AML is like the rulebook that stops people from using digital money like Bitcoin for shady stuff.

It’s all about keeping things clean in the financial world.

But with cryptocurrencies being fast and private, tracking them can be tough.

So, how do we make sure this digital cash isn’t fueling the wrong activities?

That’s where AML steps in, tailoring its rules for the crypto universe.

This article will break down AML and highlight its importance in crypto.

We will also see how it helps keep your digital dollars safe.

If you’re curious about how these regulations work in the crypto world, stick around.

Understanding Anti-Money Laundering (AML)

Anti-Money Laundering, or AML, might sound like something from a spy movie.

But it’s a big deal in the real world.

AML is a set of laws and rules that help stop people from hiding illegal money.

It’s like a game’s rules that ensure everyone plays fair.

Think about it this way: when people make money from doing something illegal, like stealing, they can’t just use it freely.

It would be easy to catch them. So, they try to make it look like the money came from a legal source.

AML rules are there to catch these tricks.

Governments, banks and crypto exchanges use AML to monitor where money is coming from and where it’s going.

They look for anything suspicious. It’s like having a referee in a game who watches for any cheating.

These rules aren’t just for big banks or companies.

They touch almost everyone who deals with money, including businesses and regular people.

So, understanding AML is important for staying on the right side of the law.

It’s all about keeping the money in our world clean and legal. Let’s keep going and see how this connects to cryptocurrencies.

The Basics of Money Laundering

Money laundering sounds like it has something to do with a washing machine, but it’s a sneaky way for people to hide dirty money.

Imagine someone making money by breaking the law.

They can’t just spend it openly because it would be obvious they got it illegally.

So, they try to make it look clean and legal. Here’s how it usually works, in three main steps.

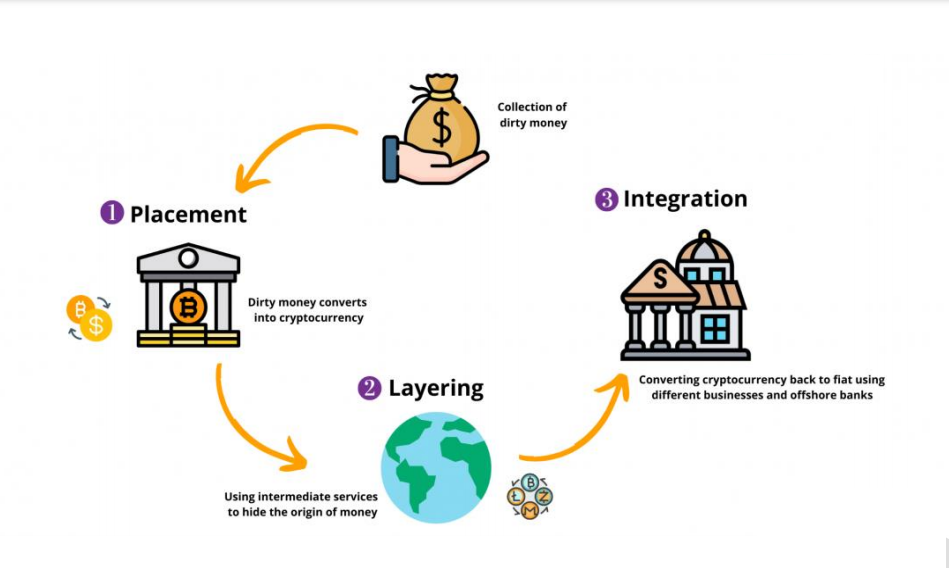

- Placement

This is where the illegal money is put into the financial system. It’s like sneaking a forbidden snack into your lunchbox.

- Layering

This is where things get tricky.

The money is moved around through different accounts or businesses to confuse anyone tracking it.

Think of it as a shell game, where you try to track which cup the ball is under.

- Integration

Now, the money looks clean and can be used openly.

It’s like finishing a magic trick where the rabbit suddenly appears in the hat, and no one knows how it got there.

Understanding money laundering is key, especially in crypto. This is because, here, transactions can be fast and anonymous.

Let’s see how all of this ties into cryptocurrencies and AML rules.

New to crypto trading? Know How are crypto exchanges different from traditional stock exchanges?

AML Regulations and Cryptocurrencies

Regarding cryptocurrencies, AML (Anti-Money Laundering) regulations are super important.

These digital coins are famous for moving quickly and being pretty private, which is great for many reasons.

But here’s the catch: their speed and secrecy can make it easier for people to hide illegal money.

This is where AML rules come into play.

Governments and financial experts realized that they needed to keep an eye on crypto transactions.

This was to stop them from being used for bad stuff.

It’s like setting up security cameras in a game arcade to ensure no one breaks the rules.

AML regulations for crypto mean businesses dealing with them must do certain things.

They need to know who their customers are, keep records of transactions, and report anything that looks suspicious.

It’s like when you join a new online game and have to provide your email and create a username.

These rules also mean you might need to share some of your info if you’re trading crypto.

The business you’re trading with must ensure you’re not using your crypto for the wrong reasons.

It’s like having a referee in the game who checks to make sure everyone is playing fair.

Some people worry that these rules could take away some of the privacy and freedom that make cryptocurrencies special.

But the goal is to make the whole crypto world safer and more trustworthy.

It’s about the balance between keeping things private and ensuring nothing illegal happens.

So, while AML regulations might seem like a hassle, they’re there for a good reason.

They help ensure cryptocurrencies are used correctly and keep the bad actors out of the game.

Let’s keep going and look at some challenges of applying these rules to digital money.

Recommended Read: Which crypto exchanges are registered with SEC?

Challenges of Applying AML to Cryptocurrencies

Putting AML (Anti-Money Laundering) rules into the world of cryptocurrencies isn’t a walk in the park.

It’s got its own set of challenges.

Let’s face it: cryptocurrencies are a new ballgame compared to regular money.

- Reduced Privacy

First off, one of the big draws of crypto is privacy.

People like that their transactions aren’t always in the open.

But with AML rules, some privacy must be given up.

It’s like having to wear a name tag in a place where everyone used to wear masks.

For some crypto users, this is a big change.

- Advanced Technology

Then, there’s the issue of technology.

Cryptocurrencies use some pretty advanced tech.

Applying AML rules means the systems need to be smart.

They have to track and report suspicious activities without making mistakes.

It’s like asking a goalie to block every shot, no matter how fast it comes.

- Borderless Transactions

Another challenge is the global nature of cryptocurrencies.

They aren’t tied to just one country or set of rules.

So, when it comes to AML, it’s tricky.

Different countries have different rules, and keeping up with them can be like trying to juggle a bunch of balls simultaneously. For instance, the USA has its own set of rules around crypto.

- Fast-paced innovation

Lastly, some people worry that too many rules might slow down the growth and innovation of crypto.

It’s like putting too many speed bumps on a fast track.

The goal is to make things safe but not so slow that the excitement of crypto is lost.

So, applying AML to cryptocurrencies is a balancing act.

It’s about keeping things safe and legal and keeping crypto’s unique spirit alive.

It’s difficult, but ensuring digital money works well for everyone is important.

Next, let’s explore how the world is trying to meet these challenges.

Recommended Read: Who regulates bitcoin & other cryptos in the US?

Global AML Standards and Crypto Compliance

Regarding Anti-Money Laundering (AML) rules and crypto, the whole world is trying to get on the same page.

It’s like a global team working together to play a fair game.

Countries are creating rules to ensure crypto isn’t used for bad stuff, like hiding illegal money.

These global standards are set by big organizations that many countries listen to.

These standards help countries set up their own rules for crypto and AML.

But here’s the thing: not every country sees crypto similarly. Some are open to it, while others are more cautious.

So, each country creates rules that work for them but still follow the big game plan.

For people who use crypto, this means they need to know the rules of their own country.

It’s like knowing the rules of the field you’re playing on.

Staying within these rules ensures you play a fair and safe game in the crypto world.

Next, let’s check out the tools and strategies that help follow these AML rules in crypto.

It’s all about playing the game right and keeping it fun for everyone.

Tools and Strategies for AML Compliance in Crypto

Staying on top of AML (Anti-Money Laundering) rules in the crypto world requires smart tools and strategies.

It’s like having the right gear for a tough game.

- Special Software Programs

These are like high-tech detectors that scan through all the crypto transactions.

They look for anything that seems out of the ordinary, kind of like a detective looking for clues.

This software can spot patterns suggesting someone is trying to hide illegal money.

- KYC Norms

Next, there’s something called KYC, which stands for Know Your Customer.

It’s a way for businesses dealing with crypto to know who they’re working with.

They check IDs and keep records, making sure their customers are who they say they are.

It’s like a coach knowing every player on the team.

However, crypto investors can use a non-KYC crypto exchange to deal with this.

- Customer Training

Training is also key. People who work in crypto need to know all about AML rules.

They must stay sharp, just like players practicing for a big game.

Regular training sessions help everyone understand the latest rules and how to follow them.

By using these tools and strategies, businesses and individuals in the crypto world can stay compliant with AML rules.

It’s about playing fair and safe in the exciting world of cryptocurrencies.

Next, look into the future and see how AML and cryptocurrencies might continue working together.

Recommended Read: Ways to buy and sell crypto without paying taxes

The Future of AML and Cryptocurrencies

Thinking about the future of AML (Anti-Money Laundering) and crypto is exciting and unpredictable.

But one thing is certain: AML and crypto’s relationship will grow.

As crypto becomes more popular, governments are working even harder to ensure they’re used correctly.

It’s like adding more rules to a game as it gets more players. These rules are there to keep the game fair and fun for everyone.

We might see new technologies in crypto to make AML easier and more effective.

Imagine even smarter software that can catch bad activities faster and better.

There’s also a chance that the rules for crypto will become more similar worldwide.

This would make it easier for people to use crypto in different countries.

It’s like having a universal rulebook for a game, no matter where you play.

So, the future of AML and cryptocurrencies looks busy and bright.

It’s all about finding the right balance between keeping things safe and letting the exciting world of crypto grow.

Let’s wait and see what new developments come our way!

Also, you might be interested to know about how crypto exchanges comply with anti-money laundering laws.

Conclusion: The Role of AML in the Crypto Ecosystem

As we wrap up, remember that AML plays a big part in the crypto world.

It’s like having a referee in a game, ensuring everyone plays fairly.

AML rules help stop bad guys from using crypto for illegal stuff.

This way, everyone can enjoy the benefits of cryptocurrencies without worry.

As crypto keeps growing, AML will continue to be super important.

It’s all about ensuring this exciting digital money world stays on the right track.