With 24h derivatives trading volumes of more than USD 50 billion and open interests worth more than USD 10 billion, Binance exchange is the most popular crypto trading platform globally.

It offers many features and benefits that make it one of the leading exchanges for trading crypto futures. For instance, it supports more than 50 pairs for crypto trading and over 700 cryptocurrencies for spot trading, which is the highest in the crypto market.

High leverage, low margin trading fees, a best-in-class trading platform, and top-notch security and customer support are some reasons to use Binance.

Here is an in-depth review of the Binance trading platform and the futures trading experience it offers.

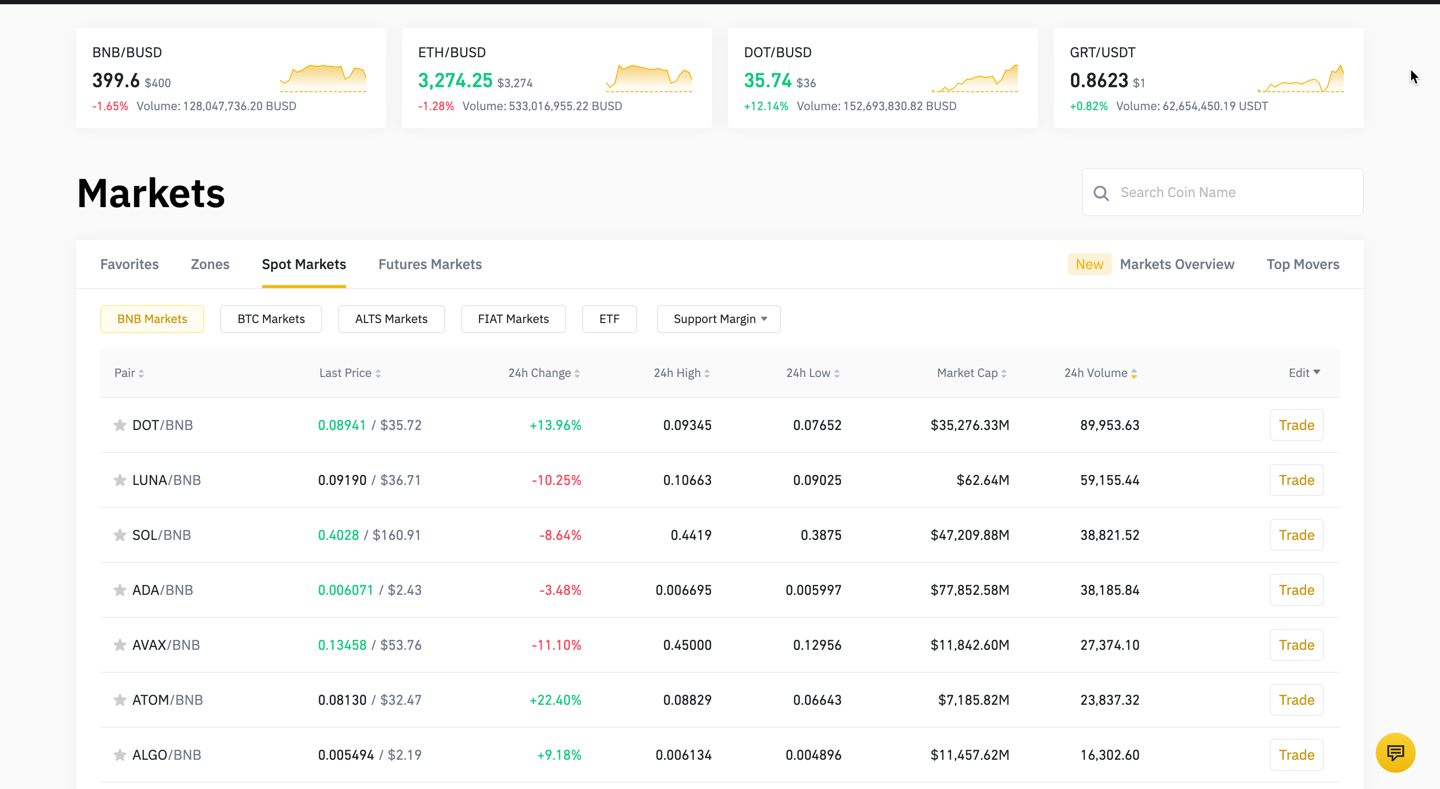

Supported Coins: Binance Futures Trading Exchange

Binance supports over 50 cryptocurrency trading pairs for futures trading, in addition to 740+ cryptocurrency and fiat pairs. Cryptocurrency pairs supported on Binance exchange include:

BNB, BTC, ETH, BCH, XRP, EOS, LTC, TRX, ETC, LINK, XLM, ADA, XMR, DASH, ZEC, TZ, ATOM, ONT, IOTA, BAT, VET, NEO, QTU, IOS, THETA, ALGO, ZILU, KNC, ZRX, COMP, OMG, DOGE, SXP, KAVA, BAND, RLC, WAVES, MKR, SNX, DOT, DEFI, YFI, BAL, CRV, TRB, YFII, RUNE, SUSHI, SRM, BZRZ, EGLD, SOL, ICX, STOR, BLZ, UNI, AVA, FRM, HNT, ENJ, FLM, TOM, REN, KSM, NEAR, AAVE, FIL, RSR, LRC, MATIC, OCEAN, CVC, BEL, CTK, AXS, ALPHA, ZEN, SKL, GRT, 1INCH, BTCB, AKRO, CHZ, SAND, ANKR, LUNA, BTS, LIT, UNFI, DODO, REEF, RVN, SFP, XEM, COTI, CHR, MANA, ALICE, HBAR, LINA, ONE, STMX, DENT, CELR, HOT, MITL, OGN, BTT, NKN, SC, DGB, 1000SHIB, IPC, BAKE, GTC, and ETHB.

As you can see, Binance supports all types of tokens, including popular tokens, less popular tokens, and also some leveraged tokens. This gives traders a lot of options to choose from.

The only drawback is that Binance doesn’t have any crypto-crypto margin trading pairs like BTC/ETH.

Derivatives Product Offerings

Binance has one of the broadest product offerings in the crypto space. It offers a wide range of products, allowing traders to trade futures as per their choice and convenience.

The following leveraged products and supported crypto contracts are available on Binance:

- USD-M Futures: These are margined perpetual contracts and traditional quarterly futures contracts settled in USDT or BUSD.

- COIN-M Futures: These are perpetual futures contracts and traditional futures contracts settled in cryptocurrency.

- Binance Leveraged Tokens: These tokens enable you to enjoy leveraged trading without the risk of liquidation.

- Binance Options: Binance Options allow you to trade crypto options.

Apart from derivatives products, Binance also offers:

- Spot Trading: Binance offers spot trading of more than 740 cryptocurrency and fiat pairs, allowing you to build your crypto portfolio.

- Binance Savings: Store your crypto assets in Binance Savings, choose zero lock-up periods, and earn interest on your crypto assets.

- Staking: Stake your cryptocurrencies with Binance and earn a passive income.

- Binance Launchpad: Binance offers an exclusive token launch platform to help you launch your own token.

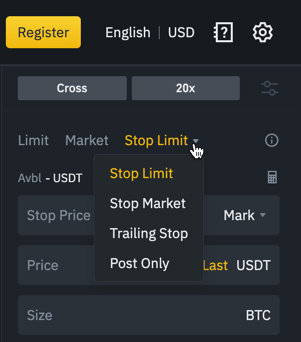

Order Types

Binance offers seven types of orders to provide you with more control over your trades. Here is a quick overview of the types of orders supported on Binance.

- Limit Order

A limit order allows you to place an order at a specific price. Suppose you want to trade a contract, but you believe you can get a better deal at another price. In that case, you can place a limit order at the desired price.

Your order will only be filled if the price reaches your entered price. However, it may happen that the price never reaches your entered price. In that case, your order will not execute.

Most professional traders use a limit order as it provides them with better control over their trades.

- Market Order

A market order is the opposite of a limit order. It executes at the current market price. If you open a futures contract chart and feel that the price is ideal for entering a trade, you can place a market order.

Please note that though market orders are meant to execute instantly, it might be the case every time. Market orders are filled depending on the liquidity. The higher the liquidity, the quicker the order will get filled.

- Stop-Limit Order

A stop-limit order is a type of limit order that is placed against an open position. Hence, such orders are also known as conditional orders.

For instance, if you go long on a pair. Now, two outcomes are possible. Either the price will go up – in the direction of your trade. Or, it will go down – against the direction of your trade.

If the price goes up, you will make a profit. If the price goes down, you will incur a loss. However, there is no limit to making a profit or loss. The price can keep going higher, and your profits can keep multiplying. Similarly, the price can keep sinking, and your losses can keep increasing.

Stop-limit orders allow you to secure your profits and limit your losses. You can place these orders to exit your positions at a specific price. Once the price reaches that point, your position will automatically close.

Stop-Limit Orders are of two types:

Stop-Loss Orders: Placed against the direction of the trade

Take-Profit Orders: Placed in the direction of the trade

- Stop-Market Order

Stop-market orders work similarly to stop-limit orders; however, they trigger as a market order. This means they don’t enter the order book, unlike stop-limit orders.

As a trader, you won’t notice any difference between stop-limit or stop-market orders, apart from one subtle difference that stop-limit orders may execute more rapidly than stop-market orders.

- Trailing Stop Order

A trailing stop order allows you to trail your stop loss based on the price movement. Let’s understand this concept with a quick example.

Suppose you want to go long on a BTCUSDT perpetual contract currently trading at USDT 35,000. However, you are not certain whether the price will go up or down, so you decide to place a take-profit order at USDT 35,500 and a stop-loss order at USDT 34,500. Here, your risk and reward are 500 points – a 1:1 risk-reward ratio.

After entering a trade, you see that the price has moved up by 250 points and reached USDT 35,250. Here, your target is 250 points away, while your stop-loss is 750 points away. If by chance, the price reverses from here and hits your stop-loss, you will lose not only 500 USDT but also 250 USDT of your profits.

To avoid this, all experienced traders use a technique called “Stop-loss trailing.” When they enter a position and the price moves significantly in their direction, they reduce their stop loss to reduce their risk. For example, if the price has moved up by 250 points, you can trail your stop loss from 500 points to 250 points, thereby reducing your risk to half.

Trailing stop-loss orders allow you to automate the trailing process. A trailing-stop order comprises to components:

- Activation Price: It is the price at which the order will trigger.

- Callback Rate: It is the percentage of movement that will cause the trailing of the stop loss.

If all of this sounds confusing, follow this guide on trailing stop orders for better understanding.

- Post-Only Order

A post-only order is an advanced attribute placed on limit orders. It ensures that your order will only be executed if it enters the order book and doesn’t execute immediately.

Liquidation Mechanism

Binance implements a liquidation mechanism – a security feature that protects users from falling into negative equity. Binance has three stages of liquidation that enable seamless liquidation while covering the losses of bankrupt positions. These are:

- Insurance Fund: Binance uses an insurance fund to ensure that profitable traders receive their profits and the excessive losses of bankrupt traders are covered.

- Socialized Loss System: The socialized loss system distributes the losses of bankrupt positions among all profitable traders.

- Auto-Deleverage Liquidations (ADA): ADLs enable the cryptocurrency exchange to select the opposing profitable traders in order of profitability and leverage to cover the losing position.

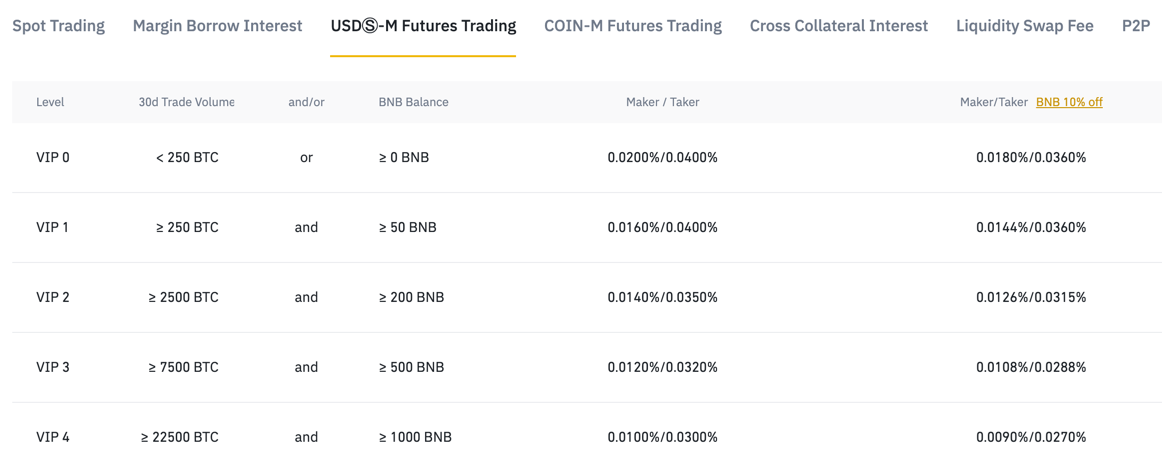

Binance Futures Trading Fees

Binance uses a market maker-taker trading fees structure. If you’re not familiar with how this model works, here’s a quick overview.

Orders placed in the cryptocurrency market either add liquidity to the market or reduce liquidity from the market. For instance, limit orders enter the order book and add liquidity, whereas market orders get executed immediately and reduce liquidity.

Orders that increase liquidity are called market maker orders, and orders that reduce liquidity are called market taker orders.

The market maker-taker fee structure is divided into two categories – the flat trading fee model and the tiered model. The cryptocurrency exchange charges specific Binance futures fees for the market maker and taker orders in a flat-fee model.

On the other hand, in a tiered model, the trading fee depends on the last 30d trading volume (and/or other factors). Binance implements a tiered fee model and has ten account tiers (VIP 0 to VIP 9).

Traders with the last 30d margin trading volume of less than 250 BTC and/or BNB (Binance Coin) balance of less than 50 BNB fall into VIP 0. For VIP 0 traders, the market maker/taker fee for USD-M futures is 0.02%/0.04%, and for COIN-M futures, the maker/taker fee is 0.01%/0.05%.

Traders with the last 30d volume of more than 750,000 BTC and/or BNB balance of more than 11,000 BNB fall into VIP 9. For VIP 9 traders, the market maker/taker fee is 0.00%(free)/0.017% for USD-M futures and –0.09%(rebate)/0.0024% for COIN-M futures.

For USD-M futures, you can also avail of an extra 10% discount on Binance futures trading fees on all tiers by using Binance Coin (BNB) tokens for completing transactions.

Deposit & Withdrawal Fees

Binance does not charge any fee on cryptocurrency deposits and withdrawals. However, blockchain network fees can apply when withdrawing funds. The blockchain network dynamically sets the fee, and the exchange doesn’t set or control it.

Binance charges a small fee when you deposit fiat currency using certain deposit methods. For example, a 1.80% fee is charged on bank card deposits of Pound Sterling (GBP). Be sure to check the fiat fee deposit fees before making a deposit.

Binance Fees – Funding Rate and Fees

Binance implements a robust funding mechanism to ensure that the price of the perpetual contracts remains close to the underlying asset price.

If you are a new crypto trader, you may not be familiar with the concept of funding rates. Here is a quick overview of how it works.

Traditional futures contracts on Binance have a quarterly expiry. Hence, no matter how far away they trade from the spot price, they converge on the day of expiry. However, perpetual swaps don’t have an expiry date, and hence, they can trade at a price away from the spot price for long periods, and the difference might increase.

This creates an unfair bias in the market.

For example, if the futures contract is trading above the spot price, it shows that buyers are dominant in the market. Hence, more buyers will hop on the trend, increasing the futures price even further. This will make the market one-sided.

To avoid this, Binance implements a funding rate mechanism. A funding rate is levied on each perpetual swap order. When the contract’s price is higher than the spot price, buyers pay a funding fee to sellers. Similarly, sellers pay a funding fee to buyers when the price is lower than the spot price.

This creates a balance and ensures that the price of the perpetual swap stays close to the spot price. Binance uses the interest rate and the premium to calculate the funding rate.

The interest rate in Binance Futures is fixed at 0.03% per day, while the premium varies based on the difference between the perpetual swap and the Mark price. The payable funding fees are calculated by the following formula:

Funding Fees: Trade Size x Funding Rate

Please note that funding fees are paid among traders, and exchange is not involved. The exchange only sets the funding rate. Binance refreshes the funding rate every eight hours.

Derivatives Trading Platform & Tools

Binance futures platform is second to none in the crypto industry. The most advanced trading platform offers a robust, simple, user-friendly, and sophisticated trading experience to beginners, experienced traders, and institutional traders.

To date, the Binance platform has never had issues regarding performance, uptime, and ease of use. Let’s take a comprehensive look at the Binance futures platform and what it offers.

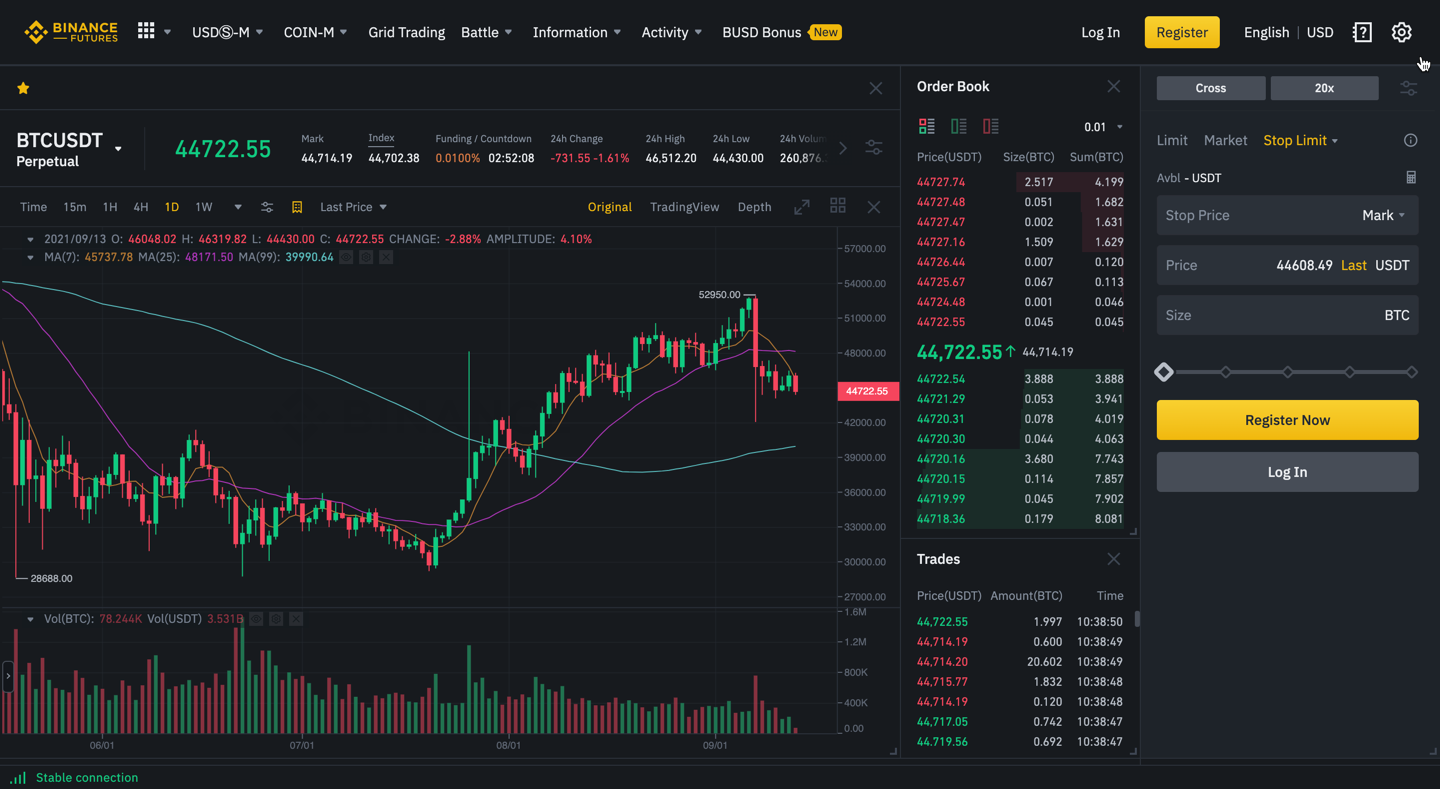

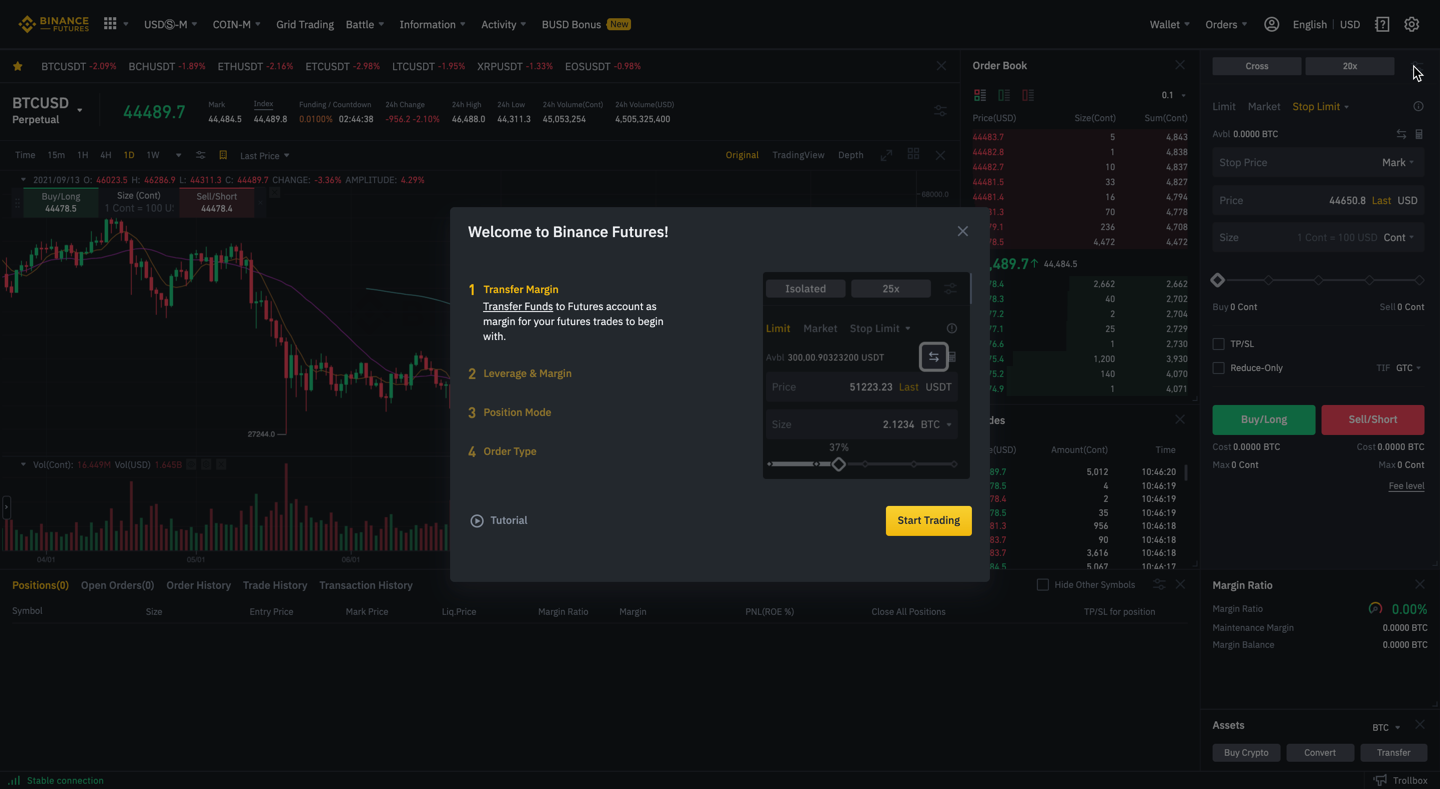

Binance Futures Platform (Desktop)

Binance has a highly intuitive desktop trading platform. The panel is feature-rich yet easy to learn, use, and navigate. On the right side of the panel is the chart of the futures contract you have selected. Binance implements a TradingView charting system.

The left side of the panel is the Order Book, recently-placed trades, and the Order Form. The Order Form allows you to place orders effortlessly. You can enter details like the quantity you want to trade, the leverage you want to use, and the type of order you want to place. Thereafter, you can go long or short by clicking on Buy or Sell.

- Binance Futures Platform for Mobile Futures Trading

Binance has a mobile app for iOS and Android devices. The Binance app is one of the most intuitive mobile trading platforms in the crypto market and offers an amazing trading experience.

It comes in two versions: Binance Lite and Binance Pro. Binance Lite is a spot-trading app that allows you to create a Binance account and add funds. Binance Pro, on the other hand, comes with desktop-level functionality and offers everything from futures trading to staking to the token launchpad.

Both versions of the app are available for free, and you can switch between the two versions with a single click.

- Charting Systems

Binance platform comes with two types of charting systems. The first one is its proprietary charting system. The Binance charting system is robust and has all the features you can find in other top-notch chart visualization tools.

It comes with numerous technical indicators, drawing tools, and chart types to help you perform technical analysis and discover potential trading opportunities.

In addition, Binance has the TradingView charting system, which is the industry standard in the crypto space. It has more features than the FTX exchange or Binance charting system and is better for professional traders who prefer more tools and indicators.

- Analysis Tools for Futures Trading

The charting systems include a wide range of technical analysis tools that enable traders to conduct comprehensive technical analysis and take high probability trades. Key technical analysis tools available on the Binance futures platform are:

- Chart Types: Binance provides seven types of charts: Bars, Candles, Hollow Candles, Heikin Ashi, Line, Area, and Baseline. You can choose a chart as per your preference.

- Time Frames: Binance allows you to view a chart on a time frame ranging from 1 minute to 1 month. Thus, you can conduct an in-depth analysis of historical price data and identify long-term and short-term trends.

- Indicators: Binance offers hundreds of indicators, allowing you to perform detailed technical analysis. You can also use multiple indicators at once to grasp more information about the price movement.

- Drawing Tools: Binance provides trend line tools, Gann and Fibonacci tools, prediction and measurement tools, and patterns to identify and mark crucial levels and make better trading decisions.

Deposit Methods

Binance offers a wide range of deposit methods, and you can choose a payment method as per your preferences. It supports trading of both crypto and fiat deposits, providing substantial flexibility to traders.

When it comes to cryptocurrency deposits, Binance accepts almost all popular cryptocurrencies.

Binance also supports fiat deposits and various currencies. Depending on the currency, you can deposit fiat money using bank transfers, cards, P2P trading, or third-party payment gateways like Banxa.

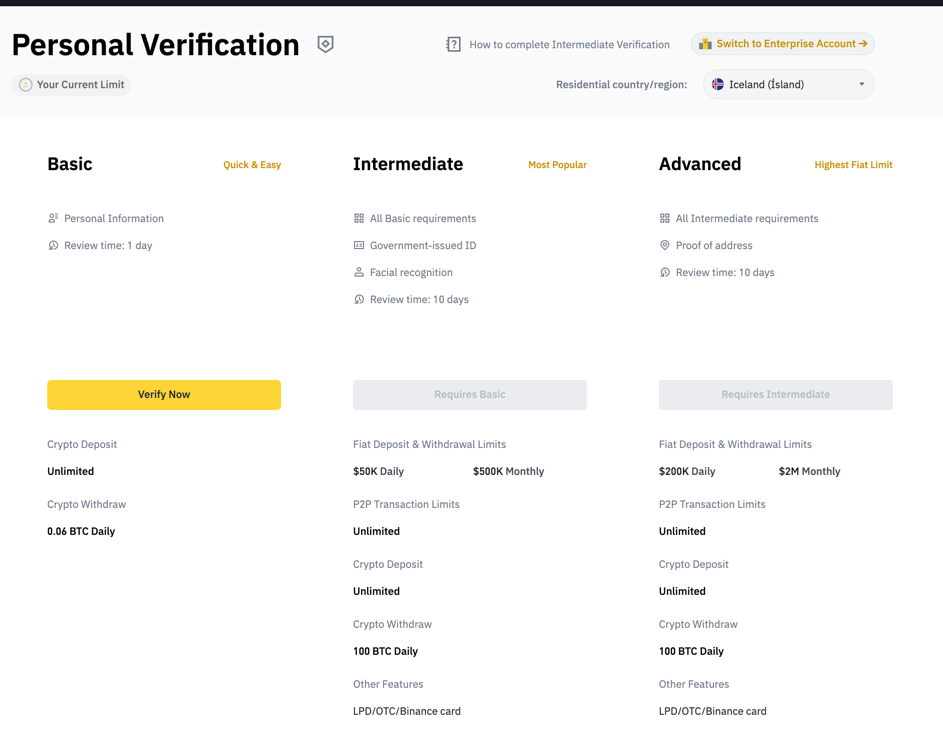

Account Types & Limits

KYC verification isn’t mandatory of Binance, but the company encourages its users to complete the verification citing security reasons. That said, Binance has three account types based on the level of verification.

Basic Verification

For basic verification, users need to provide personal information, i.e., email address and password. Basic level users can enjoy the following benefits:

- USD 300-lifetime crypto purchase and fiat deposit limits

- USD 300-lifetime fiat withdrawal

- Max 2 BTC withdrawal per day

Intermediate Verification

For intermediate verification, users need to provide basic verification information and a government ID and facial verification. Intermediate-level users can enjoy the following benefits:

- USD 50,000 daily crypto purchases and fiat deposits

- USD 50,000 daily fiat withdrawal

- Max 100 BTC withdrawal per day

- Perks like Binance Card, OTC, and P2P

Advanced Verification

For advanced verification, users need to provide intermediate verification information, along with proof of address. The advanced verification process takes ten days. Once verified, users can enjoy the following benefits:

- USD 200,000 daily crypto purchases and fiat deposits

- USD 200,000 daily fiat withdrawals

- No BTC withdrawal limits

- Perks like Binance Card, OTC, and P2P

Now, new traders might be confused about which level of identity verification they should complete.

If you are a beginner trader who just wants to explore the Binance futures market and trade futures, the basic level verification will be ideal for you. If you are a seasoned trader who wants to enjoy the Binance futures exchange benefits, intermediate-level verification will be ideal for you.

If you are an institutional trader, the advanced-level verification will be ideal for you as you can enjoy unlimited BTC withdrawals.

If your daily traded volume is more than 50 BTC, you are eligible for the Binance VIP program. As a VIP member, you can create sub-accounts in addition to users’ regular trading accounts, which can be a helpful feature for institutional traders.

How to Start Futures Trading on Binance?

If you are new to the crypto world, starting with crypto leverage trading exchanges can be daunting. But it doesn’t have to be that way. Here is a comprehensive, step-by-step guide to Binance futures trading that will set you up for success.

1. Create a Binance Futures Account

The Binance futures account is different from the regular Binance account. Once you register on Binance, you’ll need to activate your futures account. It is a one-click process, and your account will get activated instantly.

After that, you’ll have to decide whether or not you want to complete the KYC process. If you are a new trader, you may ignore this step for now and verify your identity later—lastly, deposit funds in your future wallet.

2. Pick a Contract to Trade

New traders often only know about Bitcoin and Ethereum as they are the two prominent cryptocurrencies in the crypto space. However, hundreds of hundreds of cryptos to trade, and Binance lists almost all of them.

So, instead of hopping on the Bandwagon and going long on a BTCUSD futures contract, do some research and figure out which contract is the best to trade. However, since Bitcoin futures have the highest liquidity, they are the most popular option among crypto derivatives traders.

3. Conduct a Proper Technical Analysis

Please note that nobody can be right every time in the crypto market (or the stock market). You need to predict the price movement with the highest probability and maximum possible accuracy as a trader.

Technical analysis helps you achieve that accuracy. You don’t need to be an expert technical analyst, but knowing the basics of technical analysis will give you an edge over traders who have no strategy.

Please remember that even the most accurate technical analysis doesn’t guarantee a win; however, it can increase your chances of placing a profitable trade.

4. Place an Order

Once you have decided to place an order, it’s time to enter a trade. As discussed, Binance allows you to choose from various order types.

Since the cryptocurrency market can be quite volatile, it’s better to go for limit orders. You can enter a specific price at which you want your order to execute, and it will get filled only if the price reaches your desired price. This provides you with more control over your trade.

However, you are trying to trade with the trend, the price at which you enter may not be too important. In those cases, a market order will get the job done.

The next step is to decide the quantity you want to trade. Binance allows you to trade BTC futures with up to 125x leverage, which can seem very tempting to new traders. However, keep in mind that trading futures market with high leverage is the main reason for forced liquidations.

So, choose the quantity and leverage wisely. If you are a new trader, it is better to keep your leverage under 20x.

After deciding on all these details, you can buy (go long) if you feel the price will go up and Sell (go short) if you feel the price will go down.

5. Exit Your Order

Exiting your trade at the right place and time is as important as entering a trade. If you don’t have a good exit strategy in place, you can either lose out on potential profits or end up in huge losses.

There are two ways to manage your exits. The first is the manual way, in which you continuously monitor your trade and exit when based on whether you have earned enough profit or your loss has reached your risk capacity.

The second way is to automate your exits using stop orders. You can place a stop-loss order in the opposite direction of your trade and a take-profit order in the direction of your trade. Your position will be canceled when the price reaches either of the specified prices.

Security Features

Binance is one of the safest crypto futures trading exchanges in the market, and it implements several security features to provide a safe and risk-free trading experience to its users.

Let’s look at the key security features implemented by Binance.

- Cold Wallet Storage System

Using a cold-wallet storage system is a norm in the industry system. A Cold futures wallet is an offline wallet, and withdrawing funds from it requires multiple signature keys. Binance stores most of its users’ funds in cold wallets to protect them from hackers and other risks.

- Withdrawal Authorization

The Binance team manually authorizes withdrawal requests without allowing users to withdraw their funds. Moreover, non-verified users have daily withdrawal limits of 2 BTC further to reduce the risk of unauthorized and malicious withdrawals.

- Two-Factor Authentication

Binance encourages users to activate two-factor authentication, which acts as an additional layer of protection for all users’ accounts. When 2FA is activated, the user needs to prove the ownership of the account twice to log in.

- Technologically Advanced Platform

Binance has a robust and cutting-edge platform empowered by advanced technologies. It uses IP whitelisting, SSL encryption, traffic monitoring, and other tactics strategies to ensure the platform’s security.

- Binance Insurance Fund & SAFU

Forced liquidations are a common event in the crypto space, and for a trader, that is the last thing you want to see. Binance implements an Insurance Fund and Secure Asset Fund for Users to prevent counterparty liquidations and cover losses of bankrupt accounts.

- Insurance Fund

The Insurance Fund uses the collateral from fees on clients to cover the losses of accounts below zero in value. If a user has less than 0 USDT balance after forced liquidation at the liquidation price, Binance needs to take over the remaining positions of that account.

The Insurance Fund enables Binance to take over those positions and offload them onto the futures market. If the Insurance fund is not able to take over the positions, forced counterparty liquidation will occur.

- Secure Asset Fund for Users (SAFU)

SAFU is an emergency Insurance Fund. If the Insurance Fund cannot fund the open positions of the bankrupt account, Binance can use SAFU to fulfill those requirements.

The purpose of SAFU is the same as the Insurance Fund – to avoid the forceful counterparty liquidation of users’ funds.

Binance Futures Support

Binance has a dedicated Binance customer support center that offers top-notch customer support to its users. It provides support primarily through email. You can raise a ticket, and the team will contact you within a few hours.

Apart from email, the Binance team is available on Telegram and Twitter. Binance also has a comprehensive knowledge base that answers all the questions traders can have.

Binance Futures Review Summary

Let’s quickly recap this comprehensive Binance futures review by discussing the pros and cons of using Binance for futures trading.

Coming to the pros first, Binance supports the highest number of cryptocurrencies among all exchanges. It also offers a wide range of trading options to choose from, such as COIN-M futures, USD-M futures, Vanilla Options, and more.

Binance charges low trading fees and supports numerous deposit and withdrawal methods for both crypto and fiat currencies.

Above all, it has one of the best trading platforms in the crypto market that offers an institution-grade trading experience.

The downside to using Binance is that you need a KYC verification to unlock all the features. Also, it isn’t available in the US, and US traders will need to use a VPN to trade on Binance. If you looking for an alternative we recommend Bybit exchange a worth competitor of Binance Futures.

You might also like: