The cryptocurrency market is very volatile, with massive fluctuations taking place every second. Hence, the market remains sideways most of the time. Predicting price moves in a sideways market is challenging.

Grid trading is an effective strategy that lets you earn passive income, increase your profitability, and limit your losses by countering price fluctuations in a sideways market. Grid trading bots make your life even easier, as you don’t need to manually create a grid. You just need to configure the bot once, and it automates grid trading for you.

However, choosing the right grid trading bot can be challenging. I’ve picked the eight best grid trading bots you can use to launch your grid strategy.

Best Crypto Grid Bots

Grid trading bots are a type of trading bot that helps you deploy and execute grid trading strategies. These bots automate the buying and selling of contracts in a price range. Once an order is executed, these bots automatically place a market order at a lower grid.

While grid trading bots can be beneficial and help you generate consistent grid trading profits, choosing the right bot is essential. Today, I’ll be talking about the eight best grid trading bots you can start using right now.

#1. Pionex

Pionex is an automated cryptocurrency derivatives exchange with 16 free built-in trading bots. It offers a grid trading bot that lets you buy low and sell high automatically. All you need to do is set up the bot and forget about it. The bot takes care of placing and canceling orders, so you can have peace of mind.

Moreover, Pionex’s grid bot lets you buy the dip and maximize your profits. Like 3Commas, Pionex allows you to choose between an AI strategy or manual trading. When you use AI, the bot selects the best parameters on seven days of historical data and recommends the most appropriate price ranges.

When you take a manual approach, you’ll have to set parameters yourself. These include the lower and upper limit price, the total number of grids, amount per grid, and stop-loss price.

In addition, Pionex has four exciting bots: reverse grid bot, infinity grid bot, leveraged grid bot, and margin grid bot. The reverse grid bot stores your crypto assets when the price is declining and sells them at the market. It repurchases those assets when the price drops, helping you make a small profit from the plunging crypto trading markets.

The infinity grid bot is a premium product by Pionex that lets you buy low and sell high. The number of assets doesn’t change, and you profit from the change in price. The leveraged grid bot multiplies your investment by 1.2x, 1.5x, 1.5x, and 2x to maximize your profitability. Finally, the margin grid bot uses your funds as collateral and uses it for trading.

You can use either of the four bots as per your preferences.

Here’s a pro tip. Diversify your investment by dividing your funds across all bot types. This way, you’ll get a chance to check how each bot performs. To know more about it, check this Pionex review.

Some key features of Pionex are:

- Only 0.05% trading fee for grid trading bot

- Arbitrage bot for 15-50% APR

- Trade directly using USD

- Aggregated liquidity from Binance and Huobi

- MSB-licensed platform by FinCEN

#2. Bitsgap

Bits Gap is one of the leading providers of crypto trading bots. It offers a bot for Bitcoin and other cryptocurrencies that allows you to set up automated trading on over 25 cryptocurrency exchanges. It supports all the major crypto exchanges, including Binance, Kraken and Bitfinex.

You can use the Bitsgap bot to set grid orders, including the grid quantity, exchange, upper and lower limit, and the percentage of the funds you want to allocate. The bot also lets you set grid spacing.

Bitsgap allows you to configure various variables. For example, you can implement parameters based on the grid quantity to set a minimum investment requirement. The bot also calculates the minimum order size and increment. For example, if you set the minimum order size at $20 and minimum order increment at $5, you can place orders for $20, $25, $30, and so on.

Bitsgap also has a stop loss feature that allows you to cut your position for a small loss. This way, you can limit your losses and protect your capital. You can either set a dynamic stop loss using the trailing up feature or use a permanent stop loss.

When your stop loss gets triggered, it will cancel all the grid orders the bot had placed. To learn more about the trading bot, check this Bitsgap review.

Let’s look at some key features of Bitsgap:

- Smart strategy design in just a few clicks

- Backtest any strategy for a longer period before investing

- Select from proven, pre-defined strategies

- Use TradingView charts to enhance your bot’s performance.

- Enjoy top-notch safety and security.

#3. 3Commas

3Commas provides crypto trading bots, along with a smart trading terminal to help you leverage automated trading and maximize your profitability. If you’re new to bot trading and looking for a simple platform to get started, 3Commas can be the right pick for you. It offers a wide range of smart trading and automation tools to make your cryptocurrency trading faster and more efficient.

3Commas’s Grid Bot makes grid trading easier. All you need to do is select a coin, decide an initial investment, and specify the prices at which you want your orders to be executed. The bot will automatically place orders based on your entered prices.

The bot has an intuitive interface, making it ideal for both novice and experienced traders. The platform also offers a seamless onboarding experience. You need to create an account, connect your exchange, and choose a bot mode. You can select between AI and Manual bots as per your needs. That’s it. Now, run the chosen strategy.

Let’s take a moment to understand the difference between the AI and Manual mode. When you choose the AI mode, the bot analyzes price movements and divides the investment amount between the left and right sides of the pair. In manual mode, you select the price range and add more grids manually.

3Commas also comes with paper trading functionality that allows you to test the bot and strategies before making the actual investment. Unfortunately, 3Commas lacks features like auto grid resizing and stop-loss, which could be a deal-breaker for some traders. To get a complete overview of the bot, have a look at this 3Commas review.

Here are some key features of 3Commas:

- Easy to set up and use

- Get trading volume from various exchanges

- Leverage AI to increase trading accuracy in all market conditions

- TradingView chart system for in-depth analysis

- Various trading pairs and multiple levels to choose from

#4. Quadency

Quadency is another popular trading platform that offers more than 15 bots and strategies to make your trading more accurate and profitable. It provides leading-edge grid trading bots to let you automate your trading strategies.

Quadency grid bots are simple and easy to set up. You only need to configure the number of grids, the distance between grids, amount per buy order or sell order, exchange, and any additional conditions. Once you specify these variables, you need to activate the bot and let it do its magic. As with other grid bots, the investment requirement of Quadency increases with the number of grids.

A unique feature of Quadency is it gives you four options to choose from when your exit price is reached. These options are:

- Cancel all the orders and terminate the bot

- Cancel all the orders, close all the open positions, and stop the bot

- Recreate grid and continue trading

- Do nothing

There’s no right or wrong thing to do here. You can choose what you want to do based on your requirements. For example, if you have a sufficient investment balance, you can recreate the grid and see how it works out. If you just want to wait and see how things unfold, you can choose to do nothing.

Some key features of Quadency are:

- Highly advanced charts for better analysis

- Boosted portfolio analytics

- Functional asset research

- Customizable as per your needs

- Choose between four options when you reach your exit price

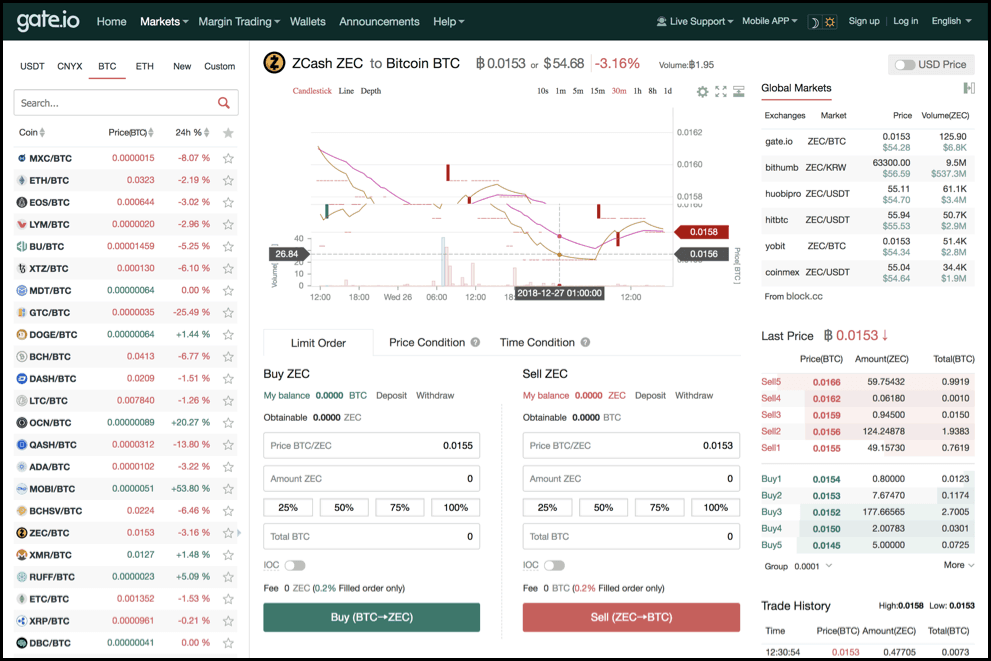

#5. Gate.io

The final grid trading bot on the list is the bot offered by Gate.io, one of the top crypto futures exchanges in the world. After logging into your Gate.io account, navigate to the Strategies Repository section. Find “Grid Trading” and click on “Create Strategy” to set up a grid trading bot. Like the Binance grid trading bot, the Gate.io bot is easy to set up and use. It works with all the cryptocurrencies listed on the exchange.

Key Features of Gate.io grid trading bot are:

- Create future grids

- No 3rd party subscription needed

- Available for USA users

- Easy to set up and use

- No need to connect with API

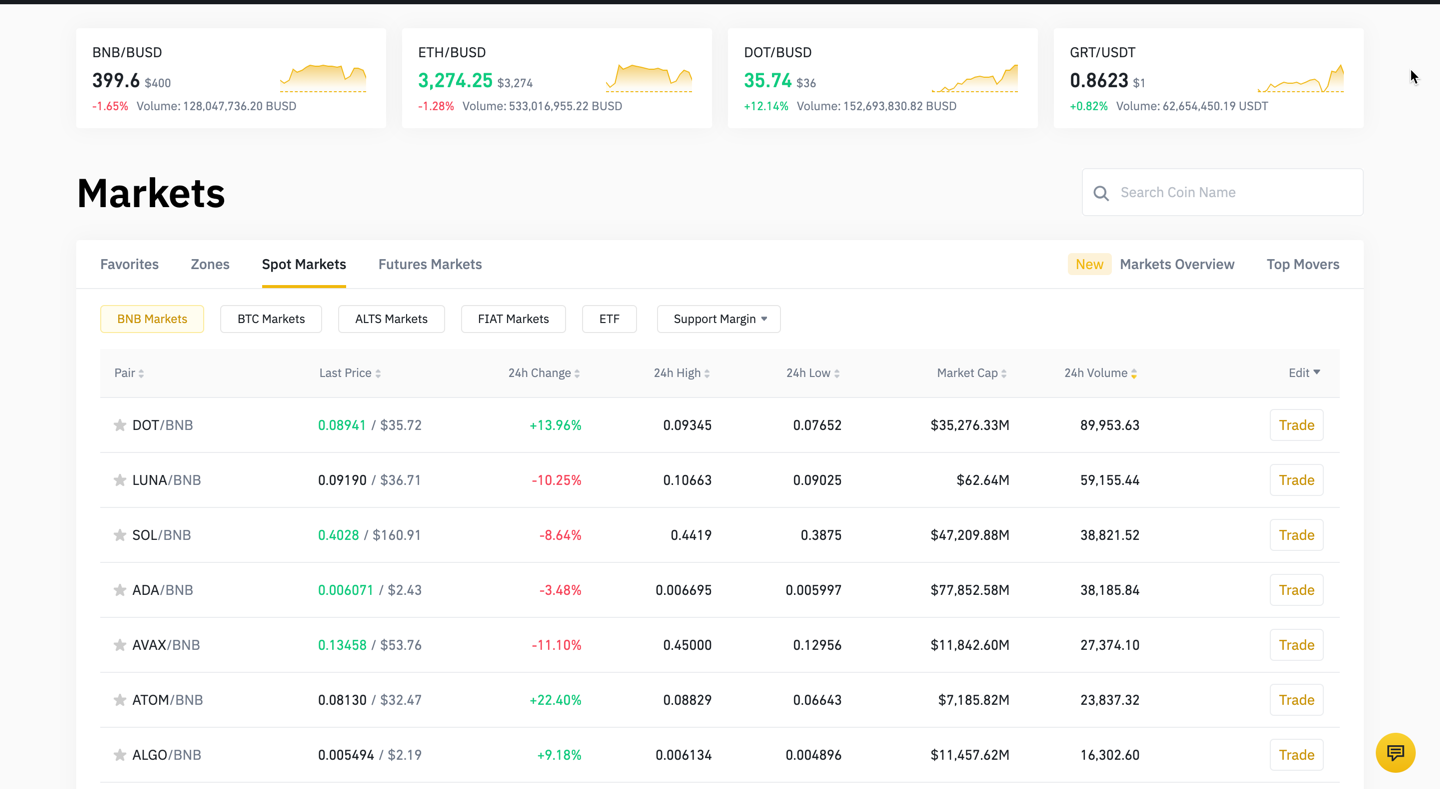

#6. Binance

Binance, the biggest crypto exchange in the world, has its proprietary grid trading bot. You can use it only if you have a Binance futures account. In the orders section, you’ll find an option for Grid Trading. You can set up your grid bot by specifying information like lower and upper prices and the total number of profitable short-time grids.

You can also choose between arithmetic and geometric grid trading. Binance has a tutorial for grid trading that you can use if you’re new to grid trading.

Key features of Binance grid trading bot are:

- Free to use

- Supports all cryptocurrencies available on the exchange

- Available for all types of futures contracts

- Arithmetic and geometric trading

- Tutorials for beginners

#7. Haasonline

Haasonline offers a range of crypto trading bots to automate proven trading strategies. The bot is called HaasBot, which provides several ways to automate your trades. The bot is configurable and is built using Haascript.

HaasBot is highly flexible. You can use it to automate proven strategies or implement new tactics. You can configure the bot using technical indicators, charting settings, and other variables.

HaasBot is easy to use. If you’re new to automated trading, Haasonline is the perfect place to get started. The bot requires minimal configuration, and you start trading within a few seconds. It also supports back-testing strategies and simulated paper trading.

Finally, HaasBot is developer-ready. If you are proficient in Haascript or C#, you can modify the bot as per your preferences.

Some key features of Haasonline are:

- Advanced crypto index with inter-exchange arbitrage

- Intelli Alice

- C# script, Flash Crash, and Mad Hatter

- Ping Pong scalping

- Place orders and use the Market-Making feature to increase liquidity

- Notifications, reporting, and email alerts

#8. BitUniverse

BitUniverse is a completely free-to-use trading bot that helps you make trading simpler and earn a better grid profit. The platform currently has 16 trading bots supporting 26+ exchanges and 6,000+ cryptocurrencies. BitUniverse has a highly effective grid trading bot with an average accounting rate of return (ARR) of 100%.

The bot runs 24/7. BitUniverse claims that the bot is very reliable and doesn’t miss a trade. It allows you to implement proven strategies and set take-profit and stop-loss orders. Since the bot is fully automated, it earns money for you even when you’re asleep.

Cutting-edge security is another key feature of the BitUniverse grid trading bot. The BitUniverse website states the bot has military-grade security, ensuring your funds are safe. The platform doesn’t use your funds directly and uses official exchange APIs to access them.

BitUniverse is ideal for you if you’re a beginner. It’s easy to set up and use, and you can learn to use it even if you’ve never done bot trading before.

Key Features of BitUniverse are:

- Support for 26+ exchanges

- Supports 6000+ cryptocurrencies

- Easy and free to use

- No sufficient balance requirements

- Secure and encrypted

What is Grid Trading Strategy?

Grid trading is a popular trading strategy used by cryptocurrency traders to earn profits in a sideways market. You can set a series of orders at predefined price intervals to create a grid of orders. Doing so helps you counter market volatility and increase your profits while limiting your losses.

However, manually doing so can be time-consuming and prone to errors. Here’s where a grid trading bot comes into the picture.

Why Use Grid Trading?

Grid strategy works, but making profits in trading is hard work. You need to analyze the markets, determine the trend, forecast the movement, and manage your trade frequency. Things get even more difficult when the market is sideways.

Grid trading eliminates the hassle of identifying the trend and predicting future movements. You can place a series of orders in both directions.

This way, you won’t miss a profit opportunity if the price goes in your predicted direction. And if the price goes against your prediction, you can exit the trade with a minor loss.

Best Crypto Pairs For Grid Trading

You can choose any crypto pair for grid trading. Liquidity is the primary factor to consider when selecting a grid trading pair. The higher the liquidity, the better. Therefore, you can pick the most liquid cryptocurrencies, such as BTC, USDT, XRP, ETH, ADA, LTC, etc.

Ideally, you should keep BTC or USDT as the base pair and trade it against other cryptos.

My top five picks for grid trading are:

- BTC/USDT

- ETH/BTC

- BTC/ETH

- ETH/USDT

- XRP/BTC

Conclusion

Grid trading is a time-tested strategy that’s becoming popular among crypto traders to manage risk and volatility.

However, if you’re new to the concept of grid trading, setting up two grids or more can be confusing. Grid trading bots make your life easier. You can easily set up a grid bot, and it will execute buy and sell orders automatically.

Which of the grid trading bots mentioned above is your favorite, and why?