Binance is one of the premium crypto exchanges for traders looking to take positions on their favourite crypto coins.

When taking positions, traders can either bet on the price of the asset increasing (going long) or that the price will decrease (going short).

Traders also have their own time frames for the trade to play out.

Some might be scalpers or short-term traders who trade on the 1-hour time frame, whereas a swing trader trades on the 1-day or even 1-week charts.

Whichever style of trading works for you, this article will take you through the ways you can take a short position on Bitcoin using Binance and profit from the downward price movement.

Short Bitcoin (BTC) Crypto on Binance

- Short Bitcoin (BTC) Crypto on Binance

- Shorting Bitcoin with Futures contracts

Shorting Bitcoin With Margin Trading

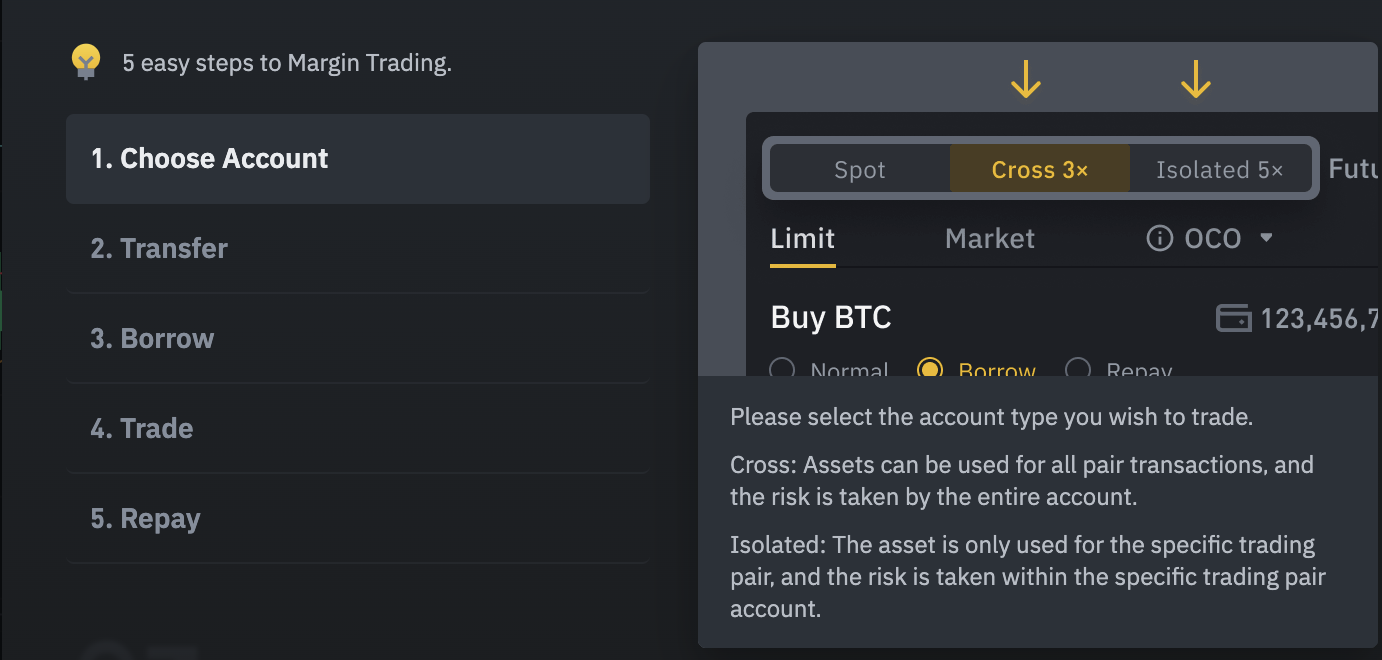

Once you have created a Margin account on Binance, you must follow the 5 steps depicted above to make money off of a short position.

- Choose Account

Once you have selected the Bitcoin pair you would like to trade, you can select whether you want to take a spot position or a leveraged position in either the Cross-margin mode or the Isolated margin mode.

In the cross-margin mode, all the assets in your Margin wallet are available for all of your open positions. The risk is then for your entire account.

For the purpose of this article, let’s consider that you take an Isolated margin position with 5x leverage.

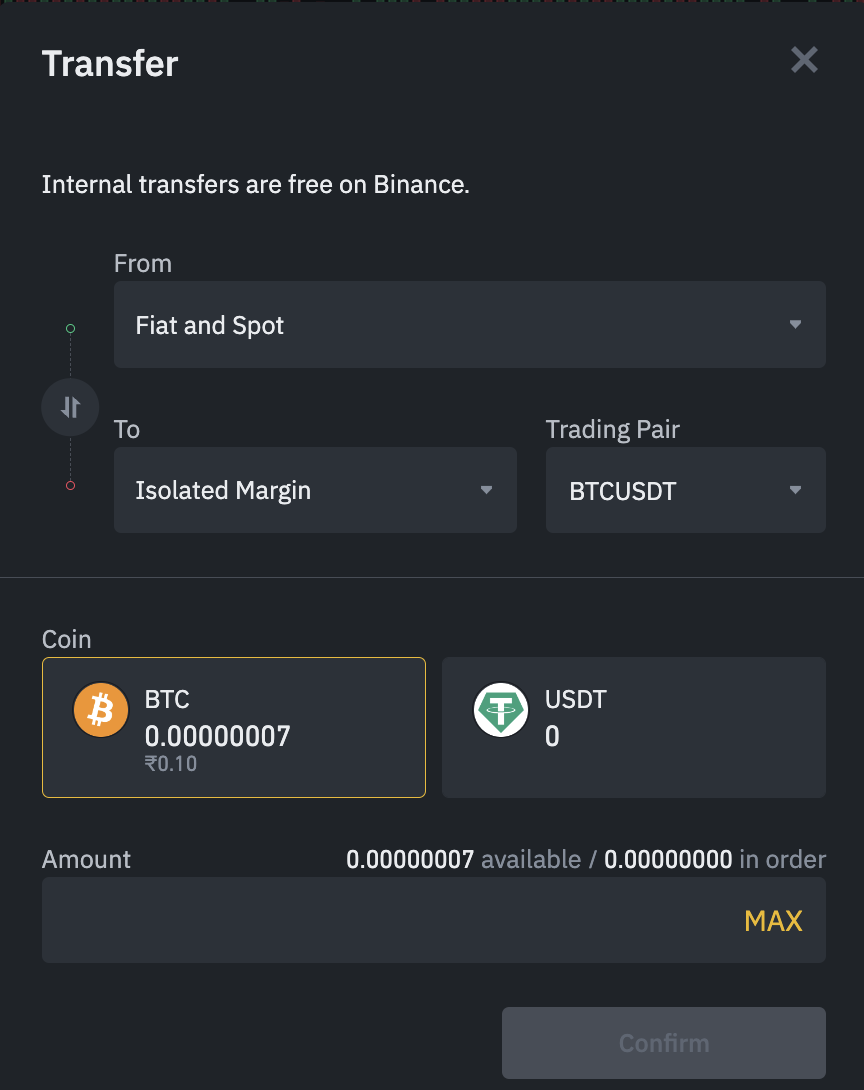

- Transfer

The next step is to transfer funds into your Cross Margin wallet from whichever wallet has the funds you would like to use.

For this example, you will transfer 1 BTC from your Fiat and Spot wallet to your Isolated Margin wallet by following the next steps.

- Click “Transfer”

- Select the “Trading Pair”, BTC/USDT in this case

- Select the “Coin” (collateral). In this case, BTC

- Select the “Amount” which is 1 BTC in this example

- Click “Confirm”

On confirmation, the Bitcoin will be transferred to your Isolated margin wallet.

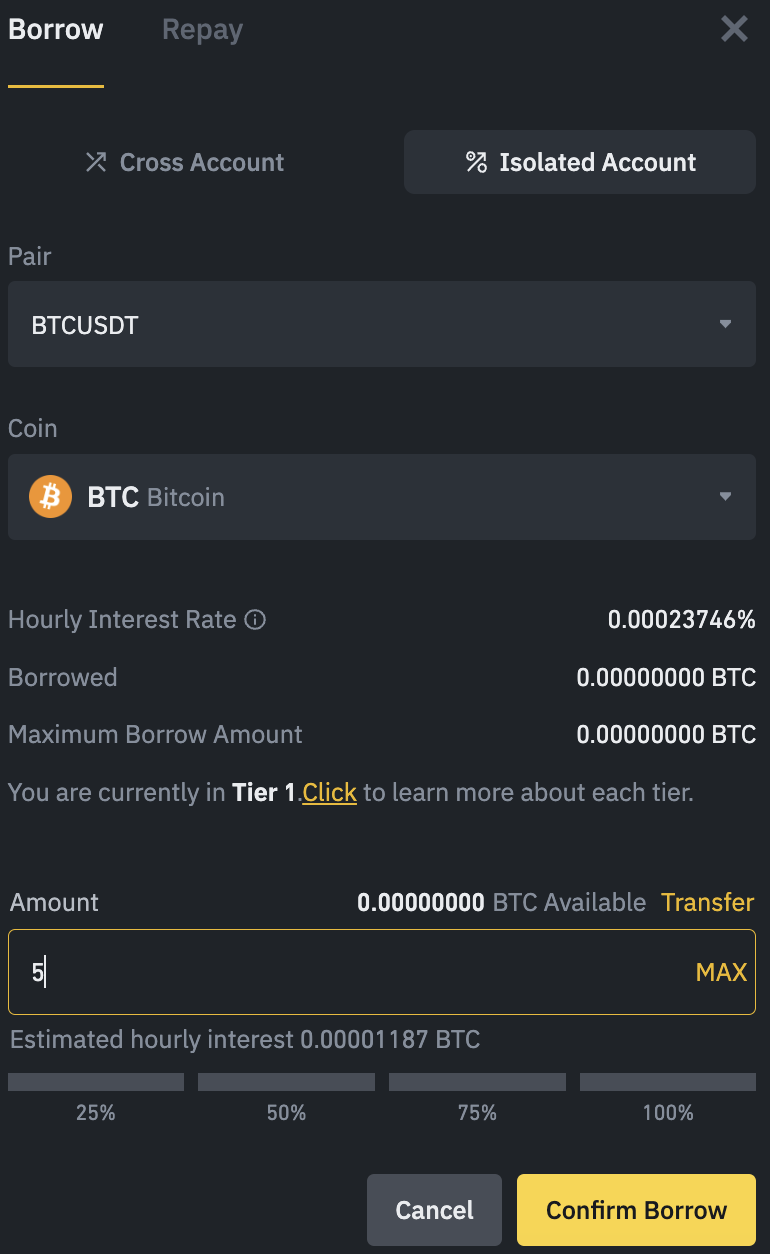

- Borrow

After you get the collateral in your wallet of choice, the next step in the Margin trading process is to borrow funds from the exchange, which you can use to beef up your position and multiply your earnings.

In Isolated Margin mode:

- Click “Borrow”

- Select the BTCUSDT Pair

- Review the Borrowing Terms & Conditions, including the hourly interest rate.

- Select the “Amount” to Borrow, which will be 5 BTC for the purpose of this example.

- Click “Confirm Borrow”

The maximum amount you can borrow and the hourly interest rate will depend on your Tier with the exchange. As you get to a higher tier, you can borrow more collateral at lower interest rates.

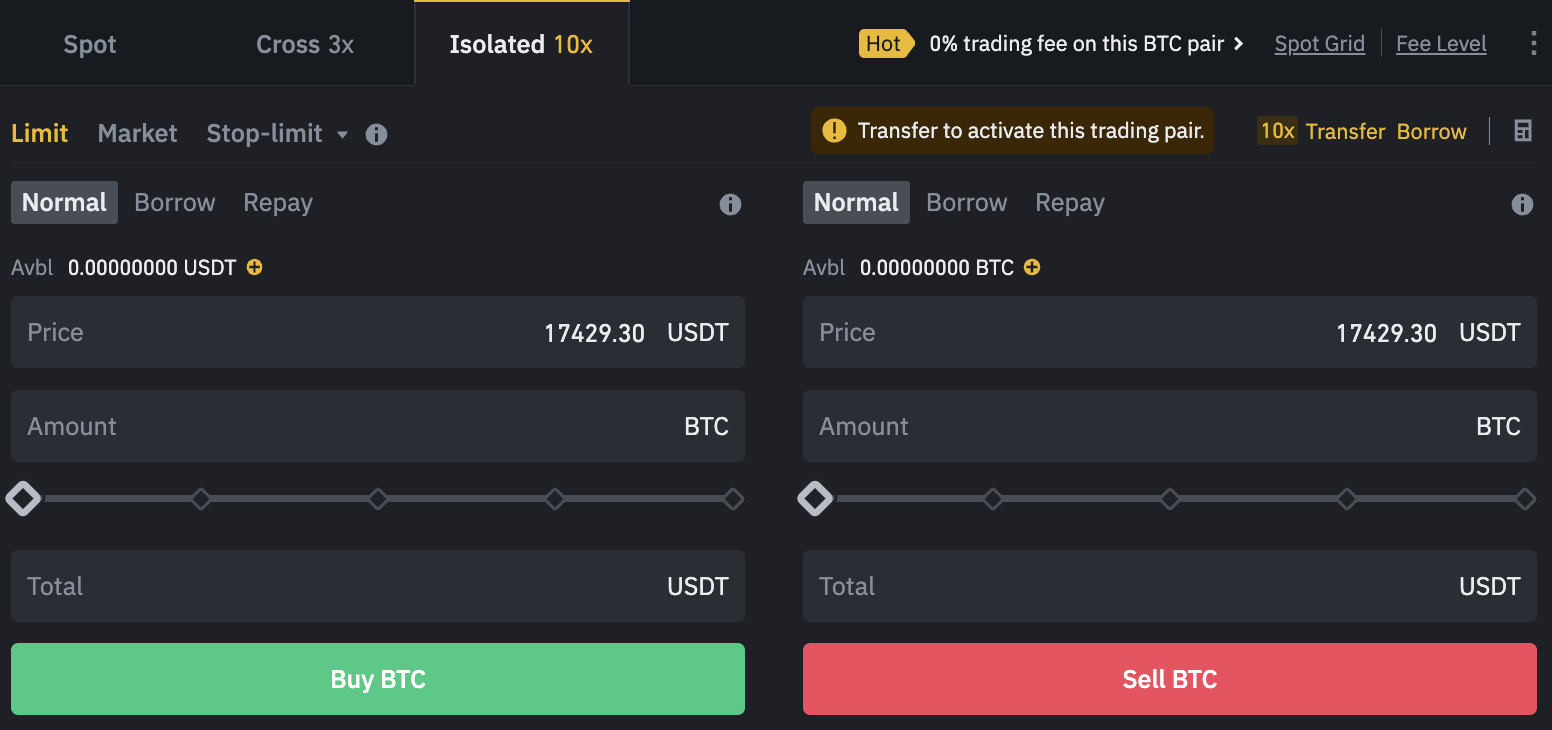

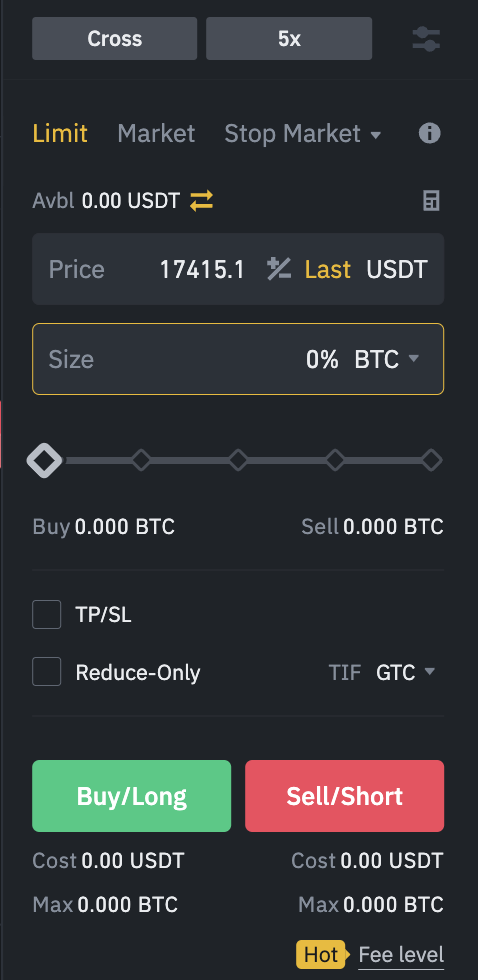

- Trade

At the end of step 3, you have transferred 1 BTC to your Isolated Margin wallet and borrowed an additional 5 BTC from Binance. So you should now be able to trade with the 6 BTC in your wallet.

The basis of a short position is to ‘Sell High’ or sell the asset when it is at a certain price and hope that it follows your technical analysis.

If all goes according to plan, the price of BTC should drop and you will be able to ‘Buy Low’.

In order to start your short position,

- Select the trading pair (BTCUSDT)

- Set the target price (17,429.30 USDT)

- Set the amount of BTC you want to invest in this position. 6 BTC, in this case.

- Press the ‘Sell BTC’ button

Once this order is filled, you have sold 6 BTC at 17,429.30 USDT per BTC and will be looking to buy it lower when the price decreases. This makes your total position size worth 104,575.80 USDT.

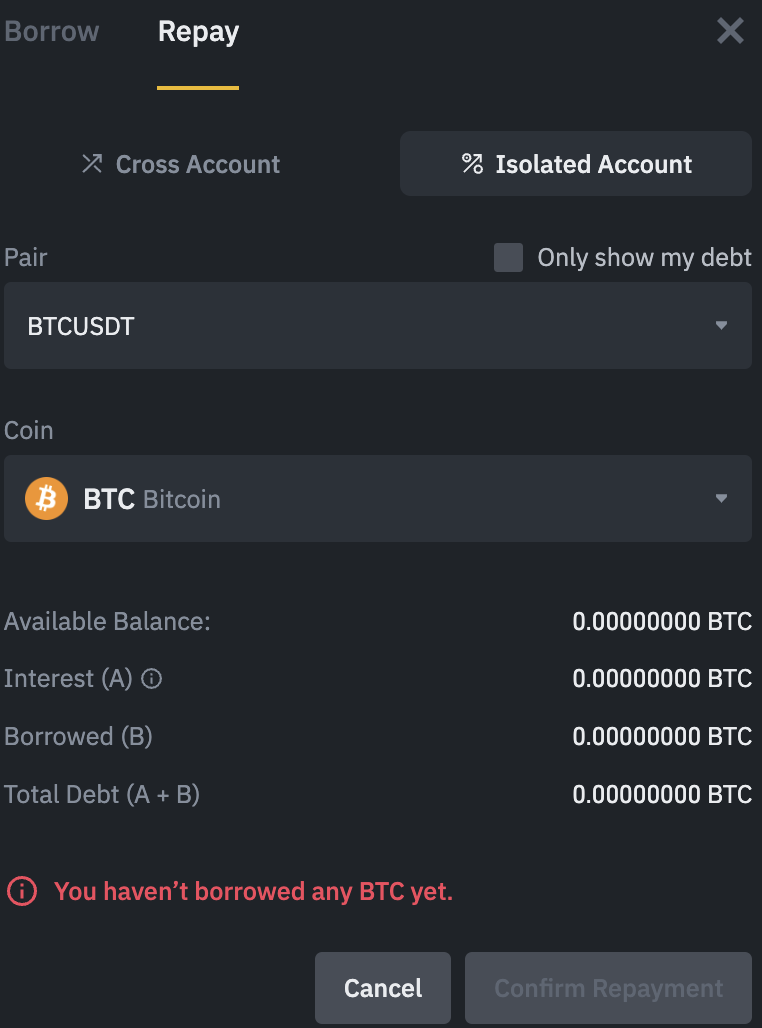

- Repay

This is the last step in your Margin trade and includes repaying the 5 BTC you borrowed from Binance. After this, you can keep all the profits you made.

After you take the trade in Step 4, once the price reaches your target price, you can purchase the same asset at a lower price.

Let’s take that your price target for this position was $16,800. Once the price is around this, you should follow these steps:

- Place a buy order for 6 BTC at $16,800

- Once the buy order is filled, go to Repay section

- Repay the debt and take the remaining assets as profit

In this case, you should have made a profit of (17,429.30 – 16,800) * 6 = 3,775.80 USDT after repaying the 5 BTC you borrowed.

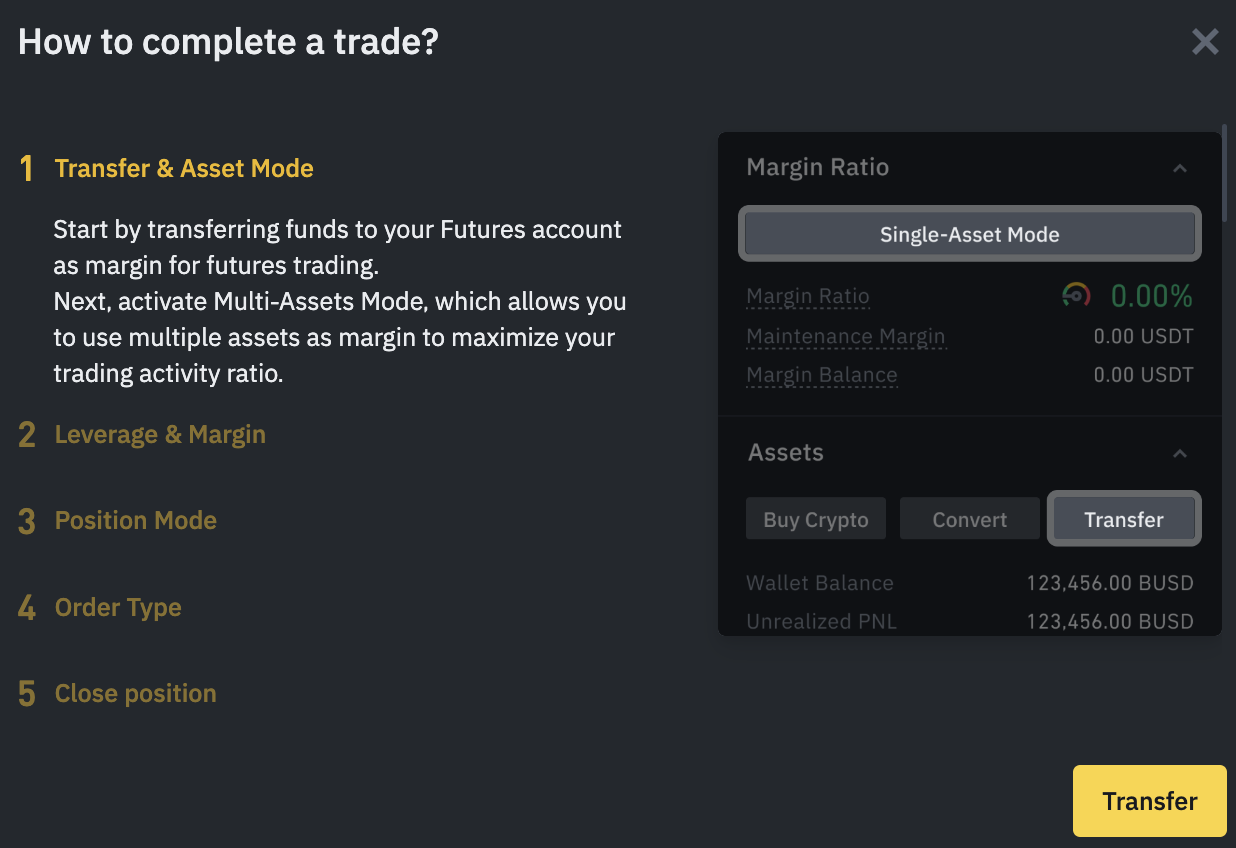

Shorting Bitcoin with Futures contracts

Activate Futures account

As with other exchanges, at Binance, you have to demonstrate a basic understanding of Futures contracts and risk management to be able to have access to an active Binance Futures account.

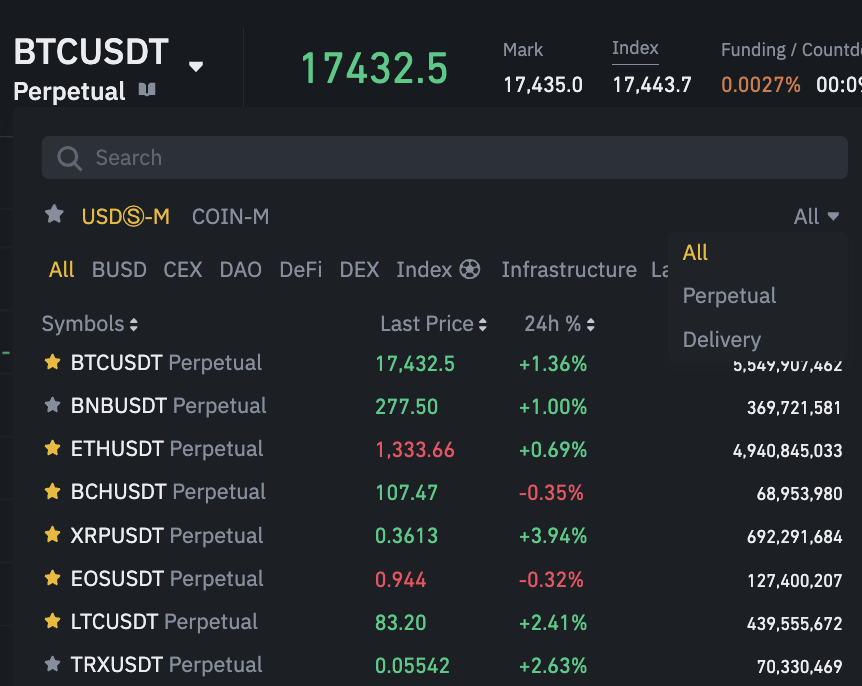

Choose the asset to short

Once you have activated the Futures account, you can make a decision of which contracts you want to trade, i.e. Perpetual or Quarterly Futures. In this case, you will choose the Perpetual BTCUSDT Futures contract.

Decide the direction of your trade and position size

Take a short position size of 10 BTC at the cost of $17,432.50/BTC. Let’s assume that we use 5x leverage in this case, so you will have to pay (17432.50 * 10) / 5 = 34,865 USDT for this.

You can take trades up to 125x in leverage with Bitcoin on Binance but these positions are very susceptible to being liquidated as a small movement in price against your bet will lead to a large amount of losses.

Choose whether you want to trade in Cross margin or Isolated margin mode.

Monitor and manage your position

Once your order has been filled, it will be visible in the Positions tab of the interface. You can check this for your current PnL numbers, position size, margin used, and direction of your trade (whether you are long or short).

Once you reach your price target, you can either take partial profits, move your stop loss to break even, or take complete profits and close your position.

If your price target is $17,000/BTC, you will earn $4,325 which is an ROE of 24.80%.

Shorting Bitcoin with Options contracts

To take a short position on Bitcoin with Options contracts, you will first need to enable the Binance Futures account which is tied to your Options account on Binance.

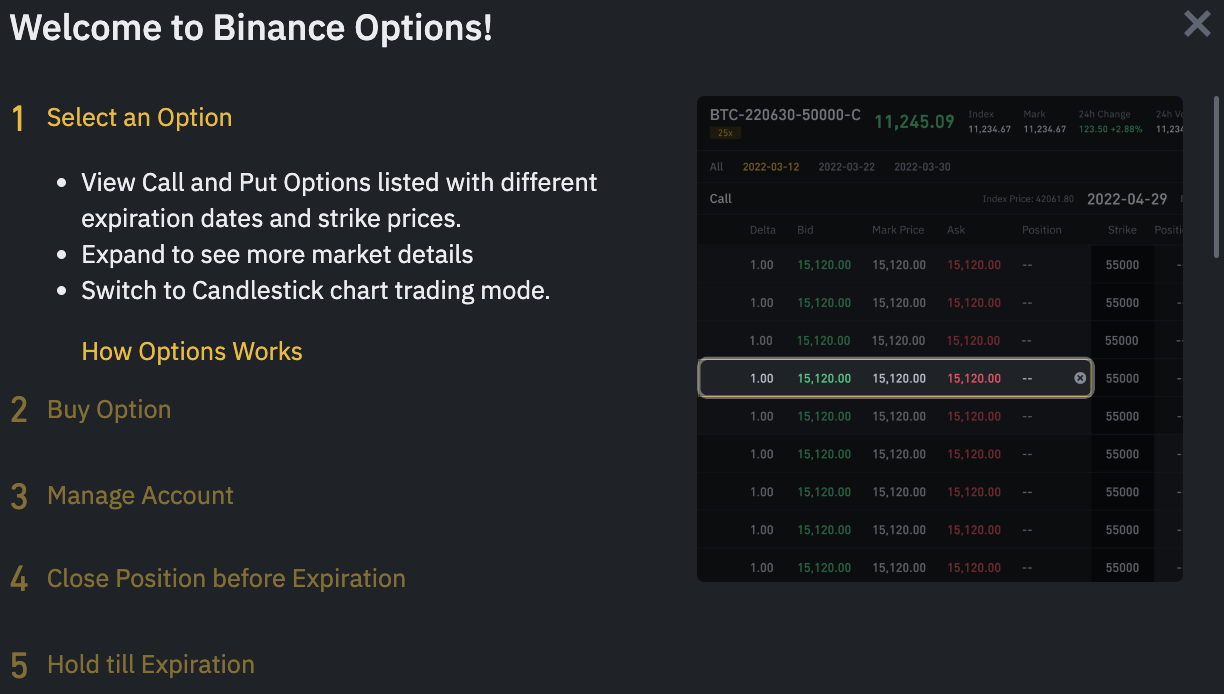

- Select an Option

In this case, you will select the BTCUSDT pair and you will have to make the next decision depending on whether you expect the price of Bitcoin to go up (Call) or down (Put).

Currently, Binance has Options contracts available for Bitcoin, Ethereum, and their native $BNB.

- Buy Options contract

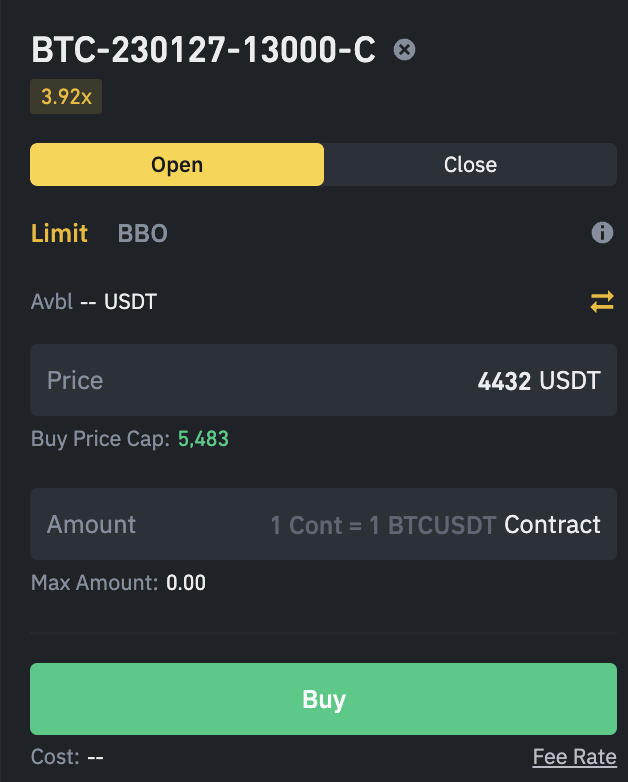

Now, you must make a decision about which contract you would like to trade. For this example, we are picking the contract expiring on 2023-01-27 which is the monthly expiry.

When you click on the contract, the user interface tells you the amount of leverage that is available on this contract which in this case is 3.92x.

For our example, let’s take a position of 6 BTC Put Options contracts that are bought at a price of $4,432/contract.

This will cost you $26,592 but your position in the market will be calculated as per the current price of Bitcoin which is $17,373.44 * 6 = $104,240.64

- Manage Account

Once the order has been filled and the contract has been purchased, you can see your current PnL numbers as well as the time to expiry in the Positions tab at the bottom of the interface.

- Close position before expiry

If you would like to close the position before its expiry date to either lock in your profits or cut your losses, you can do so by clicking the ‘Settle’ button for your position.

Having bought 1 Bitcoin Put contract for $4,432, if the price goes to $2,216, you would like to take profits from the position.

When you close your complete position at this price, you will make a profit of (4,432 – 2,216) * 6 = $13,296 which is 50% of your original investment.

- Hold till the expiry date.

On the other hand, you can keep your contract open until the expiry date, which in our example is 27 January 2023. This could be for multiple reasons, including rapid favourable price movement when the contract is close to expiry.

If the same contract at expiry is worth $2000, you will end up making (4432 – 2000) * 6 = $14,592.

Conclusion

Now you know three different ways to make money on Binance when your analysis tells you that the price of Bitcoin is going to go down.

You can either use Margin trading, Futures, or Options contracts will help you secure outstanding profits.

But you need to remember the inherent volatility in a market like cryptocurrencies and practice good risk management to make sure that you do not suffer big losses.

Techniques like trailing stop losses, taking partial profits, and good technical analysis will make sure that you succeed in this market.