Crypto trading can be highly profitable, but the only way to amplify your gains is by increasing your purchasing power. The more crypto you trade, the higher your profits if the market goes your way.

Nonetheless, not many people have the substantial financial muscle you need to buy a lot of these digital coins, given their market price. Crypto exchanges try to help traders out by allowing for leverage trading.

With leverage trading, you can open positions that are several times larger than your actual capital investment and hence increase the size of your potential gains. However, leverage trading is more complex than this, and it is vital to understand it well before giving it a try.

What is Crypto Leverage?

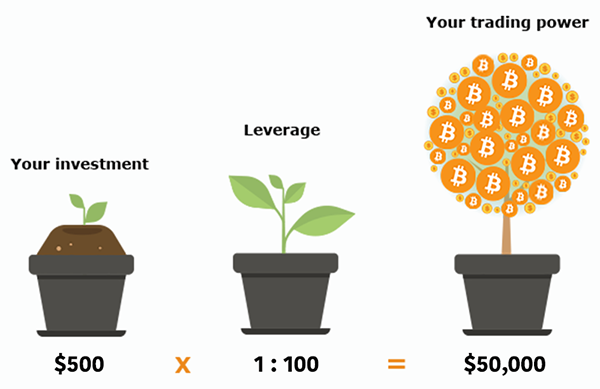

Crypto leverage is a tool in crypto trading that allows traders to trade using borrowed capital from the exchanges and other traders. Crypto leverage aims to enable traders to open large positions without investing a lot and hence get higher returns from their small capital.

With crypto leverage, traders increase their crypto purchasing powers for maximum profit gains. For example, if you have $100 to invest and do so with crypto leverage and use 10x leverage, you can open a position that is worth $1,000.

From this example, if you are going long by buying crypto hoping that the price will increase, you will earn ten times more than you would without leverage. If the market goes according to your prediction and the asset gains 10%, your investment will gain $100 (10% of $1,000). Your gain would be $10 (10% of $100) without leverage.

While crypto leverage increases your potential earnings, it also comes with a greater risk. Most crypto exchanges have systems that will ensure you never lose more than you invest.

Nonetheless, the increased risk means that it will take a slight price decrease to reach your liquidation price. For example, if you are using 100x leverage, just a 1% price drop leads to liquidation of your position.

Therefore, crypto leverage is all about making it possible for crypto traders to open positions that are several times larger than their actual investment for increased returns.

How & Where To Trade Crypto with Leverage?

Many platforms allow for crypto trading, including most leading ones. Therefore, it should be easy to find an exchange where you can leverage crypto as the chances are your favourite one offers the product.

That said, some of the most popular exchanges for crypto leverage worldwide are Bybit and Binance. These companies have some unique features that make their crypto leverage stand out. Here is a brief overview of the three companies and the features that make them good.

1. Bybit

Bybit has been around since 2018, and it is a large crypto exchange with a global presence and more than 2 million active traders. Traders looking to leverage trade on their exchange get maximum leverage of 100x.

Besides the high leverage, the company facilitates trade with several advanced tools like several risk management tools, and they also offer support around the clock and zero server downtime. Another thing that makes the platform ideal for crypto leverage is they guarantee a return of your total financial loss in case of a systems error.

2. Binance

Binance Futures has been active since 2017, and it is the biggest crypto exchange in the world based on the number of transactions. Their system transacts over 1.4 million transactions every second. The company supports over 200 different digital assets for trade.

With Binance, you can get maximum leverage of 20x, but for derivatives trading, the maximum leverage is 125x. Also, users can do leverage trading on mobile devices via their app.

Note: Some of these companies will only allow for leverage trading for specific markets. Only a few exchanges offer leverage trading there for US traders due to regulatory restrictions. Kraken is one of these few companies that allow US traders to do leverage trading with a maximum leverage of 5x.

How to Leverage Crypto

The specific process of leveraging crypto will depend on the platform you are using. However, most of these exchanges will first require you to open an account and do KYC verification.

With an account, the process is as simple as placing your order by choosing the order type, the amount to invest, and the leverage. Some companies like Binance will require you to open a margin account and then borrow funds from the platform before you start leveraging.

Once you decide where you want to do your leverage trading, most companies will have a tutorial or detailed FAQ on the specific steps to follow. So you should not have any difficulties figuring things out.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

How Does Crypto Leverage Trading Work

Leveraged trading is all about amplifying your potential gains by borrowing additional funds to increase the size of your position. In some platforms like Bybit, you will only need to choose the leverage you want to use for your position and place the order.

Supposing you have $1,000 worth of BTC in your Bybit wallet but want to amplify your potential profits. In this case, you can choose to leverage your crypto up to 100x, but 5x or 10x is optimal for most traders as it also reduces the risk.

If you invest the $1,000 in Bybit with a leverage of 10x, the size of your full positions will be $10,000. Therefore, any earnings you make from the trade will be a percentage of the $10,000 full position and not $1,000.

When leverage trading on Binance, you have to open a margin trading account and use the assets you have to borrow additional funds to increase the size of your position. For example, if you have 1 BTC in your wallet, you can transfer it to the margin trading account and use it as collateral to borrow 4 more BTC at their 5:1 fixed rate.

From this example, you can then open a position with 5 BTC, despite your actual investment being 1 BTC. Any gains you get will be a percentage of 5 BTC and not 1 BTC. However, you will need to repay the 4 BTC plus the interest they accrue later, which reduces your profit a little.

Having to borrow BTC for margin trading is quite risky given the volatile nature of the market. Luckily, Binance and most other companies that support leverage trading have mechanisms in place to liquidate your position and repay the loan plus interest before you lose the assets if the market plunges.

What Does Leverage Mean In Crypto Trading?

Leverage in cryptocurrency means using borrowed capital for trade. The borrowed funds allow you to open positions larger than your actual wallet can support.

With leverage, the broker or crypto exchange platform provides a lever that allows you to execute crypto trades that would otherwise be out of your reach.

You can also get leverage for crypto trading by borrowing from other traders and paying them interest if the exchange supports this or through derivatives.

Leverage is a two-edged sword that promises higher returns as it can help grow your crypto portfolio quickly, but it can also easily wipe out your entire investment.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Risks & Benefits of Leverage Trading Cryptos

As a crypto trader, you should not get into any form of crypto trading before knowing what it entails, its risks and its potential benefits. The same is also true for leverage trading, as you need to understand and weigh the benefits and risks before investing.

- Benefits of Leverage Trading

1. Higher Profits

If you read the market well and trade wisely, leverage will give you higher returns on your investment than trading with unlevered crypto

For example, if you are trading with $100 worth of crypto at a leverage of 10x and go long and the crypto price rises by 10%, you will earn 10 times more.

From this trade, your earnings will be $100, which is 10% of your full position with leverage ($1,000). If your position is unlevered, your profits will be just $10.

2. Portfolio Diversification

Experienced traders will often use leverage trading to diversify their portfolios. With leverage trading, you get access to more capital, which allows you to invest in different assets to grow your portfolio.

Portfolio diversification is vital for every trader. Given the highly volatile nature of crypto, it is good to diversify by buying different assets. You do not want to put all your eggs in one basket as this means you can lose everything easily.

3. Small Capital/Actual Investment

Digital assets are pretty expensive, and even with the ups and downs in the market, the price always seems to get to new highs. Therefore, buying a lot of cryptos can be an expensive venture that requires a massive capital investment.

With leverage trading, you can invest in high-value crypto with small capital. For example, to open a position worth $100,000, you will only need $10,000 actual investment when using 10x leverage or $5,000 with 20x leverage.

4. Enhances Trade Discipline and Risk Management

Given the higher risk involved in leverage trading, discipline and good risk management skills are crucial. Therefore it can be instrumental in teaching traders these positive and beneficial attributes in a trader.

If you can hack it in leverage trading, your trading skills and discipline will improve significantly. Therefore, besides earning you more, leverage trading can make you a better trader.

- Risks of Leverage Trading

1. High Trading Risk

Leveraged trading is riskier than unlevered trade. Therefore, as much as it promises higher returns, there is also a greater risk of losing your capital investment if the market does not go your way.

For example, if you are trading with $100 at 10x leverage and the price increases by 10%, you will gain $100. However, if the price drops by 10% the next day, you will lose more than the $100 you earned the previous day (10% of $1,100 is 110). You would only lose $11 (10% of $110) without leverage.

2. Easy Liquidation

With leverage trading, a slight decrease in the price of the crypto assets brings you closer to liquidation. For example, if you go long with 100x leverage, just a 1% decrease in the asset price is enough to trigger liquidation.

3. Complicated for Newbies

Buying and selling crypto is pretty straightforward, even for beginner traders. However, things become more complicated for newbies if you add in leverage. Beginner traders can suffer huge losses if they do not take time to understand how leverage works and practice it before investing actual funds.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Managing Risk When Leverage Trading

Leverage trading holds more significant risk than many other ways of making money from crypto. However, you can use some simple tricks to minimize the likelihood of suffering a massive loss when leverage trading.

One of the most effective methods is using risk management tools like stop-loss and take-profit. Stop-loss closes your position when the market is not going your way to minimize the amount you lose. Take-profit closes the trade to guarantee you get a certain amount of profit before the market movement changes.

Another effective way of managing risk when leveraging trading is to ensure you never risk more than you are willing to lose. Make sure you only leverage an amount you can pay off if the market does not go your way.

Some crypto exchange platforms will have mechanisms for resetting your account to zero in case it ends up in the negative for some reason. Also, many will not allow you to lose more than your actual investment. Both are also effective ways of managing risk from leverage trading.

Can you Margin Trade on Coinbase Pro?

Coinbase Pro started offering margin trade in 2020 but has discontinued the product. The company supported margin trading in 23 US states with a maximum leverage of 3x.

However, according to information on their FAQs section and blog, some changes in their regulatory space could not allow them to support the product.

They discontinued the product on 25th November 2020, and by December 2020, all the margin trading positions were offline after the open ones expired.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Conclusion

Leverage trading can seem daunting for traders, which is more so for those just starting it. However, like every other product in a crypto exchange, it just requires patience and enough practice to master the trade.

While leverage trading promises higher returns than unlevered trading, it also comes with more risk. Therefore, as a trader, it is crucial to managing the risk carefully with the various risk management tools exchanges provide and only invest what you can afford to lose.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023