Can Coronavirus Kill Bitcoin Revolution?

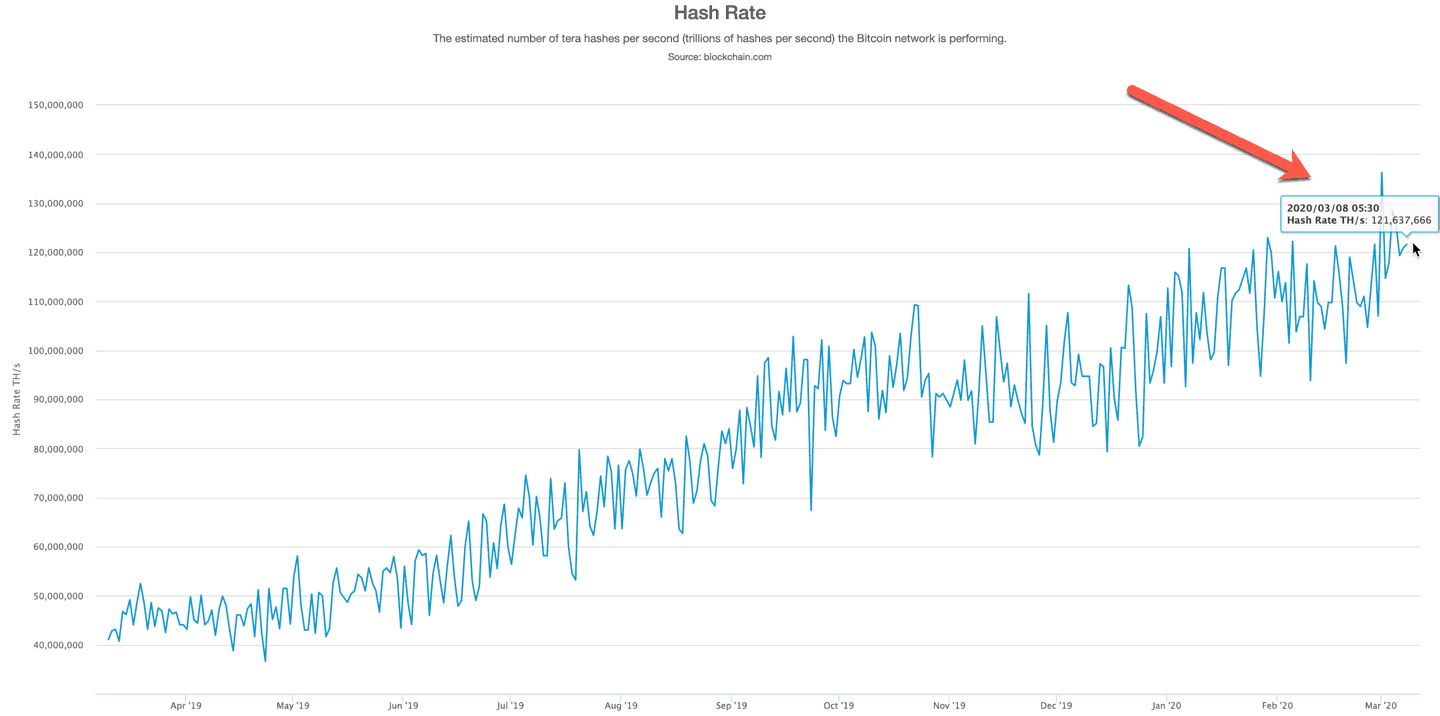

People are gasping for air over Bitcoin’s falling prices and relatively unstable hash power recently which may or may not be a direct result of the Coronavirus.

But let’s say, even if Coronavirus is really impacting Bitcoin but can it really kill it?

The answer is, No !!

Coronavirus cannot disrupt the Bitcoin network in any serious way because the Bitcoin network is fairly dispersed and distributed. Bitcoin by design is self-adapting and will adapt to Corona too.

But one cannot overlook the fact that though few but humans are involved in keeping this Bitcoin network functioning which is digital. This is what is making some worry, I believe.

To accurately understand the impact of Coronavirus on Bitcoin, one really needs to question how the human resources involved in the Bitcoin network could be impacted by the virus. As the virus is ultimately dangerous for humans but not for something digital like Bitcoin.

To help you grasp the human element in Bitcoin, just in case if you don’t know, here is quick Bitcoin network 101 for you:

Bitcoin is a nodal network spread over the internet. There are 10000+ nodes that keep the Bitcoin blockchain (or ledger). Some of these nodes are miners, who mine the Bitcoin blocks. Blocks are nothing but group transactions and miners confirm the validity of these transactions and register them on the ledger. To register them on the ledger miners need to put in some work and solve complex mathematical puzzles. Solving this puzzle is energy-intensive and hence a costly affair. There are thousands of miners trying to solve this puzzle every 10 minutes and whichever miner solves the puzzle first gets to register the transactions by appending a new block to the Bitcoin’s chain. In return the miner who solved it gets 12.5 BTC (current block reward) as well as the transaction fees attached to registered transactions as a reward. These phenomena are known as Bitcoin mining and block reward respectively.

When I say, miner, it means the actual human resource that is deployed at the mining farms is engaged in Bitcoin mining through Bitcoin mining rigs. Since humans are involved here to take care of the mining farms, the foremost thing to be considered is the potential mining infrastructure impact due to the Coronavirus because humans are maintaining these farms.

Bitcoin network fairly runs without much human intervention and with Coronavirus, a biological virus, humans are susceptible to it and not the rigs. These rigs run automatically once set and do not require much human labor. Of course, there are instances of maintenance where human intervention is a must but that doesn’t take many people to just go around the mining farms which are often far from urban centers and human settlements. That’s why it is easy to infer that Bitcoin mining is more susceptible to computer viruses rather than biological viruses.

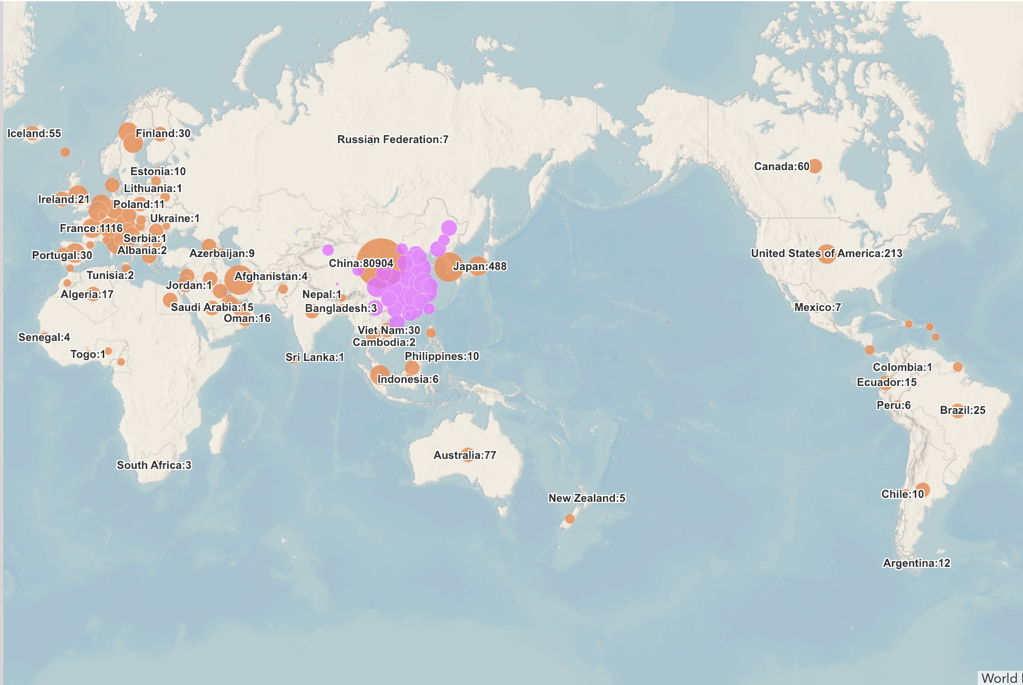

I know you are still not satisfied that’s why now let’s examine simple full-nodes and mining nodes. There are 10000+ Bitcoin nodes and 1000s of mining nodes spread across the globe that might get impacted by the ever-spreading virus. But simple full-nodes are not that crucial for the survival of the network as much as mining nodes and miners themselves. Nodes are important when it comes to enforcing governance. In this scenario, if Coronavirus lets say, takes down all the simple-nodes because people running them are infected then also you will be left with mining nodes.

Now there are some so-called risks to be considered to which Bitcoin can very well adapt that’s why after enough deliberation, I don’t see them as potential risks. 66% of Bitcoin’s hash power comes from mining farms in China and let say Chinese shut the mining farms supplying this 66% of the hash rate. Yeah, don’t get surprised they have done this just recently by shutting a farm down, so taking all down is a real possibility.

Now let say if you lose 66% hash power, we will be back to 41, 356, 806 TH/s, hash power levels which we had already seen in May 2019 because the current hash rate is 121,637,666 TH/s. The network worked in May 2019 also, so I don’t see any reason why it will NOT work when 66% hash power is taken due to any unforeseen event like Corona.

The only thing that can happen in this scenario is if the hash power drops suddenly then there will be blocks coming much later than every ten minutes and probably after 20 minutes. We will have a slow network but a working network.

But this anomaly will also self-balance due to the difficulty adjustment which happens every 2016 blocks and at present takes about 2 weeks. But in case of the slow network where blocks are taking more than 20 minutes, this re-adjustment might happen after 4-5 weeks. This is the worst-case scenario.

This slowness of network and difficult re-adjustment might just work as a blessing in disguise for miners who are online because if 66% of the network is down; the actual reward generated would be then distributed amongst the 34% miners (mining farms) who are online. This will make mining profitable and this incentive will force those who are offline to come back online ASAP as well as those who are already online will also double-down with whatever infrastructure they could get their hands-on. This will again increase the difficulty due to more miners joining the network.

This is a scenario when 66% of mining power goes off suddenly which is highly unlikely. The likely scenario is that the miners go down slowly and in a skewed manner. In this case, even if there is an increase in block time, it will be indistinguishable over the average of 2016 blocks.

I know that’s a huge empirical assumption but it really depends on how much hash power goes out and within what period of time. Hypothetically say 50% goes down in a day. Then that will have a visible impact in block time. But say 50% goes down in six months or a year then no visible effect will be seen.

Even if the virus continues to spread at the rate it is spreading, the shutdowns and new sprung-ups will be finely distributed in time and space. Surely the shutdown rate cannot be more than the rate of spread of the virus. The white spaces on the map where the virus is not there yet will encourage people there to get in mining.

What More The Virus Can Do? Actually Virus Can Quarantine Banknotes !!

Needless to say, the crypto industry is better positioned than any other due to its digital nature to endure these kinds of events of pandemic viruses.

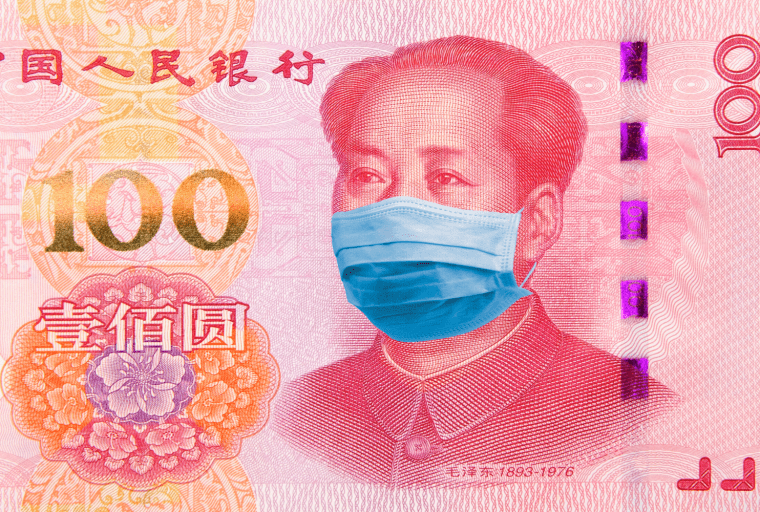

But when it comes to your cold hard cash in situations of such pandemic, they are a threat. Paper money and coins are susceptible to viruses because they can transmit viruses.

Since the Chinese govt realized the Coronavirus can be transmitted across physical objects, they have started keeping banknotes in quarantine. They are literally collecting millions and billions of fiat either to burn it or keep it with them for two weeks to disinfect to later distribute. This cannot get more absurd than this because when I transfer you Bitcoin, there is no way I will give you Coronavirus.

The Virus can be the catalyst for the upcoming financial crash that people have been talking about for so long. Helicopter money (free money) is already being used in Hong-Kong to prop-up the economy but when the virus subsides this helicopter money can lead to an inflationary or hyperinflationary crash of the fiat money system we have. And if the pandemic becomes even bigger, the governments will print more and increase the inflation even before the virus goes, thus pushing people to search for hard assets like Bitcoin.

There is no future in which Bitcoin is not there at a non-zero price and not even in the case of Coronavirus. In short, every fragility in traditional finance is a case in favor of bitcoin and any so-called fragility in Bitcoin is self-adapting and amending. If the situation gets bad enough, it might create a huge chain reaction for hard assets like Bitcoin.

This reminds me of wise words by Nassim Nicholas Taleb in his book, Antifragile:

Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.

Bitcoin is just one such antifragile thing, the more it is attacked the more it adapts to become resilient. Thus with this pandemic, I believe it’s antifragile USP will manifest, even more, get advertised, get understood, and even embraced by people who first had written it off…

If you would like to read more stuff like this, follow me on Twitter @sudhirkhatwani !!

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023