You have been using leverage for some time and watching other traders on social media posting their green PnL screenshots.

But all you have gotten are red PnLs and liquidation emails.

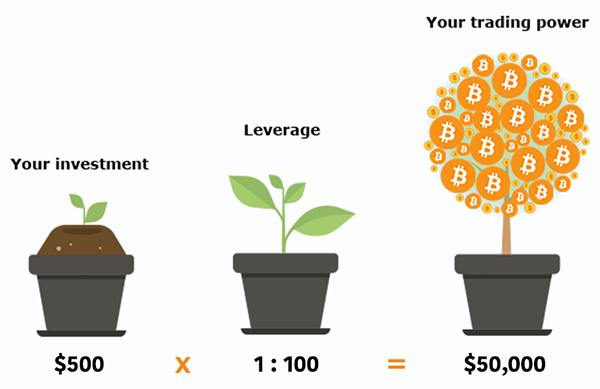

I’m sure you understand that leverage allows you to trade with more money than what is in your account, amplifying potential profits and losses.

But, with many leverage options available, how do you pick the one that suits you best?

As a fellow beginner who was once navigating these waters, let me guide you through finding the ideal leverage for your crypto journey.

Understanding Different Levels of Leverage

1x Leverage: At this level, there’s no borrowing involved. It’s essentially trading with only the capital you have.

2x-3x Leverage: Ideal for Beginners: These levels allow you to trade double or triple your deposit amount.

It offers a taste of leverage trading with relatively lower risks and is often recommended for those new to leveraged trading.

5x Leverage: At 5x leverage, the gains and losses are magnified five times.

While it can provide significant profits if the trade goes in your favor, it also means higher risks, requiring careful management.

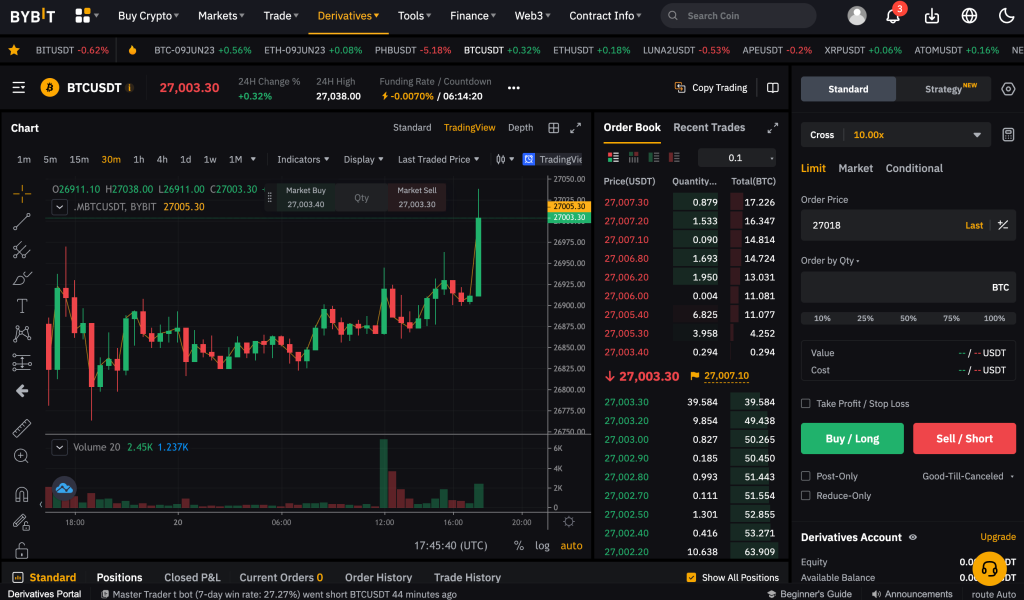

10x Leverage: For the Experienced: This level is often utilized by more experienced traders who are confident in their trading strategies and understand the market well.

It provides ten times the buying power but comes with an equal magnification of risk.

20x Leverage: High-Risk, High-Reward: 20x leverage is for seasoned veterans who are well-versed in risk management strategies.

The rewards and risks are correspondingly high, with twenty times the buying power.

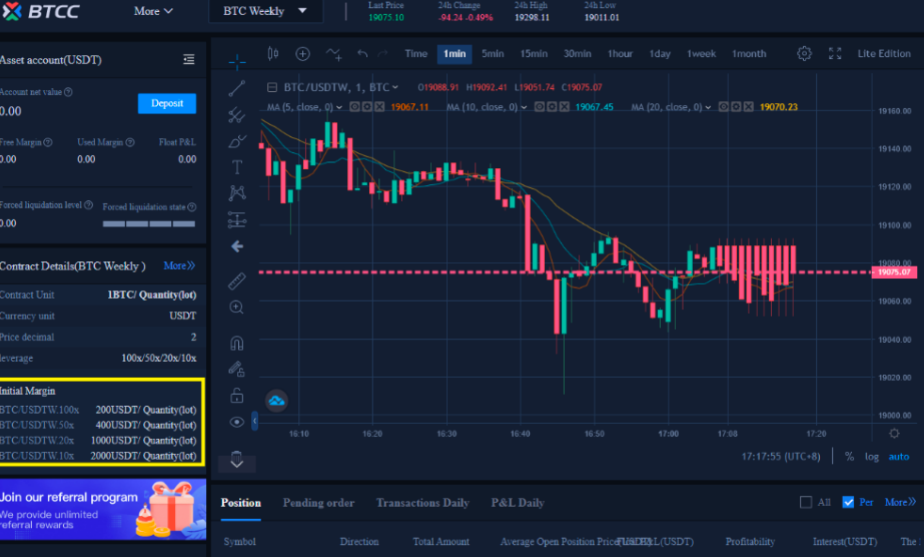

50x-125x Leverage: The Extreme End: These are some of the highest leverage levels offered by certain platforms.

They can lead to enormous profits or a complete loss of trading capital within a short period.

Extreme caution, understanding, and robust risk management are necessary at these levels.

What Leverage is Good for Beginners?

Leverage trading can be an attractive option for traders looking to maximize their profits, but it comes with a unique set of challenges and risks for beginners.

Understanding the right leverage level to start with is crucial.

Here’s an expanded view of what leverage might be suitable for beginners:

1. Understanding: Leverage allows traders to borrow funds to increase their trading position.

It amplifies gains and losses, so understanding how it works is the first step.

2. Low Leverage Levels (2x-3x): Ideal Starting Point: Low leverage levels like 2x or 3x are generally recommended for beginners.

These levels,

- Minimize Risk: Low leverage means that the potential losses are less magnified. It offers a safety net for those still learning.

- Provide Experience: Starting with low leverage helps newcomers understand how leverage works without exposing them to significant risk.

- Allow for Mistakes: Beginners are likely to make mistakes, and low leverage ensures that these mistakes won’t wipe out the trading capital.

3. Risk Management Strategies: Even at low leverage levels, implementing proper risk management strategies is essential. This includes

- Setting Stop-Loss Orders: This can limit potential losses by automatically closing a position if the price reaches a certain unfavorable level.

- Diversification: Spreading capital across different assets can reduce the impact of a wrong call on a specific asset.

- Continuous Learning: Continuous education about market trends, trading strategies, and leverage mechanics can go a long way in building confidence.

4. Platform Selection: Choosing a trading platform with robust educational resources, customer support, and clear leverage options can be a strong foundation for a beginner.

5. Gradual Increase: As beginners become more comfortable and skilled, they may gradually increase leverage.

However, this should be done with caution, understanding, and a corresponding enhancement in risk management.

6. Demo Accounts: Many platforms offer demo or practice accounts with virtual funds.

Beginners can utilize these to practice trading with different leverage levels without any real financial risk.

Advanced Traders and Leverage

For advanced traders, leverage becomes a more nuanced and tactical tool in their trading strategy.

They have the knowledge, experience, and risk tolerance to explore higher leverage.

Here’s how leverage unfolds in the world of advanced trading:

1. Higher Leverage Options (10x-100x): Advanced traders may use leverage as high as 10x, 20x, or even 100x. These levels:

- Maximize Profit Potential: High leverage can amplify gains significantly, providing potentially lucrative opportunities.

- Increase Market Exposure: With higher leverage, traders can control a larger position with less capital, enabling diversified strategies.

- Enable Complex Strategies: Advanced traders often use complex strategies that may require significant leverage.

2. Risk Management Expertise: Unlike beginners, experienced traders typically have honed risk management techniques:

- Sophisticated Stop-Loss and Take-Profit Orders: They use complex algorithms and automated tools to manage risks effectively.

- Hedging Strategies: Advanced traders can mitigate the risks of high leverage by taking offsetting positions.

- Constant Monitoring: Continuous tracking of the markets and positions allows for timely adjustments to the trading strategy.

3. Understanding Market Dynamics: An in-depth understanding of market trends, technical analysis, and economic indicators helps make informed leverage decisions.

4. Leverage in Different Market Conditions: Seasoned traders recognize when to apply high or low leverage based on market volatility, trends, and other factors.

5. Leveraging Different Assets: Experienced traders may choose different leverage levels for various cryptocurrencies based on their characteristics and market behavior.

6. Regulatory Compliance: Advanced traders are generally more aware of the regulatory environment and ensure their leveraged trading activities comply with all applicable laws and regulations.

7. Psychological Preparedness: Trading with high leverage can be emotionally taxing. Seasoned traders have often developed the emotional resilience needed to handle the ups and downs of leveraged trading.

How to Choose the Best Leverage for You

It’s not a one-size-fits-all situation, and traders must evaluate their unique circumstances.

Here’s how you can make an informed decision on the right leverage for you:

1. Assess Your Risk Tolerance:

- Low-Risk Tolerance: Lower leverage (2x-5x) might suit you if you prefer to play it safe.

- High-Risk Tolerance: More experienced traders willing to take on greater risks may opt for higher leverage.

2. Define Your Trading Goals and Strategy:

- Short-Term vs. Long-Term Goals: Your leverage might vary depending on whether you’re day trading or investing long-term.

- Type of Strategy: Scalping, swing trading, and other strategies might require different leverage levels.

3. Consider Your Experience Level:

- Beginners: As a newcomer, starting with lower leverage helps you learn without exposing yourself to excessive risk.

- Experienced Traders: Advanced traders may confidently use higher leverage, having developed robust risk management techniques.

4. Evaluate the Asset and Market Conditions:

- Volatility: Assets with higher volatility might warrant more cautious leverage.

- Market Trends: Understanding market dynamics can help you select appropriate leverage.

5. Use Demo Accounts and Simulations:

- Test Different Leverage Levels: Experiment with various levels in a simulated environment to see what feels right.

- Learn Through Practice: Hands-on experience helps you understand how different leverage affects your trades.

6. Understand the Costs and Fees:

- Higher Leverage, Higher Costs: Consider the fees associated with leveraged trading.

- Impact on Profits: Fees can eat your profits, especially at higher leverage levels.

7. Continuously Reevaluate:

- Regular Assessments: Your suitable leverage level may change as you gain experience or if market conditions shift.

- Stay Informed: Keep up with market news and trends to adjust your leverage appropriately.

Regulatory Considerations

Leverage trading in crypto can offer significant profit opportunities, but it also comes with its share of regulatory considerations that vary by jurisdiction.

Understanding these regulatory factors around crypto leverage trading is crucial to ensuring your trading activities comply with the law.

Here’s a closer look at some key considerations:

1. Different Regulations by Country:

- United States: Leverage trading might sometimes be restricted or limited, with specific requirements for brokers and exchanges.

- European Union: New regulations might impose caps on the leverage available to retail traders.

- Asia: Countries like Japan have specific regulations on crypto leverage trading, including limits on maximum leverage.

2. Licensing and Compliance Requirements:

- Exchanges: Ensure your chosen crypto derivatives trading platform is licensed and complies with local regulations.

- Traders: Understand if there are any particular requirements or reporting obligations in your jurisdiction.

3. Consumer Protections:

- Leverage Caps: Some countries have leverage limits to protect retail investors from excessive risk.

- Disclosure Requirements: There may be mandatory disclosures regarding the risks and costs associated with leveraged trading.

4. Anti-Money Laundering (AML) and Know Your Customer (KYC) Rules:

- Identification Verification: Exchanges often require identity verification to comply with AML and KYC regulations.

- Monitoring and Reporting: Ongoing monitoring and reporting might be necessary to prevent illicit activities.

5. Tax Implications:

- Tax Treatment: The tax treatment of profits and losses from leveraged trading might differ based on the level of leverage and local tax laws.

- Record-Keeping: Maintaining accurate and comprehensive records is crucial for tax reporting purposes.

6. Ongoing Changes and Developments:

- Regulatory Landscape: The regulatory environment for crypto leverage trading constantly evolves, and staying informed about changes is vital.

Conclusion

Leverage in crypto trading can be both a powerful tool and a double-edged sword.

Beginners should approach leverage cautiously, typically starting with lower levels like 2x or 3x and considering practice accounts.

More experienced traders may explore higher leverage but should never neglect risk management strategies.

Understanding your risk tolerance and the crypto market dynamics is key to choosing the best leverage for your trading journey.

As a fellow trader, I hope this guide has clarified your path in the exciting yet challenging world of crypto leverage trading.