlockFi, you can borrow from $2000 to $100 million at an LTV up to 50%. The annual interest rate differs for the duration of borrowing, but their lowest starting interest rate is 4.5 % APR.

To use BlockFi, you need to have atleast $4000 or more in crypto, and currently, BlockFi is available throughout the US except (NV, SD, VT, or HI).

BlockFi recently ended its origination and withdrawal fees, making it worthwhile for many crypto users who have smallholdings. They also provide a BlockFi savings account, and you can expect an interest rate of up to 8.6% through it. You can find more details about the Interest rates in our detailed BlockFi Review.

If you have extra BTCs with you, you can lend them out and earn interest on them using BlockFi.

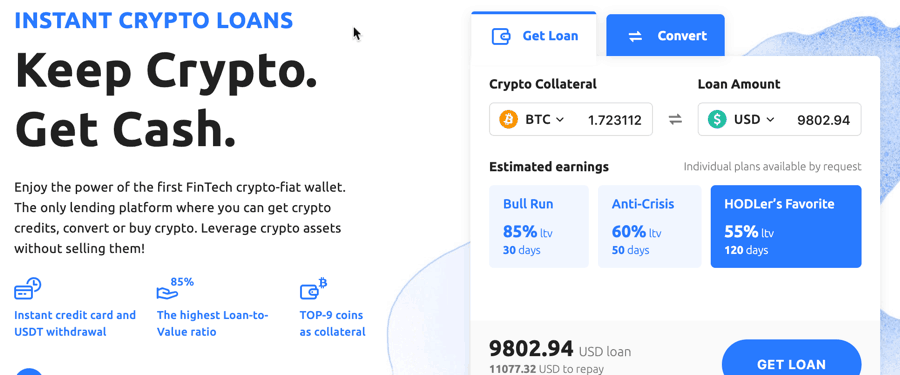

#2. YouHodler

YouHodler is a FinTech platform that provides crypto-backed loans to end-users with fiat currencies (USD and EUR), stablecoins, etc.

They have processed $10+ million in loans to customers around the globe. It is a member of the Crypto Valley Switzerland; YouHodler is revolutionalizing cryptocurrency-backed loans forever.

It gets better when you get to know that YouHodler now supports popular 12 cryptocurrencies, including Bitcoin (BTC), BCH, ETH, LTC, XLM, XRP, DASH, etc. which can be kept as collateral to get cash loans and cryptocurrency loans in EUR, USD, USDT or in BTC The most popular ones are BTC, ETH, and stablecoin loans.

At YouHodler, you can get loans up to 30,000 USD in cash-flow now for tenure up to 120 days. The interest rates vary for different currencies but are still the best in the industry. And the product is truly for the unbanked people and goes on to provide loans as low as $100 for a period maximum of 120 days which is a lot in certain countries.

During our YouHodler review, we found out their Loan-To-Value (LTV) is the highest in the industry, and using YouHodler; you can get loans of up to 90% LTV.

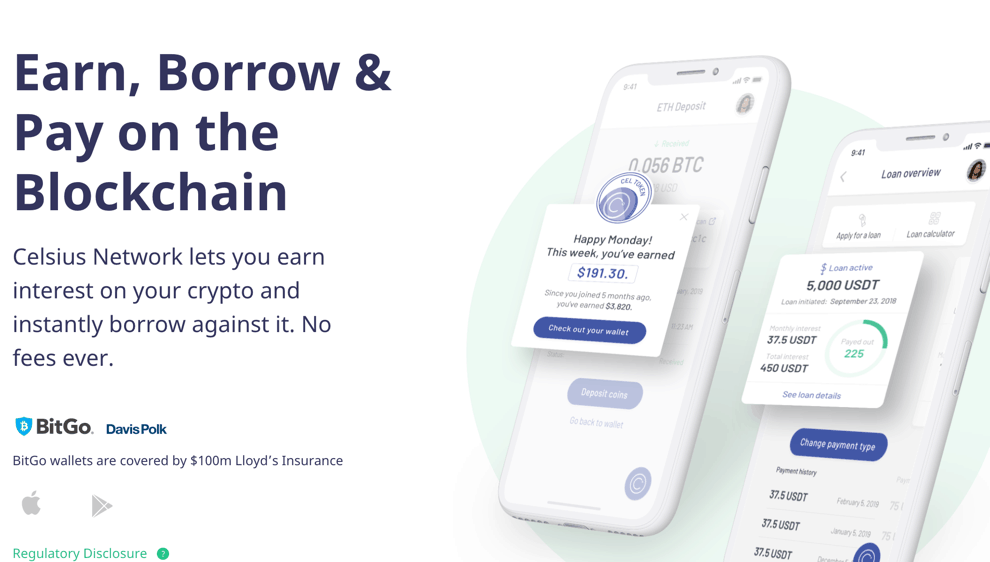

#3. Celsius Network

Another company that lends you dollars for your cryptocurrencies is Celsius Network.

Getting cryptocurrency loans is becoming the new normal, and leading in it are companies like Celsius Network. It is a digital assets lending platform that has already made cryptocurrency loans worth $100 million.

Celsius crypto lending company endeavors to bring the next $100 million people who aren’t connected to banking yet. The goal is, of course, to give banking and finance facilities through blockchain, which are otherwise denied such services by traditional means.

This way, investors who have extra crypto and want to earn on those without losing the advantage of holding them can again leverage the Celsius network to earn interest back in cash or coins.

You get cash loans for collateralizing your cryptocurrencies, and those with extra cash/cryptos get high-interest rates upto 10% for depositing the same with Celsius.

At Celsius, you can expect annual rates from 5% to 12% depending upon your collateral and can get loans up to tenure of 1 year at an LTV of up to 50%.

It is a win-win for borrowers and lenders as borrowers get the money they want without partying away from their cryptocurrencies, and lenders earn interest on their coins.

#4. Salt Lending

Salt Lending touts crypto holders to HODL their crypto and spends their cash. Its main focus is crypto lending along with other popular crypto assets (digital assets).

Salt Lending is another pioneering company in crypto lending and believes in urging its users to HODL crypto and instead take loans against it.

The company is operating since 2016, but it was only in the bear market of 2018 it really started getting a lot of traction.

The loan APRs start here from 5.99%, and you can get an LTV of 30% to 50% for a period of up to 12 months.

Through Salt Lending, you can get loans from $5000 to $100 million depending upon how much collateral you can put in. on cryptocurrency loans.

But the minimum loan amount is $5000 with no origination or prepayment fees, and when you lend, you can expect interest rates return to be up to 5.95%.

What Are Bitcoin Loans?

Bitcoin(BTC) loans are simply loans that borrowers can take against their BTC holdings. In BTC, loan borrowers need to keep their BTC holdings as collateral for which they get the extra cash they need in USD or some other stablecoin.

So basically, loans drawn over Bitcoin as collateral are called BTC loans, and there are many Bitcoin lending programs where borrowers can borrow cash for BTC, and lenders can earn extra bucks by lending their BTC.

A lender (his/her) can also loan Bitcoin and get into lending Bitcoin via the Bitcoin lending platforms mentioned below :

How does Bitcoin Loan work?

BTC loans work similarly to all the other crypto loans.

You can even compare BTC loans with HELOC loans. Heloc loans are home equity line of credit loans where one needs to keep their home as collateral to get the credit line.

But in the case of BTC loans, one first needs to keep bitcoins as collateral.

Once that is done, based on the LTV ratio and the value amount in collateral, the borrower has issued a line of credit in USD or a stable coin that he/she can use for other investments or repayment of other expenses.

This provides the borrower access to extra money without giving up the advantage of HODLing their bitcoins.

How Does Bitcoin lending work?

There is an opportunity cost for everything in the world.

When you buy and decide to HODL Bitcoin, there is an opportunity cost involved.

Let say you bought 1 BTC for $3000, and now when you HODL it, you are holding 1 BTC, which otherwise could have been invested somewhere more to earn interest on it to make it 1.1 BTC.

But some would argue that there are things like crypto trading to make your investment grow from 1 BTC to 1.1 BTC or more…

Yes, of course, there are, but not all are comfortable and used to trading crypto.

Enter Bitcoin lending !!

Everyone knows about lending, and the same concept of lending makes it Bitcoin lending if applied to Bitcoin. Moreover, in this type of lending, you have your underlying Bitcoin as collateral.

In simpler terms, when someone lends their USD or EUR or stablecoins to a borrower on an agreed interest rate for an agreed duration against their Bitcoin collateral, Bitcoin lending.

Similarly, when someone borrows extra cryptocurrencies or USD or stablecoins against their cryptocurrency holdings, it is called Bitcoin borrowing.

How & Where To Get BTC Loans?

It is 2019, and it is more than easy to get BTC loans.

To get BTC loans, you need not go through heavy documentation, KYC checks, or credit history checks that a borrower usually goes through in traditional lending & borrowing with fiat currency.

Instead, for BTC loans, you need to submit minimum documents for your identity check, and you need to have bitcoins that you are willing to collateralize.

Usually, this process only takes a few minutes, and your application for a BTC loan is made. After which, in a day or two max, your application is reviewed.

Upon review and underwriting, your loan is originated within 45-90 minutes.

So, you see how simple the process is.

But where does this all happen?

All this process of getting a BTC loan is applicable for all the sites mentioned in the previous section.

You can quickly get BTC loans through these platforms by following this simple process, which is more or less similar for all the BTC loaning sites.

But first and foremost, the loan amount or value will depend upon the current value of crypto assets (digital assets) anyone is keeping as collateral.

Now that you know the introductory part of Bitcoin borrowing and lending, let’s dwell on how crypto lending works !!

What Are Crypto-Backed Loans & How Cryptocurrency Loans Works?

As its name signifies, Cryptocurrency loans are the loans that one can take up against the cryptocurrencies that one holds.

In this type of loan, the crypto you own acts like collateral, and you can then borrow money in USD, EUR, or a stablecoin in some ratio of the value of your collateral.

The best thing about cryptocurrency loans is that you don’t need a credit history, bank account, or FICO score to get your loans.

A lot of paperwork and operational work is also discounted in cryptocurrency loans. That’s why cryptocurrency loans are straightforward and almost instantaneous to get.

So basically, here is how they work:

The cryptocurrencies (like BTC, ETH, or XRP) that you own needs to be collateralized with as much personal information that you can provide to a crypto loan platform.

Once you do that, all these crypto lending platforms have different LTV ratios set to provide you a loan. So, for example, if the LTV is 50 % and you have collateralized 20,000 USD worth of crypto, you are entitled to borrow up to USD 10,000.

Plus, for the borrowed $10,000, you need to pay the interest rate that you have agreed with the platform or the lender. For example, if you have agreed to a 5% annual interest rate, you will be required to pay $500 annually for borrowing $10,000 against your original collateral of $20,000.

Now, after six months of your borrowing, the total worth of your cryptocurrencies has increased to $40,000, which now makes you eligible for more than $10,000.

This happens because the total value of your line of credit has increased due increase in the value of your collateral. But be aware that the vice-versa is also true !!

This is also called the instant crypto line of credit.

Why Would One Want To Lend Crypto When They Have Cryptocurrencies?

This was the first question that arose in my mind when I listened to the concept of crypto-backed loans for the first time.

Of course, this should be your question, too, because it is obvious that people holding crypto can sell their crypto to get the money they want instead of taking a loan on it.

Upon further digging, I could find out that these people who need loans despite HODLing crypto are those people who need liquidity without selling their cryptocurrencies.

They want the extra money to pay for their bills or another investment without giving up their advantage of holding cryptocurrencies.

And the concept of crypto loans (or bitcoin loans) makes that possible, and that’s why you will find crypto lending programs that I have listed above doing well in the bear market also.

Why Take A Bitcoin Loan?

Many Bitcoin investors are here for the long term, and they believe in slowly accumulating as many bitcoins as possible.

But despite their long-term vision, these investors also need liquidity for various other needs such as for vacation, repayment of a loan, or to buy a car, etc.

In such cases, if they sell their bitcoins, they will lose their competitive advantage of holding BTC for the long term !!

Enter Bitcoin loans to resolve this…

Bitcoin loans resolve this dilemma of BTC holders who want liquidity without selling their BTC positions. That’s why it makes more sense for BTC investors to borrow extra cash for their BTC holdings instead of selling them outright.

Moreover, Bitcoin and cryptocurrency lending of other digital currency will become more than obvious in the coming days because financial usecases such as lending, borrowing, insurance, savings accounts like the normal bank account, etc., make more sense if done through blockchain-based cryptocurrencies.

Lastly, you get BTC loans in your Bitcoin wallet, which you control, whereas, in traditional lending, you get your loan amount in your bank account, which the bank controls.

Enter Bitcoin Lending

The working of Bitcoin lending is quite straightforward.

The borrower needs to collateralize his/her cryptocurrencies (Bitcoin) as collateral, and as per the agreed rate, duration, and LTV, he/she is issued the crypto loan.

For the lenders, also it quite easy as they need to decide to lock up their funds for the agreed duration of lending as per the agreed rates. This enables them to earn extra interest on the capital that they were holding previously.

Moreover, there are no rigorous KYC checks or credit history inquiries before carrying on Bitcoin lending.

This is because the Bitcoin loans are already overcollateralized as well as the borrowers don’t have a single source of truth that can act as a reliable credit history source.

And when it comes to Bitcoin lending, the process is similar to lending/borrowing any other cryptocurrency. But since Bitcoin is the pioneer cryptocurrency, much of the crypto lending market exists around it.

Plus, there are better lending/borrowing rates and better LTVs available while using Bitcoin. Moreover, the custodial storage infrastructure is robust and readily available for Bitcoin compared to other cryptocurrencies.

Now that you know how the Bitcoin lending cycle works, it is imperative to understand the working of Bitcoin lending platforms that facilitate this lending.

So let’s dive into it:

How Do Bitcoin Lending Platforms Work?

Almost all Bitcoin lending services work similarly except for a few processes that they might follow in-house. But if we generalize, here is a brief insight into their workings:

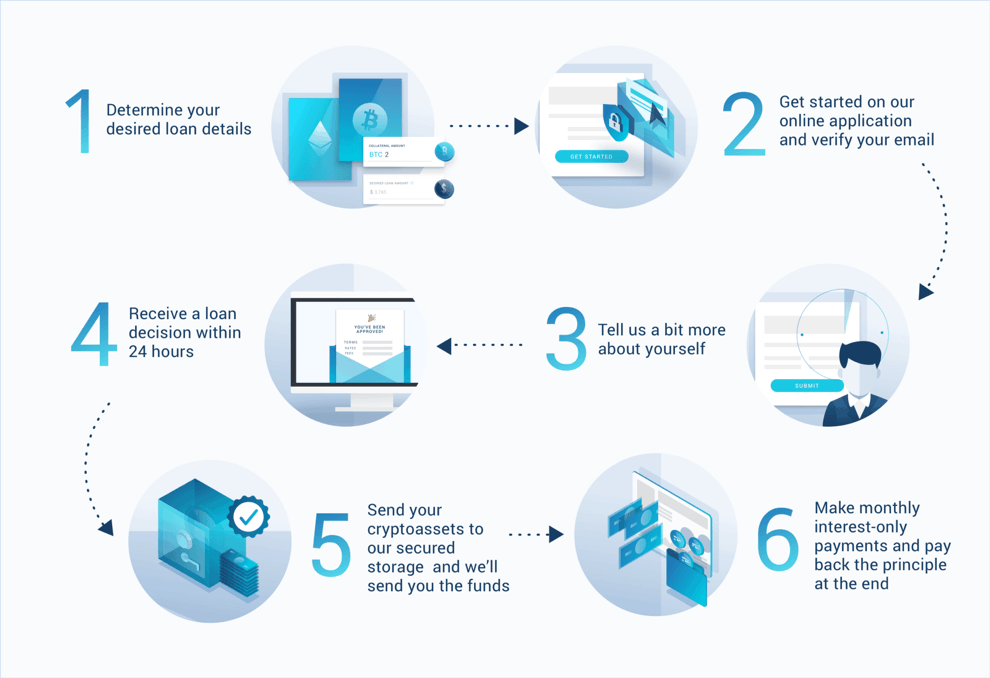

#1. Of course, first, you need to register with the Bitcoin lending platform using your email.

#2. Then you need to complete their KYC process by submitting relevant photo ID proofs.

#3. Once your KYC is complete, tell them about your loan requirements and apply.

#4. Receive a loan decision within 24 hours, including the LTV you are eligible for and the interest rate you will be required to pay.

#5. Now, you can send your Bitcoin to their safe custodial solution.

#6. Once the Bitcoins are settled on the blockchain, you will receive the promised loan amount in your bank account or stablecoins within 90 minutes.

#7. Keep paying the interest-only payments monthly and pay the principal altogether in the end. Some companies like Nexo don’t require you to pay the interest initially, and you get the option to pay the whole amount back in the end.

This is how typically the lending process works inside a Bitcoin lending platform.

Moreover, these lending platforms also give 6-7% interest on deposits you make with these platforms. For example, Nexo is offering 6.5% interest on the stablecoins that investors deposit with them. The eligible deposit stablecoins are DAI, PAX, USDC, USDT & TUSD.

On the other hand, BlockFi offers BlockFi Interest Account (BIA), interest-bearing savings account for Bitcoin lenders. You need to store your BTC or ETH with BlockFi to earn a 6.2% compounding annual interest rate on your deposit that you will receive monthly.

Bitcoin Lending Regulations

When it comes to regulatory talks around Bitcoin, the situation becomes a bit tricky.

The regulation around Bitcoin is highly fractured and fragmented across the globe, and for Bitcoin lending services, it is no different.

Many Bitcoin lending services operate only in one or two jurisdictions where there is some regulatory clarity.

For example, BlockFi operates in 45 states in the USA and is compliant with both the federal and state-level guidelines.

Another big player in the Bitcoin lending space, i.e., Nexo, claims to be regulated by SEC because they have their native security token. Also, they have different legal entities in different countries as it services 200+ jurisdictions across the globe.

The rest companies also they are operating in their small arena untill the regulatory framework is set on a global scale.

Country Wise Scenario of Bitcoin Lending

- Bitcoin Lending In The United States (US)

In the U.S., lending is regulated on the state level for non-banks and fintech companies. This regulation is similar to the MSB state-by-state approach used by Bitcoin exchanges. So any crypto lending company which aims to do Bitcoin lending must adhere to this.

- Bitcoin Lending In The UK

Bitcoin lending companies are mushrooming in the UK, too, and just like crypto exchanges need to comply and obtain a license for FCA, Bitcoin lending companies need to comply with the FCA.

- Bitcoin Lending In South Africa

Bitcoin lending is unregulated in South Africa, but Bitcoin itself is allowed. Of course, there are other taxes, such as capital gain taxes on Bitcoin in South Africa.

- Bitcoin Lending In India

India is relatively backward in terms of cryptocurrency regulations. In 2018, the RBI severed the relationship between banks and crypto businesses, which has led to chaos in the cryptosphere of India. Regarding the lending of cryptocurrencies like Bitcoin, too, there is no clarity in the Indian ecosystem. However, you will find some Indian exchanges dealing with margin lending and trading.

- Bitcoin Lending In Australia

Bitcoin lending in Australia is regulated. For example, Helio Lending is a licensed and regulated cryptocurrency lender based in Australia. This lending service provides holders of Bitcoin a safe and secure way to access fiat funds without selling any of their Bitcoin. Helio Lending issues loans under an Australian Credit License (ACL #391330).

Also, you can check with major Cryptocurrency exchanges based in Australia if they have started Bitcoin and Crypto Lending Programs recently.

- Bitcoin Lending In Canada

Canada has been particularly generous towards Bitcoin-like cryptocurrencies, and that’s why you will find Bitcoin lending services like Ledn operating from Canada.

Bitcoin Lending Risks

Bitcoin lending has many risks to start with, but they dwarf the advantages, and that’s why you have many companies starting up in this space.

But the main risk of Bitcoin lending is about custody.

There are few reliable custodial solutions for safely storing Bitcoin. Giving someone custody of your Bitcoin is quite counter-intuitive to many because this goes against the whole ethos of ‘your keys, your coins.’

But anyway, I see it this is the major risk in the Bitcoin lending space.

Bitcoin Lending Challenges

Apart from custody, there are many other challenges that the Bitcoin lending industry needs to address before it can think to go for mainstream adoption. Some of these challenges are:

- Regulatory Unclarity: There is no single international body or regulatory framework to treat cryptocurrencies like Bitcoin. That’s the reason that many lending services are acting in their fractured way in their native jurisdictions.

- Blockchain Is Immature: The blockchain infrastructure is still immature to inculcate a complex business like lending and borrowing. We don’t know who is writing these smart contracts and what’s their authenticity and reliability.

- Volatility: Cryptocurrencies are wildly volatile, and the time it takes Bitcoin collateral to change address is enough to move markets 10-20%. This can result in margin calls to the borrowers who have borrowed money by keeping their cryptocurrencies as collateral. And in drastic volatility, the borrower will be expected to increase the collateral or liquidate some of his/her collateral to rebalance the loan. This can result in an unpleasant experience for the borrower who never wanted to sell his/her bitcoins for a loan.

So these are some of the challenges and risks that I perceive that the Bitcoin lending space might face in the coming days.

Having said that, Bitcoin lending will someday become the predominant form of lending because this is natively peer-to-peer.

Moreover, Bitcoin lending gives access to billions of people who don’t have decent credit scores or a history with credit bureaus.

Some Frequently Asked Questions Interest and Loan Assets…

What is Crypto Lending & Lending Platforms?

Lending cryptocurrency to earn interest in your ideal lying cryptocurrencies is called Crypto lending. One can lend assets like Bitcoin, Ethereum, Ripple, Litecoin, etc., easy to earn extra money through interest. The places where one can loan or borrow are called crypto lending platforms.

Can You borrow Crypto?

Yes, anyone can borrow crypto, too, but the interest rates of doing are usually high. This is mostly done by experienced players to gain leverage over their trades.

What is Crypto Credit?

When one keeps crypto assets like Bitcoin, Ether, Ripple as collateral for loans, what one is effectively doing is opening a crypto credit line collateralized against the value of your cryptocurrencies.

So that’s all from our side in this introductory round-up of Crypto-backed loans sites and how you can take Bitcoin & Crypto loans?

Share this article with your friends who are interested in Bitcoin loans !!

[wptb id="12304" not found ]

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023