Have you ever wondered how some traders stay active in the volatile crypto market 24/7?

They have a secret weapon called a ‘crypto trading bot.’

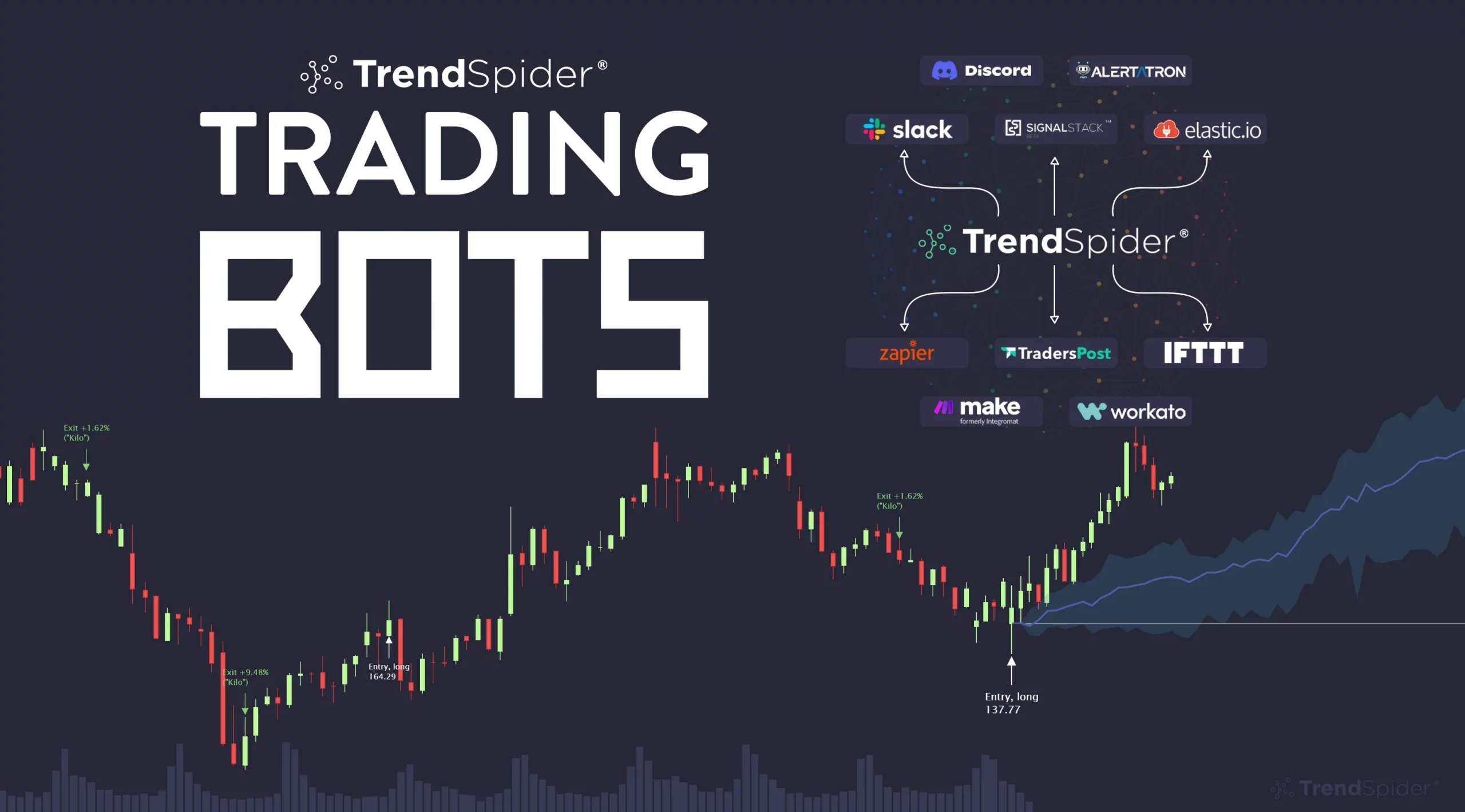

These sophisticated software programs automate trading on your behalf based on predefined rules and strategies.

They’re essential in managing and securing digital assets without constant human intervention.

In this article, I’ll delve into the ins and outs of these digital helpers.

From their basic functionalities to sophisticated algorithms, I’ll reveal how crypto trading bots work and how they can give you an edge in the crypto market.

Let’s dive in!

Types of Crypto Trading Bots

So, you’re probably wondering, “What types of crypto trading bots exist?”

Here’s the thing; these digital assistants come in various forms, each with distinct features and levels of sophistication.

Trend-Trading Bots: These guys follow the age-old wisdom, “The trend is your friend”.

They’re programmed to identify market trends and execute trades based on these patterns.

Arbitrage Bots: These shrewd bots exploit price discrepancies across different exchanges.

If Bitcoin is cheaper on Binance than KuCoin, this bot will buy from Binance and sell at KuCoin, pocketing the difference.

Market-Making Bots: Ever heard of the ‘bid-ask spread’?

These bots earn their keep by continuously placing buy and sell orders at slight variations around the market price, profiting from the spread.

Coin Lending Bots: These bots lend your coins to other traders and earn interest.

They continually monitor the lending rates to get you the best deals.

Signal Trading Bots: These bots execute trades based on signals or tips from trusted sources.

Each bot has pros and cons; the best choice will depend on your unique trading strategy and risk tolerance.

So, ready to meet your digital trading partner?

Let’s explore how these bots work in the next section.

How Do Crypto Trading Bots Work?

The answer lies in the power of automation.

So, let’s take a closer look, shall we?

The heart of a trading bot is its algorithm, the complex set of instructions that dictate its actions.

This algorithm is developed to respond to specific triggers based on market indicators, price movements, or news events.

The bot gains access to your trading corpus using the API key you get from your exchange. So the crypto in your Binance account can be used by the trading bot created in 3Commas.

Depending on the conditions you set for the trigger, you can trade when the volume of a coin is unusually high or when the order book is very lean.

The functioning of most crypto trading bots can be divided into four major stages:

- Market Data Analysis – The bot can take in a large amount of market data and analyze it according to what it has been trained to look at.

- Signal Generation – According to the market data that the bot has ingested, it generates a signal based on technical indicators and identifies potential trades. If the trade ideas are not what you are looking for, you can customize the type of data being fed to the bot.

- Market Risk Prediction – According to the signal generated by the bot and the market data it has access to, it comes up with a risk prediction for the trade and invests accordingly. This is done considering the parameters and rules set by the bot creator.

- Execution – The bot buys and sells the cryptocurrency using the API connection with the exchange and the signals generated by the preset trading system. The signals are generated by the trading bot, and the buy and sell orders are placed via the API connection.

Following are some examples of what strategies you can use:

- Moving Averages: This strategy involves a fast-moving average for short-term price movements and a slow-moving average to incorporate longer-term price movements into the calculations. For this example, we can take 10 time periods (10MA) as the fast-moving and 50 time periods (50MA) as the slow-moving indicator. In this situation, you can set up a buy signal when the 10MA crosses above the 50MA indicator and a sell signal when the 10MA crosses below the 50MA.

- Relative Strength Index (RSI): This indicator shows when an asset is overbought (>70%) or oversold (<30%). The strategy for a trading bot could be to buy when the RSI goes above 30% and sell when the RSI drops below 70%.

- Bollinger Bands: Bollinger Bands use 20 time period Moving Averages and a positive and negative standard deviation to create a range within which the price tends to trade. The bot can be set up to buy when the price breaks out from the higher standard deviation and sell when it breaks down from the lower band.

- Moving Average Convergence Divergence (MACD): MACD is calculated by subtracting the 26-period Exponential Moving Average from the 12-period EMA. The signal line is the 9-period EMA. A signal can be set up to buy when the MACD line crosses from below the zero line, the price is above the 200 EMA, and sell when the MACD line crosses from above the zero line and the price is below the 200 EMA.

But remember, while they do the heavy lifting, you’re the one setting the direction.

Bots are tools, not substitutes for strategy or due diligence.

Ready to dive deeper?

Stay tuned for the next section to discuss the benefits and risks of using these bots.

Benefits of Using Trading Bots

Trading bots are tireless, fast, and efficient.

They are also emotionally neutral when making decisions and can handle a complex trading strategy on multiple exchanges.

They don’t need sleep, food, or holidays. They can monitor the markets 24/7, ensuring you never miss a potential trading opportunity.

Let’s discuss the risks in the next section.

Risks and Drawbacks

While it’s tempting to hand over the reins to a crypto trading bot, it’s vital to be aware of the risks and drawbacks that come along for the ride.

Not all bots are created equal.

The performance of the bot depends on the implemented strategies. Some might be programmed with poor strategies, leading to potential losses.

Like any software, bots can experience downtime or bugs, potentially causing missed trades or other issues.

Contrary to what some might believe, bots are not a “set and forget” solution.

You’ll need to regularly adjust your bot’s settings to match changing market conditions.

If a bot platform is hacked, your funds could be at risk.

So, always prioritize security when choosing a bot.

Legality and Ethical Considerations

Regarding crypto trading bots, legality and ethics walk hand in hand.

In most countries, trading bots are perfectly legal, yet you’re encouraged to verify local laws before proceeding.

Ethically speaking, things get murkier.

Yes, bots can provide an edge but they might also contribute to market manipulation.

Lastly, crypto markets are unregulated, making them vulnerable to bot-driven price manipulation.

It’s your call, but it’s worth knowing the facts, right?

Up next, we’ll talk about choosing the right bot.

Choosing the Right Crypto Trading Bot

Here’s the secret: it’s all about finding one that aligns with your trading goals and skills.

For beginners, it’s crucial to choose a bot that is user-friendly and comes with detailed tutorials. Look for bots that allow for strategy customization.

While some bots offer free services, others require a subscription.

Answer questions like “Are users satisfied?”, “Has the bot been involved in any controversy?”

Do your homework; it’ll pay off.

Lastly, consider security. The bot will have access to your funds, so it needs to be from a reliable provider.

Common Misconceptions and Myths

In the realm of crypto trading bots, a few myths often circulate.

And yes, it’s important to dispel these.

Firstly, trading bots aren’t a magical solution to instant wealth.

While they can help streamline processes, it ultimately depends on your trading strategy.

Another common misconception is that they are only for the ‘tech-savvy’.

That’s not true.

With technological advancements, many bots today are user-friendly, even for beginners.

And finally, some believe trading bots are illegal.

This isn’t the case, but legal and ethical considerations do exist.

Keep reading as we cover more on these vital aspects!

Recommended Read: Best grid trading bots

Future of Crypto Trading Bots

Where is the world of crypto trading bots headed? It’s a question worth asking.

Looking forward, the increasing sophistication of these tools is evident.

As technology advances, we expect trading bots to become smarter, faster, and more efficient.

But hold on, that’s not all.

As blockchain becomes more mainstream, we’ll likely see increased regulatory oversight and standards for trading bots.

This means safer and more reliable tools for users.

And finally, as the crypto market grows, the demand for trading bots will likely follow suit.

Exciting times are ahead!

Conclusion

So, you’ve made it to the end of this journey.

From understanding what crypto trading bots are and how they work to evaluating their pros and cons, we’ve covered a lot of ground.

But wait, don’t dive in just yet.

Remember that while trading bots can be incredibly useful tools, they aren’t foolproof.

Do your due diligence, understand the risks, and choose a bot that best fits your needs.

Trading bots may be the future of crypto trading but tread with caution and wisdom.

Good luck, and happy trading!