Futures are one of the most traded crypto derivatives on the Binance platform. Many traders love them for their high returns and the fact that they give them exposure to digital currencies without holding actual crypto.

Like any other form of derivatives trading, the futures market is highly volatile. Traders need to know how to manage their risk and also have a good understanding of how futures work. But before all that, you first need to open your Binance futures account.

Opening a futures account on Binance is quick and easy. This guide explains in detail all the steps that you need to follow as a beginner on the platform.

Binance Futures Account: Open a Regular Binance Account

You need to have a regular Binance account before setting up your futures trading account. For beginner traders that do not already have one, this will require you first to go to https://www.binance.com/ and click on the yellow “Register” button at the top right section.

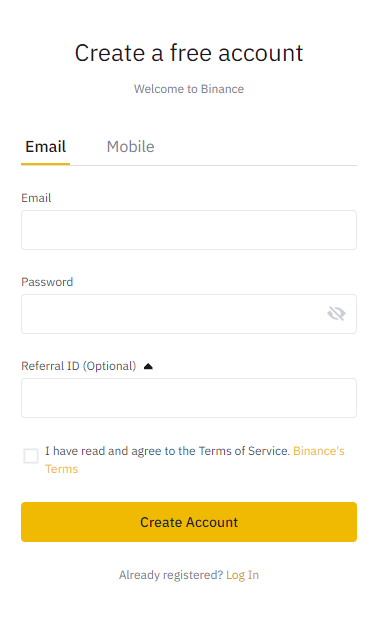

Clicking the button opens the registration form, where you will need to enter your email address and create a password for your account. If you have a referral code, you can also paste it on the box below for a discount if it has one.

You should then read the terms of service and check the box to show you agree. Once you do this, the next step is to click the “Create Account” button at the bottom to complete the registration process.

You will receive a verification email in your inbox, and you should follow the provided instructions to verify your email.

Open A Futures Account

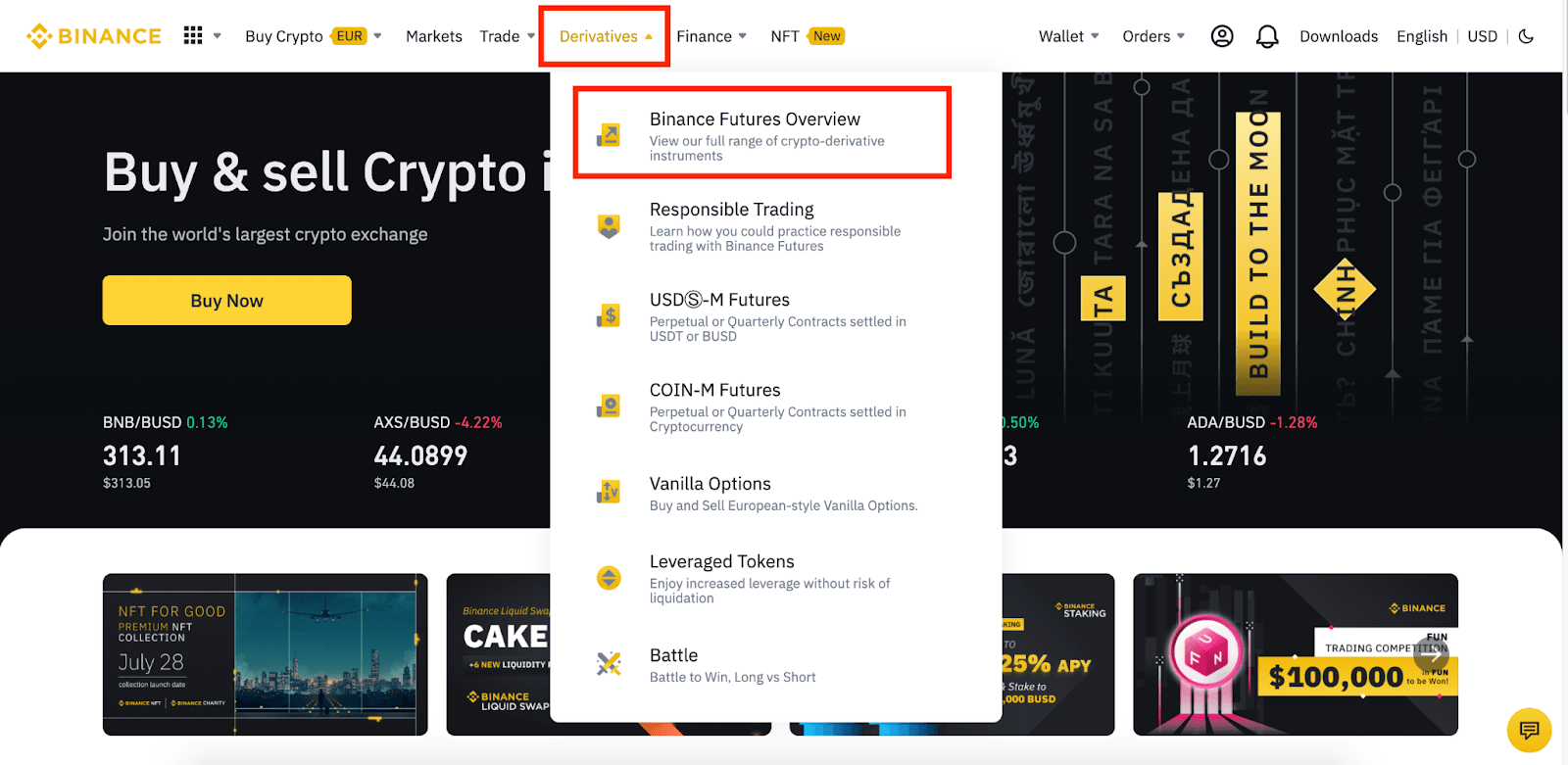

Now you can open the futures account. And to do this, you should hover your mouse over the “Derivatives” button to allow for the drop-down menu to open.

Choose and open “Binance Futures Overview” from the drop-down menu, which will be the first option on the list.

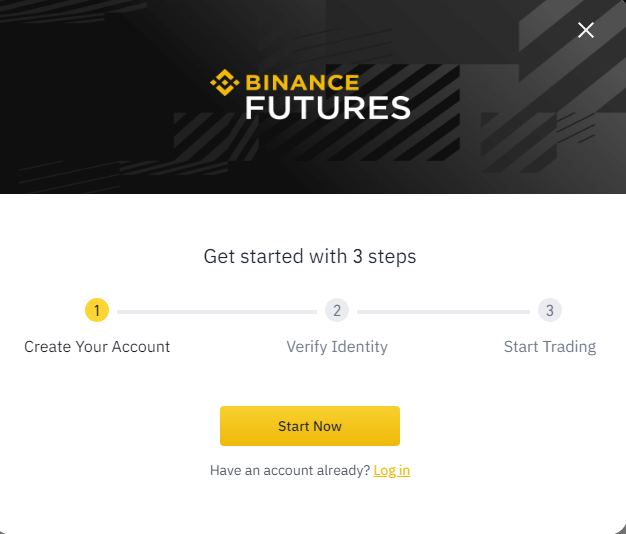

Next, you should click the “Open Now” button to activate your Binance futures account. It is important to note that you will need to verify your identity and set up 2FA to use your futures account. If you have not already done it, make sure you have your identification documents ready.

As a beginner futures trader, it is a good idea to familiarize yourself with how they work. You can get simple explanations of the basics and an overview of futures contract specifications on the futures FAQ section.

Also, Binance has a futures testnet that you can use to test things or to have a feel of the platform before risking actual funds.

Funding Binance Futures

Another important thing you need to know while figuring out how to start trading futures on Binance is how to fund your futures wallet. The good news is that the platform makes it easy to move funds from your regular Binance wallet to the futures wallet.

Hence, the most important job here is adding the funds to your regular wallet. Binance allows you to deposit both fiat and crypto assets. They offer several methods for doing this, and the right one for you depends on the specific currency you are depositing.

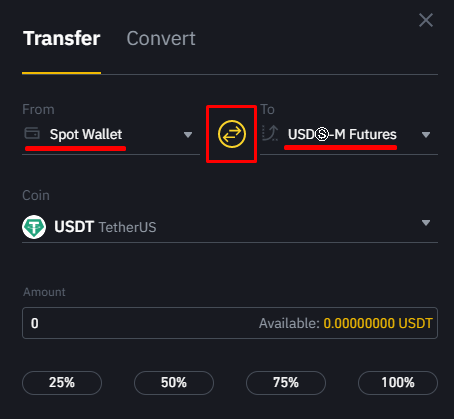

Once you have money in the regular wallet, you should click on “Transfer” on the right side when on the Binance futures page.

When the transfer page opens, you have to specify the amount you want to transfer. Other details in the transfer form will include where the funds are coming from and going to and the specific coin you are moving. If everything is okay, you should confirm the transfer, and the balance will reflect in your futures wallet shortly.

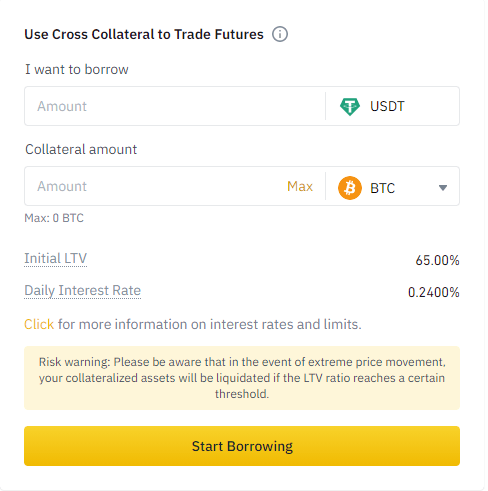

Note: You can still add funds to your futures wallet through borrowing. Here, you will have to use your regular exchange wallet assets as collateral to get a USDT loan. Binance calls it using cross collateral to trade futures.

Start Trading

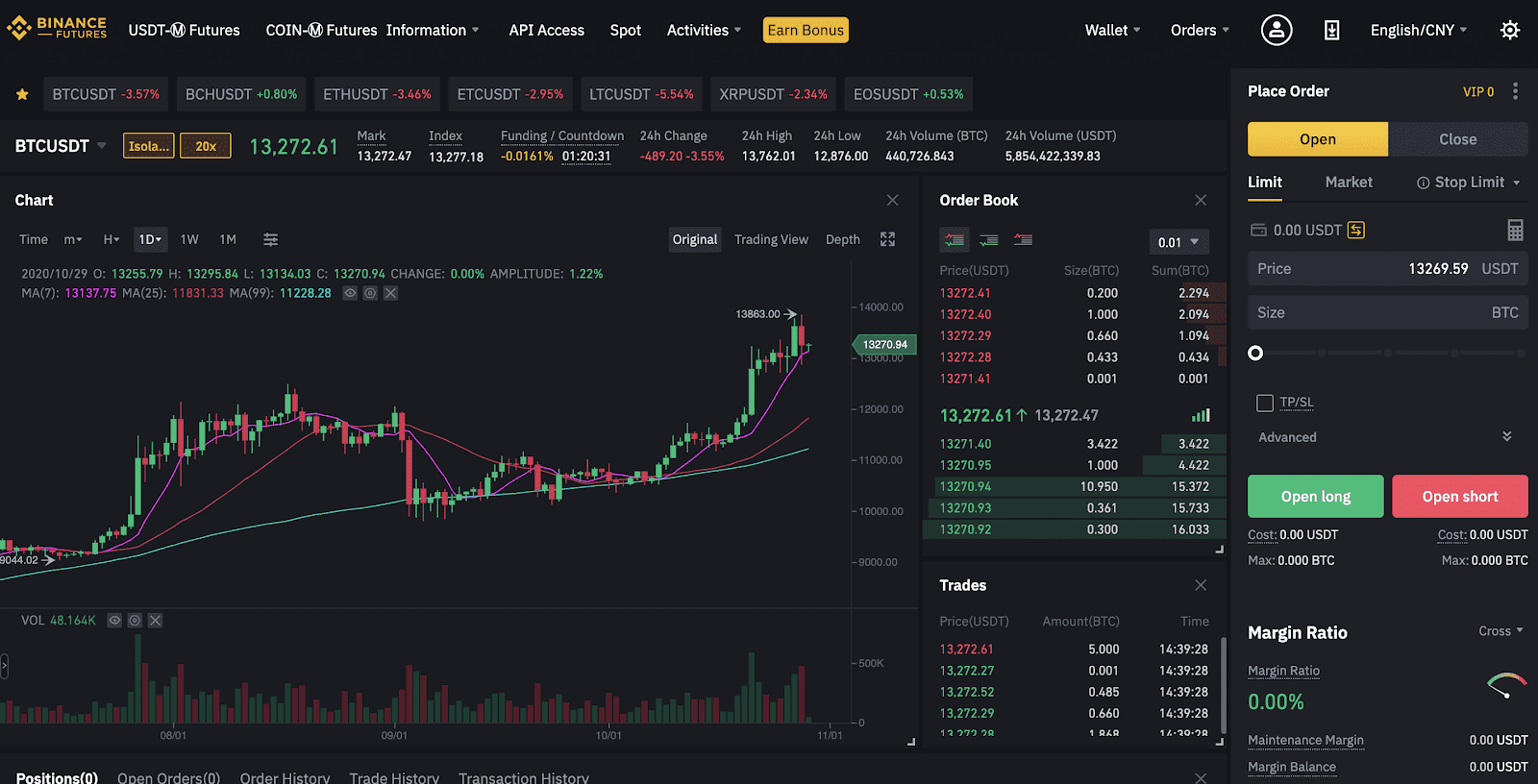

After funding your account, the next step will be to start trading. It is essential first to familiarize yourself with the Binance futures trading interface. Here is what it looks like:

The main sections in the trading interface are the chart, order book, and the place order section, where you will open a new position. Charts help you keep track of the market performance for more informed investment decisions.

When you want to open a new order to start trading, you need to choose the order type to use, with the main options here being limit and market orders, but there are still several others.

Also, you have to enter the price you are willing to pay, order size, and then adjust your leverage as it will be at 20x by default. Once you fill everything, you can open a long or short futures position.

How to Adjust Leverage

You can adjust leverage for each futures contract on Binance manually. You need to choose the contract you want to adjust and then open it on the trading interface.

Next, you should locate the leverage section on the order entry section and use the slider to change the leverage. Also, you can type in the leverage you want and click confirm.

Mark vs. Last Price

As you start your futures trading journey, you need to know the difference between the mark and last prices.

The last price is the futures contract’s last price, while the mark price is calculated using funding data and prices from other spot exchanges. Mark price will help prevent price manipulation, while the last price helps calculate your profit and loss.

Conclusion

Like most other crypto derivatives, futures contracts in Binance promise higher returns, but the risk is also high.

Although futures can also be quite confusing for beginner traders, you should be okay if you take time to understand what they are all about, starting with how to open your Binance futures account.

Luckily, Binance makes the process straightforward, even if you are new to their platform. By following the few simple steps in this guide, you should have your account set up and ready to start trading futures in just a few minutes.