Best Crypto Tax Free Countries In 2024

Tax liability can cut into your profit margins quite a bit and if you have already taken a deep dive into crypto, it makes sense to be in a country that alleviates most of this burden. Luckily for you, multiple crypto tax haven countries can help you save money that would otherwise go to the tax man in the form of capital gains tax, or income tax.

This article explores and puts in front of you the top crypto tax-free countries so that you can make an informed decision regarding where you want to move to.

Top Tax-Free Crypto Countries Of 2022

- El Salvador

- Belarus

- Switzerland

- Cayman Islands

- Puerto Rico

- Bermuda

- Germany

- Malta

- Slovenia

- Portugal

- Singapore

- Hong Kong

- Malaysia

- Antigua

- Barbados

#1. El Salvador

With the bold move by populist president Nayib Bukele and his cabinet in September 2021, El Salvador became the first country in the world to make Bitcoin legal tender for its citizens. This move has widely been seen as one that will help the country attract more investments from Bitcoin aficionados and traders alike.

All bitcoin foreign investors and bitcoin exchanges are now exempt from paying any tax on capital gains just like any other legal tender. This makes the country better than any other crypto tax havens out there.

For this purpose, the government has created and issued a digital wallet that allows users to spend their bitcoin to pay taxes and debts that were previously expressed in USD.

The concept of tax resident applies to you if you spend more than 200 days in the country during the year (permanently or temporarily) or if you earn a major chunk of your income in the country.

#2. Belarus

In looking to bring new investments into the country, Belarus in March 2018 decided to legalize crypto activities and exempt businesses and individuals from any tax for the next five years. This was when most European countries were trying to regulate or tax the booming cryptocurrency market.

This law will be up for review in 2023 so you should take advantage of it while you can. The definition of crypto tax-free activities includes mining, and day trading, which are now legally viewed as personal investments which means they can then be exempt from capital gains tax and federal income tax rate.

The law was created to give a boost to the country’s technological innovation and digital economy. It has served its purpose and Belarus was named third highest and nineteenth overall in terms of P2P trading volume.

#3. Switzerland

Having been a tax haven for fiat currency and a modern-day example of where rich people store their money, it was of high importance what their own tax laws said about becoming a crypto tax haven as well.

It has acquired the nickname of being the ‘Crypto Valley’ with the policies it has enacted for crypto taxes. As an individual, all crypto gains are exempt from capital gains tax and Swiss tax residency allows you to take advantage of these rules.

The current crypto tax laws entail that you will pay taxes on your crypto income that might come from mining, and also on any profits you make from being a qualified day trader, along with the wealth tax as applicable to your county of residence.

#4. Cayman Islands

Being a British Overseas Territory, the Cayman Islands is now a tax haven for crypto investors in addition to already being one for businesses and those who use fiat currencies. In a similar vein, businesses are not charged corporate tax, and individual investors are not charged income tax or capital gains tax as long they are residents of the country.

The Cayman Islands Monetary Authority earns most of its money from the tourism industry, import duties of 22-26% on luxury goods, and fees paid to get work permits. This means that the cost of living and the cost of acquiring residency in the country is high and your finances need to be in order if you are looking to move to the Cayman Islands.

#5. Puerto Rico

Although it is a territory of the USA, Puerto Rico is not amongst the fifty states that are represented on the national flag. When it comes to income taxes, the IRS (Internal Revenue Service) has designated it as a foreign country. This allows the country to set and enact its tax laws.

Residents of Puerto Rico who acquire digital assets in the country are exempt from capital gains tax. You also pay a lower rate of territorial income tax when compared to what the IRS deems payable on the areas it has jurisdiction over.

So you can understand that if you have purchased crypto as a USA resident, you are bound by the IRS crypto tax laws but if you establish residency in Puerto Rico, and then buy your coins of choice, you do not owe any federal income tax to the IRS.

#6. Bermuda

In Bermuda, your digital assets are not taxed under special rates, but the nation has a blanket low-tax consideration for them. There are no income taxes, tax-exempt capital gains, no withholding taxes, or other taxes on digital assets or any transactions where digital assets are involved.

So the already applicable taxes for other capital assets can now be used for cryptocurrency as well. Well before El Salvador in 2021, the government of Bermuda became the first country to accept payments for government fees, taxes, and other services in USDC coins.

#7. Germany

Germany does not make crypto tax-free like the other countries on this list but has ways that you as an investor can get tax exemptions on certain activities. Crypto is viewed as private money and not a capital asset so if you sell, swap, or spend it after more than a year of holding, no tax is levied.

You only pay income tax on it if you hold the asset for less than a year provided the profit is greater than €600.

Your income from staked crypto is tax-free only if you have held it for more than a period of ten years. At this point, this income is tax-free at the point of sale. Some crypto-related activities like getting paid in crypto and crypto mining are subject to income tax.

#8. Malta

Malta is already a tax haven for businesses and individuals earning in fiat currencies and has extended the same courtesy to crypto now. As far as the Maltese tax system is concerned, Bitcoin and some other crypto coins are a unit of account, a medium of exchange, or a store of value.

This means you will not pay capital gains tax on long-term gains on cryptos that are considered to be a ‘store of value. If you do plan on trading crypto though, it will attract a rate of 35% just like trading shares and stocks.

Depending on how much you earn from crypto, you can make use of the structuring options courtesy of the Maltese tax system and the income tax rates can then be reduced to between 0-5%.

#9. Slovenia

Slovenia treats businesses and individuals separately as part of its tax system for cryptocurrency. Its capital Ljubljana itself has close to 137 businesses and 584 different locations that accept payments in crypto assets.

There is no capital gains tax levied on individuals when they sell their bitcoin gains, and it is not considered income either so they are in the clear on that front too. When companies receive payments in crypto, or through mining crypto, the corporate income taxes apply.

As a business, you are not allowed to only conduct business operations in cryptocurrency alone, such as allowing only Ethereum or Doge as payment. Any tokens distributed as part of ICOs are also subject to tax up to 50%.

The Chamber of Commerce and Industry has supported the new draft bill on crypto taxation that the additional revenue could act as tax relief on net wages.

#10. Portugal

If you are decently active on Crypto Twitter, you will know that your favorite crypto investors are already shifting or at least entertaining the idea of shifting to Portugal for how their tax regime treats cryptocurrency.

Ever since 2018, all the money a Portuguese tax resident makes from selling and trading crypto is tax-free and the income you get from trading is not considered income and is hence free of the income tax burden.

These rules don’t apply if you are a business and as an individual, you can exempt your crypto from the VAT and income tax in the country. This makes the country one of the best crypto tax havens on this list.

#11. Singapore

The main reason behind exchanges like Phemex and KuCoin setting up shop in Singapore is that the city-state has rules that make it a tax haven for businesses and individuals alike.

Singapore does not have the notion of capital gains tax, and it considers the sale or trading of crypto to be free of tax for this reason. As far as the tax laws are concerned, cryptos are intangible property, and when you use them in exchange for goods and services, it is viewed as a barter trade rather than a payment.

You will obviously never pay 0 taxes. If you are acting as a business and accept crypto as payment, you will pay income tax on it, or if your company’s core services are related to crypto trading, you have a tax liability to the city-state.

#12. Hong Kong

When it comes to Hong Kong, the legislation on crypto is not the clearest with the latest updates being put out in the year 2020. Whether or not your coins are taxed depends on how they are used.

If your assets are bought for long-term investment purposes, any profits from the sale of these would not be considered investment income and thus not charged to profits tax. This, however, like most countries does not apply to corporations as their profits from any crypto business activities are taxable.

As far as Bitcoin is concerned, it is a virtual commodity and the tax code treats it as such.

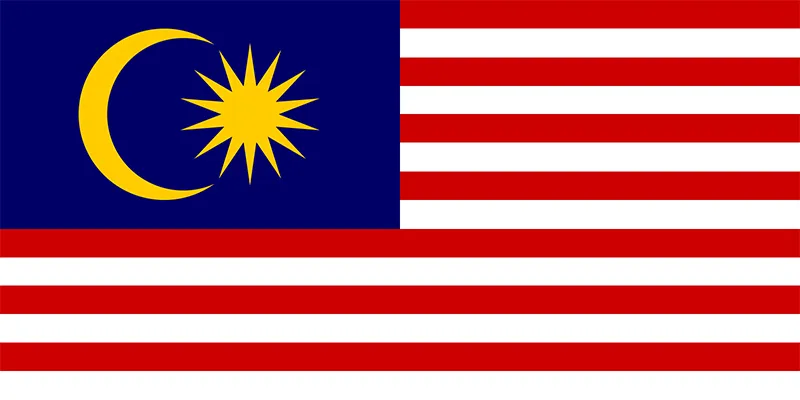

#13. Malaysia

The Malaysian Inland Revenue Board only allows crypto transactions to be tax exempt if they are not regular or repetitive. So as a day trader, you will pay tax in the country.

As a neighbour to Singapore, Malaysia has also opted to categorize crypto not as a capital asset or as a legal tender. For this reason, crypto transactions are tax-free for individuals.

Just like in Singapore, businesses involved in crypto are subjected to tax, whether the profits are in fiat currency or any other cryptocurrencies.

#14. Antigua and Barbuda

The country of Antigua and Barbuda has moved to establish its place in the cryptocurrency and blockchain fintech startup space so that these revenues can contribute to its economy which was primarily run with large help from the tourism industry.

The overall relaxed rules in the country regarding capital gains tax, income tax, and wealth tax rate extend to the realm of digital assets and will help any individual investors.

To run a business that includes digital assets, you will need a license to handle or disburse any assets that are ruled to fall under the Digital Assets Bill 2020.

#15. Barbados

Barbados is another country that is friendly towards cryptocurrency and treats it like the emerging sector it is. It is not really on the list of cryptocurrency tax-free countries but the tax rules mandate that the tax rate decreases as the profits increase.

The current rules keep the taxation on crypto profits between 0%-5.5% just like the profits that may be earned by offshore companies.

Conclusion

Stop calculating your tax liability with every crypto investment you make. It is time to look for your tax haven of choice and pack your bags, in that order.

From the looks of it, Portugal is the place to be if you want to abide by a simple crypto tax code and save all of your profits from crypto trades.

If your vibe is more tropical and you are okay with paying taxes but less of them, Barbados should be your destination of choice.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023

Contents