If you’re like me, you’ve wondered, “How do I safely store and manage my digital assets?”

Crypto wallets are digital vaults that hold the private keys to your cryptocurrency, ensuring their safety and security.

They come in various forms, from physical devices to software programs and online services.

But for many, the concept of a crypto wallet remains elusive and abstract.

I’ll demystify these essential crypto tools in this article, breaking down their functions, types, and how they work.

Enter the realm of crypto wallets.

What is a Crypto Wallet?

At its core, a crypto wallet is a digital tool that allows you to store, send, and receive cryptocurrencies.

Unlike the wallet in your pocket, a crypto wallet doesn’t “store” your money in the traditional sense.

Instead, it holds your public and private keys, two crucial pieces of cryptographic information.

These keys interact with blockchains, enabling users to monitor their balance, send money, and conduct other operations.

In essence, while banks have account numbers and passwords, the crypto world has wallets and keys.

Let’s dive deeper into how these wallets vary and which might fit you best.

Types of Crypto Wallets

When storing your digital assets, the choices might seem overwhelming.

But fear not!

Understanding the types of crypto wallets is simpler than you might think.

Let’s break it down:

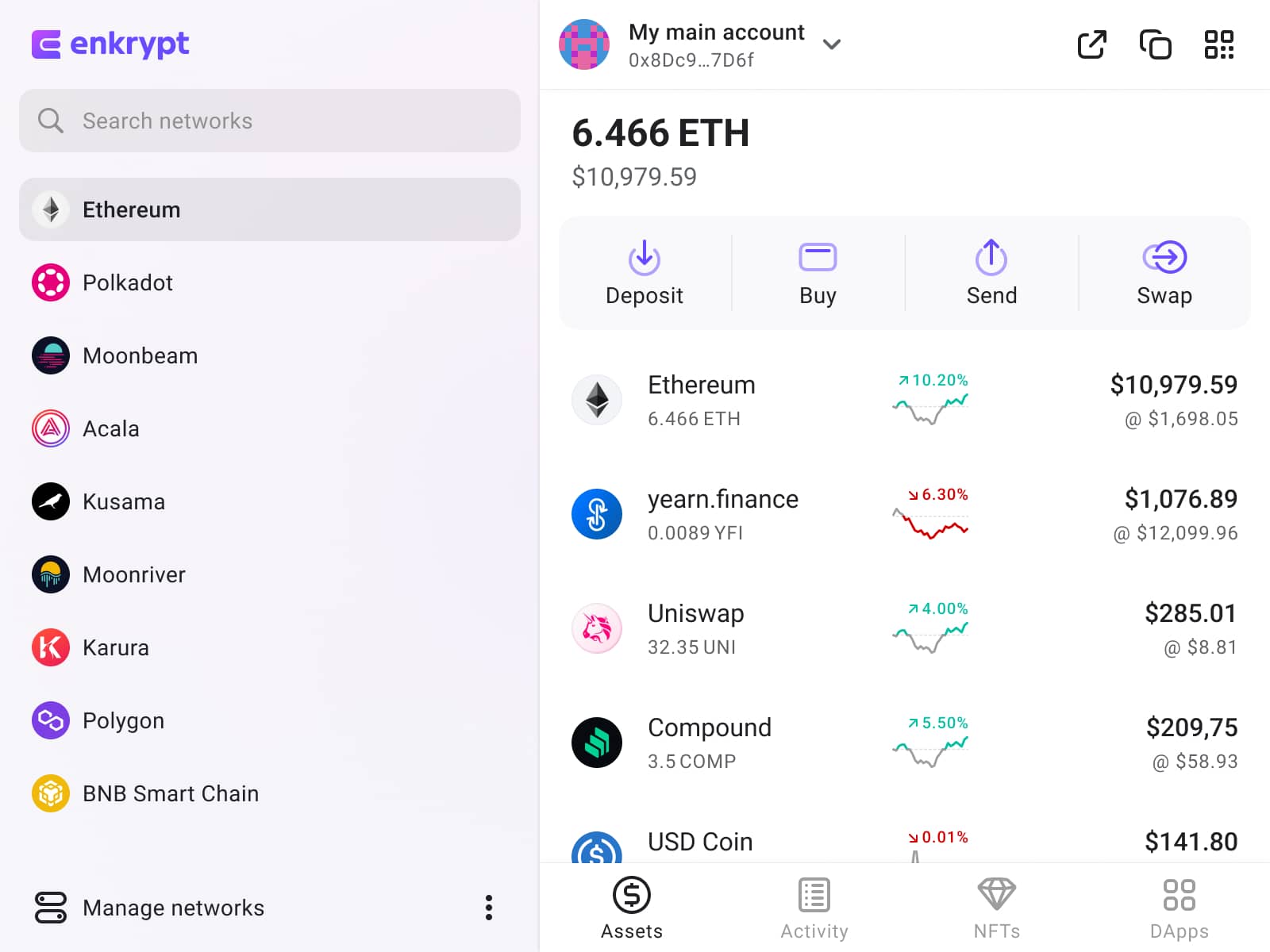

- Hot Wallets: Hot wallets are connected to the internet, making them easily accessible. They come in various forms:

- Web Wallets: Accessible via browsers.

- Mobile Wallets: Apps on your smartphone.

- Desktop Wallets: Software downloaded on your PC.

While convenient, their online nature can make them vulnerable to attacks.

- Cold Wallets: Here’s where things get interesting. Cold wallets are offline, offering an added layer of security. The main players here are:

- Hardware Wallets: Physical devices, like USB sticks, store your keys.

- Paper Wallets: Literal pieces of paper with your keys printed on them.

They’re immune to online hacks. But remember, physical damage or loss is still a risk.

- Custodial vs. Non-Custodial Wallets: This distinction is crucial.

- Custodial Wallets: Think of them as banks. A third party like Binance Futures controls your keys and, by extension, your funds.

- Non-Custodial Wallets: You’re in the driver’s seat. You control the keys and the funds.

Feeling a bit more enlightened?

With this knowledge, you can choose the right home for your digital treasures.

But hold on.

There’s more to uncover about how these wallets work in action!

How Crypto Wallets Work

Diving into the mechanics of crypto wallets can seem like a daunting task, but fear not! Let’s demystify the process step by step:

- Public and Private Keys: These cryptographic keys are the backbone of any crypto wallet.

- Public Key: Picture this as your email address. It’s a string of characters you share with others to receive cryptocurrency. While it’s visible to anyone on the blockchain, they can’t access your funds with it alone.

- Private Key: This is your closely guarded secret, akin to a password. It’s a unique string of characters that allows you to access and manage your funds. If someone gets hold of it, they can control your assets, so it’s vital to keep it secure.

- Sending and Receiving Cryptocurrency: It’s all about transactions.

- Sending: When you send crypto, you’re essentially signing off ownership of the coins to another wallet’s public key. Once initiated, this process is irreversible. Your private key is used to sign the transaction, proving you’re the owner.

- Receiving: When you’re on the receiving end, someone else assigns the ownership of their coins to your wallet’s public key. To spend or move them, your private key must match the public key the coins were sent to, ensuring only you can access them.

- Transaction Verification: How do we ensure these transactions are legitimate?

- Blockchain: This decentralized ledger records every transaction. Once you initiate a transaction, it’s broadcasted to a network of computers known as nodes.

- Nodes and Consensus: These nodes validate the transaction using a consensus mechanism. For Bitcoin, this is primarily Proof of Work. Once most nodes agree the transaction is valid, it’s added to the blockchain.

- Finality: Once your transaction is added to the blockchain, it’s there forever, providing a transparent and immutable record.

- Wallet Addresses: Think of these as single-use invoices.

- Whenever you want to receive funds, your wallet generates a new address, a hashed version of your public key. This enhances privacy as it makes it harder to link transactions to the user.

- Deterministic Wallets: Ever wondered how modern wallets manage multiple addresses?

- These wallets generate multiple public and private key pairs from a single seed. You can have multiple receiving addresses, but you only need one seed phrase to back up the entire wallet.

- Multisignature Wallets: Safety in numbers.

- Some wallets require multiple private keys to authorize a transaction, adding an extra layer of security. It’s like a digital safety deposit box with two or more keys to open.

Understanding the inner workings of crypto wallets can feel like decoding a complex puzzle.

But with each piece we’ve placed, the bigger picture becomes clearer.

Ready to delve even deeper into the nuances of crypto?

Let’s continue our exploration!

Security Aspects of Crypto Wallets

Let’s unravel the security tapestry of crypto wallets:

- Backup and Recovery:

- Seed Phrases: These are words that can help recover your wallet. It’s like a backup password but way more powerful. Store it securely, and whatever you do, don’t lose it!

- Two-Factor Authentication (2FA): You’ve probably used this for your email or bank account. It’s an extra layer of security, and it’s crucial for crypto wallets.

- How does it work? After entering your password, you must provide other information, like a code sent to your phone. Double the protection, double the peace of mind.

- Potential Threats:

- Phishing: Scammers might trick you into revealing your private keys or passwords. Always double-check URLs and be wary of suspicious emails.

- Malware: Harmful software can infiltrate your device to steal your crypto. Regularly update and scan your devices.

Navigating the crypto landscape requires vigilance, but with the right precautions, your digital treasure can remain safe and sound.

Ready to delve further into the intricacies of crypto wallets?

Let’s keep going!

Choosing the Right Wallet

So, you’re armed with knowledge about crypto wallets and their security.

But here’s the burning question: “Which wallet is right for me?”

- Determine Your Needs:

- Frequency of Transactions: Do you plan to trade often or hold long-term?

- Type of Cryptocurrency: Not all wallets support every cryptocurrency. Got your eye on a specific coin? Make sure your wallet can handle it.

- Security vs. Convenience:

- Hot Wallets: Perfect for frequent traders. They’re easily accessible, but being online makes them more vulnerable.

- Cold Wallets: Ideal for those looking to hold onto their crypto for a while. They’re offline, offering enhanced security, but accessing your funds might take longer.

- Custodial vs. Non-Custodial: Who do you trust more, yourself or a third party?

- Custodial: These wallets are often easier to set up and use, but remember, the service provider holds your keys.

- Non-Custodial: You’re in full control, but with great power comes great responsibility. Don’t lose those keys!

Choosing the right crypto wallet must fit your needs, offer comfort, and, most importantly, keep you secure.

Feeling more confident about making a choice?

Remember, the crypto journey is as much about learning as investing.

Onward and upward!

Conclusion

With a deeper dive into crypto wallets, things are starting to click.

We’ve journeyed together from understanding the intricate dance of public and private keys to weighing the pros and cons of hot versus cold storage.

And remember, just like the broader crypto universe, the realm of wallets is ever-evolving.

So, as you step forward, armed with knowledge and ready to secure your digital assets, always stay curious, and vigilant, and embrace the exciting world of cryptocurrency.