What Is Bitcoin (BTC) NVT Ration & NVT Signal ?

Wouldn’t it be great to know:

- When to sell Bitcoin and when to buy?

However, no matter how badly we want to know this but the reality is that we don’t know how to value cryptocurrencies like Bitcoin.

Bitcoin is the world’s first fully functional digital currency, and it is only humble to accept that we don’t know what’s its value is, $80 billion or $5 trillion !!

We are still learning, experimenting, and making mistakes.

I think you too have made your mistake in the last bull run and I have done mine also.

Since then many pioneers are now breaking their heads on forming innovative valuation models for Bitcoin so that the whole market can learn to value Bitcoin.

But it is not easy as it looks because there is no history to learn from and no other asset to be studied for inspiration.

So a lot has to be done a ground-up from scratch.

Moreover, Bitcoin is not like a company’s stock where you have cash flows and balance sheets that’s why we don’t have anything like PE ratios in crypto as we have in stocks.

But wait:

We do have something very close to PE ration that we can use in the cryptosphere, more specifically for Bitcoin to get a good approximation for when to invest or exit in bitcoin.

So let us, deep dive, and see what it is?

What Is Bitcoin NVT Ratio? (aka Bitcoin’s PE Ratio)

Bitcoin’s PE Ratio isn’t available because Bitcoin is not a stock, but the closest thing that we have is Bitcoin NVT Ratio.

Bitcoin NVT Ration also known as Bitcoin’s Network Value to Transaction Ratio indicates whether the Bitcoin’s price is overvalued or undervalued.

It is simply a ratio of Bitcoin’s network value (Market cap) and transaction volume transmitted through the Bitcoin’s blockchain in a period of 24-hours.

Also, if you see closely you will find a trend that Bitcoin marketcap is closely related to value transmitted through it but whenever this goes out of whack, and that’s where BTC NVT ratio comes to our aid.

BTC NVT ratio is also called as Bitcoin’s PE ratio because we are using value flowing through the network as a proxy to ‘company’s earnings,’ which I think is an educated approximation.

Now let us see how you can calculate BTC NVT.

How To Calculate Bitcoin NVT Ratio?

Bitcoin NVT can be easily calculated by dividing the Bitcoin network value (Market cap) by USD volume transacted over the blockchain in 24-hours.

You can easily fetch these data points from Blockchain.com and get values for market cap, and volume transacted. For example, see the Bitcoin NVT indicator calculated for 4th February 2019:

- 04/02/19 Market Cap (Network Value): $60,483,540,931

- 04/02/19 Transaction Volume (USD): $356,869,592

- 04/02/19 NVT (Market Cap / Transaction Volume): 169.48

Of course, you can use any other price and volume tracking service other than Blockchain.com but then expect a different NVT ratio because all these services are tracking Bitcoin data with their techniques and assumptions.

But in any case, you should get the overall picture which you are trying to get.

Suggested Readings…

History Of Bitcoin NVT Ratio

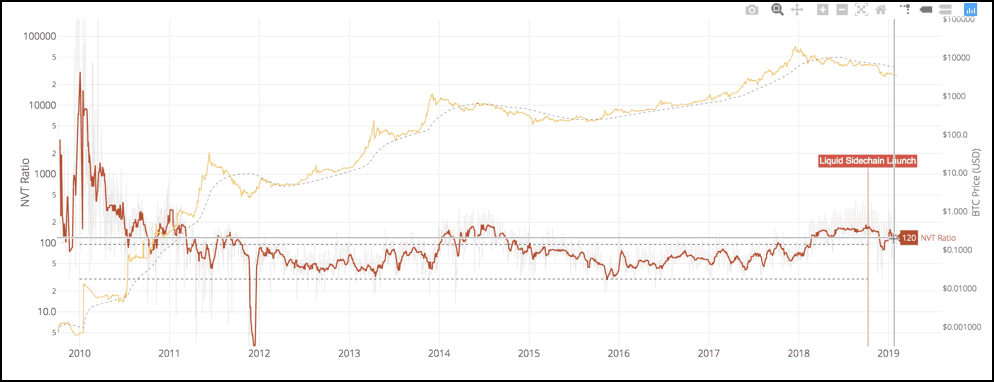

Bitcoin NVT Ratio was first proposed by Willy Woo– an independent crypto researcher and analyst on Twitter in early 2017 when the market had started panicking about Bitcoin’s overvaluation.

$BTC is not in a bubble. Here’s #bitcoin marketcap to USD volume transmitted ratio. Closest thing we have to a PE ratio. Article incoming. pic.twitter.com/OhZo9cExQV

— Willy Woo (@woonomic) February 24, 2017

And a detailed article explaining BTC NVT was published later in October 2017, Is Bitcoin In A Bubble? Check The NVT Ratio!!

But if you see the numerator in the NVT formula, you will find that market cap can vary almost instantly in Bitcoin and that’s because we know that it is a hyper-volatile asset.

And because of this price movements, the volume can also vary drastically so we need some better way to factor in these spikers and volume changes that Bitcoin usually experiences.

And that’s when NVTS, i.e., Bitcoin NVT Signal was introduced.

What Is Bitcoin NVT Signal?

NVTS or Bitcoin NVT Signal is almost the same thing as Bitcoin NVT Ratio but in a more accurate and responsive form.

NVTS is simply the ratio of Bitcoin’s network value to its 90-day transaction volume transmitted through the Bitcoin’s blockchain. This is a significant improvement over the NVT ratio because it factors in the volume changes experienced by the network in relation to Bitcoin’s last 90-days of the price.

How To Calculate Bitcoin NVT Signal?

NVTS = Network Value / 90d MA of Daily Transaction Value.

This differs from Standard NVT Ratio which is simply the Network Value divided by Daily Transaction Value and then interpolated using forward/backward moving averages to create a smooth line.

You can easily fetch these data points from Blockchain.com and get values for market cap, and volume transacted.

Of course, you can use any other price and volume tracking service other than Blockchain.com but then expect a different NVTS ratio because all these services are tracking Bitcoin data with their techniques and assumptions.

But in any case, you should get the overall picture which you are trying to get.

History Of Bitcoin NVTS

NVTS was conceptualized by Dmitry Kalichkin-Chief Research Officer at Cryptolab Capital in early 2018 as a more responsive indicator.

It is also known as Kalichkin NVT Signal but the creator, however, acknowledges the limitations of NVT by saying that it doesn’t factor in the number of transactions or number of active daily addresses of Bitcoin.

Conclusion: So Which Indicator You Should Believe?

So this was a brief explanation of two indicators that experts are using to decide whether Bitcoin is overvalued or undervalued.

But later it was realized that the volume has started moving off the chain with the release of Bitcoin’s sidechain, Liquid, which naturally now calls for a recalibration of Bitcoin NVT indicator & Bitcoin NVT signal.

Lastly, these indicators are experimental but have served to make correct calls to date, even when traditional on-exchange indicators were reading to the contrary.

So use them wisely !!

Do share this article with friends who are interested in buying/selling Bitcoin !!

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

Contents