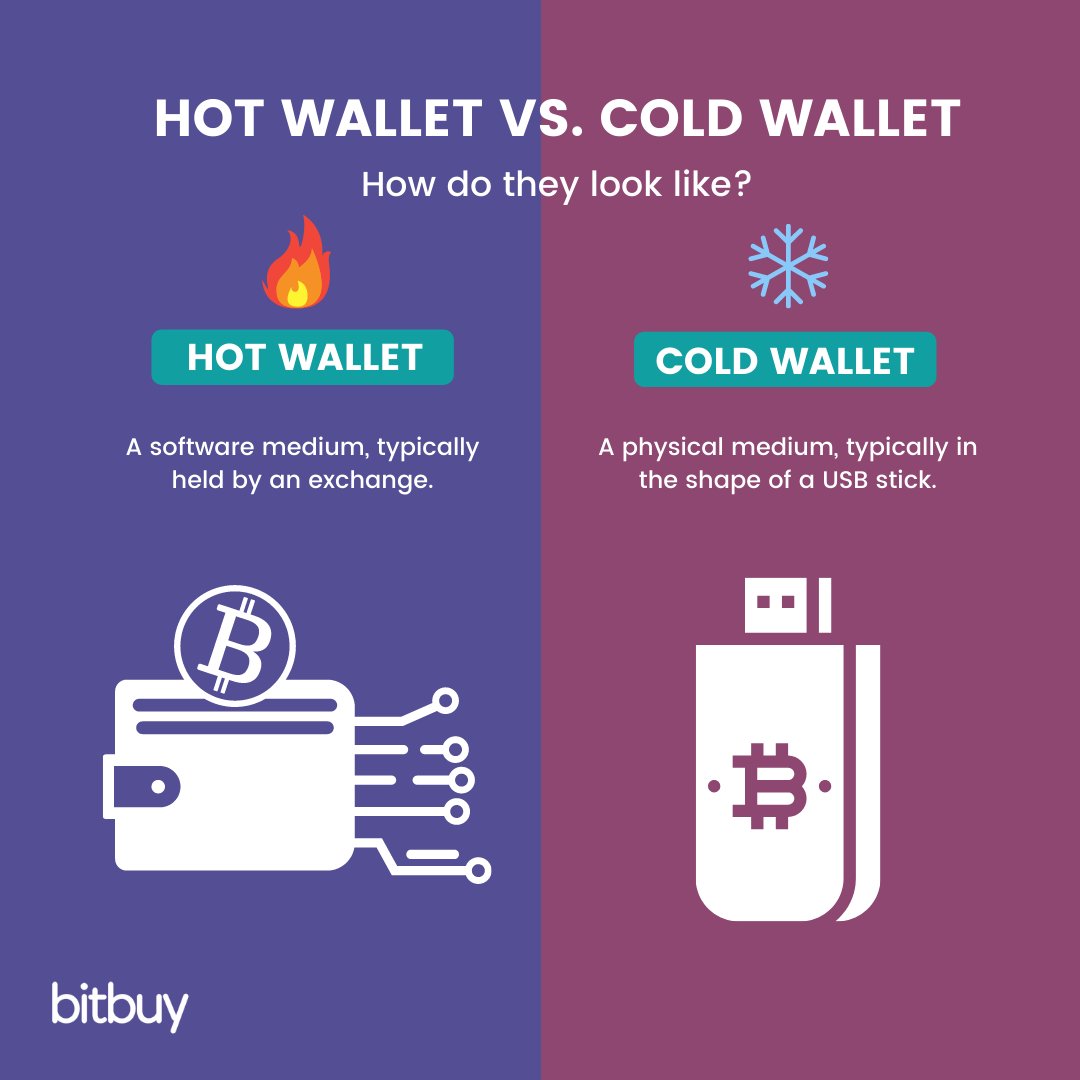

When you have bought a certain amount of crypto, it’s time to choose where you want to store them. You can choose between hot or cold wallets to do so, but choosing one of them is not so easy.

I know it is tough to choose between the two, but don’t worry; I will give you all the details you need to know to understand the wallets to the core. And then you can use them to their full potential and execute profitable trades.

Hot wallet vs Cold wallet- Introduction

As you know, a digital wallet is used for storing crypto by creating a unique algorithm. The algorithm helps the crypto wallet create a unique private key for the crypto assets it supports. A private key is a long set of numbers that accelerates your fund’s safety.

The wallet also creates a public key used for decoding the transactional data. The decoded data helps the cryptocurrency network verify the #private key without security issues.

The public key is also responsible for creating wallet addresses which are essential information for other parties to send crypto assets to the user. You could access crypto assets in your wallets by using these private keys.

These digital wallets are available in hot and cold wallets and are categorized based on their utility features. Let’s discuss now what these crypto wallets are.

What is a Hot Wallet?

Hot wallets work online and are comparatively easy to set up, use and accept cryptos. But with these many positives, hot wallets are also vulnerable to cyber breaches, require specific regulations and can be affected by other technical vulnerabilities.

Additionally, if you want to buy crypto or buy something with your crypto, using a hot wallet is relatively easy for even beginners.

When you use a hot wallet, public and private keys are stored on the internet, your computer, or your mobile phone, which is why they are vulnerable to online attacks.

But there are enough and more security measures that are taken into consideration by various cryptocurrency exchanges.

There are also specific hot wallets connected to certain cryptocurrencies or applications. You can download software hot wallets that give you more control over your keys. These hot wallets are:

#Exodus: This hot wallet supports more than 130 cryptocurrencies, making it convenient if you own many different coins. Additionally, it allows for the easy exchange of one coin for another. You can use this wallet on a desktop or mobile phone.

It’s also compatible with Tezor making it easy to move coins into cold storage. However, the wallet isn’t open-source, and there are concerns that the security depends entirely on the hot wallet’s development team.

#Mycelium: This hot wallet is compatible with multiple cold storage options, including Trezor, Ledger and KeepKey. But it is limited in the types of cryptocurrencies you can store. You can use it only for Bitcoin investments, Ethereum and ERC-20 tokens.

What is a Cold Wallet?

On the other hand, cold wallets work offline and do not require the internet to work. These wallets are comparatively more secure but don’t support as many cryptocurrencies as many hot wallets.

Similar to hot wallets, cold wallets also have private and public keys. The public key is the crypto address for your cold wallet, and the private key is used to access your crypto assets which are not stored on the network in case of cold wallets.

When making a transaction with the crypto assets, a signing process using keys takes place; in hot wallets, this process takes place entirely online, but in cold wallets, it happens offline. The transaction starts online and then moves offline into the cold storage, where you can digitally sign it.

Once signed in an offline environment, the completed information can be sent back to the online network. The main point is that the private key used to sign the transaction doesn’t end up anywhere online.

You can use a paper wallet wherein you write down your keys on paper. Printing out a QR code that allows you to sign a transaction from your cold wallet is also possible.

There are also specifically designed hardware wallets that look similar to USB drives or smart cards. Some of the most used cold wallets include:

#Trezor: This cold wallet supports many cryptocurrencies and has unlimited storage. On top of that, it’s easy to link with exchanges and can be compatible with some of the hot wallets. Models cost as little as $60 or as much as $180.

#Ledger: Unlike Trezor, Ledger doesn’t come with unlimited storage. However, Ledger has Bluetooth capability and can connect to a smartphone or desktop via cable.

The most expensive decentralized blockchain ledger wallets cost less than the highest-priced Trezor. But some Ledger model’s pricing start as low as $60. Ledger wallets are available in two models based on the features, Ledger Nano S Plus and Ledger Nano X.

Who should use Hot Wallets?

Hot wallets are a go-to option for those who frequently engage in cryptocurrency transactions online. If you are a crypto investor having a hot wallet makes it easier to complete transactions. Many exchanges offer to store coins for you in an account.

You’re also provided a cryptocurrency address besides buying and selling cryptocurrencies on the exchange. People can use that address to send you coins for payment.

It makes sense to have a hot wallet if you know that you will have a lot of transactions with individuals or exchanges. However, you should be aware that keeping a large number of assets in your hot wallet makes it a target for hackers.

As a result, it makes sense to keep only a portion of your crypto assets in a hot wallet and store the bulk of your coins in a cold wallet.

Who should use Cold Wallets?

Cold wallets are ideal for those who want to store a large number of crypto assets in a more secure environment. For example, I have a hot and cold wallet. I keep some of my coins in a hot wallet for easy use online. My hot wallet makes it easy to buy coins.

However, most of my crypto assets are transferred to a cold wallet, where they are kept offline. Some exchanges that provide hot wallets limit the storage capacity, encouraging you to move some of your assets offline and into a cold wallet to increase security.

A cold wallet offers a good solution for safely storing some of your cryptocurrencies. Just be aware that if you lose cold storage or forget your private keys, you might not get those coins back.

Hot vs Cold Wallet- Which is better?

Both these wallets are suitable for their use cases; for instance, hot wallets are a fantastic option for beginners and can easily set up their accounts and start trading with them.

As most hot wallets are free to use, it gives an additional reason for beginners to choose hot wallets.

However, cold wallets are suitable for advanced traders; it provides excellent storage utility for hefty amounts of crypto trading. Its relatively complex structure once got used to giving a much safer and impenetrable trading experience.

And most of the well-known cold wallets are expensive to buy as well, but they can be worth it when considering their safe storage.

Pros and Cons of Hot Wallet

Pros

- Ease of use: Hot wallets are always online, so there is no need to transition between offline and online to make transactions. Many traders use mobile hot wallets to trade cryptocurrency. To do that with a cold wallet will be quite complex and challenging. You need to find a computer to plug your hardware wallet (cold wallet), move the required amount of crypto to a hot wallet, and execute your trade.

- Free to use: Most hot wallets are free and don’t charge you any fees for the transactions you perform on them.

Cons

- Relatively less secure: Hot wallets compulsorily need to be connected to the internet to function, jeopardizing your exchange account’s security. However, these cryptocurrency exchanges are safe to use with various security measures. But compared to the cold wallets, yes, they are a less secure option.

Pros and Cons of Cold Wallet

Pros

- Entirely Secure: Stealing your crypto investments from a cold wallet is challenging as the hacker would need to possess your wallet physically. And even after that, the associated PINs and passwords will be required to access the funds. Cold wallets are in the form of physical hardware wallets that are similar to the size of a medium-sized USB stick. There are paper wallets and bitcoin wallets that come in the form of a physical device and are various options for cold wallets.

- Best for professional traders: Traders who trade hefty amounts should indeed be using a cold wallet. Because even if your hardware wallet is plugged into your computer or connected via Bluetooth, the funds are impossible to steal. While the transaction is signed on the device, the signature allows you to assign ownership to the recipient of a crypto transaction. Because your private keys don’t leave the device, even if malware on your computer tried to steal your funds, it would not be the correct signature, and the transaction will not be executed.

Cons

- Less Convenient: Hardware wallets are comparatively less convenient than hot wallets as they require lengthy and complex procedures of setup to sign in and execute transactions.

- Expensive: On one hand, where most of the hot wallet exchanges are free, on the other hand, cold wallets are costly to buy.

Recommended Read: Custodial vs Non-Custodial Wallets – How they’re different?

How to secure your Crypto Wallets?

As hot wallets operate online, there can be chances of cyber attacks or other security malfunctions. That is why it is important to limit how many funds and assets you have in your hot wallet.

Hefty and advanced cryptocurrency investors should use a combination of a hot and cold wallet, one for easy access to your funds and the other to store most of your crypto.

You can also back up and encrypt your hot wallet, use a strong password, and change it regularly.

Best Hot Wallets

#Meta Mask: Through MetaMask, you can manage, send and receive ETH and ERC-20 tokens. You can also manually add the Binance Smart Chain network to store and exchange BEP-20 tokens.

#Coinbase Wallet: It was designed to support ETH and ERC20 but now supports several cryptocurrencies, including Bitcoin. This software makes it easy to transfer, receive and store money.

#Edge Wallet: Edge is a smartphone wallet that makes it easy to store and trade cryptocurrencies. The wallet encrypts all your private data on your device using client-side encryption.

It gives you complete ownership of your digital assets, and you don’t even have to provide your phone number, ID or other personal information.

#Trust Wallet: Trust wallet is a decentralized open-source mobile crypto wallet that offers over 160k assets and blockchain, including ERC20, ERC223, BTC and many more.

#Exodus: It’s a multi-currency wallet with a user-friendly interface that can hold various crypto assets and is fully compatible with industry leading hardware wallets like Trezor One and Trezor Model T.

#Robinhood: Robinhood provides web and mobile trading; though the crypto support is limited, all the well-known cryptocurrencies are already listed. It is a reasonably secure option with a variety of trading features.

#AtomicDEX: Built by an open-source technology provider, Komodo. AtomicDEX is a multi-cryptocurrency wallet and cross-chain decentralized exchange with 99% cryptocurrency support, including layer 1 and layer 2 networks.

Best Cold Wallets

#Ledger Nano X: It is a physical wallet from Ledger that is the best crypto cold wallet. You can manage, exchange, and buy crypto on the go, as mobile users can use their wallets on your phones.

Ledger supports over 1800 digital coins and tokens. Its measurements are 72mm x 18.6mm x 11.75mm, weighing around 34g.

#Trezor Model T: It is a cold wallet that instantly allows users access to third-party exchanges, like Changelly and CoinSwitch, from the Trezor internet interface.

Its dimensions are 64mm x 39mm x 10mm, and its weight is around 22g.

#Ledger Nano S: It is one of the best cold wallets that Ledger has introduced. With 188+ crypto compatibility. The unit’s size is 104mm x 58mm x 5mm and weighs 16.2g.

#ELLIPAL Titan: It is the world’s first air-gap cold wallet, providing you with complete network isolation. It is built with no online accessibility or ports for cryptocurrency app support.

#CoolWallet Pro: CoolWallet Pro is a Defi- focused cold wallet that helps you connect easily to a device without the requirement of an internet connection via an encrypted Bluetooth connection within a 10-meter radius.

It offers easy interaction with Defi, Dapp and NFT. CoolWallet Pro is completely water-resistant, and a single charge lasts several weeks.

#Safepal S1: It supports 19 blockchains and 10k+ crypto tokens, including NFTs. The device doesn’t support any connectivity. It provides cryptocurrency investors with a safe, simple, easy-to-use crypto management solution.

#Keystone Pro: Keystone Pro is an entirely air-gapped cryptocurrency cold wallet with a four-inch touchscreen, open-source firmware and fingerprint sensor.

Its dimensions are 112mm x 65mm x 18mm, weighing around 115g.

Conclusion

To conclude, both hot and cold wallets have different utility cases, but at the end of the day, both are needed equally to facilitate transactions and execute profitable trades. The main difference between the two is the level of security they provide.

However, my opinion on the ongoing debate of which one is better is pretty straightforward, both wallets should be used in combination to boost your profitability.

And if you are a beginner, first get your hands on a hot wallet to understand the basics and try with limited funds. You can always use demo trading to understand different features and functions and switch on to using cold wallets when you trade with hefty sums.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023