So you have picked your favourite crypto day trading exchange and now looking for a concrete strategy that advanced traders use? You are at the right place.

This comprehensive guide will cover everything about developing a strategy to trade crypto. This guide will be beneficial if you’re new to the digital currency market or are losing money rapidly.

I will also tell you about the best strategy to day trade crypto and how to approach them when you choose them. So, let’s start with jotting down the best strategies.

- Scalping

- Range Trading

- IFC Markets

- Arbitrage

- Swing Trading

- High-Frequency Trading (HFT)/Bot Trading Strategy

- Momentum Trading

Now, let’s discuss and learn how to use them.

Best Crypto Trading Strategy

#1. Scalping

Scalping is the shortest method to day trade cryptocurrency where you buy and sell assets within seconds or a few minutes. This investment strategy involves risking a small portion of your capital and taking a trade to make a quick profit while keeping a tight stop loss.

- Time Frame: 1 min / 15 minutes

- Profit Target: 0.5-1.0%

- Risk/Reward: 1:1

When you are scalping, you may exit a trade seconds after entering and can also use automated bots to increase the frequency of your trading cycles with high trading volume.

Although the trade can be small, followed by tiny market movements, staking a significant amount with increased trading volume, will mean the scalp will come back with a hefty sum and trading frequently (making 10-20 trades a minute) will mean small gains adding up to huge profits.

#2. Range Trading

This is an active investing strategy where you identify a range in which you buy or sell over a short period. For example, if a coin is trading at $35 and you believe it will rise to $40, then trade between $35 and $40 over the next several weeks.

You might attempt to trade it by purchasing the stock at $35 and then selling it if it rises to $40. You could repeat this process until you think the coin will no longer trade in this range.

If you are range trading, pay close attention to overbought and oversold zones. Overbought means buyers have saturated their needs, and the crypto will probably sell off, whereas oversold is the opposite.

Chart indicators, included in any reputable charting system, can help you find these zones. The indicators used for this purpose include the Stochastic Oscillator and Relative Strength Index (RSI).

#3. IFC Markets

IFC markets are leading providers for crypto Contract for Difference (CFD) that allows day trading in several styles in the cryptocurrency market with:

- Over 6000 Financial Markets

- Instant Order Execution

- No Hidden Commissions

- Low Fixed Spreads

Here you can build your financial instruments and best strategies for crypto day trading, taking advantage of the 1:8 leverage and low minimum volume requirements.

Crypto CFDs are derivatives that let you speculate crypto without owning the underlying crypto, so you can go big if you think the asset’s value will rise or small if you think it will fall. The cryptocurrencies are traded as pairs against regular assets.

Another good thing about CFD trading is that you don’t need a Bitcoin wallet or an account on a Bitcoin trading platform to trade.

#4. Arbitrage

This is a prominent crypto day trading strategy in which you buy crypto in one market and then sell it in another. The difference in the buying and selling price point is called ‘Spread’.

You can book to profit because of the difference in liquidity and trading volume. To do this, you must open accounts on exchanges showing a significant difference between prices for the crypto which you are trading.

At a point, Bitcoin traded at a 40% higher price in South Korea than in the U.S., which was known as the “Kimchi premium,” and it showed up multiple times. Traders profited by purchasing Bitcoin on U.S. exchanges and immediately selling it on South Korean exchanges.

However, the discrepancy will not usually be this significant, but the low barrier to entry for newer exchanges brings new arbitrage opportunities more often than in traditional markets.

You should also consider trading fees when attempting arbitrage. The fees to execute a trade on an exchange may eliminate the gains from the trading spread.

New to crypto trading? Learn about the Best Leverage For Bitcoin Trading

#5. Swing Trading

Swing trading is a prominent name among cryptocurrency trading strategies where you buy an asset and hold it for a few minutes or hours. It is a short-form trading strategy. Swing trading aims at buying breakout crypto markets that could show significant momentum in the future.

- Time Frame: 1 hour / 4 hours, 4 hours / 1 day

- Profit Target: 10-25%

- Risk Reward: 1:2, 1:3

The point is to capture a chunk of a potential price move by seeking out volatile assets with lots of movements or sedatives. In either case, swing trading is recognizing where an asset’s price trends are likely to move next, then entering a position and capturing a chunk of profit if that move materializes.

A successful crypto trader looks to capture a chunk of the expected price move and then move on to the next opportunity.

Recommended Read: How long can you hold crypto futures contracts?

#6. High-Frequency Trading (HFT)/Bot Trading Strategy

It is a type of algorithmic trading strategy used by quant traders. High-Frequency Traders take advantage of price movements in seconds or even milliseconds.

The system constantly monitors as well as analyzes digital assets across multiple exchanges and identifies trends with other trading triggers.

Trading bots involve developing a specific strategy, developing the appropriate program to execute that strategy, and then constantly monitoring, backtesting, and updating the algorithms to keep up with changing market conditions.

It takes practice to master this strategy since developing such bots requires knowledge of mathematics and computer science as well as an understanding of complex market concepts. Beginner traders can easily combine HFT with different crypto trading strategies by instituting specific trading logic.

#7. Momentum Trading

On paper, momentum trading looks like the standard investing practice in which traders buy securities that are increasing in price and then sell them when they look to have peaked, where the goal is to work with the market volatility by finding buying opportunities in the short-term uptrends and then sell them when the securities start to fall in momentum.

This statistical trading strategy is purely based on the skills that take time and learning to master. Skilled traders understand when to enter a position, how long to hold it, and when to exit. It can be a comparatively risky strategy for newbies, but following a set of rules can be beneficial while starting.

The rules of momentum trading can be broken down into five elements:

- Selection, or what equities you choose.

- Risks revolve around the timing of opening and closing the trades.

- Position management combines wide spreads and your holding period.

- Entry timing means getting into the trade early.

- Exit points require consistent charting.

The best momentum trades are when a news shock hits, triggering rapid movement from one price level to another. Alternatively, this sets off buying or selling signals for observant players who jump in and are rewarded with instant profits through careful news and sentiment analysis.

Early positions offer the greatest reward with minimum risk, while ageing trends should be avoided by all means. The opposite happens in the real world because most traders don’t see the opportunity until it’s late and then fail to act till everyone else jumps in.

Exit when the price is rushing into an overextended state. A series of vertical bars often signals this state on the 60-minute chart.

Recommended Read: What Is Liquidation In Crypto Trading?

Frequently Asked Questions

How to choose a day trading strategy?

While choosing a crypto strategy to fit your trading requirements, you should keep the following things in mind:

- Entry and Exit: In this part, you decide when and where to enter and exit a trade.

- Risk Management: What will be your desired risk and reward for each trade? Where will be your stop loss? What will be your position sizing?

- Fundamental Analysis: Analyzing the fundamental aspects of an asset

- Technical Analysis: Analyzing the technical aspects of an asset, such as candlestick patterns, indicators, etc.

- Long and Short: Long means to buy, and short means to sell

- Squaring Off: Squaring off means exiting an open position

- Profit Target: The price at which you will book your profit

- Stop Loss: The price at which you will exit a position in loss

- Risk Reward: The ratio of the profit target and stop-loss

What are the useful indicators to look for while trading crypto?

Following are the major technical analysis indicators and how to use them in growing your crypto investments:

- Relative Strength Index (RSI)

RSI is a momentum indicator, indicating how strong a move is. The highest value on the RSI graph is 70, and the lowest is 30. When the RSI graph shows a value over 70, the condition is known as an “overbought market.”

If the RSI is above 70, i.e., overbought, it’s likely to fall quickly. Similarly, if the RSI is below 30, i.e., oversold, it’s expected to rise soon. So, it’s a good confirmation if you’re looking to go long and the RSI is below 30. You can also use other indicators that show momentum.

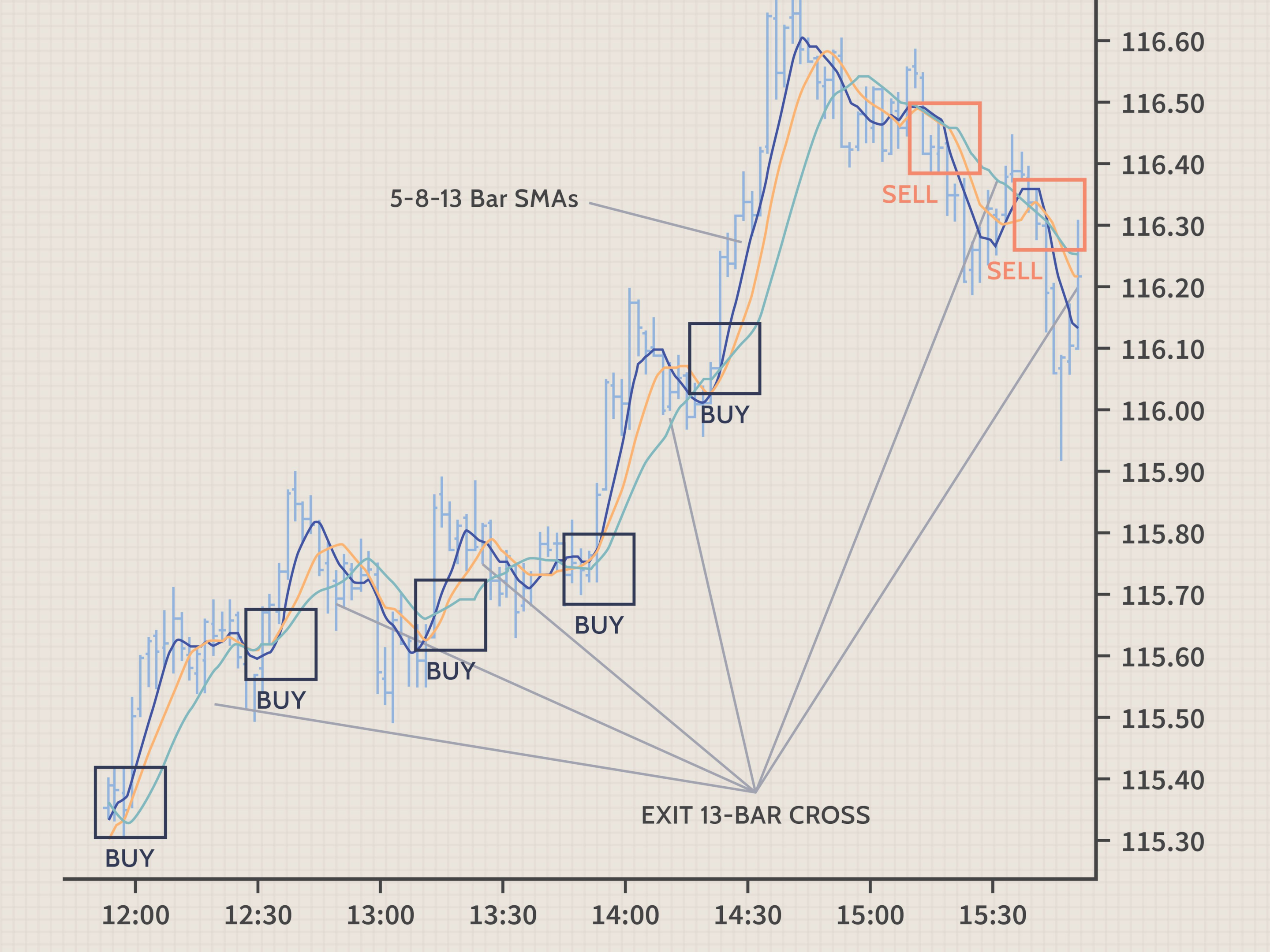

- Moving Averages

Moving Average is one of the most popular indicators in the cryptocurrency space. This indicator plots a line, which is the average of previous candles. So, a 9 M.A. means it’ll plot the average price of the last nine candles.

The best way to use Moving Averages is to plot two M.A.s — 12 MA and 26 EMA — simultaneously. This strategy helps you confirm trends. If the market seems to be an uptrend, and the 12 EMA crosses over 26 EMA, it can be a buying confirmation.

- Moving Average Convergence Divergence (MACD)

MACD is a blend of RSI and Moving Averages. It plots M.A.s on the chart and shows a histogram with an RSI chart. Hence, you can get double confirmation. It can be considered a buying signal if the RSI is below 30 and the 12 EMA has crossed over 26 EMA.

- Bollinger Bands

Bollinger Bands comprise one Moving Average, along with an upper and lower band. Ideally, it’s a buy signal when the price comes close to the lower band and then moves upward and crosses the Moving Average. You can use this for both long and short strategies.

- Parabolic SAR

Parabolic Stop and Reverse (SAR) places dots across the chart’s price action. When the price touches a dot, a signal is issued. This indicator is best used for trading reversals. If crypto is in an up move, touches a dot, and starts reversing, it’s a sell signal.

Similarly, if the price goes down, touches a dot, and reverses, it’s a buy signal.

- Fibonacci Retracement

These indicators can be used to place entry orders, determine stop-loss levels, or set price targets. For example, a trader may see an asset moving higher. After a rise, it retraces to the 62.8% level.

Then, it starts to move up again. Since the bounce occurs at the Fibonacci level during an uptrend, subsequently, the trader decides to buy. The trader might also set a stop loss at the 62.8% level, as a return lower than that level would indicate that the rally has failed.

This indicator also arises in other ways in technical analysis. For instance, they are frequent in Elliott Wave theory and Gartley patterns. After a significant price movement both up or down, these methods of the technical analysis indicate that reversals tend to form close to certain Fibonacci levels.

Fibonacci retracement levels are stable, unlike moving averages. The stable nature of the price levels allows for quick and easy identification. That helps traders and crypto investors to anticipate and react prudently when the price levels are tested based on the market data. These levels are inflexion points where price action is expected, either a reversal or a break.

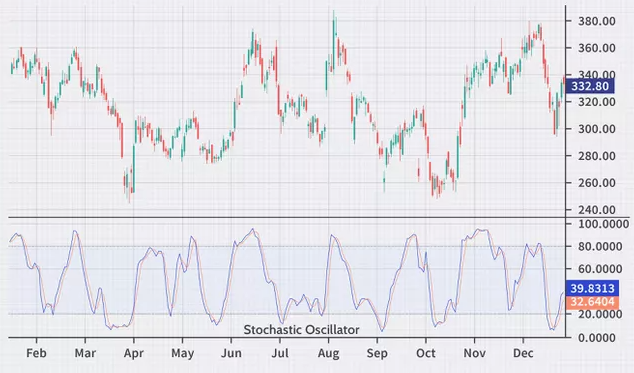

- Stochastic Oscillator

The stochastic oscillator is range-bound, which is always between 0 and 100. This makes it a valuable indicator of overbought and oversold conditions.

Usually, readings over 80 are considered in the overbought range, and readings under 20 are considered oversold. Although these are not always indicative of impending reversal, strong trends can maintain overbought or oversold circumstances for an extended period.

Alternatively, traders should look for changes in the stochastic oscillator for signs of future trend shifts.

This charting generally includes two lines: one reflecting the actual value of the oscillator for each period and one reflecting its three-day simple moving average. As the price is thought to follow momentum, the intersection of these two lines signals that a reversal may be in the process, as it indicates a significant shift in momentum daily.

The divergence between the stochastic oscillator and trending price action is also an essential reversal signal. For instance, when a bearish trend reaches a new lower low, but the oscillator prints a higher low, it may indicate that bears are exhausting their momentum, and a bullish reversal is brewing.

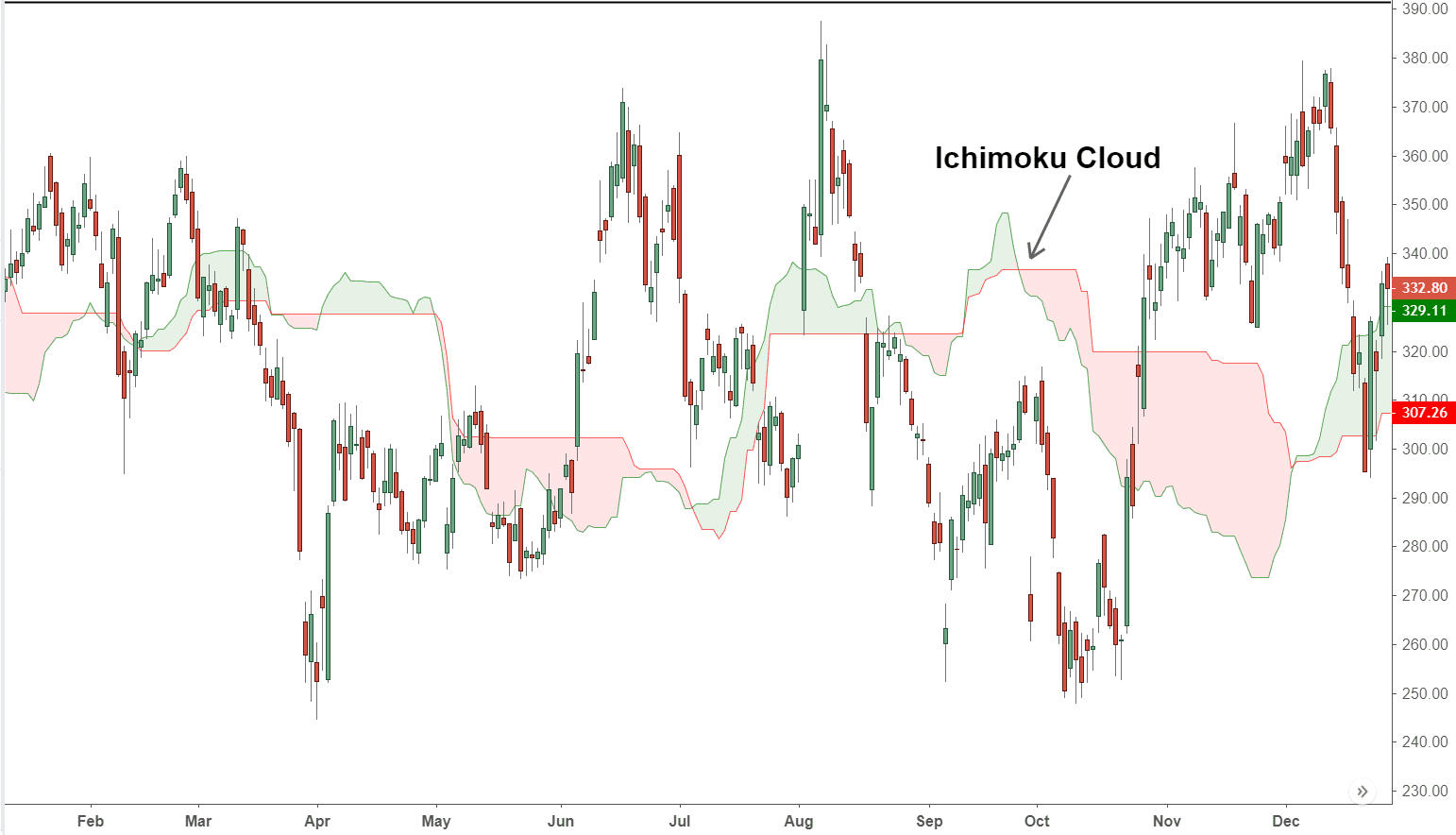

- Ichimoku Cloud

The Ichimoku Cloud is a compilation of technical indicators that show support, momentum, resistance levels and trend direction, which is done by taking multiple averages and indicating them on a chart. It also uses these figures to compute a “cloud” that forecasts where the price may find support or resistance in the future.

The Ichimoku Cloud provides more data points than the traditional candlestick charts. While it seems complicated at first, those familiar with reading charts often find it easy to understand with well-defined trading signals.

What is the best day trading cryptocurrency?

There is no single best crypto asset to trade in the crypto market. You should make a list of cryptocurrencies and keep monitoring them. If crypto presents an opportunity to trade, go for it.

However, it’s essential to trade crypto assets with high volume and market cap, as they have better liquidity.

Which strategy is best for day trading crypto?

No strategy is the best for trading. Instead of finding the best strategy, traders should find a strategy with an average accuracy of over 50%. When paired with adequate risk-reward management, it can become a highly profitable setup.

Here’s a secret from advanced day traders. You don’t need an accurate strategy. You can be profitable even if you are right 50% of the time. All you need to do is maintain a positive risk reward.

Let’s do some math to understand this. You take ten trades in a month, winning five and losing five. You set a profit target of $100 per trade and a stop-loss of $100 per trade. Hence, your risk-reward is 1:1. Here, your net profit will be 0.

Now, you improve your risk-reward to 1:2, which means you set a profit target of $100 per trade and a stop-loss of $50 per trade. If your accuracy is 50%, your net profit will be $250.

So, the golden rule of trading is to focus on risk-reward instead of finding a highly accurate strategy.

Which timeframe is best to day trade crypto?

The timeframe you choose for crypto trading will depend on your trading style. If you are a scalper, 1 minute / 15 minutes time frame will be best. For day trading cryptocurrencies, 15 minutes / 1 hour will be the best.

Recommended Read: How much money do you need to trade crypto futures?

Conclusion

A good trading strategy is crucial to becoming a successful trader. A proven system helps you take advantage of all market conditions and make informed decisions that reduce your trading costs, improve profitability and minimizes the market risk.

However, it’s critical to focus more on risk-reward and less on accuracy when formulating a strategy. Always remember that an average strategy with good risk-reward can make you profitable.

All these strategies have been tried and tested. Experimentation and learning are the keys to trading, which would surely be your toolset for executing more and more profitable trades.

Feel free to post your queries in the comment section below. So without any further waiting, just try these strategies out and see yourself growing a heck of a fortune.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023