BankProv Review 2024 – The Crypto Friendly Bank For Businesses

We are heading to a world where crypto will be a mainstream thing. As a result, businesses need to start preparing themselves to indulge in crypto and look for ways to accept it.

However, most banks have strict policies against crypto in today’s time. They don’t provide you with any traditional banking solutions for crypto-related business.

As a result, most crypto-related businesses struggle to run their business efficiently. But with BankProv, a crypto-related business can enjoy traditional banking tools and solutions.

However, if you have not heard about the bank before, let me explain everything about it to you:

What is BankProv?

BankProv is one of the newest banks in the town. It is suited for crypto-related businesses like mining operations, exchanges, and BTM operators.

BankProv is the rebrand of the popular traditional banking company The Provident Bank. The bank is said to be a future-ready commercial bank that is suited for corporate clients.

The bank has specialized in adaptive and technology-first banking solutions for niche markets, including crypto. Also, it has its focus on other areas like financial technology, and renewable energy.

Crypto-Friendly Business Banking Products

- Business Checking Accounts

BankProv offers business checking accounts. As a result, it will be super easy for you to manage your money seamlessly.

It has different plans for different types of business requirements. For instance, if you go with the classic business plan, there is a $0 monthly fee, and the highest plan, ProvX Partner, has a $5,000 monthly fee. Also, depending on your selection, you get to enjoy different sorts of features.

BankProv is also a member of both FDIC and DIF. As a result, your deposits are insured. This gives you the trust that your funds are safe and secure.

- Cash Management

BankProv also makes it super easy to manage the flow of your business funds. It allows you to manage your payables easily and securely. As it offers secure processing of transactions and assists you with managing all your remittance and payment needs. It supports ACH credits and debits, and domestic and foreign wires.

Also, with ProvXchange, you can transfer funds between your accounts to other BankProv clients in real-time without any delays from traditional payment rails.

You will enjoy features related to receivables, and it allows you to quickly turn your receivables into cash with a fast processing time. It also supports multiple channels to collect payments and consolidate funds for easy liquidity management.

Also, you will get to enjoy easy cash management through online and mobile banking or access them with BankProv’s automatic APIS.

- Online & Mobile Banking

BankProv offers easy online and mobile banking. You can easily pay your bills online, originate same-day ACH credit transactions or pay invoices. As well as enjoy a bunch of other features.

Such as the ability to access your account 24/7, e-Statements, transfer funds between BankProv accounts, view your transaction history, put your misplaced card on hold, temporarily increase your card limit, and so on.

In short, you can enjoy a true banking experience while sitting in comfort at your home or office.

Crypto Banking Solutions

The most highlighted feature of BankProv is definitely its crypto banking solutions. BankProv offers full-service USD banking products for crypto natives and related businesses.

It offers two types of services under crypto banking, which are:

- 100% fully-insured USD deposits

Your deposits are 100% insured. Like other banks which offer deposit insurance up to $250,000 only through the Federal Deposit Insurance Corporation FDIC. But since BankProv is a member of both FDIC and DIF, your deposits are 100% insured and this benefit comes with no additional cost or complexity at your end.

- Full API banking suite

With the ProvXchange network, you will get access to a full API banking suite. It will allow you to conduct real-time transfers without any delays.

Plus, the API banking suite will help you to communicate and perform a series of tasks automatically. Also, it offers you access to your financial information in the way you need it.

You can use APIs to integrate your BankProv account into your own platform or apps. So you can streamline your operations, manage your finances, and so on.

- Range of Payment Solutions

You can manage your payables and receivables easily with BankProv. It offers you secure processing of transactions and assists you with managing all your remittance and payment needs.

Also, it supports multiple channels to collect payments and consolidate funds for easy liquidity management. Plus, BankProv supports a variety of solutions like electronic payments, checks, and even cash.

- ProvXchange

There is also the ProvXhange which allows you to transfer funds between your accounts or other BankProv clients in real-time without any details of traditional payment rails. To get started with that, you have to use the bank’s API’s, and by accessing it, you will get up-to-date and accurate information on your accounts. Plus, you will easily be able to maintain receivables and payables and easily maximize business productivity.

Benefits & USPs of Using BankProv

With BankProv you can enjoy a wide range of features that most banks don’t offer. With BankProv’s online and mobile banking, you can manage all your finances. Plus, there is no need to visit a physical bank at all.

However, to help you quickly understand. Here are some benefits of using BankProv for your business:

- You can easily pay bills with their integrated bill payment system.

- Sign up for e-statements.

- Access your account anywhere, anytime.

- Quickly transfer funds between BankProv accounts.

- View your transaction history.

- Deposit a check and view your check deposit history.

- Place a stop payment on a check.

- Manage your personal finances.

- View images of written and deposited checks.

- Put your misplaced card on hold.

Also, it offers deposit services to cryptocurrency exchanges, institutional investors, and brokers.

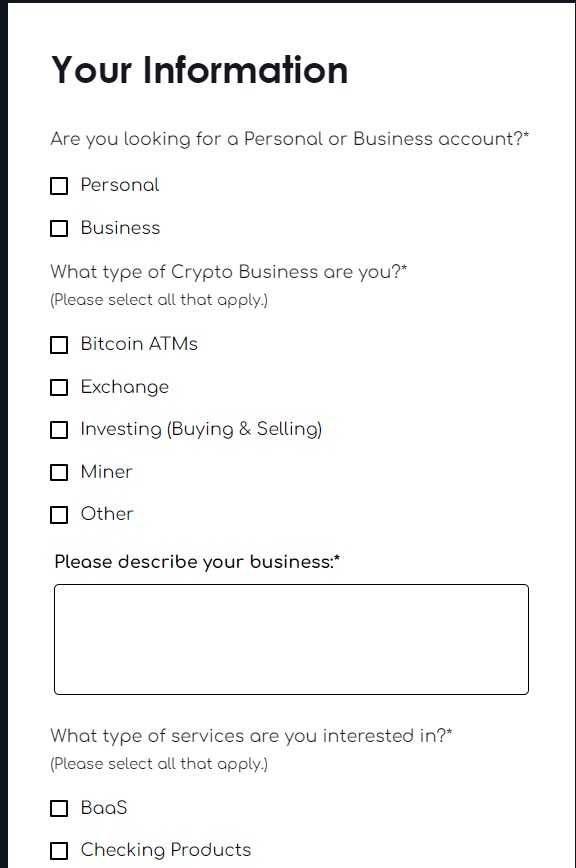

How To Open a Crypto Business Account With BankProv?

The account opening process of BankProv is extremely straightforward. However, there are some eligibility criteria that you have to meet. These requirements are:

- You should have a USA-based business. As BankProv is not operational outside of the US.

- You should be a legal US resident.

- At least 18 years old.

If you meet the above requirements, then you will need to keep some documents handy before you apply to open an account. Documents required by BankProv are:

- Full Name

- Date of birth

- Phone number

- Email address

- Mailing address

- Social security number

- Occupation

- Driver license or passport

If you have your documents ready, you can apply for a BankProv account. Simply contact them through their website by filling out a form, and they will walk you through the whole process.

Once done, click on the submit button, and soon you will be contacted by BankProv’s customer executive.

Conclusion:

Overall, BankProv is an innovative banking solution suitable for crypto-related businesses. It offers you tons of features that crypto businesses would love to use.

For instance, it offers you a complete online and mobile banking experience that lets you run your business

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023

Contents