Cryptocurrencies have been the subject of regulations for a long time, thanks to their decentralized nature.

This asks whether crypto should be classified as a currency or security before the governments.

To come up with the answer, the U.S. Supreme Court created a tool called the Howey Test to determine whether a particular transaction constitutes an “investment contract” and should be considered a security.

However, many newbie investors must know the Howey Test and its impact on cryptocurrencies.

Hence, to help you understand this better, I have explained all about it below:

What Is the Howey Test?

In simple terms, the Howey Test is a tool to determine whether a transaction can be qualified as an “investment contract” or not.

It is a test to see if someone is giving money to a business to make more money in return without doing any of the work themselves.

If so, the transaction is considered a security and must be disclosed.

It must also follow the registration requirements under the Securities Act of 1933 and the Securities Exchange Act of 1934.

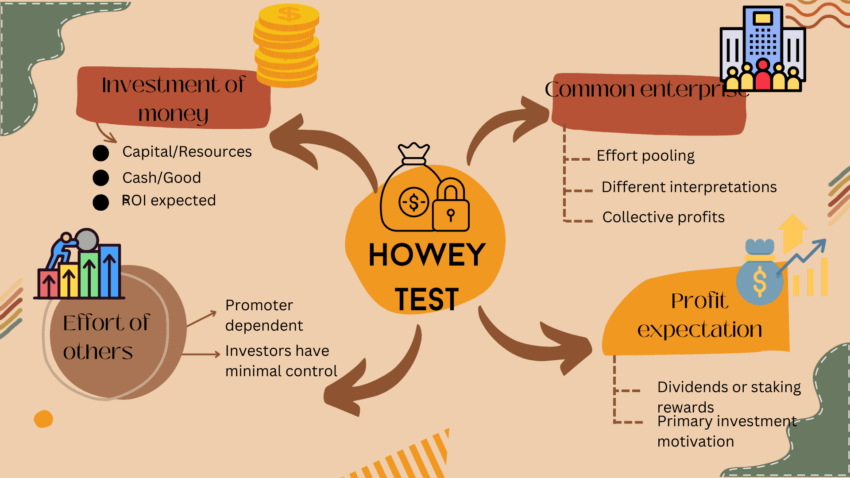

Four simple questions are associated with the Howey Test to break down the concept further.

These are:

- Did you invest money?

This means you gave some of your money to a business or project. - Is it a common business or project?

This means you’re not the only one; others also put in their money. (Applies to ICOs) - Do you expect to make a profit from it?

This means you’re hoping that the business or project will do well so that you get more money back than you put in. - Will the profit come from the efforts of others?

This means you’re counting on others to do the work to make the business successful, not you.

If the answers to all the above questions are yes, then according to the Howey Test, you are investing.

So, you will be required to follow certain rules set by the government to make sure you are playing a fair game.

Now, if you put the Howey Test from the perspective of Initial Coin Offerings or ICOs, then as you already know, developers launch ICOs to fundraise for their projects.

So by buying ICOs, you are investing, so you have to follow the government-made rules.

The Howey Test is crucial because it helps if a business or individual needs to follow these government rules.

For things like cryptocurrencies, especially ICOs, this test can help determine if they’re supposed to be treated like other traditional investments, like stocks or bonds.

Overall, you can consider the Howey Test a checklist to protect investors investing their money.

The investors must ensure they know the risk and that the business’s people are honest about what they do with their money.

New to crypto investments? Know Ways to buy and sell crypto without paying taxes

Howey Test Historical Background: SEC v. W.J. Howey Co. Case

The Howey Test comes from a well-known U.S. Supreme Court case in 1946.

The case was related to a company called the “W.J. Howey Co.”.

The company was selling pieces of land with orange groves on them.

They offered buyers a deal: you buy the land, and we’ll take care of the orange trees.

If the trees make money, you get a share of the profits. The company did not call this an investment.

However, the government needed to figure out what this exactly was.

As a result, to come up with this, the Supreme Court came up with the Howey Test to determine if this deal was an investment contract or not.

If so, then it should be regulated by the government.

The Supreme Court looked at what the Howey Company was doing and then applied the test.

The test found that the buyers were investing money by buying the land.

The company and the land buyers were together, making it a joint enterprise.

The buyers knew they would make a profit cut from the oranges sold by the company.

And they don’t have to do any work at all.

As a result, all the parts of the test were met, and the Supreme Court decided that the Howey Company was offering an investment contract.

This meant the company had to follow the rules for investments.

Recommended Read: Reasons why the government is taxing crypto

Cryptocurrencies and Securities Regulation

One of the most challenging aspects of cryptocurrencies is the regulation.

The first major problem with digital assets is the categorization.

Unlike traditional investments, cryptocurrency can act as a medium of change, a store of value, or a unit of account.

Thanks to this diverse versatility, crypto poses a regulatory challenge for agencies like the SEC, whose main job is to protect investors and crypto traders and maintain fair practice.

This is where the Howey test plays a crucial role, as it helps the regulatory bodies determine how cryptocurrency should be traded and what rules would be applied to it.

The Howey test specifically focuses on the intent of the buyer and the seller, the expectation of profits, and whether those profits are derived from the efforts of others.

Now, coming to ICOs, as mentioned earlier, Initial Coin Offerings (ICOs) are used to raise capital to fund a crypto project.

The main spotlight in this picture is raising funds.

As a result, most ICOs meet the specifications laid out by the Howey Test.

It involves investors putting money into a common enterprise, expecting profits from another’s purpose.

Regulatory bodies like the SEC have been very active in the crypto market.

Over the last few years, the SEC has fought against cryptocurrency exchanges and fraudulent schemes.

It has released private statements to clear the crypto scene for the general public.

In the end, the message from the SEC is very clear: if a cryptocurrency operates like a security, it must follow the regulatory standards. Also, USA crypto investors must use SEC registered crypto exchanges to be safe.

Determining Securities

In finance, Securities stands for a wide range of investment products such as stocks, bonds, or mutual funds.

These contracts promise to pay back more than what investors have initially invested in based on the efforts of a company issuing the security.

However, figuring out what is not a security can get challenging regarding cryptocurrencies.

However, the Howey test lays down a standard method to help one figure out the investment type.

If the investment checks all four questions, it is indeed a security and should be treated like that.

Thanks to this classification, crypto investments will be labeled security and fall under the regulatory framework.

So the investors can stay protected.

The security creators must follow specific rules about disclosing information and registering with regulatory bodies like the SEC.

As a result, no entity can launch an ICO to trick investors into investing money and later run away with the capital raised.

Instead, the entity should be held accountable for the funds raised through ICO.

Furthermore, with the rise of digital assets, regulatory bodies working to apply the Howey test to various digital assets.

However, there are still cryptocurrencies that aren’t treated like a security.

These currencies are primarily coins that are used for money transactions.

But ICOs that promise return on investments must declare themselves as security.

But applying the Howey test to cryptocurrencies can be tricky.

Digital assets are decentralized and pretty complicated most of the time.

As some ICOs may not promise any return at all.

As a result, regulators must determine the intent and then classify it.

Recommended Read: Ways to legally avoid paying crypto taxes

Initial Coin Offerings (ICOs) and the Howey Test

Initial Coin Offerings or ICOs are a raising capital mechanism used by crypto startups promising to offer ROI to the investors.

As crypto companies offer tokens in return for investments, it is like an IPO or Initial Public Offering done by traditional companies.

So when a company launches an ICO, they ask investors for money and give out their tokens in return.

In this case, the Howey test determines whether this transaction acts as an investment contract.

In this picture, there is also a viewpoint of the SEC.

As per the U.S. Securities and Exchange Commission (SEC), most tokens issued through ICOs are indeed security and should be subjected to the rules and regulations that govern stocks or bonds.

This means the issuer should register their offer and sale of their tokens.

As a result, the company has to provide all the information related to the ICO.

Like the details of the company, the details of the project, the use of funds, and any risks involved.

If the company fails to comply with these regulations, it can face penalties, fines, or legal action by the SEC.

Thanks to this, there have been many instances when some ICOs were forced to refund their investors.

Some were fined, and many adjusted their business model to comply with the rules and regulations.

Also, the Howey test played an important role in reducing financial frauds or scams conducted through ICOs.

Recommended Read: Why are so many crypto exchanges banned in the US?

What do Cryptocurrency Companies Need to Know?

Cryptocurrency companies operating in the United States must follow all the rules and regulations to avoid penalties, fines, or strict action from the SEC.

And here are a few things that crypto companies must know:

- Most digital assets are seen as securities by the Securities and Exchange Commission. As a result, crypto companies operating in the states must follow federal security laws and fulfill all the requirements for registration and disclosure.

- Any crypto company using ICOs to raise capital should know that giving out tokens is a security. As a result, the company should follow the securities rules and disclose every detail of the company and the project.

- Furthermore, the crypto companies should also disclose the use of funds. While fulfilling the rules, a crypto company must mention its financial goals when raising money through securities offerings. Also, the business is required to keep its investors aware of how the money will be used.

- Cryptocurrency trading companies are required to follow a different sort of rule. They are required to file an SEC registration form and adhere to other security regulations.

- Finally, crypto companies must know they can face huge penalties if the SEC finds any noncompliance. Hence, the best way to deal with this is to consult a lawyer who understands the subject well.

Conclusion

The Howey Test is a special checklist that regulatory bodies use to determine whether a crypto transaction is a security.

Making financial transactions through crypto will attract different rules and regulations than making financial transactions to gain ROI.

And from the perspective of ICOs, they are usually considered securities.

Their main intent is to raise capital from investors, promising them investment returns.

As a result, ICO issuers must comply with the rules and regulations laid by the regulatory bodies in the USA.