3Commas is growing its market share tremendously in the field of crypto automated bots.

Bots help to copy the trading strategies of other professional traders and skip the learning curve hence, saving a lot of your time. It acts as a shortcut toward profitable trading strategy building.

3Commas offers state-of-the-art trading bots helping traders automate their trading strategies and amplify their profits making it so popular among crypto traders. In this article, I will tell you in detail about all the aspects and share my honest 3Commas review with you.

Let’s start with a brief background about 3Commas.

3Commas Bot Introduction

3Commas was founded in Tallinn, Estonia, in 2017. Since its origination, 3Commas has become one of the leading non-custodial trade automation platforms. In 2019, 3Commas and Binance became official partners allowing users to connect to variable products offered by Binance.

In November 2020, Alameda Research, the company behind FTX and ProjectSerum, invested $3 million in 3Commas from its first funding round, and since then, 3Commas has kept flourishing, introducing many more exchanges and features.

3Commas offers innovative and advanced tools to generate profits for its users, Let’s first go through the supported exchanges and coins available on the platform.

3Commas Supported Exchanges & Coins

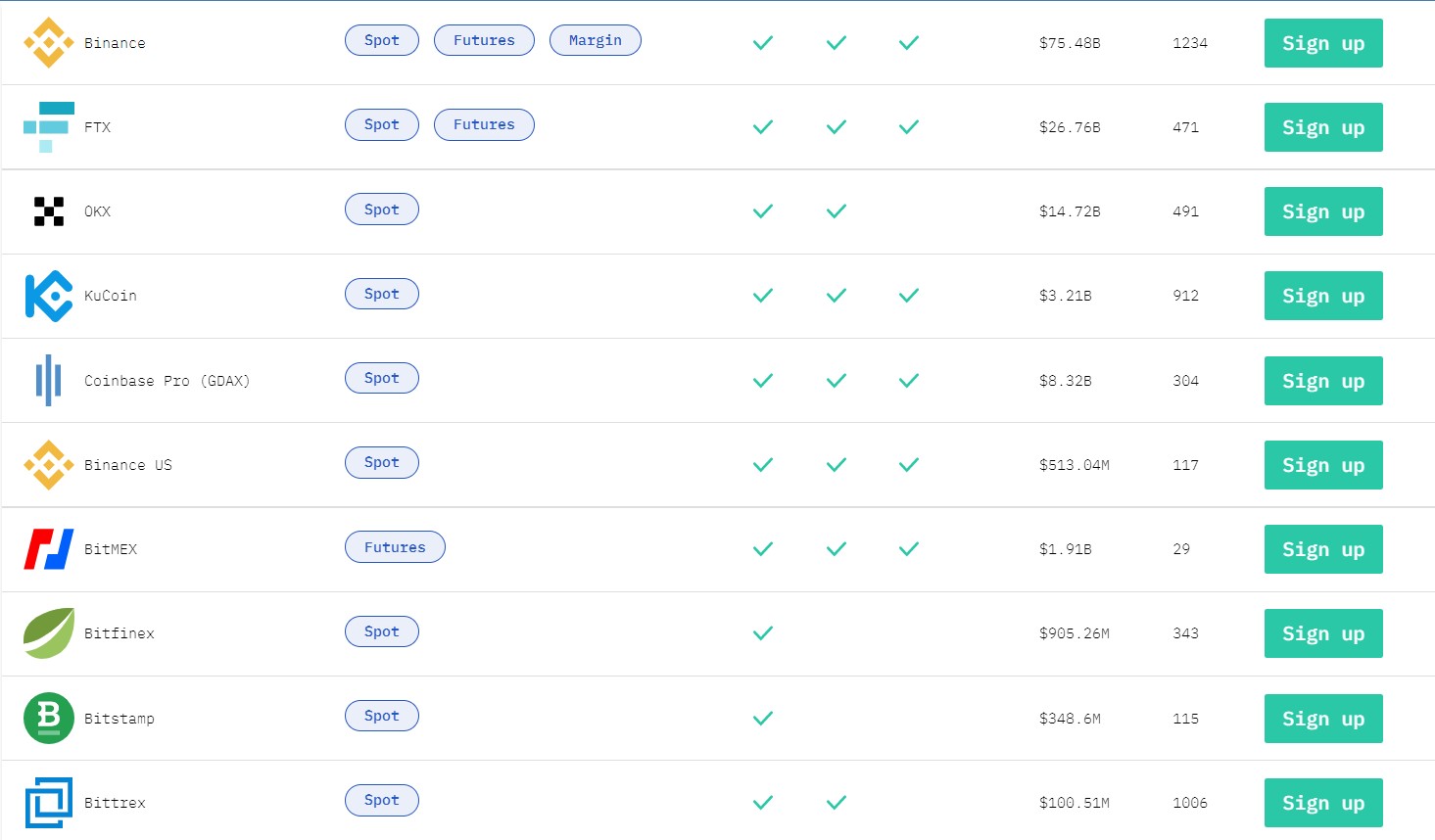

3 Commas support various exchanges with different order and product types; you can trade-in and benefit from their different bots offerings.

On 3Commas currently, there are 19 exchanges available to trade on and take advantage of the products and features of all these platforms under one single window. You can also optimize your trading strategies using automated bots on the platform.

For example, if there are 200 crypto to crypto trading pairs available in one exchange and 100 in some other exchange you can trade in all those 300 trading pairs under one roof using 3Commas. The same goes for the spot and leverage coins.

As there are currently 19 exchanges you can imagine what advantage you’ll have using 3Commas.

Different Types Of Bots on 3Commas

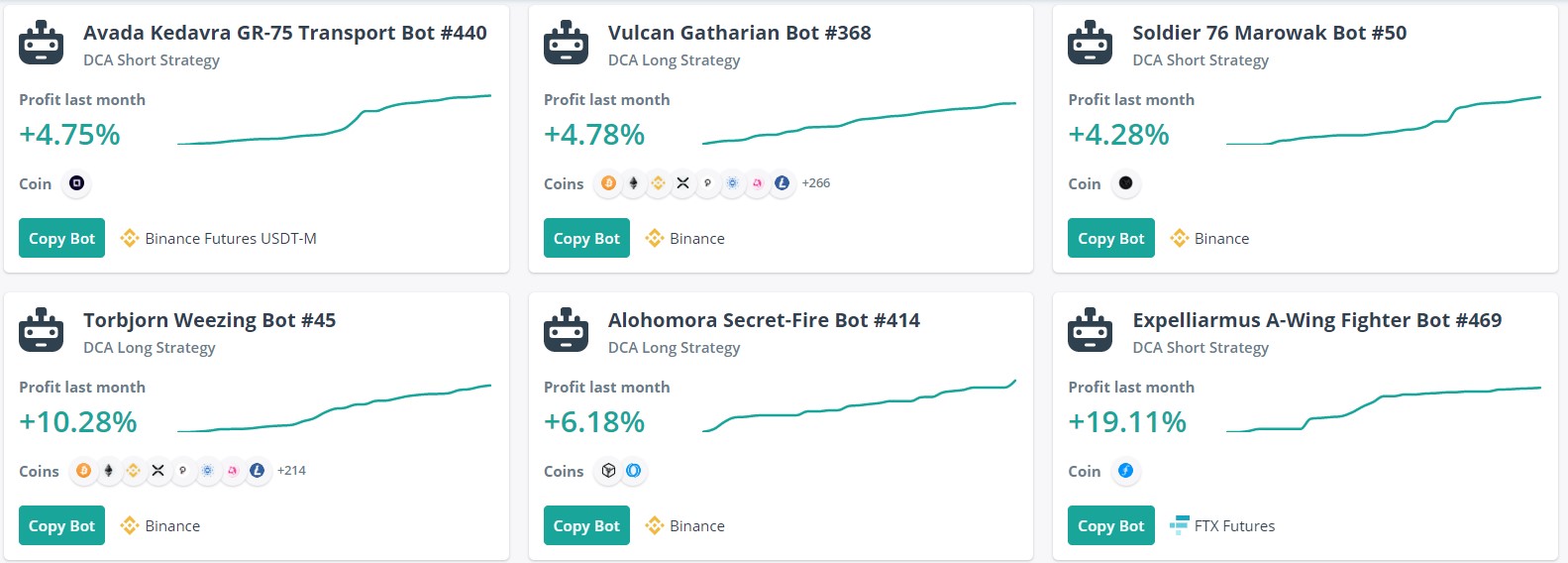

3Commas offers different types of bots which can be used for various purposes. These bots can be created using presets based on the strategies of pr0 traders.

- DCA Bot

Dollar-Cost Averaging (DCA) strategy is a practice of investing in a cryptocurrency at preset intervals reducing the initial price of a position over time and mitigating volatility risk. By using DCA, you can divide your investments into smaller pieces and buy assets at various points over time at different prices.

By doing this, you can get a better average price for your position and significantly reduce risks from the consequences of volatility.

- GRID Bot

The GRID bots help to take profits with little effort automatically. Choose a coin and initial trade size, and the bot will buy when the price drops and sell when it rises.

The bot analyses price volatility on your selected token for the last 7 days and forms price channels and price extremes for trading. The GRID bot divides the investment amount in the bot between the left and right sides of the pairs selected and sets up a limited buy and sell order grid.

When the price reaches a buy or sell level, it automatically performs the trade on your behalf.

- Options Bot

Options can be challenging to master for some, but this entire process of long and complex learning, experimenting, and trading is simplified using the options bot. As you know, options are an instrument of exponential profits options bot at 3Commas comes in handy for doing so.

Through the options bot, you can earn hefty profits in different market conditions reducing the risk for you, and you don’t even need to be glued to your computer screens all day.

Now that you know about the bots, I will share some unique features of 3Commas.

3Commas Features & USPs

Various features make 3Commas unique and a favourite of both new and more experienced traders. Let’s discuss these features and their functions now.

Manual trading with Smart trade

With Smart trading, you can sell and buy coins in a single-window there are even more functions like:

- Concurrent Take profit and Stop loss: The deal closes reaching the indicated price, or when the price drops at or below the mentioned value.

- Take Profit and Stop Loss Trailing: Automated trading value adjustments as the price of the coin rises. Take Profit and Stop Loss points can be automatically set to increase if a coin’s price increases.

- Sell through multiple targets: Sell your coins by various targets. For example, you can sell half the coins for $10,000, then the 25% for $11,000, and the rest for $11,500.

- Smart Cover: It lets you earn additional profits under unexpected market conditions. By Selling and buying back coins.

- Chart and Signals from TradingView: View accompanying currency rate charts and TradingView signals in a single window.

Automated trading with trading bots

As you know already, through trading bots, you can trade 24 hours a day using the trading strategies of a professional trader. These automated trades can then work for you on their own on the guidelines set by you. Let’s discuss now what features 3Commas automated bots offer.

- Single-pair Bot: It helps to run one trading pair at a time.

- Multi-pair Bot: It is used to run multiple trading pairs simultaneously.

- Long algorithm: Bot buys a coin with the guidelines you create. Orders for sale are then placed at a higher price. For example, you buy it for $10 and sell it for $11.

- Short algorithm: Bot sells a coin after creating settings and then setting a buy order at a lower price. For example, if you sell it for $10 and buy it for $9.

- Deal Close Signals: Bot trades depend on the trading view signals: RSI-7; ULT-7-14-29; TA Presets; CQS Scalping; Trading View Custom signals. Which you can use to set a deal start condition.

- Analyze and copy bots: Bots can be used to analyze the performance and view as well as copy other bot settings on the 3Commas platform.

Portfolios

You know it’s an investment tool; let’s see what unique features 3Commas provides using these.

- Creation: You can create portfolios with any coin amounts on 3Commas.

- Balancing: You can balance your portfolio by maintaining coin ratios.

- View: It helps to analyse the incomes of other 3Commas users.

- Copy and Edit: You can use them to copy and edit coin ratios in your portfolio.

Other features

There are even many other features other than these.

- Notifications: You’ll receive deal notifications on your browser through a mobile app, Telegram, and Email.

- Marketplace: Utilise trading signals from Cartelsignals, Crypto Quality Signals Premium, and others.

- Apps on App Store and Google Play: Their app allows you to trade and follow deals through your smartphone or tablet.

- Referral program: Earn via crypto referral payments. Spend it on 3Commas or withdraw your money.

- API access: Set up and utilize API (Application Programming Interface) functionality on your platform.

3Commas has a varied set of order types. Let’s see what all order types are offered through the exchanges currently present on the platform.

3Commas Order types

On 3Commas, you can create different types of orders via the Terminal’s Order control, let’s see what are they:

- Good- Till- Cancelled: It is nothing but a Limit order that stays on the order book until you physically cancel it.

- Fill or Kill: It is used when a trader buys or sells a security at or better-specified price. The trade must be completed entirely or the order gets cancelled.

- Immediate or Cancel: This order type requires the trader to execute trades immediately, any portion that cannot be filled gets cancelled.

- Post-Only: This order is widely used for futures trades, it requires Limit Order to be placed into the order book compulsorily as a ‘Maker’ order if the order is placed as ‘Taker’ it will be cancelled. Maker orders get a fee rebate making them desirable to be used.

3Commas Product Types

3Commas provides a range of product types through different exchanges, making your overall trading experience more convenient. These product types are available on the following exchanges:

- Spot: Binance, FTX, OKX, KuCoin, Coinbase Pro (GDAX), Binance US, Bitfinex, Bitstamp, Bittrex, Bybit, Crypto.com, FTX US, Gate.io, Gemini, Huobi, Kraken, Poloniex,

- Futures: Binance, FTX, BitMEX, Bybit, Gate.io

- Margin: Binance

- Options: Deribit

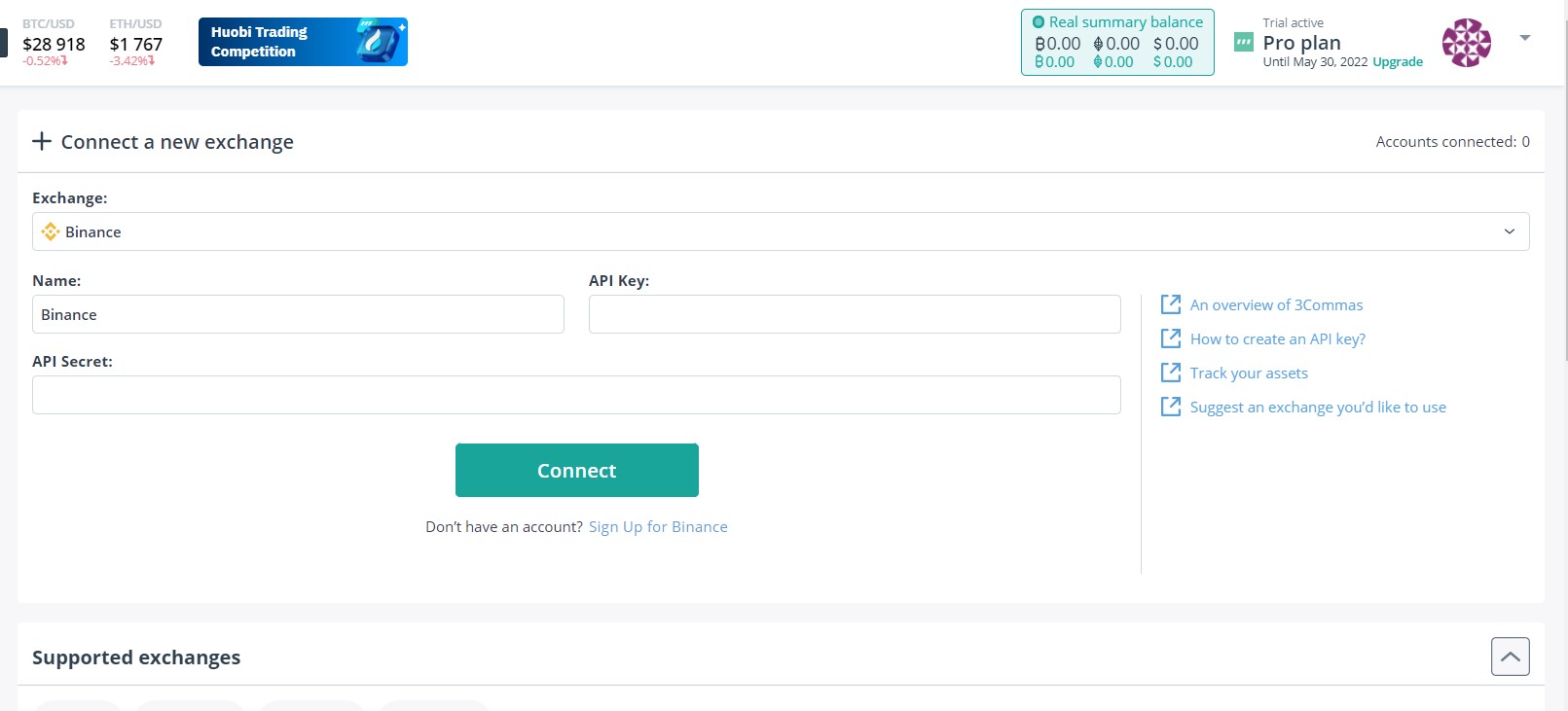

Account creation on 3Commas is pretty hassle-free and requires just a few minutes, Let me tell you how simple it is.

How to get started with 3commas?

1. Create a 3Commas account by filling up the registration form on the 3Commas homepage. You’ll get a free trial to test bots.

2. Choose between paper trading or exchanges. You can opt for paper trading if you are new to trading as it doesn’t require any funds.

3. Or, when you choose exchanges, you can connect exchanges to your 3Commas account. First, you need to create your API key on your exchange.

4. After the API key is created, head to the ‘My Exchange’ page. Select the exchange you want to connect to and choose a name that quickly makes you recognize the exchange account.(This name will be used on the trading terminals, bots, statistics, and the trading history as well).

5. Now fill in the API key and the API secret. You have to enter the Passphrase if you opt for one, unique for every API key.

6. You then have to enter your Customer ID; it is optional and depends on the exchange.

7. Once all the boxes are filled in, click the ‘Connect an exchange’ button. You’ll see the exchange statistic page when it connects.

(For Binance traders, always hold spare BNB to pay exchange fees and avoid problems with small deals).

8. Now that your exchange is linked with your account, you can set up your bot with which you want to automate your trading strategies. Once you do that, you are ready to trade.

3Commas also provide different deposit methods to ease your trading experience, let’s go through them.

3Commas Deposit Methods

On 3Commas, you can deposit using 2 methods, they are:

- Visa, Mastercard credit, debit or any other card brand or type of payment card can be used.

- PayPal account (including payment cards and bank accounts linked with PayPal).

In addition to these, 3Commas is also linked with external exchange accounts. You can also opt for the deposit methods available on those respective exchanges.

You can use a limit order to add funds to a specified price in your preferred currency.

When a Limit order is ongoing, the bot will use the available funds to place the limit order on the exchange order book. After clicking the “Save” button, it will put a limit buy order for a long deal and a limit sell order for a short one.

With the knowledge of the deposit methods let me tell you how money can be withdrawn from 3Commas.

How do I withdraw money from 3Commas?

To withdraw funds from 3Commas:

- Open the 3Commas wallet app.

- Tap on the Open wallet button or the Wallet button in the bottom menu.

- Now, tap on receive button. Then choose the coin from the list of digital currencies or use the search bar to find your coin and tap on it.

- Copy the address and use it to send funds.

Now, that you know the deposit and withdrawal methods let me tell you the fee structure and pricing of 3Commas.

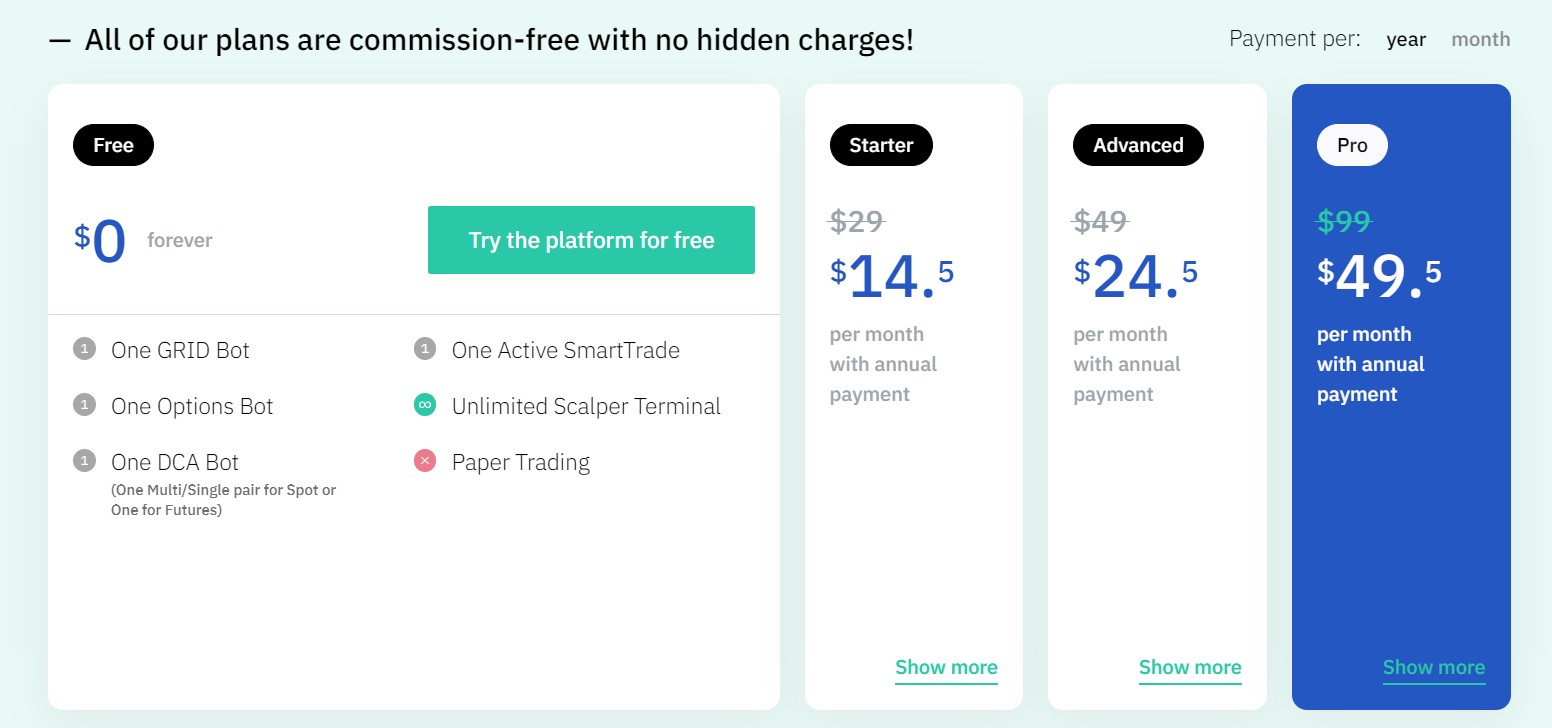

3Commas Trading, Deposit & Withdrawal Fees/Pricing

3Commas is a commission-free platform where you can execute all the trades available with no hidden charges. As your trades are executed through the linked exchanges, there will be charges applied as per the fee structure of those exchanges.

3Commas also has four plans depending on the features, accessibility, and cryptocurrency trading bot they offer.

1. Free

- It doesn’t charge you any fee, allowing you:

- One GRID Bot

- One Options Bot

- One DCA Bot

- One Active Smart Trade

- Unlimited Scalper Terminal

- No Paper Trading

2. Starter

It charges $14.5 per month if paid via annual payment; otherwise, the monthly pricing is $29 for this subscription, allowing:

- One GRID Bot

- One Options Bot

- One DCA Bot

- Unlimited Active Smart Trades

- Unlimited Scalper Terminal

- Paper Trading

3. Advanced

The monthly charge for this subscription is $49, but if paid annually, the amount comes down to $24.5 per month, with the following features:

- One GRID Bot

- One Options Bot

- Unlimited DCA Bots

- Unlimited Active Smart Trades

- Unlimited Scalper Terminal

- Paper Trading

4. Pro

The monthly subscription amount is $99; however, with an annual payment method, the monthly charge becomes $49.5 with unlimited access to all the features.

- Unlimited GRID Bots

- Unlimited Options Bots

- Unlimited DCA Bots

- Unlimited Active SmartTrades

- Unlimited Scalper Terminal

- Paper Trading

3Commas also provides certain features that are available by default on all plans like:

- Multi-level referral program

- Free mobile apps

- TradingView Integration

3Commas Customer Support

3Commas users have highly praised the customer service. With trained and dedicated representatives, customer support is responsive and ready 24×7 to help you with your queries.

You can also reach them by submitting a request in the Help Centre or through their Twitter account, Telegram Group, or Facebook.

3Commas also has a pretty comprehensive and detailed FAQ page that would answer all your queries. It also comes with a guide that would help you be introduced to their various features and options.

3Commas Security

When choosing a trading platform, security is an important aspect to look upon, and 3Commas is renowned for its security features. 3Commas connect with exchanges through APIs; they don’t store any funds or information.

While performing any deposit or withdrawal in the trading process, users simply need to provide their API keys generated by their selected exchange. The API keys strictly provide trading bots with restricted access to the trading account to conduct trades and no withdrawal rights.

Looking for any other trading bot? Have a look at these 3Commas Alternatives

In addition to these protocols, 3Commas also has two-factor authentication and notification alert options that notify you on every log-in on your account. If the platform detects a new IP address, it sends you verification Emails.

This gives users an extra level of security and eliminates the risk of cyber attacks to a great extent.

3Commas Pros & Cons

Pros

- Beginner-friendly: 3Commas user interface is quite subtle yet straightforward, with all the features and options readily available at your fingertips making it user friendly for beginners as well as experienced traders.

- Wide Exchange availability: There are currently 19 exchanges available on the platform, and they keep adding more exchanges.

- Variety of order and product types: With good-till-cancelled, fill or kill, immediate or cancel, post-only order types as well as spot, margin, futures and options products, 3Commas is a pretty attractive platform for many traders globally.

- No personal data required: With the incorporation of APIs, 3Commas doesn’t store your information on the platform; it lets you trade anonymously.

Cons

- Insufficient exchange list: Some of the other widely used exchanges are not present on the exchange. Though the majority of them are available they still need to update their list with many more. And I am pretty sure they will.

How reliable is 3Commas while trading?

One of the most reliable and well-regarded platforms on the dimensions of cryptocurrency trading bot is 3Commas. The platform offer tonnes of features and options to make your trading experience hassle-free and safe.

You can use these trading features to build your own custom bot, which can then be tested and used by multiple exchange platforms.

So far, there is not a single report of any security issues, lag, or any other kind of misconduct, and there are quite a good number of customers adding every day. You can judge the reliability factor of this platform.

Is 3Commas Safe & Trustable?

The security features on 3Commas are top-notch; there’s no doubt about it. Even though the platform doesn’t require any personal information, thanks to its API functionality, the platform adds even more security features by default on the platform.

Two-factor authentication and notification feature with verification through EmailEmail are some of its additional security features that you can choose from.

3Commas is safe and trustable, eliminating cyber attacks and theft extensively, making the platform trustworthy for millions of users worldwide.

Which bot is best in 3Commas?

Using 3Commas for a long time now, after using the trading bot feature on many other platforms, I can point out that the GRID bots on 3Commas are THE BEST.

To launch a GRID bot, you just need to select a coin and your investment amount. After that, set the range in which your Bot will purchase and sell. Then Adjust your trading strategy accordingly for maximum efficiency.

On 3Commas, you can even adjust your GRID bot via two simple options:

In the “AI Strategy mode,” The bot analyses price volatility on selected token for the last 7 days from price channels and price extremes for trading;

GRID bot distributes the total invested amount in the Bot between the left and right side of the selected pair setting up a limit buy and sell order grid.

When the price reaches a buy or sell level, it will then execute the trade on your behalf automatically.

GRID bots on 3Commas are comparatively easy to use and can be optimized through various cryptocurrency exchanges for automation and profit magnification.

Is 3Commas insured?

As you know, 3Commas links your 3Commas account with the major crypto exchanges present on the platform. 3Commas doesn’t offer any insurance themselves, and they don’t even need to provide one.

Because you are linked to other exchanges, the insurance offering of those exchanges applies to your trades by default.

For example, in the case of Gemini, they offer FDIC insurance; when you trade through this platform using the automated trading bots of 3Commas, the FDIC insurance applies to your trades automatically.

And hence your trade through 3Commas becomes FDIC insured.

Are 3Commas bots profitable?

It is for sure that 3Commas trading bots save a lot of time, allowing you to place hundreds of trades that would be impossible to be done through manual trading.

In addition to this, because you don’t have to go through long hours of learning different trading skills, you can simply copy the strategies of professional traders while saving time and decreasing the complexity making 3Commas bot profitability more consistent than manual trading.

Through bots, all your trades are active all the time, with multiple exchanges on which you have complete control, even though you are not watching your trades all the time. The automated bot on your behalf on the linked exchanges is carrying out your trades and creating profits for you.

And anytime you want, you can access your trades via your 3Commas trading dashboard and access all your trading tools at your fingertips. Therefore, Yes 3Commas are immensely profitable and can boost your profits exemplarily.

How to set up your first Single-pair bot?

Using the paper trading method

- Go to ‘DCA Bot’ and click ‘+Create bot.’

- Enter a unique name by changing the default name, making it easy to identify.

- Under recommended pairs section select the pair you want; for now, let’s stick with USDT-BTC.

- Set base and safety orders size to 100 USDT. Bots use the base order size as the initial trade size. This bot will open deals of 100 USDT.

- Now disable safety trades by setting ‘Max safety trades count’ to 0. It’s a feature for your second bot.

- Set take profit to 0.1%. Small targets make trades faster, meaning you can execute more trades.

- In the ‘Deal start condition,’ select ‘Open new trade asap’ because the Bot starts the next deal immediately after closing the current one. The first deal comes up just after you enable the bot.

- Click ‘Create Bot’ and click ‘Start.’

How to create a Single-pair DCA bot using a Built-in Technical Analysis Indicator?

- Head to the main menu, select ‘DCA Bot,’ and click the ‘Create Bot’ button.

- Ensure that the ‘Advanced’ tab is selected at the top and choose a unique name for the bot. Choose the ‘Exchange’ account and choose Single- pair for your bot typesetting.

- Now choose the trading pair from the ‘Pairs’ selection using the procedure I told you in the previous section.

- Select the options as per your strategy in the’ Strategy’ settings.

- Next set the Deal Start Condition; this setting tells the bot when to open a new trade on the coin selected. As an example, I am taking the RSI-7 value of less than 20 on the 5-minute chart time frame.

- This will enable the bot to open the trade if there is a quick drop in the buying strength for your selected coin.

- Now, set the ‘Take Profit’ settings by entering Target profit (%) and Take profit type.

- Now edit the Safety order section as per your requirements.

(I recommend the beginners to keep the values of all these settings as low as possible for experimentation or opt for Paper Trading. Remember, you will learn with every trade you execute, so be patient).

How To Customize Your Trading Bot On 3Commas?

You can adjust the following aspects on 3Commas:

- Exchanges: You need to specify the cryptocurrency exchanges you want your custom trading bots to trade on. If you plan to trade on large volumes, it’s better to trade on multiple exchange platforms, and the bot will execute trades following your instructions simultaneously. You will not miss any trading opportunities as your orders will be spread on multiple platforms.

- Pairs: You must instruct your custom trading bots about the trading pair you want them to trade in. Simply choose trading pairs from the drop-down list. You can also look for the ‘Recommended Pairs’ tab, which lists suitable trading pairs in relation to the market situation.

- Initial trade size: You need to let your bot know how much you want to open your trade. The bot will also place additional trades once the initial order has been executed as per your previous instructions, so keep this in mind. You have to enter the amount you want to purchase in relation to the base currency.

Safety trade parameter: It is used to perform a cost average exercise, allowing you to bring your average buy price down as the coin decreases in value. The bot will typically open safety trades for every subsequent percentage against you.

- Limit of your safety trades: This parameter leads on from the above metric. The bot can then decide to place a new safety order for each subsequent per cent decrease against you. However, you need to specify how often you want the bot to do so.

- Deviation of your safety trades: If you don’t want the bot to determine the percentage drop at which to execute safety trades you can specify this yourself. Simply enter the fixed percentage in the box.

- The scale of your safety trades: If you don’t want to confine yourself to a fixed percentage, you can instead instruct the automated bot to utilize a scaled safety trades strategy. You can increase the safety trade size for each subsequent percentage decline.

- Trading volume Restrictions: This particular metric is of great significance. You can instruct your automated bot only to execute your trading conditions if your chosen pair hits a minimum 24-hour trading volume. Suppose you want to trade BTC/ETH, but you only want to enter the market when trading volume surpasses 1,000 BTC, then this can be done. Keep in mind the minimum 24-hour volume must be expressed as the base currency.

Conclusion

Trading bots make your trading experience more controlled, organized, and informed and save a lot of time. These features can be even more optimized when carried out on 3Commas.

3Commas comes with all the necessary tools and features that you can think of while carrying out automated cryptocurrency trading. It makes both manual trades, and automated trades executed like a charm.

With the carefully designed, clean, and informative interface, 3Commas is my favourite for automated bots trading, and I am sure you’ll love it too.

Just get your hands on this fantastic crypto trading bot and skyrocket your profits!!

You might also like: