In cryptocurrency, leverage trading has emerged as a double-edged sword.

It’s a world where traders, perhaps even you, can amplify gains, turning a modest investment into substantial profits.

Sounds enticing.

But here’s the catch – While leverage trading has many benefits, the risks are equally magnified.

Now, if you’re wondering how traders undertake such high-stake trades, the answer lies in one word: collateral.

It’s the silent yet powerful component that makes this high-octane style of trading possible.

I will remove the curtain on the intricate dance between collateral and crypto leverage trading in this article.

Ready to dive in?

You’re about to embark on a journey to unravel the complexities, unveiling the risks, rewards, and collateral’s pivotal role in this dynamic arena.

Hold on tight.

It’s going to be an enlightening ride!

Understanding Collateral and Leverage in Trading

Leverage in trading is like a gateway to amplified profits, but it doesn’t come without its share of risks.

Intrigued? Let’s break it down.

Essentially, leverage allows traders to borrow funds to increase their position size, meaning they can control a larger position with a relatively small amount of capital.

Sounds like a golden opportunity, right?

But wait, there’s more to it.

With leverage, profits can be magnified, offering the allure of substantial gains from even the smallest market movements.

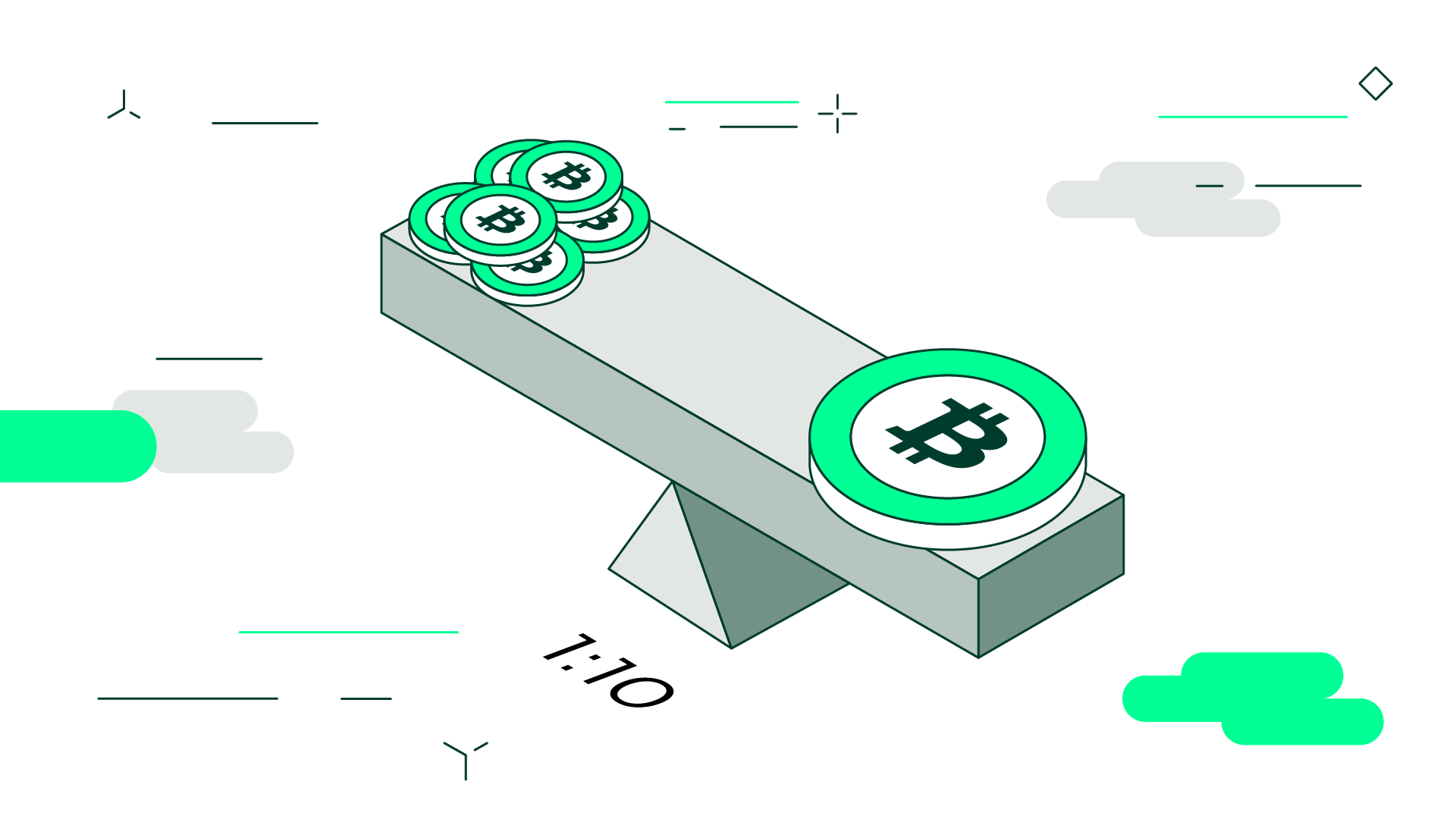

Imagine turning a 1% price movement into a 10% gain. However, this power to amplify profits works both ways.

Losses can be equally magnified, making the risk management paramount.

So, how does collateral fit into this high-stakes game?

It acts as a security deposit, a safety net ensuring traders can cover losses if the market doesn’t favor them.

The unsung hero makes leverage possible, balancing the scales between risk and reward.

Stay tuned as we delve deeper into collateral’s pivotal role in this intricate dance of crypto leverage trading.

The Concept of Collateral in Leverage Trading

Now, let’s dive into the nitty-gritty of collateral in leverage trading.

Have you ever wondered how you can amplify your trades in the first place?

Well, collateral is the silent enabler.

It’s akin to the security deposit you’d put down when renting a property.

Intriguing.

Here’s the deal: collateral is the asset you pledge to back your leveraged trades.

It’s a safety net for the lender, a guarantee that there’s something of value on the line should the trade not pan out as anticipated.

Consider it your ticket to the exhilarating world of amplified profits and heightened risks.

But wait, there’s a twist.

The type and amount of collateral required vary widely among crypto exchanges and trading platforms.

Some might accept fiat currency, others only specific cryptocurrencies.

It’s a dynamic landscape, one where the rules of engagement can shift rapidly.

In essence, collateral is the linchpin holding the delicate balance of leverage trading.

The unsung sentinel guards against excessive risk, ensuring the high-octane world of leveraged crypto trading doesn’t spiral into uncharted risk territories.

Are you curious about how this plays out in real-time trading scenarios?

Read on.

New to crypto leverage trading? Learn What is over-leveraging in crypto?

Types of Collateral Accepted

So, you’re curious about the types of collateral accepted in the crypto world.

Well, buckle up because it’s as diverse as it is fascinating.

In the dynamic world of crypto leverage trading, exchanges are not one-size-fits-all. Each has its own set of rules.

Some exchanges are like strict parents, only accepting stablecoins as collateral.

It’s a safety-first approach, aiming to mitigate cryptocurrency’s wild volatility.

But here’s where it gets interesting.

Others are more adventurous, welcoming a broader array of digital assets.

Bitcoin, Ethereum, and other altcoins often join the party, each bringing its level of risk and reward.

In a nutshell, the type of collateral you can use is as varied as the exchanges themselves.

It’s a mixed bag, offering traders flexibility but demanding a keen eye for detail and risk management.

Intrigued?

Let’s venture deeper.

Not sure how much leverage to use? Learn What leverage is best in crypto trading?

Risks Associated with Collateral in Leverage Trading

Ever wondered about the dark side of using collateral in leverage trading?

Let’s pull back the curtain.

Collateral is your entry ticket when playing in the high-stakes game of leverage.

But hold on, it’s not all sunshine and rainbows.

The risks? They’re as real as the potential rewards.

Imagine this: you’re trading with borrowed funds, and the market takes an unexpected nosedive.

Panic sets in. Your collateral is now on the frontline, a buffer against the losses.

But what if it’s not enough?

If the market’s wrath is too severe, your collateral can be wiped out in the blink of an eye.

And if the losses exceed your collateral?

You’re in for a rough ride, potentially owing the exchange a hefty sum.

In crypto leverage trading, understanding the risks associated with collateral is not just smart – it’s essential.

It’s about weighing the potential gains against the lurking dangers and knowing that in this volatile dance, every step can lead to triumph or tumble.

Are you ready to navigate this intricate dance?

Let’s step into the nuances.

How to Mitigate Risks Associated with Collateral

So, you’re knee-deep in the crypto leverage trading world, and the risks tied to collateral are looming large.

But wait, there’s a silver lining.

You can mitigate these risks, and here’s the golden nugget – it’s simpler than you might think.

First off, diversification is your ally. Don’t put all your eggs in one basket.

Spread your collateral across different assets to cushion the blow if the market takes a hit.

And here’s another gem – education. Equip yourself with knowledge.

Understand the market trends and keep an eye on the economic indicators.

Knowledge is power; in this case, it’s your shield against unforeseen market volatility.

Lastly, keep your emotions in check.

Trading decisions driven by emotions are a recipe for disaster.

Stay informed, stay calm, and let rationality be your compass.

In the turbulent seas of crypto trading, it’s your anchor.

Ready to dive deeper?

Let’s navigate these waters together.

Recommended Read: How to leverage trade crypto?

Future Trends in Collateral and Leverage Trading

As we peer into the future of collateral and leverage trading in the crypto space, innovation, and adaptation are the watchwords.

Blockchain technology is evolving at breakneck speed, and new forms of collateral are emerging.

Imagine a world where not just cryptocurrencies but tokenized assets like real estate or art become commonplace as collateral.

And let’s not overlook the role of regulations.

As governments and regulatory bodies play catch-up, we will likely see more structured and secure frameworks governing collateral and leverage trading.

This means enhanced security and, perhaps, a broader acceptance among traditional investors.

So, are you ready to ride the wave of the future, where technology and innovation meet security and diversity?

Hold tight because the collateral landscape in crypto leverage trading is on the brink of transformation.

The future is not just bright; it’s dazzling.

Recommended Read: Is crypto leverage trading safe?

Conclusion: Navigating the Collateral Landscape in Crypto Leverage Trading

Navigating the collateral landscape in crypto leverage trading can seem daunting.

But remember, knowledge is your compass.

Understanding the role of collateral, risks, and mitigation strategies is crucial as we’ve unraveled.

It’s a dynamic world with evolving trends and emerging innovations.

So, are you ready to step into this world armed with insights and prepared for the future?

Your path to mastering the art of leverage trading begins now.

Dive in, and let the exploration begin!