Crypto exchanges are like busy airports where digital currencies take off and land every second.

But just like airports, they have rules to keep everything safe.

Enter Anti-Money Laundering (AML) laws.

AML laws ensure that the money passing through these exchanges isn’t coming from or going to bad activities.

To be able to follow AML laws, centralized crypto exchanges have to check who their customers are, keep an eye on transactions, and report anything that looks suspicious.

These laws are about stopping money laundering – that’s when illegal money is made to look like it’s earned honestly.

This article will dive into how crypto exchanges tackle this challenge.

We’ll explore the tools they use, the hurdles they face, and what this means for the future of digital money.

So, if you’re ready, let’s jump in and unravel this complex yet fascinating part of the crypto universe!

Understanding Anti-Money Laundering (AML) Laws

Let’s get to grips with Anti-Money Laundering (AML) laws.

Imagine someone making money by doing something illegal.

They then try to ‘clean’ the money in various ways to be used for legitimate transactions.

AML laws are there to prevent this from happening.

Here’s how it works: AML laws require financial institutions to monitor the money flowing through them closely.

They need to know their customers, where their money is coming from, and where it’s going.

These laws also mean that if a bank or crypto exchange sees something fishy, like a lot of money moving strangely, they must report it.

Consider it raising a red flag when something doesn’t look right.

Next, we’ll see why these laws are especially important for crypto exchanges.

New to crypto trading? Know about Ways to Buy and Sell Crypto Without Paying Taxes

Key AML Compliance Measures for Crypto Exchanges

Crypto exchanges must play by some key rules to stick with Anti-Money Laundering (AML) laws.

These are the must-do chores to keep their trading house in order.

Let’s take a look at what they are.

- Know Your Customer

This is like a get-to-know-you quiz for customers. Exchanges need to check who’s signing up.

They usually ask for ID, like a driver’s license or passport.

They say, “Hey, we need to know you’re the real deal before you start trading.”

- Monitoring Transactions

Then, they have to watch transactions like a hawk. This means keeping an eye on how money moves in and out.

If something looks weird, like a huge amount of money popping up out of nowhere, the exchange must check it out.

It’s like a lifeguard keeping watch at a pool. Exchanges also need to keep detailed records.

It’s like writing down who came to your party and when they left.

These records help if any questions pop up later about a transaction.

- Reporting Suspicious Activities

If a crypto exchange spots something fishy, they must report it to the authorities.

It’s like telling a teacher when something’s not right in class.

- Exchange Employee Training

Lastly, training is super important.

People working at these exchanges need to know all about AML rules.

They often have training sessions to stay sharp.

It’s like a team practicing together, so everyone knows the plays.

By doing all this, crypto exchanges can keep on the right side of AML laws.

It helps them run a safe place for people to trade their digital money.

Next, we will examine some hurdles exchanges face in keeping up with these rules.

Recommended Read: Why is the government taxing crypto?

Challenges Faced by Crypto Exchanges in AML Compliance

Following Anti-Money Laundering (AML) laws isn’t a walk in the park for crypto exchanges.

They face quite a few challenges. It’s like playing a tough level in a video game where you must be on top.

- Slow Signup Process

Firstly, crypto is all about being fast and private, but AML rules can slow things down.

Exchanges have to check customer IDs and track transactions.

This is like having to stop and tie your shoelaces during a race.

It’s necessary, but it can slow you down.

- Lack of Privacy

Then, there’s the privacy issue. Many people use crypto because they like keeping their business to themselves.

But AML rules mean exchanges have to ask for personal information.

This can be a bit like asking someone used to whispering to start shouting. Not everyone is comfortable with it.

A workaround to this problem can be choosing to use a non-KYC cryptocurrency exchange.

- Keeping Up With Technology

Another big challenge is the technology side of things.

Crypto exchanges need good tech to track and report all the required information.

This is like needing a super-fast computer to play the latest games.

It’s a must-have, but it’s not always easy to get.

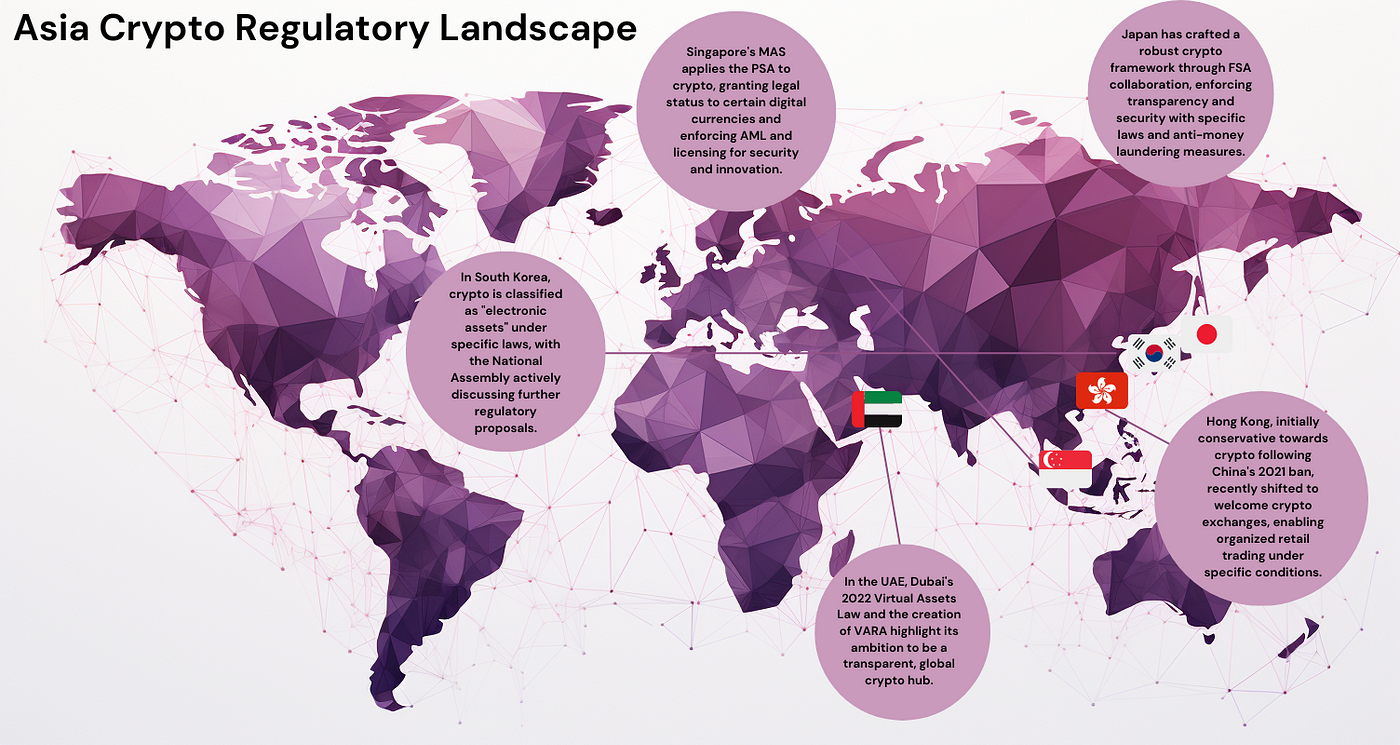

- Different Global Laws

Also, remember that crypto is a global thing. But AML laws can be different in each country.

This is like following a recipe that changes depending on where you cook it.

Exchanges must ensure they follow the rules for each place they operate in.

- Associated Cost

All this checking, tracking, and reporting needs money and people.

It’s like needing to buy more gear to play a sport at a professional level.

It’s necessary, but it can be expensive.

So, while crypto exchanges must follow AML laws, it’s not easy.

They must juggle privacy, speed, technology, global differences, and costs.

It’s a tricky balancing act, but it’s crucial for keeping the crypto world safe and fair.

Up next, let’s explore how global AML standards impact these exchanges.

Recommended Read: Ways to legally avoid paying crypto taxes

AML Compliance: A Priority for Crypto Exchanges

Following Anti-Money Laundering (AML) laws is super important for crypto exchanges.

It’s a rulebook they must stick to to keep everything running smoothly.

Here’s why it’s a big deal: if a crypto exchange doesn’t follow AML laws, it can get into serious trouble.

We’re talking big fines or even getting shut down.

So, to stay in the game and keep their reputation shiny, exchanges must be careful about AML laws.

This means checking who their customers are and watching over transactions.

If anything is off, the exchanges are required to report it.

By sticking to these rules, crypto exchanges can keep their business safe and build trust with their users.

Next, let’s dive into how global AML standards impact these exchanges.

Global AML Standards and Their Impact on Crypto Exchanges

Global Anti-Money Laundering (AML) standards are set by the Financial Action Task Force (FATF).

These are what exchanges must follow to stop illegal money from moving around.

They’re like the coaches who make most of the rulebook.

They give guidelines on how to prevent money laundering and keep an eye on who’s buying and selling crypto.

Now, these global standards mean that crypto exchanges must know their customers well.

They need to check IDs, know where the money comes from, and report any weird transactions.

However, not all countries agree on how to handle crypto.

Some are strict, while others are more laid back.

For crypto exchanges, they have to adapt to different rules in different places.

Keeping up with all these rules can be tough for exchanges.

It’s a lot of work, but it’s important.

For these reasons, most big exchanges have an AML/KYC department, which deals with the intricacies of achieving global compliance for the business.

Next, we will examine how exchanges use tools and strategies to meet these AML requirements.

Case Studies: Crypto Exchanges and AML Compliance

Let’s examine how some crypto exchanges handle Anti-Money Laundering (AML) laws.

First, consider a big player like Coinbase. They take AML very seriously.

Coinbase does thorough checks on who their customers are (KYC) and keeps an eye on all transactions.

Then there’s Binance Futures, another giant in the crypto world. Binance faced some challenges because it operates globally.

They had to adapt to different AML rules in different countries.

Binance ramped up its technology and hired compliance experts to stay on top of things.

This way, they ensure they’re playing by the rules, no matter where they are.

But it’s not just the big exchanges that are stepping up. Smaller exchanges are also doing their part.

For instance, Kraken, another well-known exchange, has a dedicated team for AML compliance.

They train their staff regularly and use advanced software to monitor transactions.

It’s like having a dedicated detective team, always looking for clues to keep things safe.

These case studies show that, whether big or small, crypto exchanges are putting a lot of effort into following AML laws.

It’s all about building trust with their users and making the crypto world safer.

By learning from these examples, other exchanges can find ways to improve their own AML practices.

Next, let’s explore the future of AML compliance in the ever-evolving world of cryptocurrencies.

The Future of AML Compliance in Crypto Exchanges

Thinking about the future of AML in crypto exchanges is like trying to guess the next big thing in video games.

It’s always changing and evolving. But one thing is clear: AML will become even more important.

As cryptocurrencies become more accepted, governments worldwide are paying more attention.

This means crypto exchanges must be even more careful about handling their business.

We might see new technologies making AML easier to exchange.

Imagine software that can quickly spot suspicious activities, like a super-smart detective.

This would help exchanges stay safe and follow the rules without slowing down.

Also, there could be more cooperation between countries on AML standards.

This would make it easier for exchanges to know what they need to do, no matter where they operate.

So, the future of AML compliance in crypto exchanges looks busy but promising.

Next, let’s wrap up what all this means for the crypto ecosystem.

Recommended Read: Advantages and disadvantages of using crypto over traditional currencies

Conclusion: Navigating AML Compliance in the Crypto Sphere

Navigating Anti-Money Laundering (AML) laws in crypto exchanges is like following a roadmap through a busy city.

It can be complex, but it’s crucial for a safe journey.

Exchanges have a big job: they must be vigilant, like watchful guardians, ensuring no bad money slips through the cracks.

As crypto keeps growing, staying on top of AML rules will be more important than ever.

It’s all about balancing safety with the exciting opportunities in the crypto world.

For exchanges, keeping up with AML is key to a smooth ride in the ever-changing landscape of digital money.